Expense Management

How To Choose the Right Expense Reporting Solution in 2024

Learn how to evaluate Expense Reporting solutions available on the market and which is the best Free solution that you should consider today.

September 21, 2024

As a finance professional, you understand the importance of efficiently managing employee expenses. In today’s fast-paced business environment, having a reliable and user-friendly expense report solution is crucial for maintaining financial control and compliance.

When evaluating expense report solutions, it’s essential to consider factors such as ease of use, integration capabilities and scalability, which will allow you to maintain expense management best practices. Choosing the right tool can significantly streamline your expense reporting process, saving valuable time and resources. We’ll also provide guidance on how to select the best solution for your unique business needs and ensure a smooth implementation.

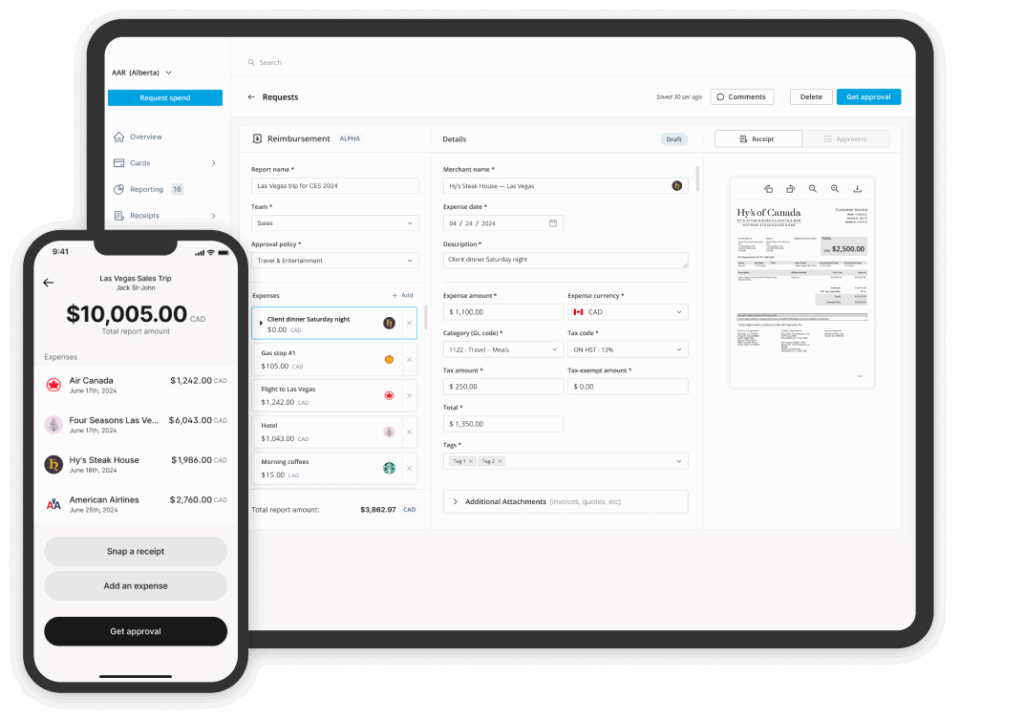

Reimburse Employees with Ease with Float

Canada’s only fully-fledged AI-powered expense reimbursement and mileage tracking platform — plus unlimited Visa Corporate Cards with cashback for high-frequency spenders.

What is an expense report solution?

An expense report solution helps businesses track, manage, and report employee expenses. It automates the expense reporting process, reducing manual effort and errors. Key features include receipt capture, expense categorization, policy enforcement, and analytics.

Benefits of using an expense report solution

- Streamlined workflow: Automating the expense reporting process saves time and increases efficiency.

- Real-time visibility: Gain insights into employee spending patterns for better financial control.

- Compliance assurance: Ensure adherence to company expense policies and tax regulations.

Top features to look for in a free expense report solution

- Mobile-friendly: A user-friendly mobile app simplifies receipt capture and expense submission on the go.

- Automatic categorization: Customizable rules automate expense categorization, reducing manual effort.

- Seamless integration: Look for solutions that integrate with your existing accounting software and corporate cards.

- Robust reporting: Comprehensive analytics provide valuable insights into spending patterns and trends.

- Multi-level approvals: Ensure proper review and authorization with customizable approval workflows.

Nice-to-have features

- Mileage tracking: GPS-based mileage tracking enables accurate reimbursement for business travel.

- Per diem management: Streamline travel expenses with automated per diem calculations.

- AI-powered audits: Detect policy violations and potential fraud using advanced machine learning algorithms.

How to choose the right free expense report solution for your business

- Assess your needs: Identify pain points in your current expense reporting process and prioritize must-have features.

- Consider user experience: Evaluate ease of use and adoption to ensure employee buy-in.

- Evaluate integrations: Ensure compatibility with your existing financial tech stack for seamless data flow.

- Plan for growth: Choose a solution that can scale with your business as it expands.

Key questions to ask

- Free plan limitations: Determine if the free plan offers sufficient features or if an upgrade will be necessary.

- Support and training: Inquire about available customer support resources and training materials.

- Security and compliance: Ensure the solution meets data privacy regulations and security standards.

Implementing and rolling out your free expense report solution

- Assign a champion: Designate an internal champion to oversee the implementation process and drive adoption.

- Configure policies: Align the solution’s settings with your company’s expense policy for consistent enforcement.

- Migrate data: Transfer historic expense data into the new system to maintain continuity.

- Communicate benefits: Clearly articulate the advantages of the new solution to employees.

- Provide training: Offer comprehensive training sessions and resources to ensure successful adoption.

Best practices for a smooth rollout

- Pilot testing: Begin with a pilot group to identify and address any issues before company-wide deployment.

- Gather feedback: Actively seek employee input and iterate on processes based on their experiences.

- Celebrate success: Recognize employees who embrace the new tool and share their success stories.

Reimburse Employees with Ease with Float

Canada’s only fully-fledged AI-powered expense reimbursement and mileage tracking platform — plus unlimited Visa Corporate Cards with cashback for high-frequency spenders.

Maximizing ROI from your free expense report solution

- Leverage integrations: Optimize usage by integrating with your float corporate card for seamless expense tracking.

- Analyze spend data: Regularly review expense analytics to identify cost-saving opportunities and refine policies.

- Explore advanced features: Utilize spend controls and automated approvals to further streamline processes.

- Quantify impact: Calculate time and cost savings to demonstrate the solution’s tangible benefits.

Strategies to increase expense policy compliance

- Clear guidelines: Establish and frequently communicate explicit expense policies to all employees.

- Automated enforcement: Leverage the solution’s built-in rules and manager approvals to minimize violations.

- Real-time visibility: Provide employees with instant access to their expense data for proactive management.

Canada’s Best Expense Reporting Solution — Float

While free expense report solutions can significantly improve your financial processes, they may lack advanced features like AI-powered automation and direct payout capabilities. That’s where we come in. Get started for free with Float’s powerful expense management platform designed specifically for Canadian businesses.

Frequently Asked Questions

Yes, reputable solutions prioritize data security and comply with industry standards like SSL encryption and regular backups.

Most solutions allow you to import historic data via CSV or through direct integrations with accounting software.

Implementation timelines vary, but with proper planning and training, you can be up and running within a few weeks.

Many free solutions offer paid plans with additional features, allowing you to scale as your needs evolve.

Float is Free to use on our Essentials plan, where you will be able to issue unlimited virtual CAD/USD cards, earn 4% interest on deposits, reimburse employees and pay vendor bills. If you need more sophisticated functionality, like over 20 physical cards, Netsuite integration, or an API solution, you will have to consider our paid Professional and Enterprise plans.

Float offers Charge Card and Prepaid funding models. You can apply (*Conditions apply. Book a demo to learn more) for unsecured, 30-day credit terms with high limits up to $1M, no credit checks and personal guarantees. Prepaid model offers 4% interest on all deposits with no cash lockups with account opening in < 24 hours.

Unlike traditional cards that get you to spend more, Float is the only corporate card in the world that helps businesses spend less. Through a combination of financial rewards like our 1% cashback, 4% interest on deposits, no FX fees with our USD cards and time savings of at least 8 hours per employee Float’s customers on average save 7% on their spend.

Written by

All the resources

Corporate Cards

How to Control Employee Spending: 5 Tips for Finance Teams

Employee spending out of control? These five tips for finance teams will help you control employee spending with ease, without

Read More

Corporate Cards

Corporate Card Alternatives: Comparing Your Options in 2025

Are your outdated cards slowing you down financially? Corporate card alternatives might be what will free you up — time-wise

Read More

Corporate Cards

No Annual Fee Business Credit Cards: A Smarter Way to Manage Spend

You don't need to be saddled by hefty annual fees to get the most benefits from your business cards. Here's

Read More