Paying invoices from Mexico can be a complex process, but understanding the steps involved is essential for businesses to maintain smooth operations and good relationships with Mexican vendors. By familiarizing yourself with the invoice payment process in Mexico, you can ensure timely and accurate payments while avoiding potential delays and extra fees.

In this guide, we’ll walk you through the steps involved in paying an invoice from Mexico, including choosing the right payment method, gathering necessary information, and handling any issues that may arise. By following these guidelines, you can streamline your international financial transactions and maintain compliance with local regulations.

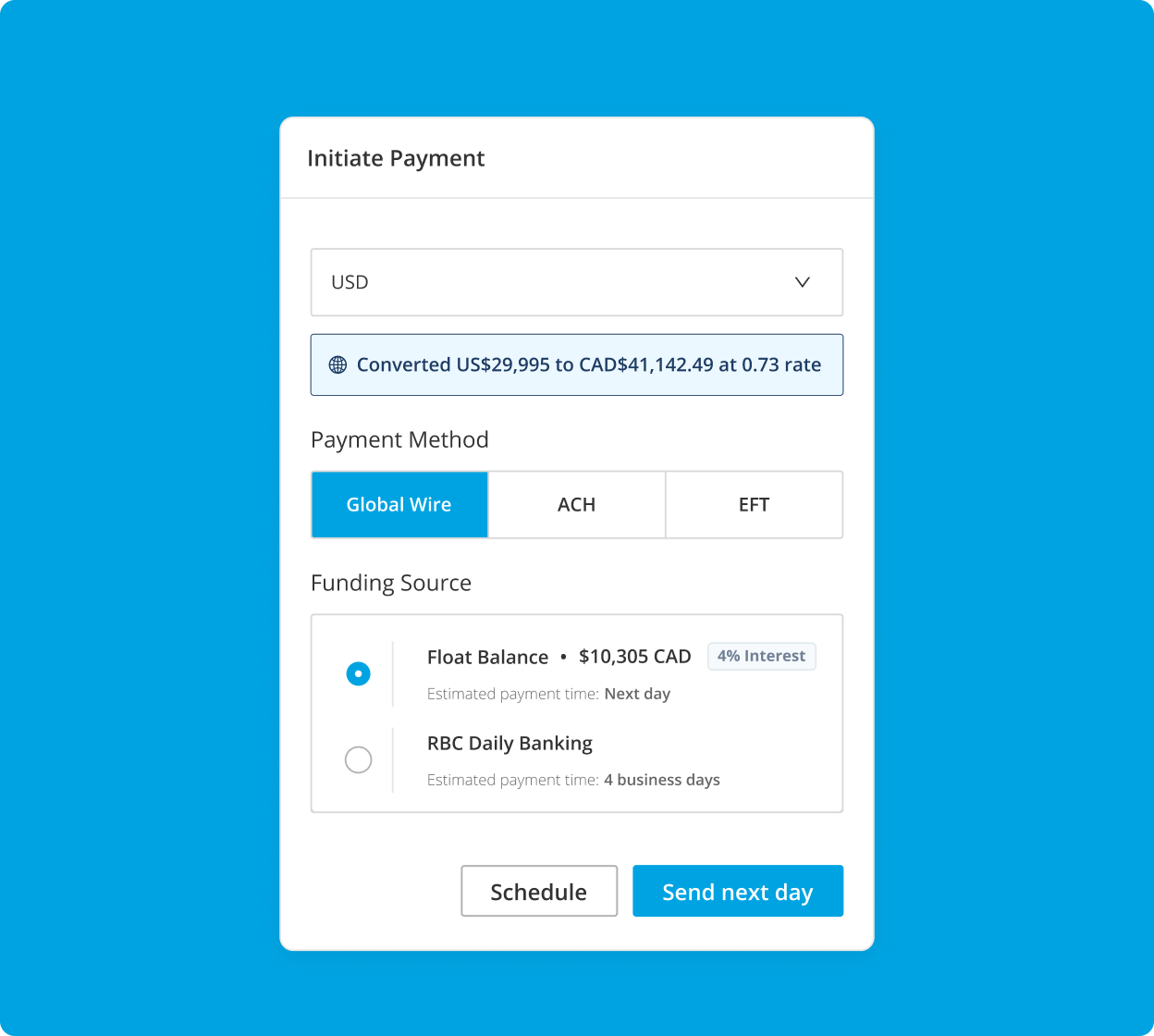

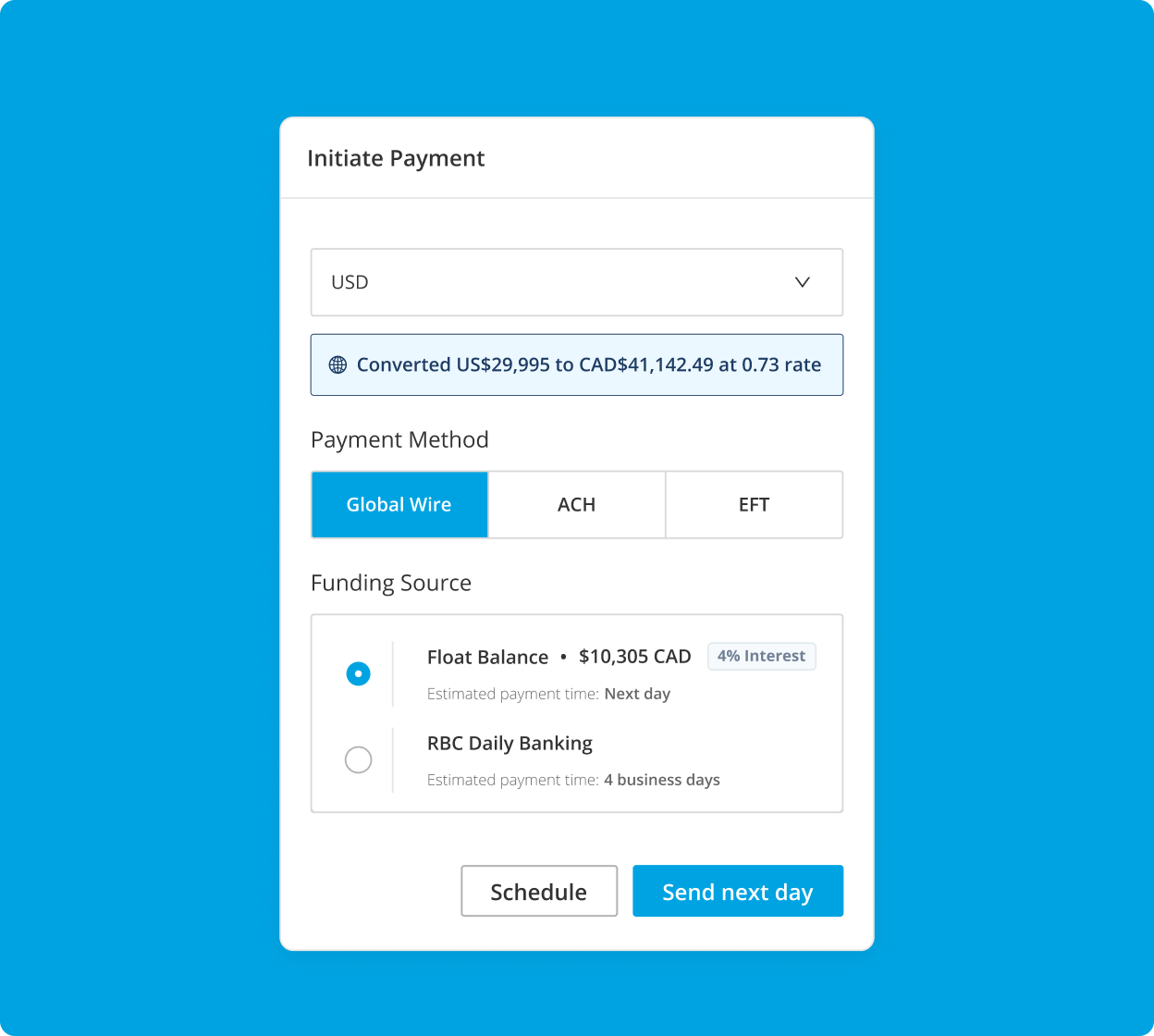

Pay Mexico Bills with Float

Canada’s best-in-class Payments platform for Global Wires, EFT, and ACH payments — plus average savings of 7%.

What is the invoice payment process in Mexico?

The invoice payment process in Mexico involves specific steps to ensure timely and accurate payments. It includes understanding payment methods, gathering necessary information, and following correct procedures to avoid delays and extra fees.

Why is understanding how to pay an invoice from Mexico important?

Understanding how to pay an invoice from Mexico is crucial for businesses to maintain good relationships with Mexican vendors, avoid payment delays, and ensure compliance with local regulations. It also helps in managing international financial transactions efficiently.

How to pay an invoice from Mexico

Paying an invoice from Mexico involves several steps, each of which is important to ensure a smooth and successful transaction. Choosing a reliable payment method and understanding the process is crucial to avoid delays and extra fees.

Step 1: Choose the right payment method

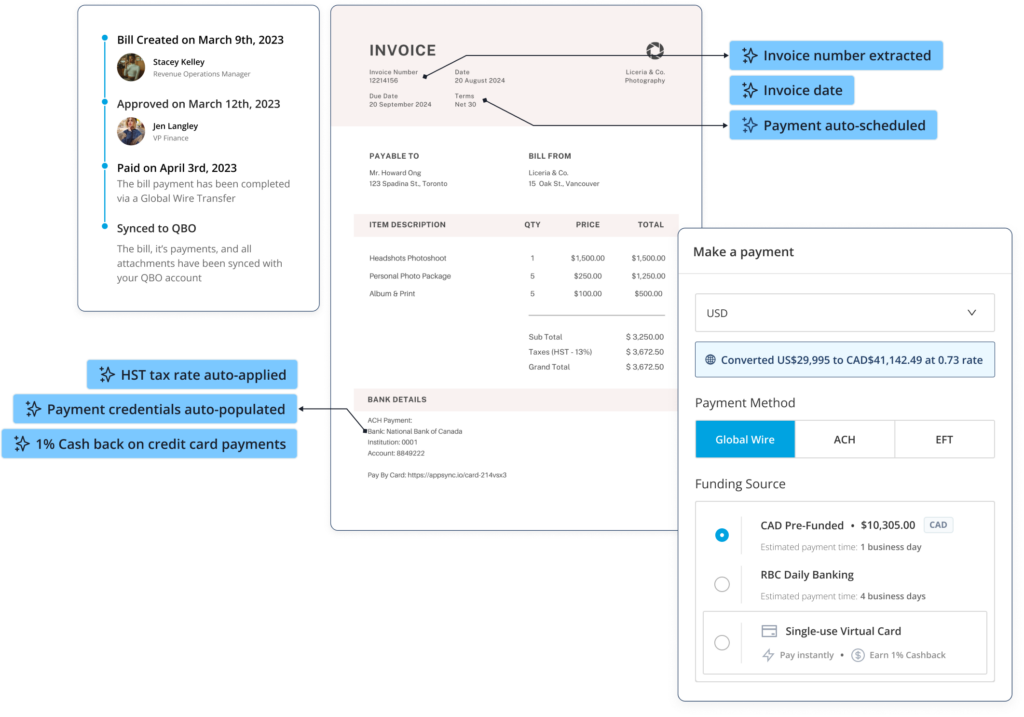

When paying an invoice from Mexico, you have several options, including bank transfers, online payment platforms, and payment services. Consider factors like fees, processing times, and convenience when selecting the best international payment methods for your needs.

Step 2: Gather necessary information

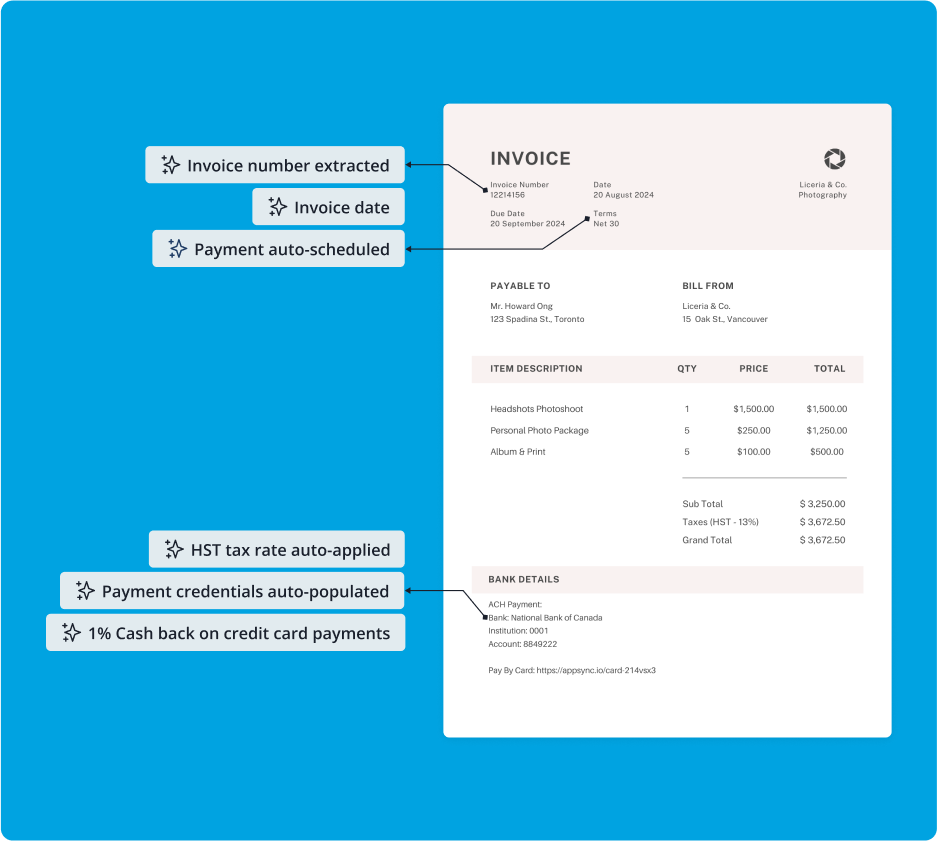

Before initiating the payment, ensure you have all the necessary information, such as the recipient’s bank details, invoice number, and payment amount. Verifying the accuracy of this information is crucial to avoid payment failures. Using the best accounts payable platform can help streamline this process.

Step 3: Initiate the payment

Once you have chosen your payment method and gathered the necessary information, you can initiate the payment. The specific steps will vary depending on whether you’re using an online platform, bank transfer, or payment service. Be sure to follow the instructions carefully and double-check all details before submitting the payment. When paying from the US, consider using services that specialize in paying bills from US to Mexico to ensure a smooth transaction.

Step 4: Confirm the payment

After initiating the payment, it’s important to check the payment status and confirm receipt with the vendor. This helps ensure that the transaction was successful and allows you to address any issues promptly. Keeping records of the confirmation for future reference is also a good practice.

Step 5: Handle any issues

In some cases, you may encounter issues such as failed transactions or incorrect details. If this happens, it’s important to take steps to resolve the issue quickly and efficiently.

Pay Mexico Bills with Float

Canada’s best-in-class Payments platform for Global Wires, EFT, and ACH payments — plus average savings of 7%.

Tips on avoiding payment delays

To minimize the risk of payment delays when paying invoices from Mexico, consider the following tips:

- Verify all details before initiating payment: Double-check recipient information and payment amounts to ensure accuracy.

- Choose the right payment method based on your needs: Consider factors like fees, processing times, and reliability when selecting a payment method.

- Keep records of all transactions: Maintain documentation for future reference and tax purposes.

- Communicate regularly with vendors: Ensure clear communication to address any issues promptly and maintain good relationships.

The Best Solution for Paying Invoices from the UK

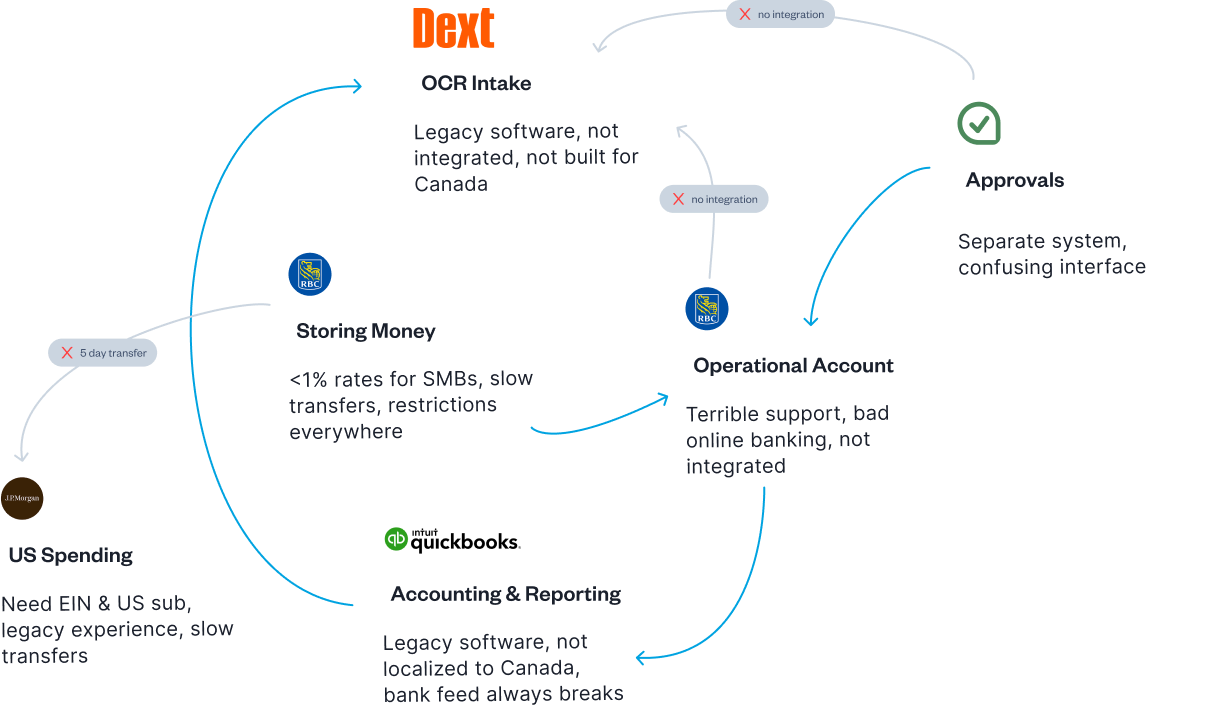

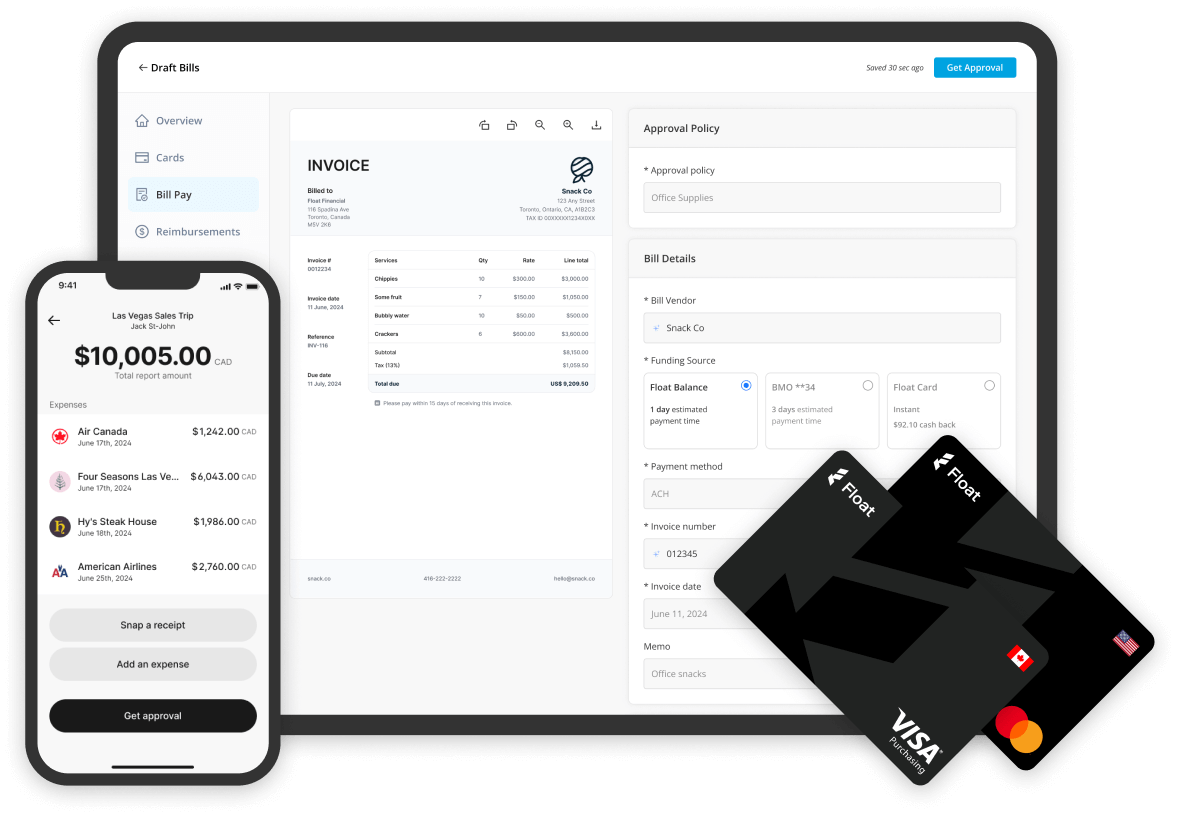

When it comes to paying invoices from Mexico, using a dedicated bill pay service can greatly simplify the process and provide additional benefits. A reliable bill pay solution should offer features like Global Wires for international payments. By using a comprehensive bill pay service, you can enjoy a centralized platform for managing all your invoice payments, regardless of the payment method or currency. This streamlined approach saves you time, reduces the risk of errors, and provides greater visibility into your financial transactions.

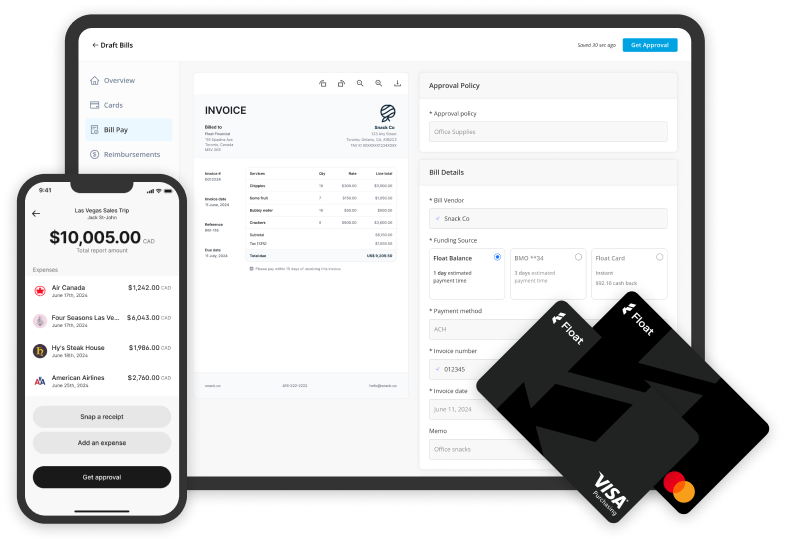

At Float, we understand the importance of streamlining your invoice payment process and ensuring smooth transactions with your Mexican vendors. Float’s user-friendly platform and expert support team are here to help you navigate the complexities of international payments.

Frequently Asked Questions

The best methods to pay invoices in Mexico include bank transfers, online payment platforms, and payment services. Choose the method that best suits your needs based on fees, processing times, and convenience.

Yes, you can pay invoices online from the US to Mexico using various payment services and platforms. Look for providers that specialize in international payments to ensure a smooth transaction.

To pay an invoice in Mexico, you’ll need the recipient’s bank details, invoice number, and payment amount. Double-check all information for accuracy before initiating the payment.

Payment processing times in Mexico can vary depending on the payment method used. Bank transfers may take several business days, while online payment platforms often offer faster processing times.

Float is Free to use on our Essentials plan, where you will be able to issue unlimited virtual CAD/USD cards, earn 4% interest on deposits, reimburse employees and pay vendor bills. If you need more sophisticated functionality, like over 20 physical cards, Netsuite integration, or an API solution, you will have to consider our paid Professional and Enterprise plans.

Float offers Charge Card and Prepaid funding models. You can apply (*Conditions apply. Book a demo to learn more) for unsecured, 30-day credit terms with high limits up to $1M, no credit checks and personal guarantees. Prepaid model offers 4% interest on all deposits with no cash lockups with account opening in < 24 hours.

Unlike traditional cards that get you to spend more, Float is the only corporate card in the world that helps businesses spend less. Through a combination of financial rewards like our 1% cashback, 4% interest on deposits, no FX fees with our USD cards and time savings of at least 8 hours per employee Float’s customers on average save 7% on their spend.