How to Set Business Card Spending Limits: A Finance Leader’s Guide

Corporate cards should empower your team, not open the floodgates on company spending. But if you’re still relying on shared cards or static business card spending limits, you’re likely dealing with bloated approvals, manual reconciliation and a lot of crossed fingers at month end.

Smart spending limits are a finance leader’s secret weapon, especially when paired with credit card internal controls. Done right, they give teams the autonomy to act fast without blowing past budgets or losing visibility.

Among the top five obstacles faced by Canadian businesses are rising inflation, debt costs and the cost of inputs—all driving up the urgency for proactive spend control.

This guide breaks down how to set effective business card spending limits, build compliance into your corporate credit card management process and use tools like Float to do it all without the admin burden.

Step 1: Determine eligibility

Not everyone needs a corporate card, but nearly everyone needs to spend company money at some point. The first step is rethinking what “having a card” means.

Float customers often issue $0 cards across the org. These aren’t blank cheques. They’re access cards. Employees can request spending as needed, and limits are only activated after approval. That means you can empower more team members without exposing the business to unnecessary risk.

Still want to keep things tighter? Prioritize card access for:

- Employees who travel frequently (sales, execs or field staff)

- Team leads with recurring budgets (marketing, ops or events)

- Anyone frequently submitting reimbursements

If a role involves regular purchasing, make it easier and faster with card access. And skip the painful pay-back process.

Step 2: Define acceptable uses for business cards

Before you assign limits, clarify what the card is for. Clear spend categories are your first line of defence against corporate card misuse and will help lay the groundwork for streamlined spend control with company cards.

Start with the basics:

- Travel and lodging

- Client meals and events

- Recurring software or tools

- Approved subscriptions

- Marketing and ad spend

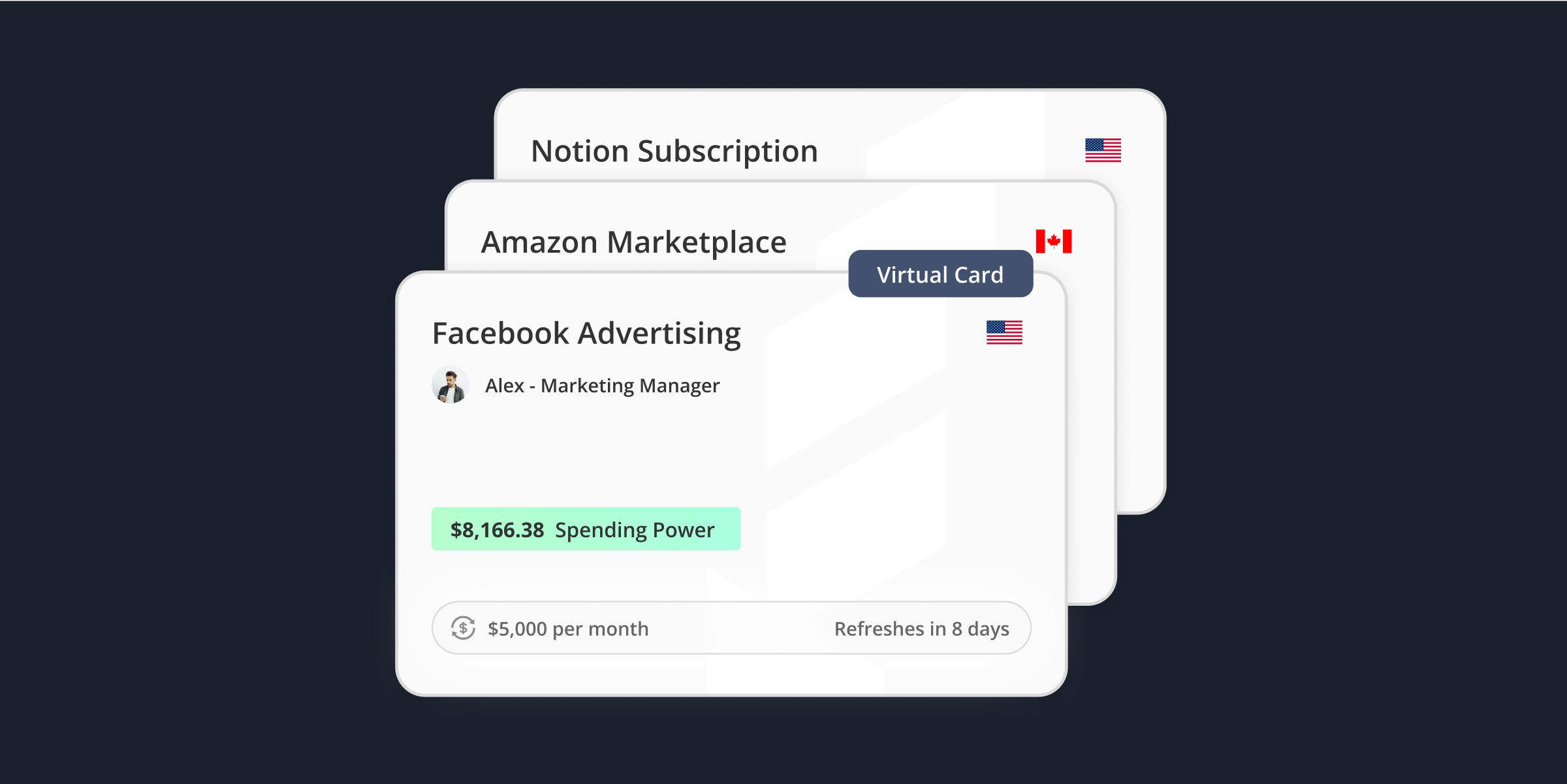

Float makes this even easier with category-specific cards. Want to make sure your Meta Ads budget doesn’t sneak into “miscellaneous”? Create a virtual card just for that vendor, set a monthly cap and automate the coding. If the vendor overcharges or your budget changes, you’ll know right away because the card will decline.

Setting expectations up front avoids awkward conversations later and builds accountability into the process.

Step 3: Establish appropriate business card spending limits

Here’s where most teams get stuck. How much is too much? Setting the right spending limit isn’t about playing gatekeeper. It’s about creating guardrails that give your team the freedom to move quickly, without sacrificing control, budget oversight or peace of mind.

As your company grows, with more spenders and more transactions flying around, vague or inflated limits can quickly lead to policy breaches and reconciliation headaches.

This step is where your business card spending limits strategy becomes real. You can set corporate card limits by aligning them with actual business needs—by team, role or vendor—and keep things moving without losing track of where the money’s going.

Instead of fixed limits tied to job titles, modern finance teams take a dynamic approach:

- Frequent travellers get per-trip or per-month limits based on historical averages

- Vendor-specific cards match the monthly budget (for example, $20K/month on Google Ads)

- Occasional users request temporary limits as needed, with expiry dates built in

Float allows you to set default limits, enable spend requests and schedule automatic resets. For example, you might approve a $5K limit for a conference with an automatic drop back to $0 after the event.

Step 4: Implement internal controls and compliance measures

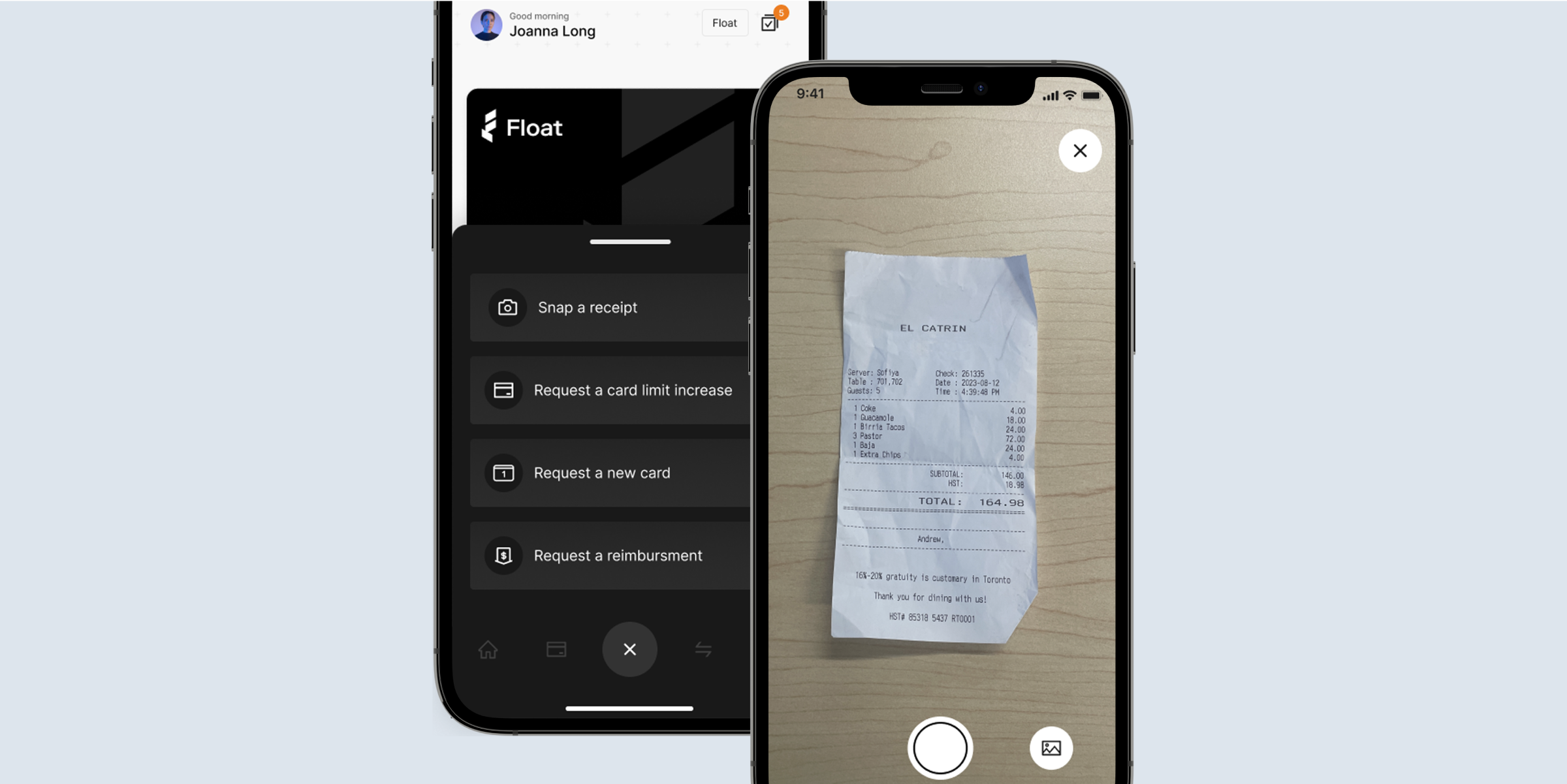

Every business credit card policy needs teeth, and ideally, automation. Float’s platform makes it easy to set submission rules (like mandatory receipts or GL codes) and approval workflows based on spend thresholds. That way, the right people sign off at the right time, before money goes out the door.

Want to avoid finance being the bottleneck for every $200 purchase? Route smaller approvals to team leads and save yourself for the big-ticket items. You can even run post-transaction reviews for additional oversight without slowing things down.

If someone fails to submit a receipt or explain a charge, Float can pause their card automatically until they catch up. These practical credit card internal controls are built-in.

Step 5: Utilize automation for enhanced card management

Here’s where Float earns its keep. Traditional cards force finance teams to manually update limits, monitor budgets and chase down documentation.

Float automates all of that:

- Real-time notifications for spending and receipts

- Custom approval flows by team, spend type or amount

- Vendor-specific cards with auto-coding and category locks

- Expiring limits so temporary budgets don’t stick around

That means your team gets what they need quickly, and you keep full control without playing email ping-pong. It also reduces reconciliation headaches, improves month-end accuracy and frees up finance to focus on strategy over tracking down receipts.

Learn more about Float

Get a 10-minute guided tour through our platform.

Step 6: Monitor and adjust spending limits regularly

Set it and forget it doesn’t work when your company is scaling. As teams grow or budgets shift, it’s essential to set corporate card limits that adapt to the current business reality.

Here’s what to watch for:

- Frequent declines may mean your limits are too low

- Unused cards or stale budgets suggest that overspending isn’t your real problem

- Make it a habit to pause or remove cards during employee turnover

Float makes it easy to spot stale cards, low limits or users who no longer need access, so you can keep things clean without digging through spreadsheets. You can review card activity, pause inactive users and adjust limits with a few clicks.

Monthly or quarterly limit reviews help keep your corporate credit card management clean, relevant, and low risk.

Float: Implementing effective spending controls

Setting business card spending limits isn’t about micromanaging. It’s about enabling smart, strategic spend.

The right system gives your team the freedom to act without opening you up to risk. With Float, you can ditch static policies, clunky card-sharing and “Oops, who spent this?” moments for good.

You’ll have real-time visibility, automated guardrails and the flexibility to support every team without slowing them down. It’s spend control with company cards that work.

A smart first step is to eliminate the guesswork from your business credit card policy. Grab Float’s free expense policy template and get started today.