Resources

Level up your finance game with Float’s Resource Hub: expert insights, practical tips, and real stories from Canadian businesses using Float to work smarter.

💡 Need to troubleshoot features in your Float account?

Visit our Help Centre for access to even more instructional articles and guides.

Built in Canada: How Impact Kitchen Saves Time with Float

Impact Kitchen saves 100+ hours a year with Float by streamlining expenses across 7 Toronto locations. With better compliance and fewer manual tasks, Float is helping them scale efficiently—including their first US store in NYC.

Cash Flow Optimization

Working Capital Management for Controllers: Optimize Cash Flow with Corporate Cards

Let’s explore how controllers can use corporate cards to strengthen cash flow, improve operational control and support smarter financial decision-making across the organization.

Read MoreCash Flow Optimization

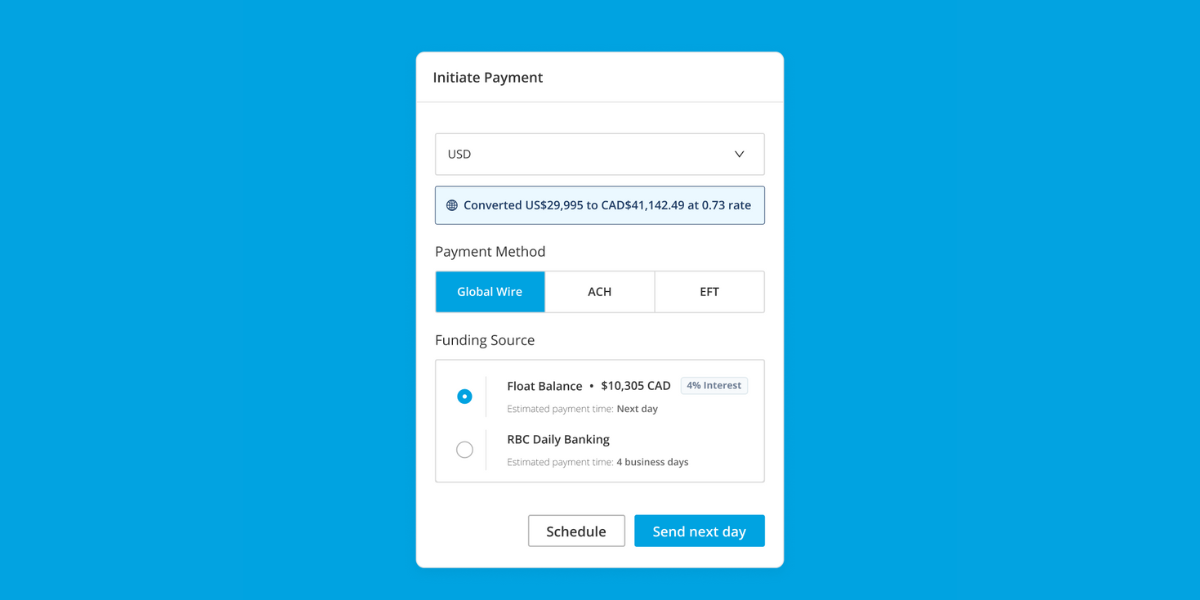

How to Make EFT Payments in Canada: Complete 2026 Guide

Learn how to initiate EFT Payments as a Canadian Business and innovative solutions available on the market, like Float, that you can use for free.

Read MoreCash Flow Optimization

Cash Flow Management for Canadian Businesses: 2026 Strategic Guide

Unlock business growth with our ultimate guide to understanding and improving cash flow in your business. Learn key strategies and tools to optimize today.

Read MoreCash Flow Optimization

7 Best Business Accounts in Canada for 2026

Finding the best business account in Canada isn’t as simple as walking into your nearest branch. That’s where this guide comes in.

Read MoreCash Flow Optimization

Working Capital Turnover: Measuring Efficiency

Ready to master your working capital turnover? Get expert tips from Float and Sendy Shorser.

Read MoreCash Flow Optimization

Net Working Capital: How to Measure & Manage It

Let’s explain what net working capital is, how to calculate it and tips for best ways to use it.

Read MoreCash Flow Optimization

A Step-by-Step Guide to Cash Flow Forecasting

Let’s explore what cash flow forecasting is, why it matters to your business and how you can build a reliable forecast.

Read MoreCash Flow Optimization

Best Business Account Alternatives to Traditional Banking

Compare traditional banking head-to-head with Float and see why many Canadian companies are moving away from banks and toward modern digital business banking alternatives.

Read MoreCash Flow Optimization

How to Calculate Your Working Capital Ratio: A Step-by-Step Guide

Let’s break down what the working capital ratio means, how to calculate it, and how to use it to keep your business financially strong.

Read MoreCash Flow Optimization

Working Capital: Definition, Importance & Strategies

Let’s unpack working capital, why it matters and, most importantly, how you can take control of it with proven strategies.

Read MoreCash Flow Optimization

Capital Efficiency: Getting More from Your Funds

See what Brian Didsbury, CPA and Senior Manager/Controller at LiveCA, says about capital efficiency and learn a few financial concepts along the way.

Read MoreCash Flow Optimization

Payment Optimization: Strategies to Improve Cash Flow

Unlock effective payment optimization strategies to enhance cash flow. Discover actionable insights to streamline your payment processes.

Read MoreCash Flow Optimization

Working Capital Management: Best Practices for Businesses

Working capital management is a key lever for growth—here are the best practices for your small business.

Read MoreCash Flow Optimization

Liquidity Management: Ensuring Cash Readiness

Let’s unpack what liquidity management is, why it matters, and the strategies and tools that will help you stay cash-ready.

Read MoreCash Flow Optimization

The Hidden Cost of FX Fees: Why Businesses Should Pay Attention

FX costs quietly erode revenue and reduce the profitability of your international transactions. Here’s what to do about it.

Read MoreCash Flow Optimization

How to Read Your Business Cash Flow Statement

Master cash flow statements with our how-to guide. Learn to analyze this important business finance document to make informed decisions and drive success.

Read MoreCash Flow Optimization

10 Cash Flow Problems (and Solutions) for Small Businesses

Explore 10 common cash flow problems small businesses face and discover practical solutions to manage and improve your finances effectively.

Read MoreCash Flow Optimization

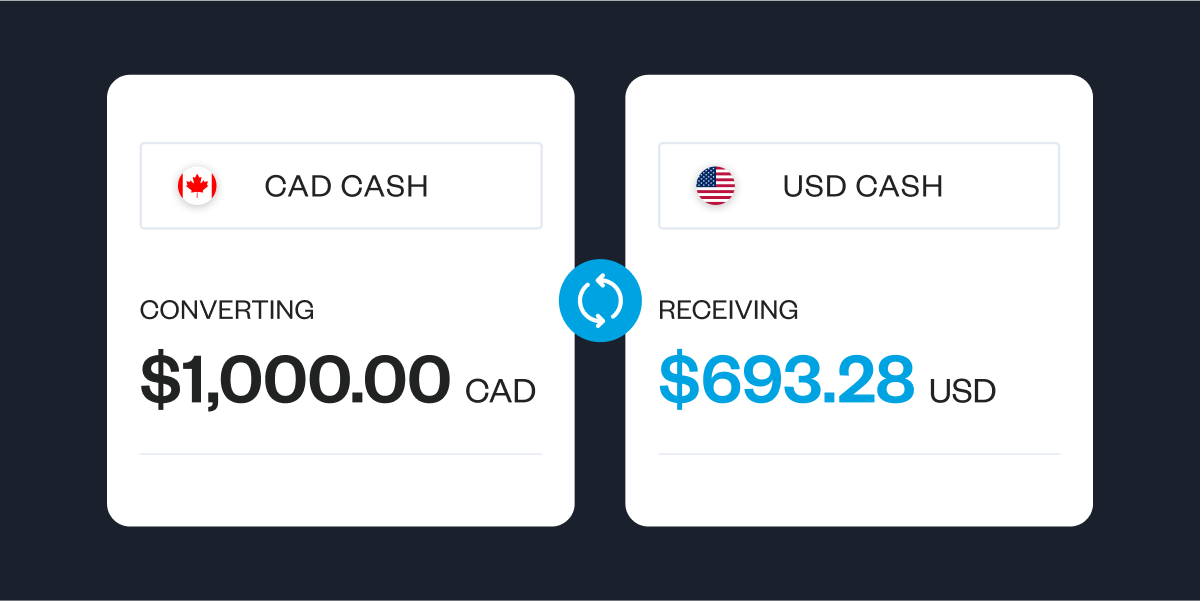

Understanding FX Fees: Save on CAD to USD Conversions

Discover how to minimize FX fees on CAD to USD conversions. Learn tips and strategies to save money and optimize your currency exchanges

Read MoreCash Flow Optimization

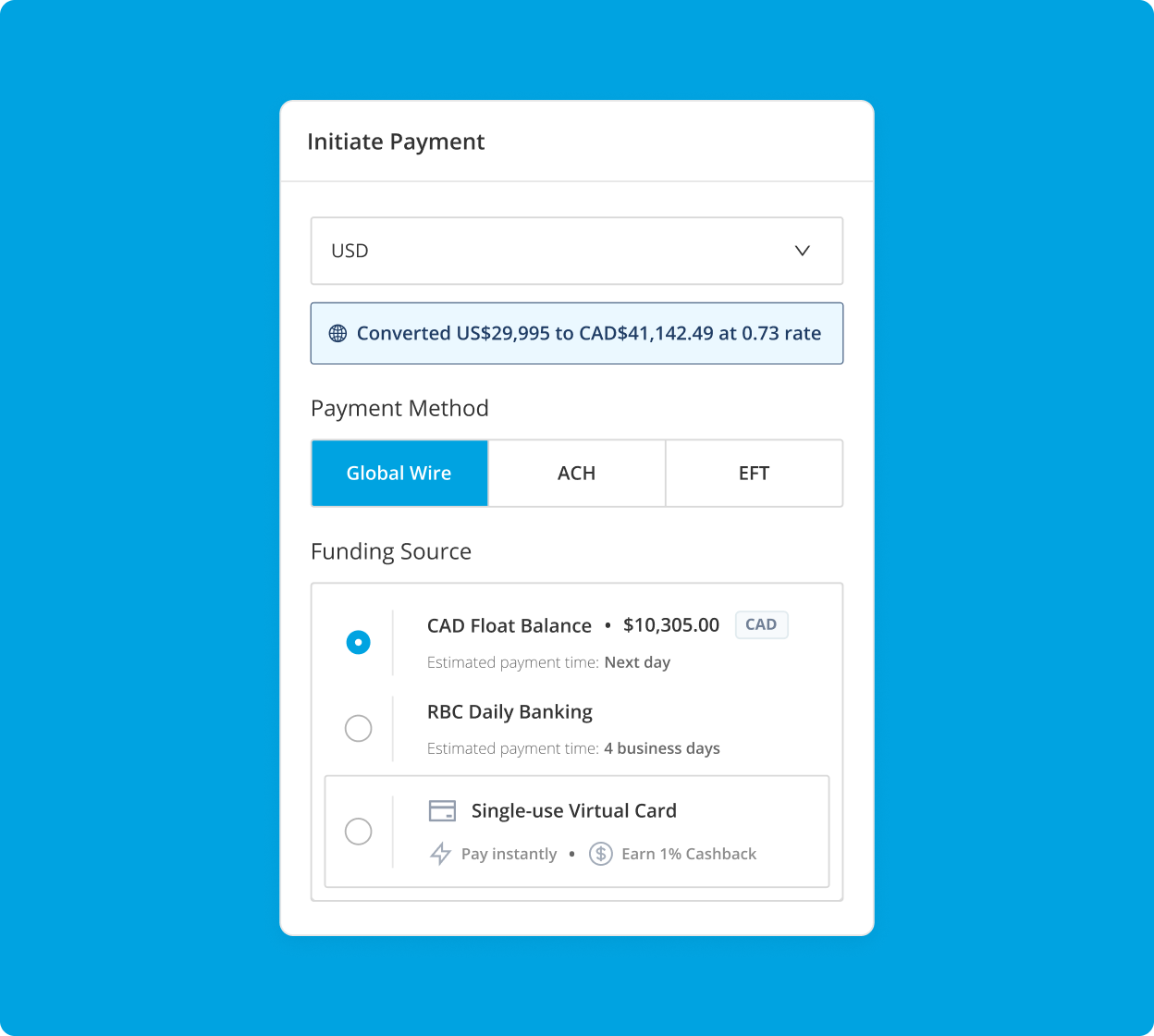

ACH vs EFT Payments: Key Differences for Canadian Companies

Learn the key differences between EFT and ACH payments, how they work, which options might be available to your business and how to choose.

Read MoreCash Flow Optimization

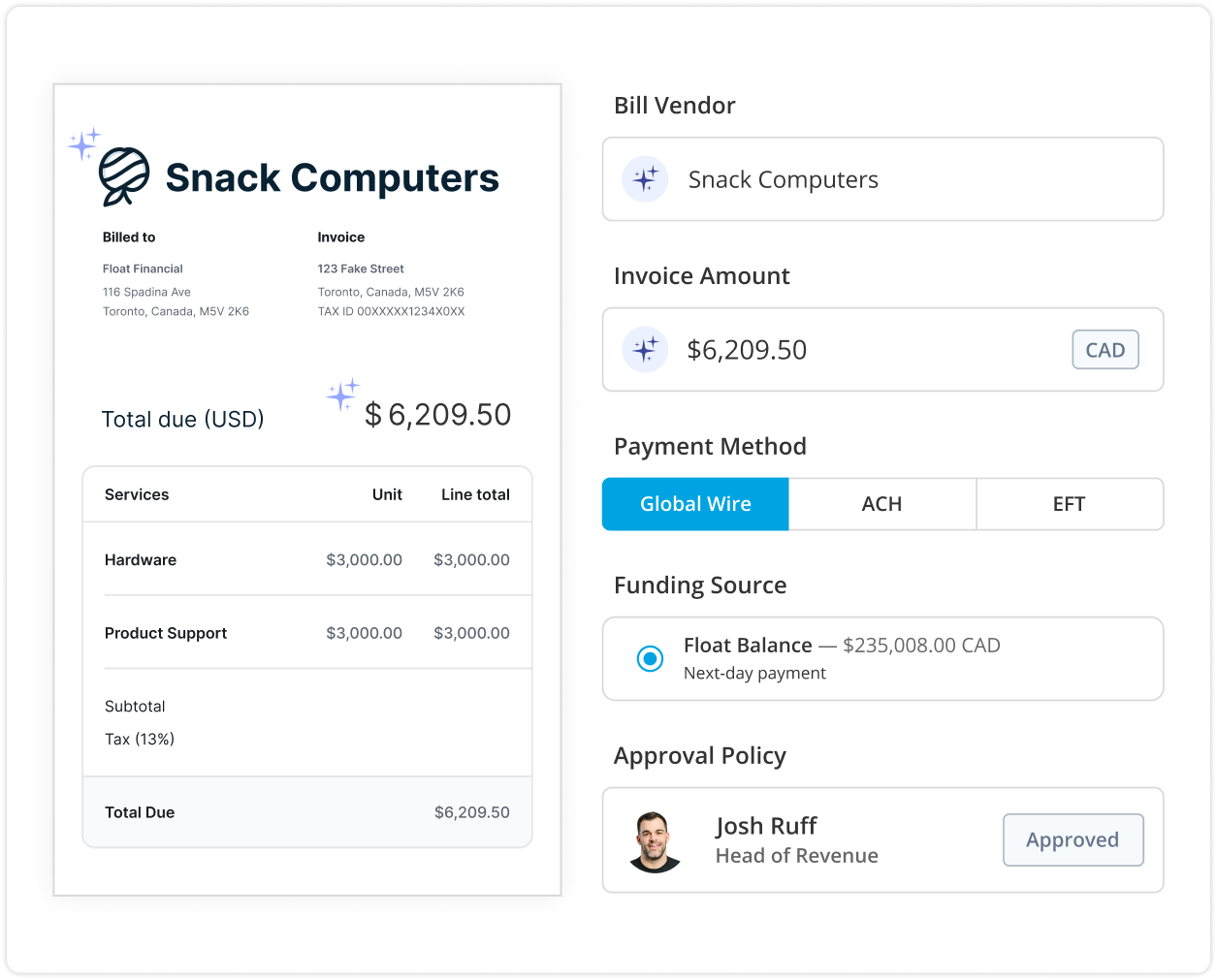

What is Accounts Payable? Your Guide to a Modern AP Process

Everything you need to know about accounts payable and how modern AP automation, corporate cards and expense management can streamline your business spending.

Read MoreCash Flow Optimization

How to Efficiently Pay Invoices as a Canadian Business

Discover efficient strategies for Canadian businesses to pay invoices on time. Streamline your processes and improve cash flow with expert tips from Float.

Read MoreCash Flow Optimization

Step-by-Step Guide to ACH Payments for Canadian Companies

Discover our step-by-step guide to ACH payments for Canadian companies. Simplify your payment processes and improve cash flow with Float’s expert tips!

Read MoreCash Flow Optimization

3 Effective Strategies to Speed Up Accounts Payable

Discover 3 strategies to streamline the accounts payable process, enhance cash flow, and improve supplier relationships with Float’s tips.

Read MoreCash Flow Optimization

Steps to Increase Your Business Credit Card Limit Effectively

Discover steps to increase your business credit card limit. Boost your financial flexibility and fuel your growth with our expert tips!

Read MoreCash Flow Optimization

How to Pay Invoices from the Philippines: A Step-by-Step Guide

Learn how to pay Invoices from Philippines as a Canadian Business and innovative solutions, like Float, that you can use for free to send Global Wires.

Read MoreCash Flow Optimization

How to Pay Invoices from the EU: A Step-by-Step Guide

Learn how to pay Invoices from EU as a Canadian Business and innovative solutions, like Float, that you can use for free to send Global Wires.

Read MoreCash Flow Optimization

How to Pay Invoices from India: A Step-by-Step Guide

Learn how to pay Invoices from India as a Canadian Business and innovative solutions, like Float, that you can use for free to send Global Wires.

Read MoreCash Flow Optimization

How to Pay an Invoice from Mexico: A Step-by-Step Guide

Learn important requirements when it comes to paying Mexico invoices and innovative solutions available on the market, like Float, that you can use for free.

Read MoreCash Flow Optimization

How to Pay an Invoice from the UK: A Step-by-Step Guide

Learn important requirements when it comes to paying UK invoices and innovative solutions available on the market, like Float, that you can use for free.

Read MoreCash Flow Optimization

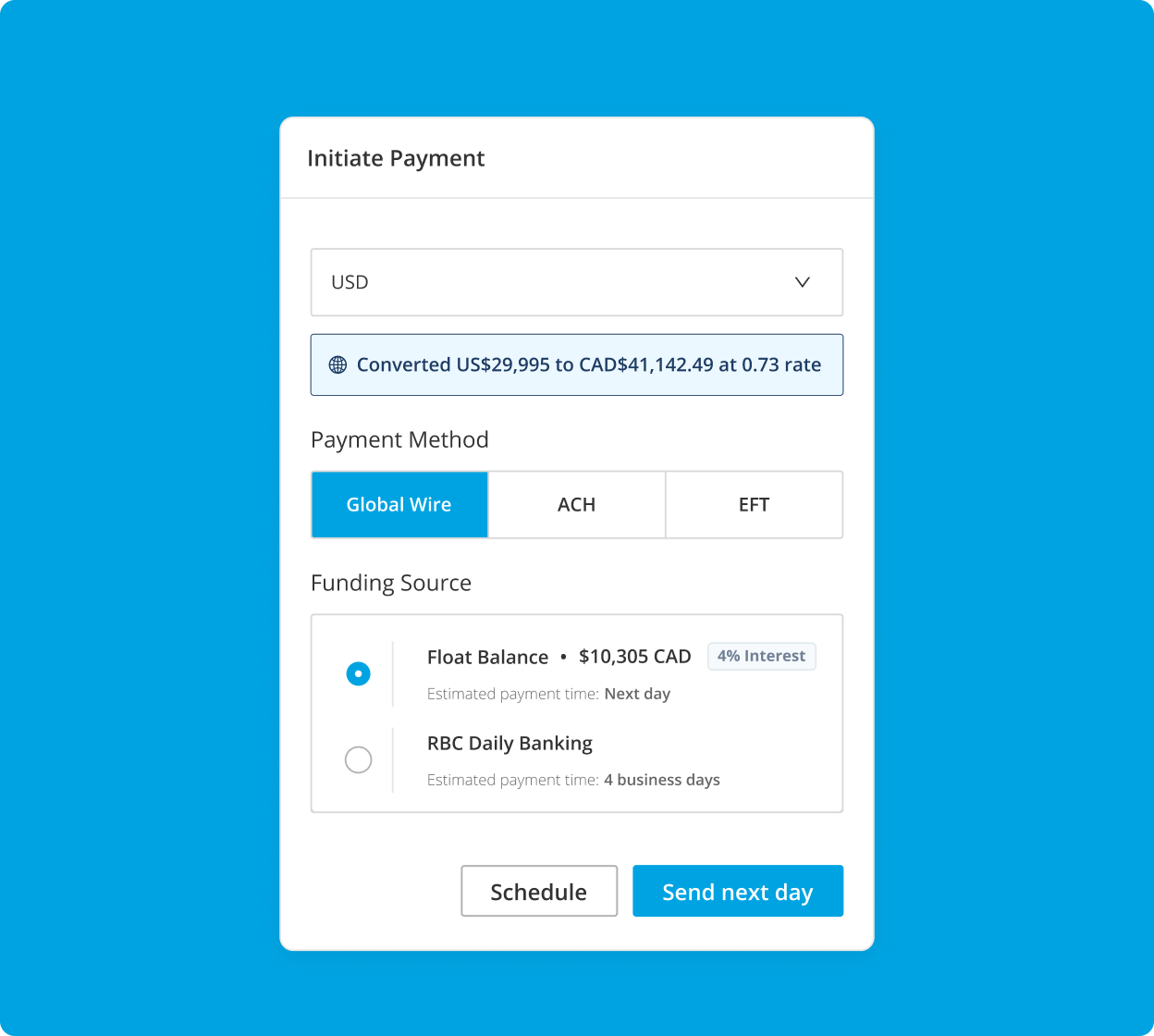

How to Pay Invoices from the US: A Step-by-Step Guide

Learn important requirements when it comes to paying US invoices and innovative solutions available on the market, like Float, that you can use for free.

Read MoreCash Flow Optimization

How To Build Business Credit in Canada: A Comprehensive Guide

Learn how you can build business credit in Canada. Ask any business owner and finance team in the country and they’ll likely agree that one of the most common stressors is building and qualifying for new business credit.

Read MoreYour questions,

answered

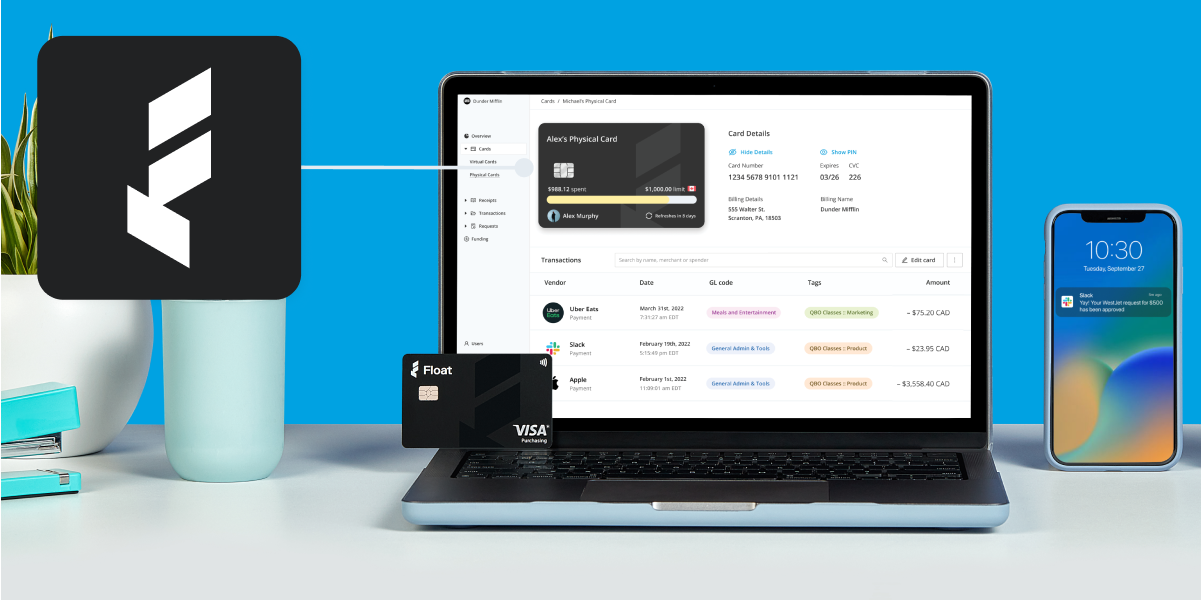

Float is an easier, smarter way to manage your business spending. Think of it as a combination of no-personal-guarantee corporate cards and intelligent spend management software to help you automate, control, and manage your company’s spending.

Float customers have access to physical and virtual corporate cards in both USD and CAD. Once you issue cards to employees, Float will collect receipts after every transaction. Each transaction is then automatically coded and matched with its receipt, ready to export to your accounting software.

Just like a ‘regular’ corporate card, our cards are used around the world anywhere VISA and Mastercard are accepted. With accounts in both CAD and USD, it’s easy to switch between the two currencies when you need to.

Physical and virtual cards work essentially the same way! Virtual cards act the same way as physical cards, in that you can use them for any spend where you need to enter in a card number. Virtual cards can be created instantly whenever you need them, and are perfect for online expenses like recurring expenses or ad spends. Both virtual and physical cards are linked directly to Float software with individual card controls to help manage spend.

Float offers personalized payment terms based on your business’s stage of growth. With Float’s Pre-funded CAD and USD cards, your limits = your bank balance. You can connect multiple bank accounts in CAD or USD, and even set up automatic top-ups to ensure your cards never run out of funds. With Float’s Charge card (CAD and USD), you can apply for up to $1M in unsecured 30-day credit terms that you can automatically pay down throughout the month.