Corporate Cards

Best Corporate Card Management Software & Solutions for Canadian Businesses

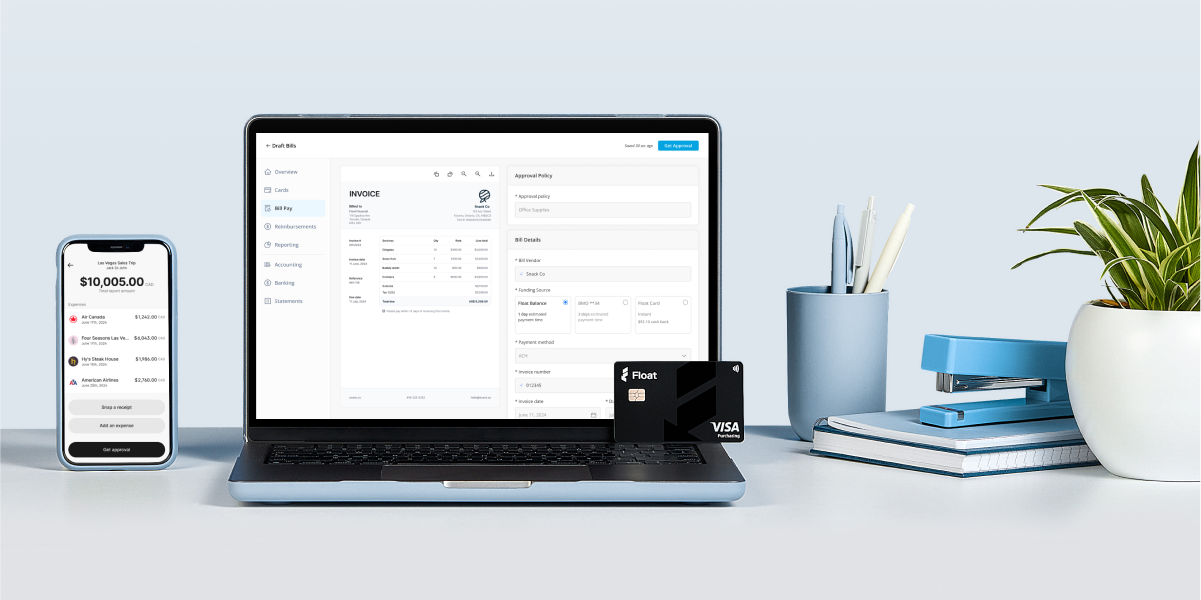

Discover the best corporate card management software for Canadian businesses. Streamline your finances, save time, boost business efficiency with Float

July 18, 2025

As a finance leader, you know that managing corporate credit card expenses can be a time-consuming and error-prone process. Manual data entry, lost receipts and lack of real-time visibility into spending can lead to costly mistakes and missed savings opportunities. That’s where corporate card management software comes in.

In this article, we’ll explore the top corporate card expense management solutions for 2025, highlighting the key features and benefits that can streamline your expense reporting process and provide better control over your company’s spending. Whether you’re a small business owner or a CFO of a large enterprise, you’ll find valuable insights and recommendations to help you choose the right solution for your needs.

What is corporate card expense management?

Corporate card expense management is the process of tracking, categorizing and reconciling credit card transactions. It involves setting spending limits, enforcing expense policies and ensuring compliance. The goal is to streamline the expense reporting process, reduce manual work and gain real-time visibility into company spending.

With the right corporate card management software, businesses can automate credit card expense tracking, integrate transactions directly into accounting systems and reduce the risks of fraud or policy violations. This ensures that finance teams have accurate, up-to-date records of corporate spending while allowing employees to make necessary purchases efficiently.

How corporate card expense management differs from expense management

Corporate card expense management is a specialized subset of expense management that focuses on tracking, categorizing and reconciling corporate credit card transactions in real time. Unlike general expense management, which includes reimbursements, vendor invoices and cash expenses, credit card expense management deals exclusively with company-issued credit cards. This allows businesses to automate tracking, enforce spending controls upfront and reduce manual reconciliation.

A key difference is that corporate credit card expenses are automatically recorded, categorized and matched with policies, whereas general expense management often involves at least some manual submissions and approvals. Credit card management also enables real-time visibility into spending, fraud prevention through virtual cards and transaction limits and seamless integrations with accounting systems.

While both processes aim to control business spending, corporate card expense management offers a more automated, proactive approach compared to the broader, often more reactive, nature of general expense management.

Best business credit cards

Compare top options, fees and benefits for

Canadian companies.

Corporate cards vs. other payment methods

A well-managed corporate card system can replace multiple outdated methods. It gives you more control and less risk.

Let’s review the pros and cons of different methods:

| Payment method | Pros | Cons |

| Corporate cards | Real-time controls, automated coding, cashback, visibility | Requires upfront setup |

| Reimbursements | Easy for employees | Policy violation risks, slow reconciliation |

| Vendor invoices | Suitable for large/recurring payments | Delayed visibility, manual approvals |

| Petty cash | Immediate access | No visibility, high misuse risk |

Benefits of corporate card expense management solutions

Now that you’re clear on what corporate card expense management is, and the pros and cons of using credit cards vs. other payment methods, let’s look at the advantages a corporate card platform can offer. From time-saving automation to enhanced visibility into spending, the right software can transform how your team manages credit card spend.

- Automation: Automate the capture and categorization of credit card transactions to eliminate time-consuming manual data entry.

- Policy enforcement: Enforce spending policies and limits in real-time, reducing the risk of fraud and overspending.

- Simplified reporting: Streamline the expense reporting process for employees with features like receipt management solutions and mobile apps.

- Real-time visibility: Provide finance teams with real-time insight into company spending, enabling more informed budgeting and decision-making.

- Seamless integration: Integrate with accounting systems for seamless expense reconciliation and financial reporting.

With these benefits in mind, it’s clear why Canadian businesses are turning to corporate card platforms to simplify operations and strengthen financial control.

Key features to look for in a corporate card expense management solution

Reaping the benefits of a corporate card platform comes down to choosing the solution that best fits your company’s needs. No two expense management systems are the same, so you’ll want to assess the features of each one you’re considering to determine how they stack up against one another.

Here are a few elements to evaluate:

Convenience

Look for easy issuance of physical or virtual cards. Once the cards are in hand, it should be effortless for employees to capture on-the-go receipts and submit expenses through mobile apps.

Advanced card controls

Restrict transactions to specific merchants with card control. You can also automate expense categorization based on merchant codes and customizable rules.

Security features

Solutions like Float offer real-time reporting and insights, so you have full visibility into transactions as they happen and make decisions faster—especially when something doesn’t look right. Also look for a system with built-in approval workflows and policy enforcement for better transparency.

Card lifecycle management

Find a provider that will enable you to issue physical cards for team members or one-time-use virtual cards for vendors. You should be able to easily update spend limits or ownership transfers, and renew, freeze, cancel or reassign cards instantly.

Integration

Choose a provider with software that easily integrates with popular accounting solutions like QuickBooks, Xero and NetSuite.

Keep in mind that choosing the right platform isn’t just about ticking feature boxes. The key is to find a system that complements the way your team works, that scales with your business, and that strengthens your financial oversight.

Top types of corporate card expense management solutions

In addition to assessing features, another way to choose the best corporate card platform for you is to understand the different types of solutions available. For instance, some focus on automating a specific part of the process, while others offer end-to-end functionality.

Here’s a breakdown of the most common types.

- Automated expense reporting: Solutions that eliminate manual data entry and streamline the expense reporting process.

- Smart corporate card programs: Corporate card programs with built-in spend controls and real-time expense notifications.

- Automated receipt matching: Receipt scanning and matching technology for accurate and efficient expense reconciliation.

- Integrated spend management: Spend management guide with budgeting, forecasting, and analytics capabilities.

- All-in-one platforms: Expense management solutions that combine corporate cards, expense reporting, and bill payments into a single platform.

The right solution type for your business will depend on your size, structure and specific pain points—from managing employee expenses to gaining clearer spend insights.

How to choose the right corporate card expense management solution for your business

You’ve now had the crash course in corporate card platform benefits, features and types.

Let’s walk through how to choose a solution in five steps.

- Step 1: Evaluate your current expense management process and identify pain points and inefficiencies.

- Step 2: Determine your key requirements, such as the number of cardholders, expense policy complexity and accounting system integration needs.

- Step 3: Compare features and pricing of different solutions, considering factors like user experience, customer support and scalability.

- Step 4: Look for a provider that offers a free trial or demo to test the solution before committing to it.

- Step 5: Consider the long-term value and ROI of the solution, not just the upfront cost.

Corporate card program setup and administration

Choosing a corporate card expense management solution is only half of the task at hand. Finding success with a new platform also comes down to smart implementation.

Here are three key steps to follow during the setup phase.

1. Define your policies

Creating clear company credit card policies is key to ensuring compliance and minimizing the risk of misuse. (Say goodbye to the “I thought it was covered” excuse!)

An effective expense policy should outline the types of purchases that are permitted and the approvals required. Similarly, a purchasing policy helps standardize how vendors are paid, regardless of whether a formal purchase order system is used.

If your team travels often, a travel policy should make it crystal clear what’s covered—flights, hotels, meals and all the usual suspects.

To keep things smooth, automated approvals, built-in checks and real-time monitoring can support you in enforcing these policies—no micromanaging required.

2. Communicate with your team

Having a policy is a great start, but it won’t enforce itself. Don’t be shy about clearly communicating expectations and best practices. Training sessions, lunch-and-learns and handy digital guides can all help make your corporate card policies easy to understand (and even easier to follow).

Be sure to cover the real-world stuff too: how to submit expenses, which purchases are allowed and how to request temporary card access when needed. When in doubt, overcommunication beats crossed wires any day.

3. Optimize and evolve

A corporate credit card program isn’t a crock pot—you can’t just set it and forget it. Ongoing oversight is crucial to maintaining efficient operations.

Finance teams should regularly review spending patterns to ensure expenses align with policy and spot areas for improvement. For instance, this can help you catch unnecessary reimbursements that happen simply because someone didn’t have card access.

Don’t overlook the reconciliation process, either. If closing the books still feels like a marathon, it’s probably time to fine-tune your workflows. Consider it your financial check engine light—it’s telling you something needs attention.

End-to-end corporate card expense management for Canadian businesses

As you embark on your journey to streamline your corporate card expense management process, remember that choosing the right software can make all the difference. We invite you to explore the innovative features and benefits of our platform, designed specifically with the needs of modern Canadian businesses in mind. Get started for free today and experience the power of automated corporate card management firsthand.

Written by

All the resources

Industry Insights

Canada’s Crossroads: Why Now is the Moment to Move from Defensive to Intentional Growth

Float's 2025 report on Canadian business shows modest growth, rising costs and shrinking reserves. Find out exactly what the data

Read More

Expense Management

Controller Month-End Close Automation: Streamline Financial Reporting

Controllers, this one's for you. Let's talk about how how automating month-end close helps you move faster without sacrificing accuracy.

Read More

Corporate Cards

Corporate Card Program Implementation: Complete Management Guide

Ready to implement a corporate card program? This is where to start.

Read More