Corporate Cards

7 Best Business Credit Cards Canada 2025

Pinpoint the right credit card choice for your company in a sea of options with our roundup of the seven best business credit cards in Canada.

July 3, 2025

Business credit cards might not be the flashiest part of running a company, but getting the right one can quietly power everything from payroll to plane tickets. Finding the best business credit card in Canada is worth your time, so your spending doesn’t unravel your company goals.

Credit is a critical topic for businesses. Nearly 30% of Canadian independent businesses surveyed still carry pandemic-related debt, with an average balance of $65,000. While there have been some reductions in credit card fees, only 7% of businesses eligible for reductions have noticed savings.

But here’s the catch: not all business credit cards are built for how you do business. That’s where this guide comes in. We’ll help you find the one that pulls its weight.

Try Float for free

Business finance tools and software made

by Canadians, for Canadian Businesses.

What is a business credit card?

A business credit card is exactly what it sounds like—a credit card built for business spending. Whether you’re a sole proprietor or running an incorporated company, a business card helps keep your work expenses separate from your personal ones (because no one wants to sort through a messy statement at tax time).

But it’s not just about staying organized. Business credit cards often come with perks tailored to how companies spend. They can also help you smooth out cash flow, cover short-term expenses and build your business credit profile, which comes in handy when it’s time to scale up.

Why are business credit cards important?

As a small business owner in Canada, you’re juggling many responsibilities, and one of the most critical is tracking your expenses. Let’s break down why this matters and how to do it effectively.

Why expense management matters

From tax time to audit season, strong expense management helps you stay compliant, save money and make smarter decisions.

- Keeps you compliant with CRA regulations

- Enables you to claim tax rebates and benefits

- Prepares you for potential audits

- Provides clear insights into your business finances

Key responsibilities of small business owners

These key responsibilities aren’t just best practices; they’re must-dos if you want to stay onside with the CRA and unlock financial benefits.

Accurate tracking

You’re responsible for recording all business expenses and reporting them correctly to the CRA.

Tax rebate opportunities

Proper expense tracking allows you to apply for GST, HST and other tax rebates in Canada, potentially saving your company significant money.

Audit readiness

Good record-keeping ensures you can pass an audit if one comes your way, reducing stress and potential penalties.

Can I use a personal credit card for business expenses?

It’s a common question. After all, as a small business in Canada, it can feel like the easiest option for you to start with.

Here’s what’s important about having a dedicated business credit card:

- Separates personal and company finances

- Builds business credit

- Offers higher spending limits

- Provides company-specific rewards and perks

- Makes tax time a breeze

Sounds good, right? Now, let’s check out the different kinds of business credit cards available for small businesses in Canada.

Types of small business credit cards in Canada

There are two main types of small business credit cards in Canada: cards from traditional banks and cards from modern fintech providers.

Traditional banks offer corporate cards with familiar perks. However, banks often design these cards with larger, established companies in mind, which means higher fees, more paperwork and slower approval processes. In some cases, we’re talking about weeks to open a credit card. If you get approved at all.

On the other hand, fintech providers are bringing business credit cards into the modern age. With fast approvals, virtual cards, real-time expense tracking and integrations that actually talk to your accounting software, they’re built for businesses that want more control and less hassle. For example, you can open an account with Float and get started with a corporate card in close to 24 hours.

💡Pro tip: This is also a good time to learn about the different types of credit and charge cards that small businesses can leverage.

Learn more about Float

Get a 10-minute guided tour through our platform.

5 best practices for business credit card use in Canada

Whether you’re just starting out or scaling up, a few smart habits can help you avoid unnecessary costs, build credit, and make the most of your spending.

Here are 5 best practices to keep your business finances on track:

- Keep business and personal spending separate

Mixing expenses can get messy, especially at tax time. Use your business card strictly for business to stay organized and protect yourself legally if you’re incorporated.

- Pay off your balance every month

Interest charges eat into your cash flow fast. Paying in full helps you avoid fees and can boost your business credit score over time.

- Don’t spend right up to your limit

High credit usage can hurt your credit score. Keep it under control by tracking your spending or making early payments mid-month.

- Pick a card that pays you back

Look for a card with low fees and rewards that match your business’s spending, whether on travel, office supplies, or digital tools.

- Avoid cash advances

They’re pricey. If a vendor doesn’t take cards, consider other financing options instead of pulling cash from your line of credit.

Key features to look for in a business credit card

When you’re shopping around for the best credit card for business in Canada, keep these factors in mind:

- Annual fee: Is it worth the perks?

- Rewards structure: Points, cash back, or travel miles?

- Additional cardholders: Can employees get cards, too?

- Foreign transaction fees: Important for international businesses

- Insurance coverage: For travel, purchases, or even cell phones

- Digital experience: Software integrations, easy-to-use banking portal and easy expense tracking

Remember, the best card for you depends on your business needs. A small local shop might benefit from different features than a globe-trotting consulting firm.

💡Pro tip: Travel a lot for business? Check out our list of the best business credit cards for travel, specifically for Canadian companies.

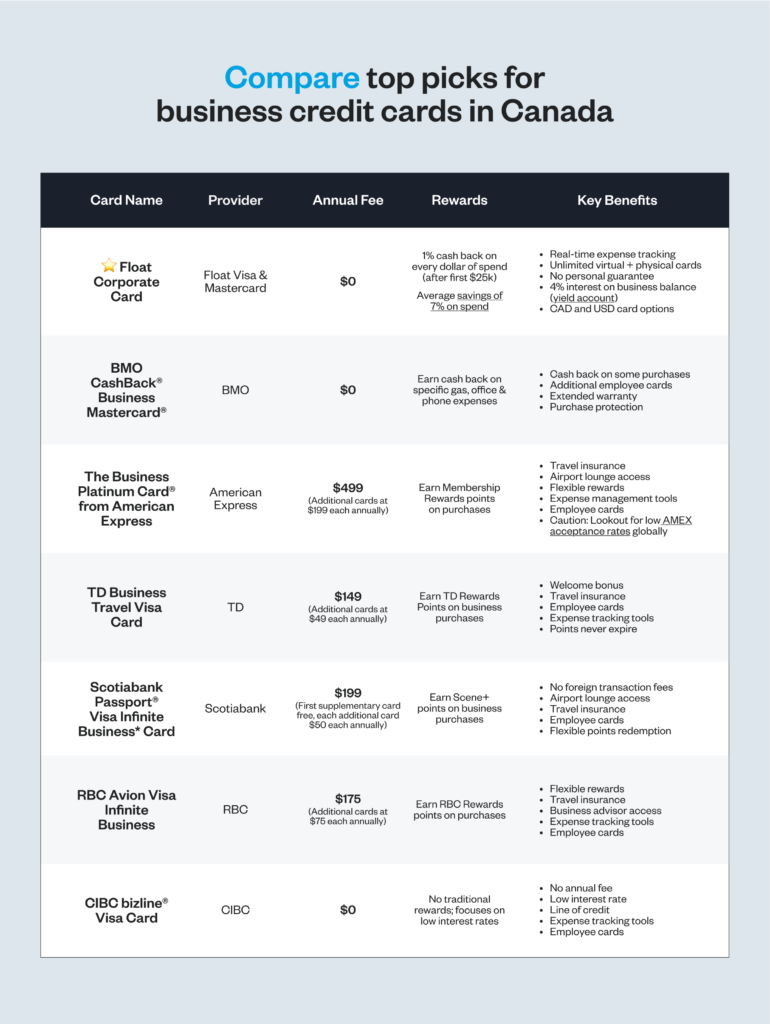

Top picks: Comparing business credit cards in Canada

Let’s dig into a few of the contenders for the best Canadian business credit cards and see how their key benefits, rewards and annual fees stack up.

Try Float for free

Business finance tools and software made

by Canadians, for Canadian Businesses.

FAQ

Not quite. Corporate cards are typically for larger companies and often require the business to be liable for charges.

It’s not recommended. Mixing personal and business expenses can create accounting headaches.

Regular use and timely payments on a business credit card are reported to business credit bureaus, helping establish your company’s credit history.

If you are a business owner, we recommend choosing a company credit card that doesn’t require personal background checks, can offer you high credit limits, and is easy to get started with! Float is a great option with no personal guarantee requirements!

Written by

All the resources

Corporate Cards

Corporate Cards for Consulting Firms: An Industry-Specific Guide

Corporate cards for consulting firms don't need to be a headache. Get tips from industry experts to make the most

Read More

Corporate Cards

Credit Card Fraud Prevention Strategies for Canadian Businesses

Credit card fraud is a risk, but it's even riskier if you aren't prepared. Get tips from CPA and Senior

Read More

Corporate Cards

How to Get a Business Credit Card: A Step-by-Step Guide

Discover how to secure a business credit card with our guide. Boost your financial flexibility and manage expenses effectively with

Read More