Expense Management

Escape Marketing Excel Hell

Do you still manage your spend on marketing campaigns using excel sheets? Then this is for you…

August 10, 2021

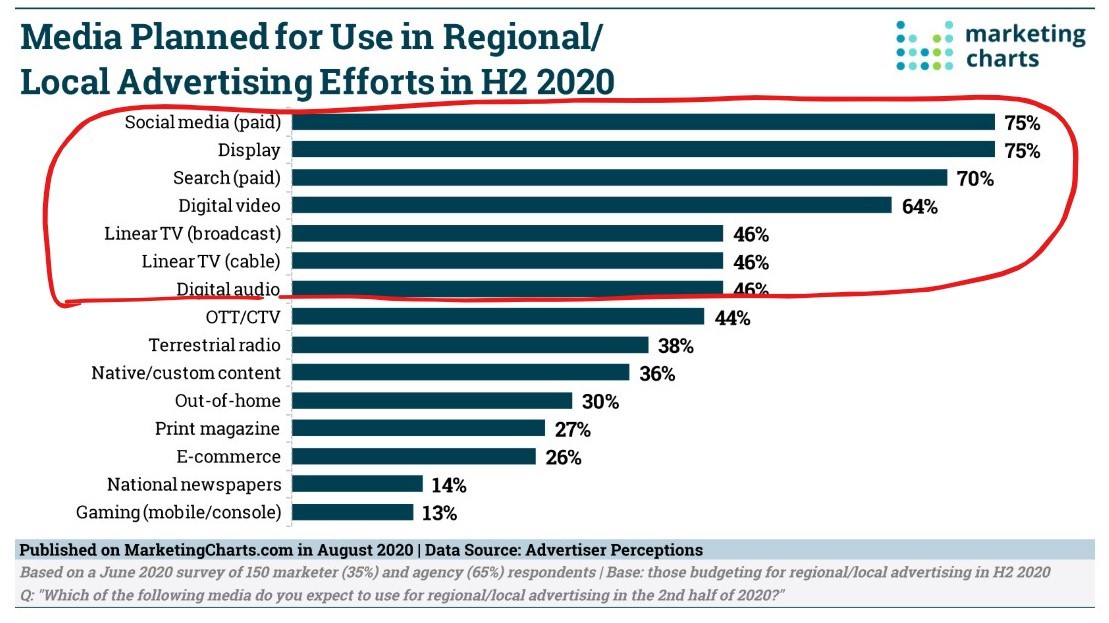

Let’s look at some facts:

- Digital marketing spend is increasing and is going to reach US $640B by 2027, growing at CAGR of 10.3%

- During COVID digital marketing is the main lead generation channel (source)

This means that the companies must get better at tracking the impact of their marketing spend and empowering their marketing teams with the right tools/workflows. So what are the problems marketing teams are facing today?

Problem 1: How much do I have left to spend?

With many finance workflows happening at the end of the month, teams usually don’t have real-time reporting on their spending. This means that your marketing team most likely does the following:

What makes this worse is that, from interviews with marketing specialists, the marketing teams are forced to assign one of their colleagues on expense tracking duty. This usually takes up a lot of their time and clearly isn’t the most exciting activity of their day.

Problem 2: Reconciling expenses with T&E expense workflows

One job that a marketing specialist should not do, is reconcile expenses – that’s the role of the finance team. Yet, some marketing teams are forced to use T&E-like workflows from Concur, Intact, etc. which were designed to capture diverse expenses that occur on a sales trip.

Current workflow:

- Create an expense report

- Write out charges as line items for each campaign

- Attach invoices

- Categorize transactions

- Match expense to transaction from the bank statement

This workflow is extremely inefficient and clearly wasn’t designed for marketing expenses. Oh and by the way, online advertising platforms charge you on daily basis, so you have to do this EVERY DAY just to keep up with your spending. Not great… 😢

Possible solutions

Excel sheet

Marketing needs to keep their own books: an excel sheet that you need to update every day with daily campaign spend from all accounts across the entire team. This will require someone to spend hours every day collecting spend from all accounts and will cost a fortune in inefficient use of labour. Excel sheet is more like a flex tape.

Virtual cards 🌈

A much better approach is to use technology that was designed to solve this problem. Virtual cards have been built for the trucking industry to get visibility over trucker’s cashflows. Similarly, in marketing virtual cards can offer a lot of benefits:

- Real-time spend visibility – you are always in the know how much you’ve spent

- Set and forget – label a virtual card with accounting tags once and all transactions will be automatically tagged for you

- Spend control – assign cards with limits to employees, campaigns or channels to always be aware of where the money is going

- and more… flexible limits, easy receipt capture, secure payments, easy card sharing

So the virtual cards can automate all of the accounting for your marketing team and relief the pressure off the finance team’s reporting function!

Written by

All the resources

Corporate Cards

Corporate Cards for Consulting Firms: An Industry-Specific Guide

Corporate cards for consulting firms don't need to be a headache. Get tips from industry experts to make the most

Read More

Corporate Cards

Credit Card Fraud Prevention Strategies for Canadian Businesses

Credit card fraud is a risk, but it's even riskier if you aren't prepared. Get tips from CPA and Senior

Read More

Corporate Cards

How to Get a Business Credit Card: A Step-by-Step Guide

Discover how to secure a business credit card with our guide. Boost your financial flexibility and manage expenses effectively with

Read More