Canadian Businesses Can Easily Calculate Per Diem Allowances for Employees with Our Free Tool

Streamline Employee Travel Expenses with Clear Claims and CRA-Compliant Allowances

Canadian Per Diem Calculator

How to Use the Canadian Per Diem Calculator?

1. Input Dates: Select the Start and End dates of your trip.

2. Enter Location: Choose the Province and optionally enter the City.

3. View Results: See your travel allowance based on CRA regulations.

This makes reporting your travel fast, simple, and hassle-free! If you have any questions reach out to support@floatcard.com.

Per Diem Basics and FAQs

What is a Per Diem Rate?

A per diem rate is a fixed daily allowance paid by employers to cover employees’ necessary business travel expenses, such as meals, lodging, and incidentals. Per diem rates are designed to simplify the reimbursement process and eliminate the need for employees to submit detailed expense reports. The Canada Revenue Agency (CRA) allows employers to use per diem rates for tax purposes, provided they meet certain criteria.

Advantages of Using Per Diem Rates

- Simplified expense reimbursement: Per diem rates streamline the process for both employers and employees, reducing administrative burden by eliminating the need for detailed expense tracking and reporting.

- Clear travel allowance: Employees have a clear understanding of their daily travel allowance, helping them budget accordingly. This also allows employers to better control and predict travel costs.

CRA Guidelines for Per Diem Rates

Reasonable Amount

The CRA considers a per diem rate to be reasonable if it is based on the federal government’s meal and vehicle rates, which are updated annually. For the 2024 tax year, the CRA’s reasonable per diem rate for meals is $69 per day within Canada and $69 USD per day for travel to the United States.

Tax Implications

When per diem rates are considered reasonable by the CRA, they are non-taxable benefits for employees. However, if the per diem rate exceeds the reasonable amount, the excess portion is taxable and must be included in the employee’s income.

Advantages of Using Per Diem Rates

- Simplified expense reimbursement: Per diem rates streamline the process for both employers and employees, reducing administrative burden by eliminating the need for detailed expense tracking and reporting.

- Clear travel allowance: Employees have a clear understanding of their daily travel allowance, helping them budget accordingly. This also allows employers to better control and predict travel costs.

CRA Guidelines for Per Diem Rates

Reasonable Amount

The CRA considers a per diem rate to be reasonable if it is based on the federal government’s meal and vehicle rates, which are updated annually. For the 2024 tax year, the CRA’s reasonable per diem rate for meals is $69 per day within Canada and $69 USD per day for travel to the United States.

Tax Implications

When per diem rates are considered reasonable by the CRA, they are non-taxable benefits for employees. However, if the per diem rate exceeds the reasonable amount, the excess portion is taxable and must be included in the employee’s income.

Implementing a Per Diem Policy

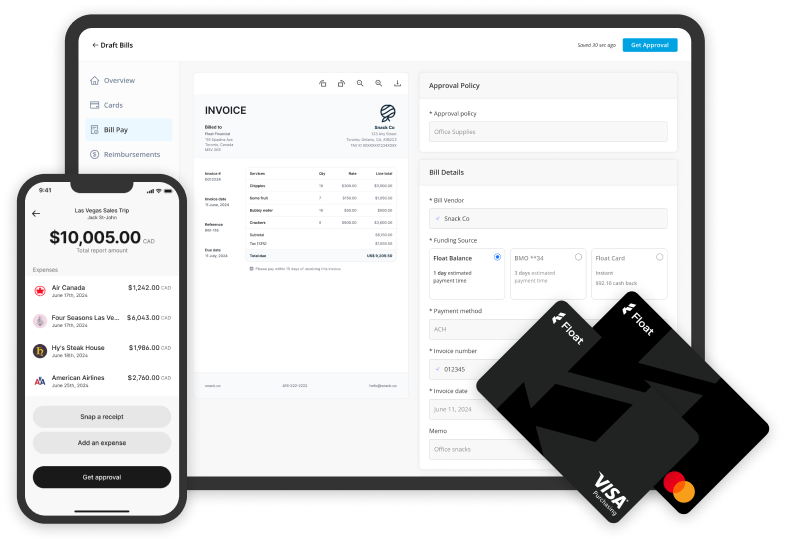

To successfully implement a per diem policy, develop a clear, written policy outlining the per diem rates, eligibility criteria, and reimbursement process. Communicate the policy to all employees and provide training as needed. Regularly review and update the policy to ensure compliance with CRA guidelines and industry best practices. Consider using float expense management tools to streamline the per diem tracking and reimbursement process.

Calculating Per Diem Allowances

Use a reliable per diem calculator to determine the appropriate daily allowance for each employee based on their destination and travel duration. Ensure that the calculated per diem rates align with your company’s policy and the CRA’s reasonable allowance guidelines. Keep accurate records of per diem allowances paid to each employee for tax purposes and potential audits.

Optimizing Business Travel with Per Diems

Encourage employees to make cost-effective travel choices, such as staying at budget-friendly hotels or booking flights in advance, to maximize the value of their per diem allowance. Regularly assess your company’s travel patterns and expenses to identify opportunities for cost savings and policy improvements. Consider offering float pricing plans that include comprehensive expense management features to better manage and optimize your business travel costs.

By implementing a well-designed per diem policy and utilizing the right tools, your Canadian business can streamline expense management and optimize travel costs. We’re here to help you navigate the complexities of business travel expenses and ensure compliance with CRA guidelines. Get started for free today and discover how our comprehensive expense management solutions can benefit your company.