What is an Expense Reimbursement? Definition and Benefits

As a business owner or manager, you know that keeping track of employee expenses can be a time-consuming and tedious task. But did you know that having a clear expense reimbursement policy in place can actually benefit your company in numerous ways? In this article, we’ll dive into the definition of expense reimbursement, explore the advantages it offers businesses, and provide tips for streamlining the process.

Expense reimbursement is a critical aspect of managing your company’s finances and expense management as a whole. It also ensures that your employees are not burdened with out-of-pocket costs incurred while performing their job duties. By understanding the ins and outs of expense reimbursement, you can create a system that works for your business and your team, ultimately saving time and money in the long run.

What is expense reimbursement?

Expense reimbursement is the process of paying back employees for out-of-pocket expenses incurred while performing their job duties. Common reimbursable expenses include travel, meals, lodging, and supplies. It’s important to note that reimbursements are separate from regular wages and are not considered taxable income.

Why is expense reimbursement important for businesses?

Encouraging employees to make necessary purchases without worrying about personal financial burden is a key benefit of expense reimbursement. This allows companies to maintain control over spending while empowering employees to make timely decisions. Expense reimbursement also provides transparency and accountability in business spending, streamlining purchasing processes and speeding up the supply chain.

Make expense reporting easy

Grab your free Google Sheets expense report template.

What are some examples of reimbursable expenses?

- Travel costs: Airfare, lodging, transportation, and meals incurred during business trips are typically reimbursable.

- Supplies and tools: Expenses for items like computers or stationery necessary for job performance can be reimbursed.

- Client entertainment: Costs associated with entertaining clients, such as meals or event tickets, may be reimbursable.

- Professional development: Expenses related to attending conferences or training to improve job skills are often eligible for reimbursement.

- Mileage reimbursement: Employees using personal vehicles for business purposes can be reimbursed for mileage at a set rate.

- Remote work expenses: Costs associated with working from home, such as internet, cell phone, and home office setup, may be reimbursable.

It’s also important to understand reimbursable expenses under the Canadian CRA requirements. Generally, expenses must be reasonable and directly related to earning business income to qualify for reimbursement.

How can companies streamline the reimbursement process?

Implementing clear expense policies that outline what is reimbursable and set spending limits is crucial for streamlining the reimbursement process. Using automated employee expense reimbursement software can help track and manage expenses more efficiently. Requiring timely submission of expense reports and receipts, setting up direct deposit for quick, paperless reimbursements, and regularly reviewing and updating expense policies are also key steps in optimizing the process.

What are the benefits of automating expense reimbursements?

Automating expense reimbursements can save significant time by eliminating manual data entry and paperwork. Automated systems can reduce errors and fraud by enforcing company policies and providing real-time visibility into spending trends. Integrating with accounting systems allows for seamless reporting and reconciliation, while improving employee satisfaction with a faster, more convenient reimbursement process.

Looking to automate your reimbursement processes with a modern software but struggling to decide with so many options out there? Review our guide on How to Choose the Right Reimbursement Solution in 2024.

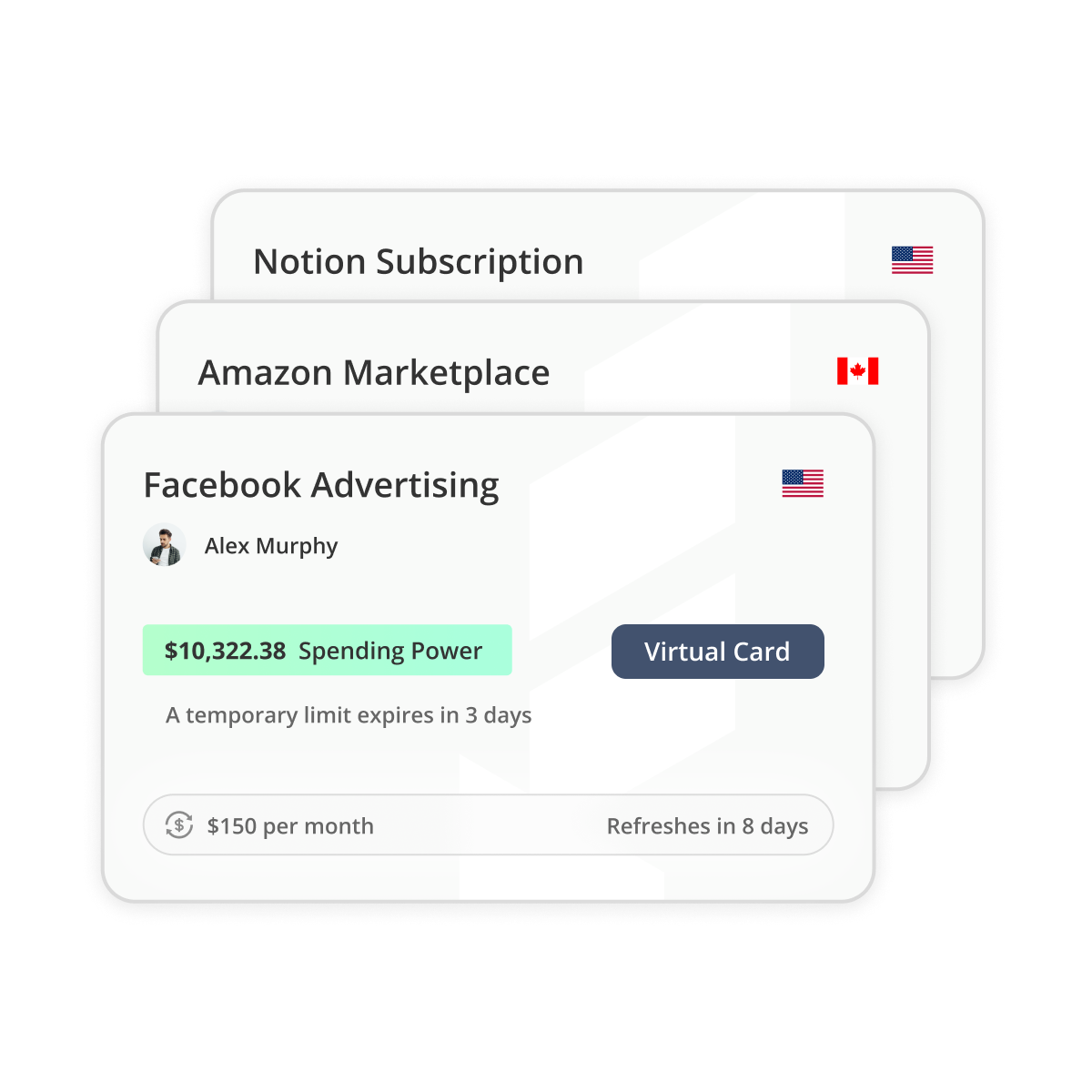

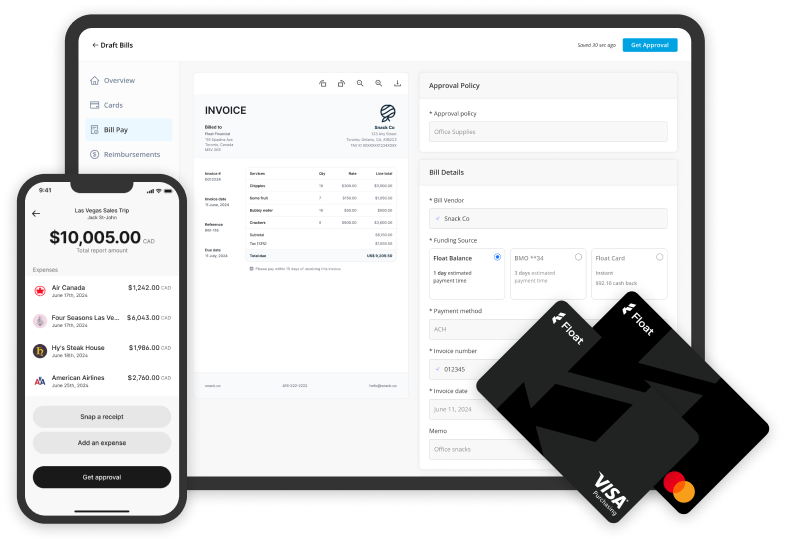

How can automated solutions simplify employee reimbursements?

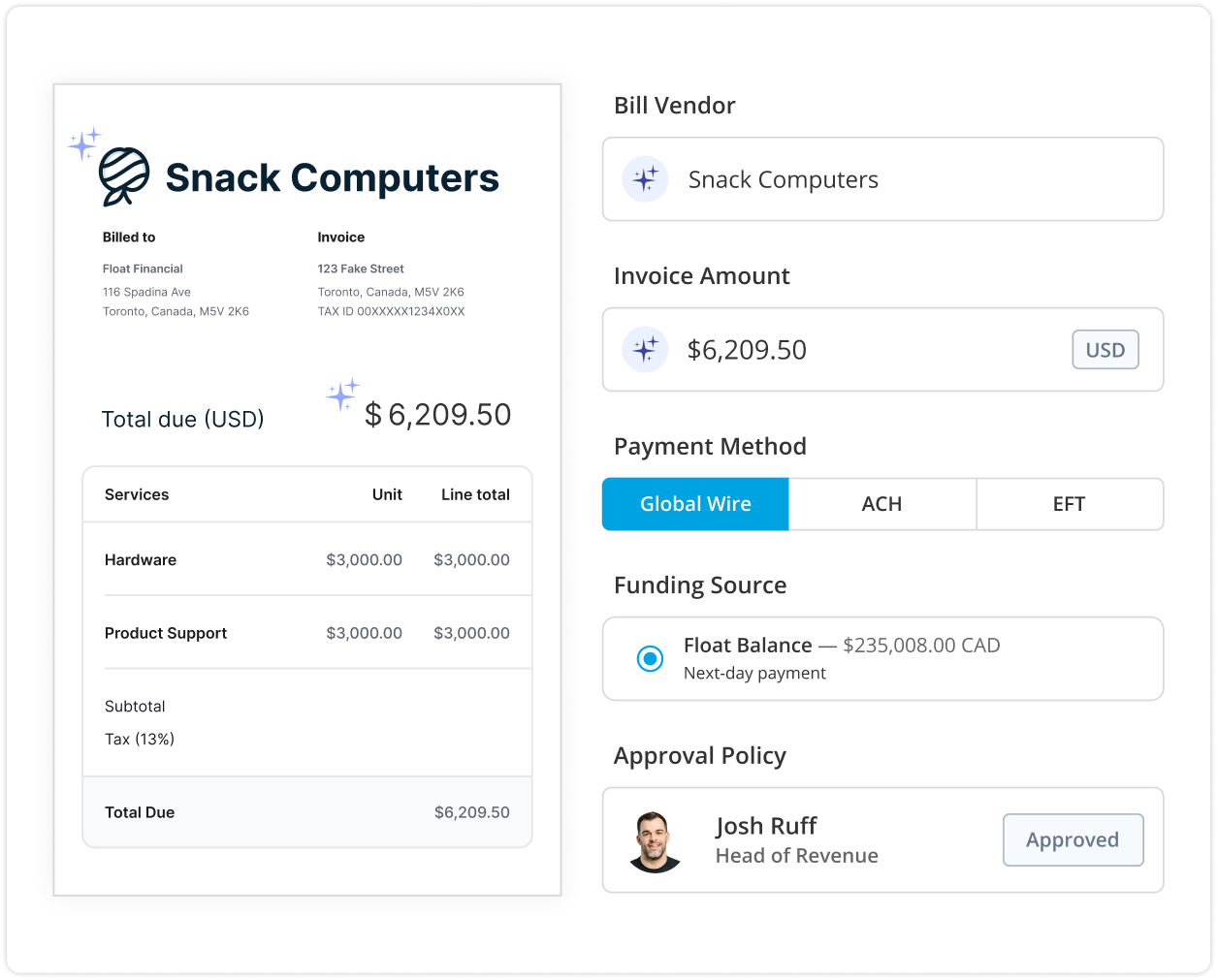

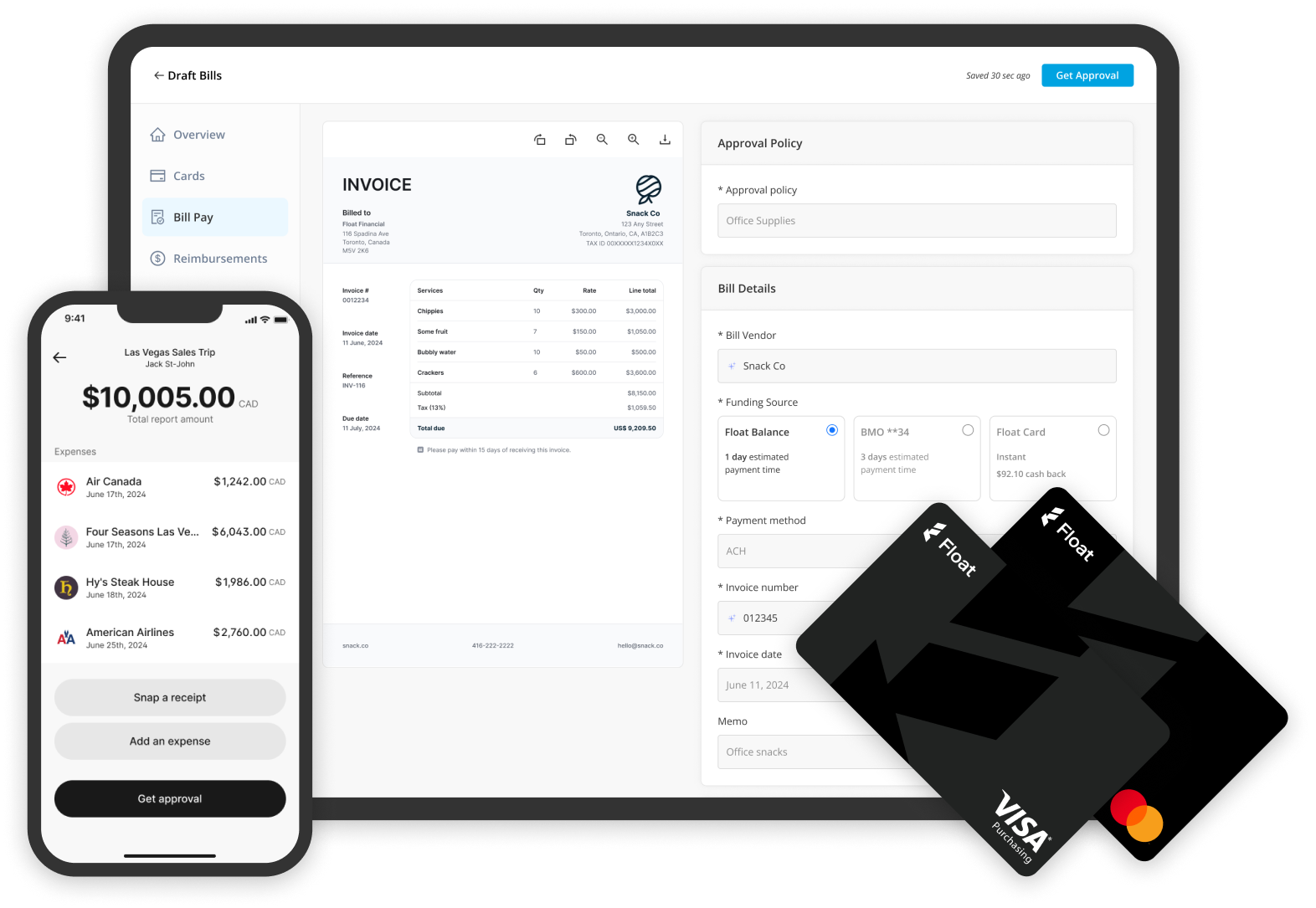

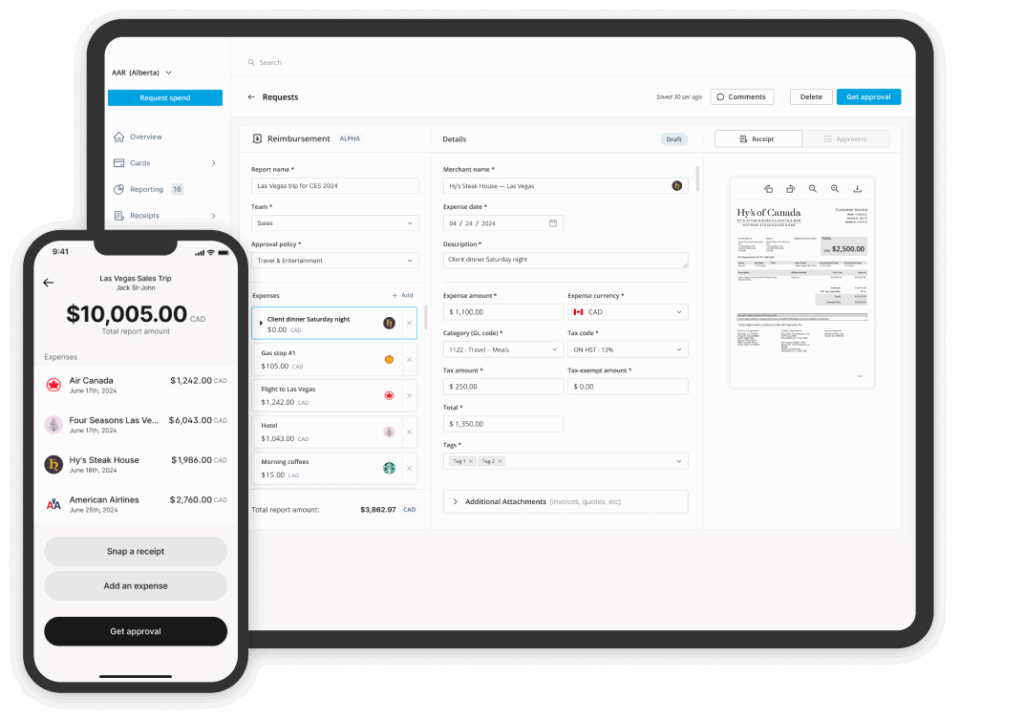

- Mobile app submission: Allows employees to easily submit expenses on-the-go via a user-friendly mobile app.

- Automatic policy enforcement: Automatically enforces company spending policies and flags out-of-policy expenses for review.

- Streamlined approval and reimbursement: Routes reports for approval and reimburses employees via direct deposit, eliminating manual steps.

- Detailed analytics: Provides detailed spending analytics to optimize budgets and catch potential fraud early.

- Accounting integration: Syncs expense data with accounting systems to save time on month-end close and ensure accurate financial reporting.

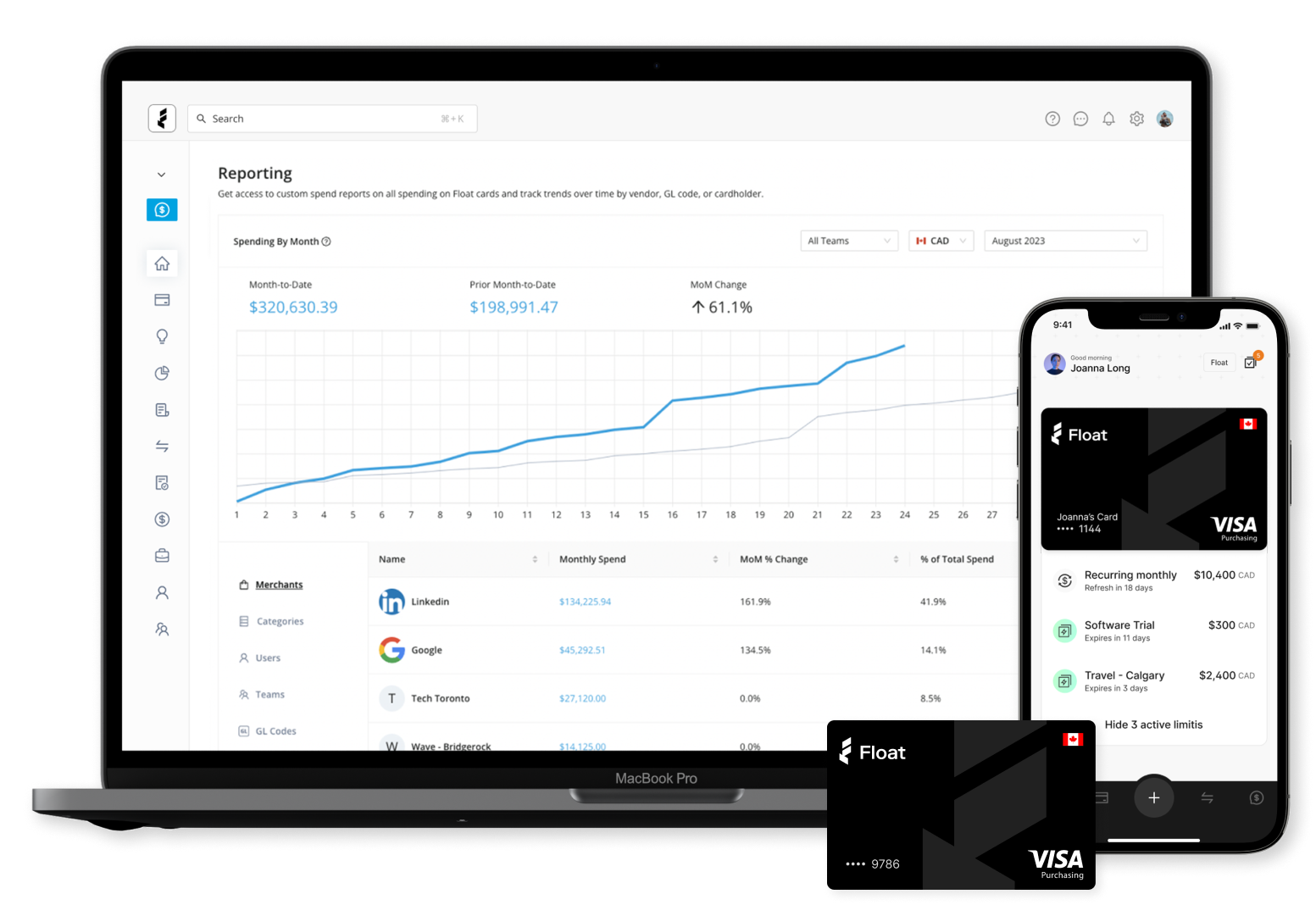

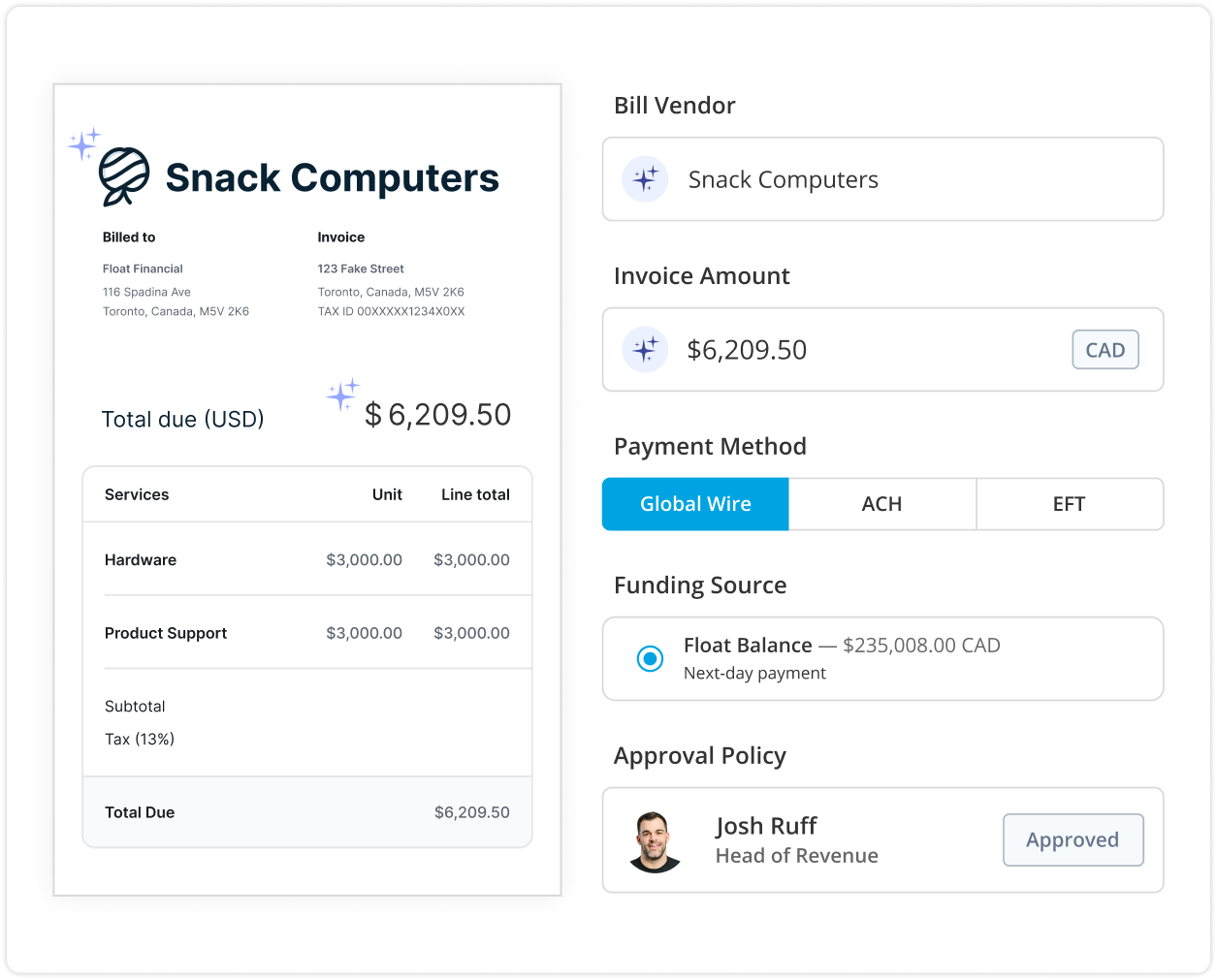

Best Expense Reimbursement Solution for Canadian Businesses — Float

If you’re looking to streamline your company’s expense reimbursement process, Float can help. Float’s automated solution simplifies employee reimbursements, saves time, and provides real-time visibility into spending trends. Learn more about Float’s Reimbursements and Mileage Tracking products.

While free expense report solutions can significantly improve your financial processes, they may lack advanced features like AI-powered automation and direct payout capabilities. That’s where we come in. Get started for free with Float’s powerful expense management platform designed specifically for Canadian businesses.

Frequently Asked Questions

Yes, reputable solutions prioritize data security and comply with industry standards like SSL encryption and regular backups.

Submitting expense reports past the deadline may result in delayed reimbursement or rejection of the claim. Aim to submit reports promptly to avoid issues. Read more about expense report best practices.

Your company’s expense policy should clearly outline what types of expenses are eligible for reimbursement. When in doubt, ask your manager or HR department for clarification.

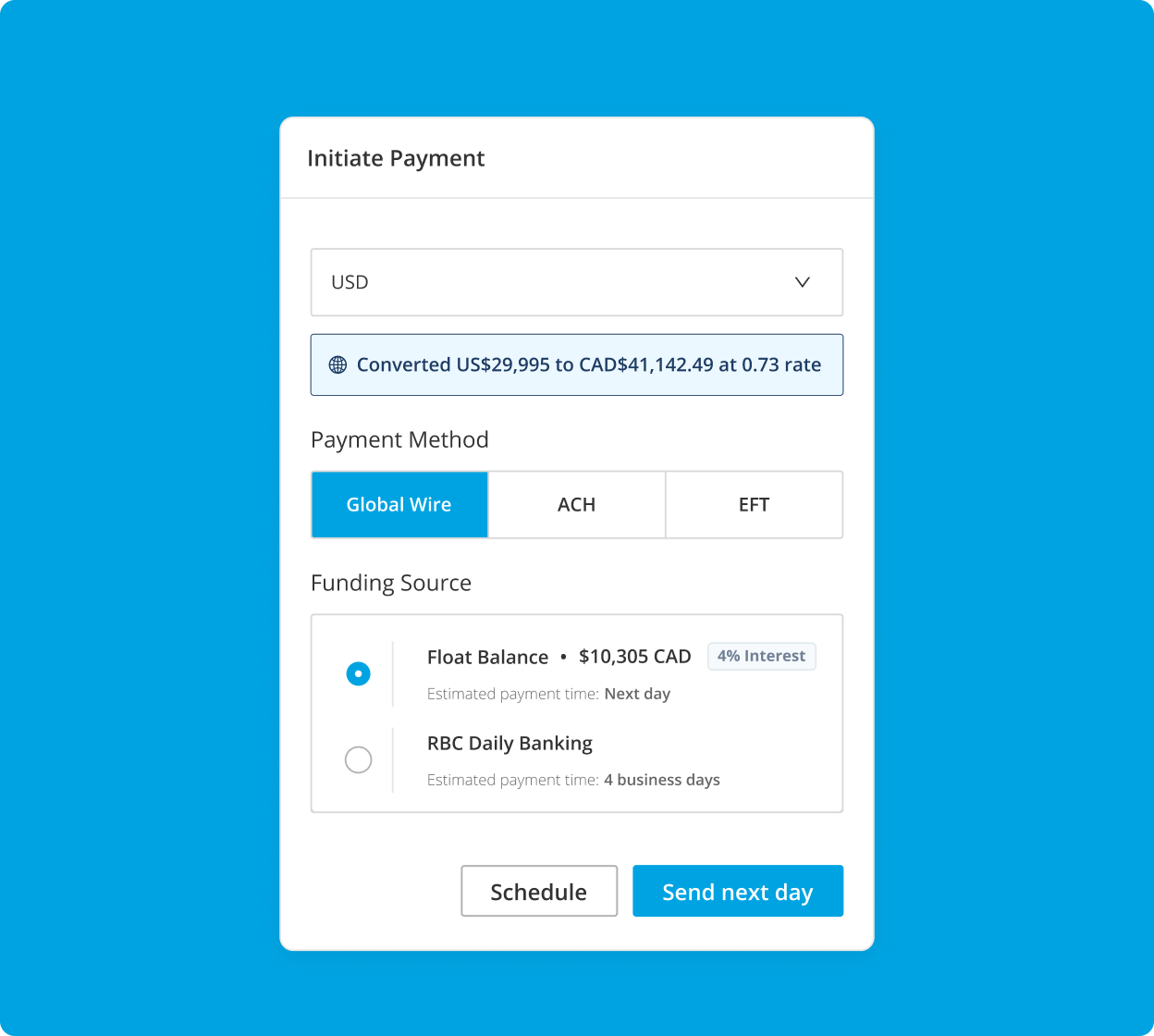

Float is Free to use on our Essentials plan, where you will be able to issue unlimited virtual CAD/USD cards, earn 4% interest on deposits, reimburse employees and pay vendor bills. If you need more sophisticated functionality, like over 20 physical cards, Netsuite integration, or an API solution, you will have to consider our paid Professional and Enterprise plans.

Float offers Charge Card and Prepaid funding models. You can apply (*Conditions apply. Book a demo to learn more) for unsecured, 30-day credit terms with high limits up to $1M, no credit checks and personal guarantees. Prepaid model offers 4% interest on all deposits with no cash lockups with account opening in < 24 hours.

Unlike traditional cards that get you to spend more, Float is the only corporate card in the world that helps businesses spend less. Through a combination of financial rewards like our 1% cashback, 4% interest on deposits, no FX fees with our USD cards and time savings of at least 8 hours per employee Float’s customers on average save 7% on their spend.