Resources

Level up your finance game with Float’s Resource Hub: expert insights, practical tips, and real stories from Canadian businesses using Float to work smarter.

💡 Need to troubleshoot features in your Float account?

Visit our Help Centre for access to even more instructional articles and guides.

Built in Canada: How Impact Kitchen Saves Time with Float

Impact Kitchen saves 100+ hours a year with Float by streamlining expenses across 7 Toronto locations. With better compliance and fewer manual tasks, Float is helping them scale efficiently—including their first US store in NYC.

Expense Management

Controller Month-End Close Automation: Streamline Financial Reporting

Controllers, this one’s for you. Let’s talk about how how automating month-end close helps you move faster without sacrificing accuracy.

Read MoreExpense Management

Canadian Month-End Close Process: 2026 Best Practices Guide

Discover what month-close is, steps of the process, the most significant challenges and the best strategies to overcome them.

Read MoreExpense Management

Effective Working Capital Management: 2026 Strategic Guide for Canadian Businesses

Let’s explore how credit can help you manage your working capital needs more effectively.

Read MoreExpense Management

Managing Travel Expenses for Growing Companies

Learn how to streamline manual work and empower your teams with a solid travel expense management process.

Read MoreExpense Management

How Do You Handle Employee Reimbursements Efficiently?

Learn how to simplify employee reimbursements with efficient, scalable strategies for small businesses and growing finance teams.

Read MoreExpense Management

CDIC Insurance for Canadian Business Banking: Complete Protection Guide

Uncertainty about where your money sits—or whether it’s protected—is the last thing any business needs. That’s why understanding CDIC insurance for business accounts matters.

Read MoreExpense Management

Working Capital Management Software Guide

There’s a lot that goes into managing your working capital. But, like many things, the right software can help make it easier.

Read MoreExpense Management

Float vs Venn: Which Solution Fits Your Business?

What’s right for your business, Float or Venn? This article dives into the pros and cons of each, as well as what you need to know for your business.

Read MoreExpense Management

What is Mileage Reimbursement? A Quick Overview

Discover what mileage reimbursement is and how it can benefit you. Get insights on rates, policies, and tips for maximizing your reimbursements today!

Read MoreExpense Management

Automating Conference Expense Management for a Smoother Workflow

Explore how finance teams can empower employees to spend confidently, how they can prepare smartly for business travel and how Float can help.

Read MoreExpense Management

Best Practices for Ensuring Expense Policy Compliance

Tired of chasing receipts? Get smart, drama-free tips to tighten your expense policy.

Read MoreExpense Management

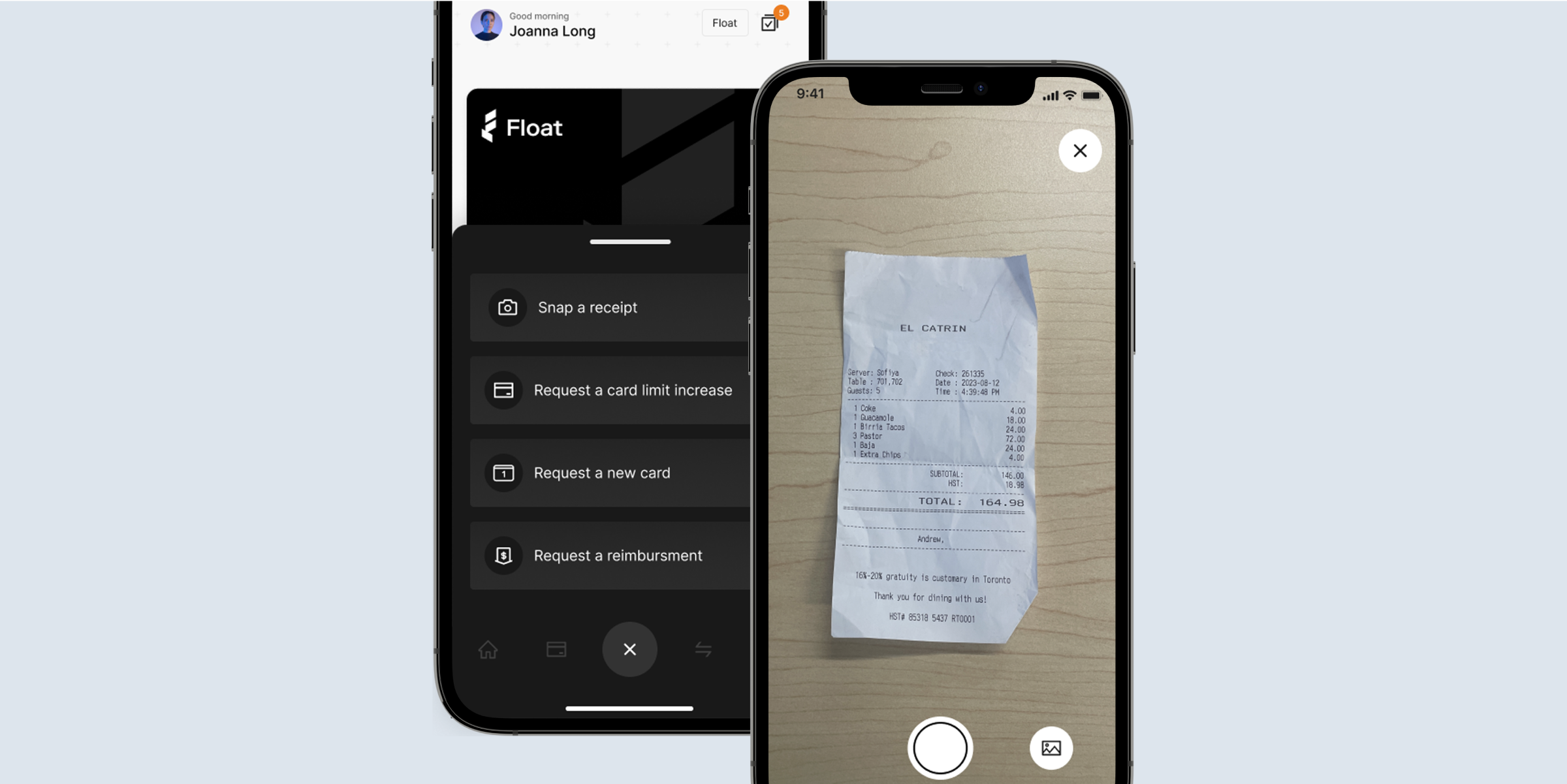

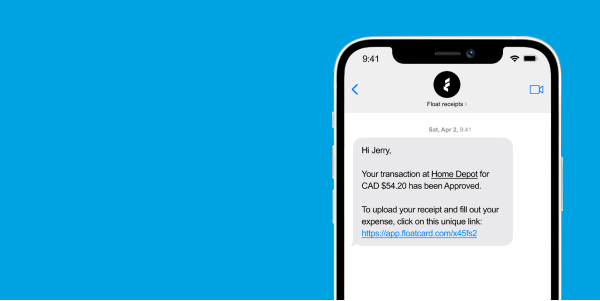

Smart Receipt Management: Tips for Timely Receipt Submission on Corporate Cards

Managing corporate card receipts might not sound thrilling, but getting it right is crucial for keeping your business running smoothly.

Read MoreExpense Management

Top 6 Reimbursement Solutions for Canadian Companies

Don’t let an out-of-date reimbursement solution slow you down. Here are six options that bring your business to the modern age.

Read MoreExpense Management

Top Ways to Reduce Time Spent on Your Expense Report Management

Expense report management shouldn’t be taking up countless hours—here are six methods to improving your processes.

Read MoreExpense Management

How Do You Reconcile Corporate Card Statements Efficiently?

Improve your credit card reconciliation process to manage spend, catch errors and stay audit-ready with these tips.

Read MoreExpense Management

The Best Expensify Alternatives for Canadian Finance Teams

Explore the top Expensify alternatives for Canadian finance teams. Compare features, pricing, and what’s the leading choice in 2025.

Read MoreExpense Management

Best Expense Management Software for Canadian Businesses

Explore key features of the best expense management software options for Canadian companies, and find out how to determine which tool is right for you.

Read MoreExpense Management

Best Business Expense Tracker for Small Businesses in Canada

Discover top tips for choosing the right expense tracking software for your small business.

Read MoreExpense Management

Expense Management Explained: Best Practices for Canadian Businesses

Whether you’re a startup or an established business, having a robust expense management system can significantly impact your bottom line. Learn more here.

Read MoreExpense Management

What is an Expense Reimbursement? Definition and Benefits

Learn how Reimbursements work, which expenses are reimbursable, and the best, fully automated, and free solution available in Canada.

Read MoreExpense Management

How To Choose the Right Expense Reporting Solution in 2024

Learn how to evaluate Expense Reporting solutions available on the market and which is the best Free solution that you should consider today.

Read MoreExpense Management

How Expense Management Can Transform Canadian Enterprises

Learn how expense management solutions can transform your business operations. Know what to look for when choosing the right solution for your business.

Read MoreExpense Management

How Float makes expense reports a thing of the past

Wondering how to submit your expense reports in Float? Hint: You don’t! 😉 We’ve got something better and more efficient for you.

Read MoreExpense Management

Best Receipt Inbox Solution to Minimize Employee Chasing

Minimize Employee Chasing with a Better Receipt Inbox Solution. Float is putting an end to missing receipts and massive submissions at month-end.

Read MoreExpense Management

Modern Expense Policy Guide

Understand how to revolutionize your business spending by tapping into the benefits of a modern company expense policy. With help from real-world examples, you’ll learn the types and key components of a great travel and expense policy—and discover how to streamline your expense management process with the help of automation.

Read MoreExpense Management

Marketing Expense Policy: How Float Helps Marketing Teams Spend Smarter

Learn how Float enables a Marketing Expense Policy that actually works for your team. Stay in budget, issue virtual cards to each team member, get real-time visibility into your spending

Read MoreExpense Management

New Survey Reveals Pain Points in Spend Management

Angus Reid survey of Canadian Finance leaders reveals operational bottlenecks

Read MoreExpense Management

Why Better Corporate Spending Starts With Strong Policies

They say if you follow all the rules, you miss out on all the fun. But when it comes to your financial policies, you’ll want to ensure your team knows every single one!

Read MoreExpense Management

Why You Need a Better Way to Track Employee Receipts

Tracking receipts. It can feel like climbing Everest – unless you’re doing it the right way.

Read MoreExpense Management

A First-Class Ticket to Managing Corporate Travel Expenses

Managing travel expenses is not exactly a “vacation.” In fact, if finance teams are doing things the manual way, the entire department may need a real getaway to recover from it all.

Read MoreExpense Management

The Most Bizarre Business Expenses Ever Submitted

Are you in for a good laugh? Read along for some of the funniest, most outrageous business expenses ever submitted – some that were even approved!

Read MoreExpense Management

Let’s Make Smarter Spending Your 2022 Resolution

Manual spend management tools are time-consuming and prone to error. With a near year around the corner, it’s time for a fresh start! Allow us to introduce you to a better, more efficient way to track and manage your spending with smart spend software and virtual corporate cards.

Read MoreExpense Management

Say Goodbye to Year-End Headaches With Automated Expense Software

The whole point of year-end accounting is to ensure that your financial data is up to date and recorded correctly. So why are so many companies sticking to archaic year-end processes that do more harm than good?

Read MoreExpense Management

It’s Time to Wave Goodbye to Expense Reports. Here’s Why.

Startups are growing at high speed and the last thing they need is something to bog them down. That’s why startups across North America are beginning to see the value in eliminating time-consuming, manual processes and making way for more innovative and efficient tools.

Read MoreExpense Management

Why is it Important to Track and Control Your Expenses?

Properly managing your expenses today is one step startups can take to protect their future.

Read MoreExpense Management

How to Promote a Healthy Spending Culture in Your Company

Financial stability in any organization is the result of having the proper processes, systems, policies and values in place. This is what many refer to as a “healthy spending culture.”

Read MoreExpense Management

Why Expense Management Automation Is a Good Idea

If you’re a company looking to streamline your financial processes, automated spend management software will flip your biggest pain points right on the head.

Read MoreExpense Management

Escape Marketing Excel Hell

Do you still manage your spend on marketing campaigns using excel sheets? Then this is for you…

Read MoreYour questions,

answered

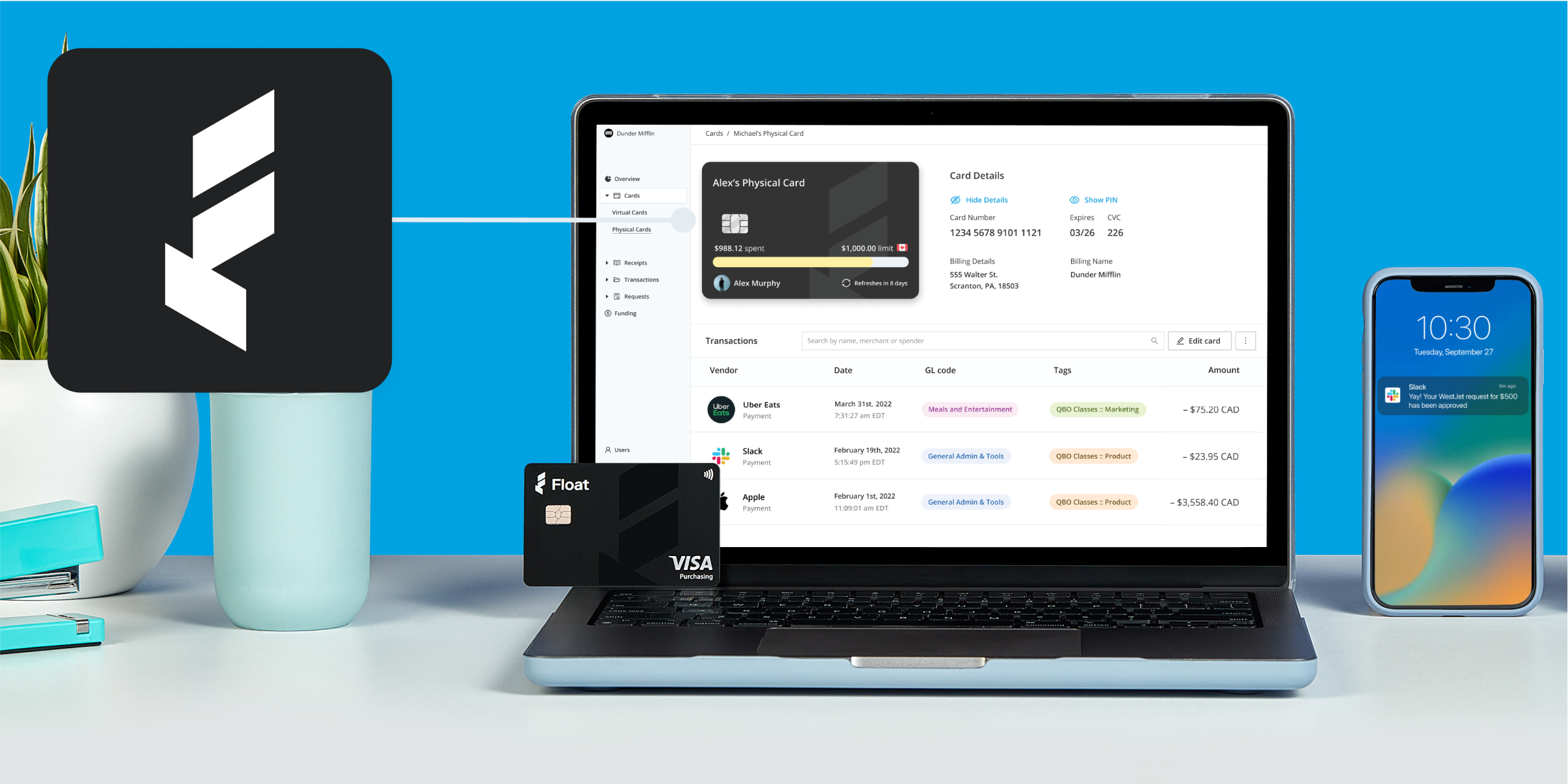

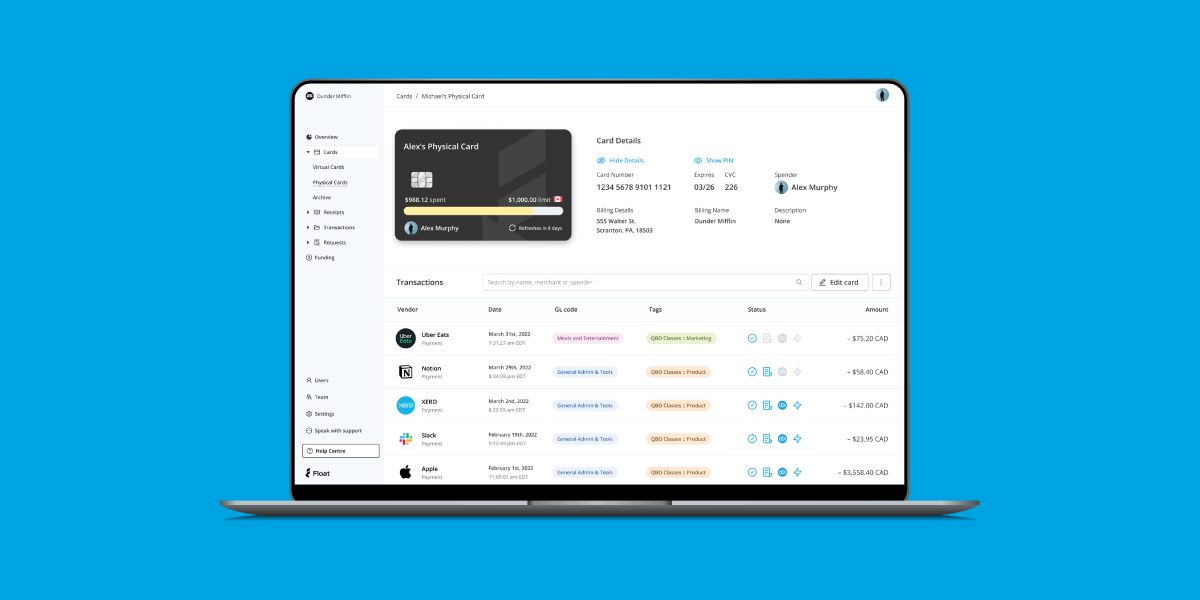

Float is an easier, smarter way to manage your business spending. Think of it as a combination of no-personal-guarantee corporate cards and intelligent spend management software to help you automate, control, and manage your company’s spending.

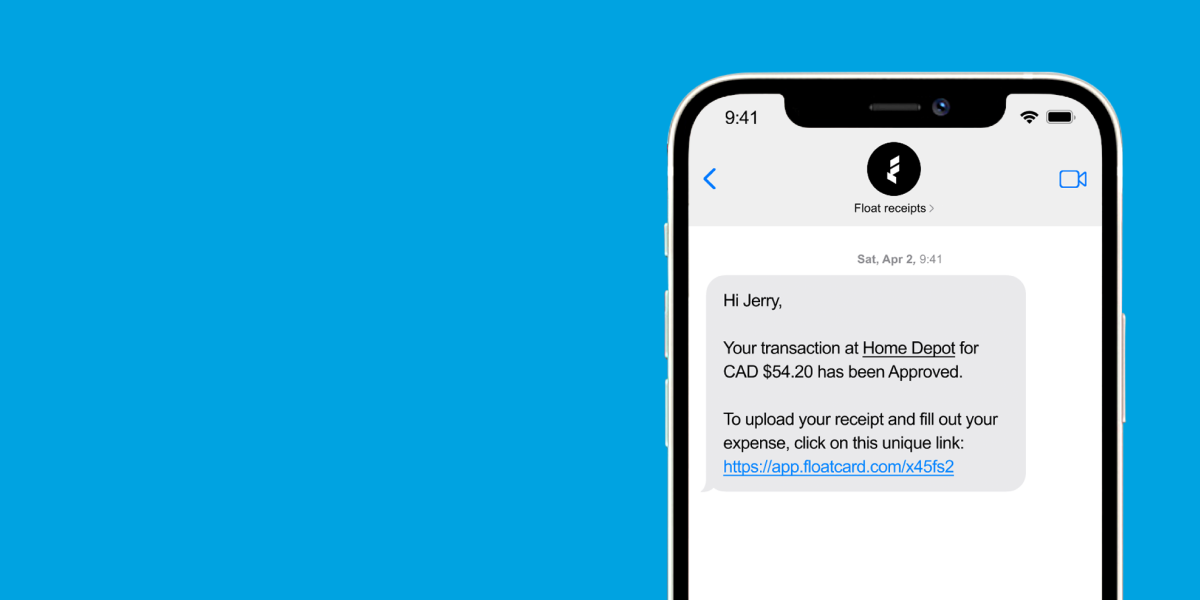

Float customers have access to physical and virtual corporate cards in both USD and CAD. Once you issue cards to employees, Float will collect receipts after every transaction. Each transaction is then automatically coded and matched with its receipt, ready to export to your accounting software.

Just like a ‘regular’ corporate card, our cards are used around the world anywhere VISA and Mastercard are accepted. With accounts in both CAD and USD, it’s easy to switch between the two currencies when you need to.

Physical and virtual cards work essentially the same way! Virtual cards act the same way as physical cards, in that you can use them for any spend where you need to enter in a card number. Virtual cards can be created instantly whenever you need them, and are perfect for online expenses like recurring expenses or ad spends. Both virtual and physical cards are linked directly to Float software with individual card controls to help manage spend.

Float offers personalized payment terms based on your business’s stage of growth. With Float’s Pre-funded CAD and USD cards, your limits = your bank balance. You can connect multiple bank accounts in CAD or USD, and even set up automatic top-ups to ensure your cards never run out of funds. With Float’s Charge card (CAD and USD), you can apply for up to $1M in unsecured 30-day credit terms that you can automatically pay down throughout the month.