Corporate Cards

Understanding Credit Cards, Charge Cards and Secured Cards

Explore the differences between credit cards, charge cards, and secured cards. Learn how each option can benefit your financial journey with Float.

January 30, 2025

When it comes to managing your business expenses, choosing the right type of card can make a significant difference in your financial strategy. Understanding the key differences between corporate credit cards, charge cards, and secured cards is essential for making an informed decision that aligns with your company’s needs and goals.

In this article, we’ll dive into the unique features, benefits, and drawbacks of each card type, helping you determine which option is the best fit for your business. By the end, you’ll have a clear understanding of how these cards work and how they can impact your company’s financial health.

Best business credit cards

Compare top options, fees and benefits for

Canadian companies.

What are credit cards?

Credit cards extend a line of credit up to a preset limit, allowing you to make purchases and carry a balance from month to month. Interest charges apply to any outstanding balance not paid in full by the due date. Minimum payments are calculated as a percentage of the total balance, making it easier to manage cash flow.

There is a wide range of credit card options available, catering to various credit scores and offering rewards such as cash back, points, or discounts. Responsible use of a credit card can help build your business’s credit history and improve its credit scores over time.

How do charge cards work?

Charge cards require full payment of the balance at the end of each billing cycle, typically on a monthly basis. Unlike credit cards, charge cards usually don’t have a preset spending limit, providing more flexibility for business expenses. However, failing to pay off the balance in full can result in substantial fees and penalties.

Approval for a charge card generally requires good to excellent credit. These cards often come with high annual fees but offer premium rewards and perks in return. Differences between charge cards and credit cards include payment terms and the impact on credit utilization.

What are secured credit cards?

Secured credit cards require a security deposit that serves as collateral and usually determines the credit limit. These cards are designed for businesses looking to build or rebuild their credit. Charge card issuers often conduct automatic reviews to potentially upgrade users to an unsecured card based on their payment history.

The security deposit is refundable if you upgrade to an unsecured card or close the account in good standing. Secured cards typically have lower credit limits compared to unsecured cards. All account activity is reported to credit bureaus, making responsible use crucial for improving your business’s credit profile.

Comparing credit cards, charge cards, and secured cards

Credit cards are the most common and accessible option, with a variety of choices for different credit profiles. Charge cards are less widely available and target businesses with excellent credit. Secured cards are a good choice for companies with limited or poor credit history.

When selecting a card, consider factors such as fees, rewards, credit card comparison, and your business’s spending habits. The impact a card has on your credit score can vary based on its terms and how you use it.

Best business credit cards

Compare top options, fees and benefits for

Canadian companies.

How to choose the right card for your needs

To choose the right card for your business, start by assessing your credit score and history to determine which types of cards you may qualify for. Evaluate your spending habits and financial goals to find a card with features and benefits that suit your needs.

Compare fees, interest rates, rewards programs and other perks across different card offers. Consider whether you can responsibly manage payments and avoid carrying a balance. Carefully read the card’s terms and conditions, and select a product that aligns with your business’s needs and financial situation. You may also want to consider how these cards fit into a larger corporate card program, to centralize your business spending and standardize reimbursements.

Why Coinberry switched from AMEX

“When we were using AMEX, it was incredibly time-consuming to fund our cards. It often put our ad campaigns on pause & we’d lose users every day.”

Jerry Lin

VP Finance

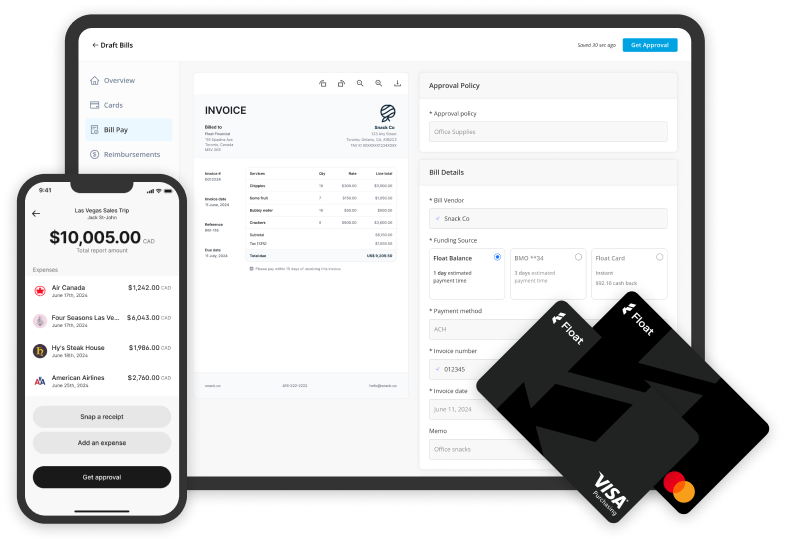

Float’s Charge Card — Best Solution for Canadian Businesses Looking to Grow

Float’s Charge Card offers a tailored solution for Canadian businesses seeking to streamline their expense management and boost their financial performance. With flexible spending limits, powerful budgeting tools, and seamless integration with your existing accounting software, Float’s Charge Card empowers you to take control of your company’s finances and fuel its growth.

If you’re ready to take your business to the next level with a smarter, more efficient expense management solution, we’re here to help. Join the countless Canadian companies who have already discovered the power of our innovative platform and get started for free today. Let us show you how easy it can be to optimize your finances and fuel your company’s growth.

Written by

All the resources

Corporate Cards

Corporate Card Security Best Practices for Canadian Businesses: 2026 Complete Guide

Corporate cards should streamline spending, not invite fraud. Seb Prost, CPA, shares how businesses can stay ahead with proactive security.

Read More

Corporate Cards

Discover: Virtual Credit Cards for Canadian Businesses

Explore the benefits of virtual credit cards with Float. Discover how this modern payment solution enhances security and simplifies your

Read More

Cash Flow Optimization

ACH vs EFT Payments: Key Differences for Canadian Companies

Learn the key differences between EFT and ACH payments, how they work, which options might be available to your business

Read More