CASE STUDY

How Wahi’s Finance Team got 76% More Time Back

Less than 5h

month-end close

95%

receipts submitted on time

Quickbooks

integration to close books faster

THE CHALLENGE

- Wahi’s finance team was devoting excess time every month to tedious tasks like chasing receipts, reconciling payments, and manually inputting information into Quickbooks.

- Manual journal entries to input receipts and expenses were time-consuming and a waste of resources.

- Month-end close was taking upwards of 15 days each month.

THE SOLUTION

Wahi provided Float cards to office employees and realtors, saving hours of manual data input. The team fully transitioned to Float’s spend management platform, giving more autonomy to employees while increasing visibility for managers and the finance team.

THE RESULTS

- Wahi’s finance team spends up to 76% less time on receipt collection, reconciliation, and month-end close.

- Receipts are submitted in minutes vs. days; 95% of receipts are now submitted on-time with appropriate GL codes.

- Automated reconciliation reduces month-end close from 15-20 days to less than 5.

- Float’s QuickBooks integration eliminates 1 full day of manual data entry.

- The team gets back time for value-added work that helps grow the business.

About Wahi

Modern real estate experts Wahi are all about redefining the home buying and selling experience. Pairing home buyers and sellers with the right Realtor for their needs, the Wahi difference is all about utilizing their proprietary technology to help their clients make informed decisions. The company is most known for its cashback program, where they share up to 1% of their sales commission with buyers after closing. Wahi currently spans across Canada, with service in British Columbia, Alberta, Saskatchewan, Ontario, Nova Scotia, and New Brunswick.

THE DETAILS

As an innovative real estate brokerage, Wahi is tech-forward when it comes to helping Canadians buy and sell homes quickly, easily, and cost-effectively. But behind the scenes, Wahi was stuck in an old-school cycle of managing employee expenses and bookkeeping. In an industry with plenty of individual expenses, Wahi realtors and employees were often charging traditional corporate charges and credit cards—and the more expenses they had, the more the admin tasks piled up for the finance team.

Every month, Wahi’s finance team was spending up to 76% of their time collecting receipts, assigning GL codes, and closing the books. Matching receipts to travel expenses, entertainment invoices, and marketing costs took days, not to mention ensuring all costs were approved and on-budget. Then, once all the information was finally available, the finance team needed at least two days just to enter the data into QuickBooks, increasing the risk of errors and adding an unnecessary duplication of effort.

“With up to 200+ expense-related transactions every month, the process was incredibly tedious,” reported Jessie Zhang, Head of Finance. “We were ready for a better solution that decreased manual effort while giving more autonomy to our team, without the worry and cost of expensive individual cards.”

“Float makes it easy to send the receipt right with the GL code, which saves our finance team hours.”

Jessie Zhang, Head of Finance, Wahi

That’s where Float’s spend management platform came in, complete with multiple individual cards at no extra cost, and a seamless QuickBooks integration to reduce manual entry time.

“Float has been an incredible game changer that gives us the end-to-end solution we needed,” raves Jessie. “Our team has more flexibility and control in submitting receipts in the moment; Float makes it easy to send the receipt right with the GL code, which saves our finance team hours.”

So far, 6 employees have virtual Float cards for spending. Each individual card has its own approval hierarchies and limits that can be adjusted in real time, with team members able to both request specific spends and also have access to pre-set limits as needed. It’s this level of control that’s critical in a spend management solution as Wahi scales, so that managers are able to keep approvals lean and fast while still getting visibility and being able to adjust limits.

“The receipt reminders and auto-match are easy to use for the entire team and have truly made a difference in our team’s happiness and efficiency as it relates to month-end.”

Jessie Zhang, Head of Finance, Wahi

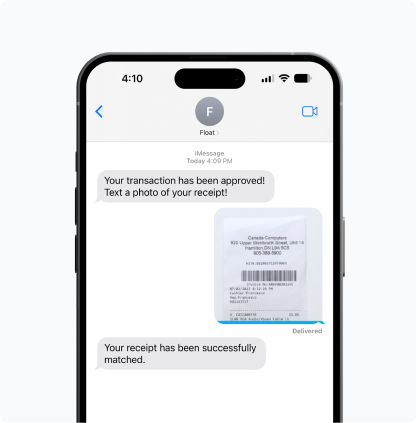

Employees and agents also saw huge time savings; with a quick scan or email, Float’s smart inbox automatically matches receipts to transactions, flagging any discrepancies and even sending reminders if there’s a missing receipt. Recurring spend can even be managed separately on individual cards, perfect for expenses like monthly subscriptions or memberships.

Each quarter the Wahi finance team has increased the spend managed through Float, trusting the partnership to continue making month-end as pain-free as possible. They are now looking into utilizing Float’s Bill Pay product to pay invoices easily and Reimbursements product to pay out-of-pocket employee reimbursements and mileage.

“We’re considering putting all of our payments onto the Float platform,” shares Jessie. “The receipt reminders and auto-match are easy to use for the entire team and have truly made a difference in our team’s happiness and efficiency as it relates to month-end.”

Explore more customer stories

Makeship

Float provides seamless management in both CAD and USD currencies, while decreasing time spent on month-end by 60%.

Coastal Reign

Float cards are issued to a quarter of their team, providing immediate access to spend capital in order to do their jobs more efficiently.

Practice Better

“Where it took 12 days before, I can now close expenses in one or two days. It just reconciles so easily.”