How to Promote a Healthy Spending Culture in Your Company

We often hear a lot about how companies are actively promoting a positive corporate culture within their organizations. It builds trust with employees, boosts engagement and ultimately creates a workplace people want to be in. But there’s another side to this coin that’s worth looking into. What are companies doing to promote a healthy spending culture in their organizations? 🤔 After all, taking care of your company’s financial health is really what makes everything else possible.

First, what is a spending culture and why does it matter? 🤷🏾♂️

A company spending culture is the infrastructure of processes, policies, systems and values that govern how, when and why an organization spends, manages and saves money. This infrastructure is essential as it lays the foundation for the success of any organization. Why? Well, it determines their financial stability, longevity and ability to invest in the right people, drive innovation and increase revenue for growth and expansion. ✅

It’s a way of being. 😎

A healthy spending culture needs to be embodied and promoted by management so they can lead by example and educate employees on why it’s important and how it relates to everything they do. When every employee operates with these values in mind, it will have a compounding effect by normalizing smart spending decisions company wide.

It’s a team effort. 👫👫

To be successful, this requires effective communication and collaboration across all departments to ensure the entire company is aligned on spending expectations. If one department falls short, it can have a domino effect (and not in a good way). 🎲

It’s a non-negotiable. 🙅🏻♂️

If growth is on your priority list, keep reading.🧐 How you manage and spend capital can literally make or break you if it goes unchecked over time. That’s why it’s important to have the infrastructure in place to give you clear financial oversight at all times.

Healthy spending culture vs. unhealthy spending culture

| Healthy Spending Culture 👍🏼 | Unhealthy Spending Culture 👎🏼 |

| ✅ Robust financial policies in place to govern company spending | 🚫 Teams are not aligned with corporate spending goals due to lack of communication and no policies in place |

| ✅ Foolproof processes that use automation software to monitor, track and manage daily spending and expenses | 🚫 Manual and tedious expense processes that waste time due to errors and delays |

| ✅ Finance teams can easily approve spend requests for employees and promptly collect receipts | 🚫 Employees can lose a sense of responsibility for work because they’re relying on approvals from someone in another department |

| ✅ Leaders can set spending limits that align with departmental budgets for various employees and teams | 🚫 Leaders have little to no control or visibility of corporate spending |

| ✅ Employees are empowered to make spending decisions mindfully, responsibly and quickly so that they can progress in their projects | 🚫 Employees choose to make impulse decisions without approval to spend simply because they want to move forward with projects |

When you have the system, everything falls into place. Float has the system.

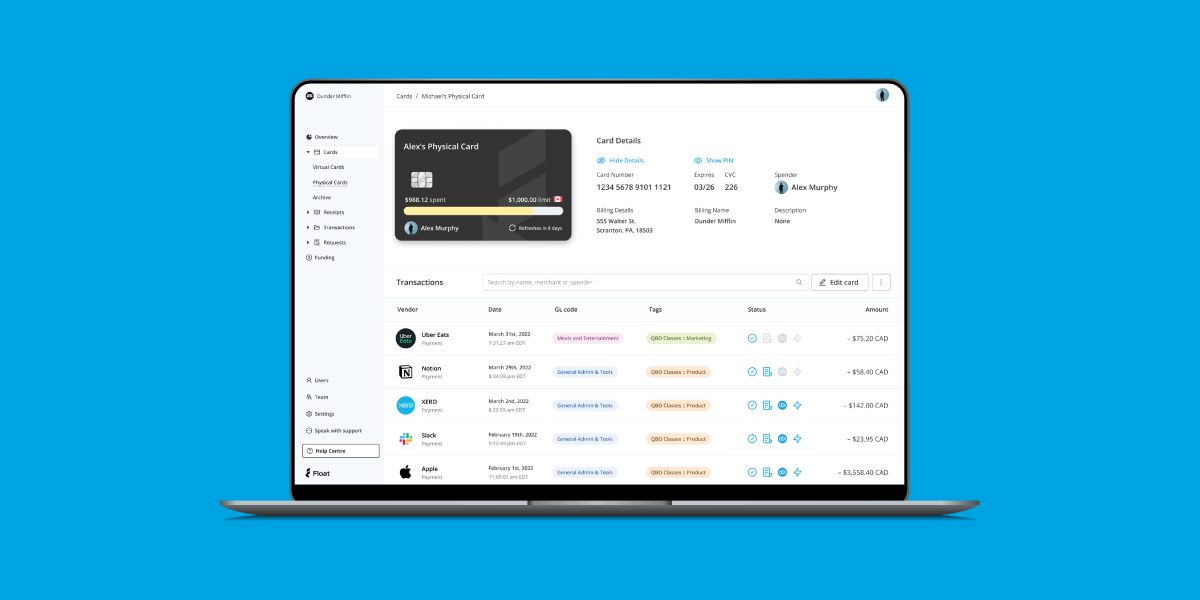

We weren’t going to tell you all of the amazing things that come with a healthy spending culture, without a REAL solution. 😆 Cause we sure have one for you! Float’s automation software and corporate cards are designed to bring every organization into their financial prime.

Our automation spend software serves as a core component of the infrastructure needed to achieve a healthy spending culture. Why? It empowers startups to establish financial policies, simplify complex processes and garner more visibility into company spending so they can keep a pulse on their finances at all times. Leaders can set category spend controls, maintain project budgets and drive operational efficiency in their financial departments, with full insight into financials and reporting in real time.

They can authorize transaction and category spending in advance, giving employees greater freedom to act on innovative ideas and make critical purchase decisions faster. Not to mention, they can have a closer eye on where their money is going, who’s spending it and what it’s being spent on. 💰👀 This creates a workplace where employees feel empowered to take action, make valuable decisions and have a hand in driving the company toward growth. Bonus: startups in particular can motivate their employees to view corporate spending as a team effort that should be done mindfully, honestly and strategically. 👍🏽

At Float, a big part of our mission is promoting a healthier spending culture by simplifying the way your team spends, tracks and manages your money. Backed by automation software, our corporate cards are approved in one day and delivered to you within three! No long wait times. No complicated processes. No headaches.

If improving the spend culture in your company is top of mind, connect with us today to learn more about how we can help!