Cash Flow Optimization

How to Pay Invoices from India: A Step-by-Step Guide

Learn how to pay Invoices from India as a Canadian Business and innovative solutions, like Float, that you can use for free to send Global Wires.

September 21, 2024

As a business owner or financial manager, understanding how to pay invoices from India is crucial for maintaining smooth operations and strong relationships with your suppliers. Whether you’re dealing with domestic or international vendors, timely invoice payments ensure uninterrupted cash flow and help you avoid late fees and penalties.

In this comprehensive guide, we’ll walk you through the step-by-step process of paying invoices from India, covering everything from gathering necessary information to choosing the right payment method and tracking your transactions. By the end of this article, you’ll be equipped with the knowledge and tools to streamline your invoice payment process and keep your business running smoothly.

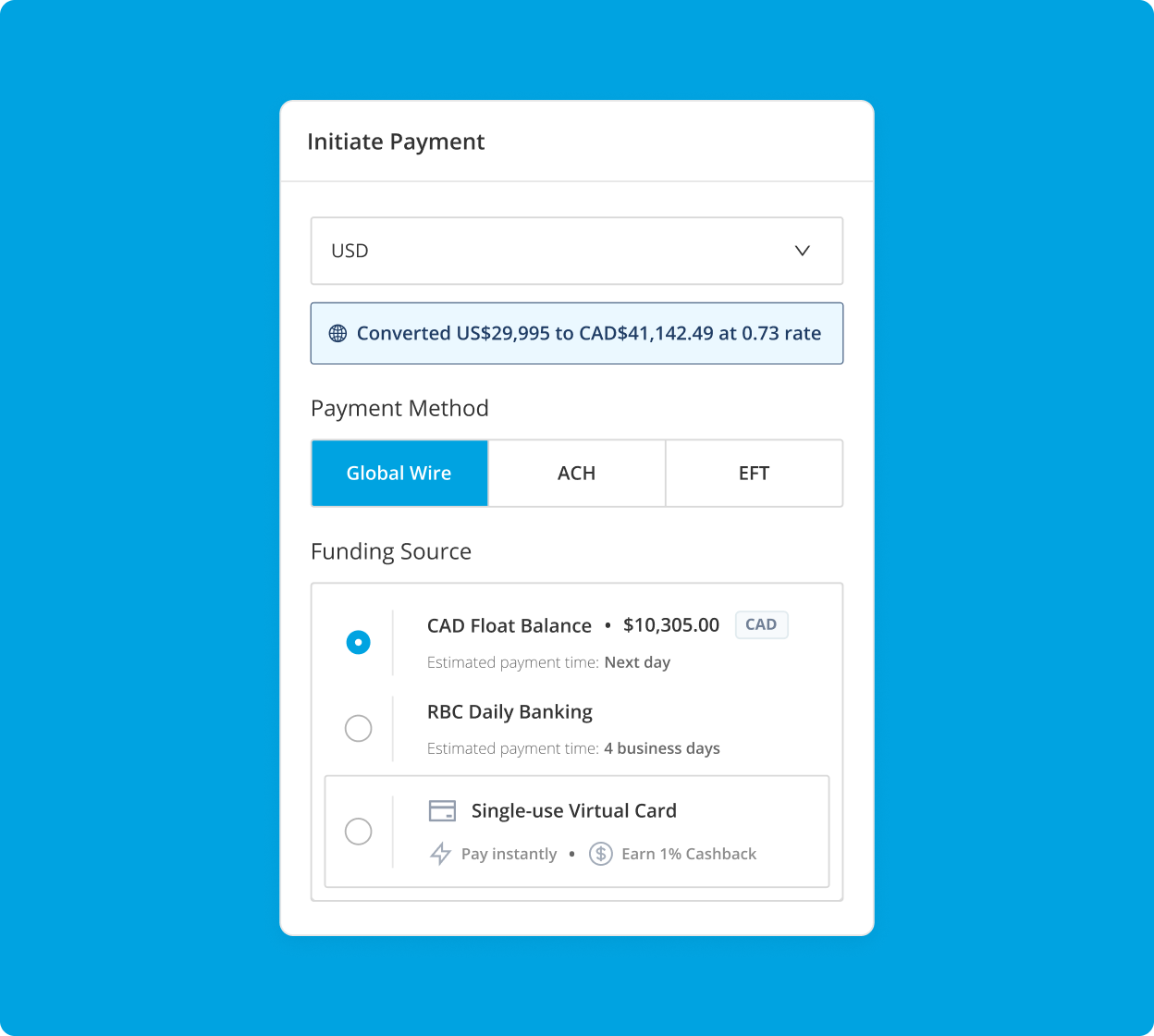

Make Global Wire Payments with Float

Canada’s best-in-class EFT, ACH, and Global Wires payments platform — plus average savings of 7%.

What is an invoice?

An invoice is a document issued by a seller to a buyer that itemizes and records a transaction. Invoices are essential for businesses to request payment for products or services provided.

Why is it Important to Pay Invoices Promptly?

Paying invoices promptly helps maintain good relationships with suppliers, ensuring they continue to provide you with the goods and services your business needs. A smooth accounts payable (AP) process also ensures smooth operations and cash flow management, as late payments can disrupt your supply chain and hinder your ability to meet customer demands. Moreover, timely invoice payments help you avoid late fees and penalties, which can add up quickly and eat into your profits.

How to Pay Invoices from India: A Step-by-Step Guide

Now that you understand the importance of paying invoices promptly, let’s dive into the steps involved in paying invoices from India. This guide will cover the essential information you need to gather, the various payment methods available, and how to track and record your transactions.

Step 1: Gather Necessary Information

Before you can pay an invoice, you need to ensure you have all the necessary details. This includes the invoice number, amount due, and the due date. You’ll also need to collect the recipient’s bank account information, such as their account number, IFSC code, and SWIFT code, if you plan to make a wire transfer.

Step 2: Choose a Payment Method

There are several payment methods available for paying invoices from India, each with its own advantages and disadvantages. Evaluate the various options, such as wire transfers, credit/debit cards, and online payment platforms, considering factors like transaction fees, exchange rates, and processing times. Choose the method that best suits your business needs and the supplier’s preferences.

Step 3: Using International Payment Methods

- Wire Transfers: Utilize wire transfer services offered by banks or online platforms to directly transfer funds overseas. This method is secure and reliable but may involve higher fees and longer processing times.

- Online Payment Gateways: Choose reputable online payment gateways that support international transactions, such as PayPal or Stripe. These platforms offer secure payment processing and often have lower fees than traditional wire transfers.

- Credit/Debit Cards: If your supplier accepts credit or debit card payments, ensure your card is enabled for foreign transactions. Keep in mind that card payments may incur additional fees and exchange rate charges.

Step 4: Enter Payment Details

Once you’ve chosen your payment method, log in to your selected payment platform and enter the invoice amount and recipient’s bank details or payment gateway information. Double-check all the information to ensure accuracy and avoid delays in processing.

Step 5: Review and Confirm the Payment

Before finalizing the payment, review all the entered information once more to ensure accuracy. Check for any applicable fees and exchange rates, and make sure you understand the total cost of the transaction. Once you’re satisfied, confirm the payment and save the transaction receipt for your records.

Step 6: Track and Record the Payment

After initiating the payment, monitor its status through your bank or payment platform to ensure it reaches the recipient successfully. Record the transaction in your accounting software or ledger, and keep a copy of the payment confirmation for future reference. This will help you maintain accurate financial records and simplify reconciliation processes.

Important Things to Know

What are the steps to pay an invoice from India?

To pay an invoice from India, gather necessary information, choose a payment method, enter payment details, review and confirm the payment, and track and record the transaction.

What payment methods can I use to pay invoices internationally from India?

You can use wire transfers to directly send funds overseas, online payment gateways that support international transactions, or credit/debit cards enabled for foreign transactions to pay invoices from India.

Are there any fees associated with paying invoices from India?

When paying invoices from India, you may encounter transaction fees, currency conversion fees, and other applicable charges depending on the payment method and platform you choose.

What information do I need to provide when paying an invoice from India?

When paying an invoice from India, you’ll need to provide the invoice number, amount due, recipient’s bank details (account number, IFSC code, SWIFT code), and any other relevant information requested.

Make Global Wire Payments with Float

Canada’s best-in-class EFT, ACH, and Global Wires payments platform — plus average savings of 7%.

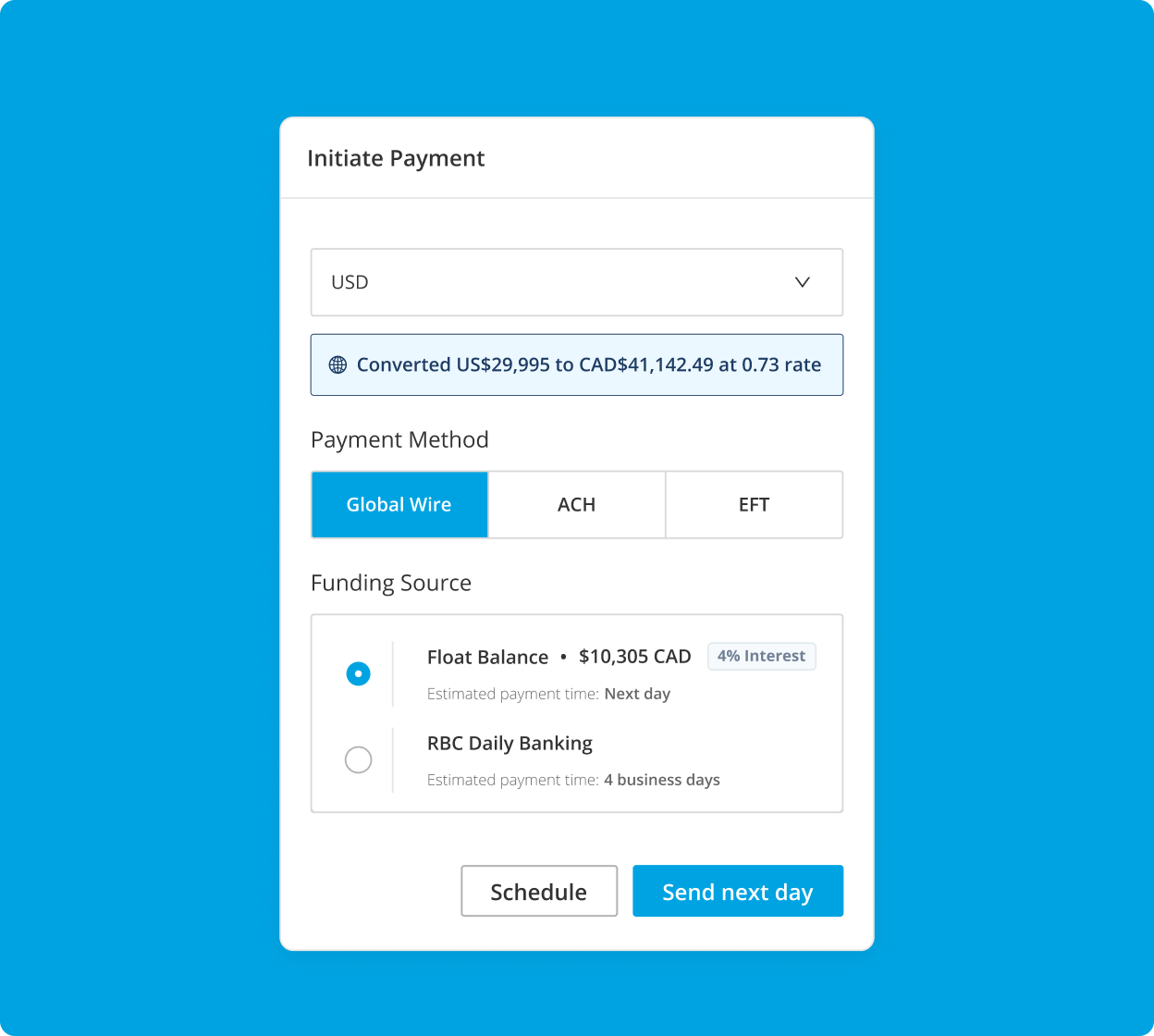

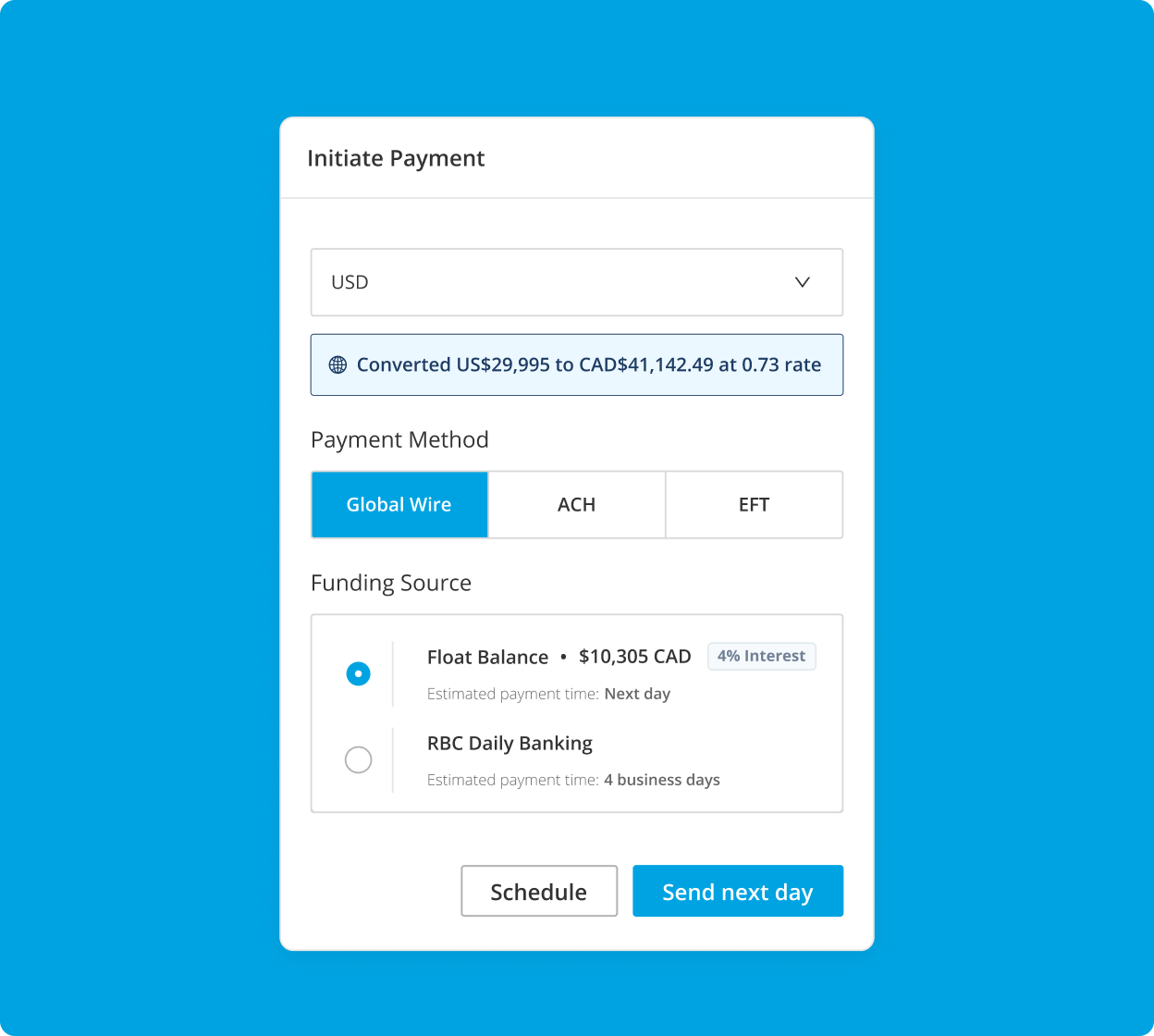

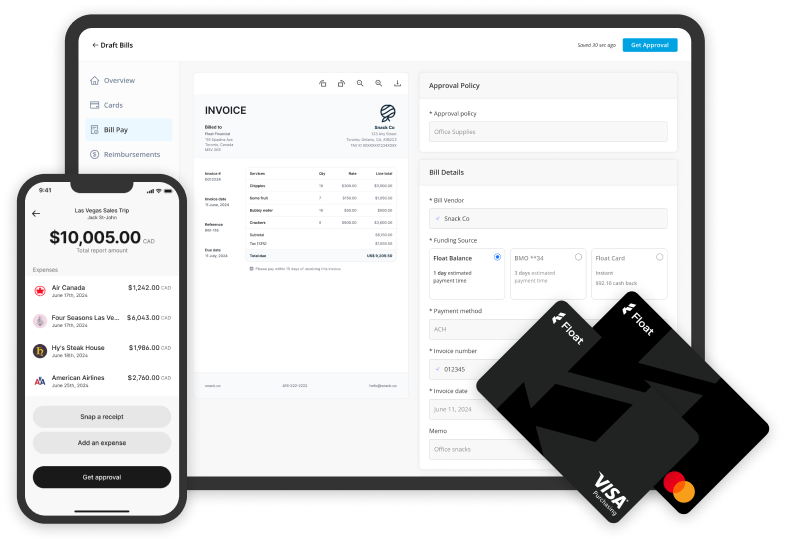

Best Solution to Send Global Wires in Canada — Float

Float’s Bill Pay solution offers a streamlined and efficient way to manage your invoice payments from India. With features like Global Wires in USD, AI-powered bill processing, and integrated accounting workflows, Float’s Bill Pay simplifies the process of paying invoices internationally. By using Float’s Bill Pay, you can save time, reduce errors, and maintain better control over your business expenses.

At Float, we understand the challenges of paying invoices from India and are committed to simplifying the process for you. Our platform offers a comprehensive solution that streamlines your invoice payments, saving you time and effort while ensuring secure and reliable transactions. Get started for free with Float today and experience the difference in managing your business expenses.

Frequently Asked Questions

Processing times for international invoice payments vary depending on the payment method and the banks involved, but it generally takes 1-5 business days for funds to reach the recipient.

To pay an invoice using a credit card issued in India, ensure your card is enabled for international transactions, enter the required credit card details, and confirm the payment.

Contact your bank or payment platform’s customer support to investigate the issue and provide any necessary documentation to resolve the problem promptly.

Choose reputable payment platforms that use encryption and follow industry-standard security protocols to protect your sensitive information and funds during transactions.

Float is Free to use on our Essentials plan, where you will be able to issue unlimited virtual CAD/USD cards, earn 4% interest on deposits, reimburse employees and pay vendor bills. If you need more sophisticated functionality, like over 20 physical cards, Netsuite integration, or an API solution, you will have to consider our paid Professional and Enterprise plans.

Float offers Charge Card and Prepaid funding models. You can apply (*Conditions apply. Book a demo to learn more) for unsecured, 30-day credit terms with high limits up to $1M, no credit checks and personal guarantees. Prepaid model offers 4% interest on all deposits with no cash lockups with account opening in < 24 hours.

Unlike traditional cards that get you to spend more, Float is the only corporate card in the world that helps businesses spend less. Through a combination of financial rewards like our 1% cashback, 4% interest on deposits, no FX fees with our USD cards and time savings of at least 8 hours per employee Float’s customers on average save 7% on their spend.

Written by

All the resources

Corporate Cards

How Corporate Card Programs Deliver ROI for Canadian Companies: Measuring Financial Impact

When every dollar matters, the right payment solution can help you grow—and a smart corporate card program is your first

Read More

Financial Controls & Compliance

GST/HST Tracking in Canada: Why It Matters and How Float Simplifies the Process

Learn how GST/HST tracking works in Canada, why it’s essential for your business, and how Float automates the process to

Read More

Corporate Cards

How to Get Approved for a Virtual Corporate Card as a New Business (Without Hurting Your Credit Score)

Looking to add a virtual corporate card to your wallet without messing with your credit score? This guide is for

Read More