Save 7% on your Spend with Float

We asked over 200 customers across Canada how Float helps them save time and money. With responses from businesses of all sizes and industries, the results were clear.

Float offers savings far beyond the traditional rewards offered by banks like cashback (but we have that, too). From increasing team productivity to creating efficiencies by eliminating unwanted spend, Float saves companies an average of 7% of their total spend and closes books up to 8x faster.

How Float Calculates Savings

Total savings are calculated combining three areas:

1. Financial Rewards 💳

Float offers financial rewards (and services) beyond the banks.

- High Yield Accounts

- Float offers 4% interest on both CAD and USD business balances with rates up to 2.7x the Canadian banks. Learn More →

- 1% Cashback

- Businesses earn 1% cashback on CAD and USD spend over $25k/month. Learn More →

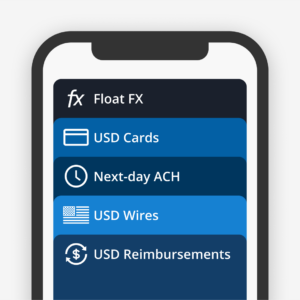

- USD Cards

- Float offers USD cards so you can avoid FX fees altogether, or get a low 1.5% FX rate on foreign transactions. Learn More →

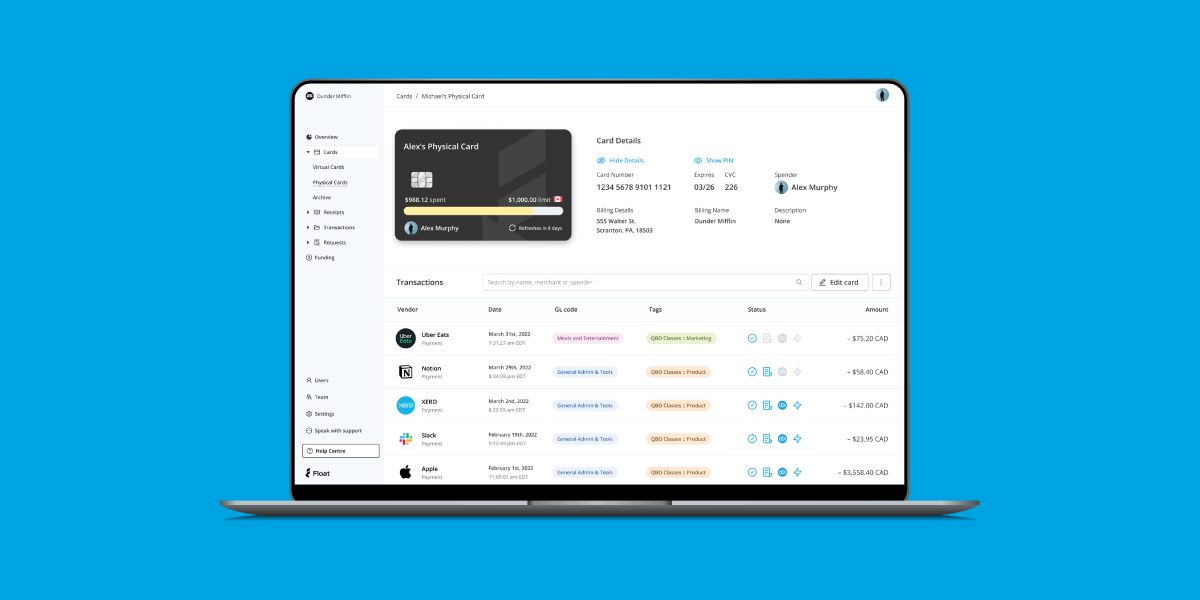

2. Productivity Gains ⌚

Float saves companies valuable time by eliminating administrative tasks so your teams can focus on what matters most.

- Finance team members – 8 hrs/month

- From streamlining spend requests to automating coding and receipt collection, Float can improve your month-end close by 1 full business day. Learn More →

- Employees – 2hrs/month

- By eliminating traditional expense report processes, Float saves employees 3 days a year worth of administrative work. Learn More →

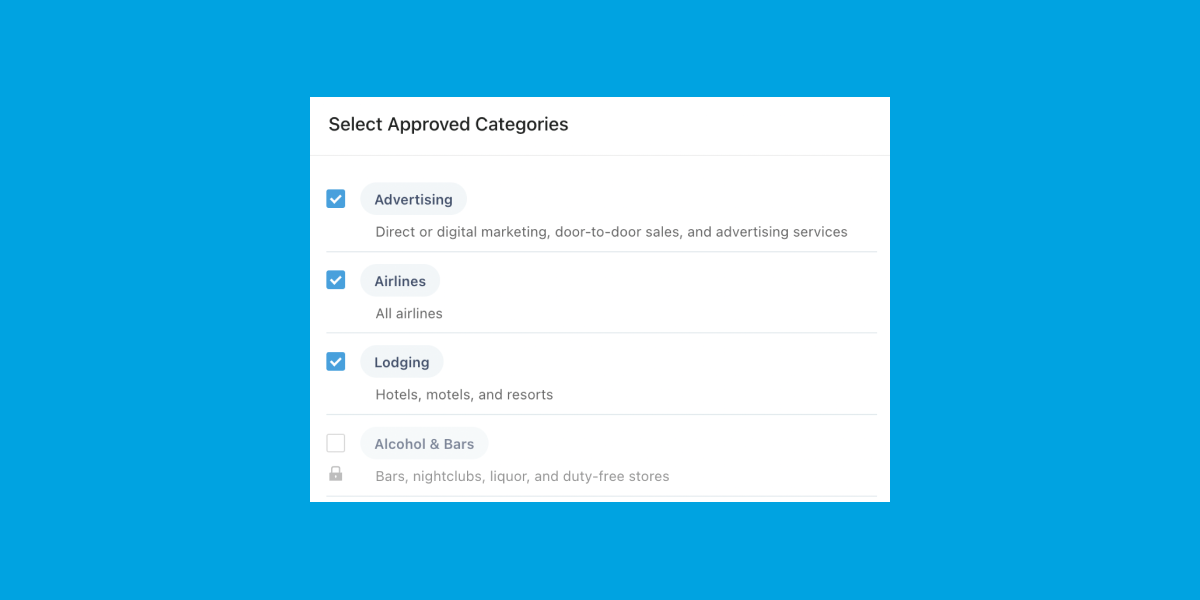

3. Efficiency Improvements 💸

Float helps finance teams eliminate unwanted spend and unnecessary expense software costs.

- Save 1.3% on unwanted spend

- Through custom card limits and controls and real-time transaction reporting, finance teams save 1.3% of their total card spend with Float. Learn More →

- Reduce software costs

- Float’s all-in-one software eliminates the need for expensive expense report software with both cards and reimbursements in one platform. Learn More →

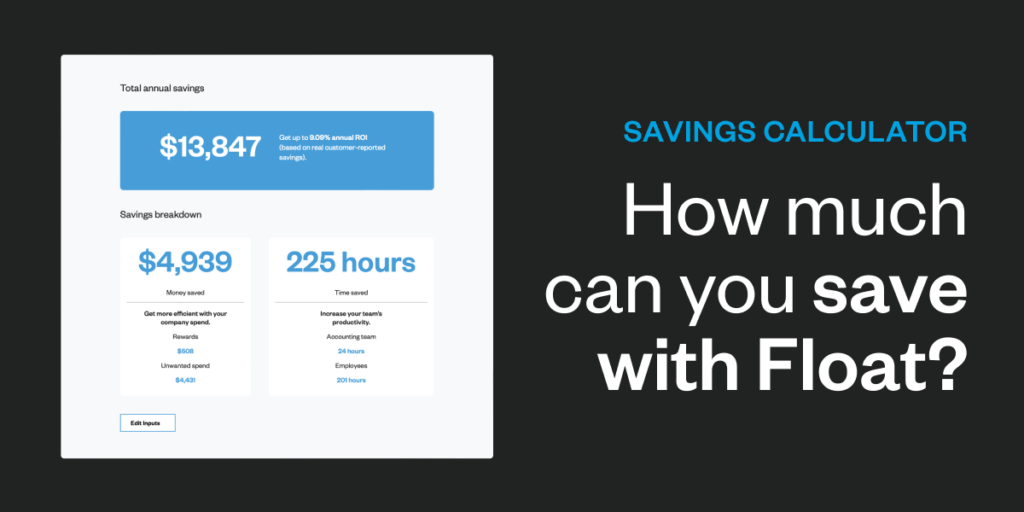

Calculate your ROI

Float saves customers an average of 7% on their spend and closes their books up to 8x faster – see your company’s potential ROI using Float’s Savings Calculator. Your business’ results may vary, but we feel pretty good about it.

Interested in learning more on how much your business could be saving with Float? Get a personalized ROI analysis with a member of our team and see how Float can help you save today.

Methodology

Our calculations are based on real customer-reported savings from over 200 businesses of all types and sizes across Canada.

The survey was run from November 1-30 and included responses from companies with average employee sizes ranging from 15-200. Respondents were primarily C-suite executives, Heads of Finance, Controllers, and Accountants.

Participants were asked a series of questions relating to their time savings with Float in two primary areas: time savings for team members and cost reductions resulting from Float’s software.

Responses were paired with Float’s platform data and industry research to create an ROI calculation representative as a percentage of an illustrative customer’s total card spending when using spend management features designed to reduce business expenses. We also take into account what you have to give up by joining Float, including existing rewards programs and the monthly subscription cost, if you select the Professional and Enterprise plan.