Finance Team Efficiency

Closing Your Books Faster at Month End

Float’s management software helps users effectively manage their corporate spending and closing books faster by providing automation, collaboration and integration.

March 29, 2022

Introduction

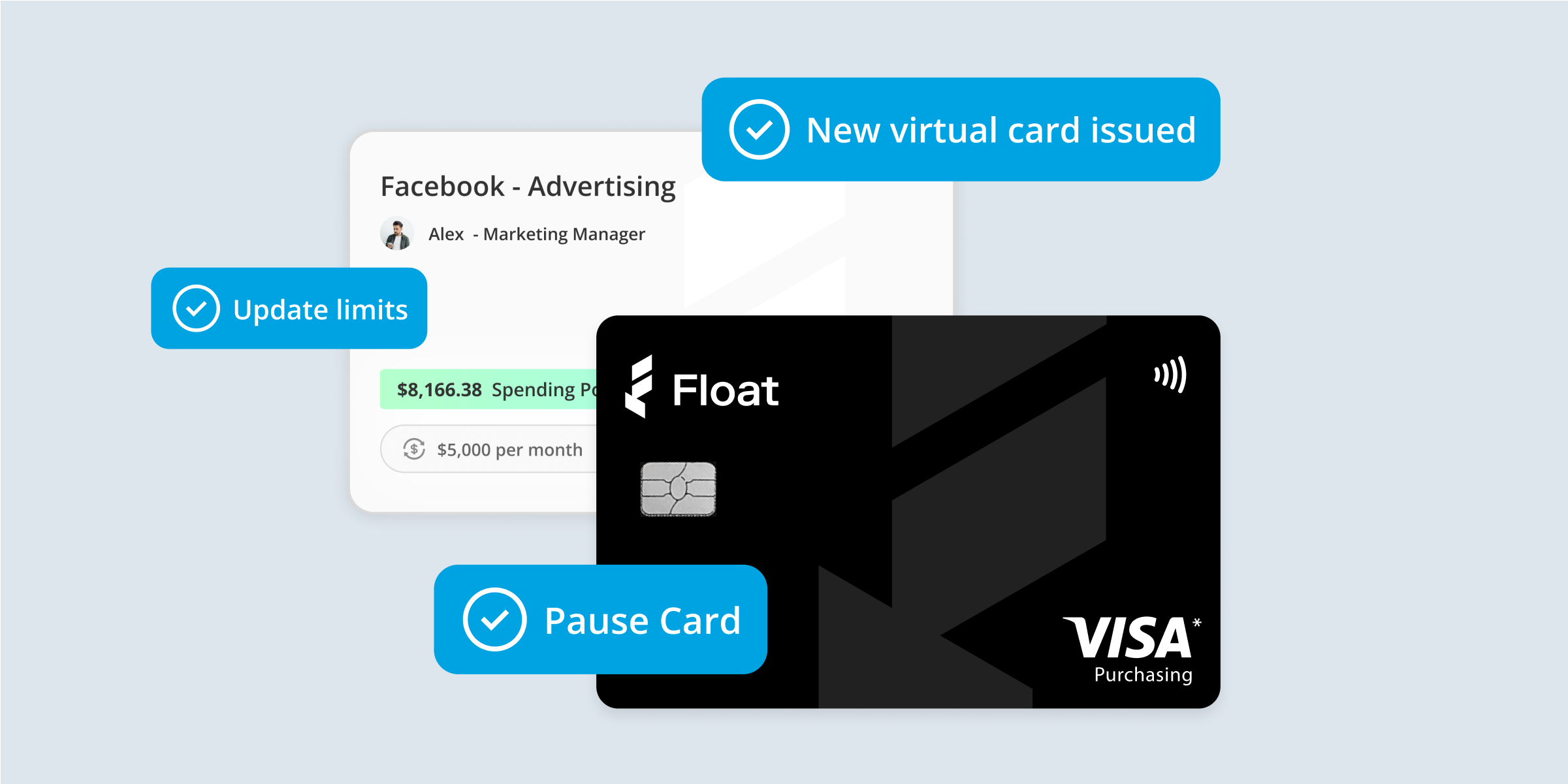

Many companies are frustrated by their inability to close their books efficiently at month-end. Employees’ misplaced receipts, ineffective software and lengthy credit card reconciliation processes are some of the challenges that financial teams encounter. Companies looking for a more effective way to control and monitor their spending should consider Float. Float ensures that your books are accurate and closed by month-end.

Automation

Float allows businesses to save time by eliminating the need to manually enter data and ease the minds for their finance teams. Companies no longer have to worry about expense reports because our software automatically gathers and matches receipts. Businesses can also set up spend guidelines for their employees, automatically pre-approve expenses and attach simple notifications anytime Float requires a receipt when a transaction is made.

Centralized platform for collaboration

Float has put together a collaborative platform that allows for immediate communication between departments. The team management feature allows businesses to build divisions and designate specific managers within Float, providing transparency and smarter spending habits for employees. TM features relieve the workload for finance managers by delegating controls to managers and securing key financial information for administrators.

Float also makes sure all data points and context have been centralized on the platform by categorizing transactions, making closing books month-end simpler. This includes:

- Preprograming GL accounts to the cards at the time of a cards creation

- Using merchant rules which automatically categorizes transactions

- Card users having the option of writing a description to provide context of purchase

- Receipts being uploaded directly from card users

- Bookkeepers having access to Float’s platform

Integration speeds up the process

Float has an adaptable platform and software that connects readily with other applications like Slack and Quickbooks, guaranteeing that books will close quicker. Companies can integrate specific financial software with Float, making work more effective and convenient for all teams involved. Another advantage is companies do not need to fight with downloading CSV files and uploading them to accounting software. It’s merely a matter of pressing a button. In fact, you’ll likely save 1 to 2 hours by using Float’s software.

Conclusion

Are you looking for a better way to manage your corporate spending and close your books faster? Book a demo with Float today.

Written by

All the resources

Corporate Cards

Best 0% Interest Business Credit Cards for 2025

Explore why choosing a 0% APR business credit card can be a strategic move for Canadian businesses.

Read More

Corporate Cards

7 Best Business Credit Cards Canada 2025

Pinpoint the right credit card choice for your company in a sea of options with our roundup of the seven

Read More

Corporate Cards

Instant Corporate Card Issuance: How to Get Cards in Minutes, Not Days

Ready to equip your team to spend quickly while minimizing risk? Cue instant corporate card issuance.

Read More