What is a Fleet Card? Your Guide to the Best Fleet Fuel Cards in Canada

Rising costs at gas pumps nationwide can make operating vehicles in your business both challenging and expensive. In addition to maintenance, fuel accounts for a major portion of operational spend for companies that use vehicles to provide services. The good news? Finding the best fuel card or fleet card for your business can save you money and give you control over the cost of getting from A to B.

What is a fleet card, exactly, and how is it different from a corporate credit card? When should you choose one over the other?

In this guide, we’ll go over how businesses benefit from providing fleet cards to employees and introduce some of the best fleet fuel cards Canada has on offer—plus a few alternatives.

What is a fleet card?

Fleet cards, also known as fuel cards, enable employees to pay for the costs associated with operating a vehicle—including gas, maintenance and repairs—and forward the charge to their company as a business expense. Fleet cards can only be used for vehicle-related expenses, whereas other corporate cards can be used for purchases like office supplies, software subscriptions, or meals.

Fleet cards are for businesses of all sizes with employees who drive a vehicle as part of their job. This includes companies that manage field workers or contractors who commute to different job sites (think plumbers, landscapers and telecommunications techs). Fleet cards are a must for long-haul trucking and last-mile delivery companies that need a way for drivers to pay for fuel and maintenance while they’re on the road.

How does a fleet card work?

If you’re looking into business cards, you might be wondering: What is a fleet card used for? Can’t a corporate card do the same thing?

There are definitely similarities. Employees can use fleet cards to make fuel and vehicle maintenance purchases on the company’s tab the same way they’d pay with a company debit or credit card. Many fleet cards are a type of credit card or charge card that accumulate a balance the employer needs to pay down on a regular basis. Some providers, like Float, also offer prepaid business credit cards for fuel.

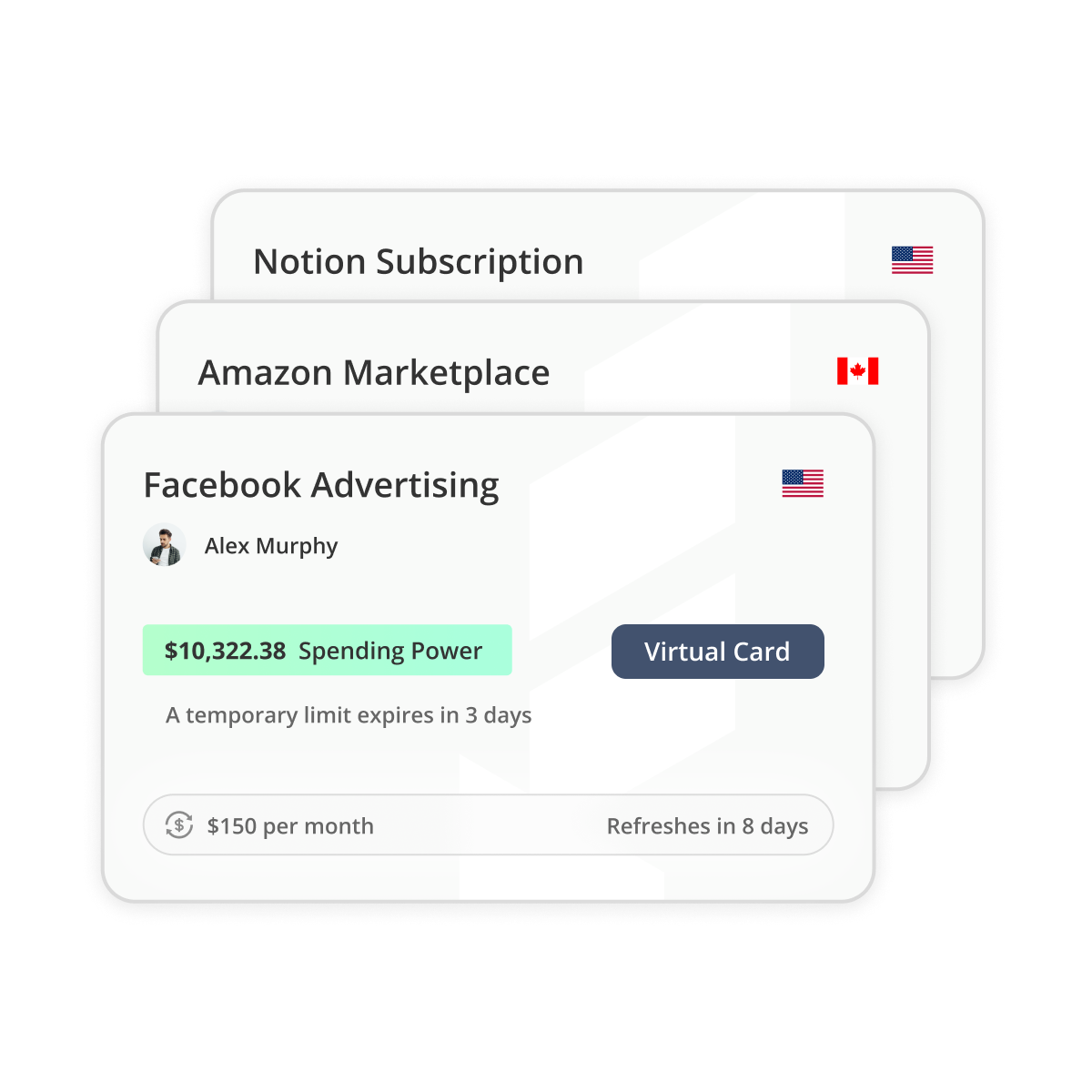

Unlike general-use business credit cards, fleet cards enable employers to set strict spending limits and restrict the types of transactions employees make—and even where they can make them.

There are two types of fleet cards:

- Closed-loop fleet cards are offered by fuel retailers and can only be used within their fuel networks. One of the major downsides is that drivers have to go out of their way to use them at specific gas stations and truck stops.

- Open-loop fleet cards are offered by financial institutions or corporate card providers and can be used anywhere the card’s brand is accepted. Open-loop cards are often Visas or Mastercards.

You can assign a fleet card to an employee or to a vehicle, which makes it easier to track total cost of ownership (TCO) and identify any gas-guzzling lemons in your fleet. The cards also offer security features like flagging unauthorized transactions and allowing you to suspend or cancel non-compliant cards.

Benefits of fleet cards

1) Eliminate the reimbursement rigamarole

With a fleet card, employees don’t have to worry about gathering receipts to submit for approval or wait for reimbursement. In turn, your accounting team doesn’t have to spend time hunting down receipts or juggling payouts, making it easier to control cash flow.

2) Give drivers autonomy without compromising on control

Using a fleet card keeps the budget under control without causing roadblocks for drivers. Fleet cards give you the best of both worlds: the ability to set spend limits and track usage while also allowing your team to fuel up when it’s convenient for them.

3) Get better insights and analytics

Top-performing fleet cards can be integrated with bookkeeping or expense management software to automatically log details like fuel grade, fuel price, and location. This enables you to measure fuel efficiency and maintenance costs so you can spot opportunities for improvement.

4) Take advantage of savings and rewards

Many closed-loop fleet cards offer rebates or discounts on fuel, car washes, tires and mechanic services. Some also offer cash back or points programs. At Float, our corporate cards offer a stack of rewards including 1% cashback and 4% interest on yield account balances—without the restrictions that come with closed-loop cards.

Best fleet fuel cards in Canada

The best fuel card will offer employees flexibility and convenience when they need to fuel up while giving you greater visibility and control around your vehicle expenses. If your employees are driving out-of-province or into the U.S., you need to consider cards that work across borders.

To help you find the card that fits your business, here’s an overview of some of the best fleet fuel cards Canada has to offer:

Closed-loop fleet cards

Shell Fleet Plus: One of the leading fuel cards for trucking companies in Canada. Offers discounts at Shell stations and Jiffy Lube, plus Air Miles. Includes purchase controls and reporting.

Esso and Mobil Business Card and Premier Plus Business Card: Another leader with a wide network offering fuel cards for trucking companies in Canada. Provides volume discounts and, at the Premier Plus level, advanced performance reporting.

Co-op Fleet Cards: A popular option for transport and agriculture companies. Can only be used at Co-op, Tempo and Western Nations Gas Bars in Western Canada.

Open-loop fleet cards

Shell Fleet Navigator: An open-loop Mastercard that has all the benefits of Shell Fleet Plus along with additional chip and PIN security and universal acceptance.

BMO Fleet Card: BMO offers the Mastercard Corporate Fleet Card that can be used everywhere, including Mastercard ATMs. Offers spend controls and reporting.

Foss National Leasing Fuel Card: This open-loop-ish card is accepted at 98% of Canadian fuel retailers. The program includes tire services from Foss, which also offers vehicle leasing.

Corporate cards for vehicle expenses from modern business finance providers

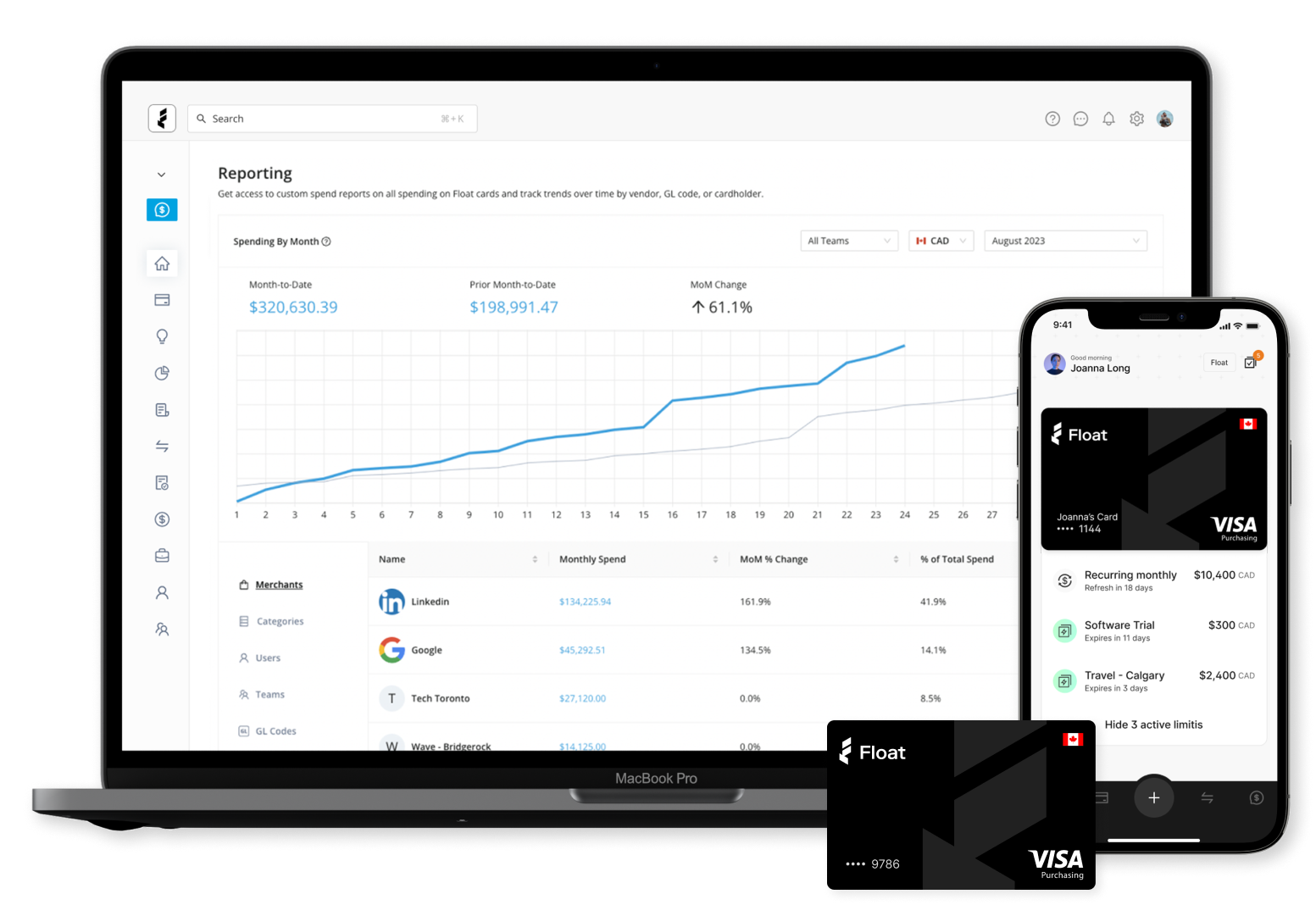

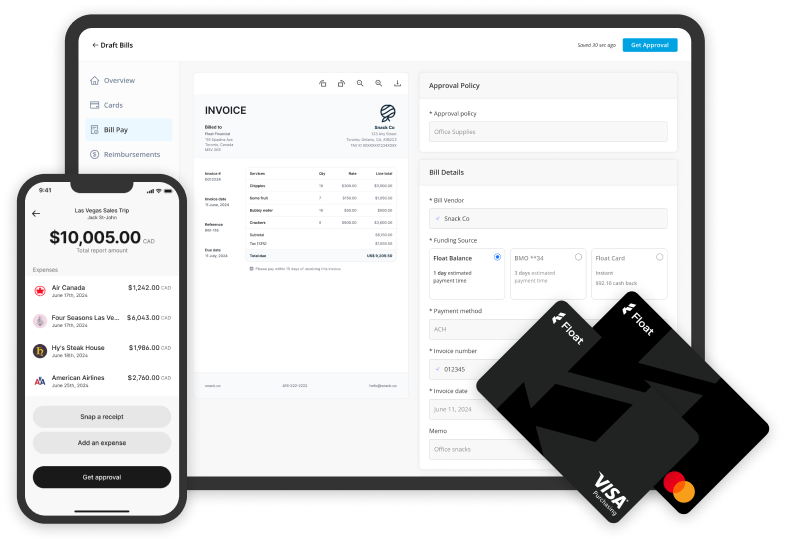

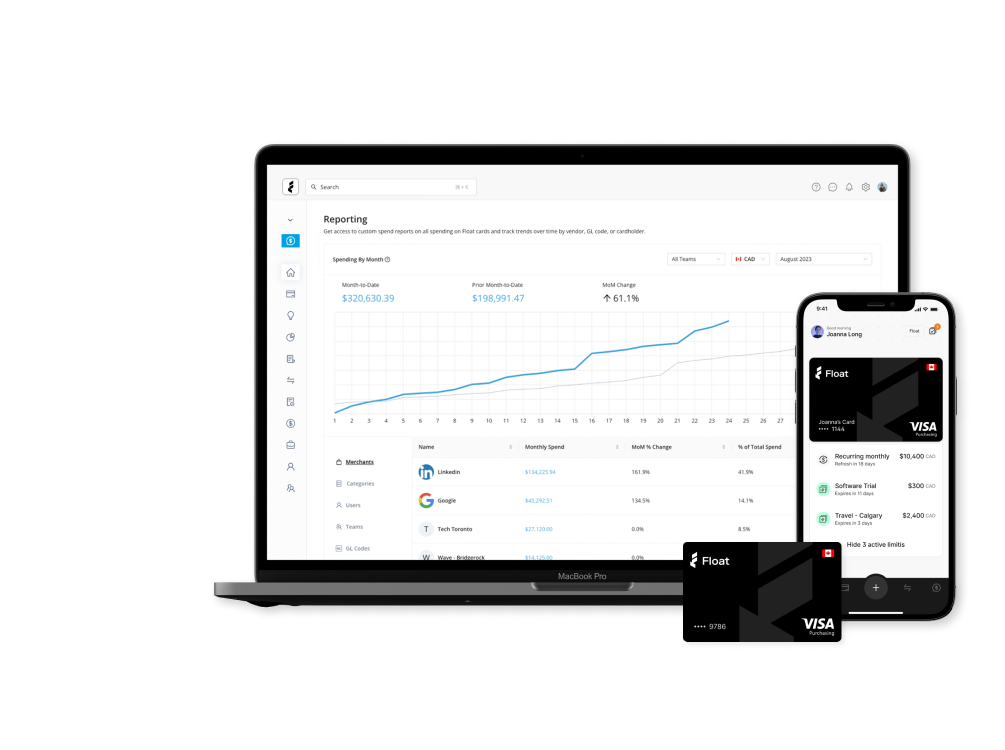

Float: Flexible open-loop corporate card solutions, including fuel cards for small businesses in Canada. Provides built-in expense management and spend limit features and offers 7% total average savings. Built for Canadian businesses.

Keep: General-use corporate card with higher credit limits. Offers basic spend controls and expense tracking. Not available in Québec.

Loop: General-use corporate card with no FX fees. Offers points rewards on purchases. Expense management through a single pane of glass.

Vault: General-use corporate cards that offer 1% cashback on purchases and no FX. Provides multi-currency accounts. Not available in Québec.

Grow Your Business With Float

Canada’s only finance & corporate cards platform that helps businesses save 7% on their spend.

What to keep in mind when choosing a fleet card

Fuel cards should give you tools to track fuel efficiency and maintenance costs to better understand TCO so you can invest wisely in new vehicles moving forward.

Fleet cards that integrate seamlessly with your tax and accounting or business intelligence software make it easy to stay compliant and measure success.

The best fuel cards for trucking companies in Canada offer expense management solutions that integrate with telematics and electronic logging device (ELD) software for a holistic view of vehicle costs.

Bear in mind that some cards require you to buy a certain volume of fuel each month to qualify for benefits like discounts and rebates. If fuel purchases aren’t a major cost for your business, choosing a general-use corporate card allows you to have the same level of control over employee purchasing, without limitations around what types of expenses they can pay for with their card.

How to apply for fleet cards

Unlike business credit cards, many fleet cards on the market are provided by fuel retailers or corporate card providers, not traditional financial institutions. If you’ve looked into how to get a business credit card before, you might be wondering, what is a fleet card application process like?

You’re in luck. Applying for a fleet card is typically quick and easy. Here’s how.

1) Get your business info together

Applications require information like your company name, location, type, industry, registration documents and your GST/HST number.

2) Gather fleet information

You’ll need to report details like the size of your fleet, your monthly fuel and maintenance costs and your monthly fuel use.

3) Gather financial documents and check your credit score

Some providers may need to look at financial statements, proof of income and your credit score to determine the credit limits you’re eligible for. Some also require a personal guarantee or other collateral.

4) Complete your application

Many closed-loop cards and cards that are available through banks require you to speak directly to a representative about your needs. Open-loop cards, especially those offered by fintechs, typically have fast online application processes. At Float, it takes just 10 minutes to apply for your corporate cards.

5) Get approved and issue your cards

With Float, you can get a 24-hour turnaround on approval. Some providers have longer approval timelines. Once you’ve been approved, you can put rubber to the road and start assigning cards to your drivers.

Managing fuel expenses in your business

According to the American Transport Research Institute (ATRI), fuel accounts for almost a quarter of trucking company operating expenses and costs an average of $22.23 USD per hour, per vehicle in 2023.

Saving on fuel frees up cash in your business. Reducing fuel costs also goes hand-in-hand with lower emissions, which can help you meet climate action targets.

Here’s how you can control your fuel costs in addition to using a fleet card.

Optimize routes and loads

Use telematics solutions to find faster routes and enable drivers to proactively navigate around traffic and construction. Ensure your drivers are only carrying what’s required—i.e., don’t let employees lug their hockey bags around in the company car—as fuel consumption increases by about 1% for every 25 kg in mid-sized cars.

Reduce idling and speeding

The average car wastes one cup of fuel every 10 minutes that it’s idling. Going 20 km/h over the 100 km/h speed limit on the highway isn’t just a safety risk—which can lead to costly fines—it also increases fuel consumption by 20%.

Coach drivers

Habits like repeatedly hitting the breaks and speeding up can increase fuel use by up to 33%. Coasting rather than using the accelerator and brakes can also save gas. Proactively coach drivers on techniques to reduce fuel use and minimize wear-and-tear on your vehicles.

Perform preventative maintenance

Replacing air filters, changing oil, and checking tire pressure on a regular basis boosts fuel efficiency and ensures your fleet is in good working order. This reduces unnecessary emergency repair expenses.

Float for fleet management

Fuel cards are great for trucking companies or last-mile delivery companies whose drivers mostly spend money at fuel stations, truck stops, and mechanics. But if you run a trades- or service-based company, and/or provide commuter vehicles for your employees, the best fuel card for you might be a general use corporate card.

Float offers the best business credit card in Canada. Our flexible corporate cards enable you to manage all of your employee expenses, including fleet costs like fuel and maintenance, in one place. Drivers can use Float cards wherever Visa and Mastercard are accepted across Canada.

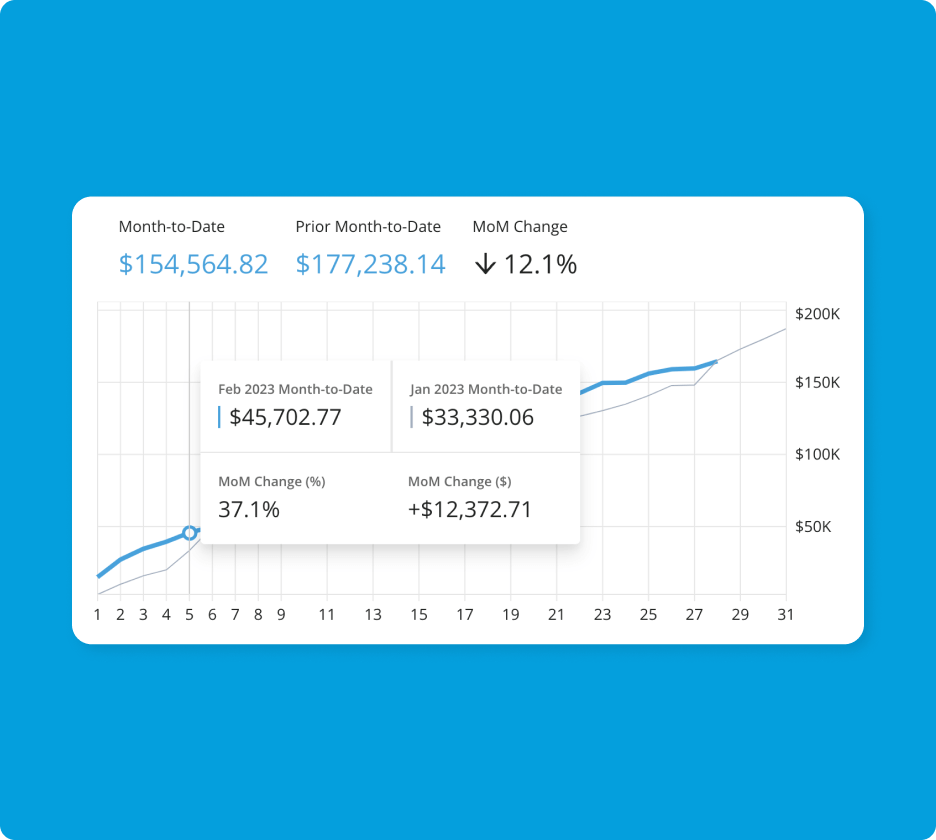

With Float, you can set the same strict spending limits that you’d expect from the best fleet fuel cards in Canada and customize those restrictions—in real time—for all the purchases your employees need to make. Float’s suite of powerful reporting features show transactions as they happen in the moment and enable you to track budgets vs. actuals over time.

Float also offers high spending limits up to $1M with no personal guarantees. Benefits like 1% cash back, 4% interest on funds kept in your Float and low USD conversion fees rolled up with increased efficiency across your team delivers 7% total cost savings.

Take control of your fuel costs with Float and discover how to make every dollar go further—on and off the road.