Cash Flow Optimization

What is Accounts Payable? Your Guide to a Modern AP Process

Everything you need to know about accounts payable and how modern AP automation, corporate cards and expense management can streamline your business spending.

February 25, 2025

Managing business expenses can quickly become chaotic without the right systems. From vendor invoices to employee reimbursements, keeping track of payments is a critical part of maintaining healthy cash flow.

This is where accounts payable (AP) comes in—the core of your company’s financial operations. But traditional AP processes are often slow, error-prone and a major headache for finance teams. So, how can you streamline your AP process and free up time for what really matters?

In this guide, we’ll break down everything you need to know about accounts payable: what it is, how it works and how modern automation tools like Float can transform your AP workflow. Whether you’re a finance leader aiming to eliminate gruntwork or a business owner seeking better visibility into company spending, we’ve got you covered.

What is Accounts Payable (AP)?

Accounts payable (AP) refers to the money a company owes to its vendors for goods or services received but not yet paid for. It’s recorded as a liability on the balance sheet and includes payments such as supplier invoices, contractor fees and utility bills.

Examples of accounts payable:

- Invoices for supplies and equipment (e.g. office supplies, computer hardware, raw materials, etc.)

- Professional services payments (e.g. legal fees, marketing retainers, consultant invoices, etc.)

- Recurring bills (e.g. rent, utilities, subscriptions, etc.)

Why is AP efficiency so important?

The way your business manages accounts payable can make or break its cash flow, vendor relationships and bottom line. In fact, 65% of SMBs report long processing times for financial transactions, which ties directly to cash flow problems and missed opportunities for growth.

Imagine a missed invoice leads to a late fee and a frustrated vendor who pauses your deliveries. Or maybe your finance team is scrambling to fix a double payment, wasting hours chasing down refunds. Meanwhile, slow approvals stall an important purchase, putting a critical project on hold. There are just a few ways inefficient AP processes can cost you time, money and trust.

Accounts payable vs. accounts receivable

While accounts payable tracks what your business owes, accounts receivable (AR) tracks what others owe you. AP is a liability, whereas AR is an asset. Both are important for understanding cash flow and maintaining financial stability.

Tracking both AP and AR is key to maintaining a healthy cash flow—see how cash flow statements tie it all together.

What is the accounts payable process?

Accounts payable management involves outlining the journey from invoice to payment, offering a clear framework for how to pay an invoice efficiently and accurately.

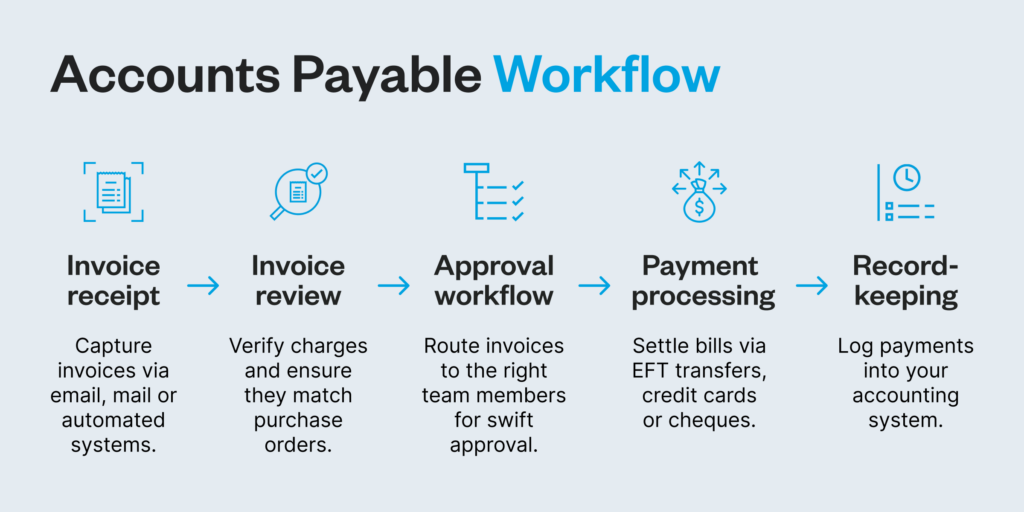

Here’s how it typically flows:

- Invoice receipt: Capture invoices via email, mail or automated systems.

- Invoice review: Verify charges and ensure they match purchase orders.

- Approval workflow: Route invoices to the right team members for swift approval.

- Payment processing: Settle bills via EFT transfers, credit cards, or cheques.

- Record-keeping: Log payments into your accounting system.

When your AP process runs smoothly, payments are on time, vendors stay happy and your cash flow stays clear.

6 common challenges in traditional AP management

Traditional accounts payable processes can feel like a time sink—slowing operations, frustrating finance teams, and leaving room for costly mistakes. Without modern tools, businesses face a range of issues that can quickly snowball into bigger problems.

1. Manual workflows

First, there’s the chaos of manual workflows. Paper invoices, spreadsheets and email chains create confusion, waste time and make it easy for documents to slip through the cracks. Finance teams end up chasing receipts instead of focusing on strategic work.

2. Approval bottlenecks

Then come the approval bottlenecks. Payments stall when they’re stuck in endless sign-off loops. The longer the delay, the greater the risk of late fees—or worse, strained vendor relationships.

3. Frequent errors

On top of that, errors run rampant with manual processes. It’s easy to enter the wrong numbers, pay the same invoice twice or miss a payment altogether.

4. Poor visibility

There’s also the issue of poor visibility into spending. Without a centralized view, finance teams are left in the dark, scrambling to piece together where money is going and struggling to catch unwanted expenses in real time.

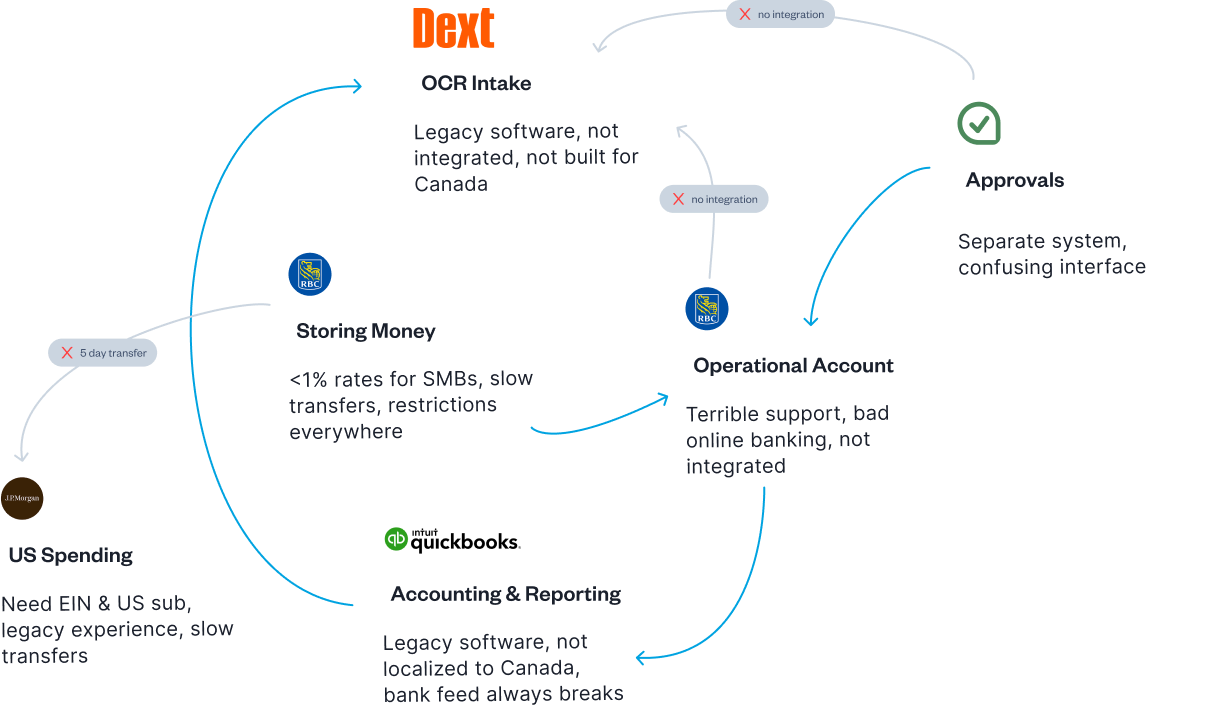

5. Decentralized tools

Compounding these problems is that many businesses still rely on disconnected tools to manage the AP process—55% of SMBs say financial tools that don’t integrate well with each other are a top inefficiency driver. Often, this looks like using one system for bill intake, another for approvals, an accounting platform to track unpaid bills and a separate bank portal to process payments.

When integrations between tools break, it causes delays and wastes time on troubleshooting. Even if you’re processing high volumes of payments every month, this patchwork approach can waste time rather than save it.

6. Fraud

What’s worse, all of these challenges compound to increase your fraud risk. Loose controls and outdated systems can leave the door open for unauthorized payments or fake invoices to slip through unnoticed, costing your business money and damaging trust.

When these challenges pile up, they can have real-world consequences. But with a modern, automated accounts payable process, you can gain the visibility and control you need to make payments simpler.

Confident SMBs are 2x as likely to expect >10% profit growth

See how they’re doing it.

Benefits of automating accounts payable management

From speeding up payments to improving visibility, accounting automation helps your business move faster, smarter, and more securely.

Here’s how:

- Faster invoice processing

Manual invoice processing is slow and clunky, often dragging payments out for days or even weeks. Automation can capture invoice data instantly and route approvals with a click. Payments that once took days can be completed in minutes, keeping your vendors happy and your operations running smoothly. - Reduced errors and fraud risk

Manual data entry is a breeding ground for costly mistakes: duplicate payments, missed invoices and misfiled records. Automated accounts payable systems use built-in validations to catch errors before they happen, reducing the risk of costly slip-ups. With proper controls and approval workflows in place, you’ll minimize the chance of fraudulent activity or unauthorized spending. - Improved cash flow management

With automation, you get real-time insights into every outgoing payment—what’s due, what’s paid and what’s pending. Clear visibility into your liabilities helps you forecast expenses, avoid late fees and take advantage of early payment discounts. - Increased visibility and control

No more chasing down receipts or wondering where an invoice stands. Automation centralizes your AP data into one dashboard, giving you a complete, real-time view of every transaction. You can track approvals, spot spending patterns and enforce policies, all without digging through email threads or spreadsheets.

Modern accounts payable strategies

Focus on these accounts payable strategies to reduce delays, eliminate errors, and gain better control over your AP processes.

1. Automate invoice processing

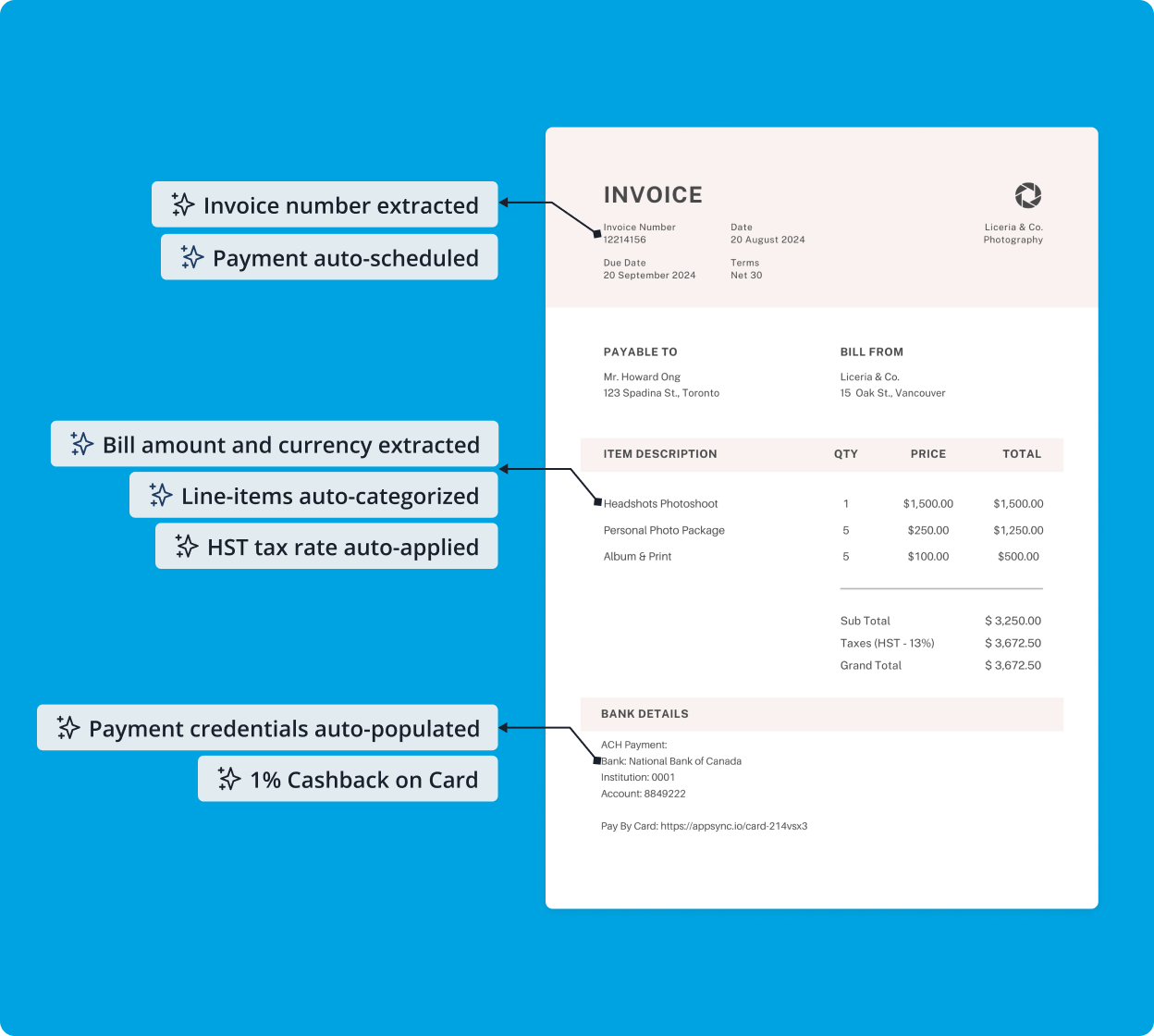

Manual data entry is a productivity killer that leads to errors and slows down your entire AP workflow. Automating invoice processing is one of the fastest ways to make your AP process more efficient and accurate.

Here’s how to do it right:

- Digitize invoices with OCR technology. Optical character recognition (OCR) technology scans and converts paper invoices into digital records. This eliminates manual data entry, reduces errors, and speeds up processing—especially if you’re dealing with high volumes of invoices.

- Automate invoice-to-PO matching. Set up rules to automatically match invoices to purchase orders (POs). With automated matching, any discrepancies like price differences or unexpected charges are flagged for review. This helps catch errors early and prevents overpayments.

- Schedule recurring payments. For vendors with regular billing cycles, such as utilities or monthly service providers, automate recurring payments. This ensures that predictable bills are paid on time without the risk of missed deadlines or late fees.

2. Optimize approval workflows

Bottlenecks in the approval process slow down payments, frustrate vendors, and create unnecessary delays. Streamlining your approval workflows keeps payments moving and eliminates confusion.

Here’s how to do it:

- Establish clear approval hierarchies. Define who needs to approve invoices based on payment amounts, vendor types, or departments. With clear guidelines, everyone knows their role, and invoices don’t get stuck waiting for the right sign-off.

- Set spending limits for team members. Create thresholds for automatic approvals to reduce unnecessary reviews. For example, purchases under $250 can be pre-approved, while anything above requires manager review. This keeps small expenses moving without bottlenecks.

- Route approvals digitally. Use an automated system to assign invoices to the right approvers, notify them instantly, and track every step of the process. Real-time updates and digital records eliminate back-and-forth emails and make it easy to follow the status of each invoice.

3. Transition to electronic payments

Paper cheques are slow, costly and prone to error. Switching to electronic payment methods speeds up your accounts payable process and reduces administrative headaches.

Here’s how to make the shift:

- Prioritize virtual cards for all online payments. Virtual cards are single-use or limited-use payment numbers tied to your corporate account. They’re easy to track, help prevent fraud and are perfect for one-off payments or online purchases (especially software trials). Many vendors prefer virtual cards because they process instantly and don’t require banking details.

- Use electronic transfers for domestic payments. For all other domestic transactions, EFT (Electronic Funds Transfer) payments are faster, more secure and often cheaper than traditional cheques in Canada. An EFT payment is ideal for recurring payments and bulk transfers, cutting out mailing delays and lowering processing costs.

💡 Pro tip: Understand the difference between ACH vs EFT. Automated clearing house payment (ACH) is a specific type of EFT used primarily for domestic payments within the US. Some more modern providers do offer cross-border ACH payments, but you’ll need to check with your bank. Or, try making international payments with Float.

New to digital payments? Start by learning how to make an EFT payment, from setting up vendors to scheduling transfers.

Looking to pay invoices from Canada to other countries?

Check out our articles on how to pay invoices from the U.S., Mexico, Philippines, EU and India..

While this may seem overwhelming at first, modern tools have come a long way. Solutions (like Float) will allow you to implement all of these strategies in one place.

Accounts Payable Metrics to Track

- Days Payable Outstanding (DPO): measures the average time it takes to pay vendors

- Invoice processing time: tracks the efficiency of the AP process from invoice receipt to payment

- Early payment discount capture rate: shows the percentage of available discounts captured

- Electronic invoice adoption rate: indicates the level of automation in the AP process

- Vendor satisfaction score: assesses the strength of vendor relationships based on timely payments and communication

Tips for choosing the right accounts payable software

Accounts payable software should simplify your processes, not complicate them.

Here’s what to look for.

Start with automation. Capabilities like invoice capture and approval workflows will save your team time and reduce errors. Look for features like OCR technology to digitize invoices and automatic matching to purchase orders to streamline your process.

Next, prioritize integration. Your software should connect seamlessly with your accounting system, keeping your records accurate without extra manual work.

Visibility matters, too. Real-time dashboards and easy-to-read reports help you track spending, catch errors and make smarter financial decisions.

Don’t forget security. Built-in safeguards like multi-factor authentication and role-based permissions protect your payments from fraud and unauthorized access.

Last, choose software that grows with you. Look for a solution that can handle increasing transaction volumes, add users easily and adapt to your changing needs, all while offering responsive support.

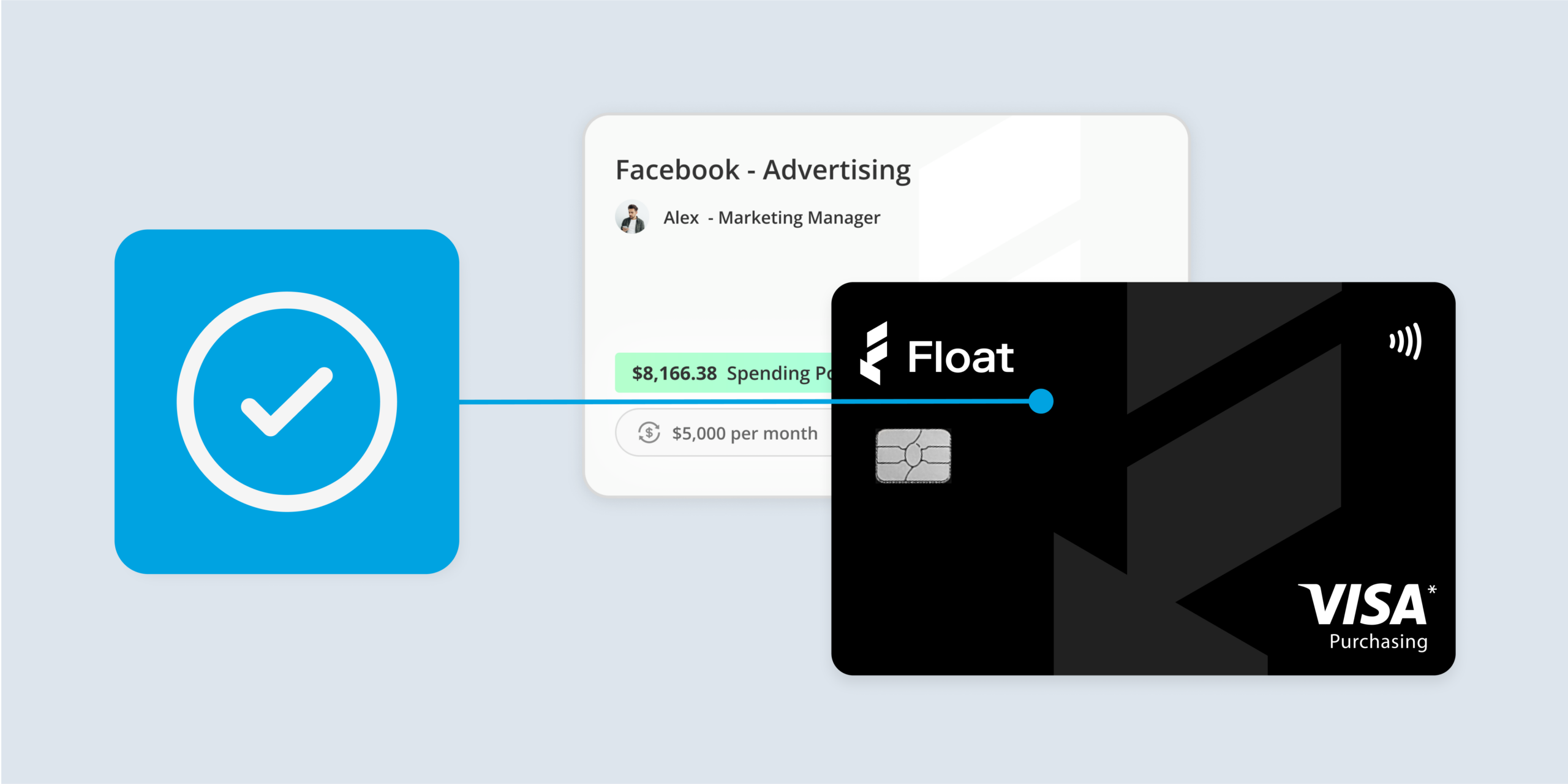

Why Float fits the bill

Float offers fast automation, real-time insights and secure, seamless integrations—everything you need to manage your accounts payable process without the headaches. With built-in tools like bill pay to automate invoice payments, you can process transactions faster and reduce manual work. Plus, it’s built to scale with your business, supporting your growth every step of the way.

Simplify business spending with Float’s smart AP & corporate cards

“Float’s Bill Pay has become our main AP solution for Canadian business expenses. They built a product that is better than anything else on the market in Canada.”

Thomas Kwon

Head of Finance & Operations

Accounts payable management doesn’t have to be complicated or costly. Float brings everything you need into one easy-to-use platform, helping you automate your AP workflows, track spending in real time, and process payments faster—all while keeping complete control over your finances.

With Float, you get a smarter way to manage every dollar your business spends.

- Issue corporate cards instantly

- Automate bill payments from one place

- Close your books up to 8x faster with seamless accounting integrations

- Earn 4% interest on your Float balance

- Get 1% cashback on card spend

Float is trusted by thousands of Canadian businesses to simplify their spending, from approvals to payments—all with no hidden fees and fast, friendly support when you need it. Whether you’re eliminating approval bottlenecks or gaining better control over your cash flow, Float helps your business spend smarter and scale faster.

Ready to take control of your business spending?

Get started with Float today and experience faster payments, fewer errors, and complete visibility.

Try Float for free

Business finance tools and software made

by Canadians, for Canadian Businesses.

Written by

All the resources

Corporate Cards

How Corporate Card Programs Deliver ROI for Canadian Companies: Measuring Financial Impact

When every dollar matters, the right payment solution can help you grow—and a smart corporate card program is your first

Read More

Financial Controls & Compliance

GST/HST Tracking in Canada: Why It Matters and How Float Simplifies the Process

Learn how GST/HST tracking works in Canada, why it’s essential for your business, and how Float automates the process to

Read More

Corporate Cards

How to Get Approved for a Virtual Corporate Card as a New Business (Without Hurting Your Credit Score)

Looking to add a virtual corporate card to your wallet without messing with your credit score? This guide is for

Read More