Canadian Month-End Close Process: 2026 Best Practices Guide

The end of the month is approaching, which means your blood pressure is about to go up. For Canadian small and medium-sized business owners handling the month-end close of their books, it’s crunch time. Think lots of strong coffee and too many extra work hours—but it doesn’t have to be this way.

Our State of SMB report found that half of businesses are spending 10 to 40 hours a month on payments and reconciliation. These are hours that owners could devote to growing their companies and staying ahead of competitors.

On the other hand, closing the books accurately and efficiently isn’t something you can neglect. Clean books are key to maintaining financial records, avoiding costly mistakes and giving owners the insights they need to make smart decisions. And the right choices make all the difference for business owners struggling to manage cash flow and overall business spend.

So how do you improve the process? Whether you’re dealing with manual reconciliations, tight deadlines or data inconsistencies, this guide will walk you through the most significant month-end close challenges and the best strategies to overcome them.

What is month-end close?

Month-end close is the process businesses use to wrap up their financials from the previous month. It’s all about ensuring that you account for every transaction, correctly categorize every expense and prepare accurate financial reports. Too often, it also involves chasing receipts, random charges on cards and whatever that scrap of paper from your colleague was supposed to mean.

For many businesses, month-end close means reconciling accounts, reviewing bank statements and adjusting journal entries. You’ll be managing mileage reimbursements, expense reimbursements and per diem calculations when needed. All of this combined without a solid plan in place can quickly become a tedious process, especially when done manually. You may need to coordinate with other people in the company or other teams to gather the necessary information.

However, when managed efficiently, month-end close gives business owners the financial clarity they need to make informed decisions and comply with regulations.

Understanding the accounting month-end close process

Month-end close is an opportunity to wrap up numbers throughout the year regularly, but its impact extends beyond simple calculations. A structured process means fewer errors, smoother reporting and a clearer picture of your company’s financial health.

On the other hand, businesses risk inaccuracies, delays and missed opportunities to optimize their finances without a solid month-end process.

What are the steps for month-end close?

A smooth month-end closing process doesn’t happen by accident. Instead, it requires a clear, repeatable set of steps that keeps everything on track. Without structure, it’s easy to overlook key details, leading to delays, errors and frustration for everyone involved.

Understanding the steps in your month-end close procedures and their importance can help ensure accuracy.

Here are the essential elements of a month-end close and what they entail:

1. Organize and prepare for the process

Set deadlines for your team, assign responsibilities for individuals and gather all necessary financial data upfront. Don’t worry, we’ve included a handy checklist of the necessary documents below.

2. Consolidate your financial data

Ensure you have complete, accurate and up-to-date revenue, expenses, payroll and accounts payable/receivable records.

3. Reconcile your accounts

Match transactions to statements to catch any discrepancies before they become more significant problems.

4. Adjust entries as needed

Account for items like accrued expenses, depreciation and prepaid costs to keep everything accurate.

5. Create and review financial statements

Generate your balance sheet, income statement and cash flow statement to finalize the process.

6. Review for accuracy

Ensure you’ve captured all relevant information, double-check that your month-end close is clean and review statements before distributing them.

How long does month-end close typically take?

A few factors will impact how long it takes you to work through each month-end close: company size, complexity and whether you’re using manual or automated processes. Some businesses can be wrapped up in a few days, while others may take up to two weeks.

💡 Pro tip: Businesses using automation tools like Float have reduced their close time from days to a few hours. Sounds like magic, we know, but it’s doable.

Learn more about Float

Get a 10-minute guided tour through our platform.

Speeding up the month-end close isn’t just about saving time. It also directly impacts a business’s ability to make timely and informed decisions. A faster close means companies can review performance sooner, identify trends earlier and make smarter choices before the next month is already halfway over.

Month-end close common problems and solutions

If month-end close feels like a constant battle, you’re in the right place. Many business owners struggle with data inconsistencies, tight deadlines and inefficient manual processes that make closing the books stressful and time-consuming.

Inaccurate financial data or rushed reconciliations can lead to reporting errors that impact decision-making. Understanding these challenges is the first step in overcoming them and making month-end close smoother and more predictable.

Let’s look at some common challenges and barriers to a streamlined month-end close and the solutions that help you tackle each obstacle:

Data accuracy and consistency

Nobody wants to scramble at the last minute to fix errors. But without a solid process, inaccuracies creep in. Manual data entry, missing transaction details and last-minute adjustments can throw everything off, leading to delays and frustration.

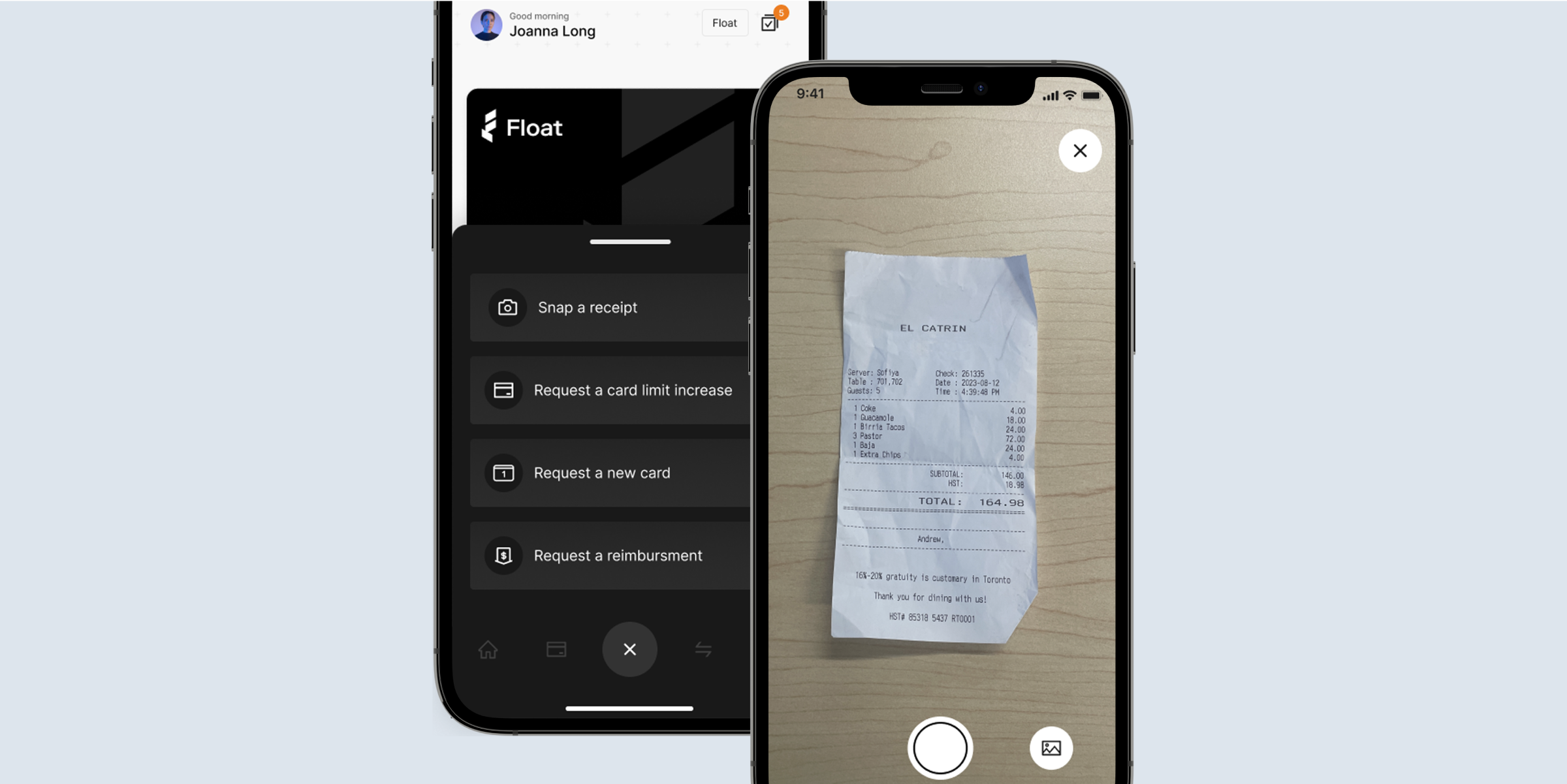

With instant receipt capture at the time of spend along with automated coding, you can ensure you have audit-ready books with accurate and consistent data.

Time constraints

Anyone handling month-end books operates under tight deadlines. Company owners need accurate financial information to make informed business decisions. It’s easy to get stuck in a cycle of reviewing, adjusting and chasing down missing information without automation, making it hard to close the books on time.

Save hours (and sometimes days) with automated tools like Float that expedite month-end. With real-time notifications and approvals, no one has to wait for anything as the tool prompts users to move the process along. Plus, most of the work happens before month-end, so there is no last-minute scramble.

Manual entry and reconciliation

Are you still relying on spreadsheets? That’s a recipe for long hours and potential mistakes. Manual reconciliations take up valuable time, and when details are missing, you or your bookkeeper have to track down employees for clarification. It’s inefficient and stressful.

Modern tools like Float automate a number of processes such as receipt capture and coding (including multi-part tax codes), making month-end quick and relatively painless. Instead of spending hours deep in admin work, you can focus on more strategic tasks because the admin work is already done.

Vendor and contractor chaos

Invoices can pile up or you may be missing T4A data, which can lead to delayed payment cycles. As a result, you may be straining your relationships with vendors and contractors, which can negatively impact the performance of your business.

With automated solutions like Float, you can track vendor and contractor information from day one for a smooth accounts payable process. On-time payments mean strong business relationships, which no doubt leads to success.

Disconnects or lack of context

An external bookkeeper may not have the context needed to reconcile every transaction. Guessing risks accuracy, but asking for details causes delays. Recurring expenses may take too much time, leaving fewer opportunities to find and examine more serious inconsistencies.

Context needs to be captured at the time of spend. With tools like Float, your business can capture receipts, notes, approvals and other pertinent information all in one place. External and internal team members then have everything they need at their fingertips to close the books on time.

Accelerating month-end close with modern tools

If the thought of month-end close makes your heart beat faster (and not in a good way), it’s likely because your processes and tools are stuck in the last century. You’re not alone, though—many small and medium businesses struggle with month-end.

If you’re looking to close your books faster at month-end, start by investigating modern tools that can make the process more efficient, less error-prone and definitely less frustrating.

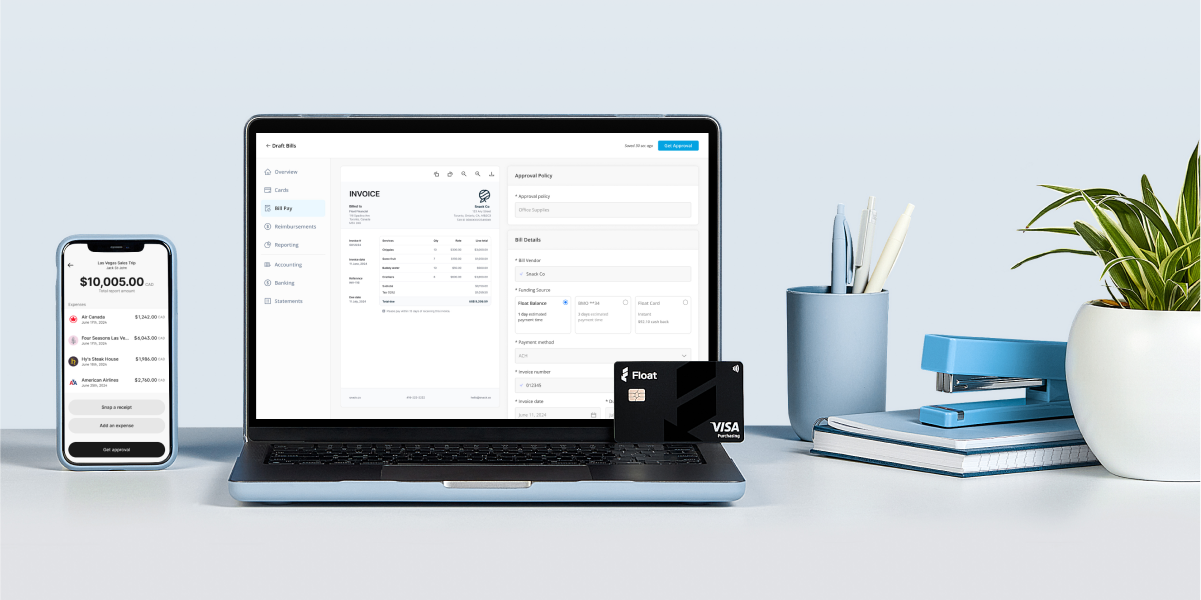

Tools like Float are designed for small and medium businesses that find themselves endlessly chasing receipts, manually coding transactions and dealing with cumbersome systems integrations. With a tool like Float, you can get back hours lost to low-level admin work so you can focus on strategic business priorities.

But what do you need from a modern solution? Here’s what to look for when evaluating modern tools to accelerate month-end.

1. Real-time receipts

Instead of begging employees to submit their receipts at the end of every month, go with a tool like Float that lets employees upload receipts instantly via mobile. If a receipt is missing, the system sends an automatic reminder.

2. Automated accounting

Make reconciliation happen at lightning speed with tools that auto-code expenses to general ledger (GL) accounts, vendors and tax categories. Float integrates with accounting tools like QuickBooks Online, so there’s no need to move data over manually.

3. Comprehensive live dashboards

For a clear picture of your finances at all times, choose a modern solution that offers a view of real-time spending by department, card or vendor. This way, you can forecast your cash flow and burn rate more accurately.

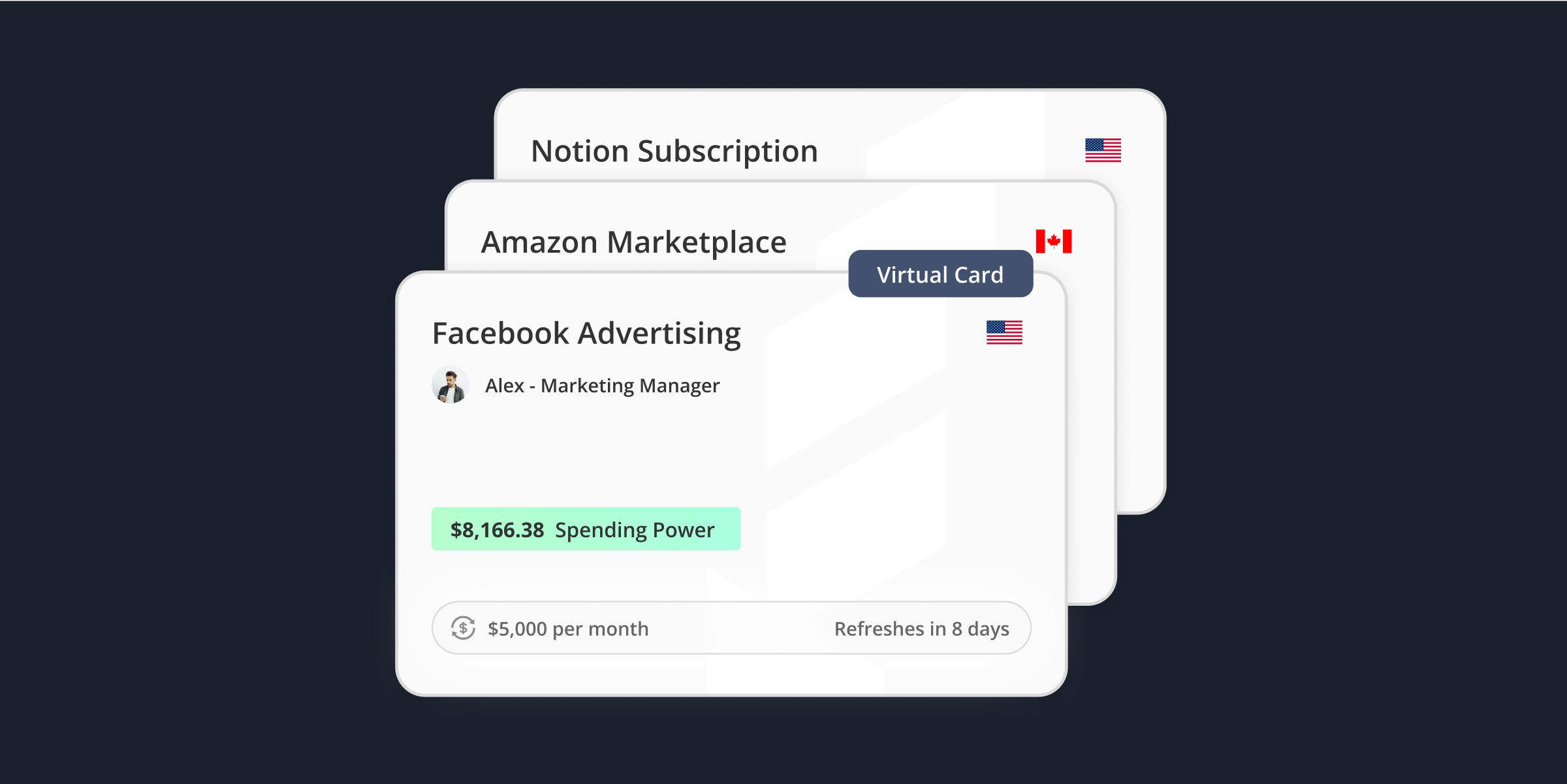

4. Pre-approved corporate cards

Control company spend before it happens with prepaid corporate cards, both virtual and physical. With Float, you can set spending limits and expiration dates on cards to ensure your money is being used wisely.

You need to make sure that you don’t overlook Canadian regulatory and compliance considerations when it comes to modern tools that help speed up month-end processes. With tools like Float, you can auto-collect receipts with HST/GST information and ensure you have the details to support tax credit claims. At tax or audit time, your business will be ready for the tax man with no stress, thanks to centralized receipts and approvals.

Are you doing business south of the border? For cross-border spending, choose tools like Float that track your USD charges in real-time and have consistent coding for foreign transactions in QuickBooks Online. Even reconciling spend in another country is easier with the right solution.

How automation reduces close time and errors

If your business has been manually completing month-end close up until this point, using an automated solution can seem overwhelming. Will it really speed up the month-end process? Will it make more mistakes than it will fix? These are typical concerns that many small and medium-sized business owners face. For small business owners and finance teams, using automated tools like Float can save you up to eight hours per month by streamlining spend requests, automating coding and collecting receipts via mobile.

For non-finance staff, Float eliminates traditional expense report processing, saving employees an average of two hours per month per employee. Here’s how automation gives your business more time back in your day:

- Real-time data all month long: Instead of waiting till month-end to have a clear picture of your finances, you have clarity at all times. Transactions sync automatically and receipts and invoices are collected at the point of spend.

- Automated coding: Remove manual error with automated coding by GL accounts, tax codes, departments and projects. Fewer coding mistakes mean cleaner books.

- Integrated systems: There’s no need to manually transfer data from one system to another. You have one source of truth, no duplicate entries and no typos.

- Automated reconciliations: Instead of waiting till month-end to catch errors, you can see daily transaction feeds with automated reconciliations. This lets you catch issues before they snowball.

- Built-in audit trails: Every single transaction is tied to a receipt, approver and user so there is no guessing involved. You have a clear audit trail for the CRA.

6 effective strategies to improve your processes

Let’s dial down the adrenaline a few levels. Leveraging automation and standardizing procedures allows you to spend less time on tedious tasks and more time driving financial insights that add real value to the business.

1. Automation

We’ve said it before, but it’s worth repeating: It may be time for an upgrade if you’re still manually handling most of your month-end close tasks. Tools like Float bring corporate cards, expense management and bill payments into one system, making reconciliations automatic. With pre-set rules for transaction coding, businesses can drastically cut down on manual work, speeding up the close process.

2. Standardize financial procedures

A set company process for tracking expenses, coding transactions and handling reconciliations makes a huge difference. A comprehensive expense policy that covers the most likely situations can also help reduce errors and murk. The more standardized your financial workflows are, the fewer surprises you’ll run into at month-end.

3. Schedule regular financial reviews

Catching errors early saves headaches later. Monthly reconciliations help prevent financial inconsistencies from snowballing, making your books cleaner and more accurate over time.

4. Close sub-ledgers periodically

Waiting until the last minute to reconcile everything? That’s a surefire way to make month-end more stressful. Instead, closing sub-ledgers throughout the month keeps everything in check and prevents a backlog of work at the end of the month.

5. Collaborate and communicate

Finance isn’t an island. Expense reports, approvals and coding all depend on other teams. The better your communication with other employees, the easier it is to keep things running smoothly.

6. Set realistic deadlines

Reverse-engineering your timeline can help you close on time. Start with your final reporting date and work backward, setting clear deadlines for each step of the process. This keeps everything on track and prevents last-minute chaos.

Real-time financial data for faster closes

One of the major issues with manually closing the books every month is that your business doesn’t have insight into its finances until the month ends. For almost 30 days, your business is flying blind with data that is obsolete the moment the previous month closes. This is why real-time financial data is so critical—not just for faster closes but also for making smart business decisions.

With solutions like Float that offer real-time financial data, transactions sync daily. Employees attach receipts at the point of spend so there is no missing information. If any issues arise, you can address them on the day they happen, rather than weeks later at month-end. Reconciliations happen continuously throughout the month, making the actual month-end close much faster. There is no backlog waiting for you on a Friday afternoon.

With accurate, up-to-date information about your business’ financial status on any given day, you can quickly course correct spend as needed to ensure departments are staying within budget. You can also adjust forecasts dynamically to reflect your actual operations.

Real-time financial data empowers your finance team—and your business—to take on a strategic role. It enables you to identify profitable products and services more quickly, allowing you to capitalize on sales opportunities. You can track working capital on a daily basis to determine how you want to invest in your business. And most importantly, you can focus on turning your business into a growth engine, instead of being stuck chasing receipts.

Month-end close checklists for Canadian businesses

If you’re feeling stressed about everything that comes with closing the books at month-end, a well-organized checklist can shift your month-end closing process from a stressful rush into a smooth, predictable process. Taking a structured approach helps businesses reduce errors, maintain compliance with expense and regulatory policies and ensure financial clarity.

Here’s what you’ll need in two handy month-end checklists:

Key financial records:

✅ Revenue and sales data

✅ Accounts receivable and payable reports

✅ Expense receipts and supplier invoices

✅ Bank statements and reconciliations

✅ Payroll data

✅ Inventory totals (if applicable)

✅ Balance sheets

✅ Income and expense accounts

✅ General ledger and sub-ledger reports

Key tasks to complete:

✅ Enter all invoices and transactions into the accounting system

✅ Reconcile all bank accounts and financial records

✅ Review and adjust journal entries as needed

✅ Generate and review financial statements

✅ Close the period in the financial system

✅ Distribute reports to key stakeholders

How Float can help simplify your month-end process

The end of the month doesn’t have to be a headache. You can eliminate the complexity of closing your books by automating transaction categorization, reconciliation and reporting.

By integrating corporate cards, expense management and bill payments, Float helps businesses eliminate manual tasks and speed up financial workflows.

With Float, you can:

- Capture receipts at the time of spend, not weeks later

- Automate transaction coding, which means no more manual expense categorization

- Gain real-time visibility to track spending and reconcile transactions instantly

- Lower bookkeeping costs by automating processes and reducing reliance on external accountants

- Stay audit ready all month long with clean, up-to-date books with a detailed audit trail for every transaction

- Reduce close times from days to hours

If you want to reclaim valuable time and improve accuracy, Float is the smart choice for making month-end close easier and more efficient.