Resources

Level up your finance game with Float’s Resource Hub: expert insights, practical tips, and real stories from Canadian businesses using Float to work smarter.

💡 Need to troubleshoot features in your Float account?

Visit our Help Centre for access to even more instructional articles and guides.

Built in Canada: How Impact Kitchen Saves Time with Float

Impact Kitchen saves 100+ hours a year with Float by streamlining expenses across 7 Toronto locations. With better compliance and fewer manual tasks, Float is helping them scale efficiently—including their first US store in NYC.

Cash Flow Optimization

ACH vs EFT Payments: Key Differences for Canadian Companies

Learn the key differences between EFT and ACH payments, how they work, which options might be available to your business and how to choose.

Read MoreCorporate Cards

Xero Integration for Corporate Cards: Modern Accounting Software Guide

Using Xero becomes more powerful the second you integrate it with your corporate cards. Here’s what you need to know.

Read MoreFloat News

Float 2025: Year in Review

How Float is building the financial system Canadian businesses run on

Read MoreIndustry Insights

Canada’s Crossroads: Why Now is the Moment to Move from Defensive to Intentional Growth

Float’s 2025 report on Canadian business shows modest growth, rising costs and shrinking reserves. Find out exactly what the data says and how this year’s winners will respond in 2026.

Read MoreExpense Management

Controller Month-End Close Automation: Streamline Financial Reporting

Controllers, this one’s for you. Let’s talk about how how automating month-end close helps you move faster without sacrificing accuracy.

Read MoreCorporate Cards

Corporate Card Program Implementation: Complete Management Guide

Ready to implement a corporate card program? This is where to start.

Read MoreCash Flow Optimization

Working Capital Management for Controllers: Optimize Cash Flow with Corporate Cards

Let’s explore how controllers can use corporate cards to strengthen cash flow, improve operational control and support smarter financial decision-making across the organization.

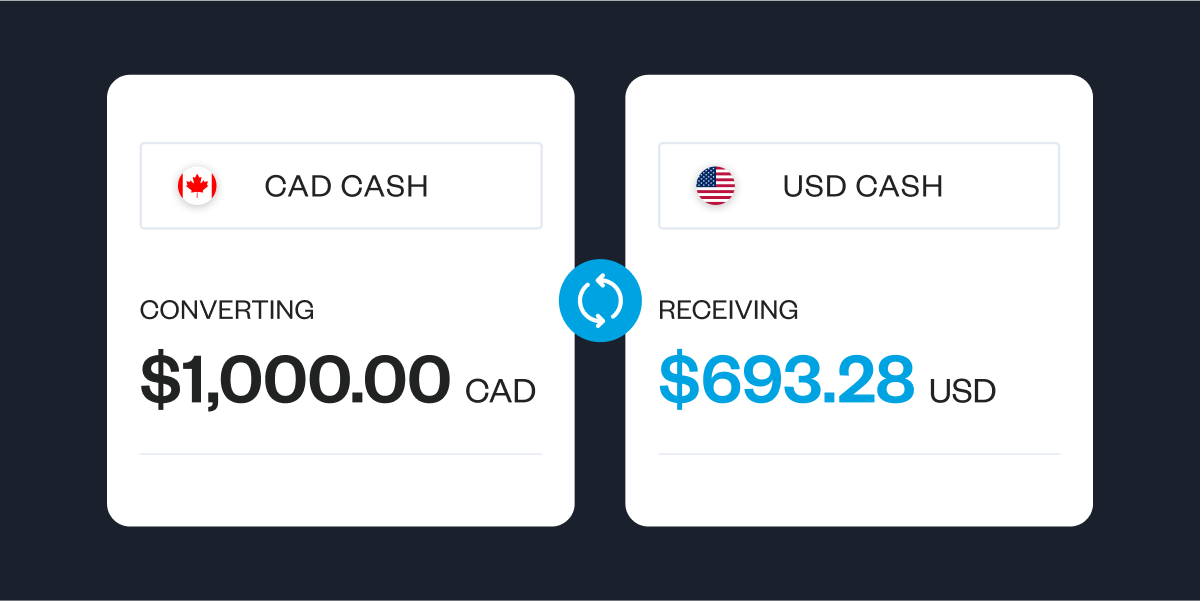

Read MoreHow Toonie Tours Maximizes Every Dollar with Float FX and Business Accounts

Learn how Vancouver-based Toonie Tours solved their foreign exchange problem that was draining their margins, using Float FX and Business Accounts.

Read MoreCorporate Cards

Sole Proprietor Corporate Cards: Business Credit Solutions for Single-Owner Companies

Let’s explore the best sole proprietor corporate cards to give you the business finance access you need at any size.

Read MoreCorporate Cards

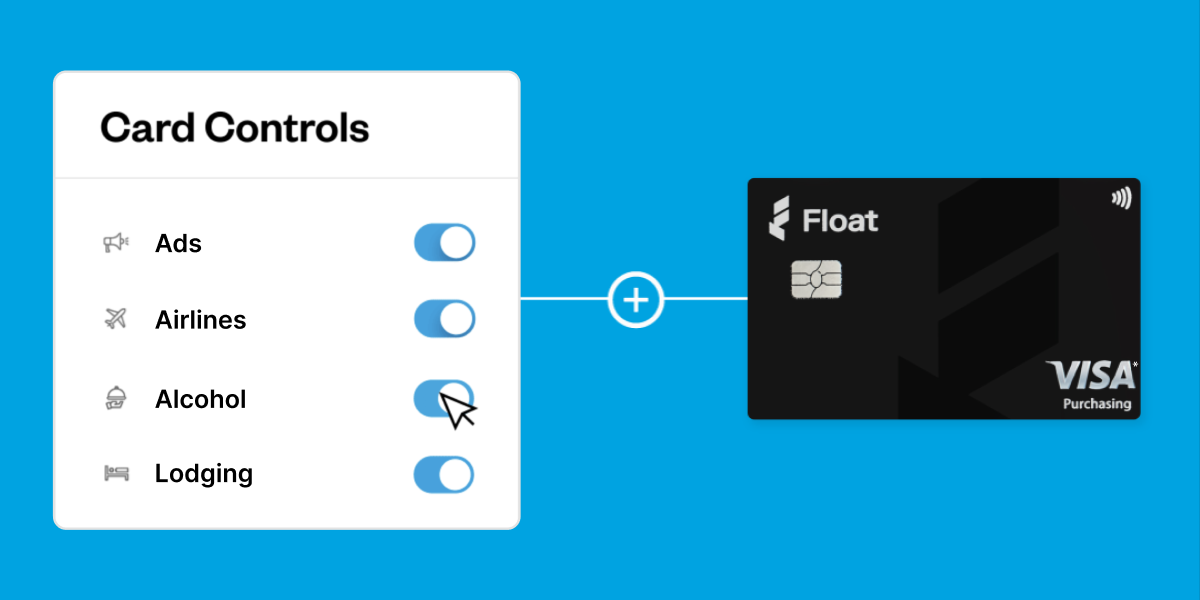

Corporate Card Misuse Prevention: 2026 Control Strategies for Canadian Businesses

Corporate cards can be a powerful tool—if you set the right guardrails from the start. Here’s what you need to know.

Read MoreFinance Team Efficiency

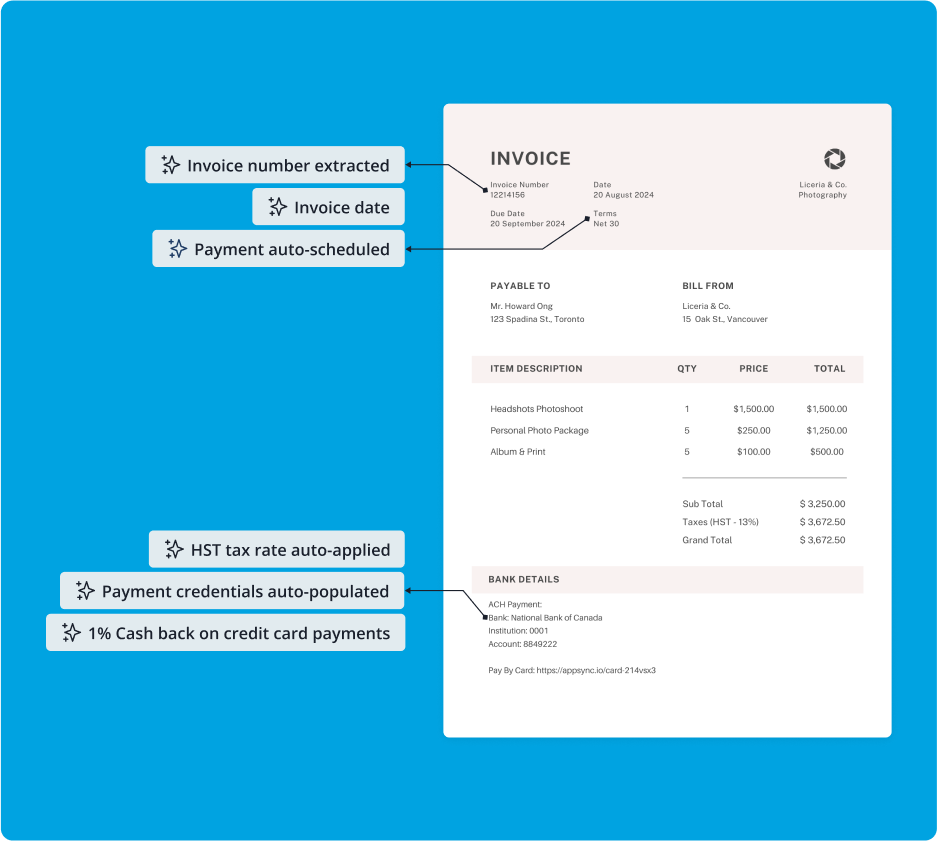

Best Accounts Payable Software for Canadian Businesses in 2026

Make accounts payable more efficient with AP automation. Compare the best accounts payable automation software built for Canadian businesses.

Read MoreFinance Team Efficiency

Best Accounting Software for Canadian Businesses: 2026 Complete Guide

Discover the best accounting software solutions for Canadian businesses. Compare top solutions like Quickbooks, Xero, FreshBooks, Sage 50, and Wave.

Read MoreExpense Management

Canadian Month-End Close Process: 2026 Best Practices Guide

Discover what month-close is, steps of the process, the most significant challenges and the best strategies to overcome them.

Read MoreExpense Management

Effective Working Capital Management: 2026 Strategic Guide for Canadian Businesses

Let’s explore how credit can help you manage your working capital needs more effectively.

Read MoreExpense Management

Managing Travel Expenses for Growing Companies

Learn how to streamline manual work and empower your teams with a solid travel expense management process.

Read MoreExpense Management

How Do You Handle Employee Reimbursements Efficiently?

Learn how to simplify employee reimbursements with efficient, scalable strategies for small businesses and growing finance teams.

Read MoreCorporate Cards

Amex Global Platinum Dollar Card Alternatives for Canadian Businesses in 2026

Canadian businesses are dealing with the discontinuation of the Amex Platinum Global Dollar Card and looking for a replacement card. Here’s what you need to know.

Read MoreExpense Management

CDIC Insurance for Canadian Business Banking: Complete Protection Guide

Uncertainty about where your money sits—or whether it’s protected—is the last thing any business needs. That’s why understanding CDIC insurance for business accounts matters.

Read MoreExpense Management

Working Capital Management Software Guide

There’s a lot that goes into managing your working capital. But, like many things, the right software can help make it easier.

Read MoreExpense Management

Float vs Venn: Which Solution Fits Your Business?

What’s right for your business, Float or Venn? This article dives into the pros and cons of each, as well as what you need to know for your business.

Read MoreCash Flow Optimization

How to Make EFT Payments in Canada: Complete 2026 Guide

Learn how to initiate EFT Payments as a Canadian Business and innovative solutions available on the market, like Float, that you can use for free.

Read MoreCash Flow Optimization

Cash Flow Management for Canadian Businesses: 2026 Strategic Guide

Unlock business growth with our ultimate guide to understanding and improving cash flow in your business. Learn key strategies and tools to optimize today.

Read MoreCorporate Cards

What is a Fleet Card? Complete Canadian Business Guide 2026

Explore the best fuel cards for small businesses in Canada. Learn about the benefits of using fleet cards to save on fuel and vehicle maintenance costs.

Read MoreFinancial Controls & Compliance

How to Find Your Business Incorporation Number: 2026 Guide

Learn how to find your business incorporation number in 2025. Discover why it’s important, where to look and what’s changed with the updated registration process.

Read MoreCorporate Cards

QuickBooks Integration for Corporate Cards: Canadian Business Accounting Guide

Want a clear understanding of your expenses at all times without the hours spent chasing receipts? A QuickBooks integration might be exactly what you need.

Read MoreCorporate Cards

Auto-Load Corporate Cards: Eliminate Transaction Declines with Smart Funding

Say goodbye to declined transactions and budgeting headaches! Let’s explore why smart funding matters and how auto-load works.

Read MoreFinancial Controls & Compliance

Financial Controller Guide: Roles, Responsibilities & Success Strategies

Behind every confident CFO is a financial controller who knows the numbers inside out—and how to use them to guide the business forward.

Read MoreCorporate Cards

Business Credit Cards with No Personal Guarantee: Your Options

Want to avoid leveraging your personal credit for business financing? Business credit cards with no personal guarantee may be the path for you.

Read MoreCorporate Cards

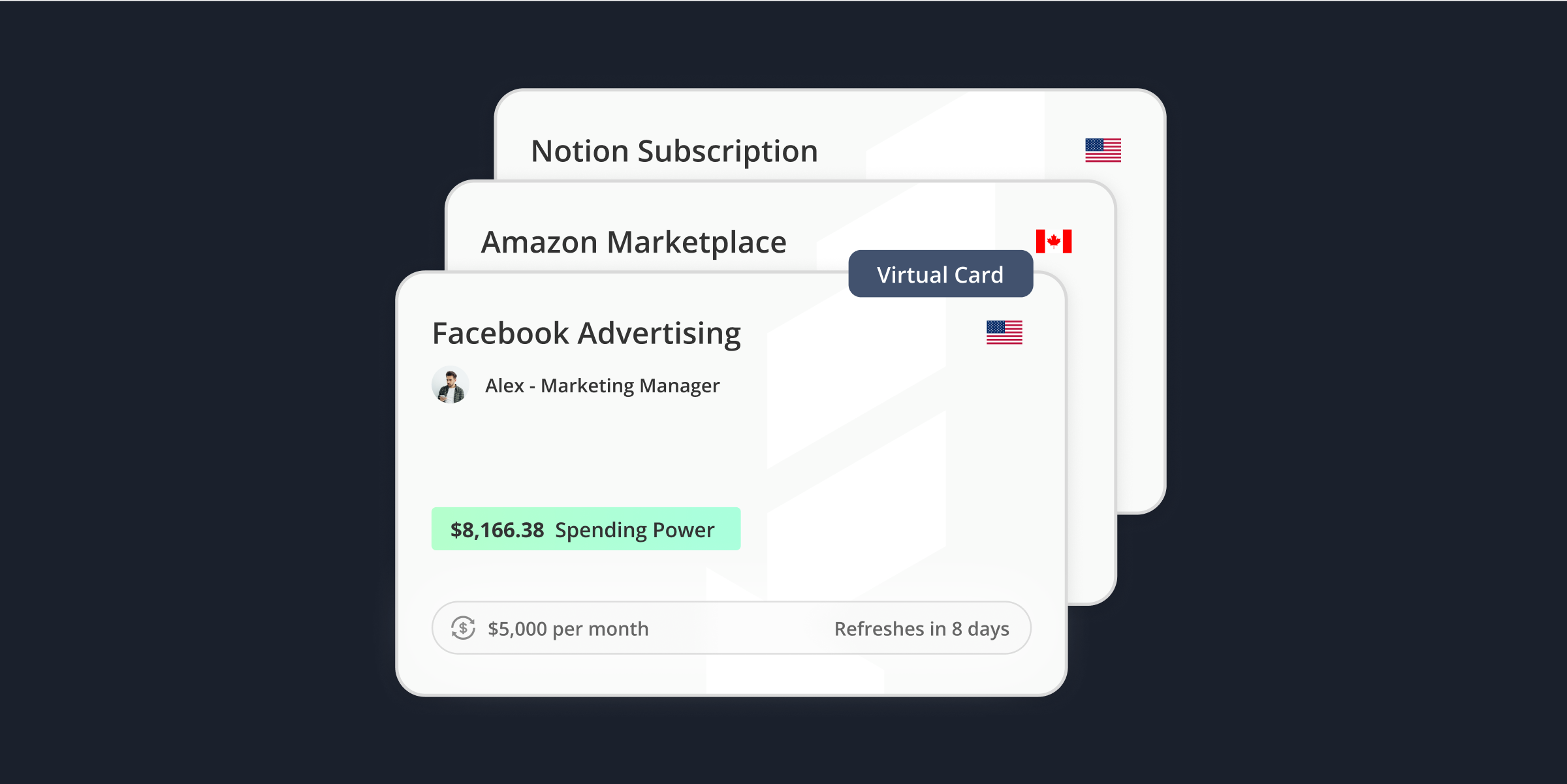

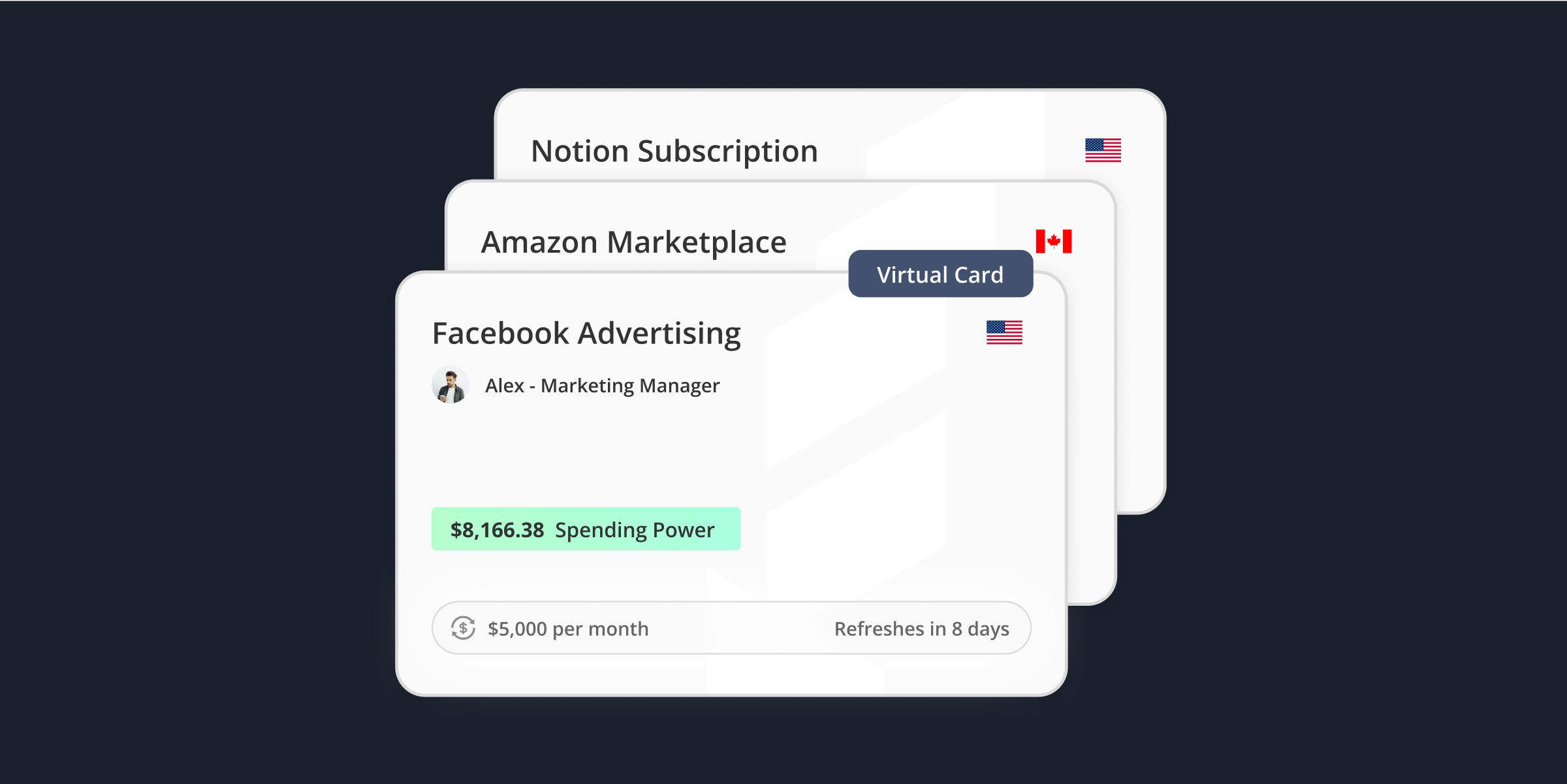

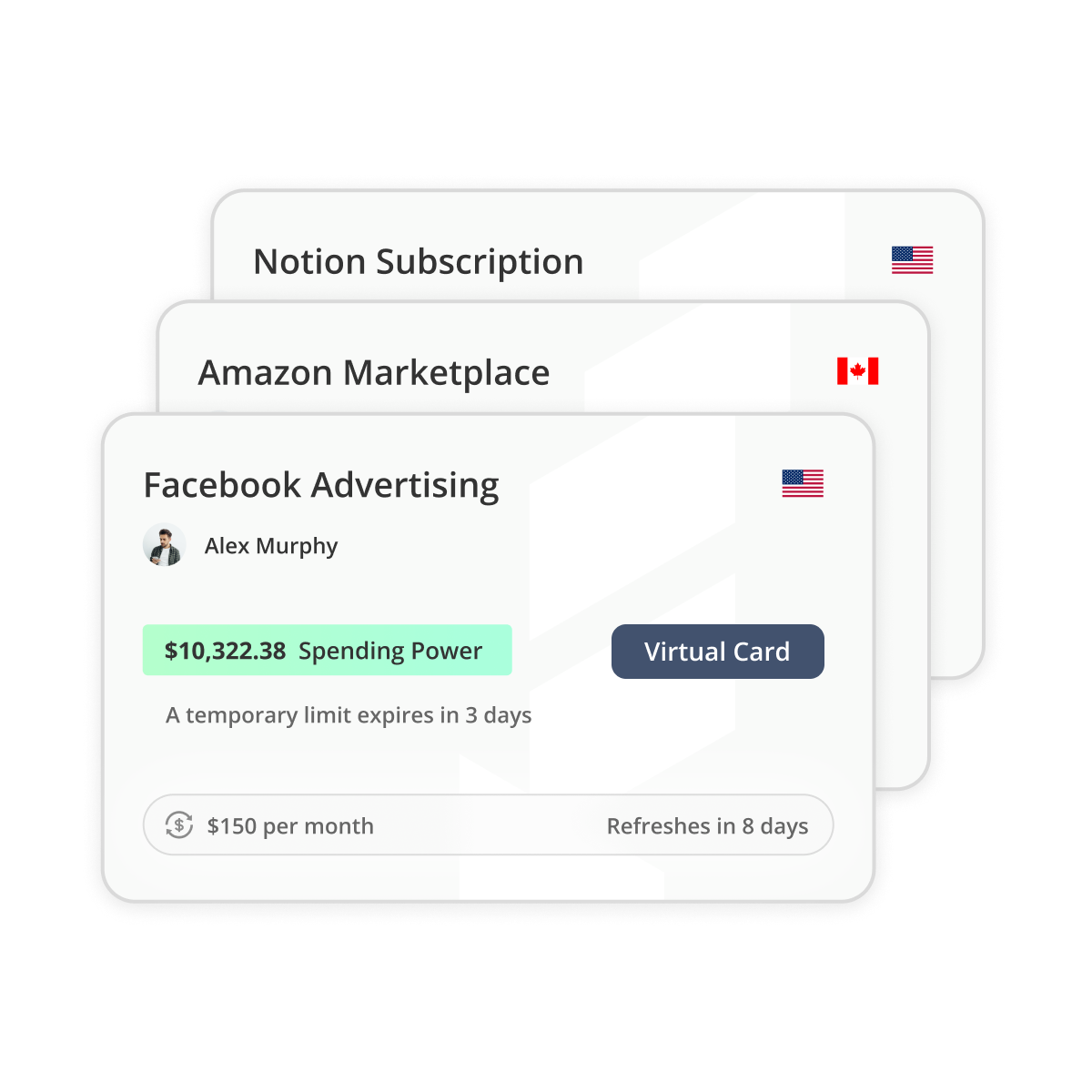

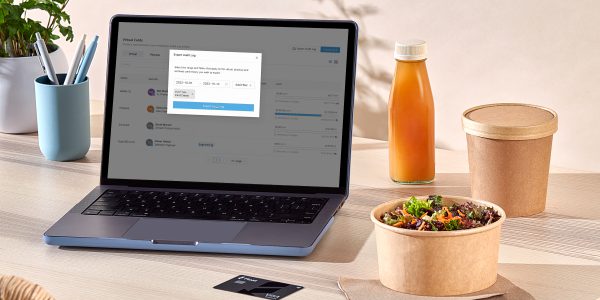

Discover: Virtual Credit Cards for Canadian Businesses

Explore the benefits of virtual credit cards with Float. Discover how this modern payment solution enhances security and simplifies your financial transactions.

Read MoreCash Flow Optimization

7 Best Business Accounts in Canada for 2026

Finding the best business account in Canada isn’t as simple as walking into your nearest branch. That’s where this guide comes in.

Read MoreCorporate Cards

No-Credit-Check Business Credit Cards: Complete 2026 Guide

Looking for access to credit? A no-credit-check credit card might be the path forward.

Read MoreHow Blue J cut foreign transaction fees and scaled financial automation with Float USD Payments

Learn how Blue J boosted financial efficiency and eliminated foreign transaction fees by adopting Float’s USD Payments for seamless global spending.

Read MoreCash Flow Optimization

Working Capital Turnover: Measuring Efficiency

Ready to master your working capital turnover? Get expert tips from Float and Sendy Shorser.

Read MoreFinancial Controls & Compliance

4 Free Online Bookkeeping Courses for Canadian Businesses

Want to level up your bookkeeping? These courses might be the key. Read more to learn what you should be enrolling in.

Read MoreExpense Management

What is Mileage Reimbursement? A Quick Overview

Discover what mileage reimbursement is and how it can benefit you. Get insights on rates, policies, and tips for maximizing your reimbursements today!

Read MoreCash Flow Optimization

Net Working Capital: How to Measure & Manage It

Let’s explain what net working capital is, how to calculate it and tips for best ways to use it.

Read MoreCash Flow Optimization

A Step-by-Step Guide to Cash Flow Forecasting

Let’s explore what cash flow forecasting is, why it matters to your business and how you can build a reliable forecast.

Read MoreCash Flow Optimization

Best Business Account Alternatives to Traditional Banking

Compare traditional banking head-to-head with Float and see why many Canadian companies are moving away from banks and toward modern digital business banking alternatives.

Read MoreCash Flow Optimization

How to Calculate Your Working Capital Ratio: A Step-by-Step Guide

Let’s break down what the working capital ratio means, how to calculate it, and how to use it to keep your business financially strong.

Read MoreCash Flow Optimization

Working Capital: Definition, Importance & Strategies

Let’s unpack working capital, why it matters and, most importantly, how you can take control of it with proven strategies.

Read MoreCash Flow Optimization

Capital Efficiency: Getting More from Your Funds

See what Brian Didsbury, CPA and Senior Manager/Controller at LiveCA, says about capital efficiency and learn a few financial concepts along the way.

Read MoreCash Flow Optimization

Payment Optimization: Strategies to Improve Cash Flow

Unlock effective payment optimization strategies to enhance cash flow. Discover actionable insights to streamline your payment processes.

Read MoreCash Flow Optimization

Working Capital Management: Best Practices for Businesses

Working capital management is a key lever for growth—here are the best practices for your small business.

Read MoreCash Flow Optimization

Liquidity Management: Ensuring Cash Readiness

Let’s unpack what liquidity management is, why it matters, and the strategies and tools that will help you stay cash-ready.

Read MoreCorporate Cards

Corporate Cards for the Hospitality Industry: A Smarter Way to Manage Spending

Corporate cards for hospitality industry businesses can be your key to levelling up. Here’s what you need to know.

Read MoreCorporate Cards

Temporary Card Spending Limits: Setup & Management Guide

Temporary card spending limits might just be the key you need to empowering your team. Read on to learn more about how to keep spending moving without breaking the budget.

Read MoreCorporate Cards

Best Credit Card for E-commerce and Retail Companies in Canada

Find the right credit card for your retail or e-commerce company with our roundup of the industry’s best business credit cards in Canada.

Read MoreCorporate Cards

7 Best Business Credit Cards Canada 2026

Pinpoint the right credit card choice for your company in a sea of options with our roundup of the seven best business credit cards in Canada.

Read MoreCorporate Cards

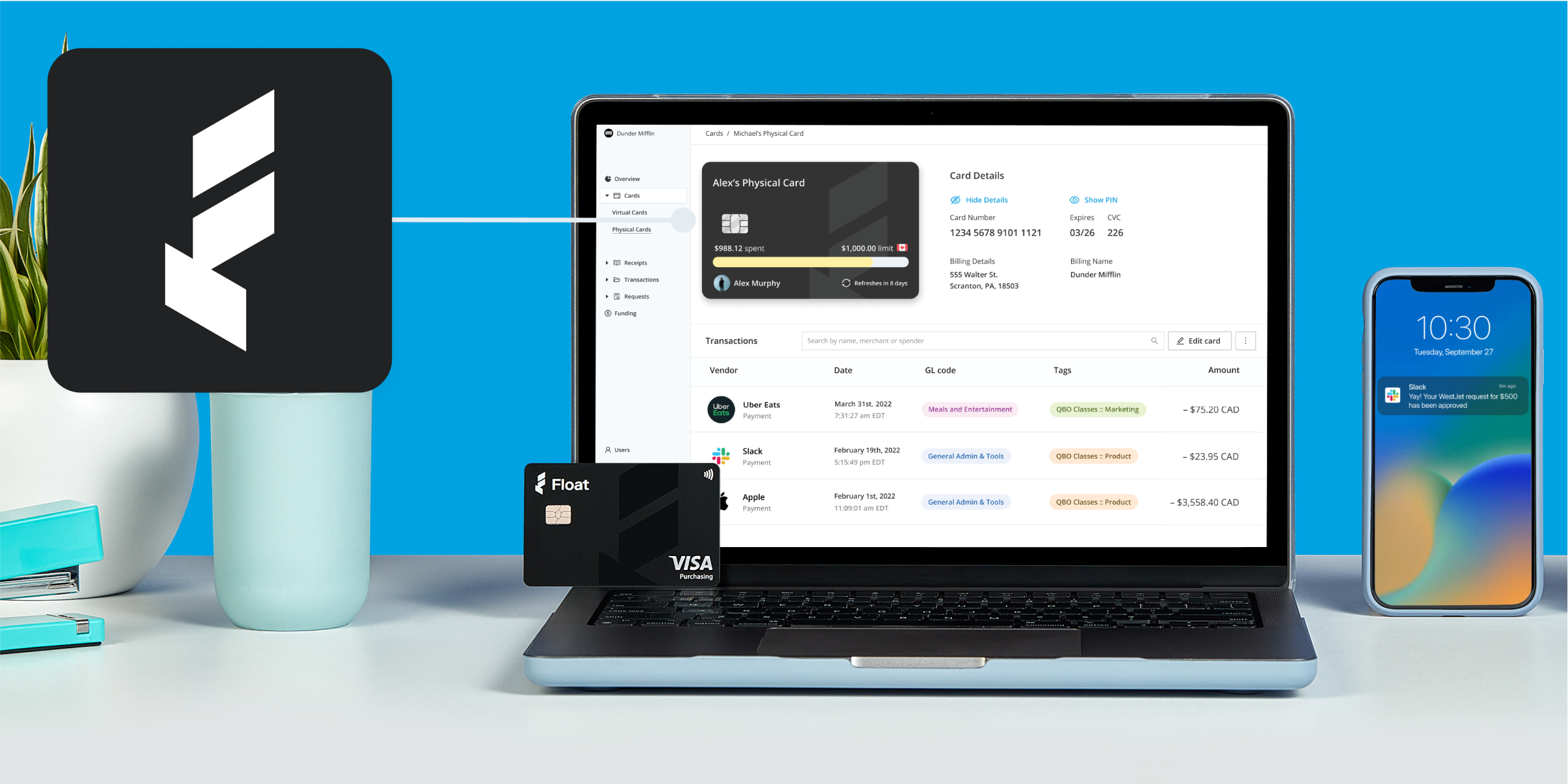

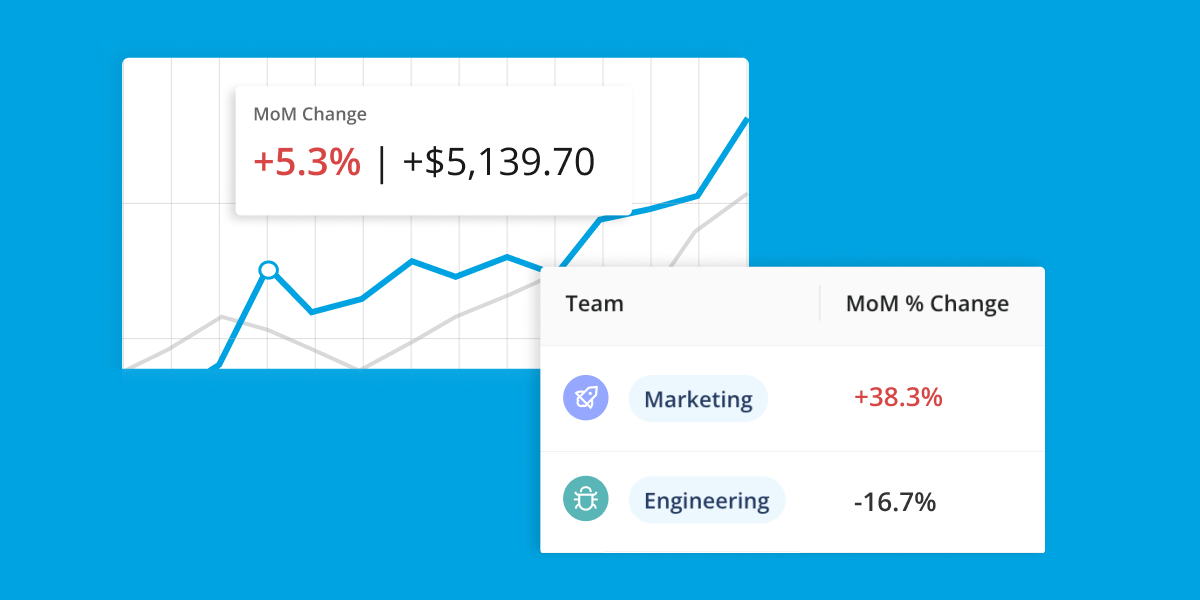

Corporate Card Program Management Dashboard: Features & Benefits Guide

Explore modern card program management dashboards that streamline expense management for Canadian businesses.

Read MoreCorporate Cards

Corporate Cards for Non-Profits: Everything You Need to Know

Explore how non-profits manage expenses with corporate cards, what to look for and how to get a corporate card as a non-profit.

Read MoreCorporate Cards

Corporate Card Spend Tracking: Real-Time Visibility Guide

Explore why real-time corporate card spend tracking matters and what features Canadian businesses should seek in these tools.

Read MoreHow Ocean Wise Recaptured 1,200+ Admin Hours Annually

Discover how this Vancouver-based not-for-profit ocean conservation organization saved 1,200+ hours in just the first year of using Float.

Read MoreCorporate Cards

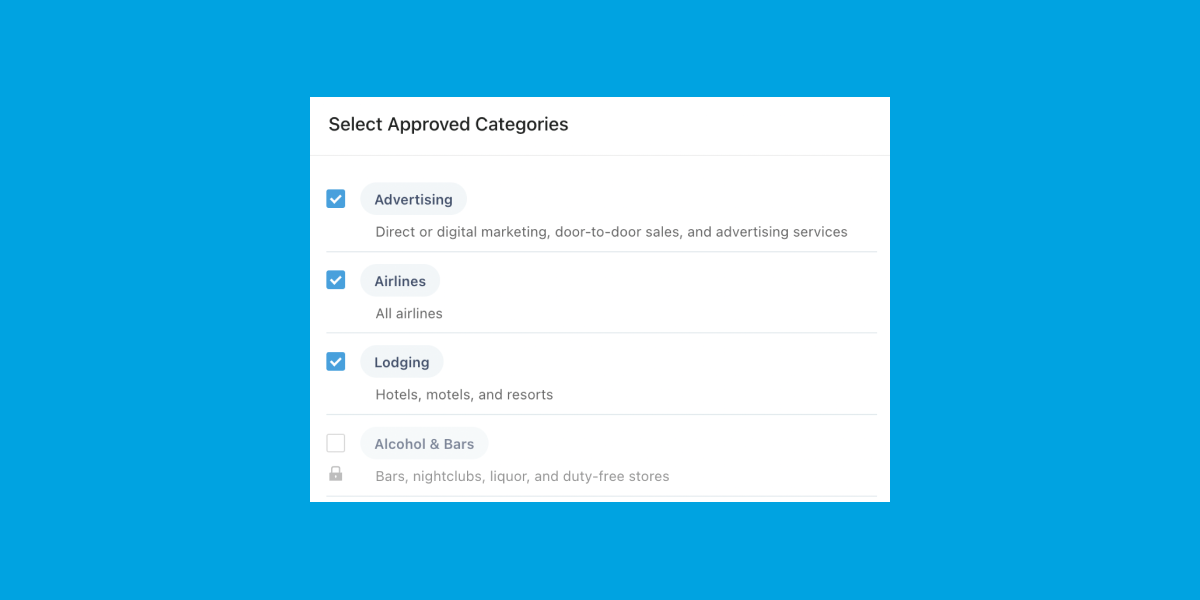

Merchant-Specific Spending Controls: Implementation Guide

Learn how to implement merchant-specific spending controls. Discover best practices and tools to manage employee expenses effectively.

Read MoreCorporate Cards

Employee Offboarding Card Security: Best Practices Guide

Offboarding employees is never fun, but it can become even more of a headache if your card security is compromised. Here’s what you need to know.

Read MoreCorporate Cards

Procurement Cards vs. Corporate Cards: Which is Right for Your Business?

Let’s break down how procurement cards and corporate cards work, where each one shines and how Float offers the flexibility to do both.

Read MoreHow Impact Kitchen saved 100+ hours a year with Float

Discover how Impact Kitchen unified spend across 7 restaurants and saved 100+ hours a year by switching to Float. Learn how automation and NetSuite integration transformed their finance operations.

Read MoreCorporate Cards

American Express vs. Float: Corporate Card Comparison for Canadian Businesses

American Express vs. Float? Which corporate card is right for you? Let’s break down the details to help you make the right decision.

Read MoreCorporate Cards

Corporate Card Security Best Practices for Canadian Businesses

Corporate cards should streamline spending, not invite fraud. Seb Prost, CPA, shares the top risks he sees and how businesses can stay ahead with smart security practices.

Read MoreCorporate Cards

Best Corporate Card Management Software & Solutions for Canadian Businesses

Discover the best corporate card management software for Canadian businesses. Streamline your finances, save time, boost business efficiency with Float

Read MoreCorporate Cards

Corporate Cards for Consulting Firms: An Industry-Specific Guide

Corporate cards for consulting firms don’t need to be a headache. Get tips from industry experts to make the most of your corporate spend.

Read MoreCorporate Cards

Credit Card Fraud Prevention Strategies for Canadian Businesses

Credit card fraud is a risk, but it’s even riskier if you aren’t prepared. Get tips from CPA and Senior Manager/Controller Brian Didsbury on protecting your business.

Read MoreCorporate Cards

How to Get a Business Credit Card: A Step-by-Step Guide

Discover how to secure a business credit card with our guide. Boost your financial flexibility and manage expenses effectively with Float!

Read MoreCorporate Cards

How to Set Business Card Spending Limits: A Finance Leader’s Guide

Learn how to establish effective spending limits for business credit cards. Gain insights and tools for better financial management.

Read MoreCorporate Cards

How to Control Employee Spending: 5 Tips for Finance Teams

Employee spending out of control? These five tips for finance teams will help you control employee spending with ease, without slowing anybody down.

Read MoreCorporate Cards

Corporate Card Alternatives: Comparing Your Options in 2026

Are your outdated cards slowing you down financially? Corporate card alternatives might be what will free you up — time-wise and financially.

Read MoreCorporate Cards

No Annual Fee Business Credit Cards: A Smarter Way to Manage Spend

You don’t need to be saddled by hefty annual fees to get the most benefits from your business cards. Here’s what you need to know about no annual fee business credit cards.

Read MoreCorporate Cards

Best Business Virtual Corporate Cards in Canada in 2026

Discover the Best Business Virtual Credit Card in Canada in 2025. Compare top options from major banks, explore rewards, fees, and benefits.

Read MoreCorporate Cards

Best 0% Interest Business Credit Cards for 2026

Explore why choosing a 0% APR business credit card can be a strategic move for Canadian businesses.

Read MoreCorporate Cards

Instant Corporate Card Issuance: How to Get Cards in Minutes, Not Days

Ready to equip your team to spend quickly while minimizing risk? Cue instant corporate card issuance.

Read MoreCorporate Cards

On-Demand Virtual Cards: Revolutionizing Business Payments

On-demand virtual cards are a game changer for businesses wanting to move quickly—learn how to get set up today.

Read MoreHow Viva Reclaimed 8 Hours of Financial Admin Monthly with Float

See how Float helped unlock Viva’s finance team from overwhelming manual expense tracking and approvals with a more modern solution.

Read MoreCorporate Cards

How Corporate Card Programs Deliver ROI for Canadian Companies: Measuring Financial Impact

When every dollar matters, the right payment solution can help you grow—and a smart corporate card program is your first step.

Read MoreHow Holistic Roasters Streamlined Spending and Bookkeeping with Float

See how this growing coffee business streamlined expense tracking by replacing fragmented systems and personal card use with Float.

Read MoreHow a 3-Person Team Saved 3+ Hours a Month by Switching to Float

Built-Environment Signage & Décor cut reconciliation time from half a day to under an hour using Float. With 20+ virtual cards, automated receipts, and QuickBooks integration, their lean team runs a smooth, finance-ready operation—no extra admin required.

Read MoreFinancial Controls & Compliance

GST/HST Tracking in Canada: Why It Matters and How Float Simplifies the Process

Learn how GST/HST tracking works in Canada, why it’s essential for your business, and how Float automates the process to save you time.

Read MoreCorporate Cards

How to Get Approved for a Virtual Corporate Card as a New Business (Without Hurting Your Credit Score)

Looking to add a virtual corporate card to your wallet without messing with your credit score? This guide is for you.

Read MoreCorporate Cards

What Your CFO Wishes You Knew About Pre-Spend Controls

CFO Vinnie Recile shares what every business leader should know about pre-spend controls—a proactive approach to spotting and stopping risky expenses before they spiral into costly, morale-draining problems.

Read MoreCorporate Cards

Establishing a Business Credit Card Policy: Key Steps

Thomas-Louis Lafleur, CPA, shares his go-to steps for building a business credit card policy that keeps spending smart and scalable.

Read MoreHow Andgo Systems Saved $2.5K and 20+ Hours Per Month with Float

Before switching to Float, Andgo’s finance stack relied on a patchwork of disconnected tools—separate solutions for payment processing, receipt collection, US contractor reimbursements and even transaction coding into Xero.

Read MoreCorporate Cards

Corporate Cards for Small Canadian Businesses: Benefits and Implementation Guide

Managing business spending shouldn’t be a constant source of stress—especially when the right tools can make it easier.

Read MoreCorporate Cards

Physical vs. Virtual Corporate Cards: Pros, Cons & Best Use Cases

Let’s break down the pros, cons and best use cases for virtual and physical corporate cards so you can take advantage of corporate card benefits.

Read MoreCorporate Cards

When to Opt for Corporate Cards Over Personal Cards

This guide will help you evaluate corporate cards vs personal cards and, just as importantly, how to switch your company spending habits.

Read MoreCorporate Cards

Who on Your Team Should Have a Corporate Credit Card?

Get help cutting through card confusion with us breaking down how to decide who gets a card and how to protect your business.

Read MoreExpense Management

Automating Conference Expense Management for a Smoother Workflow

Explore how finance teams can empower employees to spend confidently, how they can prepare smartly for business travel and how Float can help.

Read MoreProduct Education

Float Reimbursements: A Setup Guide for Finance Teams

Everything you need to confidently roll out Float Reimbursements across your company.

Read MoreExpense Management

Best Practices for Ensuring Expense Policy Compliance

Tired of chasing receipts? Get smart, drama-free tips to tighten your expense policy.

Read MoreExpense Management

Smart Receipt Management: Tips for Timely Receipt Submission on Corporate Cards

Managing corporate card receipts might not sound thrilling, but getting it right is crucial for keeping your business running smoothly.

Read MoreExpense Management

Top 6 Reimbursement Solutions for Canadian Companies

Don’t let an out-of-date reimbursement solution slow you down. Here are six options that bring your business to the modern age.

Read MoreExpense Management

Top Ways to Reduce Time Spent on Your Expense Report Management

Expense report management shouldn’t be taking up countless hours—here are six methods to improving your processes.

Read MoreExpense Management

How Do You Reconcile Corporate Card Statements Efficiently?

Improve your credit card reconciliation process to manage spend, catch errors and stay audit-ready with these tips.

Read MoreExpense Management

The Best Expensify Alternatives for Canadian Finance Teams

Explore the top Expensify alternatives for Canadian finance teams. Compare features, pricing, and what’s the leading choice in 2025.

Read MoreCorporate Cards

Should Employees Use Personal Credit Cards for Work?

Explore the risks of personal card use for business and learn smart, practical steps to roll out corporate cards with confidence.

Read MoreHow Alvéole saved over $4,000/month and streamlined expense management with Float

When Jessica De Fanti Teoli joined Alvéole’s finance team, she inherited a fragmented spend management setup. Concur handled reimbursements—but at a steep price and with frustrating complexity.

Read MoreCash Flow Optimization

The Hidden Cost of FX Fees: Why Businesses Should Pay Attention

FX costs quietly erode revenue and reduce the profitability of your international transactions. Here’s what to do about it.

Read MoreCorporate Cards

Credit Cards for Business Travel: Top Picks for Canadian Companies in 2026

Find the best business travel credit card Canada has to offer and make travel expense tracking a breeze.

Read MoreCorporate Cards

Best Credit Card for Startup Businesses in Canada

Discover the best credit card for startup businesses in Canada, with top picks, perks, and tips to manage spend and support your growth.

Read MoreFinancial Controls & Compliance

Filing Small Business Taxes for the First Time in Canada? Start Here

Filing small business taxes for the first time in Canada? Learn how to file business taxes, understand tax rates and avoid common mistakes with this step-by-step guide.

Read MoreExpense Management

Best Expense Management Software for Canadian Businesses

Explore key features of the best expense management software options for Canadian companies, and find out how to determine which tool is right for you.

Read MoreFinancial Controls & Compliance

Top 10 Small Business Deduction and Expenses to Claim in 2026

Discover the top 10 small business tax deductions for filing in 2025. Learn how to maximize your savings and reduce taxable income with these essential deductions.

Read MoreCash Flow Optimization

How to Read Your Business Cash Flow Statement

Master cash flow statements with our how-to guide. Learn to analyze this important business finance document to make informed decisions and drive success.

Read MoreExpense Management

Best Business Expense Tracker for Small Businesses in Canada

Discover top tips for choosing the right expense tracking software for your small business.

Read MoreCash Flow Optimization

10 Cash Flow Problems (and Solutions) for Small Businesses

Explore 10 common cash flow problems small businesses face and discover practical solutions to manage and improve your finances effectively.

Read MoreIndustry Insights

How Companies Are Using AI in Canada: Industry Trends, Tools and Costs

Discover how Canadian businesses are using AI across industries, the most popular AI tools, and what companies are spending on AI. Get key insights from real-time transaction data.

Read MoreExpense Management

Expense Management Explained: Best Practices for Canadian Businesses

Whether you’re a startup or an established business, having a robust expense management system can significantly impact your bottom line. Learn more here.

Read MoreCash Flow Optimization

Understanding FX Fees: Save on CAD to USD Conversions

Discover how to minimize FX fees on CAD to USD conversions. Learn tips and strategies to save money and optimize your currency exchanges

Read MoreCash Flow Optimization

What is Accounts Payable? Your Guide to a Modern AP Process

Everything you need to know about accounts payable and how modern AP automation, corporate cards and expense management can streamline your business spending.

Read MoreCorporate Cards

How to Set Up a Corporate Card Program

Learn how to set up a corporate card program that streamlines expenses, boosts control, and empowers your team without headaches.

Read MoreCorporate Cards

Corporate Credit Cards in Canada: A Practical Guide for Businesses

Discover how corporate credit cards work in Canada. Types, perks and how to find the best ones for your business.

Read MoreProduct Education

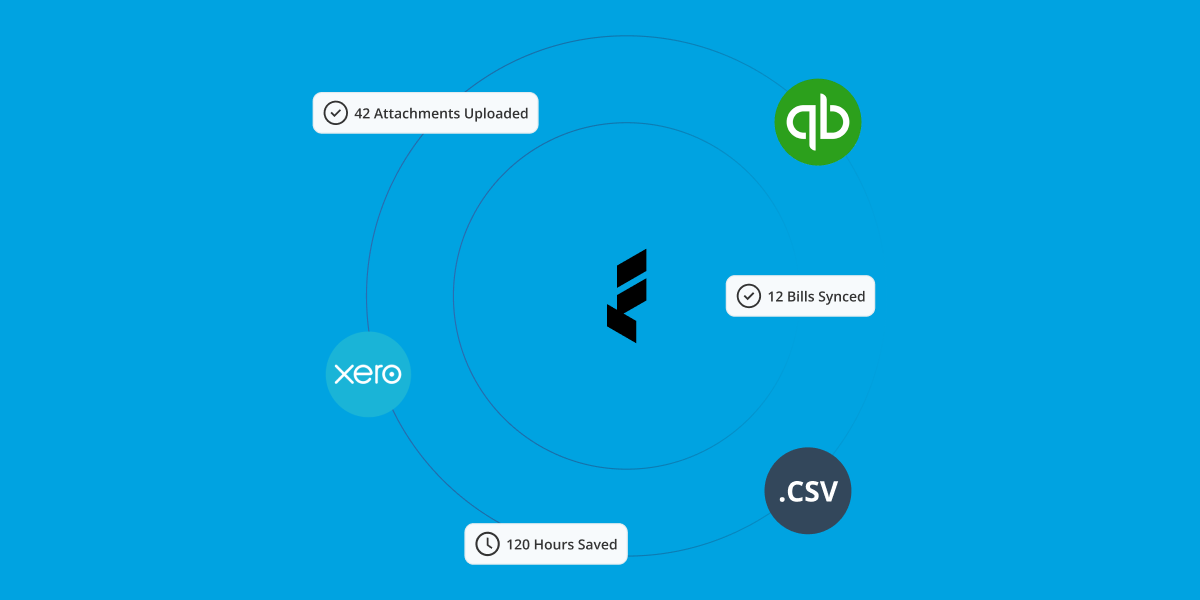

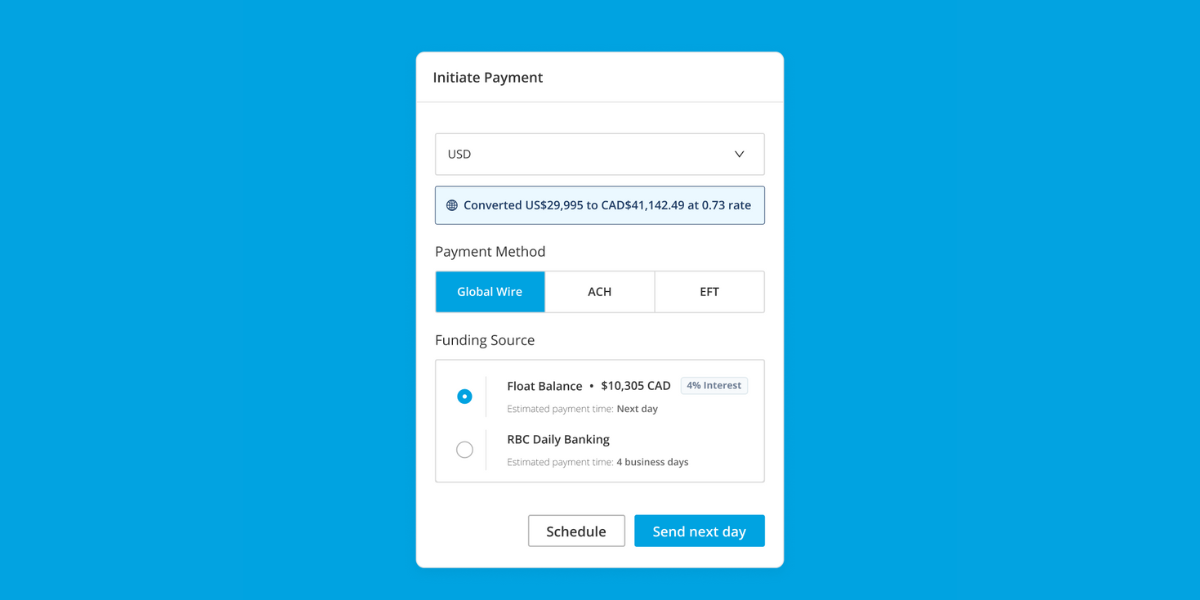

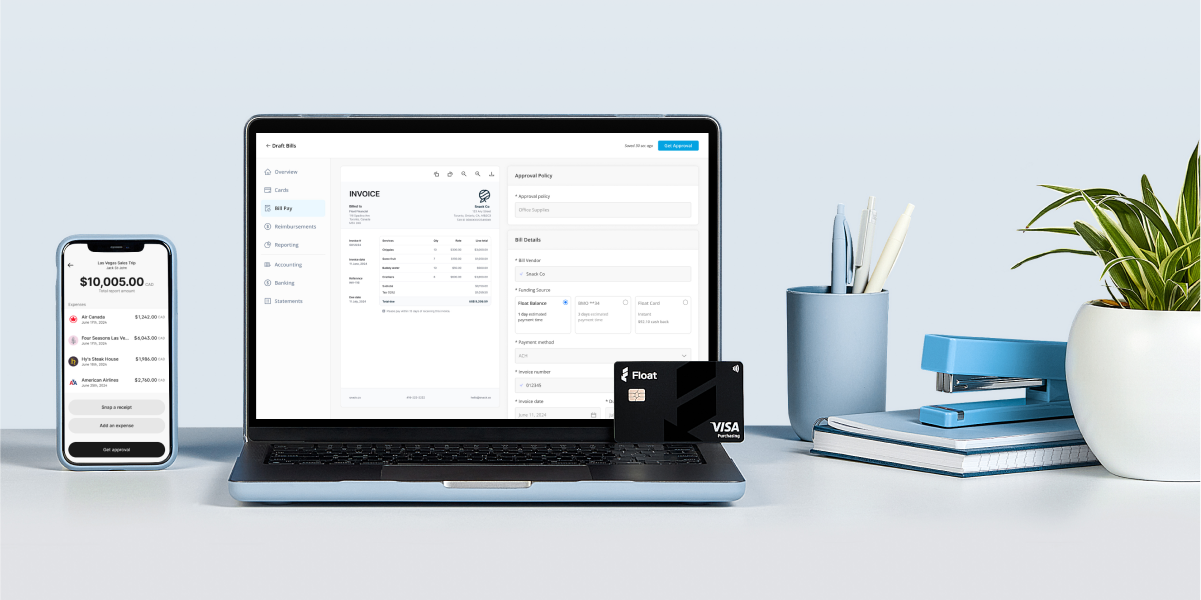

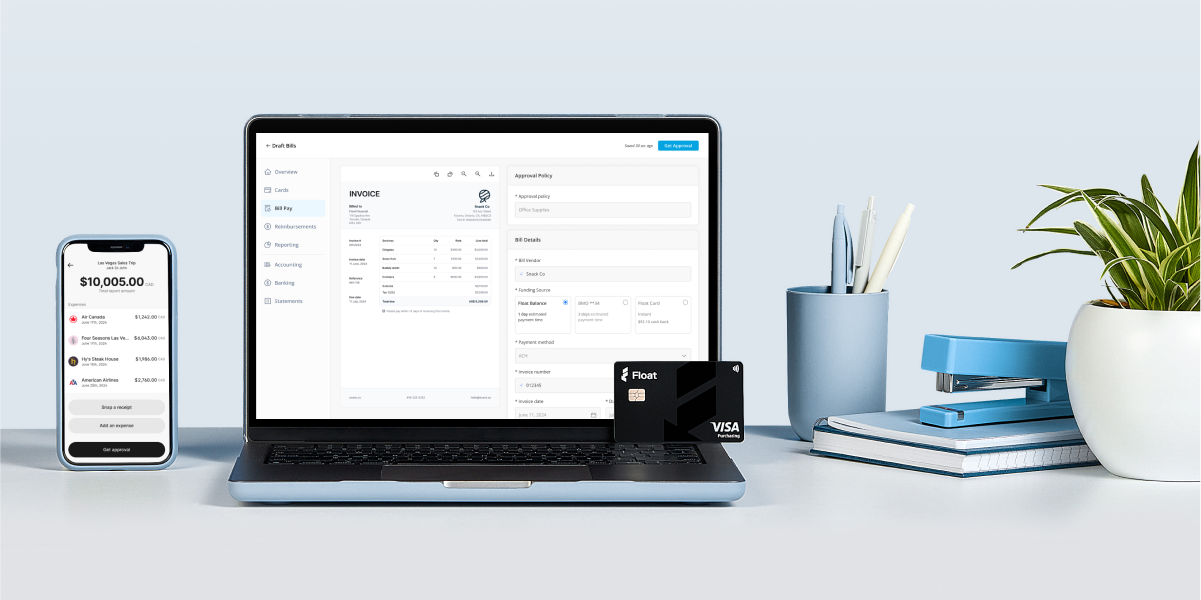

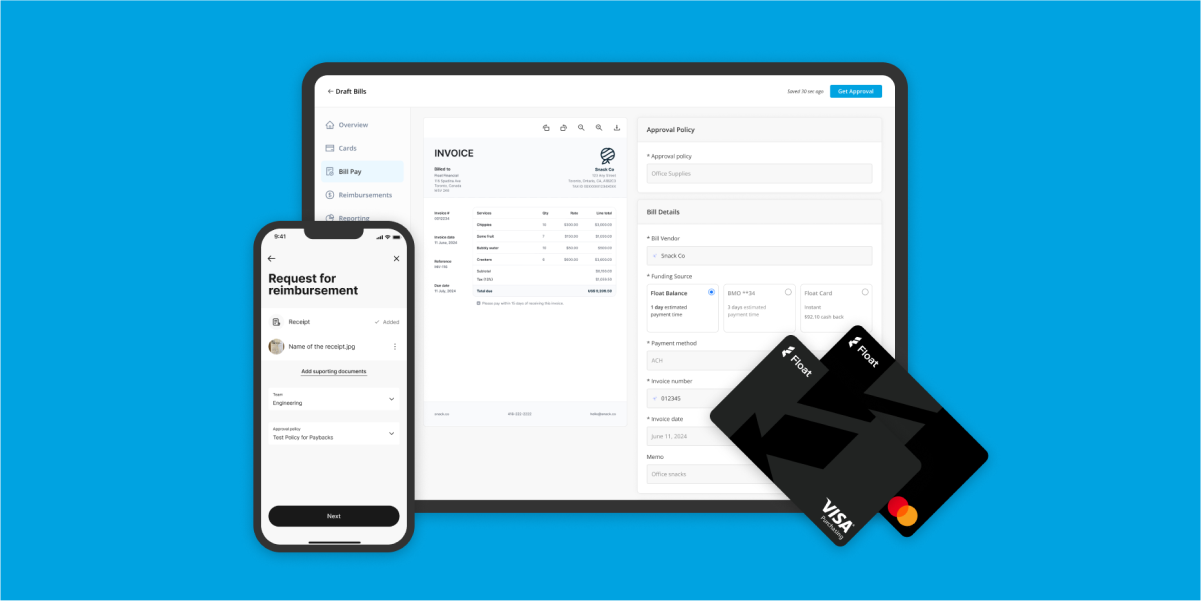

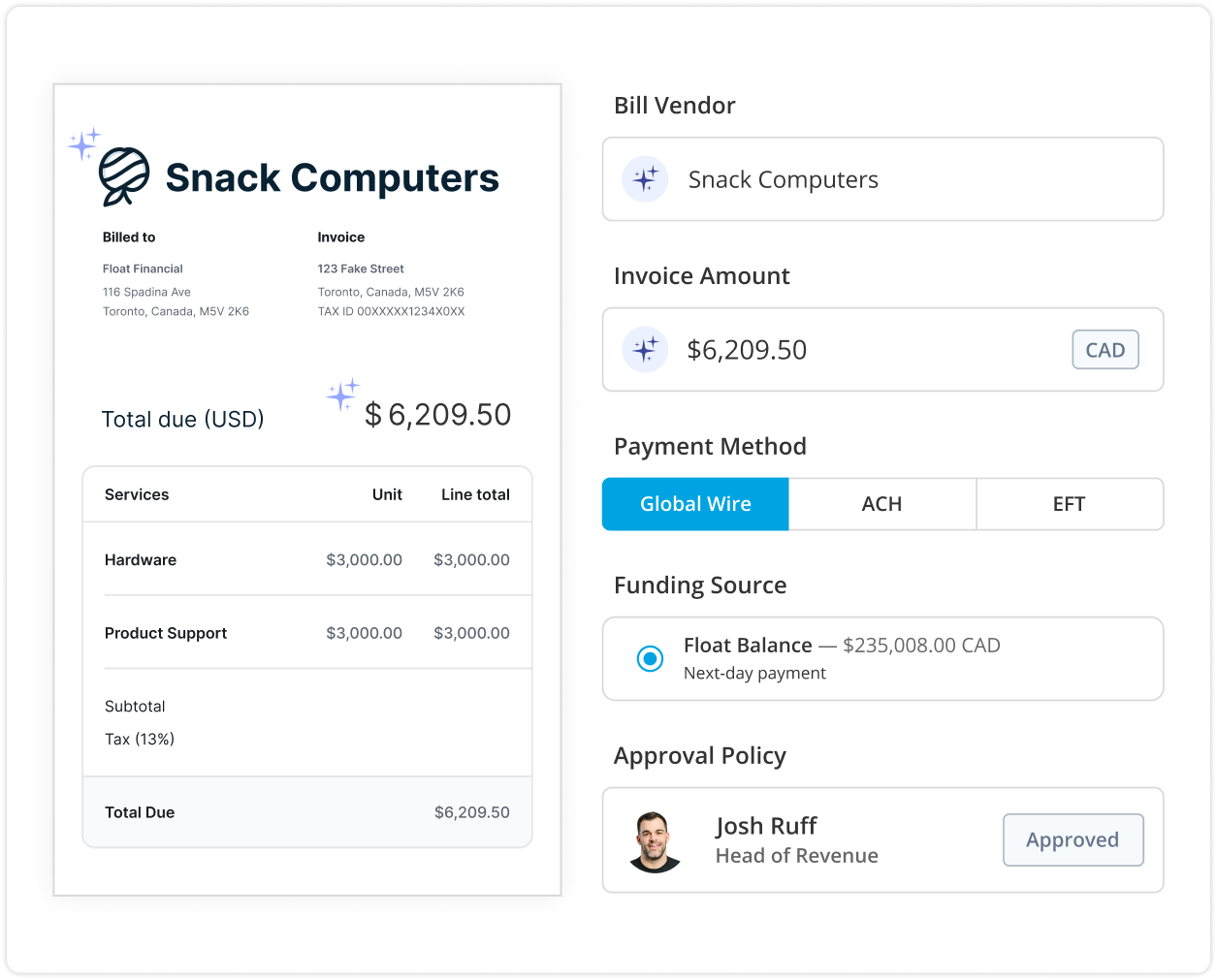

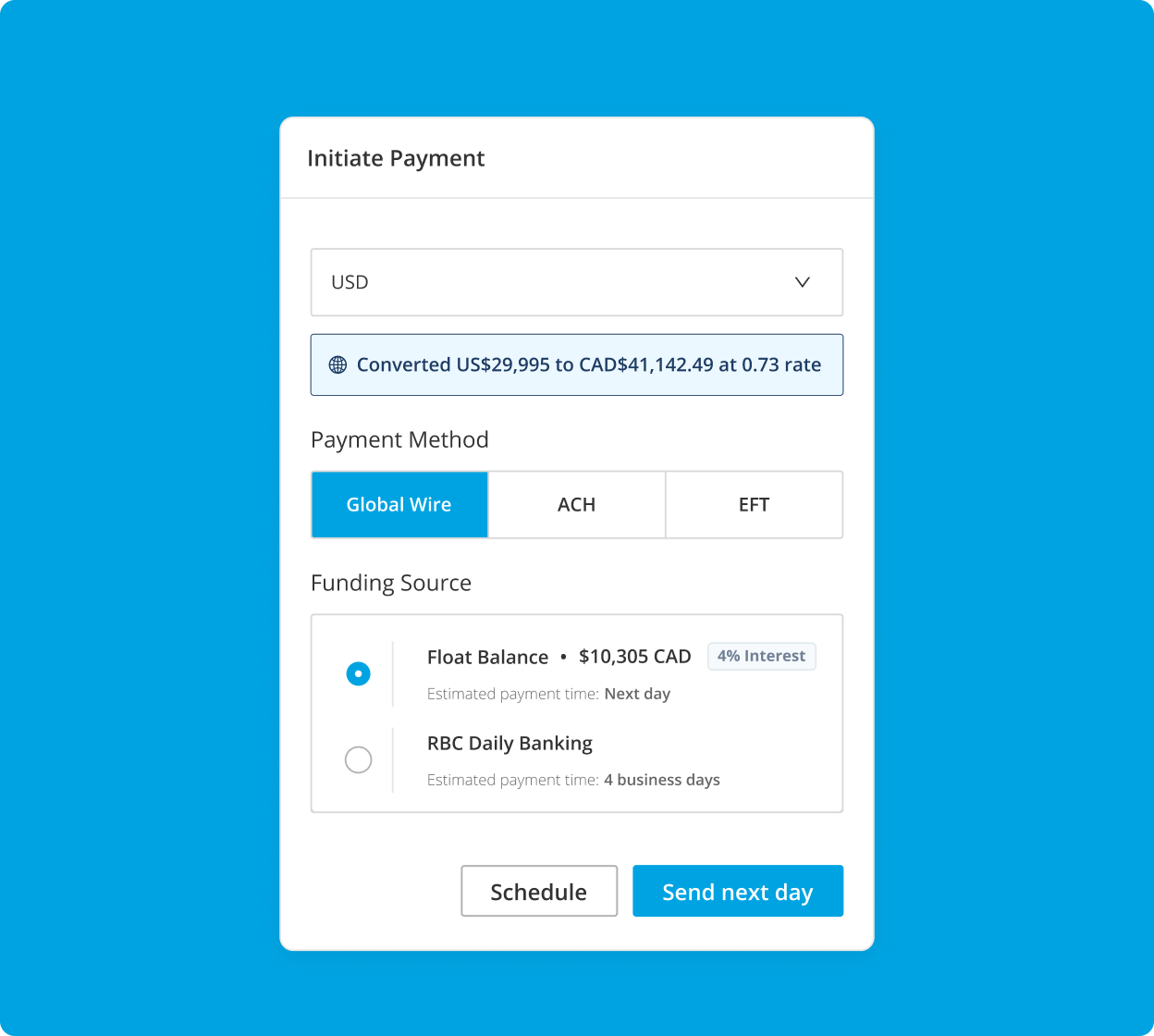

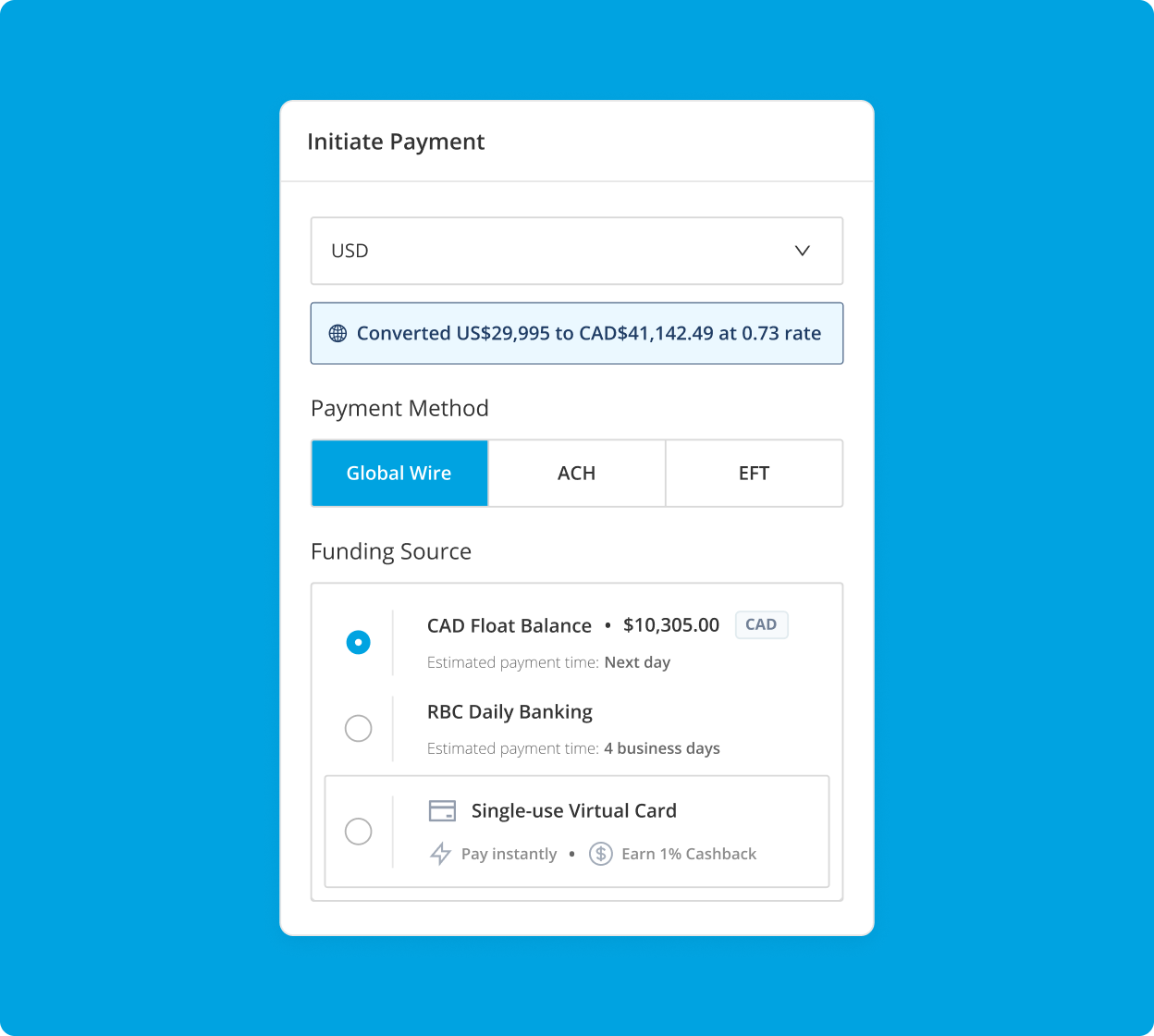

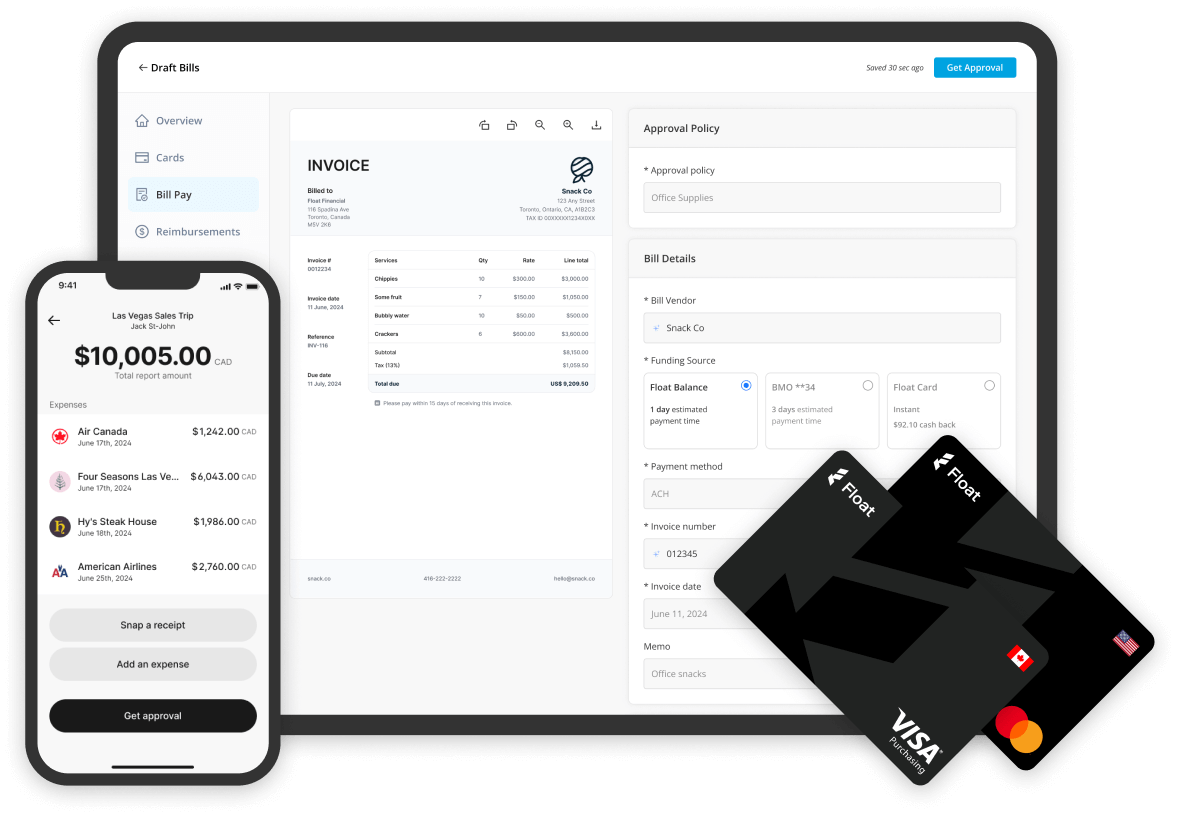

New! Bill Pay and Reimbursements

Float is the first business finance platform in Canada to offer an end-to-end solution that simplifies all non-payroll spending.

Read MoreDigital Transformation

Top five MUST LISTEN Finance Podcasts in Canada

Looking for interesting Finance Podcasts in Canada? We’ve curated a list of our 5 favorite podcasts that talk about everything from corporate finance to early stage startups.

Read MoreFinance Team Efficiency

Ultimate Guide for Bookkeeping Services in Canada

Learn costs, benefits, and tips for choosing the right financial partner for your company.

Read MoreExpense Management

What is an Expense Reimbursement? Definition and Benefits

Learn how Reimbursements work, which expenses are reimbursable, and the best, fully automated, and free solution available in Canada.

Read MoreCorporate Cards

Unlocking Benefits: How to Get a Virtual Credit Card for Your Canadian Business

Discover how your Canadian business can benefit from a virtual credit card. Unlock convenience, security, and smarter spending today with our expert guide!

Read MoreCash Flow Optimization

How to Efficiently Pay Invoices as a Canadian Business

Discover efficient strategies for Canadian businesses to pay invoices on time. Streamline your processes and improve cash flow with expert tips from Float.

Read MoreCash Flow Optimization

Step-by-Step Guide to ACH Payments for Canadian Companies

Discover our step-by-step guide to ACH payments for Canadian companies. Simplify your payment processes and improve cash flow with Float’s expert tips!

Read MoreCorporate Cards

Understanding Credit Cards, Charge Cards and Secured Cards

Explore the differences between credit cards, charge cards, and secured cards. Learn how each option can benefit your financial journey with Float.

Read MoreHow Wahi’s Finance Team got 76% More Time Back

As an innovative real estate brokerage, Wahi is tech-forward when it comes to helping Canadians buy and sell homes quickly, easily, and cost-effectively. But behind the scenes, Wahi was stuck in an old-school cycle of managing employee expenses and bookkeeping.

Read MoreHow Float Eliminated 96% of Coastal Reign’s Repetitive Bookkeeping Tasks

But despite the expansion, team members still shared one single traditional bank card for expenses, resulting in confusion, stress, and countless hours of follow-up when it came to closing the books at month-end.

Read MoreHow Makeship Found Multi-currency Freedom with Float

As a company known for its ability to help creators quickly scale and monetize, Makeship needed a corporate card solution that was as innovative and flexible as they were.

Read MoreProduct Education

Pay Your Bills on Float with Bill Pay

The 3 Top Takeaways from the “More Ways to Pay in Float” Bill Pay Webinar

Read MoreCash Flow Optimization

3 Effective Strategies to Speed Up Accounts Payable

Discover 3 strategies to streamline the accounts payable process, enhance cash flow, and improve supplier relationships with Float’s tips.

Read MoreFinancial Controls & Compliance

Bookkeeping Best Practices: How Often to Audit Your Books

Discover essential bookkeeping best practices and learn how often you should audit your books to ensure financial accuracy with Float.

Read MoreCash Flow Optimization

Steps to Increase Your Business Credit Card Limit Effectively

Discover steps to increase your business credit card limit. Boost your financial flexibility and fuel your growth with our expert tips!

Read MoreFinancial Controls & Compliance

Step-by-Step Guide to Registering for HST/GST in Canada

Navigate the HST/GST registration process in Canada with our guide. Simplify your business compliance and start saving time today!

Read MoreFinancial Controls & Compliance

When to Register for HST as a Small Business Owner in Canada?

Discover when to register for HST as a small business owner in Canada. Learn the benefits, requirements, and steps to take today!

Read MoreProduct Education

Get Fast Transfers to Float

Reliable access to funds in Float with fast one business day transfers.

Read MoreIndustry Insights

The SMB Manifesto

Canadian small businesses fuel our economy, but outdated financial systems are holding you back. You deserve tools and services designed with your needs in mind. It’s time for a financial system that truly supports SMBs to lead and succeed.

Read MoreCorporate Cards

Top Five Use Cases for Virtual Cards in Canadian Businesses

Discover the top 5 use cases for virtual cards in Canadian businesses. Streamline expenses, enhance security, and boost efficiency with Float’s solutions.

Read MoreCash Flow Optimization

How to Pay Invoices from the Philippines: A Step-by-Step Guide

Learn how to pay Invoices from Philippines as a Canadian Business and innovative solutions, like Float, that you can use for free to send Global Wires.

Read MoreCash Flow Optimization

How to Pay Invoices from the EU: A Step-by-Step Guide

Learn how to pay Invoices from EU as a Canadian Business and innovative solutions, like Float, that you can use for free to send Global Wires.

Read MoreCash Flow Optimization

How to Pay Invoices from India: A Step-by-Step Guide

Learn how to pay Invoices from India as a Canadian Business and innovative solutions, like Float, that you can use for free to send Global Wires.

Read MoreExpense Management

How To Choose the Right Expense Reporting Solution in 2024

Learn how to evaluate Expense Reporting solutions available on the market and which is the best Free solution that you should consider today.

Read MoreCash Flow Optimization

How to Pay an Invoice from Mexico: A Step-by-Step Guide

Learn important requirements when it comes to paying Mexico invoices and innovative solutions available on the market, like Float, that you can use for free.

Read MoreCash Flow Optimization

How to Pay an Invoice from the UK: A Step-by-Step Guide

Learn important requirements when it comes to paying UK invoices and innovative solutions available on the market, like Float, that you can use for free.

Read MoreExpense Management

How Expense Management Can Transform Canadian Enterprises

Learn how expense management solutions can transform your business operations. Know what to look for when choosing the right solution for your business.

Read MoreCash Flow Optimization

How to Pay Invoices from the US: A Step-by-Step Guide

Learn important requirements when it comes to paying US invoices and innovative solutions available on the market, like Float, that you can use for free.

Read MoreFinance Team Efficiency

Best Accounts Payable Platform in Canada in 2024

Discover the Best Accounts Payable Platform in Canada in 2024. Streamline your AP process, reduce errors, and boost efficiency with cutting-edge software. Compare features, pricing, and benefits to find the perfect fit for your company

Read MoreCorporate Cards

Why You Should Consider Prepaid Business Credit Cards in Canada

Discover the pros and cons of prepaid business credit cards in Canada. Learn how they work, top options, and if they’re right for your company’s financial strategy.

Read MoreCase Studies

How BenchSci Saved 40+ Hours a Month Streamlining Spend Management with Float

Trailblazing AI firm, BenchSci shares why they chose Float for secure spend management at scale.

Read MoreCase Studies

Health and Wellness SaaS Company Practice Better Closes the Books 6x Faster with Float

How the growing startup Practice Better leveraged Float to bring their spend management and bookkeeping in-house.

Read MoreCase Studies

Creative Production Company Makers Chooses Float to Scale Spend Management

Makers shares how they cut their time spent reconciling transactions in half while empowering spend across the company’s project teams.

Read MoreProduct Education

Simple Pricing for Your Stage of Growth

Choose the Float plan that works best for your stage of growth (or figure out when it’s time to upgrade).

Read MoreFinance Team Efficiency

Accounting Automations for Canadian Finance Teams

Unlock the power of automated accounting to drive growth and accuracy in your financial processes. Save time and money with Float.

Read MoreCorporate Cards

A Better Way to Manage your Company Subscriptions with Float

Learn how to audit and manage your company software subscriptions with Float

Read MoreCase Studies

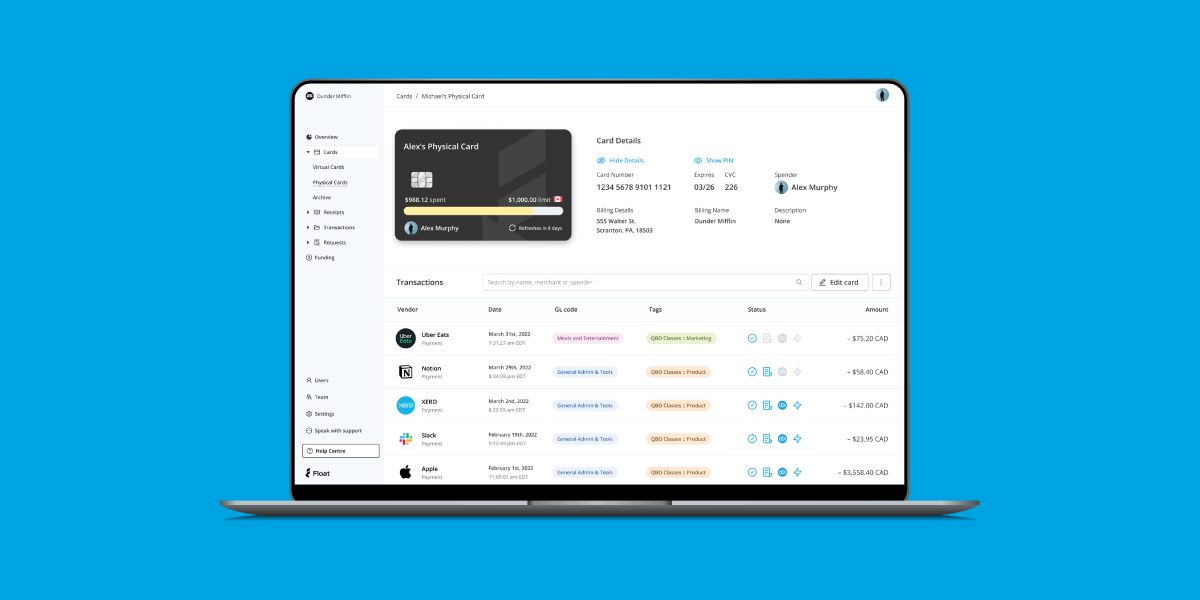

Seeking a Modern Solution: Fresh Tracks Canada Explores New Ways to Manage Spend

The travel agency turned to Float to drive efficiencies while empowering teams to spend across the company.

Read MoreProduct Education

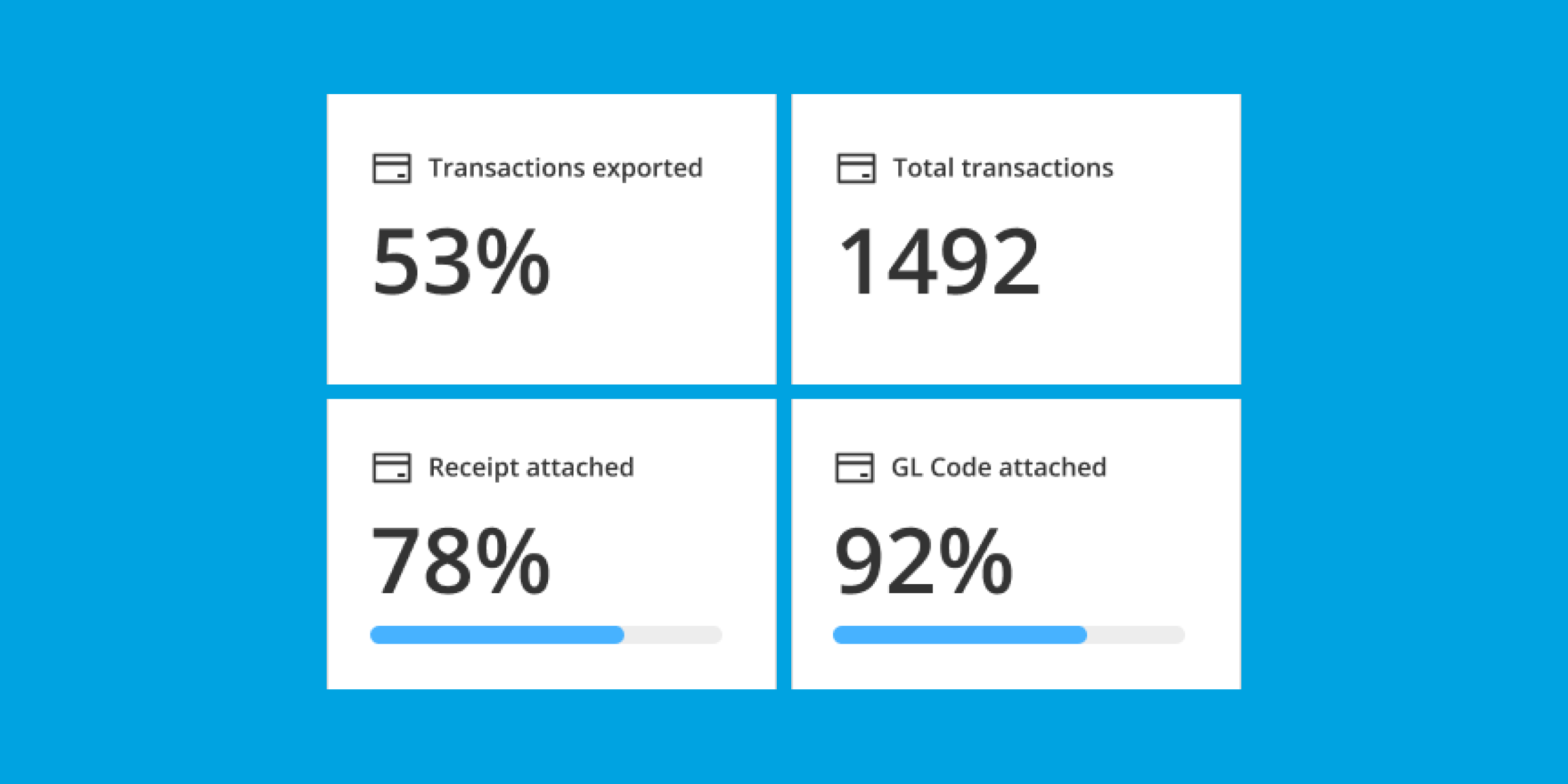

Get export-ready faster with Float’s Accounting Workboard

Save on time and unwanted spend each month-end as you close the books.

Read MoreProduct Education

Find Efficiency with Float’s Accounting Hub

A dedicated space to quickly review, automate, and export transactions at scale.

Read MoreProduct Education

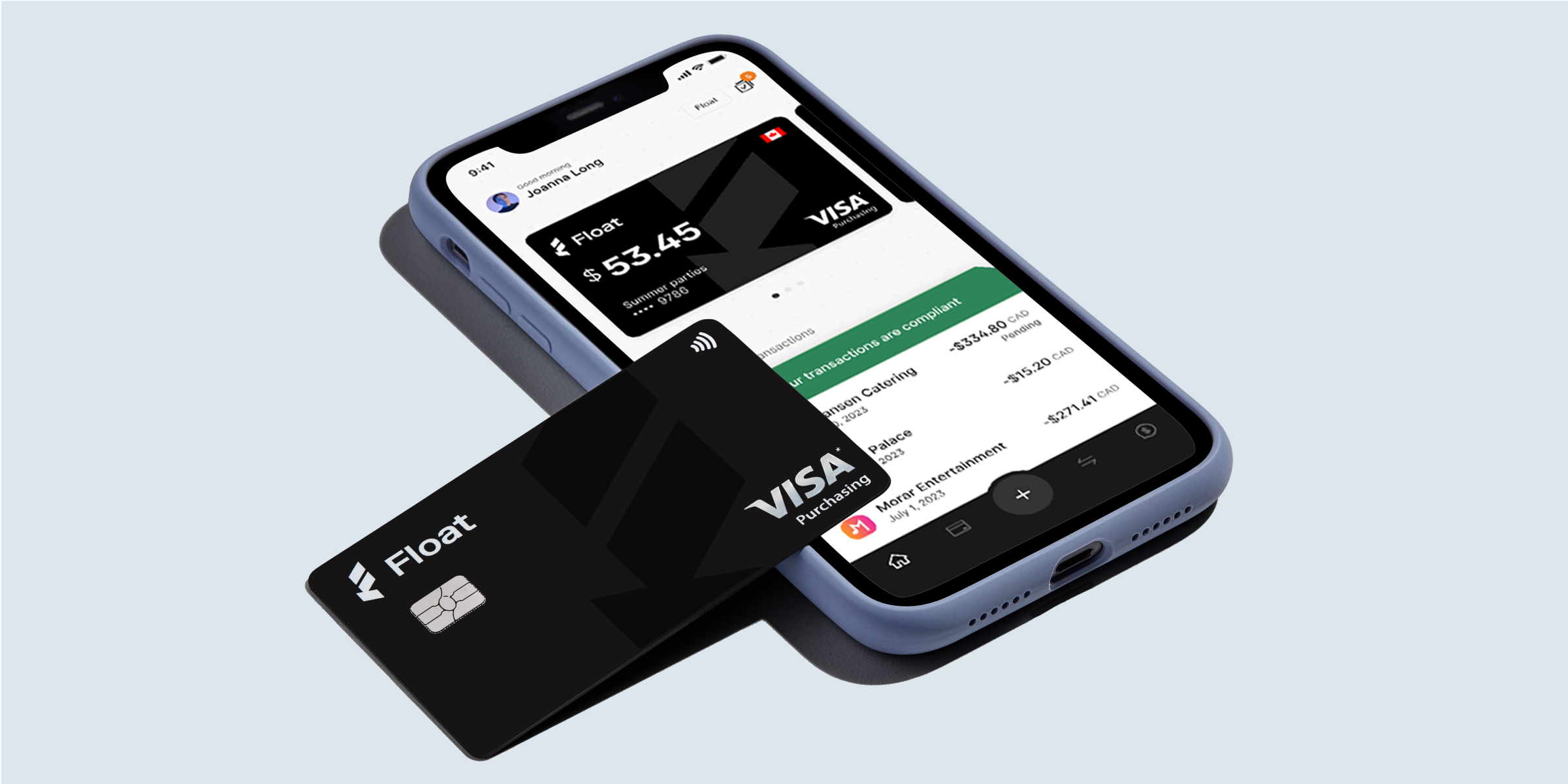

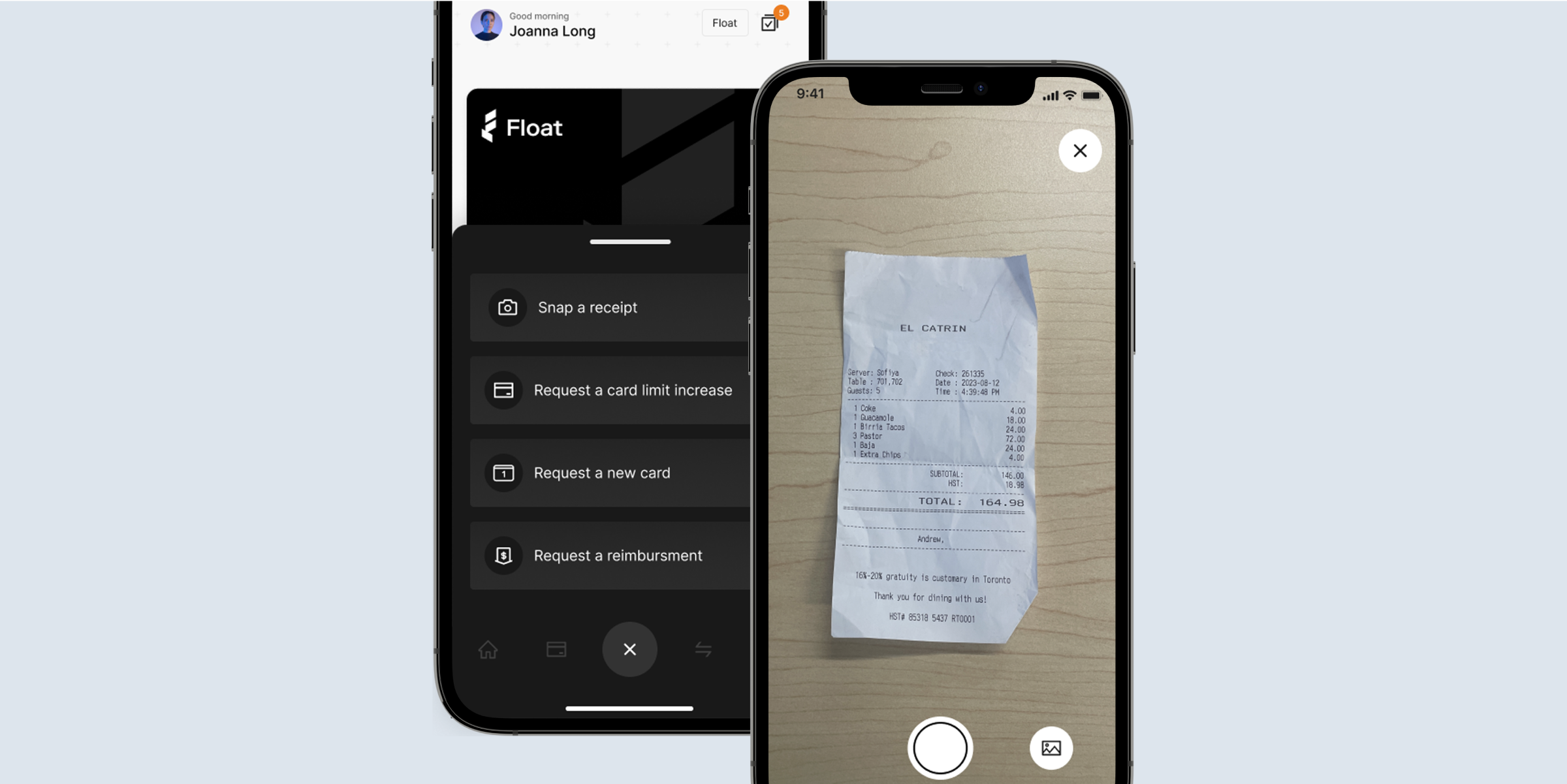

Introducing the Float Mobile App

Take your business spending on-the-go. Request new cards and reimbursements, capture receipts, and understand your spending power at a glance.

Read MoreProduct Education

The Month-End: November

What’s new at Float? Last month we launched our new Notifications Centre, earnings for Float Yield took effect, and we received our PCI-DSS certification. Read about it here.

Read MoreProduct Education

PCI-DSS: From Compliance to Certification

Learn about our dedication to safeguarding sensitive data with our recent PCI-DSS certification audit and new spend control features.

Read MoreProduct Education

Float Launches Canada’s First High-Yield Product To Help Canadian SMBs Navigate Inflation Challenges

Earn up to 2.7x the interest rate on CAD and USD balances vs traditional banks

Read MoreProduct Education

The Month-End: October

What’s new at Float? Last month we expanded access to Transaction Splits, introduced new custom features to the Accounting Hub, and announced our much-anticipated mobile app. Catch up on these latest game-changers.

Read MoreCase Studies

Feeding Efficiency: Fresh Prep Scales Their Spend Management with Float

As the meal-kit provider expanded operations, they turned to Float for a scaleable solution to manage company spend and empower employees nationally.

Read MoreCase Studies

SPI Logistics Chose Float to Bring Their Vendor Payments Into the Digital-Age

How the leading logistics firm saves thousands per year (while tackling risk) by digitizing their vendor payments.

Read MoreProduct Education

The Month-End: September

What’s new at Float? Last month we revamped the Accounting Hub, enhanced our customers’ funding experience, and introduced Reimbursements. Catch up on these latest game-changers.

Read MoreCase Studies

Black Feather Does Expense Management Differently with Float

How a Canadian wilderness adventure company transformed their expense reimbursement process with smart corporate cards for the whole team.

Read MoreProduct Education

New! Simplify Employee Reimbursements with Float

Simplify your team spending by keeping it all in one place (including employee reimbursements).

Read MoreCorporate Cards

3 Ways to Simplify Corporate Spend with Mobile Wallets

Learn how to enable team spend (with control) through smart corporate cards integrated with mobile wallets.

Read MoreProduct Education

Control Employee Expenses with Float’s Latest Features

From Dynamic Approvers to a new HRIS Integration, Float’s latest features were built in Canada with ❤️

Read MoreProduct Education

What Makes Float Uniquely Canadian

Learn what sets Float apart as the modern business spending platform for Canadian finance teams.

Read MoreProduct Education

It’s Official – Float is SOC 2 Type 2 Certified

Learn about our commitment to security and trust at Float with our recent SOC 2 Type 2 compliance audit and new spend control features.

Read MoreProduct Education

Introducing Float Cards 2.0

Meet the next generation of Float Cards that let you top-up card balances as purchases need to be made for worry-free company spending.

Read MoreProduct Education

Spend Less with Float’s Savings Insights

Get monthly suggestions on how to cut waste and save money on your company’s software spending.

Read MoreProduct Education

Get financial visibility with Float’s latest Reporting feature

Make data-driven decisions that drive savings with real-time visibility into company spending.

Read MoreProduct Education

New! Transaction splits

Easily split card transactions and allocate different amounts to different accounts directly in Float ✂️

Read MoreCase Studies

PolicyMe Turns to Float for Smarter Spend Management

PolicyMe needed a solution that gave them greater power and oversight over spending in their organization.

Read MoreProduct Education

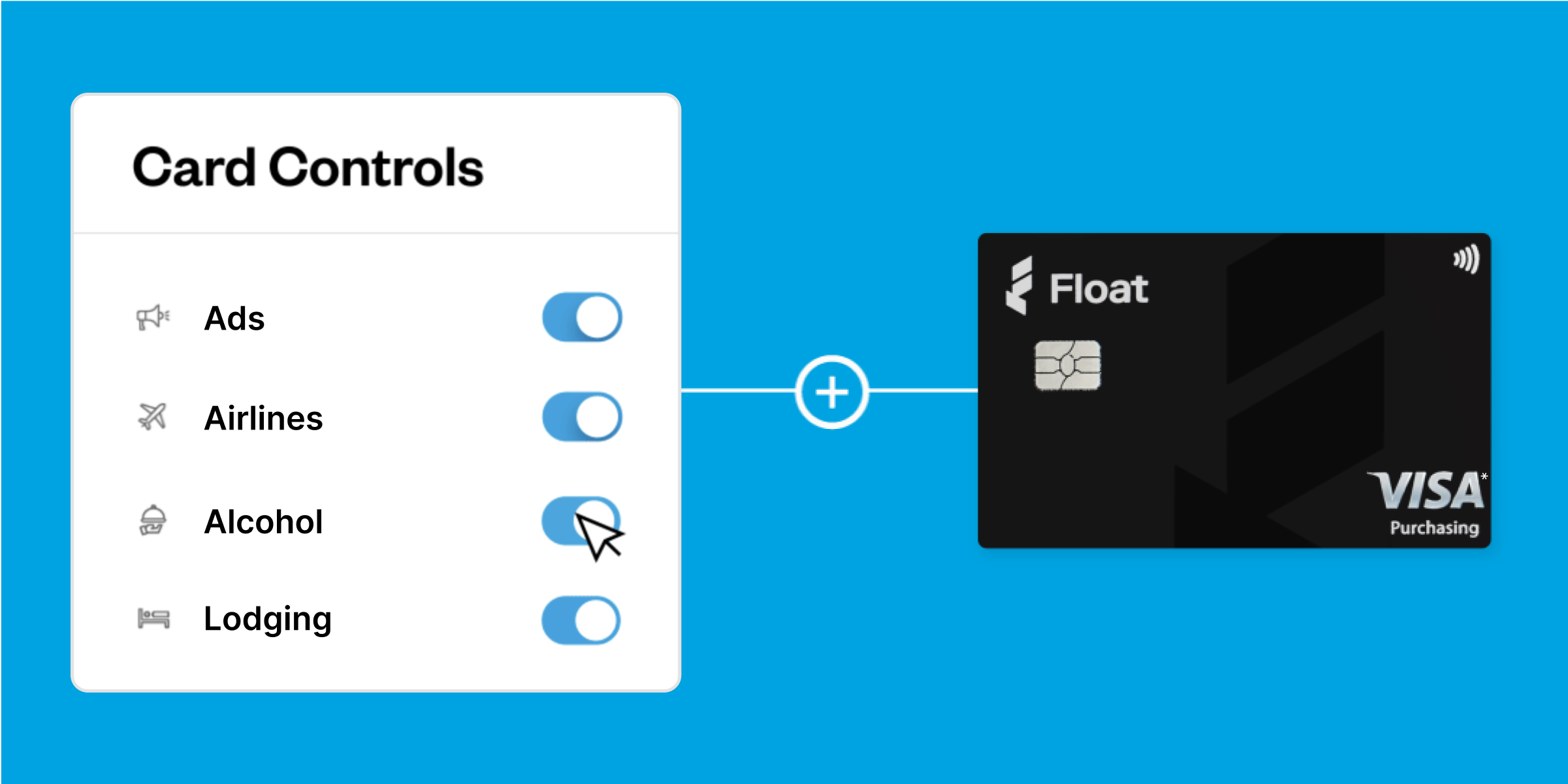

Introducing Merchant Controls

Issue cards to employees worry-free by limiting their transactions to approved merchant categories.

Read MoreCorporate Cards

Maximizing Security with Float: 5 Proven Tips

Our Risk team’s round up of important tips to help keep your account and cards safe.

Read MoreProduct Education

Float’s 2022 Product Roundup

As we close the books for 2022, it’s a great time to look back on what was accomplished and to create goals for the year ahead.

Read MoreCase Studies

How Athennian Streamlines, Simplifies and Scales with Float

With a lean finance team and rapid employee growth this past year, Athennian knew they needed to level up their internal spend and expense management process.

Read MoreProduct Education

Introducing Canada’s smartest corporate card for USD spending

Corporate spending just got a whole lot easier! You can now easily manage your USD and CAD transactions all in the Float platform.

Read MoreFinancial Controls & Compliance

How Float Simplifies Financial Audits

Audits don’t have to be spooky. 👻 Our automated financial controls are designed to set you up for success and make this commonly dreaded process a lot less stressful.

Read MoreExpense Management

How Float makes expense reports a thing of the past

Wondering how to submit your expense reports in Float? Hint: You don’t! 😉 We’ve got something better and more efficient for you.

Read MoreFinance Team Efficiency

4 Signs Your Company is Outgrowing its Accounting Software

Is your accounting software holding you back? Discover four telltale signs it’s time to upgrade. Learn how to spot inefficiencies, scale your finances, and boost your business growth with the right tools.

Read MoreProduct Education

New! Float SAML SSO Login

Set up SAML Single-Sign On for improved account security with Float.

Read MoreProduct Education

New! Sync your expenses and receipts from Float to NetSuite

Float allows you to export transactions already coded and embedded with receipts directly to NetSuite.

Read MoreCase Studies

How Forma.ai Found True Financial Autonomy With Float

When a single corporate credit card could no longer cut it, Forma.ai turned to Float and began to experience financial autonomy once and for all.

Read MoreExpense Management

Best Receipt Inbox Solution to Minimize Employee Chasing

Minimize Employee Chasing with a Better Receipt Inbox Solution. Float is putting an end to missing receipts and massive submissions at month-end.

Read MoreExpense Management

Modern Expense Policy Guide

Understand how to revolutionize your business spending by tapping into the benefits of a modern company expense policy. With help from real-world examples, you’ll learn the types and key components of a great travel and expense policy—and discover how to streamline your expense management process with the help of automation.

Read MoreCase Studies

How Klue Found Its Way to Better Spending

An interview with Adrian Pape, VP Finance at Klue.

Read MoreProduct Education

Dynamic Duo: Submission and Approval Policies

Use Float to automate your company’s expense policies for greater financial control.

Read MoreExpense Management

Marketing Expense Policy: How Float Helps Marketing Teams Spend Smarter

Learn how Float enables a Marketing Expense Policy that actually works for your team. Stay in budget, issue virtual cards to each team member, get real-time visibility into your spending

Read MoreProduct Education

Float’s New Smart Corporate Cards Are Here!

Looking for a smarter, more professional way to spend? Float’s new smart (physical) corporate cards have arrived!

Read MoreExpense Management

New Survey Reveals Pain Points in Spend Management

Angus Reid survey of Canadian Finance leaders reveals operational bottlenecks

Read MoreCorporate Cards

Five Easy Ways to Achieve Business Savings with a Corporate Card

Discover five easy ways to achieve savings for your business by picking the right corporate card solution. Earn cashback and interest, minimize FX costs, decrease inefficiencies

Read MoreProduct Education

A Guide to Setting Up Teams and Multi-level Approvals

Use Float’s Team Management feature to set team-level and multi-level approval policies.

Read MoreProduct Education

How It Works: Float’s QBO Integration

Float offers a powerful two-way integration with QBO.

Read MoreFinance Team Efficiency

Float Bookkeeper Guide

If you are a Bookkeeper that has a client (or hopefully clients!) using Float, this guide is for you! Learn about how to export Float transactions to your accounting software.

Read MoreExpense Management

Why Better Corporate Spending Starts With Strong Policies

They say if you follow all the rules, you miss out on all the fun. But when it comes to your financial policies, you’ll want to ensure your team knows every single one!

Read MoreCase Studies

Float and Letterbox Doughnuts Make for the Sweetest Combo

Letterbox Doughnuts was growing fast, but with all that dough coming in they needed a solution to keep up a pace with all their expenses. Donut worry, Float saved the day!

Read MoreCorporate Cards

Why You Should Create a Separate Card for Each Vendor

Overcharged and Overwhelmed? Not on our watch. Float has designed a feature that allows you to easily manage transactions from ALL your vendors.

Read MoreProduct Education

3 Float Hacks You Should Know

Ready to level up your experience with Float? Don’t go anywhere – we’re about to let you in on all the tips and tricks.

Read MoreCase Studies

Porta meets Float: A recipe for success

Finding the right corporate card when you’re launching a DTC startup can be challenging, but Porta avoided the hassle when they found Float.

Read MoreCase Studies

Blue J Secures Corporate Spending with Float

Blue J was in search of speed, security and smarter spending processes and Float checked all the boxes.

Read MoreProduct Education

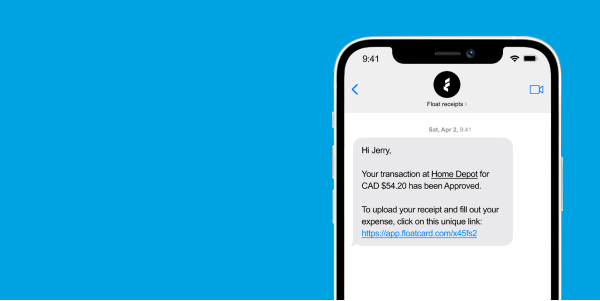

Better Expense Management with SMS Tracking

In a perfect world, expense management would be as easy as a simple text. And at Float, that’s exactly the world we’re living in! 😉

Read MoreCorporate Cards

3 Common Misconceptions About Corporate Cards for Startups

We’re here to clear the air on some of the most common misconceptions around corporate cards so you can spend smarter and scale. 🚀

Read MoreProduct Education

Product News: Introducing Float’s Slack Integration Feature

What if we told you that issuing corporate cards, requesting spend approvals and managing corporate expenses across departments was all possible at the click of a button?

Read MoreCase Studies

Nerva’s Accidental Find Turned Treasure

After stumbling across an ad, Nerva quickly became a proud user of Float. Now, they’re saving more time than ever before and have access to all the corporate funds they need.

Read MoreFinance Team Efficiency

Closing Your Books Faster at Month End

Float’s management software helps users effectively manage their corporate spending and closing books faster by providing automation, collaboration and integration.

Read MoreCase Studies

The Ultimate Trade: Coinberry Leaves Amex for Float Spend Management

We sat down with Jerry Lin, VP of Finance at Coinberry, a crypto trading platform that gives Canadians a safe and reliable way to purchase and sell their cryptocurrency.

Read MoreFinance Team Efficiency

Spring Cleaning Your Finances with Float

Spring has sprung! Out with the old and in with the new – starting with your spend and expense processes.

Read MoreCase Studies

Float: Helping Your Scaling Startup Spend Properly

Imagine having a growing startup with only one corporate card that was maxed out every other day? That’s no proper way to spend for any company on the rise.

Read MoreFinance Team Efficiency

How Float Uses Float: Insight From Our Finance Manager

Hi, I’m Jennifer McNamee. 👋🏼 The Finance Manager at Float who handles all of the corporate cards floating in our company.

Read MoreCash Flow Optimization

How To Build Business Credit in Canada: A Comprehensive Guide

Learn how you can build business credit in Canada. Ask any business owner and finance team in the country and they’ll likely agree that one of the most common stressors is building and qualifying for new business credit.

Read MoreCase Studies

Giving Clutch a Better Way to Spend

At Clutch, bookkeeping and reconciliations have never been easier – all thanks to Float.

Read MoreDigital Transformation

A Few Ways To Show Some Love To Your Finance Team

It’s February and love is in the air, and you know who needs it most? Your finance team.

Read MoreExpense Management

Why You Need a Better Way to Track Employee Receipts

Tracking receipts. It can feel like climbing Everest – unless you’re doing it the right way.

Read MoreCorporate Cards

3 Signs Your Team is Ready For a Float Card

Ideas are flowing💡, the team is growing👫 and you need a better solution to manage and track your spending.💸 You’re in the right place.

Read MoreExpense Management

A First-Class Ticket to Managing Corporate Travel Expenses

Managing travel expenses is not exactly a “vacation.” In fact, if finance teams are doing things the manual way, the entire department may need a real getaway to recover from it all.

Read MoreExpense Management

The Most Bizarre Business Expenses Ever Submitted

Are you in for a good laugh? Read along for some of the funniest, most outrageous business expenses ever submitted – some that were even approved!

Read MoreFinancial Controls & Compliance

Three Ways to Engage Your Virtual Team This New Year

With more people shifting to a hybrid work environment and virtual teams spanning the globe, managers need to take those extra steps to keep everyone engaged, connected and on the ball this new year!

Read MoreFinancial Controls & Compliance

What is a Decentralized Organizational Structure?

We’re seeing a spike in companies moving away from a centralized structure to a more decentralized one. When decision-making is shared, amazing things can happen. Here’s why.

Read MoreCorporate Cards

Why Virtual Cards Are More Secure Than You Think

Virtual cards. What are they?

Read MoreExpense Management

Let’s Make Smarter Spending Your 2022 Resolution

Manual spend management tools are time-consuming and prone to error. With a near year around the corner, it’s time for a fresh start! Allow us to introduce you to a better, more efficient way to track and manage your spending with smart spend software and virtual corporate cards.

Read MoreProduct Education

Upcoming Release: Team Management

One of the biggest platform upgrades in Float’s history is almost here and we are excited to let you in on all the fun. Drum roll please… 🥁

Read MoreExpense Management

Say Goodbye to Year-End Headaches With Automated Expense Software

The whole point of year-end accounting is to ensure that your financial data is up to date and recorded correctly. So why are so many companies sticking to archaic year-end processes that do more harm than good?

Read MoreExpense Management

It’s Time to Wave Goodbye to Expense Reports. Here’s Why.

Startups are growing at high speed and the last thing they need is something to bog them down. That’s why startups across North America are beginning to see the value in eliminating time-consuming, manual processes and making way for more innovative and efficient tools.

Read MoreExpense Management

Why is it Important to Track and Control Your Expenses?

Properly managing your expenses today is one step startups can take to protect their future.

Read MoreFinancial Controls & Compliance

How Startups Can Effectively Scale Their Teams

Demand is increasing, revenue is flooding in and your startup is on the path to unwavering growth. Now’s the time to ask yourself, is your team equipped to handle growth at full speed?

Read MoreCorporate Cards

Why You Should Split Your Business Expenses From Your Personal Expenses

One of the most common errors new businesses make is blurring the lines between personal and business expenses. Here’s a few (good) reasons to keep them separate.

Read MoreExpense Management

How to Promote a Healthy Spending Culture in Your Company

Financial stability in any organization is the result of having the proper processes, systems, policies and values in place. This is what many refer to as a “healthy spending culture.”

Read MoreExpense Management

Why Expense Management Automation Is a Good Idea

If you’re a company looking to streamline your financial processes, automated spend management software will flip your biggest pain points right on the head.

Read MoreFinance Team Efficiency

What is a Financial Controller and What Do They Do?

More recently, many startups are exploring new ways to automate their financial and accounting processes. But, how can they do this?

Read MoreFinancial Controls & Compliance

U.S. Software Companies Are Now Charging Sales Tax: How Will This Impact Startups?

If you’re a Canadian startup who often uses U.S.-based software, then you’re probably wondering how this will affect the way you purchase, monitor and record these types of expenses.

Read MoreCorporate Cards

How Corporate Cards Can Benefit Startup Companies

Many startups often fail due to a lack of capital in their first year of operating. Corporate cards — physical and virtual — serve as a great tool to help startups effectively manage their growth, monitor spending and increase operational efficiency.

Read MoreCorporate Cards

What Are Virtual Cards?

Unlock financial freedom with virtual credit cards! Instant access, customizable limits, and enhanced security. Control spending, shop worry-free online, and say goodbye to physical plastic. Embrace the future of smart spending today!

Read MoreCorporate Cards

Still Sharing Credit Card Details over Slack?

Sharing corporate card credentials creates admin overhead, security concerns and makes reconciliation harder.

Read MoreExpense Management

Escape Marketing Excel Hell

Do you still manage your spend on marketing campaigns using excel sheets? Then this is for you…

Read More

Guides

Reimbursements

Manage all your team spending in one platform. Reimbursements is a simple way for teams to manage out-of-pocket expenses.

Download

Guides

Bill Pay

Eliminate tedious AP processes and pay bills faster with the simplest way to manage company spend.

Download

Guides

Account Security 101

Our Fraud Team’s top tips and best practices for your Float Account security.

Download

Guides

Onboarding Overview

Float offers self-serve or human implementation – here’s an overview of what you can expect when choosing to onboard with

Download

Guides

Security at Float

Learn how Float keeps your business protected with the highest security and industry standards.

Download

Guides

Mobile App

Request new cards and reimbursements, capture receipts, and understand your spending power at a glance on the Float mobile app.

Download

Guides

Float Yield

Earn up to 4% on your CAD & USD business balance. No lockups. No extra steps

Download

Guides

Unified Login

Access Float using a single global login and quickly switch between businesses to manage finances across accounts.

Download

Guides

HRIS Integration

Simplify employee onboarding and offboarding and sync your company’s HR system.

Download

Guides

Float Integrations

Simplify your spending with seamless banking, HR, and productivity integrations that scale.

Download

Guides

Transaction Reviews

Learn how to let managers review team transactions after they’re made.

Download

Guides

Spend Management Guide

Learn how to control your company’s spending with Float’s intuitive spend management software.

Download

Guides

Float Charge Card

Float offers 30-day terms with no interest in both CAD and USD (conditions apply).

Download

Guides

QuickBooks Online Integration

Automate your accounting with Float’s QuickBooks Online Integration.

Download

Guides

Float One-Pager

Share this pdf with your team for a high level overview of Float’s smart corporate cards in CAD and USD.

Download

Guides

Float Overview

Learn more about Float’s smart corporate cards and spend management software.

Download

Guides

Float Admin Guide

Learn how to get started with Float as an Admin and simplify your company’s business spending.

Download

Guides

Moving Spend to Float

The sooner you move spend to Float, the faster you can start saving.

Download

Guides

Spenders and Managers Guide

Learn how to use Float as a Spender or Manager at your company to request spend and make purchases.

Download

Guides

Float for Marketing Teams

Introducing a simpler way to manage marketing and advertising spending.

DownloadYour questions,

answered

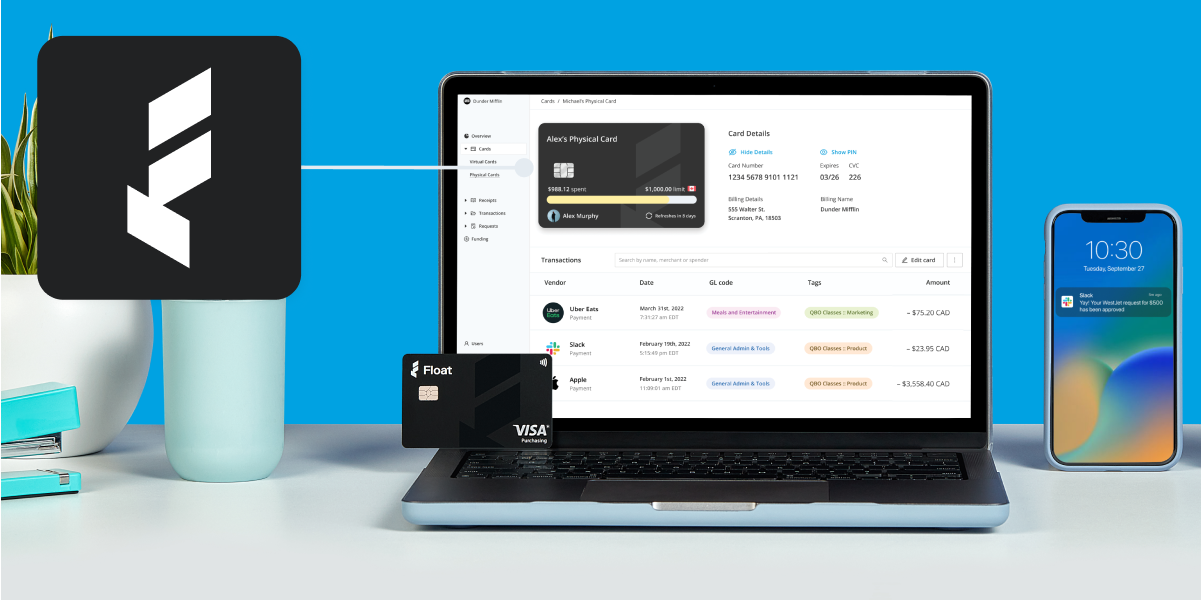

Float is an easier, smarter way to manage your business spending. Think of it as a combination of no-personal-guarantee corporate cards and intelligent spend management software to help you automate, control, and manage your company’s spending.

Float customers have access to physical and virtual corporate cards in both USD and CAD. Once you issue cards to employees, Float will collect receipts after every transaction. Each transaction is then automatically coded and matched with its receipt, ready to export to your accounting software.

Just like a ‘regular’ corporate card, our cards are used around the world anywhere VISA and Mastercard are accepted. With accounts in both CAD and USD, it’s easy to switch between the two currencies when you need to.

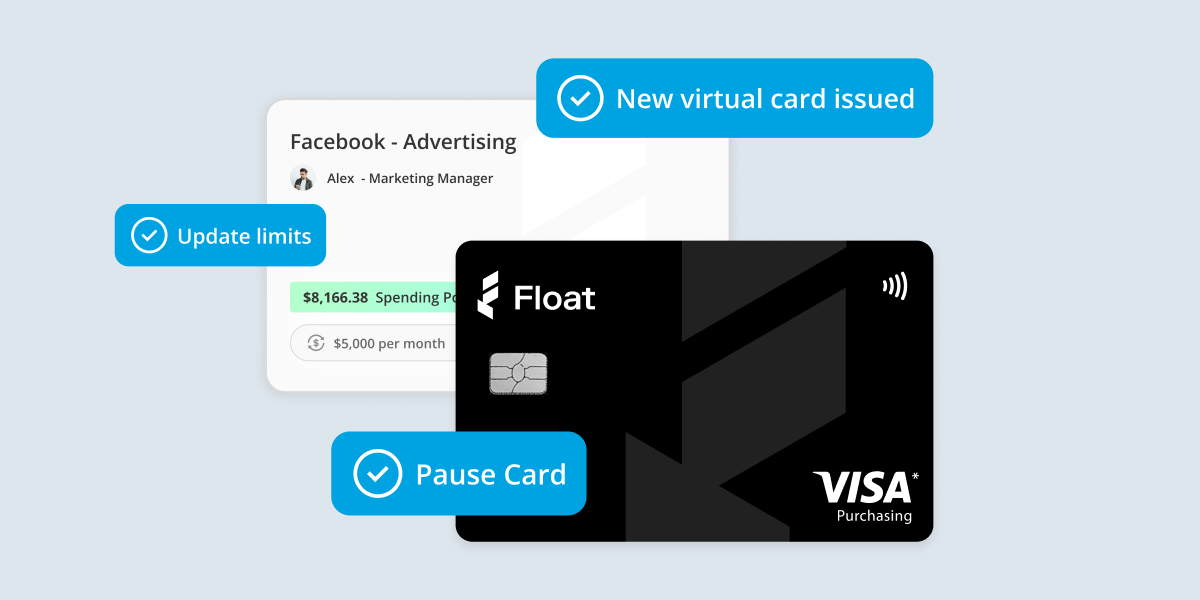

Physical and virtual cards work essentially the same way! Virtual cards act the same way as physical cards, in that you can use them for any spend where you need to enter in a card number. Virtual cards can be created instantly whenever you need them, and are perfect for online expenses like recurring expenses or ad spends. Both virtual and physical cards are linked directly to Float software with individual card controls to help manage spend.

Float offers personalized payment terms based on your business’s stage of growth. With Float’s Pre-funded CAD and USD cards, your limits = your bank balance. You can connect multiple bank accounts in CAD or USD, and even set up automatic top-ups to ensure your cards never run out of funds. With Float’s Charge card (CAD and USD), you can apply for up to $1M in unsecured 30-day credit terms that you can automatically pay down throughout the month.