Category: In the news

Float secures C$50 million in financing to accelerate growth

Toronto, Ontario, February 13, 2024 – Float, one of Canada’s fastest growing fintechs, has kicked off 2024 with an aggressive expansion plan and the backing of a C$50 million credit facility in partnership with Silicon Valley Bank (SVB), a division of First Citizens Bank.

Under the terms of the deal, Float CEO Rob Khazzam confirms the company has access to C$50 million to expand its innovative Charge Card program, which achieved nearly 300% YOY payment volume growth in 2023. This growth has been fueled by Float’s expansion of its business finance platform to serve midmarket Canadian companies across industry sectors including technology, media, manufacturing and CPG, reinforcing its position as a challenger to traditional financial institutions.

Milestone Deal Enables Accelerated Expansion

“At a time when other financial institutions are pulling back on serving Canadian SMBs, our partnership with SVB is a powerful reflection of the strength of Float’s vision, strategic direction and hyper-growth in 2023,” explains Khazzam, adding that the milestone deal required a partner with deep tech roots and experience with companies on a fast scaling trajectory.

“Float is challenging the status quo when it comes to providing payment solutions for Canadian companies and teams. Our strong partnership demonstrates SVB’s commitment in helping fintech companies succeed and scale. We’re thrilled to be a part of Float’s growth and bolster its expansion across the country.” said Brian Foley, Market Manager for Silicon Valley Bank’s Warehouse and Fintech group.

“Float’s Charge Card product, and Float’s business finance platform more broadly, has transformed the way we handle payments and expenses,” said Erin Bury, Co-Founder and CEO of Willful, an online estate planning company. “Their focus on product innovation and customer satisfaction sets them apart in Canada, and has helped us to drive efficiency at Willful.”

Since it launched as a payments and software platform for Canadian businesses in 2022, Float’s Charge Card product has seen exceptional adoption, with the launch of credit limits in both CAD and USD, and 7x customer growth since its introduction, says Khazzam. In 2024, Float will continue to expand its footprint with new payment and software solutions purpose-built for Canadian companies.

Save 7% on your Spend with Float

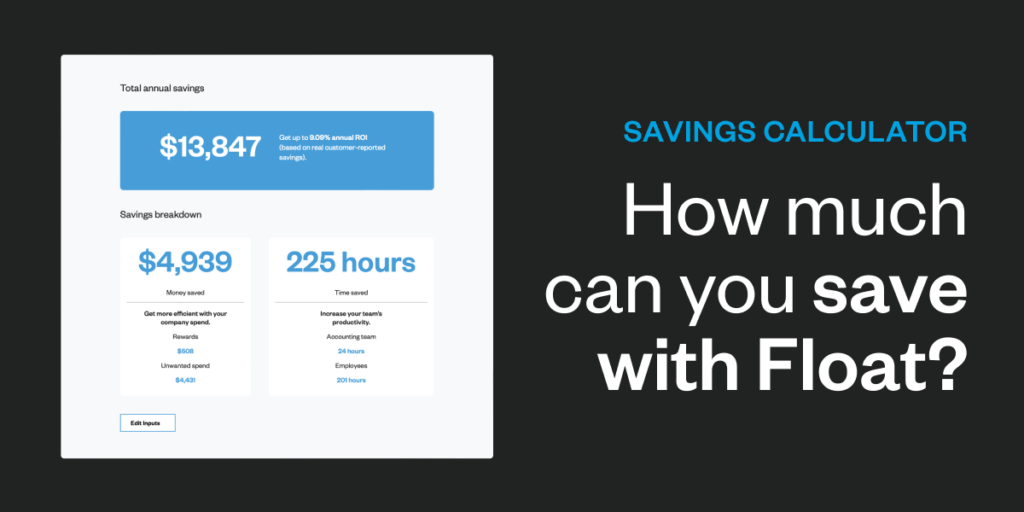

We asked over 200 customers across Canada how Float helps them save time and money. With responses from businesses of all sizes and industries, the results were clear.

Float offers savings far beyond the traditional rewards offered by banks like cashback (but we have that, too). From increasing team productivity to creating efficiencies by eliminating unwanted spend, Float saves companies an average of 7% of their total spend and closes books up to 8x faster.

How Float Calculates Savings

Total savings are calculated combining three areas:

1. Financial Rewards 💳

Float offers financial rewards (and services) beyond the banks.

- High Yield Accounts

- Float offers 4% interest on both CAD and USD business balances with rates up to 2.7x the Canadian banks. Learn More →

- 1% Cashback

- Businesses earn 1% cashback on CAD and USD spend over $25k/month. Learn More →

- USD Cards

- Float offers USD cards so you can avoid FX fees altogether, or get a low 1.5% FX rate on foreign transactions. Learn More →

2. Productivity Gains ⌚

Float saves companies valuable time by eliminating administrative tasks so your teams can focus on what matters most.

- Finance team members – 8 hrs/month

- From streamlining spend requests to automating coding and receipt collection, Float can improve your month-end close by 1 full business day. Learn More →

- Employees – 2hrs/month

- By eliminating traditional expense report processes, Float saves employees 3 days a year worth of administrative work. Learn More →

3. Efficiency Improvements 💸

Float helps finance teams eliminate unwanted spend and unnecessary expense software costs.

- Save 1.3% on unwanted spend

- Through custom card limits and controls and real-time transaction reporting, finance teams save 1.3% of their total card spend with Float. Learn More →

- Reduce software costs

- Float’s all-in-one software eliminates the need for expensive expense report software with both cards and reimbursements in one platform. Learn More →

Calculate your ROI

Float saves customers an average of 7% on their spend and closes their books up to 8x faster – see your company’s potential ROI using Float’s Savings Calculator. Your business’ results may vary, but we feel pretty good about it.

Interested in learning more on how much your business could be saving with Float? Get a personalized ROI analysis with a member of our team and see how Float can help you save today.

Methodology

Our calculations are based on real customer-reported savings from over 200 businesses of all types and sizes across Canada.

The survey was run from November 1-30 and included responses from companies with average employee sizes ranging from 15-200. Respondents were primarily C-suite executives, Heads of Finance, Controllers, and Accountants.

Participants were asked a series of questions relating to their time savings with Float in two primary areas: time savings for team members and cost reductions resulting from Float’s software.

Responses were paired with Float’s platform data and industry research to create an ROI calculation representative as a percentage of an illustrative customer’s total card spending when using spend management features designed to reduce business expenses. We also take into account what you have to give up by joining Float, including existing rewards programs and the monthly subscription cost, if you select the Professional and Enterprise plan.

My Float Face

When you make software it’s natural to focus on the nuts and bolts of how the product works. But one thing we’ve seen consistently across our customers is that Float changes the way people experience their work lives, whether you work in finance or any other role where you incur work expenses.

Our new fall brand campaign focuses on these emotions – relief, confidence, even pure delight – in a series of portraits depicting everyday work scenarios.

If you can see yourself in one of these, it’s because we turned to our customers for inspiration. Your comments come through loud and clear in our conversations, both digital and IRL. We love seeing how Float has changed the way you feel at work.

Huge thanks to our creative partners Kailee Mandel, Renga, Distilled Creative and George Street Growth for bringing this campaign to life, in Float speed, no less.

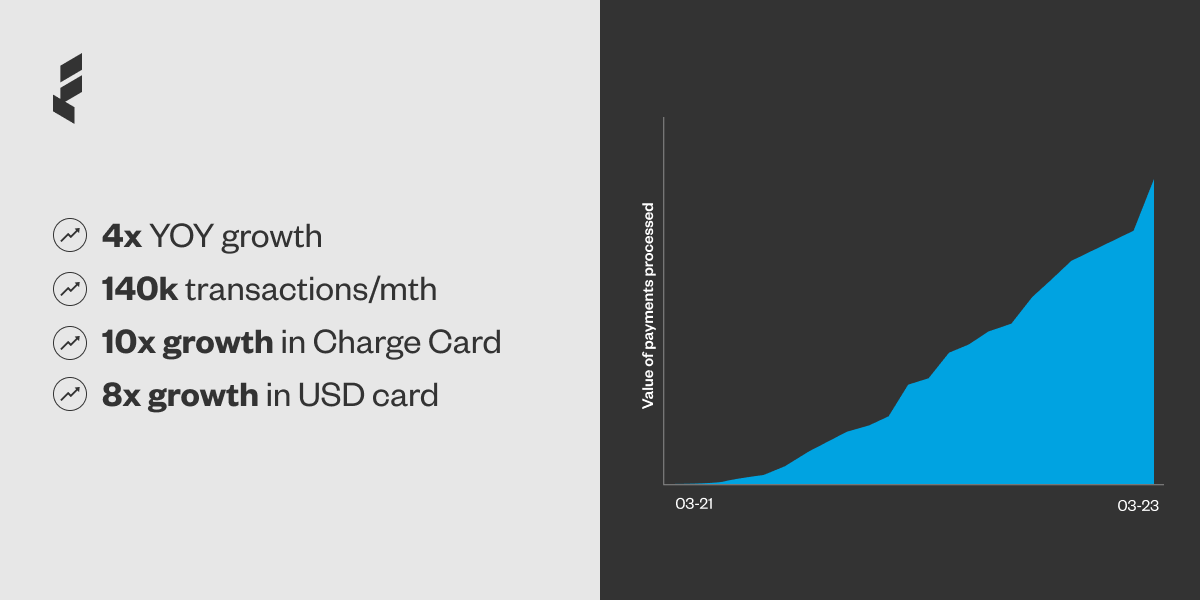

Float’s Revenue Quadruples in Strongest Year Yet

Two years ago, Float officially launched with a big, bold mission to simplify spend for Canadian companies and teams.

Since then we’ve helped thousands of finance teams take control over their spending while saving millions of hours in receipt collection and reconciliations.

As a result of providing this value, we grew revenue 4x over the past year, and over 100x since our very first month in business. We went from serving startups to a cross section of the Canadian economy, with customers now processing over 140,000 monthly transactions through Float.

Here are a few Float milestones from the last year:

New payment solutions with the launch of Float USD and Charge Card products

Since Float’s inception, USD cards have been the number one product requested by our customers. Many were frustrated by the offerings (or lack thereof) from Canada’s big banks, as most require a US legal entity, and none offer the advanced spend management tools that Float has become known for.

The response to our USD Cards has been phenomenal, resulting in a 5x increase in customers and 8x increase in transaction volume since launch. USD has become a core part of Float’s business, accounting for close to 20% of total spend.

Float’s Charge Card launched in summer 2022, offering extremely high limits compared to alternatives, with no interest or fees. Similar to our USD Cards, our Charge Card product has experienced exceptional takeup with 7x customer growth and 10x payment volume growth since its introduction.

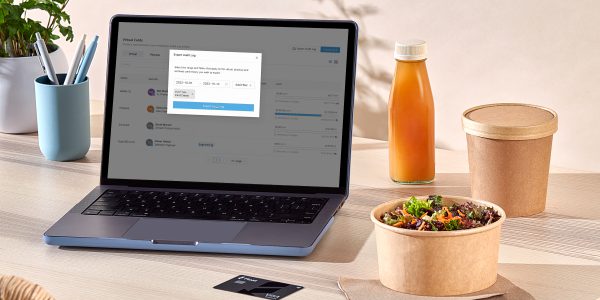

Spend controls that lower risk while increasing productivity

The economic climate of the last year has underlined how critical it is for companies to have tight control over all spending. We help finance leaders by giving them real time visibility into spending across their business, and advanced controls that lower the risk of issuing cards to employees.

Merchant Controls give finance teams the ability to restrict card spending by merchant category.

Float’s Expense Policy gives teams the ability to implement company expense policies directly in Float, from defining the transaction information that employees are required to submit, to assigning multiple approval layers for employee spend requests within an organization.

Audit Logs that enable admins to easily view and export a history of cardcreation, changes, pauses, expiration, and deletion for all their Float cards to date.

Powerful accounting automations that save thousands of hours

Every other functional team has benefited from digital transformation and modernization. Float’s spend management solution does this for the finance function.

We shipped new automations and enhancements that save thousands of hours in manual accounting tasks, including:

- Automated receipt matching

- Personalized receipt forwarding

- Suggested GL codes

Customers have shared that with Float, month-end is much faster, they can now do continuous closes, and they can scale the finance function without having to add additional overhead.

“Float saves the accounting team countless precious hours at month end. This will allow the team to refocus on more value-add activities like analysis of the spend rather than spending hours on data aggregation.”

Benjamin Koppeser, Senior Manager, Finance, Clutch

Real-time reporting that helps teams find savings

We heard from customers that traditional providers made it difficult to have real-time visibility over spend, and no reporting capabilities to easily spot concerning trends.

With that in mind, Float launched our new Reporting functionality in close collaboration with our largest customers, a feature that is being used weekly by the majority of our customers.

Float customers can see a snapshot of company spending and be able to analyze trends over time. With financial data visualizations of both CAD and USD spending, they can view month-to-date spending and quickly identify increases or decreases in spending patterns.

Admins can also run custom spend reports by merchant, vendor, GL code, category, cardholder, team, or tag to get a more detailed understanding of where company money is going. This level of insight can help finance teams identify areas of overspending or opportunities for cost savings.

“In the past I was reviewing the spending daily to spot any anomalies or large spends that required further analysis. We were not following up at month end to look at any trends or patterns in the spending by customer or by buyer. My team can now analyze company spending quickly and easily. It adds another check and balance to our arsenal that we didn’t have before.”

Gino Cacciatore, CFO, Skybox Labs

Serving the needs of larger, more complex organizations

As Float’s customers grow, so do the needs of their finance team. Over the last 12 months, we introduced new functionality to better serve these larger midmarket customers.

SSO + SAML enables Single Sign-On (SSO) and provides increased security and convenience for companies by allowing for just one set of secure login credentials across platforms, including Float. SAML works by passing information about users, logins, and attributes between the service providers and identity providers (iDp) including Azure, Okta, Auth0, and OneLogin.

MFA works to improve account security and prevent unauthorized login attempts by requiring an additional “factor” to verify that the person logging in is really who they say they are. This can include a text message with a unique code or a one-time-password (OTP) issued by a third party authenticator app such as Google Authenticator.

Float’s NetSuite integration gives admins the ability to set rules to automatically code transactions with GL Codes, Vendors, Departments, Classes, Tax Codes & Locations, as well as export them to NetSuite with embedded receipts.

The modern day finance tech stack

It’s never been a more exciting time to build a company and products that serve Canadian finance teams. People across every level of finance are eager to bring modernization, automation and new solutions to the way they work.

We are grateful to serve the most innovative and respected teams in Canada and we are excited to continue on this journey.

How Float Simplifies Financial Audits

The word “audit” can set many of us in a tailspin. It’s a heavy lift and can take up to weeks to complete and sift through financial records – especially if you don’t have the right tools in place. However, internal and external audits are a customary part of business operations and help to assess and verify the accuracy of your financial records – which means they’re here to stay.

Thankfully, Float has a solution that helps your auditing process run smoother than butter. 🧈 Our smart spend software and corporate cards give finance teams automated spend controls and quick access to audit trails for company spending. With better control and greater access to your financial records, audits are no longer something to dread. 👍🏼 Here’s why.

Get accurate information with real-time reporting 🕑

Audits are great for looking at historical snapshots of company spending, but wouldn’t it be great if you knew everything in real time? Float enables a real time overview of company spending so finance teams can ensure the books are always up to date with the right information. If your team is using Float cards for business purchases, then you’ll always know who is spending what as soon as a purchase is made. Float’s automatic SMS and Inbox receipt forwarding ensure that spenders submit their receipts on time, while automated receipt matching eliminates the need for manual expense reports and reconciliations. With Float there’s no waiting on employees to submit expense reports or tracking down receipts in the middle of an audit! 🧾

Set automated controls so everything runs smoothly 😌

Approval Policies ✅

Float allows finance managers to put financial controls in place to give teams the freedom to spend, while still having oversight and control on their end. This unique feature also offers proactive approvals for spend rather than reactive approvals. When you set up “Teams” in Float, you can ensure that approval requests are automatically sent to the right people every time an employee requests a corporate card or a spend increase. You can even set up multiple approval layers based on spend amounts and types.

Submission Policies 📩

Float also allows you to implement your company’s expense policies through our Submission Policies feature. Finance managers can set up submission policies for different expense categories and require employees to submit receipts and transaction details for purchases over a specific dollar amount or for all transactions. Float can also autopause cards for non-compliant transactions.

Seamlessly integrate with your existing accounting software👨💻

Float integrates directly into accounting software like QBO, Xero, and Netsuite to export transactions that are already coded and embedded with receipts for you. We also take the stress away through our Transaction Rules, which are designed to automatically code transactions from recurring merchants. So when an auditor is reviewing your books, you can rest easy knowing that all your transactions made on Float cards will have been exported with the correct GL codes, tax codes, and receipts too. ☑️

Stay organized and in-the-know with Audit Logs 🔎

Float offers Audit Logs for cards created on our platform and for spend requests and approvals too! 🤩 This allows finance teams to quickly access audit trails for specific time periods, ensuring their spend approval and card creation controls are being adhered to. The best part: Float provides a quick and easy way to submit documentation when it comes time for an audit. 💨 No loose paperwork or piles of receipts to gather. Our Audit Logs feature enables admins to export a history of creation, changes, pauses, expiration, and deletion for all their Float cards to date. You can also review a history of the creations, approvals, and declines of spend requests from your employees too.

—

Every finance team needs a set of controls in place to ensure business spending meets company policies – and that their financial records are as accurate as can be.👌🏼 Float’s smart spend software and corporate cards empower finance teams to easily automate their financial controls and have clear oversight of their corporate spending all year long. Finance teams can also use our real-time reporting tools and conveniently review records of audit trails for Float cards and spend requests so they’re fully prepared for an audit.

Ready to get started with Float? Book a demo or connect with us today and we’d be happy to show you all of the incredible features we have for you.

Introducing Retained Learnings Finance Podcast

The corporate finance department is changing, and so are the roles and responsibilities of its leaders. Data and technology are being used in new and strategic ways, leading to fundamental shifts in the way finance professionals work.

Automation, communications, people management and training are just some of the areas that are evolving.

When you’re looking for advice that could benefit your company in these areas, there isn’t always someone in your professional network that can help. And if you’re trying to become a better finance leader, you probably want to learn from the best.

What if you could hear from other seasoned finance professionals about how they overcame some of these challenges in their own unique way? Whether you’re implementing a zero based budgeting model for the first time or raising a Series B, there’s a good chance someone has been in your shoes before.

Listening to their stories just might help you turn these milestones into career defining opportunities.

We’re excited to launch Retained Learnings, a new podcast for Canadian finance leaders. Hosted by Float CEO Rob Khazzam, Retained Learnings will feature Canada’s most respected and accomplished finance and business names to bring you some of the lessons they’ve collected during their careers.

In each episode of Retained Learnings, we’ll share strategic advice and potential solutions to answer some of the finance departments most important questions. We’ll touch on topics like preparing to go public, hiring in a tight talent market, or even moving to an ERP solution like NetSuite.

If you’re a Canadian finance professional, curious about how the best finance leaders in the country do their jobs, be sure to listen to Retained Learnings. Now available on Spotify and Apple podcasts.

Announcing Float’s US$30M Series A Financing

We’re excited to announce that Float has closed US$30M in Series A financing led by Tiger Global. This new round of capital will help us further invest in our goal of creating Canada’s best corporate card and all-in-one spend management software.

Thanks to our loyal and supportive customers, Float is now one of the fastest-growing companies in Canada. Since our public launch earlier this year, we’ve seen hundreds of companies adopt Float for business spending. Moreover, we’ve seen engagement on the platform skyrocket. The total payment volume on Float has increased ~20x since our seed financing in June 2021, and our average monthly customer spend has increased more than 6x since our public launch in March 2021. None of this would be possible without our amazing customers, many of whom have played a major part in helping us develop new products and features. We look forward to delivering even better service to our customers over the coming months and years.

Float’s Vision & Mission

Float’s vision is to deliver an end-to-end business spending platform for small and medium-sized businesses. We want this platform to enable businesses and teams to focus on investing in their growth and eliminate the need to use different banking and software tools to make day-to-day payments. One of our first customers said it best — “It’s hard enough to run a business, let alone figure out how to spend the money in our bank account.” We believe a lot of businesses share this sentiment, which is why Float’s mission is to simplify spending for companies and teams.

The Problem Float Solves

The pain point that Float is solving has been top of mind for Canadian businesses and their teams for years, and yet largely ignored by existing market players. There are over one million companies in Canada spending nearly $3T per year and the process of getting a corporate card continues to be incredibly difficult for small-to-medium sized businesses. Despite being the number one preferred method of payment for ~80% of Canadian businesses, it still takes 4+ weeks to get approved and an endless number of forms required. If you’re lucky enough to get approved, you’ll likely get a card with stifling limitations — low limits, high FX fees, personal guarantees and the inability to share these cards with your broader workforce. And that’s just to spend! After all of that, you’re still left to find a way to systematize expense reports, receipt collection, month-end accounting reconciliation and more. Yuck.

Enter Float

Float’s mission is to simplify spending for companies and teams. We offer Canada’s first high-limit, no personal guarantee corporate card and enable any business to start spending in 3 business days or less. Most importantly, our product is digital-first and empowers businesses and their teams to take control of how they spend. Administrators can create and cancel cards on the fly, set custom spending limits and assign cards to individuals on their team. Employees can request spend using Float directly from Slack, while managers can review and approve spend in real time. Float also speeds up the month-end closing process by natively integrating with popular accounting software such as QuickBooks and Xero. Lastly, Float offers 1% cashback on all transactions. That’s right – real cash in your account, no tricks or gimmicks.

Excited About Our Mission?

Float is run by a passionate and mission-driven team that is focused on delivering world-class experiences to its customers. Our culture is dynamic, fast-paced and execution-oriented. We think we’re a great fit for talented people who want to operate with a high degree of ownership and accountability and always put customers first. We’re now hiring across major business functions! If our mission aligns with you, please get in touch or apply online.