Float: Designed for Canadian Entities

Purpose-built for Canada, approvals and cashback for Canadian entities.

Built for Canadian businesses and the Canadian tax system

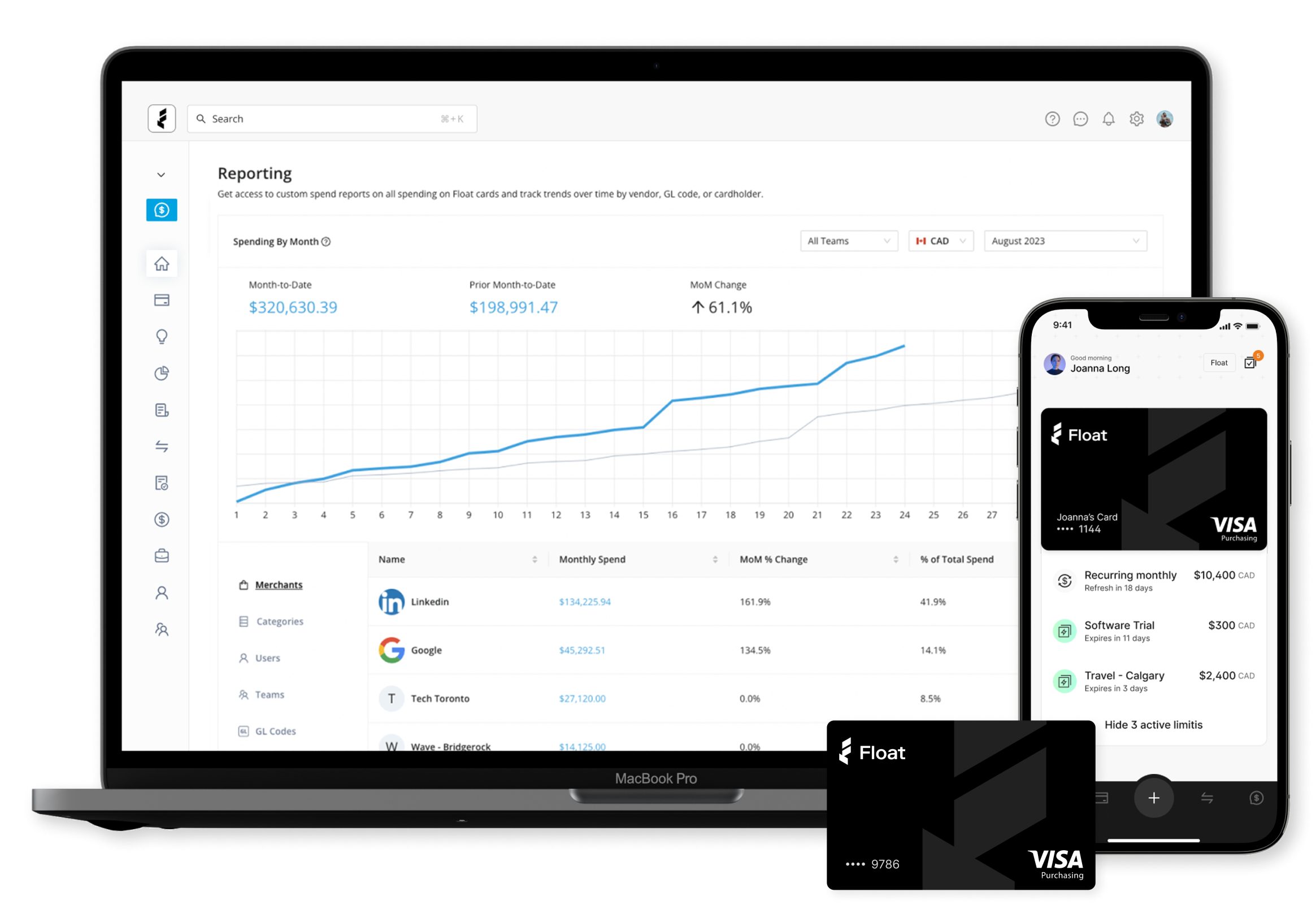

Proactively control spend with per-card customizations

Save 7% of total business spend

Trusted by thousands of leading Canadian companies.†

Compare Float vs Brex

| Approves Canadian entities | ||

| Virtual and physical cards, in CAD and USD* | ||

| Individual card limits and controls | ||

| Canadian accounting automations, including localized tax codes | ||

| Earn cashback on Canadian spend | ||

| Instant balance top-ups with Interac e-Transfer |

*For Professional plan members. Essential members get unlimited virtual cards and 20 physical cards.

Why choose Float over Brex?

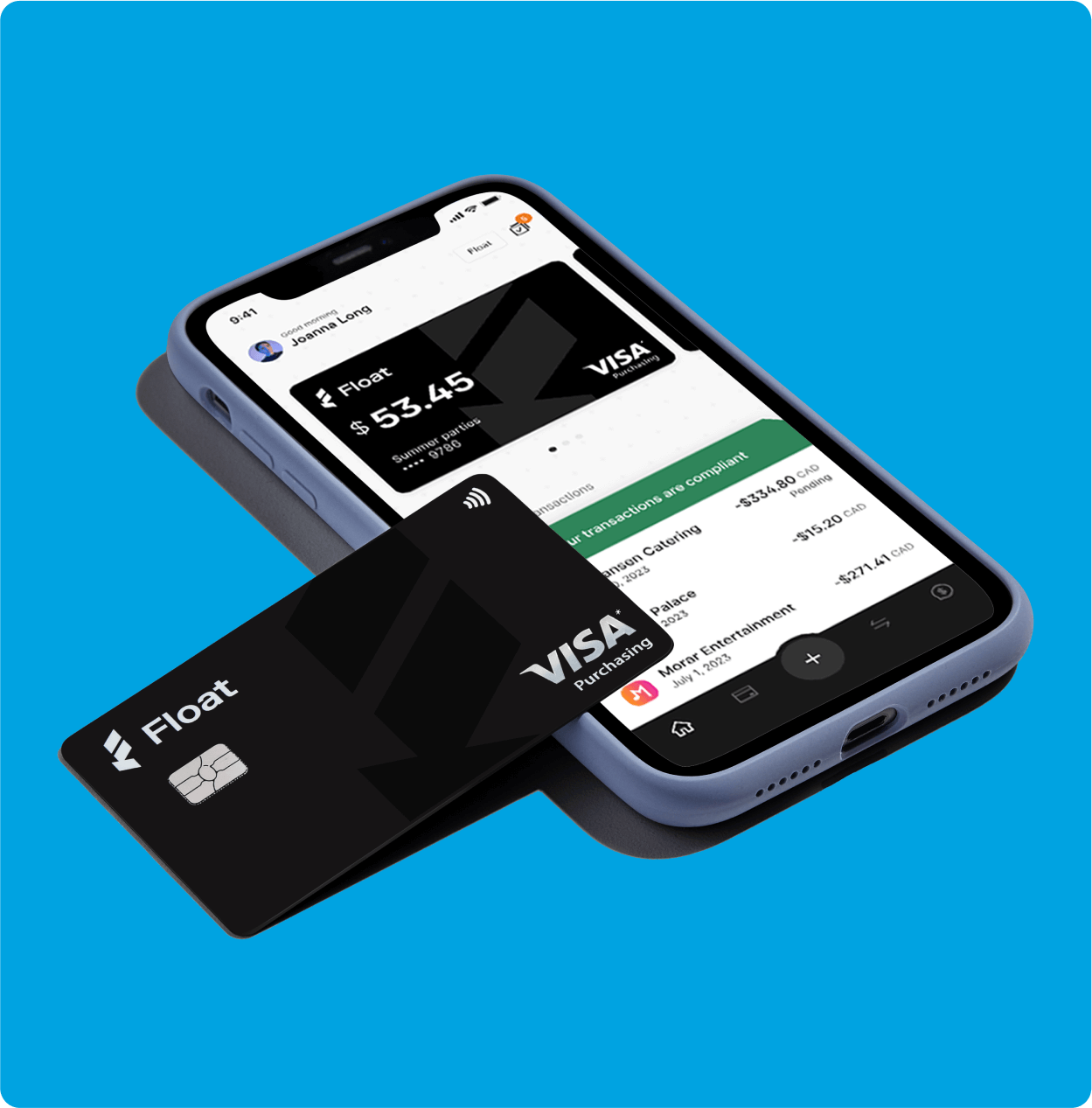

Canada’s smartest corporate card

Manage spending on a per-card basis and effortlessly track, approve, and reconcile expenses in both CAD and USD—all in one platform.

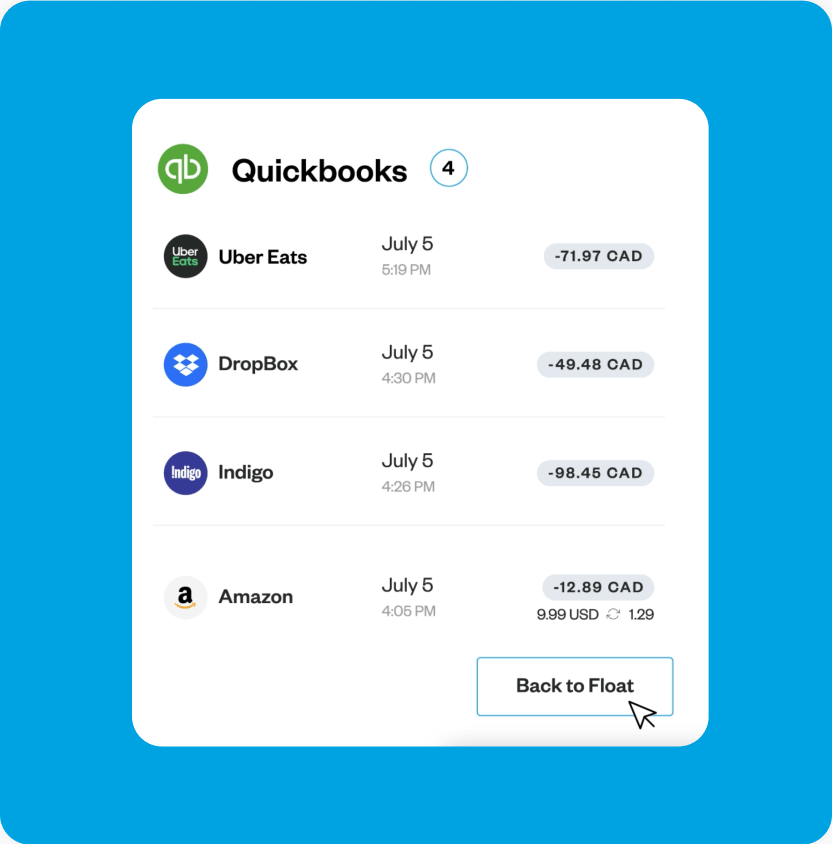

Powerful Canadian integrations

Float integrates with QBO & Xero and supports custom exports into Netsuite & Sage. Plus, Float directly integrates with Canadian banks.

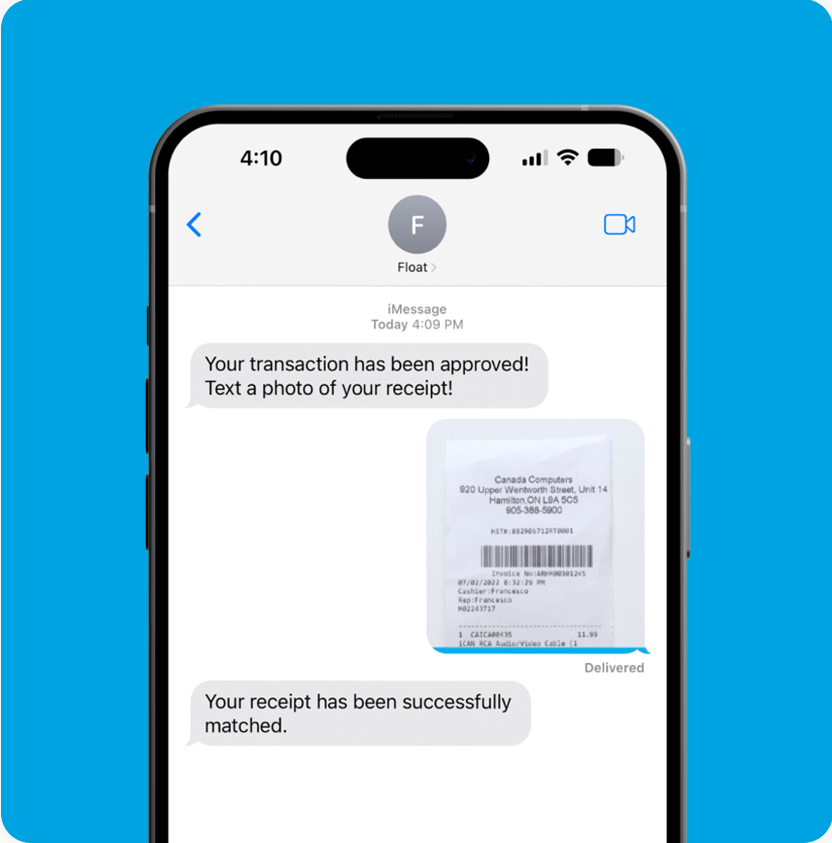

Close your books up to 8X faster

Eliminate expense reports with our automatic receipt collection and matching software, all in your local currency.

Save 7% of your total spend

Float is the only platform that helps companies save 7% of their total spend from time savings at month-end to productivity gains across the company and earnings that are anything but a bank.

Enjoy 1% cashback on card spend, up to 4% interest on cash balances, and lower FX fees.

Purpose Built for Canadian Businesses

We are on a mission to simplify spending for Canadian businesses and teams.

Float is built by Canadians for Canadians focusing on deep tax, accounting integration, OCR accuracy, french support, and compliance localization needs of the Canadian SMBs.

Why Klue loves Float

“Being able to give non-managers and non-finance employees access to an individual corporate credit card with a pre-approved limit has been great for our team.”

Adrian Pape

VP Finance

*Trademark of Visa International Service Association and used under licence by Peoples Trust Company.