Float vs. Plooto: What’s the Difference?

Choose the all-in-one tool that saves you time and earns you up to 4% interest.

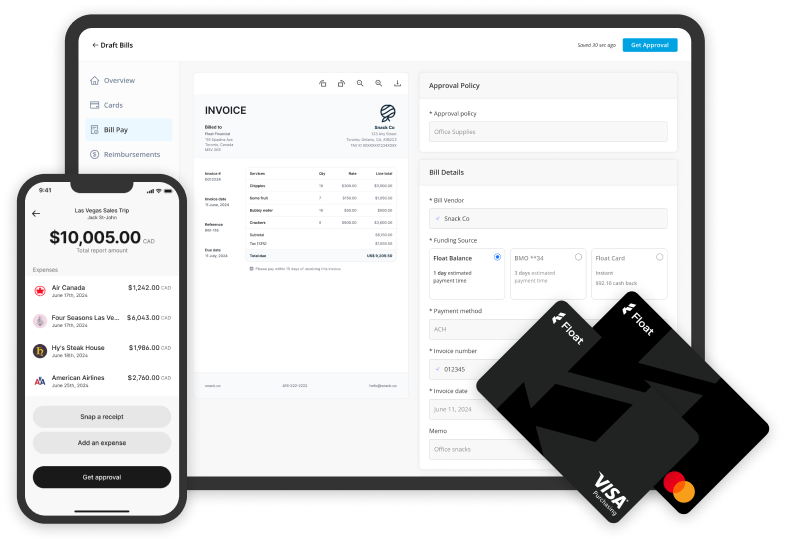

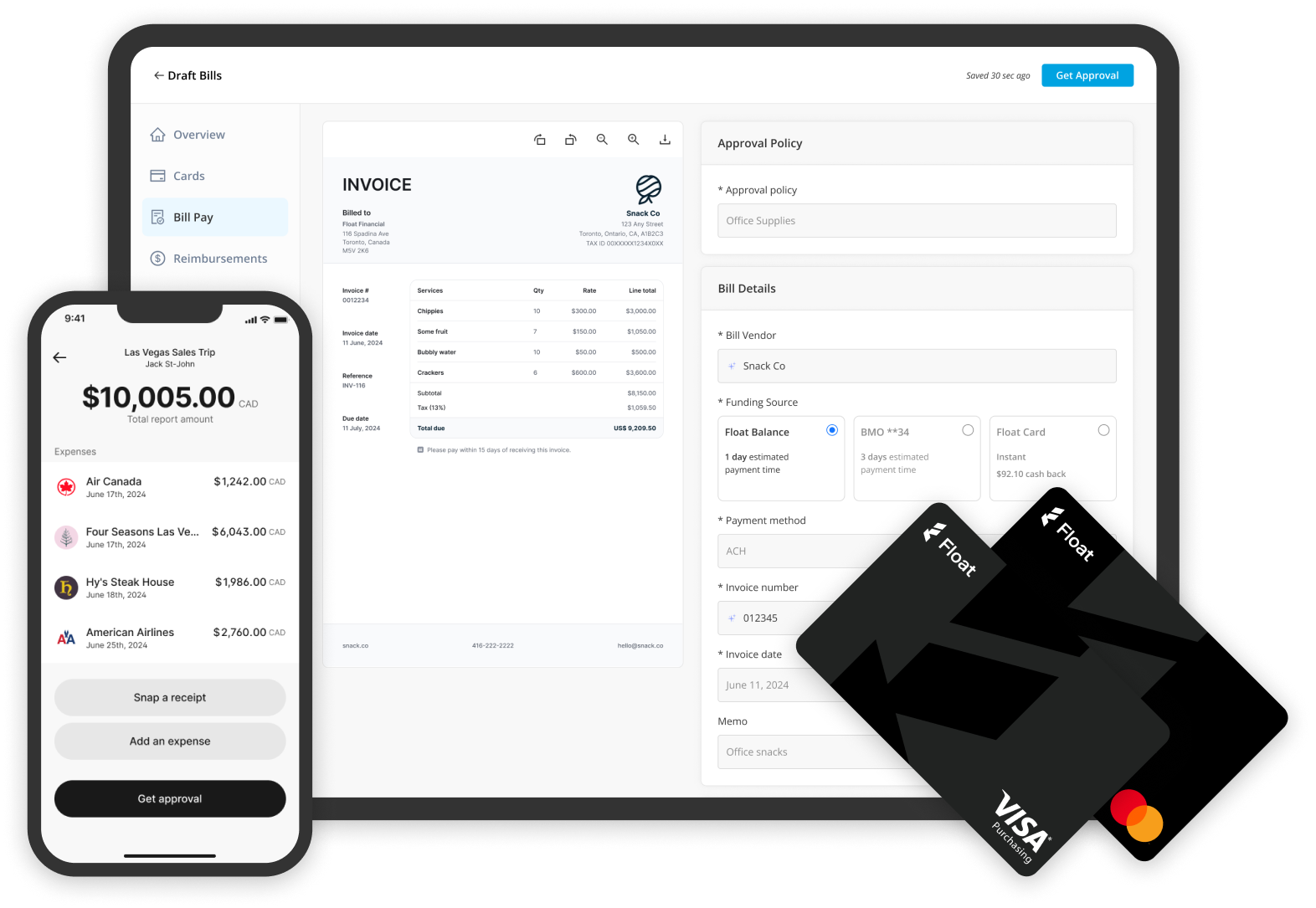

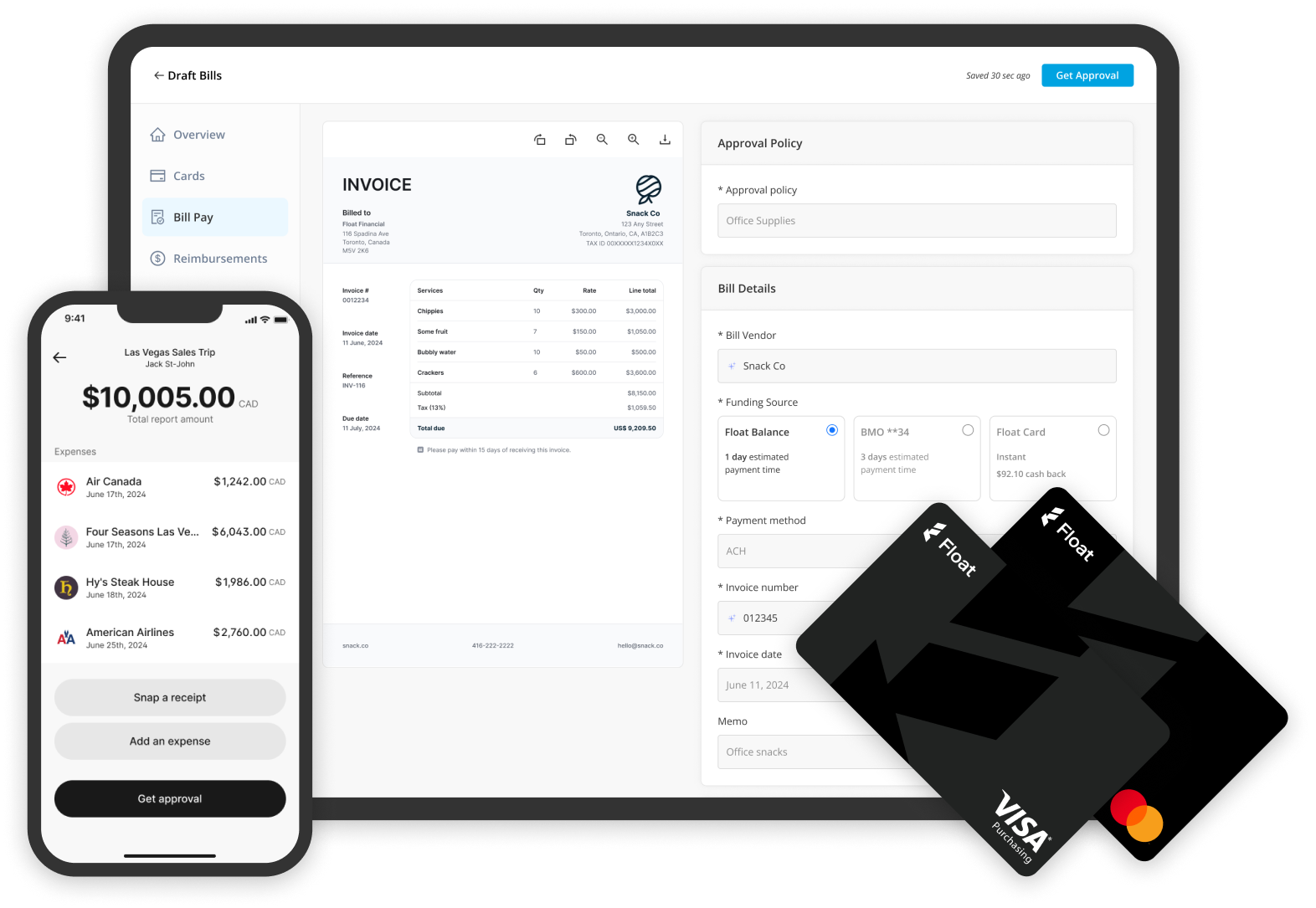

Automate the entire Accounts Payable process

Next day payments via EFT, ACH, Wire with competitive fees

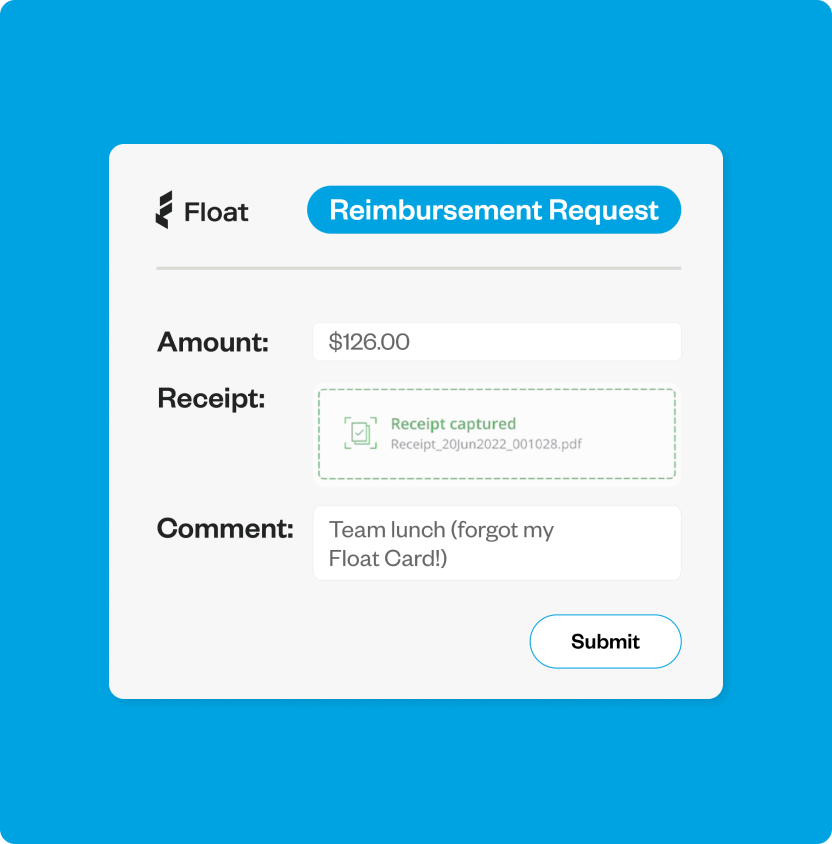

All your Corporate Cards, Reimbursements and Accounts Payable in one smart platform

Trusted by thousands of leading Canadian companies.†

Compare Float to Plooto

| Next-day payments from cash balance | ||

| Pay by EFT, ACH, or International wire in CAD or USD | ||

| Up to 4% interest on cash balance in Float | ||

| Real-time spend reporting and insights | ||

| All-in-one solution for corporate cards, accounts payable and reimbursements | ||

| Pay by virtual card & earn 1% cashback* | ||

| Best-in-class OCR line item extraction |

* 1% cashback is accrued after the first 25K of monthly spend

Why choose Float over Plooto?

Automated Accounts Payable

Automatically extract all line-items with 99% accuracy using Float’s OCR. Forward bills from your inbox to automate the entire AP workflow.

Fast next-day payments

Next- day payments via Wire, EFT, ACH in CAD or USD, with competitive fees.

All-in-one platform

One solution for your corporate cards, employee reimbursements, and Accounts Payable, that saves you 7% of your total spend.

One platform to save you time and money

Float is an all-in-one platform that helps finance teams manage corporate cards, employee reimbursements, and automate Accounts Payable.

Float’s customers save on average 7% of their spend with productivity gains, time savings and competitive rewards .

The fastest way to pay bills in Canada, US, and Globally

Float is Canada’s only business finance platform for managing all non-payroll spending in one place.

“Float’s Bill Pay has become our main AP solution for Canadian business expenses. They built a product that is better than anything else on the market in Canada.”

Thomas Kwon

Head of Finance & Operations

*Trademark of Visa International Service Association and used under licence by Peoples Trust Company.