Why Better Corporate Spending Starts With Strong Policies

They say if you follow all the rules, you miss out on all the fun. But when it comes to your financial policies, you’ll want to ensure your team knows every single one!

The road to better corporate spending is always smoother when there are robust financial policies in place. They instantly map out expectations from every employee and link their actions directly to the bottom line. For startups in particular where growth is fast and expenses pile on quick, this is even more essential. These policies act as a bridge between your finance team and employees and formally outline the “boundaries” of corporate spending in your organization. When everyone is aligned on this, you can expect greater compliance, lower risk of expense fraud and a healthier spend culture.

It keeps everyone aligned on spending goals 💰

By formally outlining financial policies, it’s an opportunity to get employees aligned and informed on the larger financial goals of the company. These policies communicate key financial expectations related to the distribution and use of corporate cards, spending responsibility as well as transaction limits across all departments. ✅ They also help to clearly define roles when it comes to spend and expense management. Having these policies in place are especially important during onboarding as you can set expectations early on and build a healthy spend culture from the moment they join. 👍🏼

It enables greater oversight and spend control 👀

As your team grows and more corporate cards are assigned, it becomes even more critical to have financial guidelines for spending – especially from a risk management standpoint. With more people having access to corporate funds, greater oversight and control is needed.

At Float, we take this one step further by allowing managers not only to create policies but to distribute corporate cards with predefined limits. Not only does this allow you to protect your business but it also empowers employees to make smart spending decisions in a fast and reliable way – without long approval wait times.

It can save time and money with the help of automation 🙌🏾

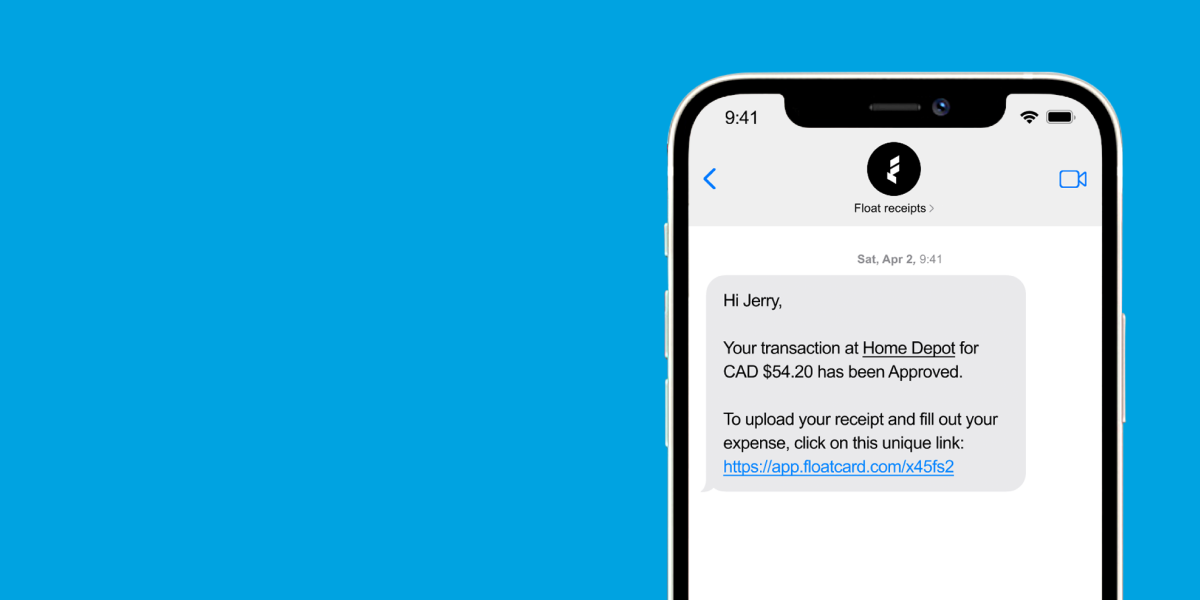

Setting financial policies eliminates a lot of frustration and wasted time – especially during critical times like month-end. When you add automation into the mix, it’s even easier! Smart spend software like ours at Float can help to promote your financial policies and encourage compliance through a range of key features. 🤩 For example, our receipt collection feature not only allows companies to set a standard for how they wish to track and manage daily transactions but it also holds employees accountable to their spending. Once a transaction is made, employees are instantly prompted to submit a photo of their receipt. 🤳🏻 And if they don’t, finance managers can auto-lock the card after a certain number of receipts are left unsubmitted.

At Float, we empower startups and SMEs to establish financial policies, simplify complex processes and gain more visibility into company-wide spending. We want to ensure that you’re equipped with everything you need to grow your team, spend smarter and keep a pulse on your finances at all times. Book a demo with us today and learn how Float can help you!