Best Accounts Payable Software for Canadian Businesses in 2025

Despite transformative innovation in accounts payable software like AI-driven optical character recognition (OCR) and workflow automation, 69% of Canadian SMBs still feel that invoice processing and vendor payment needs to be more efficient. The accounts payable system that today’s growing businesses rely on stifles operations. Twenty-seven percent of Canadian SMBs report that their most pressing challenge is delays in incoming and outgoing payments while 18% report that cash flow management issues are their biggest obstacle.

In this article, we’ll discuss why today’s businesses need better solutions for AP automation and how to choose the best accounts payable automation software in 2025.

What is accounts payable software?

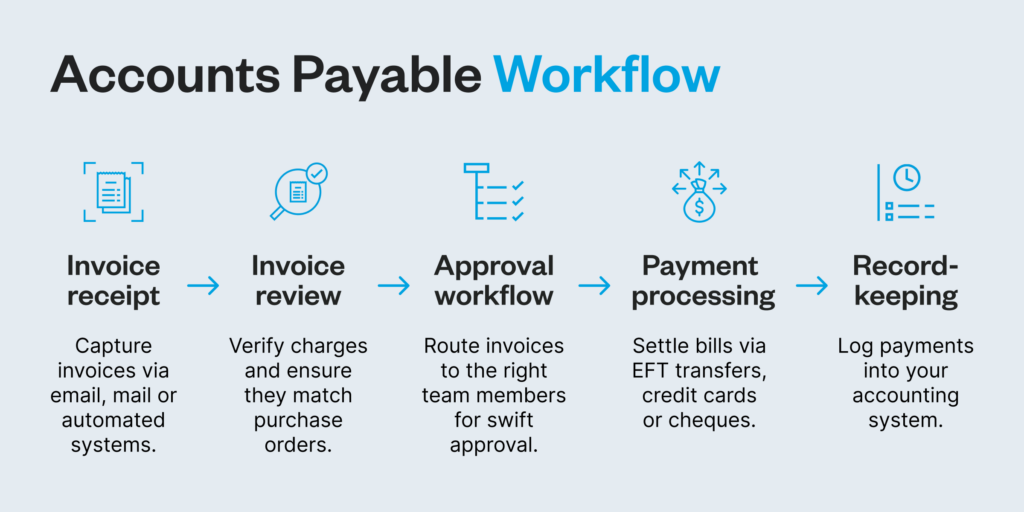

Accounts payable (AP) software solutions automate invoice and bill intake, GL coding, matching, validation, and approvals to streamline the process of paying your suppliers and vendors.

Business leaders often look into investing in accounts payable workflow software when their teams get fed up with tedious manual data entry and when their current approvals and payment processes create frustrating bottlenecks. But beyond just saving you time and labour, the right AP software solutions also give you greater control over your expenses, provide more accurate invoice validation and help you close your books quickly.

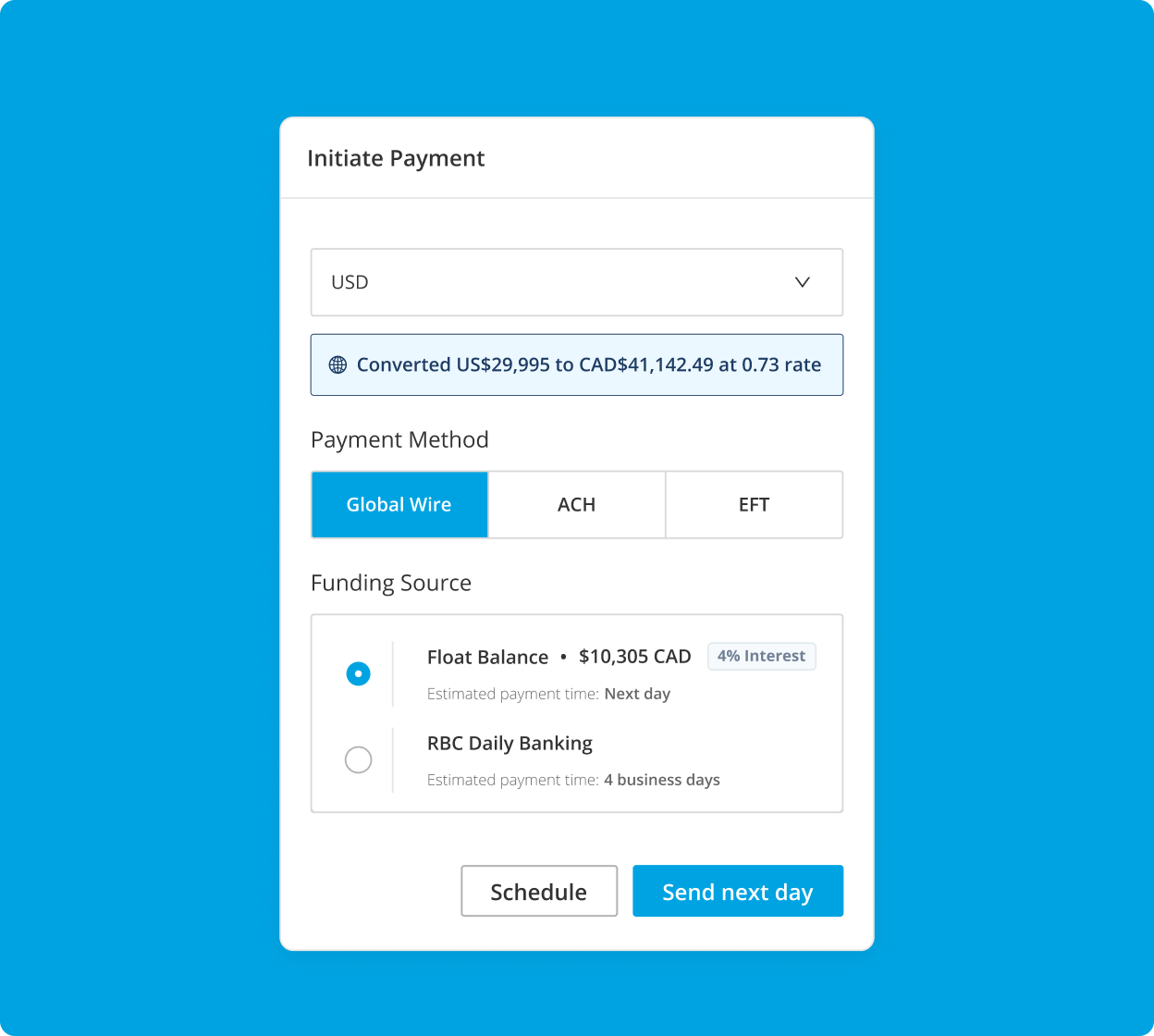

The best accounts payable automation software have embedded payment and business options, so you can make EFT payments to your vendors and contractors or pay them via ACH, international wire transfer, cheque or credit card without having to navigate through your online banking portals every time an invoice comes due.

Why Canadian businesses need accounts payable automation software

Your AP strategy is where you put your budget into action. Accounts payable automation software is an essential tool for monitoring and controlling where your cash is allocated so you can keep your business running and invest wisely in growth-driving opportunities. With AP automation software, businesses can:

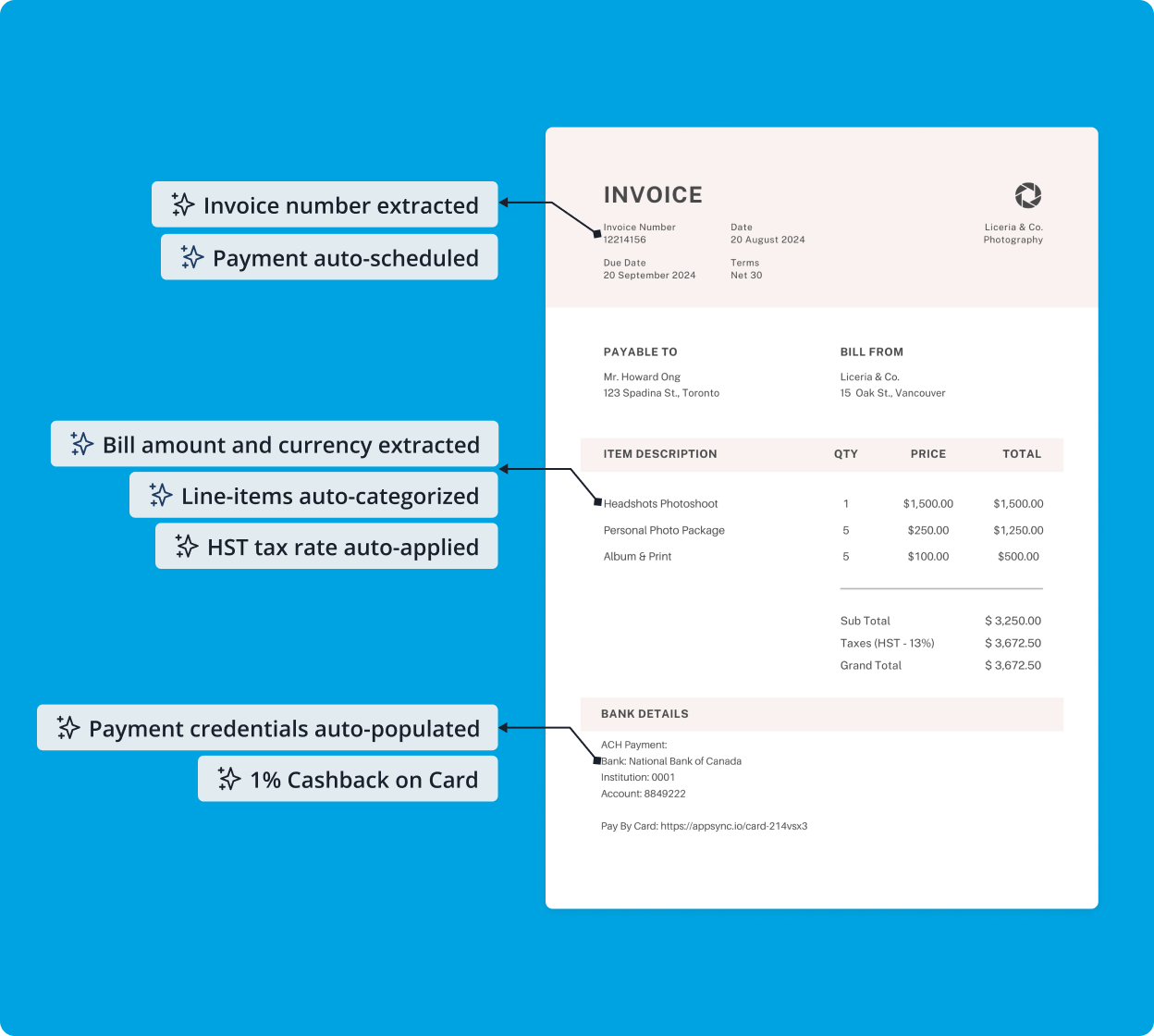

Eliminate manual data entry. The best AP software solutions offer OCR that automatically transfers information from invoices and receipts into the system and applies appropriate general ledger (GL) and tax codes.

Enhance security and reduce fraud. Two- and three-way matching automatically check invoices against purchase orders (POs) and goods receipt notes (GRN) to ensure you’re paying the right person.

Improve vendor relationships. If you’re trying to figure out how to pay an invoice faster for a valued vendor, you can schedule transactions and track payments with an AP solution to reduce days payable outstanding (DPO), build trust with your vendors, and take advantage of early payment discounts.

Control spend and manage expenses. Track spend in one place to get insights into your budget. With an AP automation solution like Float, you can also proactively set limits (not just company handbook policies) on corporate card spending to keep everyone on track.

Make global payments. Leading AP solutions allow you to seamlessly pay US invoices and international invoices within the platform.

Close the books faster. Automatically reconcile invoices in your AP solution with your accounting software.

Make EFT Payments with Float

Canada’s best-in-class EFT, ACH, and Global Wires payments platform — plus average savings of 7%.

What to look for in accounts payable software in 2025

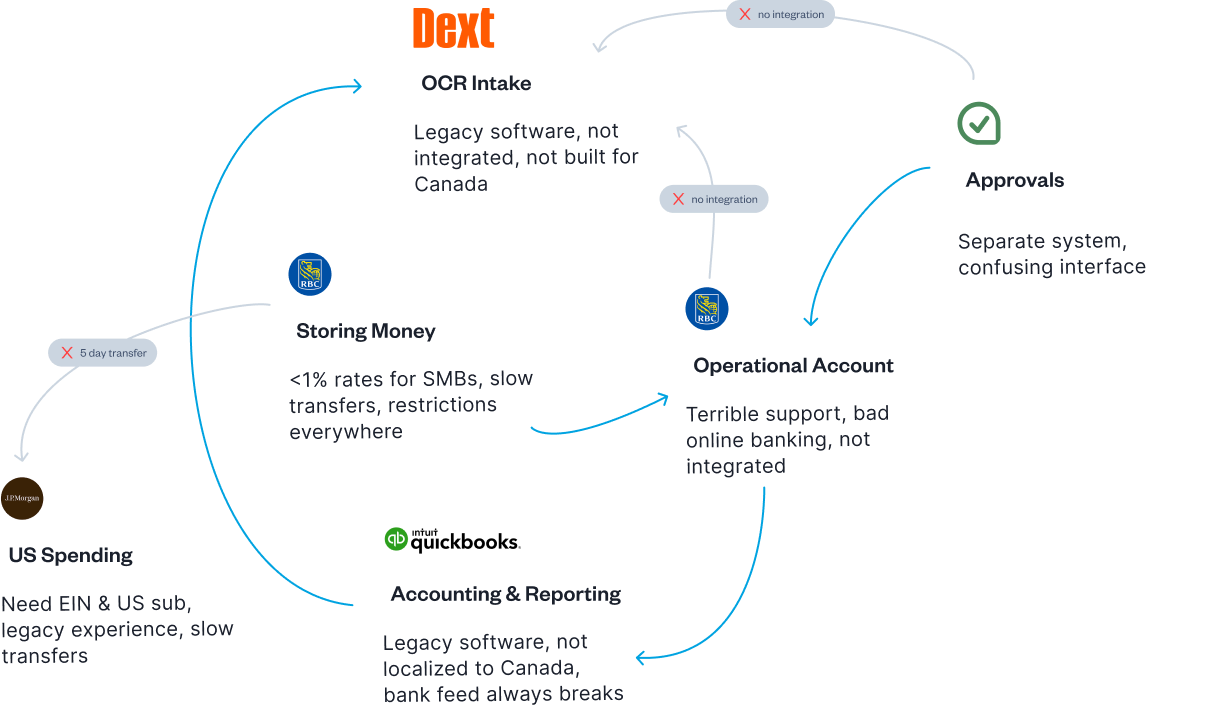

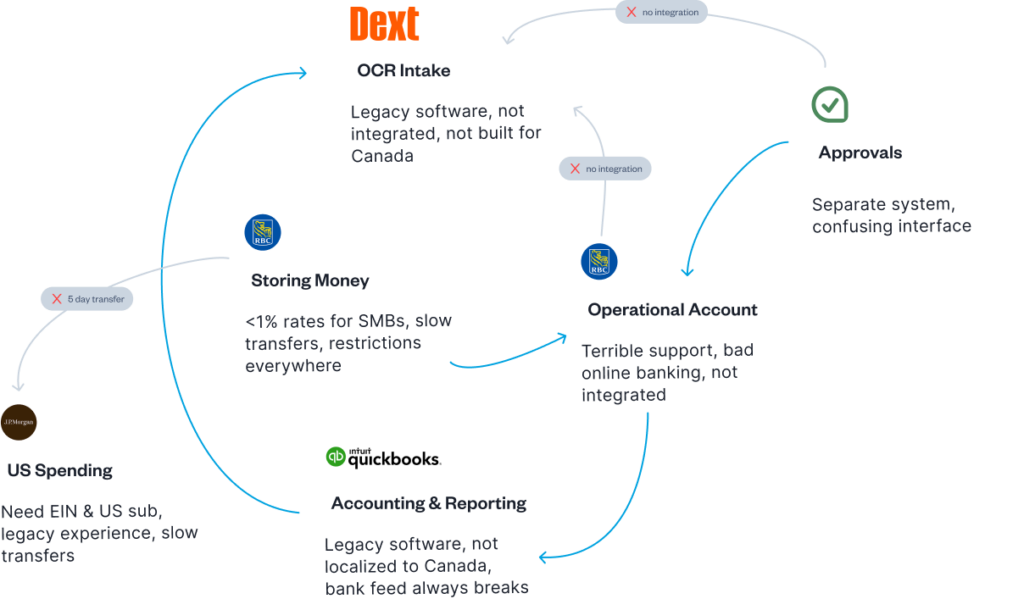

Today, the status-quo accounts payable system for a Canadian businesses includes a patchwork of point solutions that breeds bottlenecks and holds businesses back.

The best accounts payable automation software provides holistic, end-to-end workflows, speedy payments and cash flow management, facilitating financial momentum so you can grow your business. Look for an AP software solution with key features like:

✓ AI-driven OCR for automated receipt and invoice intake

✓ Automatic GL and tax coding

✓ Automatic two- or three-way invoice matching and validation

✓ Employee expense management and reimbursement capabilities

✓ Customizable approvals controls and automated approvals processes

✓ Multiple ways to pay invoices including EFT and ACH, wire, credit card or via platform-based account

✓ International payment capabilities plus low- or no-fee FX

✓ Payment tracking for both you and your vendors

✓ Reliable two-way sync integrations and automatic reconciliation with accounting software

Does accounts payable workflow software handle employee expenses?

Most AP software workflows lump employee expenses—like travel, meals, fuel, and supplies—in with vendor invoices, even though they should be treated differently. Typical AP solutions focus on facilitating vendor payments and most businesses opt to (or have to) reimburse employees through payroll.

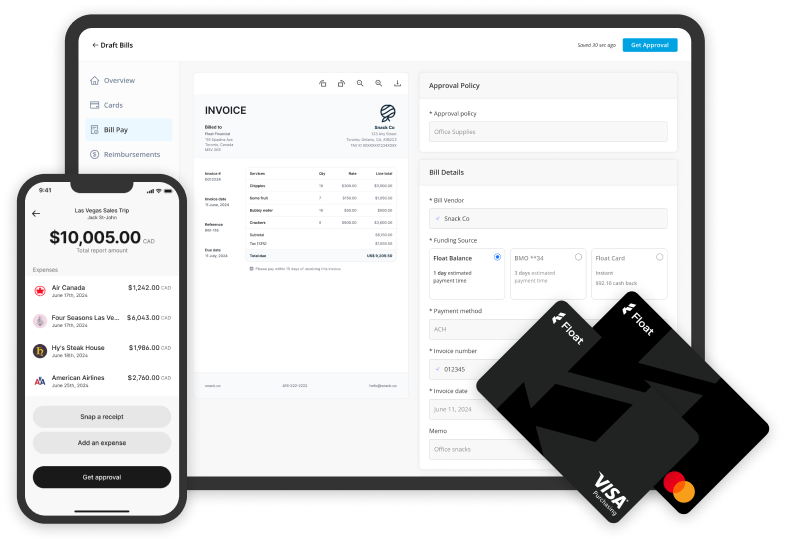

With an AP automation platform like Float, corporate card spending and reimbursements happen seamlessly in the same place as invoice management and vendor payments.

Float lets you see how spending across all your corporate cards impacts cash flow as transactions happen. You can also customize spending limits in real time, giving you total control over when and how your team spends. You can use Float to process same-day reimbursements, but with corporate cards, you don’t have to worry about reimbursements at all.

6 best accounts payable software for Canadian businesses in 2025

Float Bill Pay is an accounts payable software small business teams love to use, but there are other options out there. To help you make an informed decision about the accounts payable software that fits your business, here’s how Canadian AP software solutions stack up.

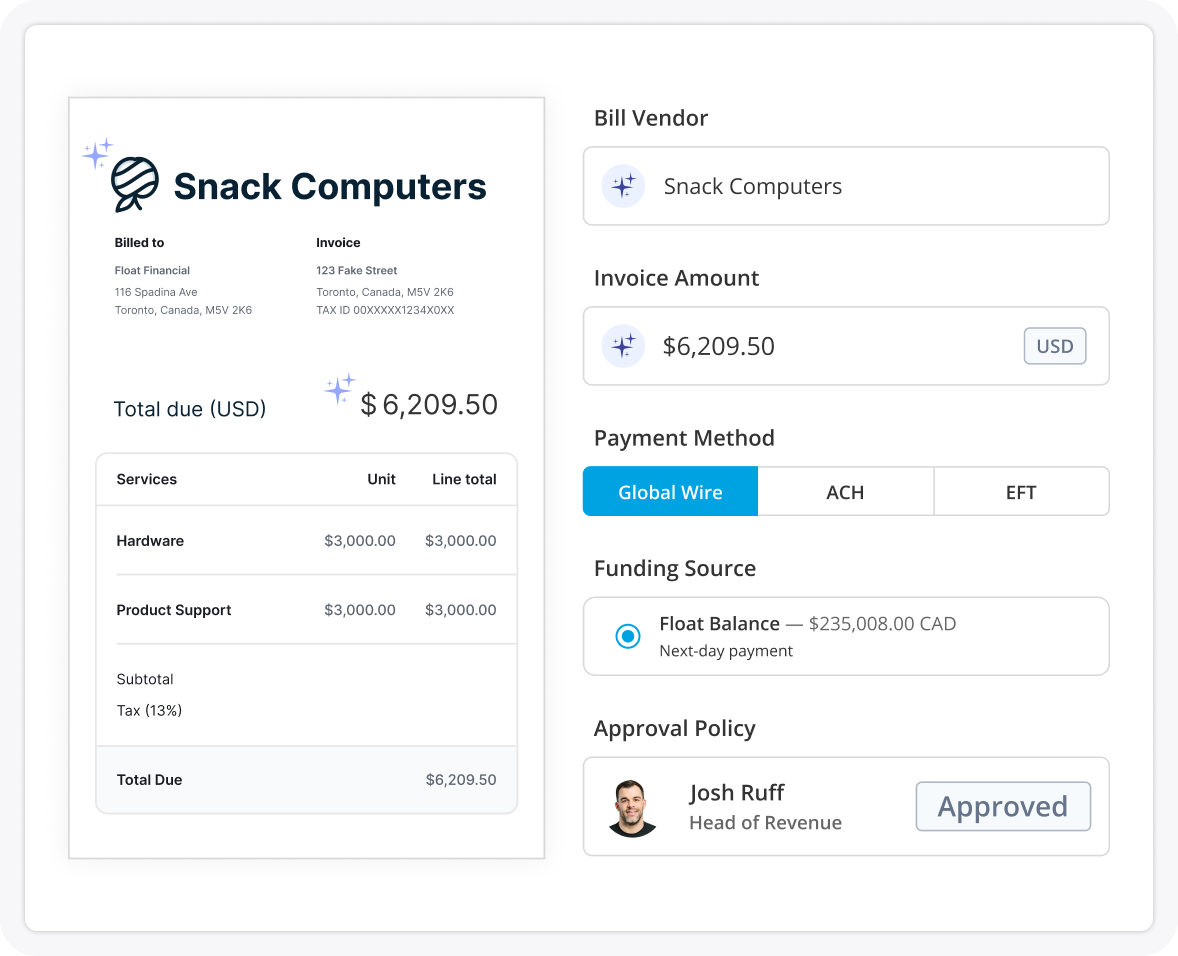

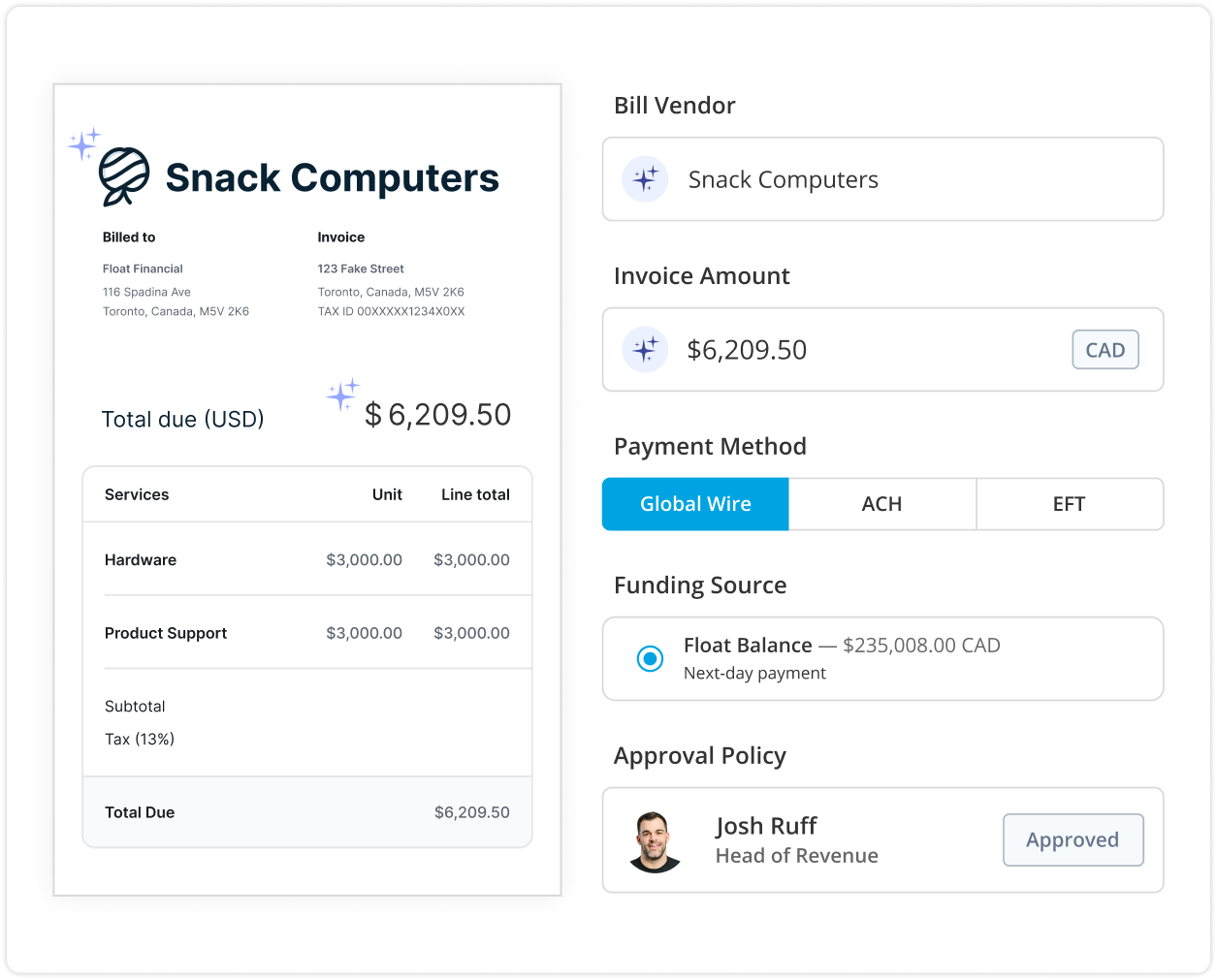

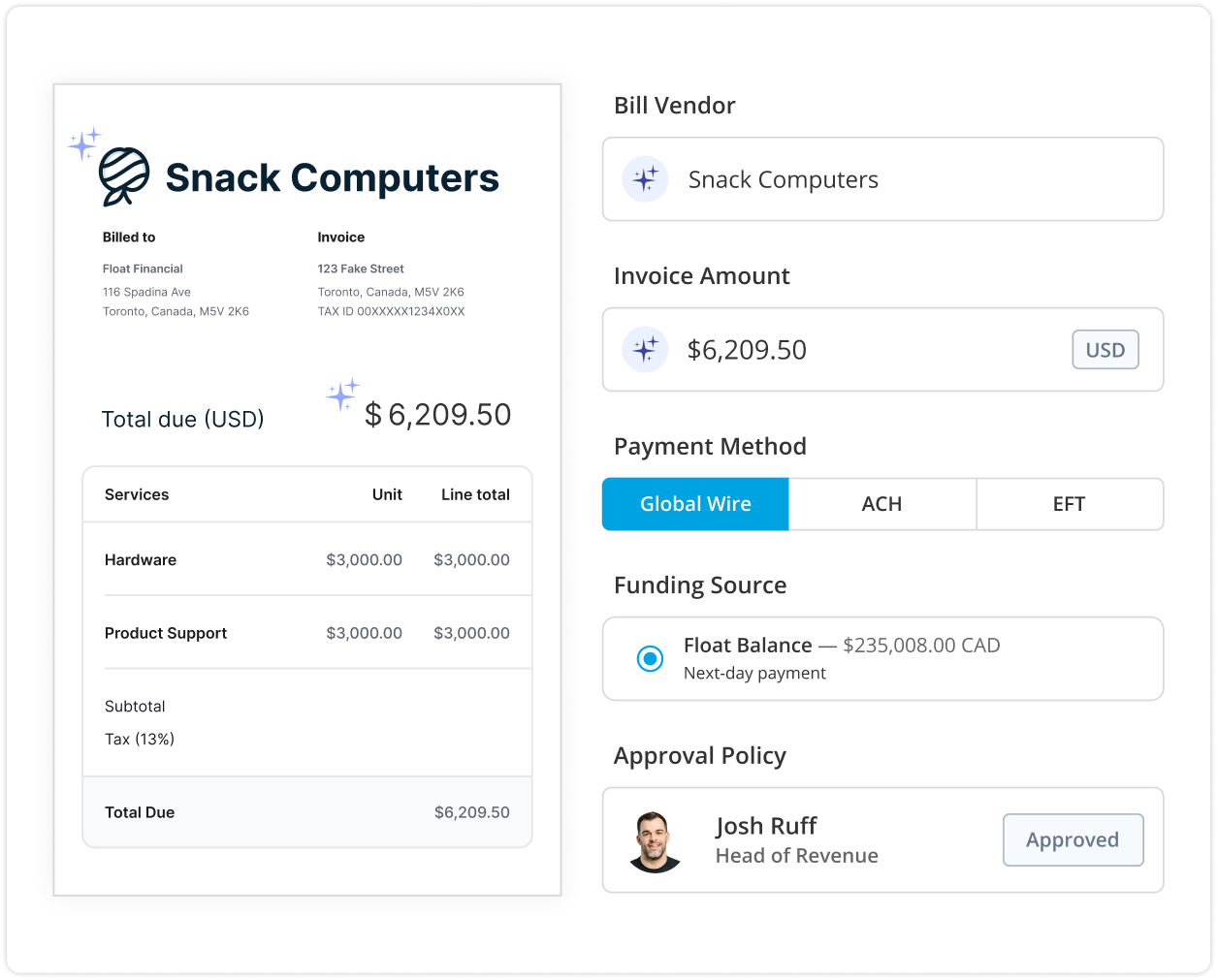

1. Float Bill Pay

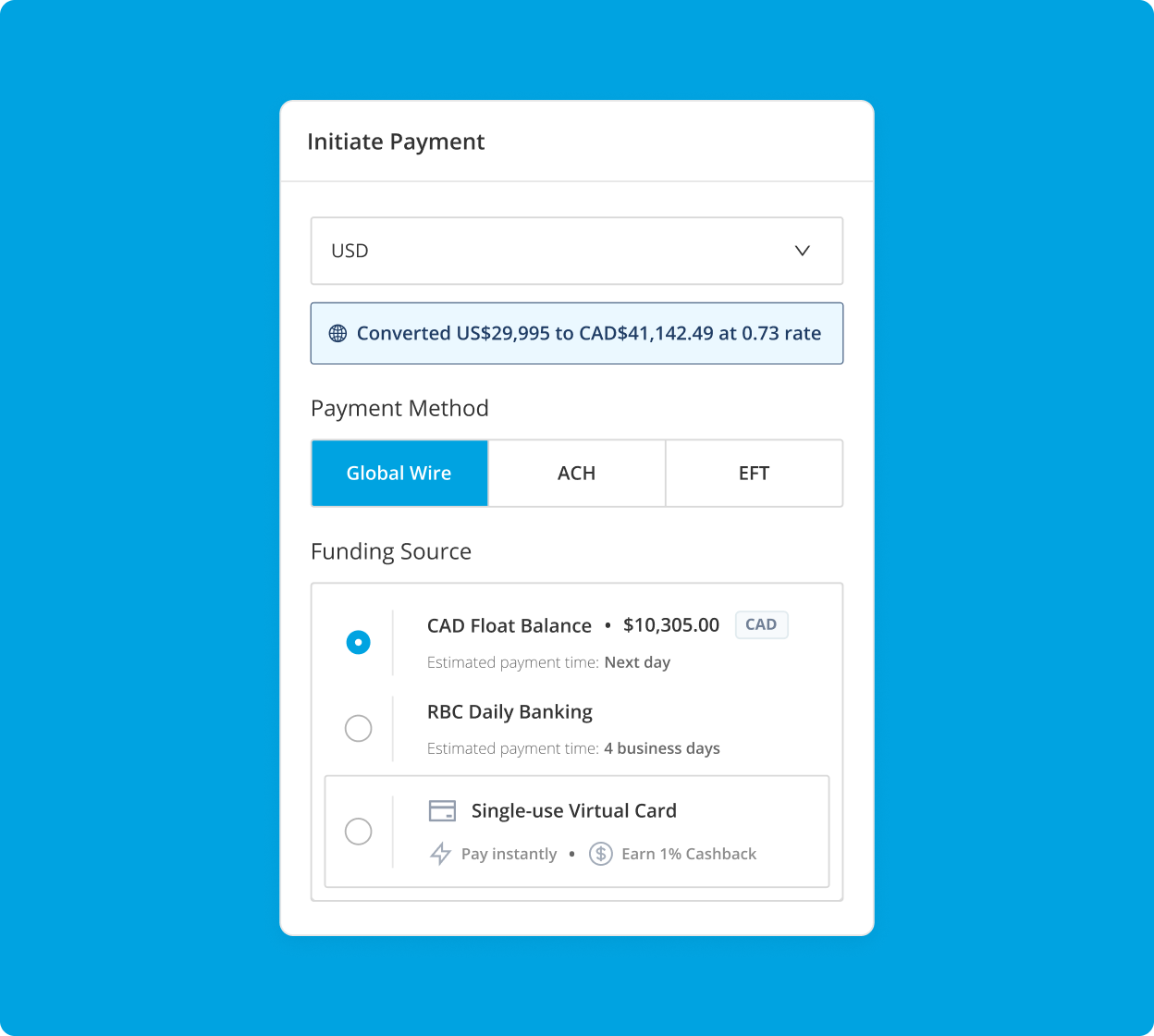

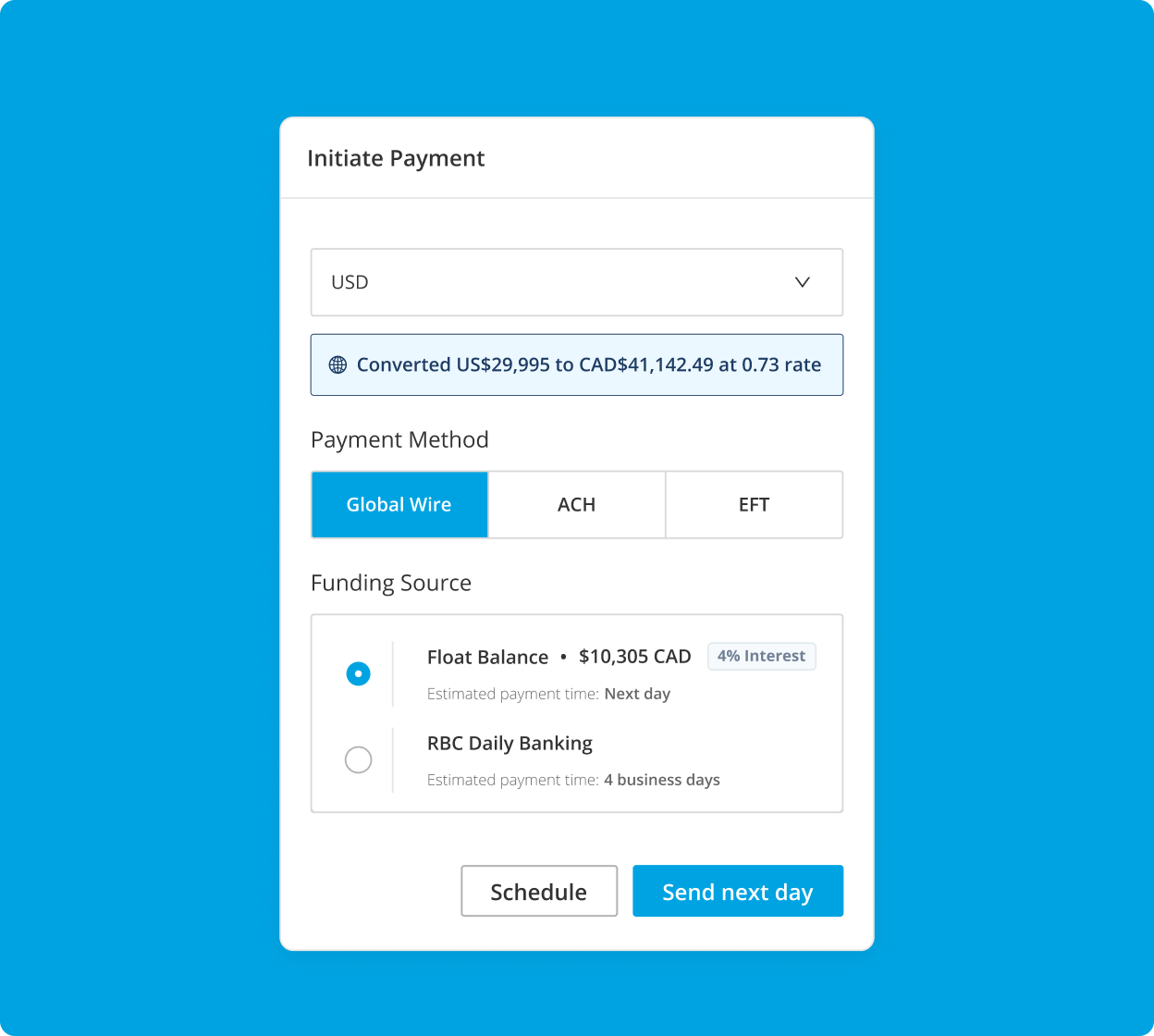

Float Bill Pay is an intuitive financial management platform built in Canada for Canadian businesses of all sizes. Designed for efficiency, it offers seamless invoice and receipt capture workflows powered by leading-edge AI data extraction. With automated GL and tax coding, custom approval workflows and embedded EFT/ACH and wire payments (CAD and USD), managing payments has never been easier. Float also includes built-in FX services, ensuring smooth international transactions.

Payments made through your Float balance arrive within one to two business days, with real-time payment tracking for vendors. The platform integrates effortlessly with QuickBooks, Xero and Netsuite through two-way sync, along with HRIS and Slack integrations.

Float Bill Pay is available at a SaaS pricing of $0 to $10 per user per month, with enterprise pricing options. EFT/ACH transactions are just $1 per transaction. Additionally, Float combines best-in-class accounts payable automation software with corporate and virtual cards for employee spend management. Businesses can also benefit from 1% cashback on corporate card purchases and earn 4% interest on CAD and USD business balances.

2. Plooto

Plooto is an AP and accounts receivables (AR) automation software. It’s a good point solution for SMBs looking for status-quo AP software.

The platform offers automated invoice processing alongside customizable automated approval workflows so that invoices are routed to the right person at the right time. The platform also provides in-depth payment history with a comprehensive audit view of transactions.

Plooto subscriptions cost between $32 and $99 per month. It offers EFT and ACH payments at $0.50 per transaction and enables international payments to over 40 countries with no FX fees. However, payments can take between 4 to 5 days to process and customers report that payments often take far longer to go though. Limited customer support and a poor payee experience are also common issues with this platform. Plooto is purely an AP/AR solution and doesn’t handle employee spend or reimbursements.

3. Dext

Dext is a bookkeeping automation software with a focus on record-keeping. Its strength is its OCR intake functionality. Dext provides multiple convenient ways for employees to upload receipts on the go with real-time expense tracking for the back office. Like Plooto, it offers robust approvals controls. It also provides automated reporting to help get the books closed quicker.

Currently, Dext doesn’t offer payment features. You’ll need to manually make payments through your bank or another platform. Dext may offer payment features in the future, but for now, it only provides a point solution that must be integrated with other platforms.

A Dext subscription costs between $30 and $107.50 per month.

4. Loop

Loop is a banking platform focused on streamlining cross-border payments. It’s built more like a digital banking app than an AP software solution. Loop delivers on flexibility and speed for making global payments, but it’s not the best choice for end-to-end AP automation. It doesn’t integrate with accounting software or automate invoice intake—you’ll need another solution for collecting and storing invoices. You’ll also have to manually validate and reconcile payments made through Loop with other systems.

Similar to Float, Loop does offer corporate credit cards in CAD and USD, as well as GBP and EUR with no annual fees, rewards points up to $1 million credit limits and a 55-day repayment grace period. The corporate card makes it easier to track and control employee spend alongside vendor payments for a more holistic view of your cash flow.

Loop has a free version, but its paid tiers cost between $49 and $199 per month. EFT/ACH payments cost between 0.25% and 0.5% per invoice plus $1, which means that the bigger the invoice, the more you’ll pay. Loop provides real-time payment tracking and payments typically arrive in 1 to 3 business days.

5. Quadient accounts payable automation by Beanworks

Primarily a mailing and customer experience solution provider, Quadient also offers a AP automation by Beanworks. Quadient might be a good option for larger, global mid-market businesses and enterprises, but it’s not flexible (or affordable) enough for SMBs. It offers comprehensive AP features like automated purchase order (PO) and invoice processing as well as automatic GL coding.

You can make payments through an integration with your online banking portal or via cheques, e-cheques, ACH or virtual credit cards which offer 1.1% cash back. Payments are automatically reconciled with your accounting software—Quadient offers custom integrations in addition to its long list of financial and enterprise resource planning (ERP) integrations.

There’s no publicly available pricing, but costs are tied to transaction volume, so it’s not ideal for rapidly growing companies.

6. RBC PayEdge

RBC PayEdge is an AP platform from RBC Royal Bank. It’s a good option if you want to make payments through the traditional banking system. The platform allows you to pay invoices from multiple Canadian bank accounts or credit cards and also offers EFT/ACH and cheque payments. You can also pay multiple vendors from a single payment order. RBC PayEdge offers tracking for global payments. Both domestic and international payments can take between 1 to 7 business days to arrive.

The platform doesn’t offer robust expense management features or reporting. As you might expect from a bank, the user interface is outdated and customers report that it’s not intuitive to use. It does integrate with accounting and ERP software.

RBC PayEdge has a free version, but its paid tiers cost between $89.95 and $219.95 per month (woof). EFT transactions cost $1 while ACH transactions cost a whopping $9.99, which means it’s not an ideal solution for businesses that need to make cross-border payments on a regular basis.

Accounts Payable Software: Quick Comparison Chart

| Solution | Costs & Fees | Standout Features | Limitations |

| ⭐️ Float Bill Pay | SaaS: $0–$10 per user/mo. (+ enterprise pricing options) EFT/ACH fees: $1/txn. | AI-powered invoice and receipt captureAutomated GL and tax codingCustom approval workflowsEmbedded EFT/ACH & wire payments (CAD, USD)Built-in FX servicesPayments in 1–2 business daysReal-time vendor trackingTwo-way sync with QuickBooks, Xero, Netsuite | Focus on incorporated businesses vs. freelancers or sole proprietorsBuilt for Canadian-based companies |

| Plooto | SaaS: $32–$99/mo. EFT/ACH fees: $0.50/txn. | Automated invoice processingEFT/ACH, cheque payments via credit cardNo FX fees.Payments (might) arrive in 4–5 business daysAR automation and payment processingTwo-way sync with QuickBooks, Xero, and Netsuite | Customers find that payments take far longer than 5 business daysLimited customer supportPoor payee user experience Doesn’t handle employee spend and reimbursements |

| Dext | SaaS: $30–$107.50/mo. EFT/ACH fees: N/A | Leading OCR receipt and invoice intakeMultiple ways to upload receiptsReal-time expense trackingRobust approvals controlsAutomated reportingQuickBooks, Xero, Sage, and other accounting software integrations | No payment functionalityDoesn’t handle employee spend and reimbursements |

| Loop | SaaS: $0–$199/mo. EFT/ACH fees: 0.5-0.25%/ invoice + $1 | Global payments Multi-currency corporate credit cardsRobust approval controlsReal-time payment trackingPayments arrive in 1–3 business days | No invoice intake or storageNo accounting software integrationsPercentage-based pricing punishes growthNo cash backNo interest |

| Quadient accounts payable automation by Beanworks | No public pricing available. Pricing is based on monthly invoice volume and purchase order and payment requirements. | Automated PO, invoice processingAutomatic GL codingReal-time spend trackingRobust approvals controls1.1% cash back with virtual credit cardsTwo-way sync with QuickBooks, Xero, Sage and moreERP software integrations | Expensive and over-built for SMBsComplex user interfaceFrequent issues with integrationsTransaction volume-based pricing punishes growthDoesn’t handle employee spend and reimbursements |

| RBC PayEdge | SaaS: $0–$219.95/mo. EFT fees: $1/txn.ACH fees: $9.99/txn. | Pay out of multiple Canadian bank accounts or credit cardsSet approval controlsEFT/ACH, cheque payments via credit cardPay multiple vendors in a single payment orderTrackable global paymentsPayments arrive in 1–7 business daysQuickBooks Online, Sage, Xero, ERP software integrations | No robust expense management features No reporting featuresOutdated user interface Limited customer supportDoesn’t handle employee spend and reimbursements |

Choosing the accounts payable automation software that’s right for your business

Migrating your AP processes to a new system is a major investment, so it’s important to choose software that’s easy to add into your existing workflows and is intuitive to use. Find a solution that can deliver tangible, measurable results—like reducing DPO and time saved closing the books—as well as intangible benefits like employee satisfaction. If you’re doing business across borders, select a solution that allows you to easily make EFT or ACH payments, wire transfers or no-fee FX payments in your required currencies.

The solution you choose should also address your business’s unique needs today while pushing your operations forward by boosting efficiency and reducing costs. Float’s Bill Pay provides accounts payable software small business owners and their accounting teams can use to manage employee spend and pay vendors for total control over AP. It’s designed by Canadians to support the nuances of Canadian accounts payable systems.

But don’t just take our word for it. Try Float for free and take the headache out of your accounts payable software processes, once and for all.

Make EFT Payments with Float

Canada’s best-in-class EFT, ACH, and Global Wires payments platform — plus average savings of 7%.