Paying invoices from the EU can be a complex process, but understanding the steps involved can make it much more manageable. In this guide, we’ll walk you through the key considerations and best practices for settling bills issued by suppliers located within the European Union.

By following these steps, you’ll be better equipped to handle currency conversion, VAT compliance, and choosing the most suitable payment method for your business needs. Let’s dive in and explore how to pay invoices from the EU efficiently and effectively.

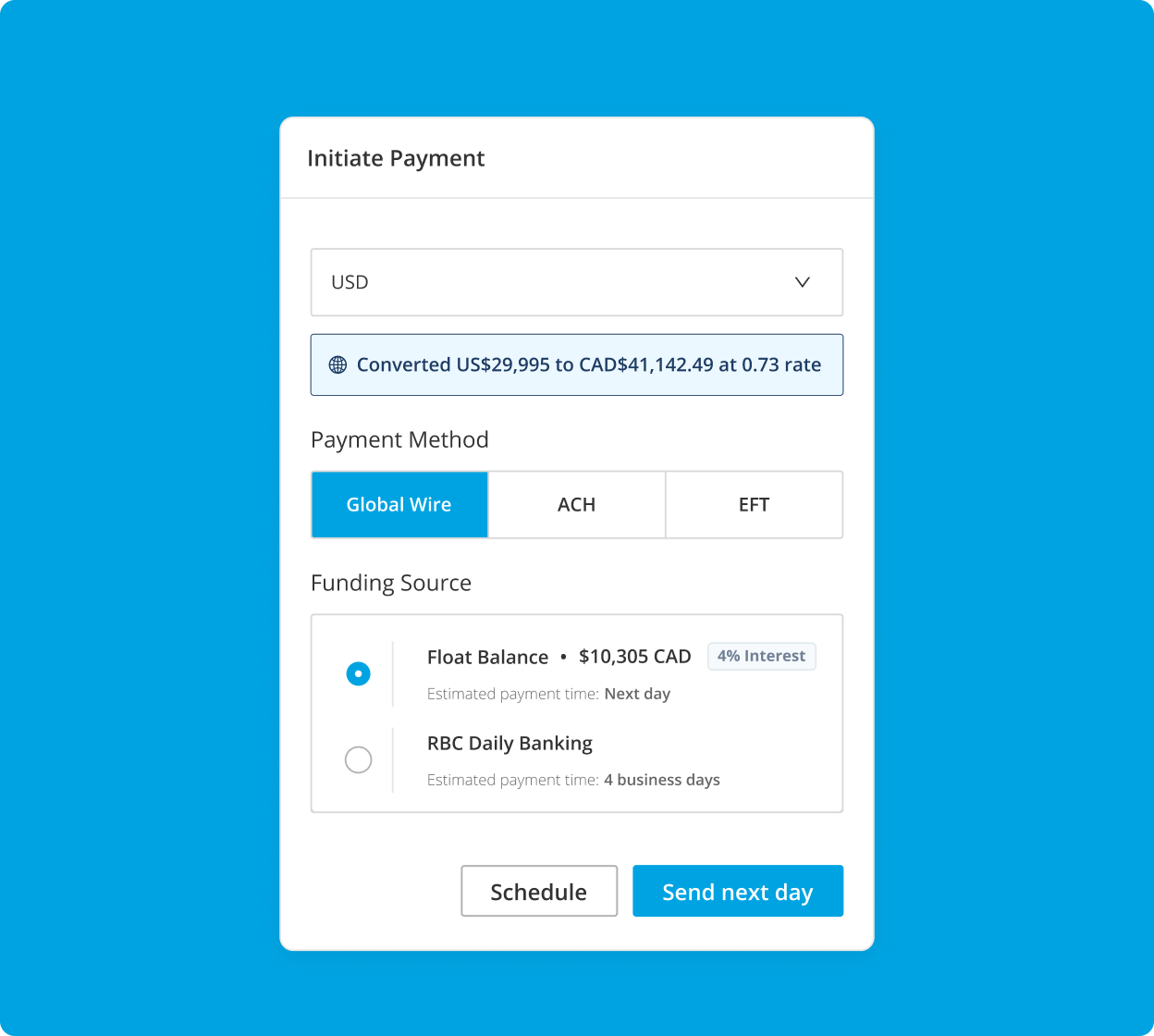

Make Global Wire Payments with Float

Canada’s best-in-class EFT, ACH, and Global Wires payments platform — plus average savings of 7%.

What is an Invoice?

An invoice is a document issued by a seller to a buyer that itemizes and records a transaction. Invoices are essential for businesses to request payment for products or services provided.

Why is it Important to Pay Invoices Promptly?

Paying invoices promptly helps maintain good relationships with suppliers, ensuring they continue to provide you with the goods and services your business needs. It also ensures smooth operations and cash flow management, as late payments can disrupt your supply chain and hinder your ability to meet customer demands. Moreover, timely invoice payments help you avoid late fees and penalties, which

How to Pay Invoices from the EU

When paying invoices from the EU, it’s essential to understand the steps involved and the importance of considering currency and VAT implications. By familiarizing yourself with these aspects, you can ensure a smooth and compliant payment process.

Step 1: Verify Invoice Details

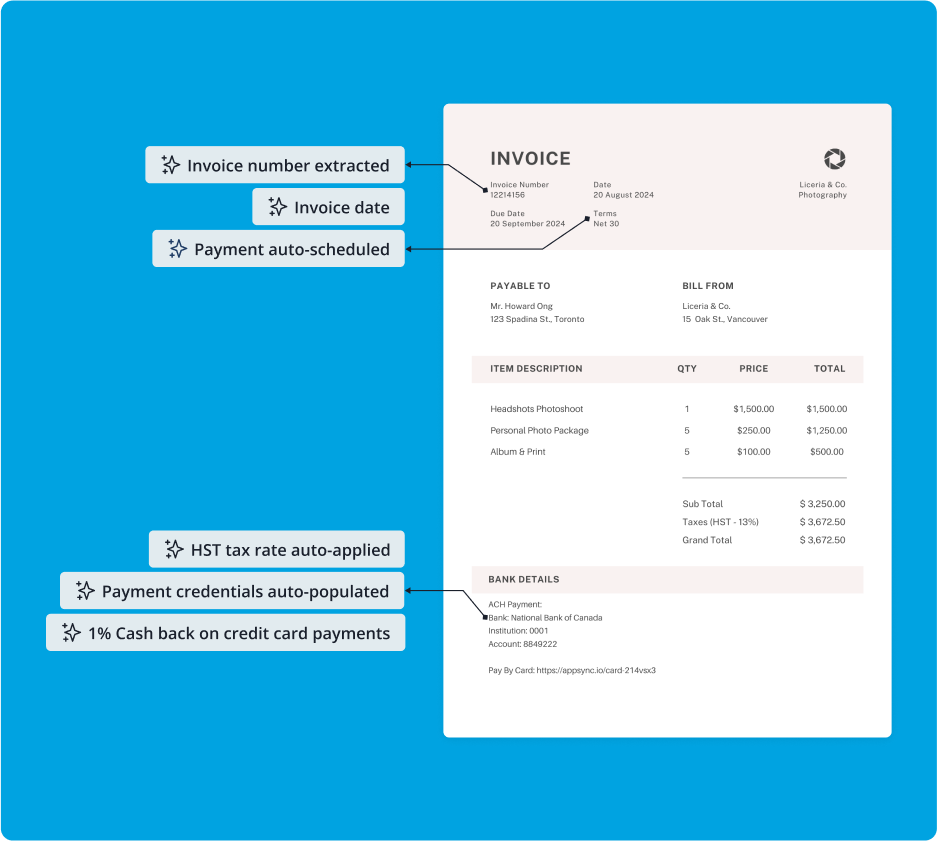

Before initiating payment, carefully review the invoice to ensure it includes all necessary details, such as the supplier’s name, address, VAT number, and payment terms. Double-check the accuracy of the information to avoid any discrepancies that could delay the payment process.

Step 2: Understand Payment Methods

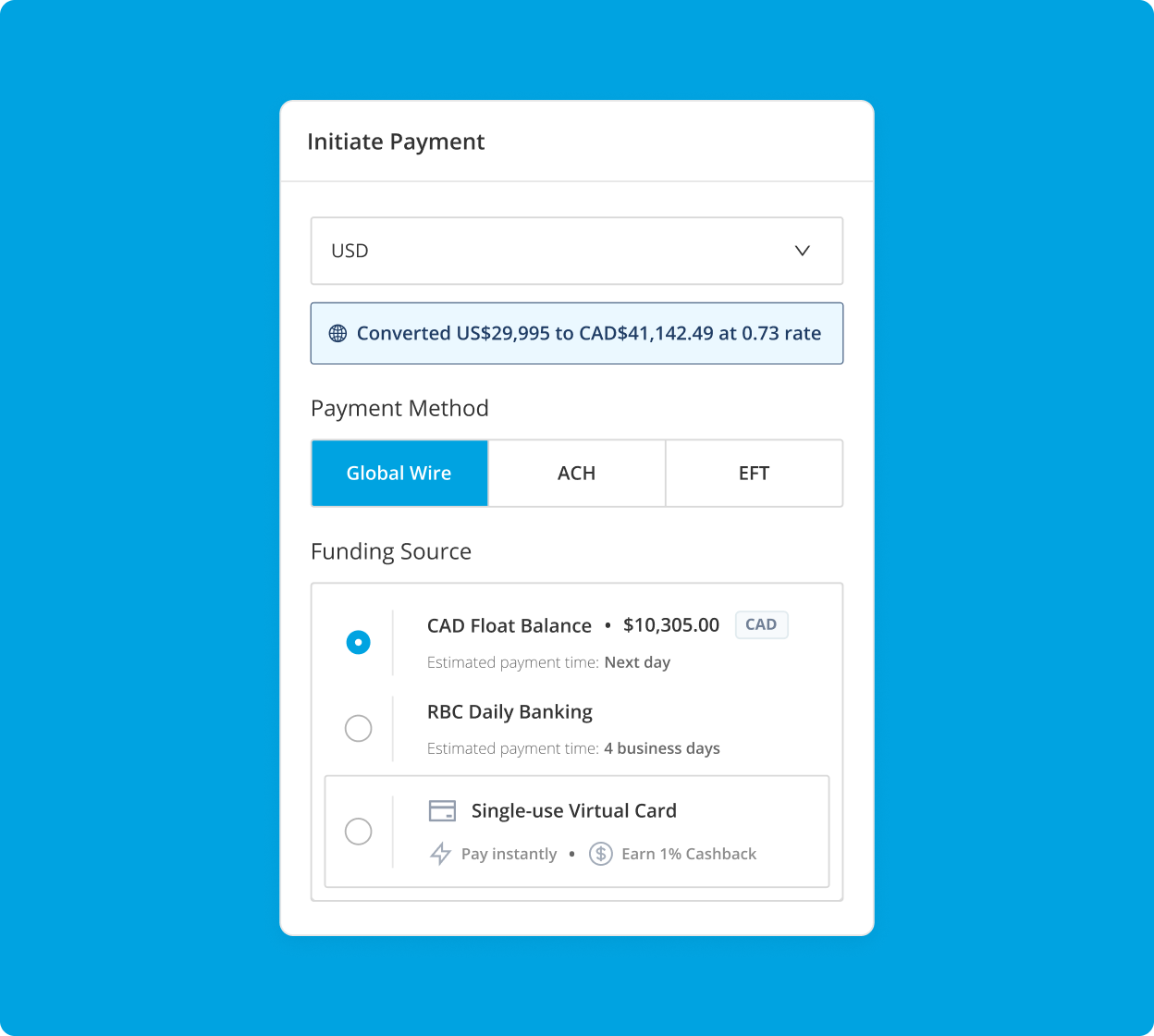

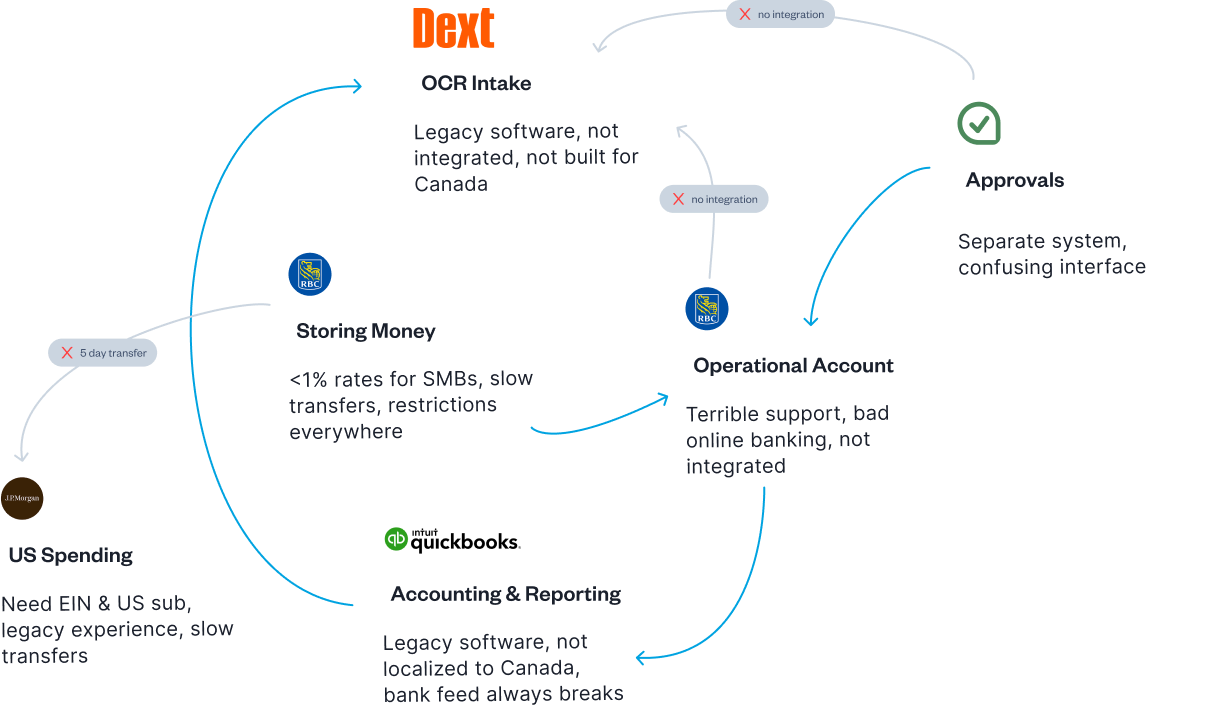

Explore the various payment methods available for settling EU invoices, such as SEPA payments, international wire transfers, credit cards, and direct debit in Europe. Consider factors like transaction fees, processing times, and the level of security each method offers to determine which one best suits your business needs.

Step 3: Consider Currency Conversion

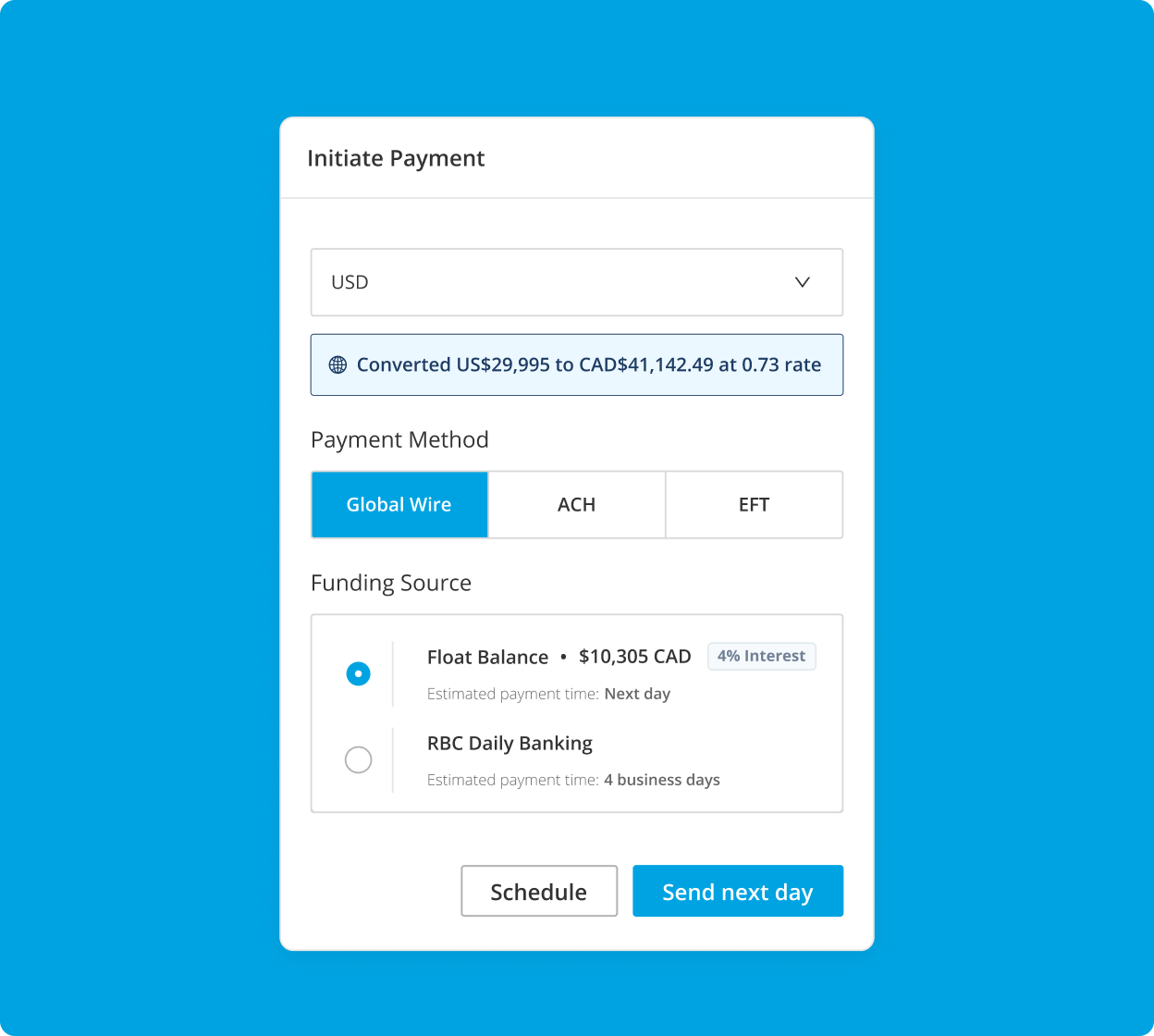

If the invoice is denominated in euros and your business operates with a different currency, you’ll need to understand the implications of currency conversion. Research reliable services that offer competitive exchange rates and minimal fees to ensure you get the best value for your money when making the payment.

Step 4: Handle VAT Implications

To maintain VAT compliance, familiarize yourself with EU VAT invoicing rules. If both you and the supplier are VAT-registered, the invoice should include both parties’ VAT numbers. Ensure that the correct VAT treatment is applied to the transaction to avoid any legal or financial complications.

Step 5: Initiate Payment

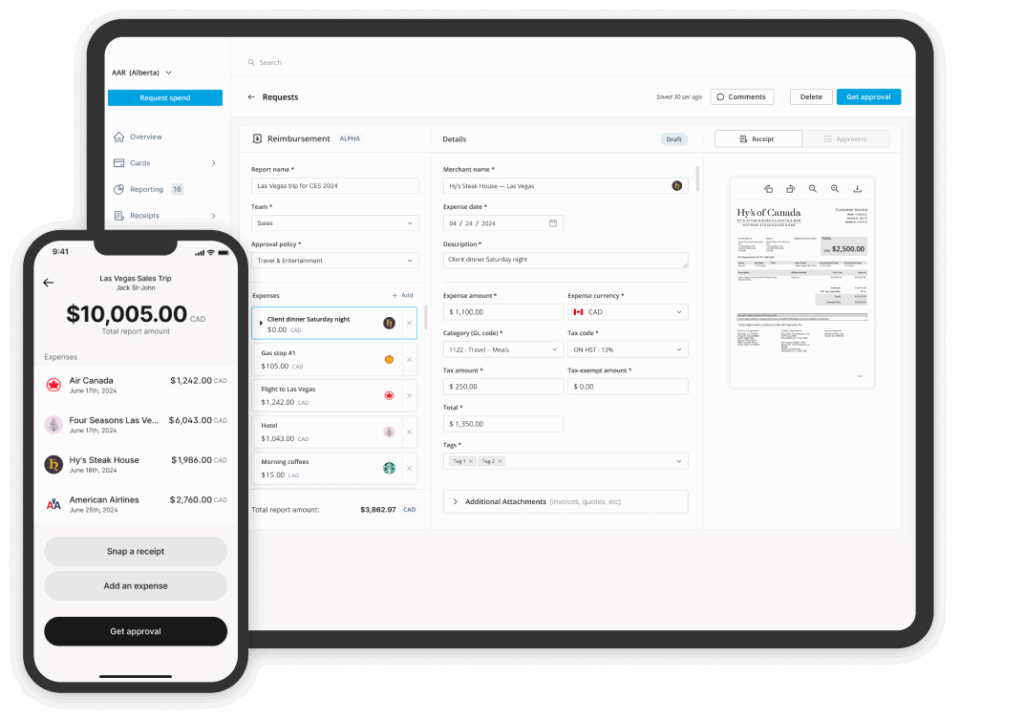

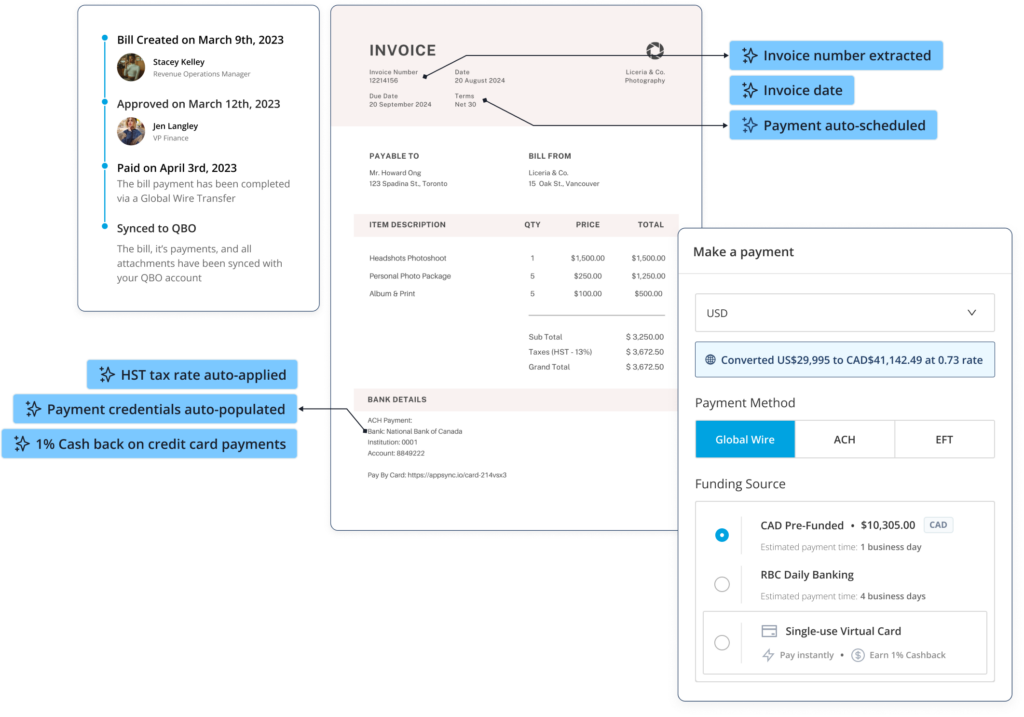

Once you’ve verified the invoice details, chosen a suitable payment method, and considered currency conversion and VAT implications, it’s time to initiate the payment. Use your accounts payable platform to process the transaction, ensuring that all details match those on the invoice to prevent delays or rejections.

Step 6: Record the Transaction

After successfully completing the payment, record the transaction in your accounting software to maintain accurate financial records. Keep a copy of the paid invoice for your records, as this may be necessary for future reference or auditing purposes.

Make Global Wire Payments with Float

Canada’s best-in-class EFT, ACH, and Global Wires payments platform — plus average savings of 7%.

Final Thoughts

Paying invoices from the EU requires careful attention to detail and a solid understanding of international payment methods and VAT regulations. While there are several options available, using a Global wire is often the safest and most reliable choice for ensuring your payments reach your EU suppliers promptly and securely.

By following the steps outlined in this guide and staying informed about the latest developments in international payments and VAT compliance, you can streamline your EU invoice payment process and maintain strong relationships with your European suppliers.

Want to learn more about the accounts payable (AP ) process more generally? Check out our AP Guide here.

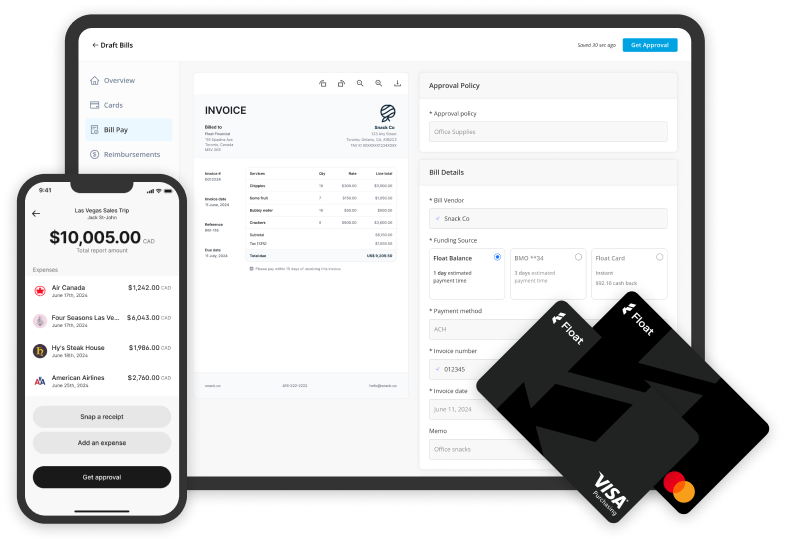

Streamline Your EU Invoice Payments with Float

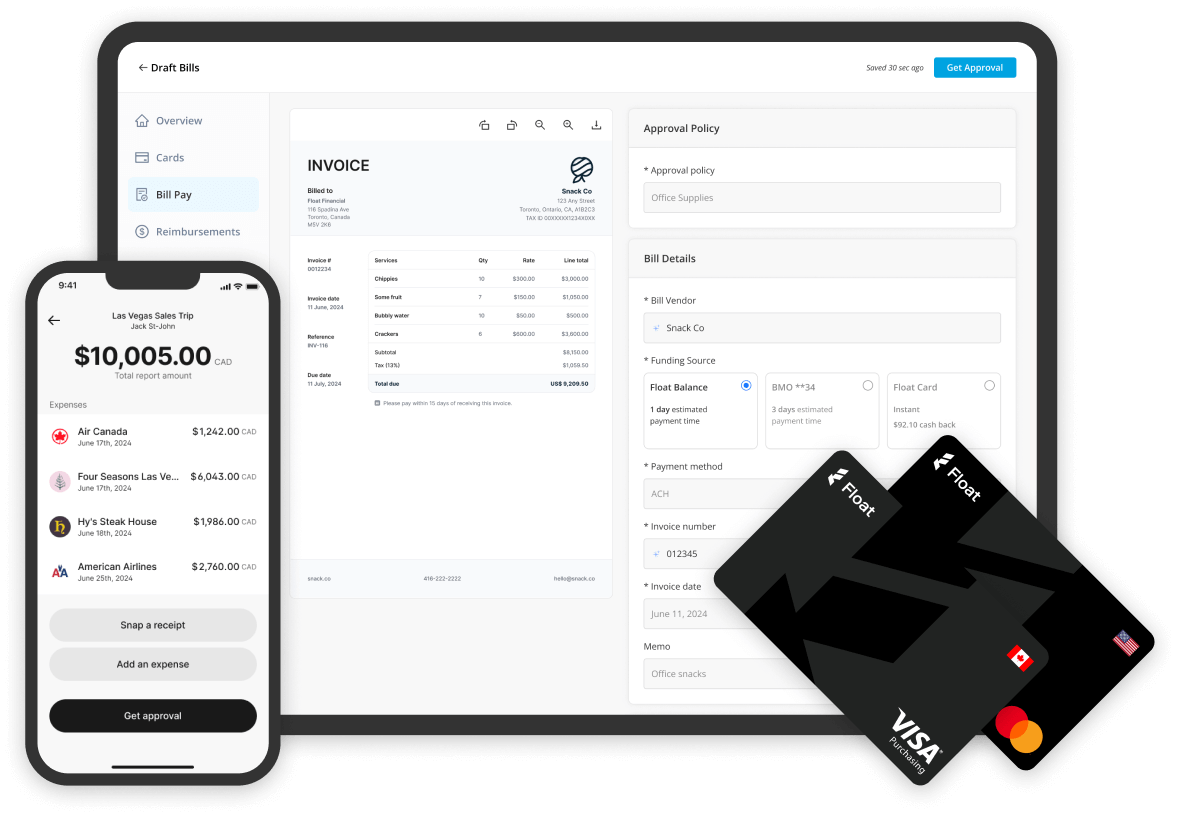

Managing international invoice payments can be a complex and time-consuming process, but with the right tools and solutions, it doesn’t have to be. Float’s Bill Pay platform offers a seamless and efficient way to handle your EU invoice payments, with built-in functionality for Global Wires in USD. With Float’s platform, you can ensure that your EU suppliers are paid promptly and accurately, while minimizing the risk of errors and delays. Say goodbye to the hassle of manual invoice processing and international payment challenges.

We’re here to help you streamline your international payables and take control of your business finances. Get started for free with our Bill Pay solution today and experience the difference for yourself.

Frequently Asked Questions

Global wire transfers: These offer a secure and reliable method for sending payments to EU suppliers, ensuring that funds are transferred directly from your account to theirs.

Global wire transfers: These offer a secure and reliable method for sending payments to EU suppliers, ensuring that funds are transferred directly from your account to theirs.

Understand VAT rules: Familiarize yourself with EU VAT invoicing regulations, ensure both parties’ VAT numbers are included on the invoice, and apply the correct VAT treatment to the transaction.

Contact your bank or payment platform’s customer support to investigate the issue and provide any necessary documentation to resolve the problem promptly.

Record transactions: After completing a payment, record the transaction in your accounting software and keep a copy of the paid invoice for future reference and auditing purposes.

Float is Free to use on our Essentials plan, where you will be able to issue unlimited virtual CAD/USD cards, earn 4% interest on deposits, reimburse employees and pay vendor bills. If you need more sophisticated functionality, like over 20 physical cards, Netsuite integration, or an API solution, you will have to consider our paid Professional and Enterprise plans.

Unlike traditional cards that get you to spend more, Float is the only corporate card in the world that helps businesses spend less. Through a combination of financial rewards like our 1% cashback, 4% interest on deposits, no FX fees with our USD cards and time savings of at least 8 hours per employee Float’s customers on average save 7% on their spend.