Corporate Cards

How to Set Up a Corporate Card Program

Learn how to set up a corporate card program that streamlines expenses, boosts control, and empowers your team without headaches.

February 13, 2025

Managing business expenses shouldn’t be a headache, but it often can be. If clunky financial processes have started slowing down your team, you may be asking yourself if the time is right to implement a corporate card program.

Before you jump in with both feet, you’ll want to get a sense of how different programs work and which features fit with your company’s needs. Without this knowledge, you risk choosing a solution that adds complexity to your business instead of reducing it.

A well-designed corporate card program should provide clear spending controls, real-time visibility into transactions and streamlined expense management. So, let’s make sure you choose a winner.

In this guide, we’ll walk through everything you need to know to set up a successful corporate card program, from selecting the right provider to setting policies, training employees and optimizing spend management as your business grows.

What is a corporate card program?

A corporate card program centralizes business spending, eliminating the need for employees to pay out-of-pocket and seek reimbursement. Unlike personal or generic business credit cards, corporate cards are issued under the company’s account, with the business handling payments.

The best corporate credit card program will improve visibility, automate expense tracking, and allow finance teams to set spending limits and policies that align with your company’s needs. Because—let’s be honest—no employee loves having awkward conversations about getting reimbursed for work expenses.

Is a corporate card program right for your business?

Maybe! A corporate card program can support different types of businesses in meaningful ways, so let’s explore what you should know to make the best decision for your company.

Here are few common questions about corporate credit cards:

- Why should I consider a corporate card program?

- Can I offer virtual credit cards in Canada?

- Should I be looking at charge cards vs credit cards?

- Are prepaid credit cards in Canada a smart idea?

The reality is, fiscal challenges loom large for many startups and business owners. Over a third of businesses in Canada aren’t able to take on any more financing, reporting cash flow as their biggest obstacle. A corporate card program offers flexibility and control for startups and scaleups, ensuring seamless approvals, automated tracking and better cash flow management.

💡Pro tip: Check out this list of the best credit cards for startup businesses.

Existing SMBs can also benefit by reducing reimbursement hassles, enforcing clearer expense policies, and leveraging rewards. The right program also minimizes administrative work, giving you time for more strategic priorities, like protecting the bottom line—and actually having time for lunch.

Best business credit cards

Compare top options, fees and benefits for

Canadian companies.

Benefits of a corporate card program

The best corporate credit card program streamlines expense management by eliminating the need for manual reimbursements and receipt tracking. With automated workflows and real-time expense reporting, finance teams spend less time chasing down transactions and more time on strategic priorities. This efficiency is a game-changer for startups and SMBs with lean teams.

Another key advantage is better cash flow visibility. Corporate credit cards for employees allow businesses to track spending in real time, set limits for individual employees and prevent budget overruns. This level of control is especially valuable for high-growth companies managing tight budgets and scaling operations.

Many programs offer perks like cashback, travel rewards and waived foreign transaction fees, turning everyday business expenses into financial advantages. Programs also help companies build business credit, opening once-stubborn doors to larger credit lines and better financing options as they grow.

Corporate cards vs. reimbursements: Why a card program is the better option

Managing business expenses effectively is crucial for maintaining financial health and operational efficiency. Traditionally, companies have relied on employee reimbursements, where employees pay out-of-pocket for business expenses and later seek repayment. While this method might seem like it gives the business more control over spending, it often leads to challenges in visibility, control and employee satisfaction.

Implementing a corporate card program addresses these issues by providing enhanced oversight and a more streamlined process.

But how can you ensure employees aren’t overspending when given access to company cards?

Overspending is the biggest concern businesses have around traditional corporate card programs. Issuing cards to employees can feel like it requires a high level of trust, as many businesses worry about potential misuse on non-approved expenses. This concern is especially significant for CFOs and finance teams focused on maintaining strict budget controls—and, in these uncertain economic times, this includes pretty much every business in Canada.

But the problem with relying solely on reimbursements is that it places the financial burden on employees, requiring them to front personal funds for business-related expenses. This approach can lead to both employee dissatisfaction and financial strain, especially if reimbursements are delayed. Employees get frustrated by having to wait until the next pay cycle or even month-end to get back funds they’ve put on personal cards. Additionally, companies miss out on potential rewards (e.g. cashback) and added visibility (e.g. surprise employee expense reports at month-end) that come with corporate spending, both of which could otherwise contribute to the organization’s financial well-being.

Modern corporate card programs like Float combine the advantages of traditional corporate cards and the control of reimbursements. Here’s how Float addresses these concerns around over-spending:

- Real-time visibility: Get immediate insights into all transactions, so your team can monitor spending as it happens. This transparency ensures that any unauthorized expenses are quickly identified and addressed.

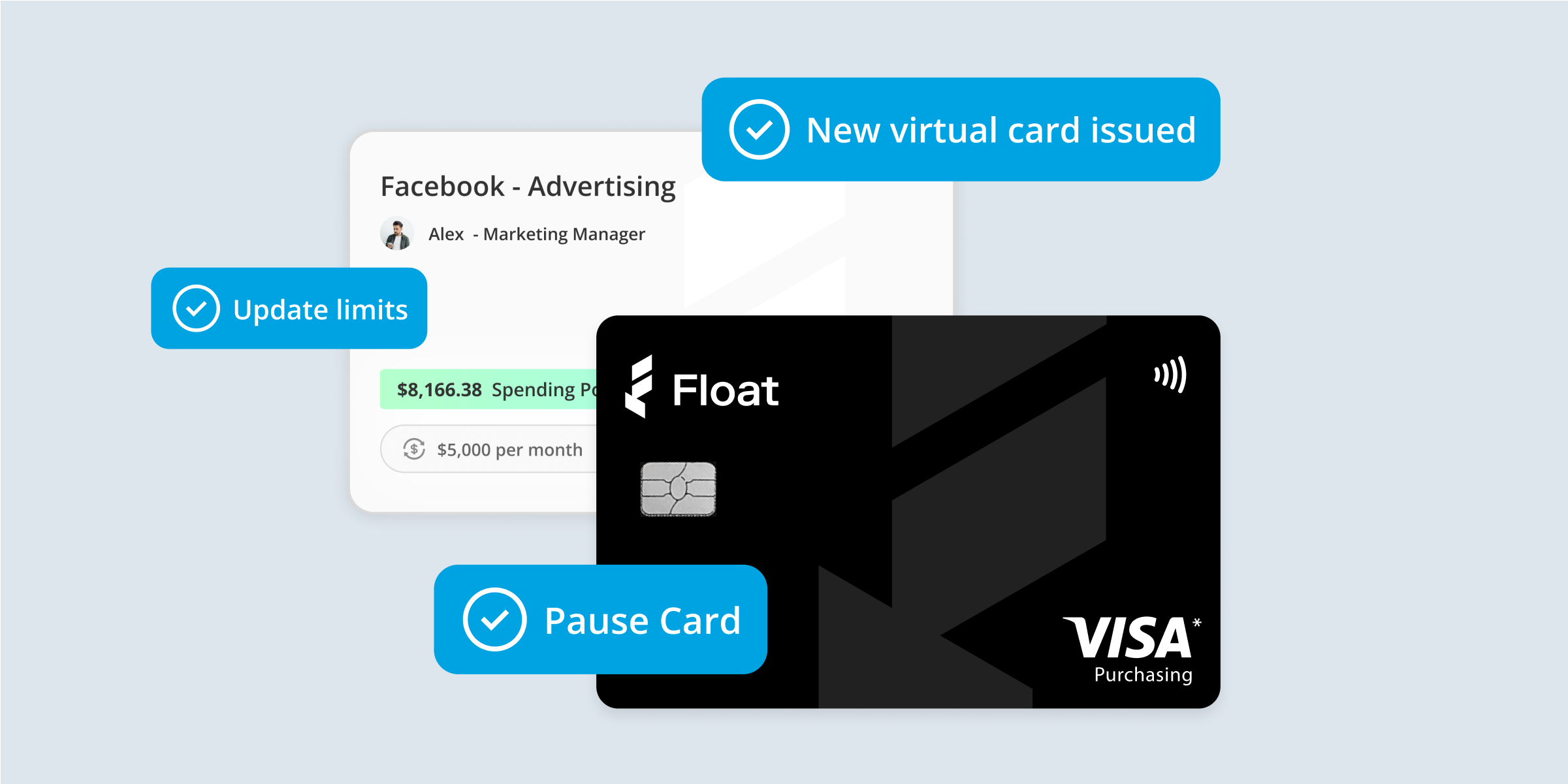

- Customizable spending controls: Set specific spending limits and policies for each cardholder (including vendor-specific cards), ensuring expenditures align with company budgets and policies.

- Automated expense management: Automate expense tracking and reporting, reducing administrative burdens and minimizing the potential for errors or fraudulent claims.

- Employee empowerment without financial strain: By providing corporate cards, employees are relieved from the need to use personal funds for business expenses, leading to improved satisfaction and morale.

Implementing a corporate card program actually provides more financial control and rewards, while helping to foster a positive and efficient workplace culture.

How to set up a corporate card program

1. Assess business needs

Evaluate your current spending patterns before implementing a corporate credit card program. You may not need a program if your business purchases are minimal or centralized. However, companies with distributed teams, frequent travel or high recurring expenses (think software subscriptions or advertising) can benefit significantly.

Next, consider the number of employees making purchases, the types of expenses that could be consolidated under a corporate card and the potential rewards or cashback opportunities. A well-designed program will give you control and efficiency, particularly for remote teams that need seamless purchasing capabilities.

2. Choose the right provider

Selecting a corporate card provider depends on business priorities. Some companies are motivated by cashback and rewards (okay, we all love these), while others focus on control and automation. Key features to evaluate include customizability, automation for reconciliation and strong spending controls.

Another critical factor is the ability to issue virtual and physical cards on demand. This ensures your employees will have the access they need without unnecessary risk. Choosing a flexible provider means the program can evolve with your business rather than become a bottleneck.

3. Set up policies and controls

Establishing a clear company credit card policy is essential for maintaining compliance and preventing misuse of corporate cards. A well-structured expense policy should outline what kinds of purchases are allowed and any required approvals.

Similarly, a purchasing policy ensures employees follow a standardized process for vendor payments, whether or not a purchase order system is in place. A travel policy for companies with frequent travellers should define what types of expenses are covered, from flights to meals and accommodations.

Automated approvals, built-in compliance checks and real-time monitoring can reinforce policies without relying solely on manual oversight.

4. Train employees

Having a policy isn’t enough, so don’t be shy about actively communicating expectations and best practices. Holding training sessions, hosting lunch-and-learn events or providing digital resources can make policies more accessible and easier to follow.

Training should also emphasize practical aspects of card use, like submitting expenses, determining what types of purchases are permitted and requesting temporary card access if needed. Overcommunication is often better than assuming employees will instinctively follow the guidelines.

Don’t forget: training materials and processes should be revisited regularly as your business scales to ensure they remain relevant and practical.

5. Monitor, adjust and optimize

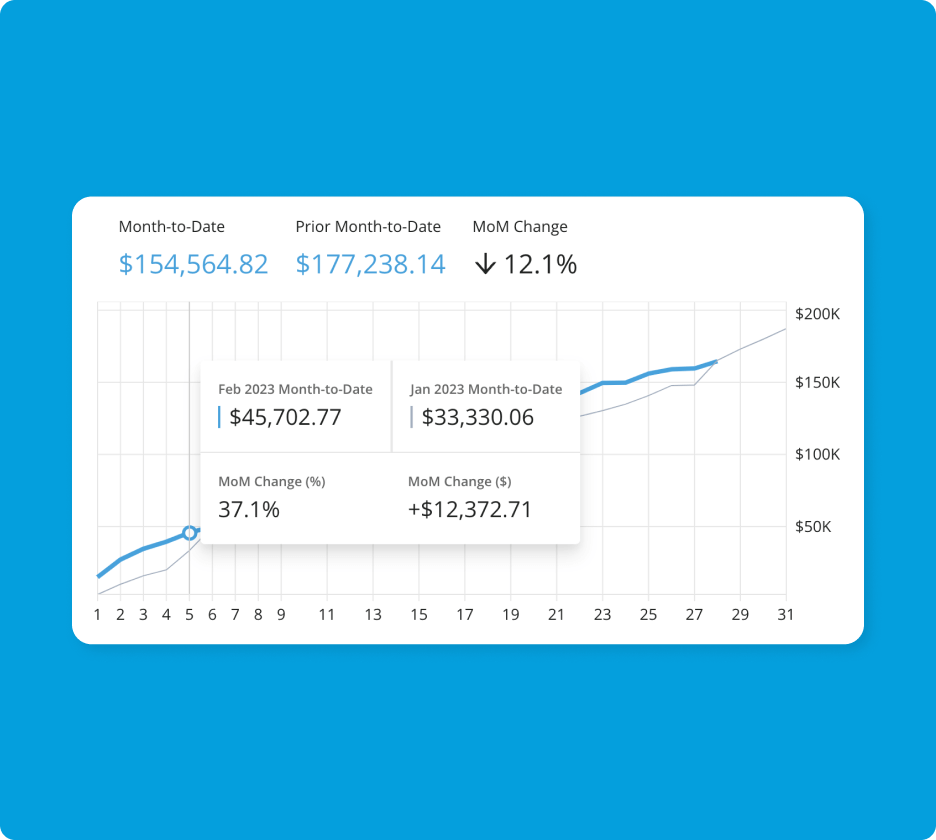

A corporate credit card program is not a set-it-and-forget-it solution. It requires continuous oversight to maximize efficiency. Finance teams should track spending patterns to ensure expenses align with company policies and identify any inefficiencies, like unnecessary reimbursements due to lack of card access.

Another key area to monitor is the reconciliation process. If month-end closing is still a time-consuming manual task, or if finance teams frequently must correct errors retroactively, this may signal the need for adjustments.

6. When to consider switching providers

A corporate card program that once worked well may become a bottleneck if it lacks automation, restricts access to employees who need it or creates unnecessary administrative work.

If finance teams frequently encounter manual reconciliation, need to increase reimbursement requests or struggle to maintain visibility over spending, it might be time to reevaluate your current provider.

You’ve also got to think long-term. If your corporate card program was initially designed for a small team but now struggles to accommodate a larger, more distributed workforce, switching to a more scalable provider can save you significant time and resources.

7. A better answer to the question: Who gets a corporate card?

Traditional corporate card programs restricted access to senior employees, but modern solutions allow businesses to issue cards based on need rather than hierarchy. A corporate card should empower your people and simplify spend, no matter how long they’ve been on your team.

With temporary virtual cards, businesses can grant short-term access without permanent commitments.

No more worrying about how to get a business credit card into the right hands in time. For example, imagine issuing a card for a two-day conference that deactivates automatically, or providing an expense card for contract employees. This flexibility reduces reimbursement delays and financial strain on employees while ensuring company funds are available when needed without unnecessary risk.

Best business credit cards

Compare top options, fees and benefits for

Canadian companies.

Let’s take a look at Float in action

For fast-growing companies, managing expenses at scale can quickly become a challenge. Practice Better, a Toronto-based software company in the health and wellness space, faced this reality as their team expanded and new departments formed. With financial processes still partially outsourced, the finance team needed a more efficient, scalable solution to keep up.

“Things would not get booked in correctly and we wouldn’t know until after close. And by then you’re almost into the next month,” says Deena Lu, Controller at Practice Better.

The company successfully transitioned to an entirely in-house financial model by implementing Float. With automated approvals, built-in controls and real-time expense tracking, Practice Better streamlined operations while mitigating risk.

“[With Float], we’ve decentralized the approval process so that it’s not all on finance,” says Deena. “It’s really the team leads now who are responsible for the budget and can approve their team’s spend requests.”

The result? A more efficient finance team and a company-wide culture of responsible, transparent spending prove that the right corporate card program can seamlessly scale with a growing business.

The smarter way to manage company spend

A well-structured corporate card program streamlines expense management, improves cash flow oversight and empowers employees while maintaining control. It provides you with flexibility in offering corporate credit cards for permanent employees or setting up expense cards for contract staff.

If the benefits sound tempting, it could be time to assess your business needs and see if Float corporate cards could help support your goals. With the right provider, clear policies, and automation, you can quickly scale your financial operations.

We think we’re offering the best business credit cards in Canada, and we’re happy to show you why. Whether you’re a startup, SMB or growing enterprise, the right program can save time, reduce administrative burdens and even unlock rewards.

Book a demo with our team to see how a Float corporate card program could work for you.

Enable team spending without losing control.

Float is a smart corporate card backed by intelligent spend management software. The software provides a real-time overview of individual, department, and category spend so you can scale with insight.

No more Past Due late fees or last-minute-declined-payments because of lack of visibility on your corporate cards.

Written by

All the resources

Corporate Cards

Best 0% Interest Business Credit Cards for 2025

Explore why choosing a 0% APR business credit card can be a strategic move for Canadian businesses.

Read More

Corporate Cards

7 Best Business Credit Cards Canada 2025

Pinpoint the right credit card choice for your company in a sea of options with our roundup of the seven

Read More

Corporate Cards

Instant Corporate Card Issuance: How to Get Cards in Minutes, Not Days

Ready to equip your team to spend quickly while minimizing risk? Cue instant corporate card issuance.

Read More