Resources

Level up your finance game with Float’s Resource Hub: expert insights, practical tips, and real stories from Canadian businesses using Float to work smarter.

💡 Need to troubleshoot features in your Float account?

Visit our Help Centre for access to even more instructional articles and guides.

Built in Canada: How Impact Kitchen Saves Time with Float

Impact Kitchen saves 100+ hours a year with Float by streamlining expenses across 7 Toronto locations. With better compliance and fewer manual tasks, Float is helping them scale efficiently—including their first US store in NYC.

Finance Team Efficiency

Best Accounts Payable Software for Canadian Businesses in 2026

Make accounts payable more efficient with AP automation. Compare the best accounts payable automation software built for Canadian businesses.

Read MoreFinance Team Efficiency

Best Accounting Software for Canadian Businesses: 2026 Complete Guide

Discover the best accounting software solutions for Canadian businesses. Compare top solutions like Quickbooks, Xero, FreshBooks, Sage 50, and Wave.

Read MoreFinance Team Efficiency

Ultimate Guide for Bookkeeping Services in Canada

Learn costs, benefits, and tips for choosing the right financial partner for your company.

Read MoreFinance Team Efficiency

Best Accounts Payable Platform in Canada in 2024

Discover the Best Accounts Payable Platform in Canada in 2024. Streamline your AP process, reduce errors, and boost efficiency with cutting-edge software. Compare features, pricing, and benefits to find the perfect fit for your company

Read MoreFinance Team Efficiency

Accounting Automations for Canadian Finance Teams

Unlock the power of automated accounting to drive growth and accuracy in your financial processes. Save time and money with Float.

Read MoreFinance Team Efficiency

4 Signs Your Company is Outgrowing its Accounting Software

Is your accounting software holding you back? Discover four telltale signs it’s time to upgrade. Learn how to spot inefficiencies, scale your finances, and boost your business growth with the right tools.

Read MoreFinance Team Efficiency

Float Bookkeeper Guide

If you are a Bookkeeper that has a client (or hopefully clients!) using Float, this guide is for you! Learn about how to export Float transactions to your accounting software.

Read MoreFinance Team Efficiency

Closing Your Books Faster at Month End

Float’s management software helps users effectively manage their corporate spending and closing books faster by providing automation, collaboration and integration.

Read MoreFinance Team Efficiency

Spring Cleaning Your Finances with Float

Spring has sprung! Out with the old and in with the new – starting with your spend and expense processes.

Read MoreFinance Team Efficiency

How Float Uses Float: Insight From Our Finance Manager

Hi, I’m Jennifer McNamee. 👋🏼 The Finance Manager at Float who handles all of the corporate cards floating in our company.

Read MoreFinance Team Efficiency

What is a Financial Controller and What Do They Do?

More recently, many startups are exploring new ways to automate their financial and accounting processes. But, how can they do this?

Read MoreYour questions,

answered

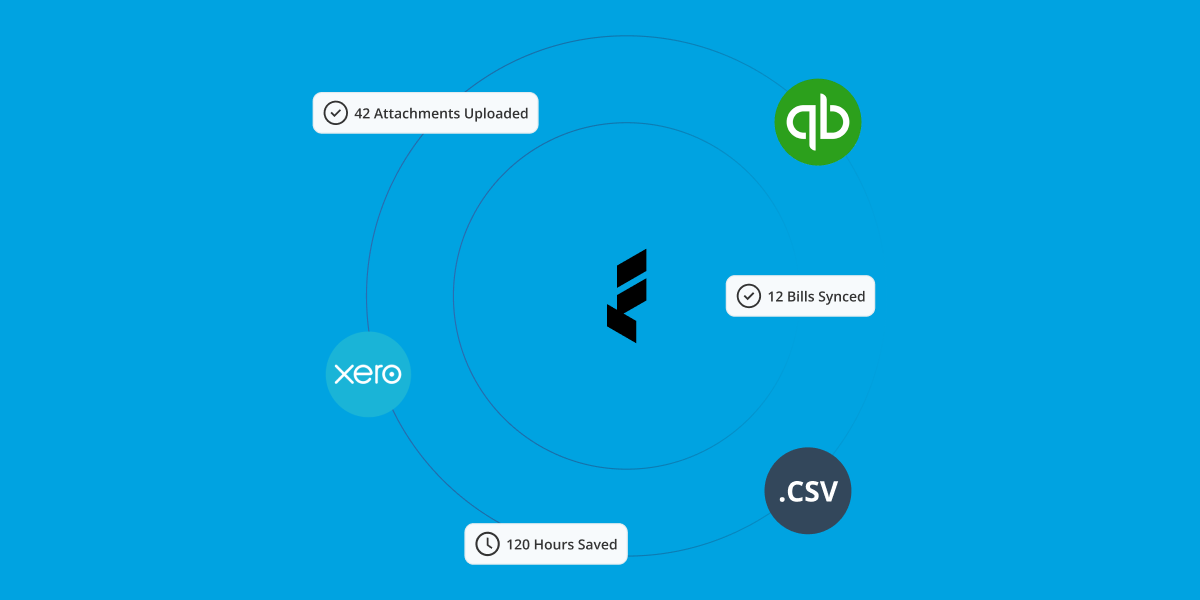

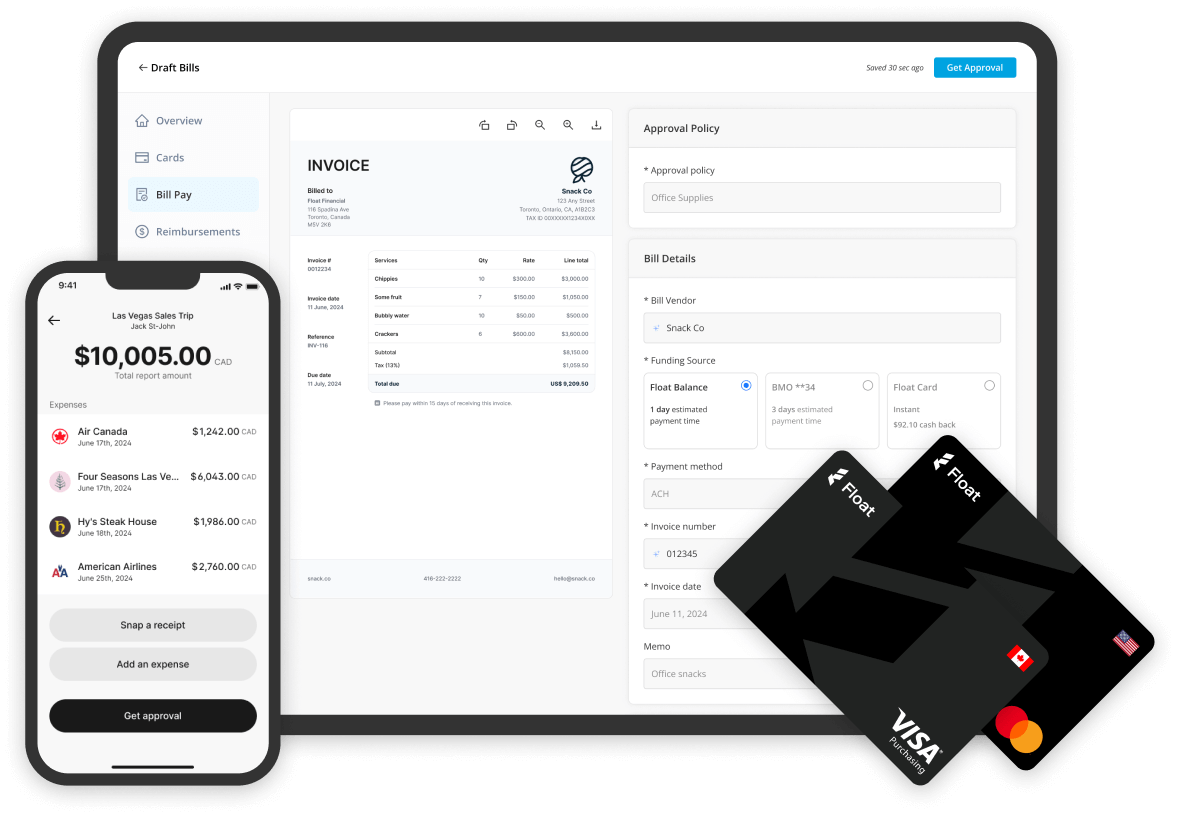

Float is an easier, smarter way to manage your business spending. Think of it as a combination of no-personal-guarantee corporate cards and intelligent spend management software to help you automate, control, and manage your company’s spending.

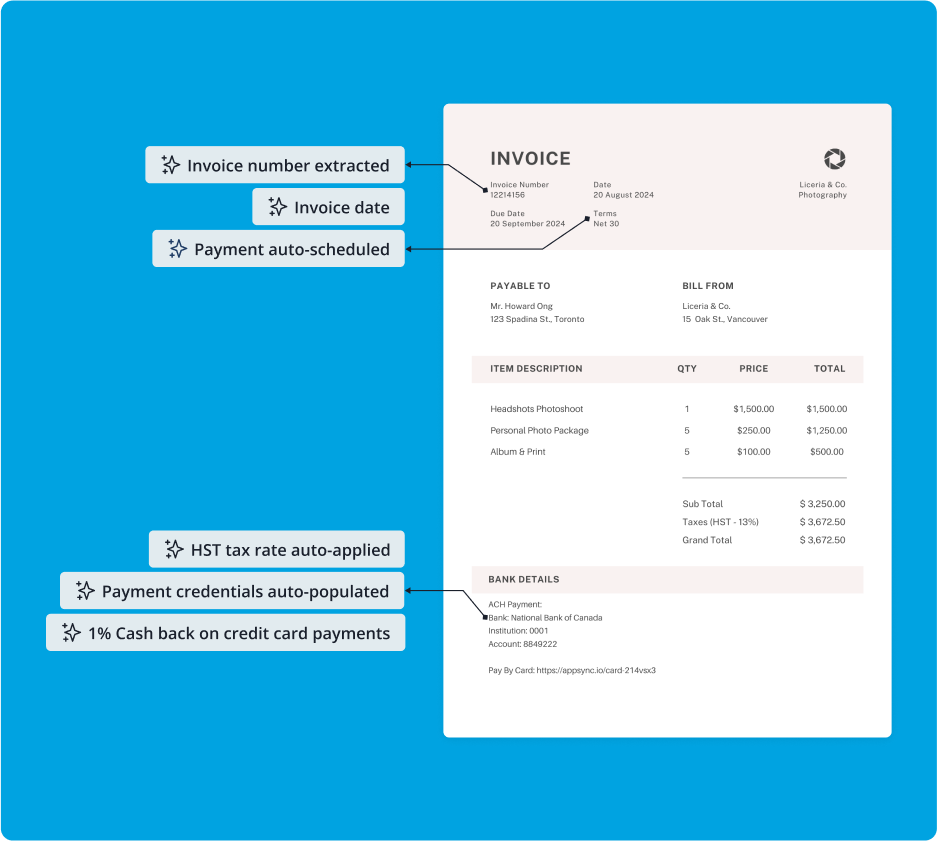

Float customers have access to physical and virtual corporate cards in both USD and CAD. Once you issue cards to employees, Float will collect receipts after every transaction. Each transaction is then automatically coded and matched with its receipt, ready to export to your accounting software.

Just like a ‘regular’ corporate card, our cards are used around the world anywhere VISA and Mastercard are accepted. With accounts in both CAD and USD, it’s easy to switch between the two currencies when you need to.

Physical and virtual cards work essentially the same way! Virtual cards act the same way as physical cards, in that you can use them for any spend where you need to enter in a card number. Virtual cards can be created instantly whenever you need them, and are perfect for online expenses like recurring expenses or ad spends. Both virtual and physical cards are linked directly to Float software with individual card controls to help manage spend.

Float offers personalized payment terms based on your business’s stage of growth. With Float’s Pre-funded CAD and USD cards, your limits = your bank balance. You can connect multiple bank accounts in CAD or USD, and even set up automatic top-ups to ensure your cards never run out of funds. With Float’s Charge card (CAD and USD), you can apply for up to $1M in unsecured 30-day credit terms that you can automatically pay down throughout the month.