Best 0% Interest Business Credit Cards for 2025

If you’re facing tight cash flow, investing in business growth or consolidating existing debt, getting access to funding can feel like a make-or-break situation. One of the best ways to navigate challenging economic times is with a 0% interest business credit card for Canadian businesses. This tool offers a low-risk, high-flexibility solution that bridges financial gaps while saving money and providing access to valuable perks.

However, not all 0% interest business cards in Canada are the same. In this guide, we’ll discuss why a 0% APR business credit card is a smart choice for Canadian businesses. We’ll also cover selecting one that will help you avoid taking on expensive debt while enabling you to meet your business goals.

What is a 0% interest business credit card?

An interest-free business credit card does not charge any interest on purchases or balance transfers. There are two types of 0% interest business credit cards:

- 0% intro annual percentage rate (APR) business credit card: These business credit cards don’t charge interest on purchases or balance transfers for a specific period, typically lasting for a few months to a year. If you pay off the balance before this period is over, you don’t pay any interest. However, if you have a balance remaining after the offer period is over, you may be responsible for paying interest on the full balance.

- Always 0% interest business credit cards (no APR cards): As the name suggests, these business cards don’t have an introductory 0% interest offer. They don’t charge interest on purchases or balance transfers at any point in time. Float is a Canadian corporate card that is always interest-free.

Both types of 0% interest business credit cards often offer additional benefits, such as travel rewards points and cash back on certain purchases.

Benefits of 0% APR business credit cards

If you’re looking for financial flexibility to make large purchases and temporarily avoid interest charges, a business credit card with no interest can offer a number of advantages:

- Save on interest: Compared to a regular business credit card APR, 0% seems ideal. If you know you can pay off the balance before the promotional APR period ends, you can avoid paying interest entirely, which can save your business anywhere from hundreds to thousands of dollars.

- Earn rewards: If you take out a loan to increase your cash flow, you’ll miss out on the rewards that come with many 0% interest business credit cards. Using a credit card means you can access perks like expense management tools that make month-end less of a nightmare.

- Build business credit: Do you know you can pay off the balance within the timeframe required to avoid interest? A 0% APR business credit card is a great way to build your business credit with financial institutions.

- Get peace of mind with consumer protections: In Canada, consumer protections for credit cards based on the Financial Consumer Protection Framework focus on transparency and fairness. All credit card agreements are clearly and plainly worded so that you understand the rules and conditions.

Drawbacks and limitations of 0% APR business credit cards

Does an interest-free credit card sound too good to be true? Be aware of potential drawbacks and limitations that could impact your business’s financial health.

- Regular APR applies after the introductory period: If you haven’t paid off the balance before this period, that balance is subject to the regular APR on some business credit cards. However, with Float, the interest-free period lasts forever (but you cannot carry a balance month to month).

- You may have to pay a balance transfer fee: Making a business credit card balance transfer to take advantage of zero interest? Some credit cards have balance transfer fees of 3%-5% or more.

- Annual fees may impact your savings: Some 0% interest business credit cards have annual fees of several hundred dollars, which can offset any savings you earn with no interest. As one of the best business cards in Canada, Float’s annual fee is $0.

Be mindful about this choice! Your company’s credit could suffer if you’re not careful when selecting the right 0% APR credit card.

How to choose the best 0% interest business credit card

When searching for the best business credit card with 0% interest, choosing from the available options can be overwhelming. Here’s what we recommend you consider:

- Assess your business’s spending habits: To maximize value, you have to know how your business spends—and pays bills. For example, do you frequently pay off big purchases in a short amount of time? Does your business only need to make large purchases occasionally? Do you have a policy for making credit card payments?

- Compare, compare, compare: To know what’s out there, you’ve got to do your due diligence. Compare different 0% APR offers, regular APR interest rates, card rewards and expense management tools available.

- Check issuer requirements: Is there a minimum credit score required? Does your business need to have a certain level of income to qualify? What business information is required to apply for the card? Determine whether you’re able to get the card you want.

- Think both short and long term: Many businesses view using a business credit card with no interest as a short-term bridge loan—which it can be. But don’t forget about the long-term impact. For example, determine how it will impact your credit score and whether you will pay more interest in the long run.

Best business credit cards

Compare top options, fees and benefits for

Canadian companies.

Top 0% APR business credit cards in Canada for 2025

Ready to start shopping? Here are the best 0% interest business credit card options for 2025.

| Provider | 0% APR offer | Post-offer interest rate | Annual fees | Key rewards | Key benefits | |

| ⭐️Float Corporate Card | Float Visa and Mastercard | 0% | N/A (can’t carry over balance) | $0 | 1% cashback on spend* 4% interest on funds held in Float | Long-term interest-free offer (no APR) Real-time visibility and expense tracking toolsNo personal guarantee Average savings of 7% on spend |

| BMO CashBack Business Mastercard | BMO | 0% introductory interest rate on balance transfers for 9 months with a 3% transfer fee | 20.99% interest on purchases | $0 | 0.75%-1.75% cashback on certain purchases | Extended warranty protection Purchase protectionUp to 22 additional cards |

| Business Platinum Card® from American Express | American Express | Up to 55 interest-free days | Vary based on credit score and other factors but typically ranging from 20.99% to 29.99% | $799 | Membership rewards points on your purchases | No pre-set spending limit Airport lounge accessExpense management tools |

| MBNA True Line Mastercard | Mastercard | 0% promotional annual interest rate for 12 months on balance transfers | 12.99% on purchases and 17.99% on balance transfers | $0 | Up to 9 authorized users Rental car savings | This is a personal card which may suit some small businesses, but it does not offer business-specific benefits. Note that it may impact personal credit scores. |

| CIBC Select Visa Card | Visa | 0% interest for up to 10 months with a 1% transfer fee | 13.99% on purchases | $29 (first year rebated) | Insurance coverage access Up to 10 cents off per litre of gas | This is a personal card which may suit some small businesses, but it does not offer business-specific benefits. Note that it may impact personal credit scores. |

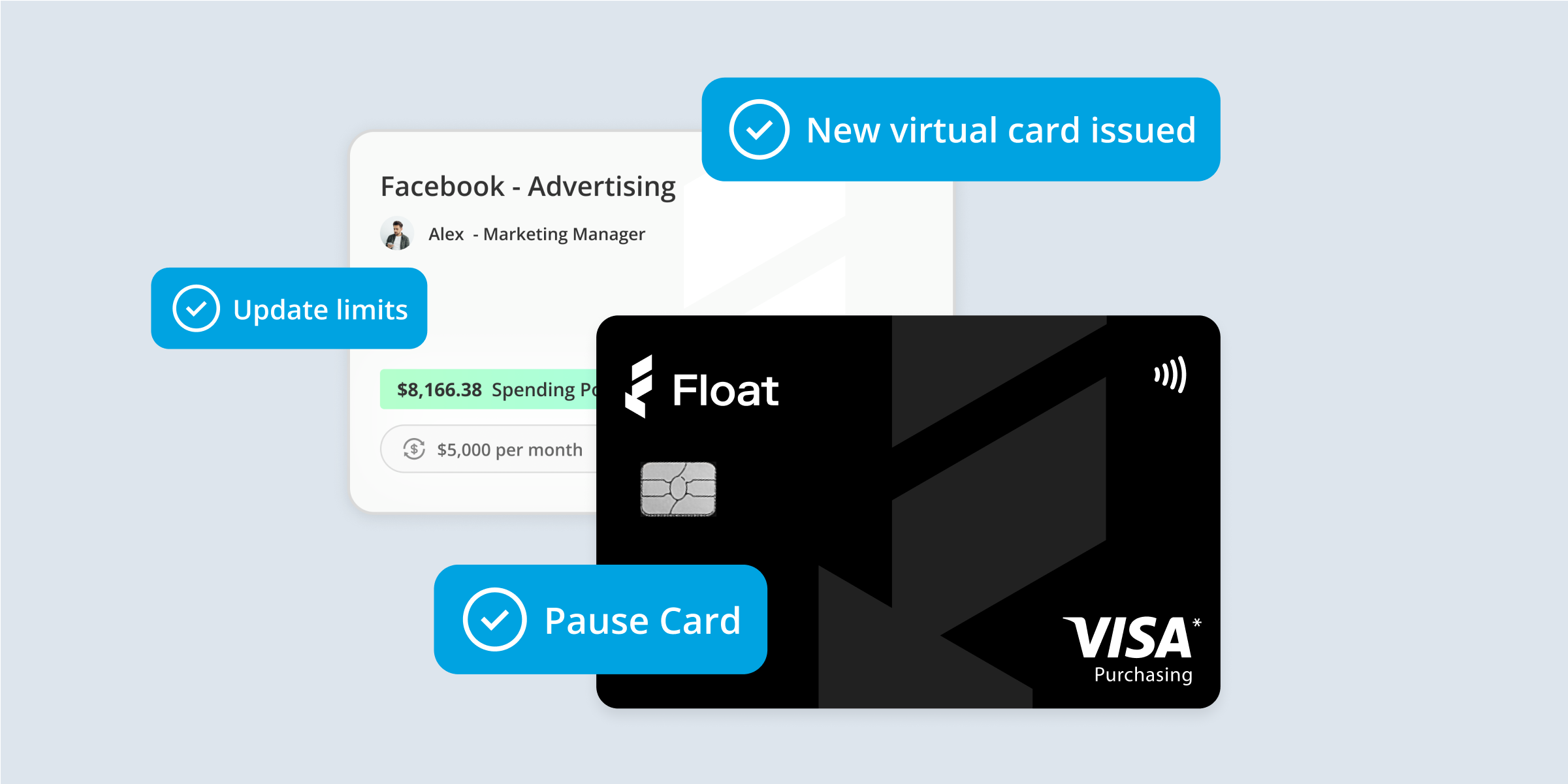

Float: Interest-free and full of perks

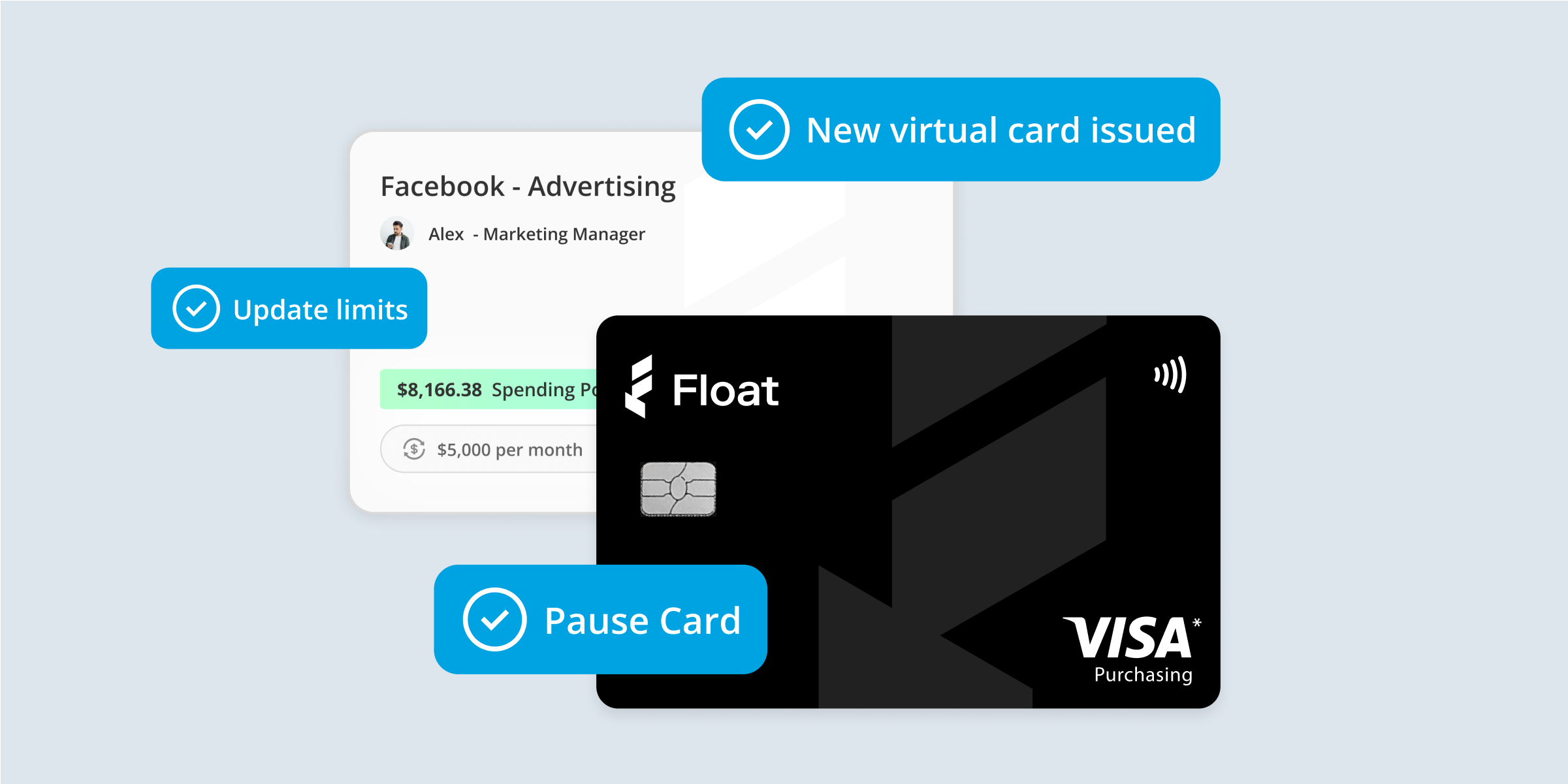

Looking for more financial bandwidth? Float’s interest-free business credit card can provide the necessary flexibility and control.

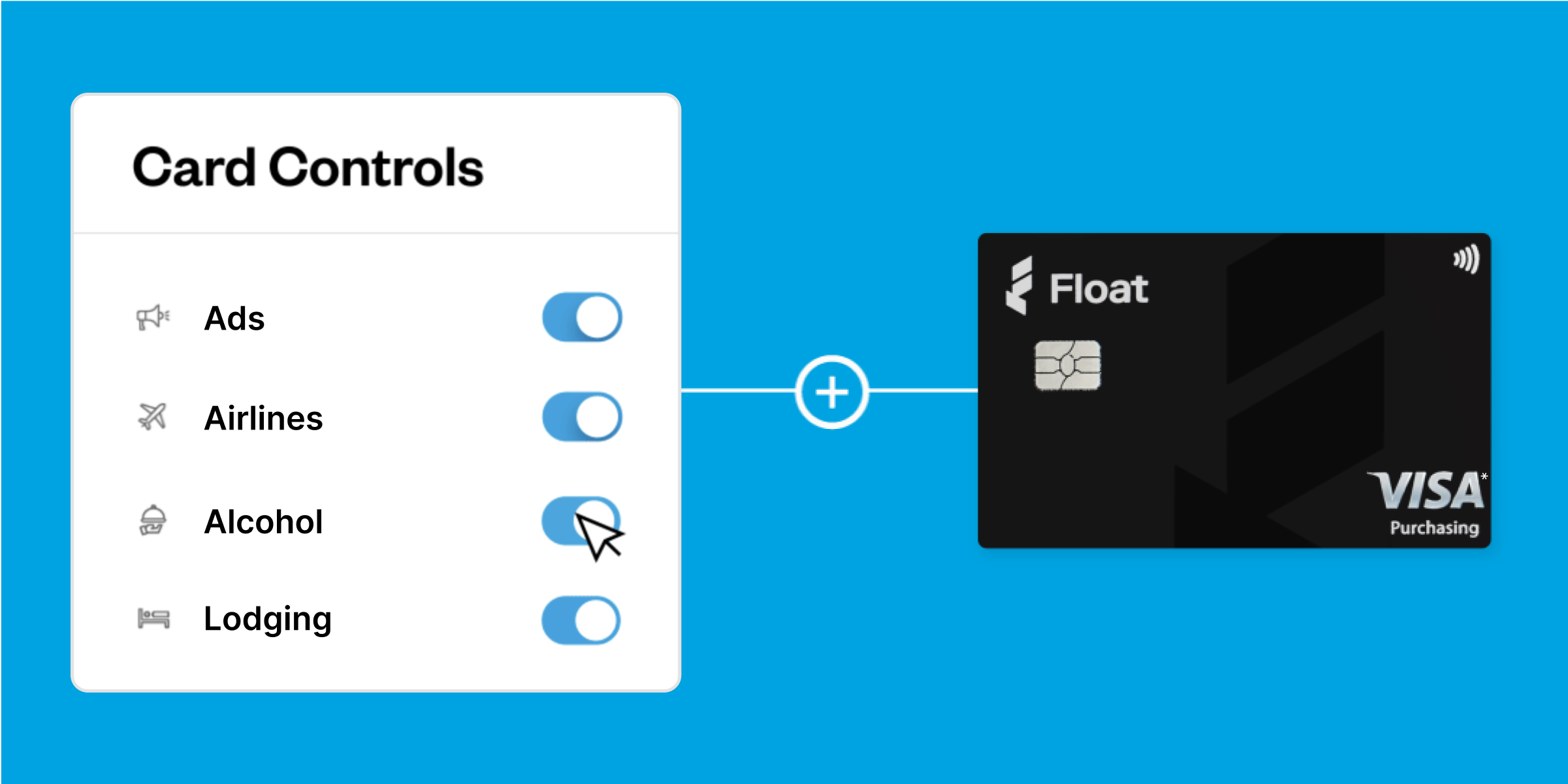

You not only avoid annual fees and interest but also get access to real-time visibility and automated expense management workflows without incurring any credit card debt. Explore how Float’s corporate credit card helps keep your business spending in check.