Resources

Level up your finance game with Float’s Resource Hub: expert insights, practical tips, and real stories from Canadian businesses using Float to work smarter.

💡 Need to troubleshoot features in your Float account?

Visit our Help Centre for access to even more instructional articles and guides.

Built in Canada: How Impact Kitchen Saves Time with Float

Impact Kitchen saves 100+ hours a year with Float by streamlining expenses across 7 Toronto locations. With better compliance and fewer manual tasks, Float is helping them scale efficiently—including their first US store in NYC.

Product Education

Float Reimbursements: A Setup Guide for Finance Teams

Everything you need to confidently roll out Float Reimbursements across your company.

Read MoreProduct Education

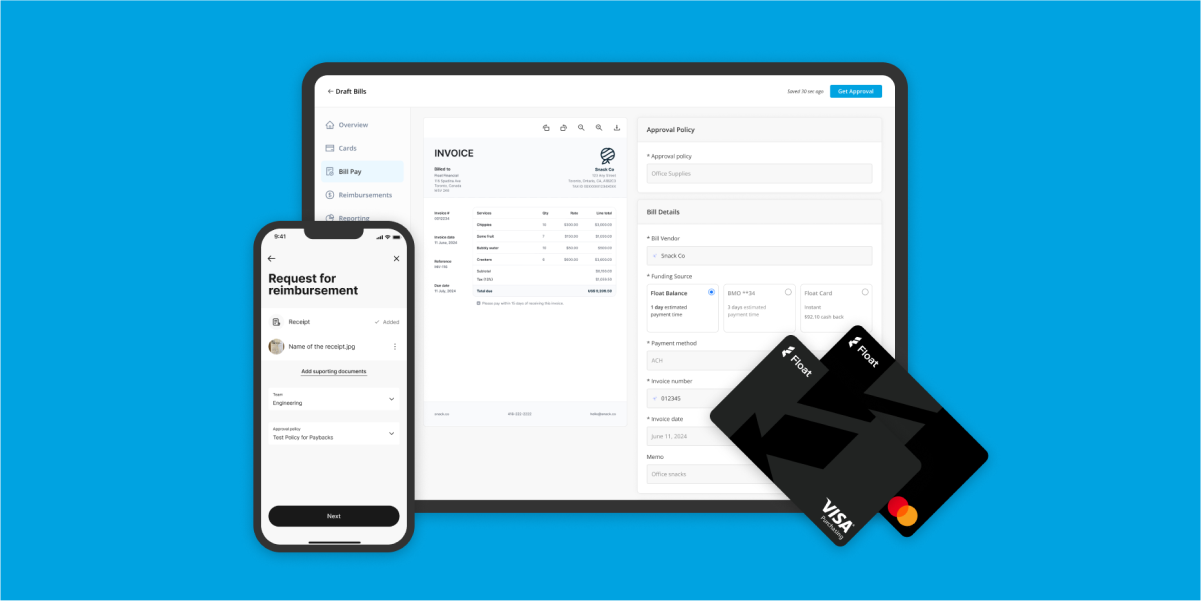

New! Bill Pay and Reimbursements

Float is the first business finance platform in Canada to offer an end-to-end solution that simplifies all non-payroll spending.

Read MoreProduct Education

Pay Your Bills on Float with Bill Pay

The 3 Top Takeaways from the “More Ways to Pay in Float” Bill Pay Webinar

Read MoreProduct Education

Get Fast Transfers to Float

Reliable access to funds in Float with fast one business day transfers.

Read MoreProduct Education

Simple Pricing for Your Stage of Growth

Choose the Float plan that works best for your stage of growth (or figure out when it’s time to upgrade).

Read MoreProduct Education

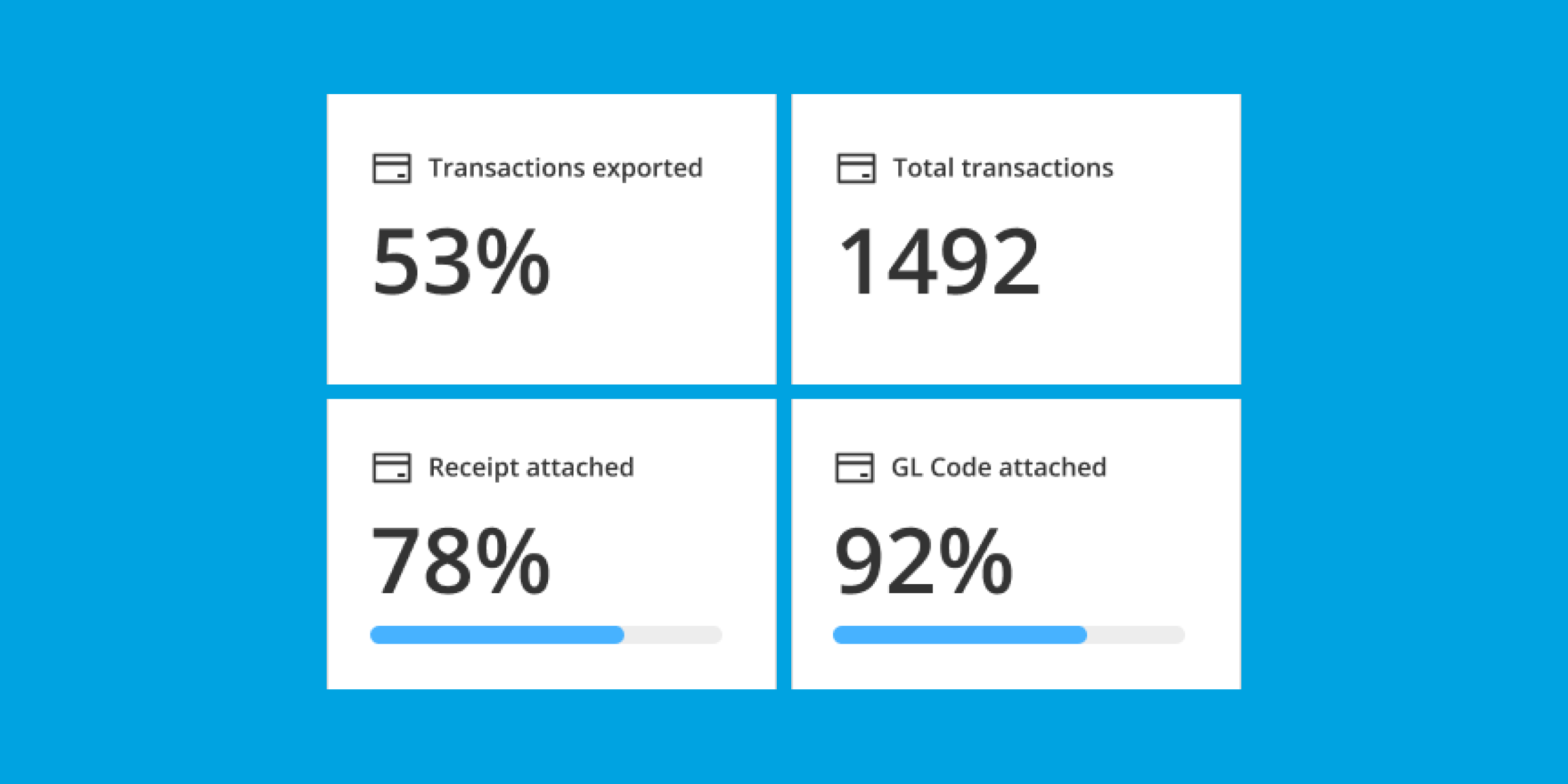

Get export-ready faster with Float’s Accounting Workboard

Save on time and unwanted spend each month-end as you close the books.

Read MoreProduct Education

Find Efficiency with Float’s Accounting Hub

A dedicated space to quickly review, automate, and export transactions at scale.

Read MoreProduct Education

Introducing the Float Mobile App

Take your business spending on-the-go. Request new cards and reimbursements, capture receipts, and understand your spending power at a glance.

Read MoreProduct Education

The Month-End: November

What’s new at Float? Last month we launched our new Notifications Centre, earnings for Float Yield took effect, and we received our PCI-DSS certification. Read about it here.

Read MoreProduct Education

PCI-DSS: From Compliance to Certification

Learn about our dedication to safeguarding sensitive data with our recent PCI-DSS certification audit and new spend control features.

Read MoreProduct Education

Float Launches Canada’s First High-Yield Product To Help Canadian SMBs Navigate Inflation Challenges

Earn up to 2.7x the interest rate on CAD and USD balances vs traditional banks

Read MoreProduct Education

The Month-End: October

What’s new at Float? Last month we expanded access to Transaction Splits, introduced new custom features to the Accounting Hub, and announced our much-anticipated mobile app. Catch up on these latest game-changers.

Read MoreProduct Education

The Month-End: September

What’s new at Float? Last month we revamped the Accounting Hub, enhanced our customers’ funding experience, and introduced Reimbursements. Catch up on these latest game-changers.

Read MoreProduct Education

New! Simplify Employee Reimbursements with Float

Simplify your team spending by keeping it all in one place (including employee reimbursements).

Read MoreProduct Education

Control Employee Expenses with Float’s Latest Features

From Dynamic Approvers to a new HRIS Integration, Float’s latest features were built in Canada with ❤️

Read MoreProduct Education

What Makes Float Uniquely Canadian

Learn what sets Float apart as the modern business spending platform for Canadian finance teams.

Read MoreProduct Education

It’s Official – Float is SOC 2 Type 2 Certified

Learn about our commitment to security and trust at Float with our recent SOC 2 Type 2 compliance audit and new spend control features.

Read MoreProduct Education

Introducing Float Cards 2.0

Meet the next generation of Float Cards that let you top-up card balances as purchases need to be made for worry-free company spending.

Read MoreProduct Education

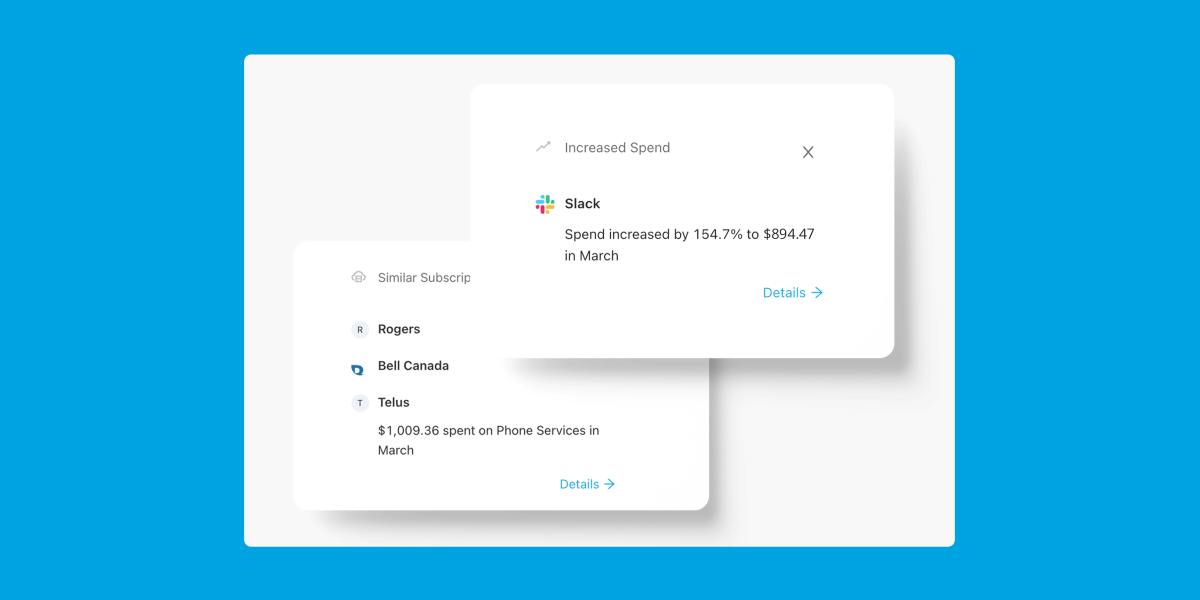

Spend Less with Float’s Savings Insights

Get monthly suggestions on how to cut waste and save money on your company’s software spending.

Read MoreProduct Education

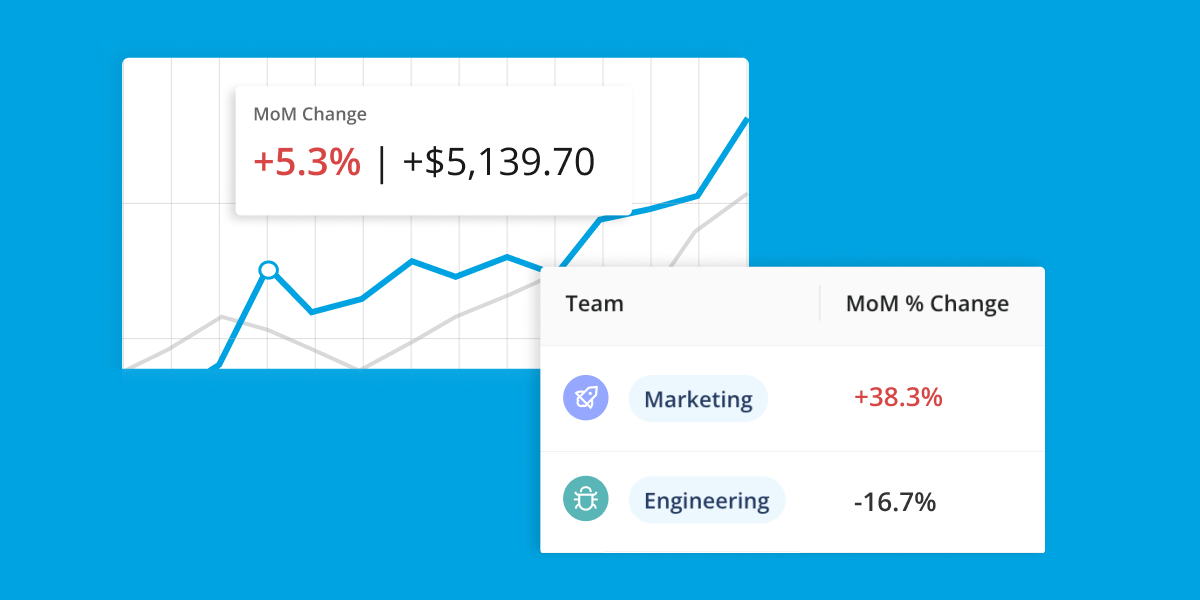

Get financial visibility with Float’s latest Reporting feature

Make data-driven decisions that drive savings with real-time visibility into company spending.

Read MoreProduct Education

New! Transaction splits

Easily split card transactions and allocate different amounts to different accounts directly in Float ✂️

Read MoreProduct Education

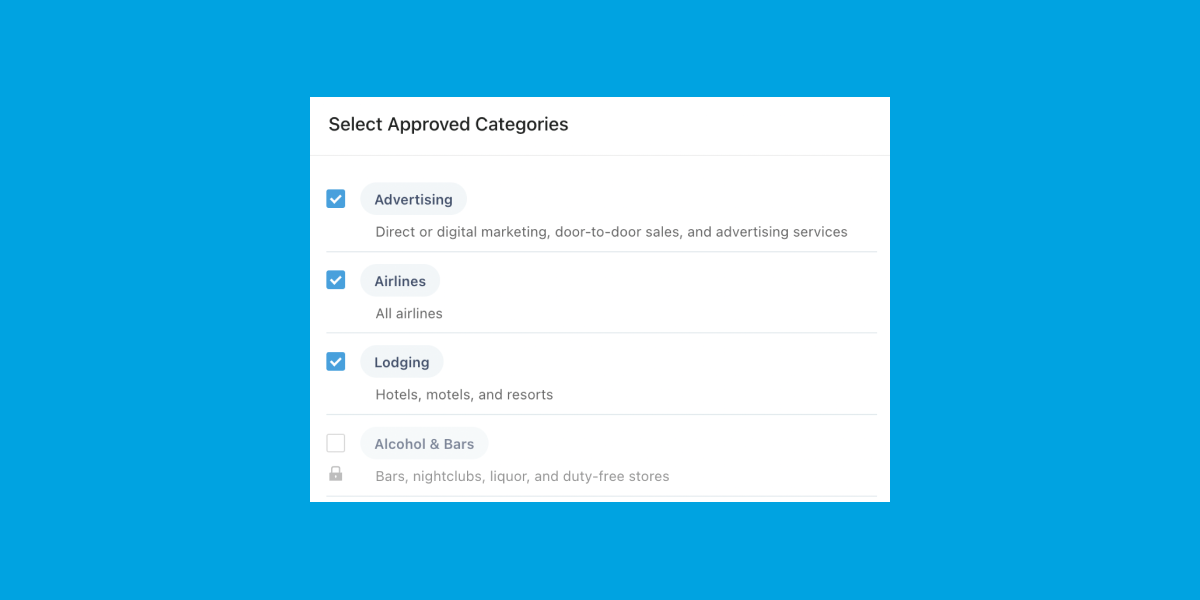

Introducing Merchant Controls

Issue cards to employees worry-free by limiting their transactions to approved merchant categories.

Read MoreProduct Education

Float’s 2022 Product Roundup

As we close the books for 2022, it’s a great time to look back on what was accomplished and to create goals for the year ahead.

Read MoreProduct Education

Introducing Canada’s smartest corporate card for USD spending

Corporate spending just got a whole lot easier! You can now easily manage your USD and CAD transactions all in the Float platform.

Read MoreProduct Education

New! Float SAML SSO Login

Set up SAML Single-Sign On for improved account security with Float.

Read MoreProduct Education

New! Sync your expenses and receipts from Float to NetSuite

Float allows you to export transactions already coded and embedded with receipts directly to NetSuite.

Read MoreProduct Education

Dynamic Duo: Submission and Approval Policies

Use Float to automate your company’s expense policies for greater financial control.

Read MoreProduct Education

Float’s New Smart Corporate Cards Are Here!

Looking for a smarter, more professional way to spend? Float’s new smart (physical) corporate cards have arrived!

Read MoreProduct Education

A Guide to Setting Up Teams and Multi-level Approvals

Use Float’s Team Management feature to set team-level and multi-level approval policies.

Read MoreProduct Education

How It Works: Float’s QBO Integration

Float offers a powerful two-way integration with QBO.

Read MoreProduct Education

3 Float Hacks You Should Know

Ready to level up your experience with Float? Don’t go anywhere – we’re about to let you in on all the tips and tricks.

Read MoreProduct Education

Better Expense Management with SMS Tracking

In a perfect world, expense management would be as easy as a simple text. And at Float, that’s exactly the world we’re living in! 😉

Read MoreProduct Education

Product News: Introducing Float’s Slack Integration Feature

What if we told you that issuing corporate cards, requesting spend approvals and managing corporate expenses across departments was all possible at the click of a button?

Read MoreProduct Education

Upcoming Release: Team Management

One of the biggest platform upgrades in Float’s history is almost here and we are excited to let you in on all the fun. Drum roll please… 🥁

Read MoreYour questions,

answered

Float is an easier, smarter way to manage your business spending. Think of it as a combination of no-personal-guarantee corporate cards and intelligent spend management software to help you automate, control, and manage your company’s spending.

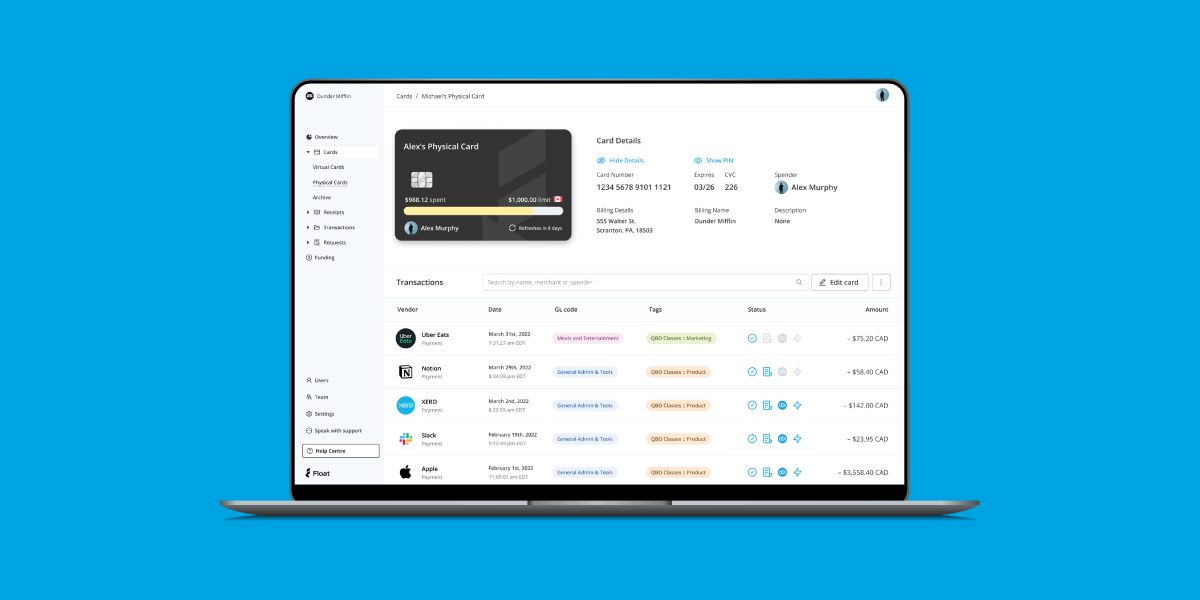

Float customers have access to physical and virtual corporate cards in both USD and CAD. Once you issue cards to employees, Float will collect receipts after every transaction. Each transaction is then automatically coded and matched with its receipt, ready to export to your accounting software.

Just like a ‘regular’ corporate card, our cards are used around the world anywhere VISA and Mastercard are accepted. With accounts in both CAD and USD, it’s easy to switch between the two currencies when you need to.

Physical and virtual cards work essentially the same way! Virtual cards act the same way as physical cards, in that you can use them for any spend where you need to enter in a card number. Virtual cards can be created instantly whenever you need them, and are perfect for online expenses like recurring expenses or ad spends. Both virtual and physical cards are linked directly to Float software with individual card controls to help manage spend.

Float offers personalized payment terms based on your business’s stage of growth. With Float’s Pre-funded CAD and USD cards, your limits = your bank balance. You can connect multiple bank accounts in CAD or USD, and even set up automatic top-ups to ensure your cards never run out of funds. With Float’s Charge card (CAD and USD), you can apply for up to $1M in unsecured 30-day credit terms that you can automatically pay down throughout the month.