How Companies Are Using AI in Canada: Industry Trends, Tools and Costs

AI adoption is growing rapidly in Canada. But how are companies using AI to drive efficiency and innovation?

Businesses use AI for everything from automating customer service and streamlining workflows to global marketing campaigns and laundry sorting. In many industries, AI adoption is quickly moving from cost-cutting advantages to must-have tools. Companies in these already innovative sectors that fail to adopt AI risk falling behind, while those in industries with lower AI adoption still have the chance to gain a competitive edge.

No matter where your business falls on the AI scale, looking at AI industry trends specific to Canada can help you benchmark its adoption efforts by understanding where competitors are likely investing, identifying emerging opportunities, and optimizing spend to make the most of your investments.

In 2024, Statistics Canada estimated that about 9% of Canadian businesses were already using generative AI. But as of the last 30 days, about 41% of Float customers have subscribed to at least one AI tool. This is up from 32% AI adoption in 2024, when it had already doubled from the previous year.

With insights from millions of transactions across thousands of Canadian businesses, Float offers a unique real-time look at corporate finance trends and AI spending. Our data highlights clear distinctions—industries leading AI adoption, those lagging behind, the tools businesses are investing in, and the average cost of these transactions.

Let’s dive in.

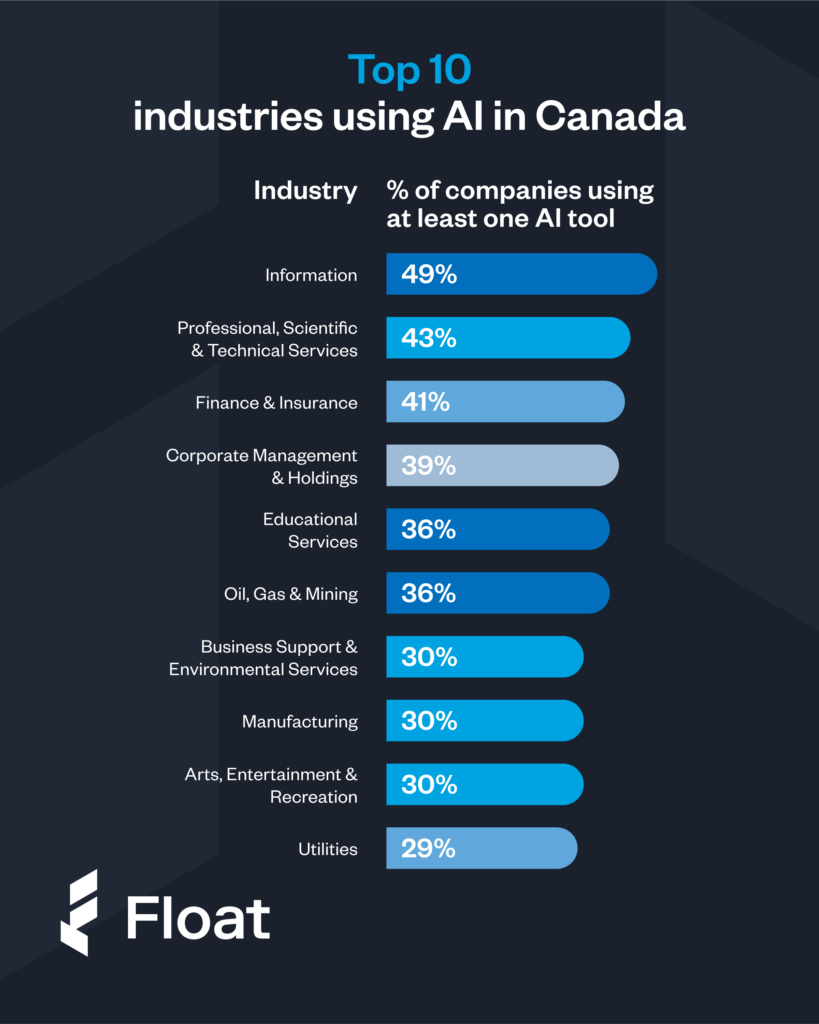

Top industries using AI in Canada

AI adoption is most prevalent in knowledge-based industries such as IT, consulting and finance-related industries, where automation, data analysis and predictive modeling provide a competitive advantage. These sectors have embraced AI to streamline operations, enhance decision-making and optimize customer experiences.

Traditional industries, including mining and manufacturing, are also incorporating AI, but at a slower rate. While these industries benefit from automation and predictive maintenance, adoption is not as rapid, likely due to infrastructure challenges and higher implementation costs.

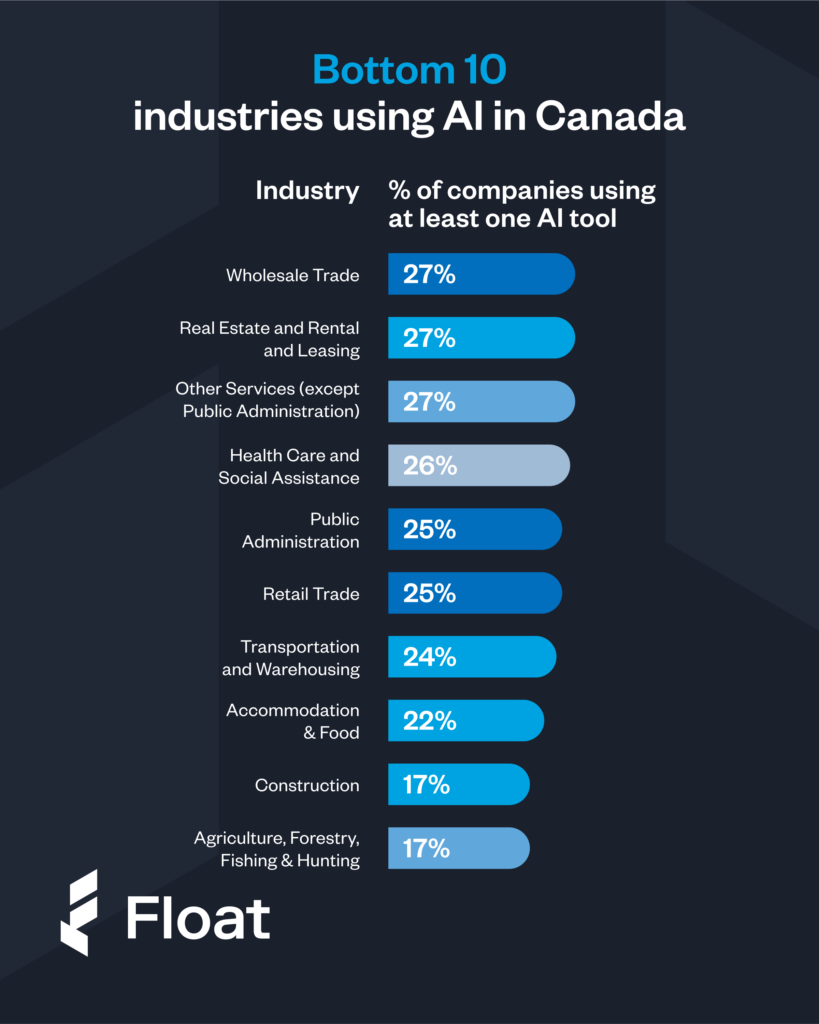

Industries lagging in AI adoption

Despite significant potential for automation and personalization, customer-facing industries such as retail and hospitality have lower AI adoption. Many businesses in these sectors still rely on traditional customer service methods and manual operations, slowing AI integration. But, retail is an industry poised for innovation, especially when it comes to spend management and overall financial operations. For example, retail and ecommerce businesses are already using virtual credits cards and expense automation to optimize ad spend with campaign-specific credit cards and targeted spend controls, keeping them growing without going over budget. AI could be the next step here.

Public sector organizations and healthcare providers are also lagging in AI adoption, despite opportunities to improve operational efficiency, patient care and decision-making. Regulatory concerns and bureaucratic hurdles may be contributing factors.

Agriculture and construction have the lowest AI adoption rates, even though AI could enhance predictive analytics, automate workflows and improve resource management. Limited technological infrastructure and the hands-on nature of these industries may be barriers to widespread AI use.

Most common AI tools used by Canadian businesses

AI-powered writing and communication tools such as ChatGPT, Claude.Ai and Otter.Ai are the most widely used across Canadian businesses. These tools support content creation, transcription and real-time collaboration, making them valuable for various industries.

Creative AI tools like Midjourney and Leonardo.Ai are gaining traction in content-driven industries. Businesses focused on marketing, design and media are increasingly leveraging AI to generate high-quality visuals and streamline creative workflows.

Productivity and workflow automation tools such as Fireflies.Ai, Reclaim.Ai, and Motion indicate a strong demand for AI-driven efficiency improvements. These tools help teams automate scheduling, transcription and workflow optimization to enhance productivity.

What this data doesn’t capture are AI features embedded within existing platforms, such as Google’s Gemini, which are seamlessly integrated into business workflows without requiring separate subscriptions. To cut costs, some businesses that already use Google workspace might consider replacing ChatGPT subscriptions with Gemini use among their employee base.

What businesses are spending on AI subscriptions

Float customers have collectively spent nearly $2 million on ChatGPT alone, significantly outpacing spending on other AI tools. This suggests that ChatGPT has become a core tool for businesses, driving efficiencies in content creation, communication and automation.

Many businesses are spending most of their AI budget on a single tool, which raises the question—are they using AI in the best way, or just relying too much on one option? Companies might get better results by either trying different AI tools or cutting back on overlapping subscriptions to save money.

Since more AI features are being built into everyday software, businesses should check if they’re fully using what they already have. It’s important to track whether these tools are actually helping with productivity, reducing costs, or increasing revenue.

The future of AI use in Canadian industries

AI adoption is expanding across Canadian industries, but its use varies significantly by sector. Businesses must regularly evaluate their AI investments to ensure they are maximizing efficiency and optimizing costs. The rapid rise in AI-related spending underscores the need for a strategic approach to AI budgeting, balancing innovation with financial sustainability.