Finance Team Efficiency

What is a Financial Controller and What Do They Do?

More recently, many startups are exploring new ways to automate their financial and accounting processes. But, how can they do this?

September 7, 2021

Canadian startups are always looking for better ways to drive efficiencies in their business. More recently, many startups are exploring new ways to automate their financial and accounting processes. But, how can they do this? It all starts with a financial controller. 🤓 This is an individual who acts as the company’s lead accountant and oversees all financial transactions and data as it relates to corporate spending.

What are their responsibilities?

It’s important for financial controllers – especially in a startup – to have strong attention to detail and lead with a bigger picture in mind. Their job is integral to the growth of a company because they provide greater insight into their cash flow and how to best manage it. They create the financial policies and processes for a company, and generate the reporting required for management to make strategic business decisions.

Some of their responsibilities include:

- General accounting oversight 👀

- Creating internal policies and spend controls 💵

- Coordinating external tax accountants 🤝

- Approving and distributing corporate cards 💳

- Setting up bank accounts 👨🏻💻

- Ensuring payment is received from customers and other debtors 🧾

- Chasing people down for receipts 🏃🏻♂️

Why automation is a financial controller’s best friend 👫

In a nutshell, a financial controller is responsible for managing all of the money coming in and going out of the company, which means they are the ones validating major spend decisions and ensuring employees are properly reporting expenses. This is crucial given the fast-growing nature of many startups.

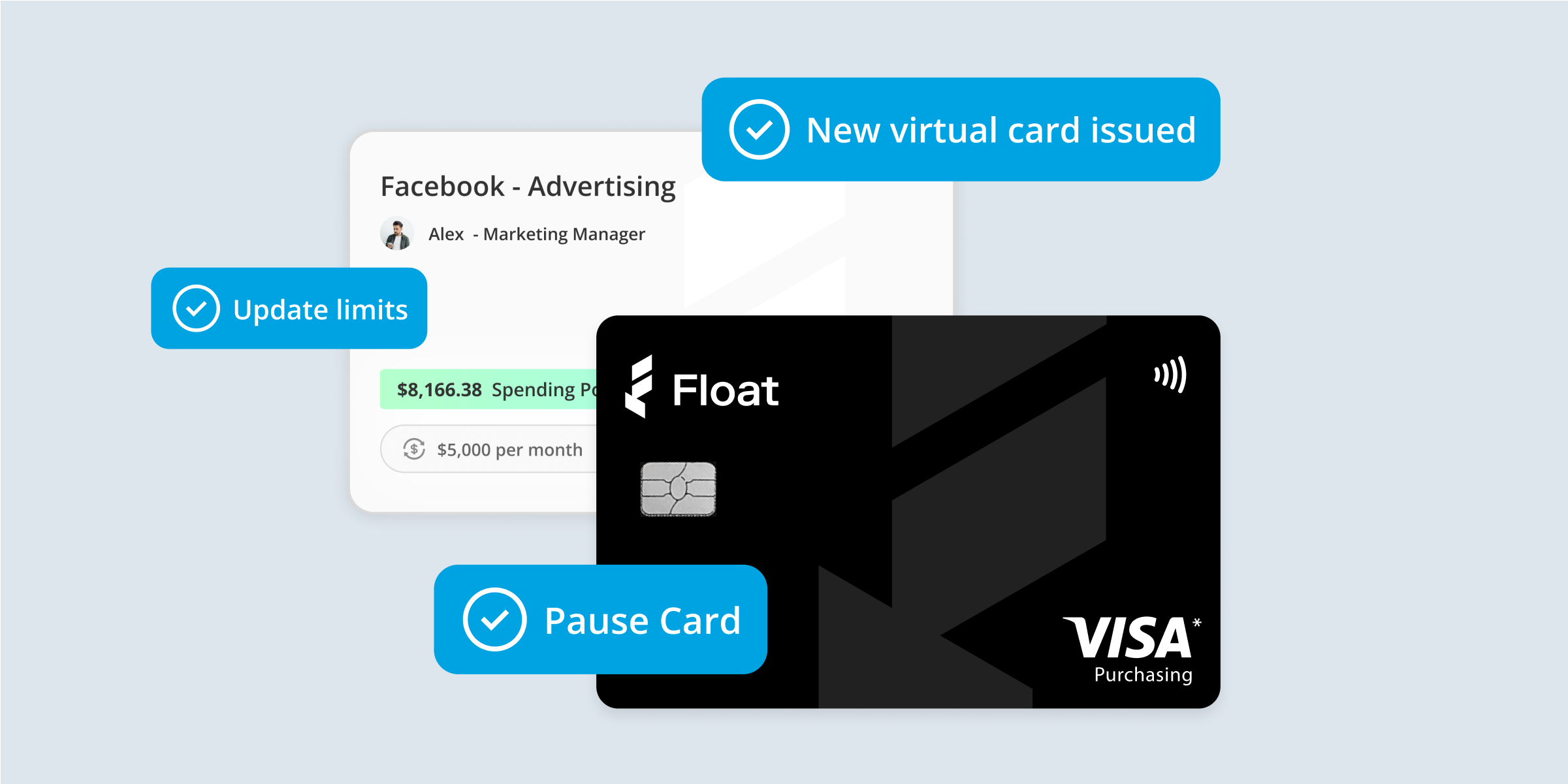

The traditional process of managing financials is time-consuming with a great deal of manual data entry and back and forth with employees. Smart spend management software like ours at Float can change that by automating complex financial processes and helping startups make better strategic decisions, especially in earlier growth stages. Not to mention, Float also allows startups to act quickly by making corporate cards available to employees in 3 days or less! 💨

Why Float is a game changer for financial controllers

- No more wait times for corporate cards from archaic banks ⏱

- Gives companies greater visibility and control over the spending in their organization and opportunity for cost savings 💰

- Our spend software is integrated with your virtual and physical corporate cards 💳

- Float collects real-time transaction data and generates reports on company spending 💸

- We’ve eliminated expense reports and manual tasks like reconciliation, reducing your month-end labour by up to 97% 🎉

- We give you the power to adjust workflow approval policies and set spending limits 📑

- Our software ensures greater accuracy by minimizing human error and expense fraud ✅

At Float, we know firsthand just how complex managing a company’s financials can be, especially for a startup. That’s why we created a corporate card and spend management software solution that not only automates your finance and accounting processes, but saves valuable time and resources. We want companies everywhere to have the tools needed to make strategic financial decisions so that they can grow and expand at rapid speed. 🤜🏼🤛🏼

If you’d like to learn more about how Float can help your organization, connect with us today!

Written by

All the resources

Corporate Cards

Best 0% Interest Business Credit Cards for 2025

Explore why choosing a 0% APR business credit card can be a strategic move for Canadian businesses.

Read More

Corporate Cards

7 Best Business Credit Cards Canada 2025

Pinpoint the right credit card choice for your company in a sea of options with our roundup of the seven

Read More

Corporate Cards

Instant Corporate Card Issuance: How to Get Cards in Minutes, Not Days

Ready to equip your team to spend quickly while minimizing risk? Cue instant corporate card issuance.

Read More