Resources

Level up your finance game with Float’s Resource Hub: expert insights, practical tips, and real stories from Canadian businesses using Float to work smarter.

💡 Need to troubleshoot features in your Float account?

Visit our Help Centre for access to even more instructional articles and guides.

Built in Canada: How Impact Kitchen Saves Time with Float

Impact Kitchen saves 100+ hours a year with Float by streamlining expenses across 7 Toronto locations. With better compliance and fewer manual tasks, Float is helping them scale efficiently—including their first US store in NYC.

Corporate Cards

Corporate Card Program Implementation: Complete Management Guide

Ready to implement a corporate card program? This is where to start.

Read MoreCorporate Cards

Sole Proprietor Corporate Cards: Business Credit Solutions for Single-Owner Companies

Let’s explore the best sole proprietor corporate cards to give you the business finance access you need at any size.

Read MoreCorporate Cards

Corporate Card Misuse Prevention: 2026 Control Strategies for Canadian Businesses

Corporate cards can be a powerful tool—if you set the right guardrails from the start. Here’s what you need to know.

Read MoreCorporate Cards

Amex Global Platinum Dollar Card Alternatives for Canadian Businesses in 2026

Canadian businesses are dealing with the discontinuation of the Amex Platinum Global Dollar Card and looking for a replacement card. Here’s what you need to know.

Read MoreCorporate Cards

What is a Fleet Card? Complete Canadian Business Guide 2026

Explore the best fuel cards for small businesses in Canada. Learn about the benefits of using fleet cards to save on fuel and vehicle maintenance costs.

Read MoreCorporate Cards

QuickBooks Integration for Corporate Cards: Canadian Business Accounting Guide

Want a clear understanding of your expenses at all times without the hours spent chasing receipts? A QuickBooks integration might be exactly what you need.

Read MoreCorporate Cards

Auto-Load Corporate Cards: Eliminate Transaction Declines with Smart Funding

Say goodbye to declined transactions and budgeting headaches! Let’s explore why smart funding matters and how auto-load works.

Read MoreCorporate Cards

Business Credit Cards with No Personal Guarantee: Your Options

Want to avoid leveraging your personal credit for business financing? Business credit cards with no personal guarantee may be the path for you.

Read MoreCorporate Cards

Discover: Virtual Credit Cards for Canadian Businesses

Explore the benefits of virtual credit cards with Float. Discover how this modern payment solution enhances security and simplifies your financial transactions.

Read MoreCorporate Cards

No-Credit-Check Business Credit Cards: Complete 2026 Guide

Looking for access to credit? A no-credit-check credit card might be the path forward.

Read MoreCorporate Cards

Corporate Cards for the Hospitality Industry: A Smarter Way to Manage Spending

Corporate cards for hospitality industry businesses can be your key to levelling up. Here’s what you need to know.

Read MoreCorporate Cards

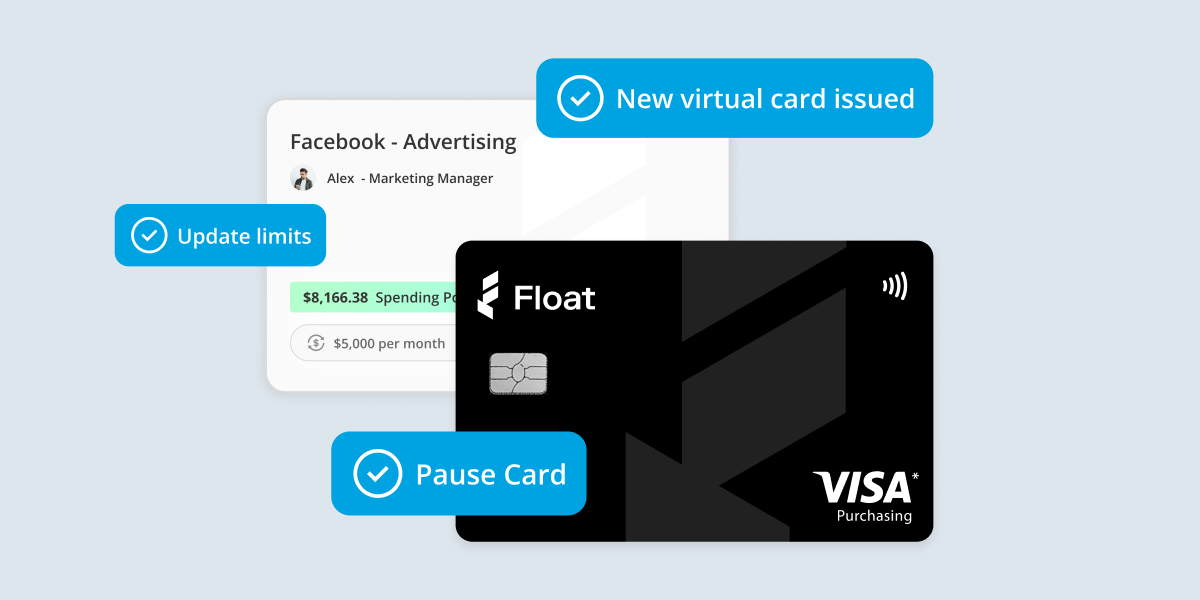

Temporary Card Spending Limits: Setup & Management Guide

Temporary card spending limits might just be the key you need to empowering your team. Read on to learn more about how to keep spending moving without breaking the budget.

Read MoreCorporate Cards

Best Credit Card for E-commerce and Retail Companies in Canada

Find the right credit card for your retail or e-commerce company with our roundup of the industry’s best business credit cards in Canada.

Read MoreCorporate Cards

7 Best Business Credit Cards Canada 2026

Pinpoint the right credit card choice for your company in a sea of options with our roundup of the seven best business credit cards in Canada.

Read MoreCorporate Cards

Corporate Card Program Management Dashboard: Features & Benefits Guide

Explore modern card program management dashboards that streamline expense management for Canadian businesses.

Read MoreCorporate Cards

Corporate Cards for Non-Profits: Everything You Need to Know

Explore how non-profits manage expenses with corporate cards, what to look for and how to get a corporate card as a non-profit.

Read MoreCorporate Cards

Corporate Card Spend Tracking: Real-Time Visibility Guide

Explore why real-time corporate card spend tracking matters and what features Canadian businesses should seek in these tools.

Read MoreCorporate Cards

Merchant-Specific Spending Controls: Implementation Guide

Learn how to implement merchant-specific spending controls. Discover best practices and tools to manage employee expenses effectively.

Read MoreCorporate Cards

Employee Offboarding Card Security: Best Practices Guide

Offboarding employees is never fun, but it can become even more of a headache if your card security is compromised. Here’s what you need to know.

Read MoreCorporate Cards

Procurement Cards vs. Corporate Cards: Which is Right for Your Business?

Let’s break down how procurement cards and corporate cards work, where each one shines and how Float offers the flexibility to do both.

Read MoreCorporate Cards

American Express vs. Float: Corporate Card Comparison for Canadian Businesses

American Express vs. Float? Which corporate card is right for you? Let’s break down the details to help you make the right decision.

Read MoreCorporate Cards

Corporate Card Security Best Practices for Canadian Businesses

Corporate cards should streamline spending, not invite fraud. Seb Prost, CPA, shares the top risks he sees and how businesses can stay ahead with smart security practices.

Read MoreCorporate Cards

Best Corporate Card Management Software & Solutions for Canadian Businesses

Discover the best corporate card management software for Canadian businesses. Streamline your finances, save time, boost business efficiency with Float

Read MoreCorporate Cards

Corporate Cards for Consulting Firms: An Industry-Specific Guide

Corporate cards for consulting firms don’t need to be a headache. Get tips from industry experts to make the most of your corporate spend.

Read MoreCorporate Cards

Credit Card Fraud Prevention Strategies for Canadian Businesses

Credit card fraud is a risk, but it’s even riskier if you aren’t prepared. Get tips from CPA and Senior Manager/Controller Brian Didsbury on protecting your business.

Read MoreCorporate Cards

How to Get a Business Credit Card: A Step-by-Step Guide

Discover how to secure a business credit card with our guide. Boost your financial flexibility and manage expenses effectively with Float!

Read MoreCorporate Cards

How to Set Business Card Spending Limits: A Finance Leader’s Guide

Learn how to establish effective spending limits for business credit cards. Gain insights and tools for better financial management.

Read MoreCorporate Cards

How to Control Employee Spending: 5 Tips for Finance Teams

Employee spending out of control? These five tips for finance teams will help you control employee spending with ease, without slowing anybody down.

Read MoreCorporate Cards

Corporate Card Alternatives: Comparing Your Options in 2026

Are your outdated cards slowing you down financially? Corporate card alternatives might be what will free you up — time-wise and financially.

Read MoreCorporate Cards

No Annual Fee Business Credit Cards: A Smarter Way to Manage Spend

You don’t need to be saddled by hefty annual fees to get the most benefits from your business cards. Here’s what you need to know about no annual fee business credit cards.

Read MoreCorporate Cards

Best Business Virtual Corporate Cards in Canada in 2026

Discover the Best Business Virtual Credit Card in Canada in 2025. Compare top options from major banks, explore rewards, fees, and benefits.

Read MoreCorporate Cards

Best 0% Interest Business Credit Cards for 2026

Explore why choosing a 0% APR business credit card can be a strategic move for Canadian businesses.

Read MoreCorporate Cards

Instant Corporate Card Issuance: How to Get Cards in Minutes, Not Days

Ready to equip your team to spend quickly while minimizing risk? Cue instant corporate card issuance.

Read MoreCorporate Cards

On-Demand Virtual Cards: Revolutionizing Business Payments

On-demand virtual cards are a game changer for businesses wanting to move quickly—learn how to get set up today.

Read MoreCorporate Cards

How Corporate Card Programs Deliver ROI for Canadian Companies: Measuring Financial Impact

When every dollar matters, the right payment solution can help you grow—and a smart corporate card program is your first step.

Read MoreCorporate Cards

How to Get Approved for a Virtual Corporate Card as a New Business (Without Hurting Your Credit Score)

Looking to add a virtual corporate card to your wallet without messing with your credit score? This guide is for you.

Read MoreCorporate Cards

What Your CFO Wishes You Knew About Pre-Spend Controls

CFO Vinnie Recile shares what every business leader should know about pre-spend controls—a proactive approach to spotting and stopping risky expenses before they spiral into costly, morale-draining problems.

Read MoreCorporate Cards

Establishing a Business Credit Card Policy: Key Steps

Thomas-Louis Lafleur, CPA, shares his go-to steps for building a business credit card policy that keeps spending smart and scalable.

Read MoreCorporate Cards

Corporate Cards for Small Canadian Businesses: Benefits and Implementation Guide

Managing business spending shouldn’t be a constant source of stress—especially when the right tools can make it easier.

Read MoreCorporate Cards

Physical vs. Virtual Corporate Cards: Pros, Cons & Best Use Cases

Let’s break down the pros, cons and best use cases for virtual and physical corporate cards so you can take advantage of corporate card benefits.

Read MoreCorporate Cards

When to Opt for Corporate Cards Over Personal Cards

This guide will help you evaluate corporate cards vs personal cards and, just as importantly, how to switch your company spending habits.

Read MoreCorporate Cards

Who on Your Team Should Have a Corporate Credit Card?

Get help cutting through card confusion with us breaking down how to decide who gets a card and how to protect your business.

Read MoreCorporate Cards

Should Employees Use Personal Credit Cards for Work?

Explore the risks of personal card use for business and learn smart, practical steps to roll out corporate cards with confidence.

Read MoreCorporate Cards

Credit Cards for Business Travel: Top Picks for Canadian Companies in 2026

Find the best business travel credit card Canada has to offer and make travel expense tracking a breeze.

Read MoreCorporate Cards

Best Credit Card for Startup Businesses in Canada

Discover the best credit card for startup businesses in Canada, with top picks, perks, and tips to manage spend and support your growth.

Read MoreCorporate Cards

How to Set Up a Corporate Card Program

Learn how to set up a corporate card program that streamlines expenses, boosts control, and empowers your team without headaches.

Read MoreCorporate Cards

Corporate Credit Cards in Canada: A Practical Guide for Businesses

Discover how corporate credit cards work in Canada. Types, perks and how to find the best ones for your business.

Read MoreCorporate Cards

Unlocking Benefits: How to Get a Virtual Credit Card for Your Canadian Business

Discover how your Canadian business can benefit from a virtual credit card. Unlock convenience, security, and smarter spending today with our expert guide!

Read MoreCorporate Cards

Understanding Credit Cards, Charge Cards and Secured Cards

Explore the differences between credit cards, charge cards, and secured cards. Learn how each option can benefit your financial journey with Float.

Read MoreCorporate Cards

Top Five Use Cases for Virtual Cards in Canadian Businesses

Discover the top 5 use cases for virtual cards in Canadian businesses. Streamline expenses, enhance security, and boost efficiency with Float’s solutions.

Read MoreCorporate Cards

Why You Should Consider Prepaid Business Credit Cards in Canada

Discover the pros and cons of prepaid business credit cards in Canada. Learn how they work, top options, and if they’re right for your company’s financial strategy.

Read MoreCorporate Cards

A Better Way to Manage your Company Subscriptions with Float

Learn how to audit and manage your company software subscriptions with Float

Read MoreCorporate Cards

3 Ways to Simplify Corporate Spend with Mobile Wallets

Learn how to enable team spend (with control) through smart corporate cards integrated with mobile wallets.

Read MoreCorporate Cards

Maximizing Security with Float: 5 Proven Tips

Our Risk team’s round up of important tips to help keep your account and cards safe.

Read MoreCorporate Cards

Five Easy Ways to Achieve Business Savings with a Corporate Card

Discover five easy ways to achieve savings for your business by picking the right corporate card solution. Earn cashback and interest, minimize FX costs, decrease inefficiencies

Read MoreCorporate Cards

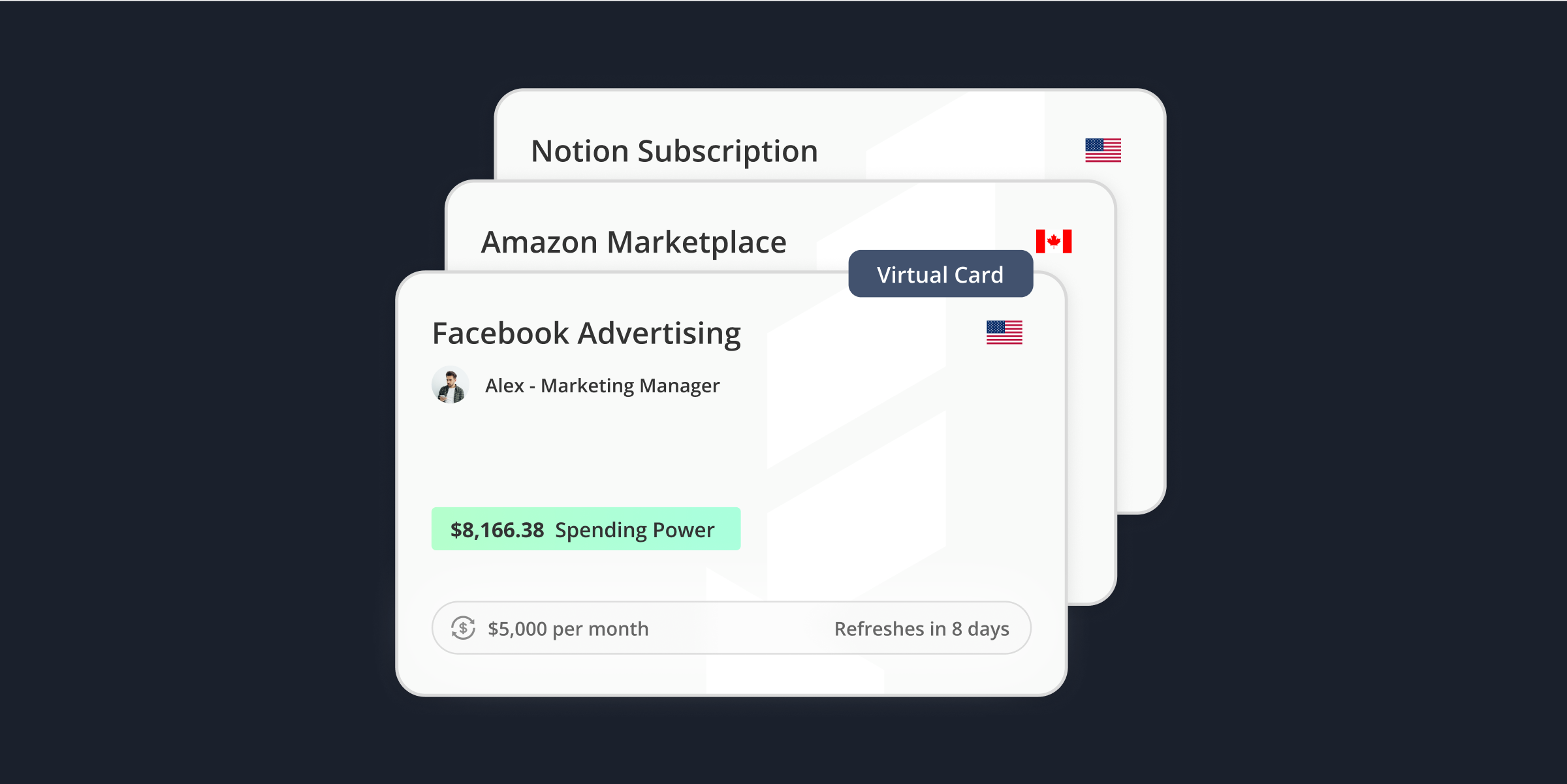

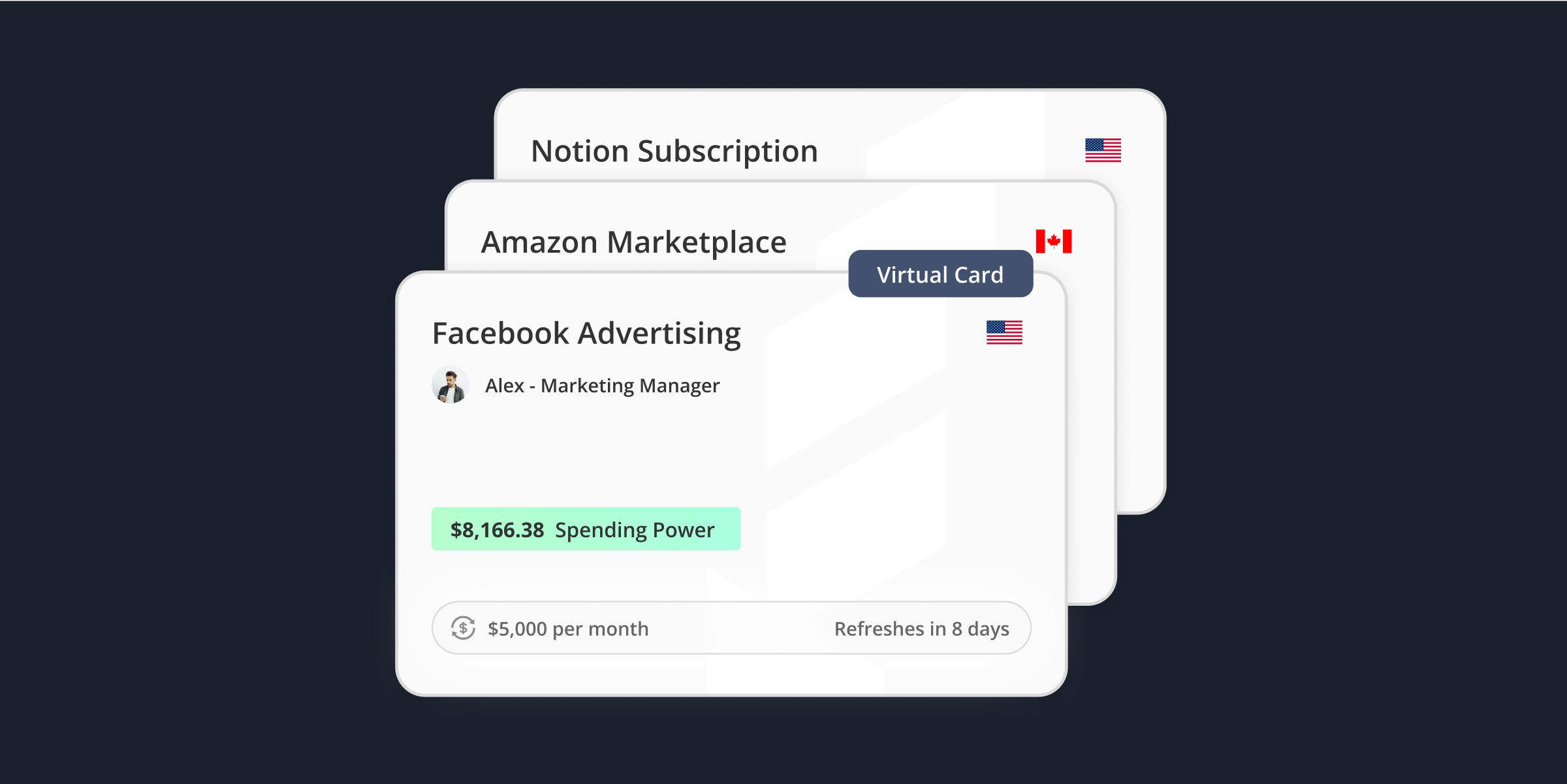

Why You Should Create a Separate Card for Each Vendor

Overcharged and Overwhelmed? Not on our watch. Float has designed a feature that allows you to easily manage transactions from ALL your vendors.

Read MoreCorporate Cards

3 Common Misconceptions About Corporate Cards for Startups

We’re here to clear the air on some of the most common misconceptions around corporate cards so you can spend smarter and scale. 🚀

Read MoreCorporate Cards

3 Signs Your Team is Ready For a Float Card

Ideas are flowing💡, the team is growing👫 and you need a better solution to manage and track your spending.💸 You’re in the right place.

Read MoreCorporate Cards

Why Virtual Cards Are More Secure Than You Think

Virtual cards. What are they?

Read MoreCorporate Cards

Why You Should Split Your Business Expenses From Your Personal Expenses

One of the most common errors new businesses make is blurring the lines between personal and business expenses. Here’s a few (good) reasons to keep them separate.

Read MoreCorporate Cards

How Corporate Cards Can Benefit Startup Companies

Many startups often fail due to a lack of capital in their first year of operating. Corporate cards — physical and virtual — serve as a great tool to help startups effectively manage their growth, monitor spending and increase operational efficiency.

Read MoreCorporate Cards

What Are Virtual Cards?

Unlock financial freedom with virtual credit cards! Instant access, customizable limits, and enhanced security. Control spending, shop worry-free online, and say goodbye to physical plastic. Embrace the future of smart spending today!

Read MoreCorporate Cards

Still Sharing Credit Card Details over Slack?

Sharing corporate card credentials creates admin overhead, security concerns and makes reconciliation harder.

Read MoreYour questions,

answered

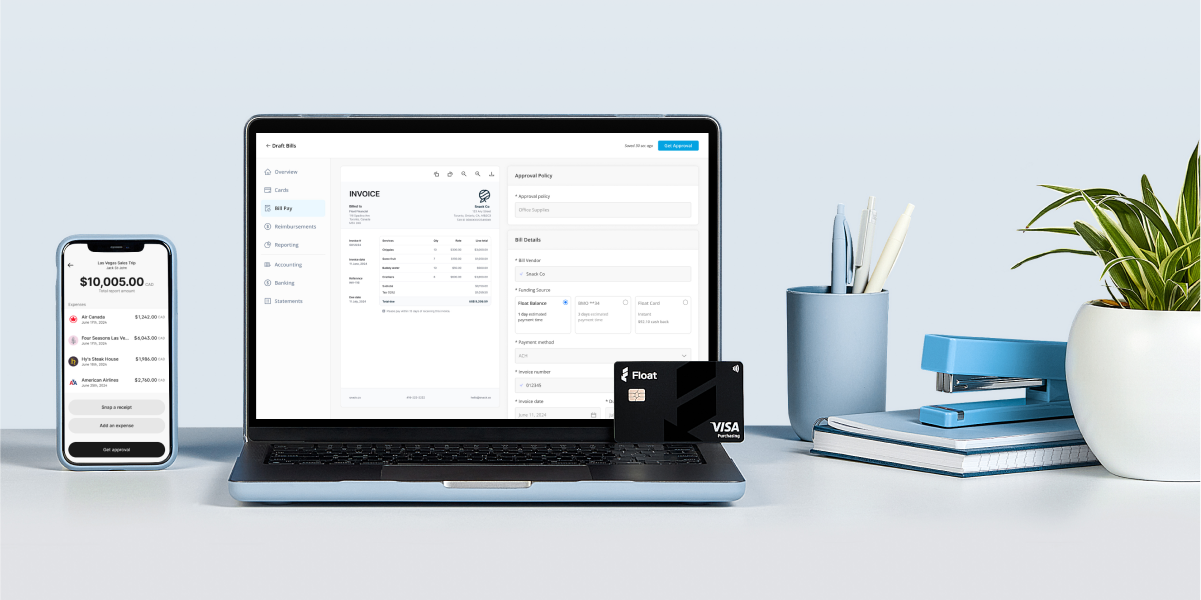

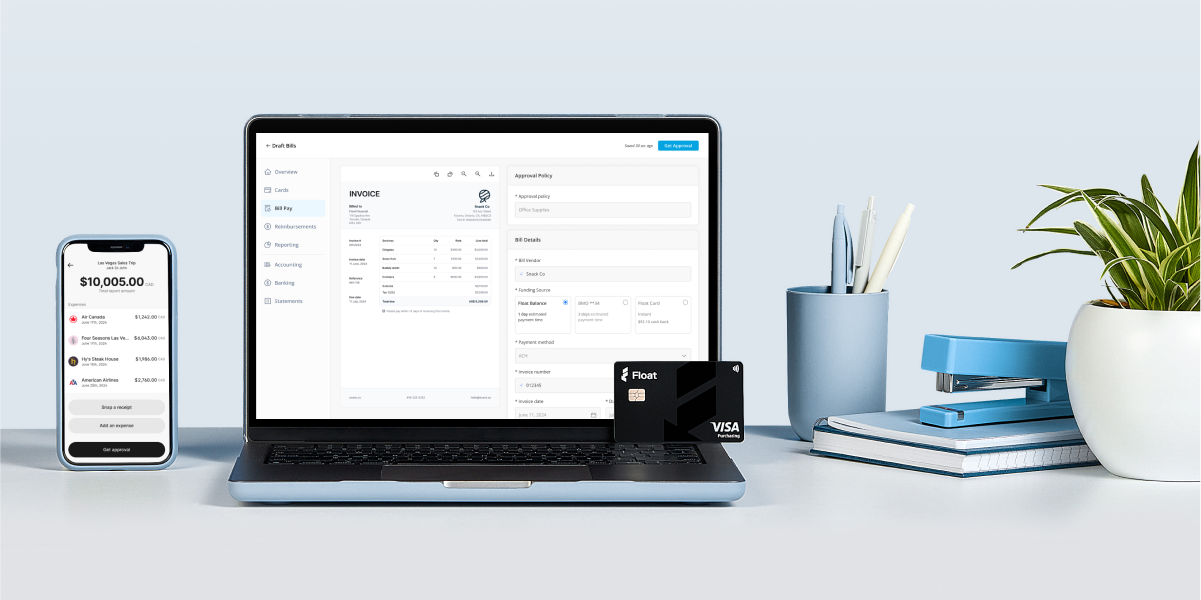

Float is an easier, smarter way to manage your business spending. Think of it as a combination of no-personal-guarantee corporate cards and intelligent spend management software to help you automate, control, and manage your company’s spending.

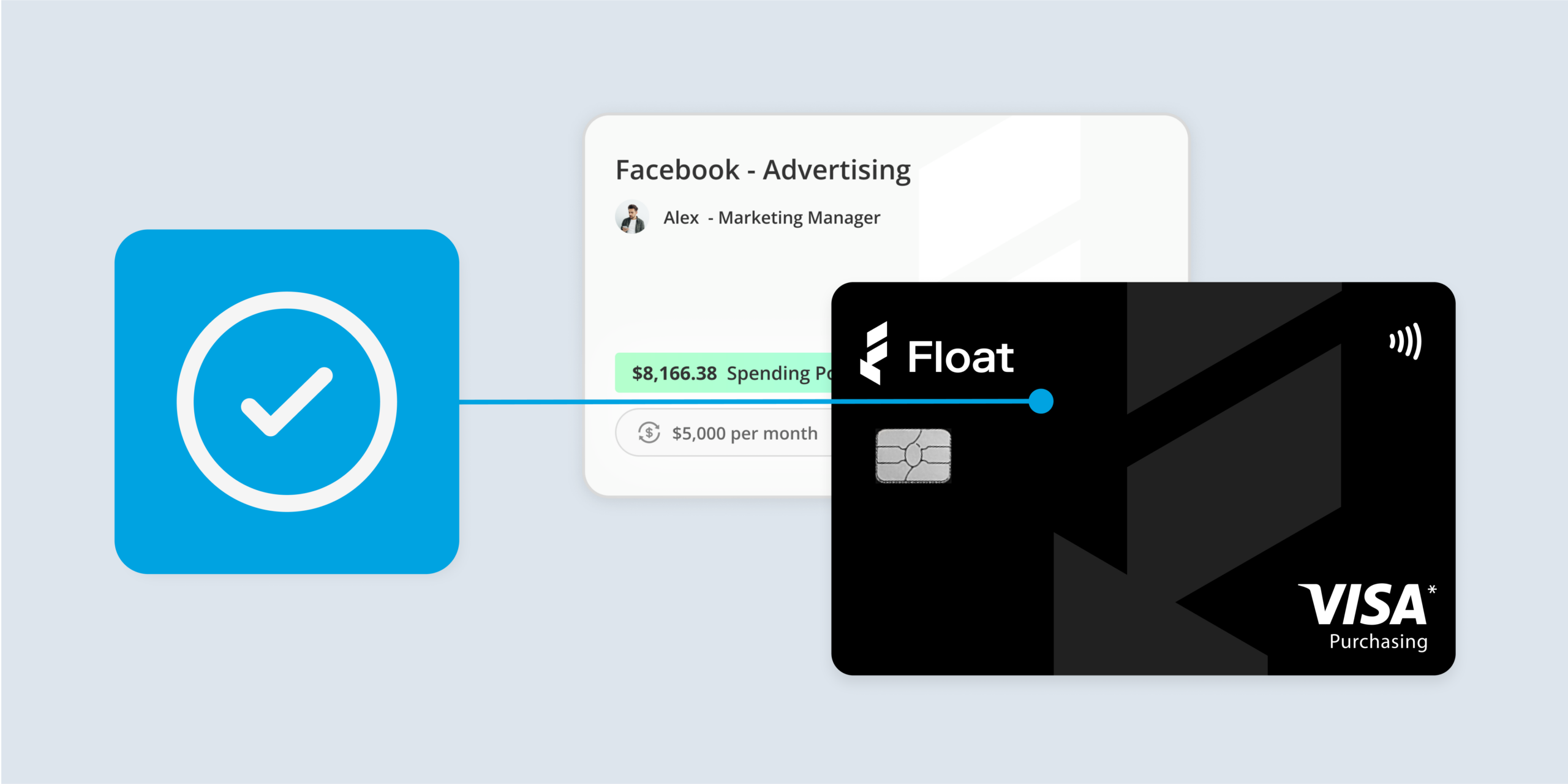

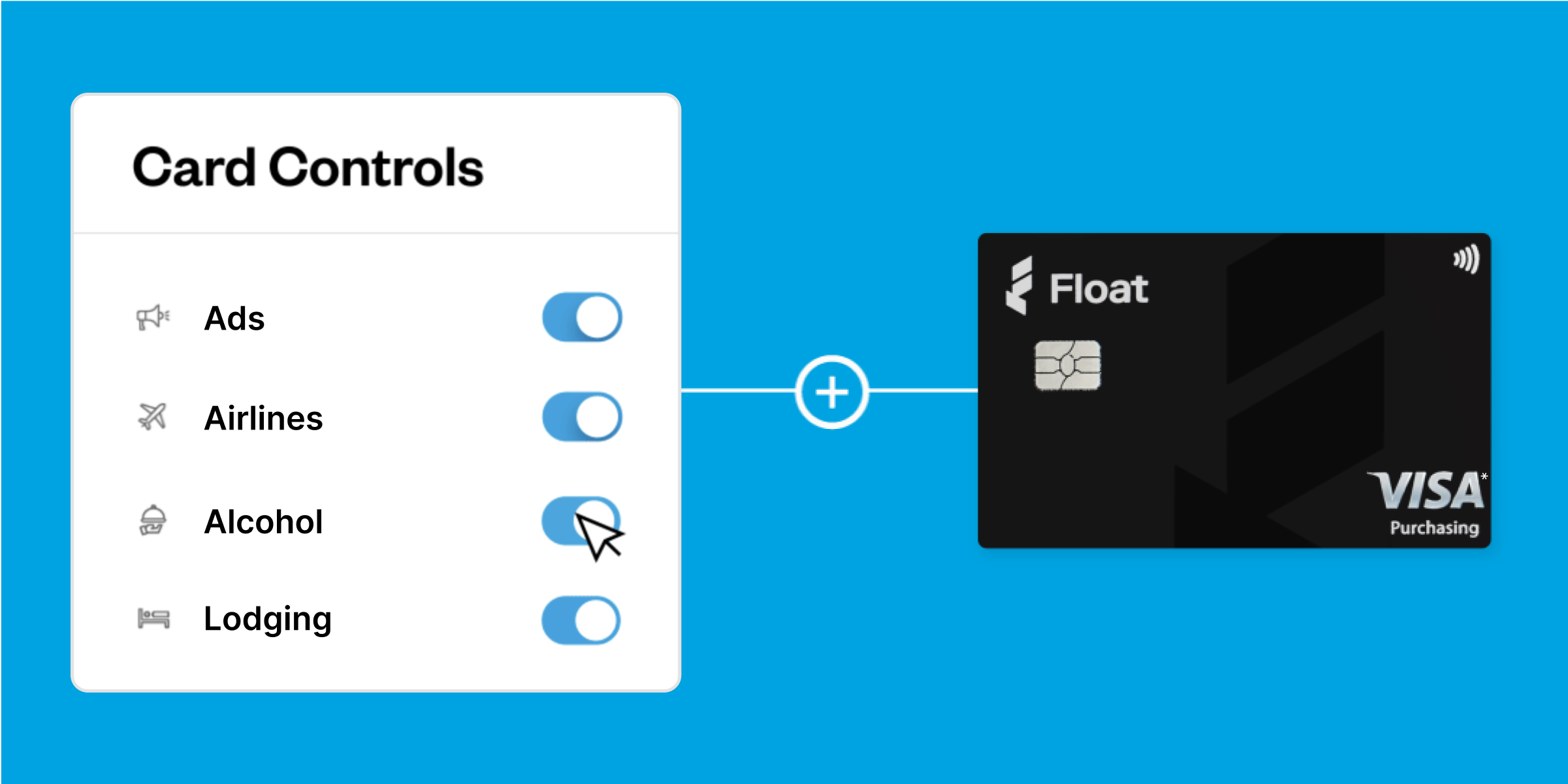

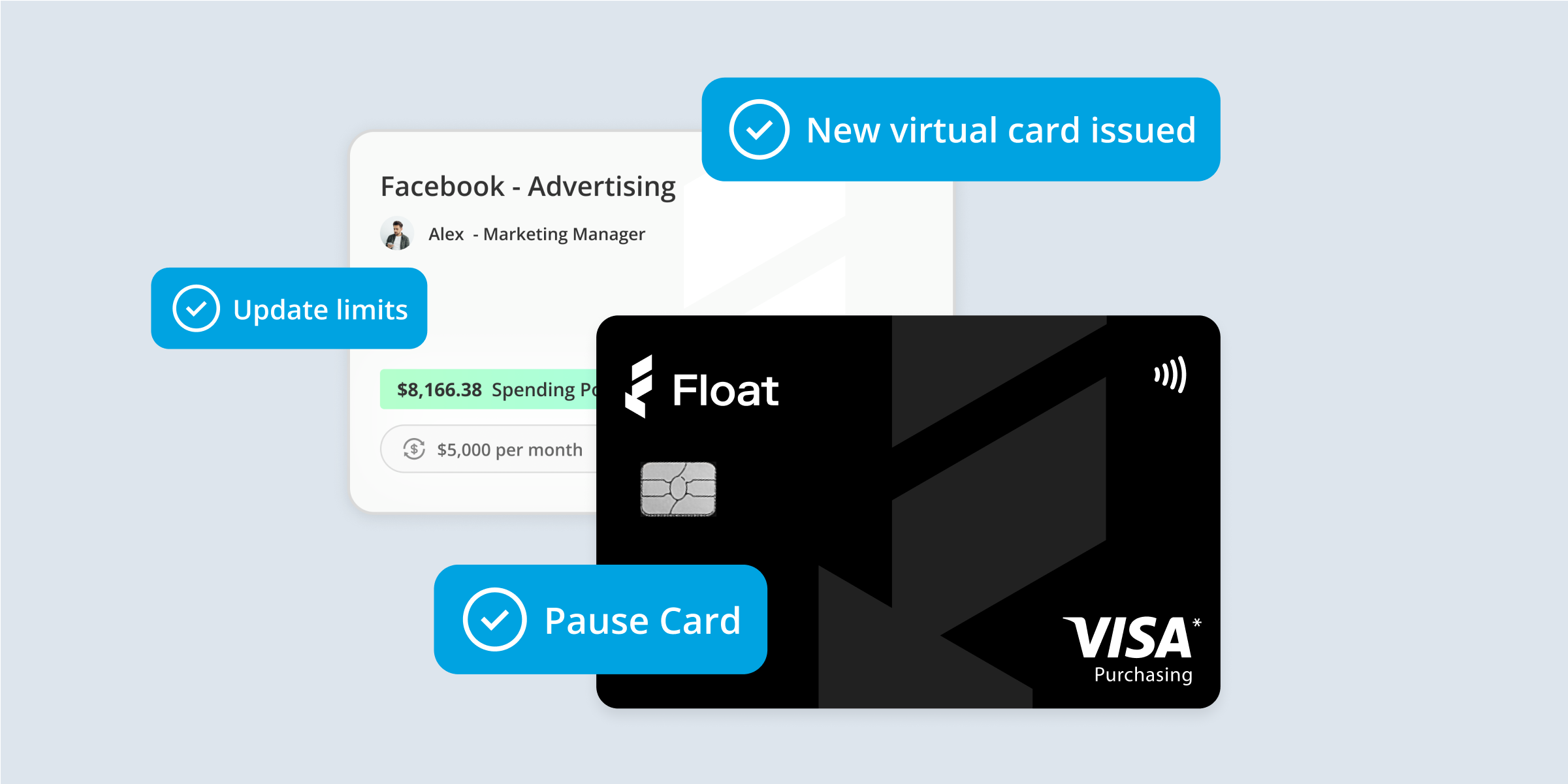

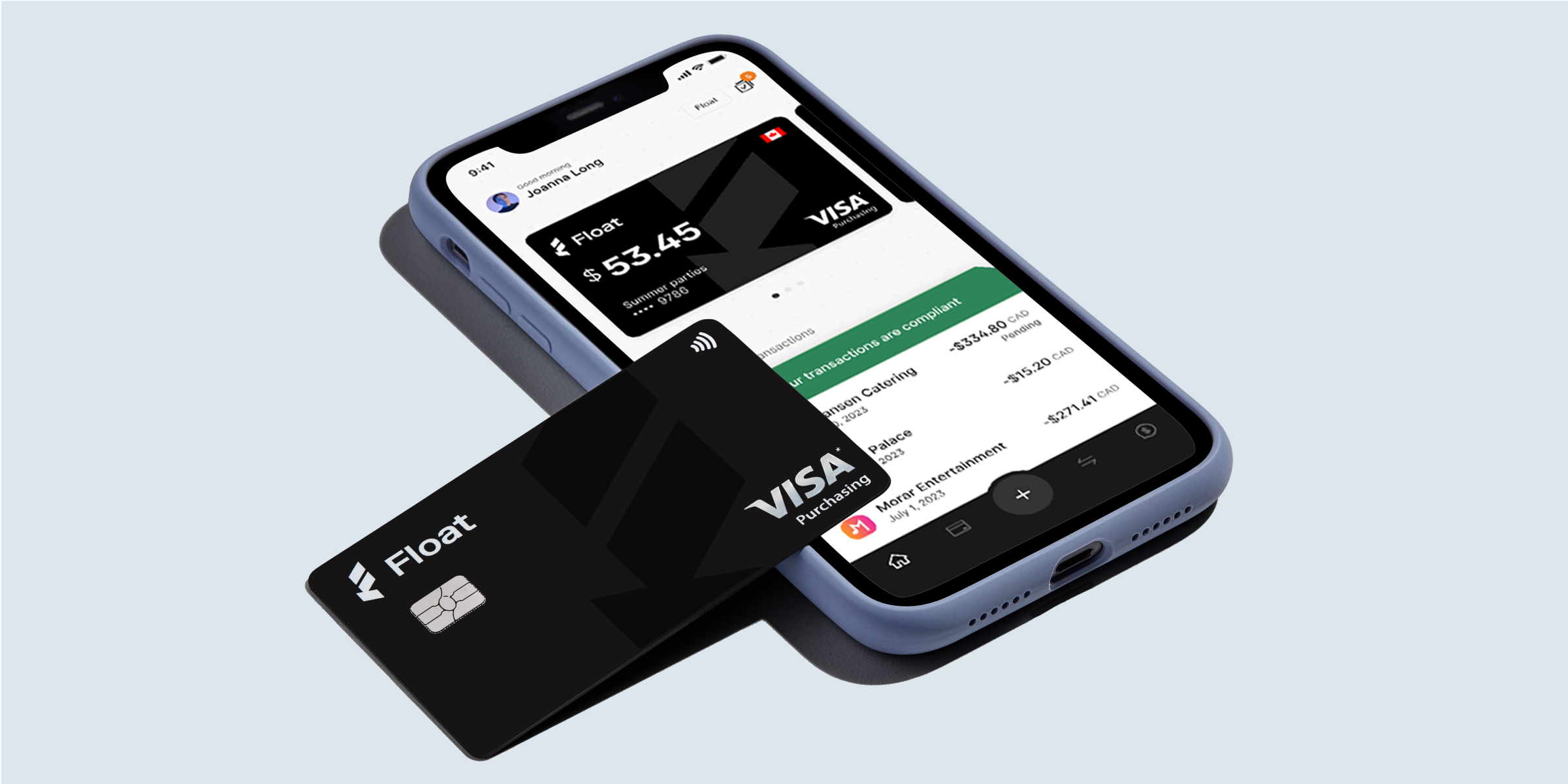

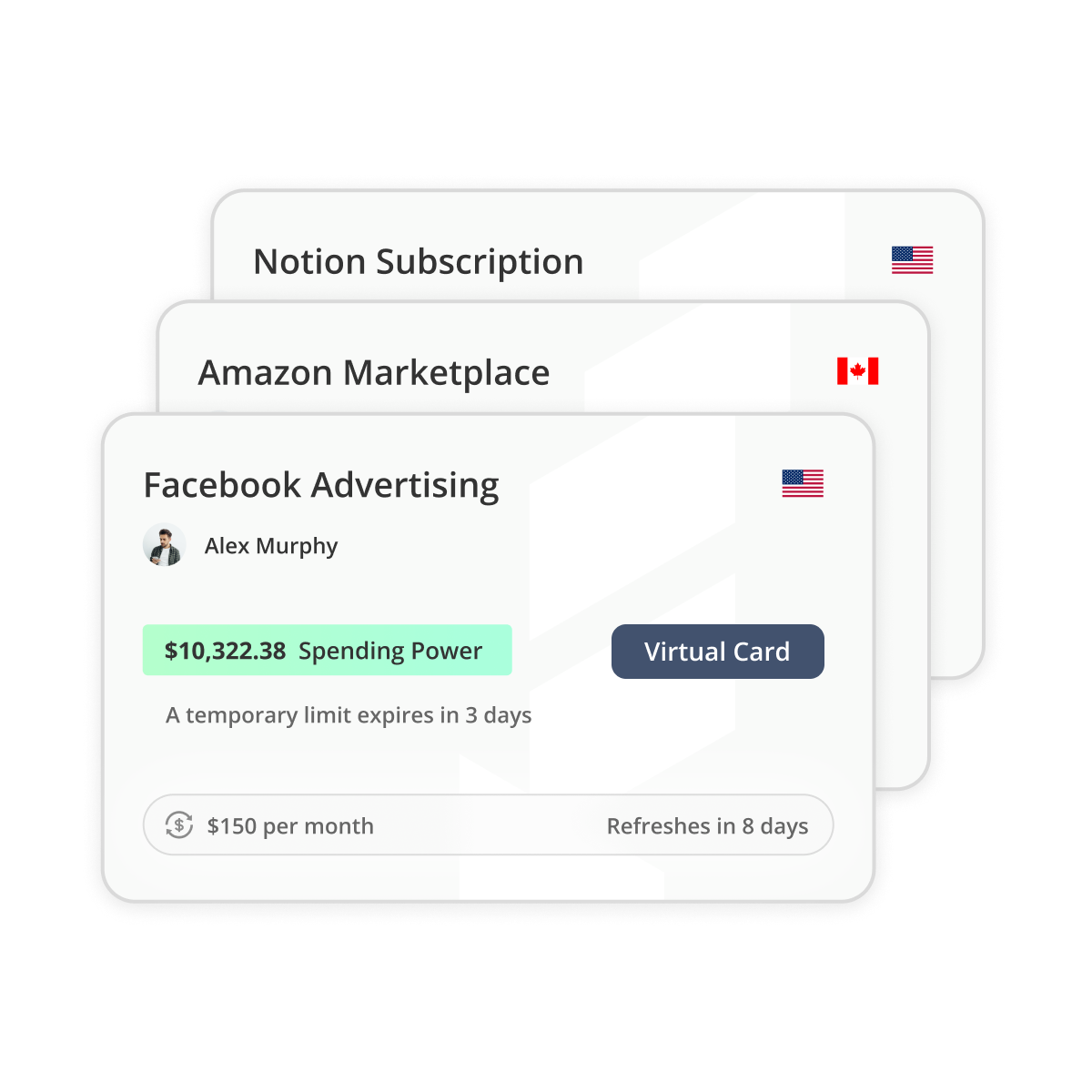

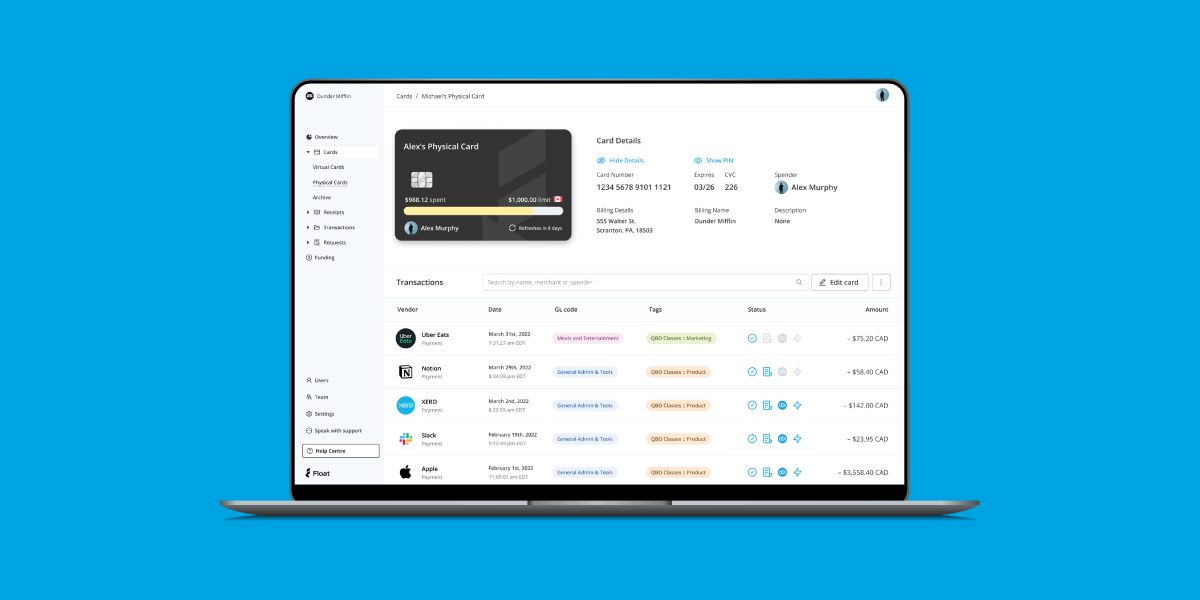

Float customers have access to physical and virtual corporate cards in both USD and CAD. Once you issue cards to employees, Float will collect receipts after every transaction. Each transaction is then automatically coded and matched with its receipt, ready to export to your accounting software.

Just like a ‘regular’ corporate card, our cards are used around the world anywhere VISA and Mastercard are accepted. With accounts in both CAD and USD, it’s easy to switch between the two currencies when you need to.

Physical and virtual cards work essentially the same way! Virtual cards act the same way as physical cards, in that you can use them for any spend where you need to enter in a card number. Virtual cards can be created instantly whenever you need them, and are perfect for online expenses like recurring expenses or ad spends. Both virtual and physical cards are linked directly to Float software with individual card controls to help manage spend.

Float offers personalized payment terms based on your business’s stage of growth. With Float’s Pre-funded CAD and USD cards, your limits = your bank balance. You can connect multiple bank accounts in CAD or USD, and even set up automatic top-ups to ensure your cards never run out of funds. With Float’s Charge card (CAD and USD), you can apply for up to $1M in unsecured 30-day credit terms that you can automatically pay down throughout the month.