What Bank of Canada Rate Cuts Mean for SMBs in 2025

Bank of Canada rate cuts are gaining momentum. But is your business ready to make the most of them?

Many follow the Bank of Canada’s decisions closely—individual consumers, business leaders and investors here and abroad—because those decisions affect so many aspects of day-to-day life, from the cost of groceries to mortgage payments to business forecasting. In fact, high interest rates and fees on financial products rank as the second-biggest financial challenge for SMBs in 2024, surpassed only by the burden of high operating costs.

Right now, many are crossing their fingers for another rate cut to bring some relief, freeing up cash flow and injecting a hint of optimism across the country.

But for small- and medium-sized businesses (SMBs) in particular, a Bank of Canada interest rate cut is only as valuable as the strategy in place to capitalize on its benefits. How will a rate cut change your borrowing decisions? What about earning on cash? Where will it boost spending, if at all?

This article explores what a Bank of Canada rate cut is, what it means for SMBs across the three main pillars of money management—borrowing, earning, and spending—and how to strategically leverage lower interest rates to thrive in this next phase of Canada’s economy.

What is a Bank of Canada rate cut?

A Bank of Canada rate cut is a decision by the country’s central bank to lower the overnight interest rate for lending in an effort to keep inflation low, stable and predictable, ideally around 2%. Major banks and other lenders use this as a benchmark rate to set their prime rates, so changes to the Bank of Canada overnight rate cascade through the financial sector rapidly following a rate decision.

Part of the larger monetary policy framework, rate cuts (versus rate hikes) are a response to economic slowdowns, aiming to stimulate growth by making it cheaper to borrow, which in turn encourages spending and investment.

Created in response to the Great Depression in 1934, the Bank of Canada is a crown corporation designed to help maintain Canada’s financial system across five main areas of responsibility:

- Monetary policy – set inflation-control target and flexible exchange rate

- Financial system – foster stable and efficient financial system, which includes banks, credits unions, markets and clearing/settlement systems

- Currency – design, print and distribute money

- Funds management – provide services to the Government of Canada

- Retail payments supervision – oversee payment service providers, ensuring standards and minimizing risk

Why does the Bank of Canada decide to cut interest rates?

A lot of factors go into deciding if and by how much the Bank of Canada decides to cut interest rates, including economic indicators such as:

- inflation rates

- employment data

- GDP growth

- consumer spending

- business investment trends

Global economic conditions, currency exchange rates, and financial market stability also play a role in the decision, as well as household debt levels, the housing market and how effective the previous rate changes have been in influencing economic activity. It’s a tricky balancing act between fostering economic growth (good for everyone) without triggering a rise in inflation (very, very bad).

So what does a rate cut indicate about Canada’s economic outlook?

Ultimately, a rate cut is a sign of an economic weakness. It means the Bank of Canada, and by extension the government, believes the economy is suffering from extremely low growth and wants to encourage both consumers and businesses to start spending more.

5 years of rates hikes and rate cuts

Leading up to the pandemic, interest rates saw only minor fluctuations since inflation was relatively stable, especially from 2018 to 2020. But when Covid hit in early 2020, the Bank of Canada cut interest rates to 0.5% because the pandemic caused widespread economic disruption, leading to a sharp decline in consumer spending, business activity and overall economic growth. The drastic rate cut was aimed at stimulating the economy by making borrowing cheaper and encouraging investment and consumption.

The result?

A temporary boost to economic activity and a period of increased liquidity in financial markets. But as the economy began to recover, inflation soared, reaching a multi-decade high of 8.1% in 2022. During this period, the cost of borrowing for businesses hovered around 10%.

Still, the Bank of Canada kept the interest rate hovering just above zero until March of 2022, when they announced their first in a series of back-to-back hikes—sometimes jumping as much as 1% at a time—which carried through to the end of the year and into the beginning of 2023.

The Bank of Canada held steady, at 5.25%, for over a year before inflation fell (and held) closer to the 2% target. June of 2024 saw the first of five rate cuts that year, with another quarter point at the top of 2025. The Bank of Canada also declared an end to quantitative tightening. In simple terms, they’re signaling confidence that inflation is under control and easing restrictive policies on the economy. It’s a way of telling Canadian businesses that now is the time to invest in growth.

Source: Statistica

Bank of Canada interest rate schedule (2024 & 2025)

The Bank of Canada makes an overnight rate announcement eight times per year, or every six weeks.

The table below shows the scheduled dates for rate announcements in 2024 and 2025.

How does a Bank of Canada rate cut impact Canadian SMBs?

When considering the impact of interest rate cuts on Canadian SMBs, we can focus on three key areas of money management: borrowing, saving, and spending.

Impact on borrowing

Many SMBs have variable interest rates, which means the cost of borrowing money can fluctuate greatly with these Bank of Canada announcements. When a rate cut occurs, the cost of servicing your business’s debt decreases, reducing your debt-related expenses and freeing up capital for other priorities. Lower borrowing costs can make it more appealing to take on new loans for growth initiatives, such as expanding operations, upgrading equipment or hiring additional staff.

Impact on earnings from cash

The flipside of lower borrowing costs is that interest-earning rates also decline, which makes saving cash a relatively less attractive option for businesses. As a result, businesses may opt to allocate funds toward investments or operational expenses rather than parking them in savings accounts that yield minimal returns.

Another consideration is the impact on long-term financial planning. With lower interest rates, you may need to reassess your strategy for building cash reserves, especially if you have relied on interest income as part of your financial cushion over the past few years.

Impact on spending

Rate cuts incentivize businesses to spend more, which means there is generally more money floating (excuse the pun) around in the economy and less being stockpiled for a rainy day/year/decade. For businesses that borrow, a rate cut can translate into greater access to credit and increased funds available for spending on growth initiatives, operational improvements, or day-to-day needs.

Despite the incentives to spend, many Canadian SMBs are still burdened by high expenses leftover from the pandemic-induced inflation. Rising costs for supplies, wages, and other overhead have eaten away at their margins, leaving some businesses hesitant to fully embrace increased spending. “We’ve been able to control the labor line at our stores to avoid uncontrollable bleeding, but really need to build the sales volume back up to get to a healthy margin,” writes one Ontario restaurant owner on an SMB thread on Reddit. “Labor and food cost has been a problem for us the last 18 months as well.”

But that’s not the only reason SMBs are hesitant to pull the spending trigger. There’s also a lack of trust in the government’s ability to manage economic volatility, which adds another layer of caution. Worries about the long-term stability of the economy and future financial imbalances and even unexpected policy reversals run high among business and finance leaders alike.

While rate cuts open up a range of opportunities for growth, SMBs should weigh their decisions carefully before making major changes to any of the above areas of money management.

But wait, there’s more: Increasing gap between loonie and USD

While Canada has implemented several interest rate cuts this year, the US has only made one, creating a growing disparity between the two countries’ interest rates. This gap directly weakens the value of the Canadian dollar (the loonie) against the US dollar.

But why does a weaker loonie matter?

As an export-heavy economy, Canada benefits in some ways from a weaker dollar. It makes Canadian products and services more affordable for Americans, potentially boosting exports. However, this advantage is offset by the looming threat of tariffs, which could make these goods more expensive for US buyers and reduce their appeal.

On the flip side, if your business relies on foreign inputs—whether that’s paying for tools, software, contractors or staff in USD—the weaker loonie can drive up costs significantly. Anything priced in US dollars becomes more expensive, putting additional strain on Canadian SMBs.

Cutting interest rates at three times the pace of the US also reflects a weaker Canadian economy by most objective measures. With a less competitive currency, the loonie becomes less attractive to global investors, further reducing demand and investment in Canada. While this does help exporters, it highlights the broader challenges Canadian SMBs face in navigating a fluctuating economy and an increasingly devalued currency.

7 tips for making the most of a Bank of Canada rate cut

A Bank of Canada rate cut can be a game-changer for SMBs. But making the most of it requires a clear strategy across borrowing, earning and spending—three key areas where thoughtful decisions can drive long-term growth and stability.

Borrowing

A rate cut is the perfect opportunity to revisit your borrowing strategy. Here’s how to make the most of it.

1. Refinance existing debt: If refinancing at a lower rate is an option for your business, take advantage of it. Whether a fixed or variable rate is better depends on your business goals and financial forecasts. Variable rates can be particularly appealing during a rate cut cycle, as they allow you to capitalize on ongoing reductions.

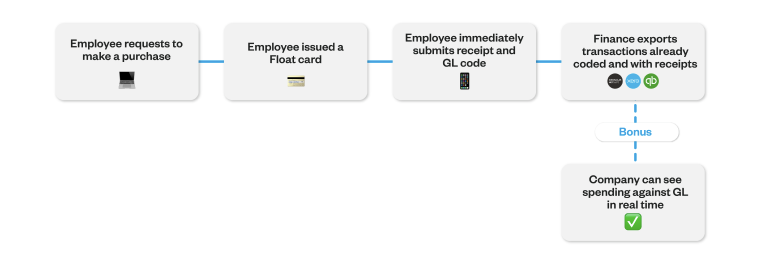

2. Leverage your finance team for borrowing strategies: If you have a Director or VP of Finance, this is their time to shine. They can provide strategic guidance on how to structure debt in a way that aligns with your business growth. Even if your finance team is small, ensure their expertise is focused on strategic tasks like optimizing borrowing decisions—not wasted on manual processes like expense management. A recent Float survey found that half of all Canadian SMBs spend up to 40 valuable hours per month on payments and reconciliation processes. Accounting automation with tools like Float can free up their time to make smarter, data-driven decisions.

Earning

Lower interest rates mean banks and lenders are likely to reduce the interest they pay on earnings. To make the most of your cash reserves, be proactive.

3. Shop for the best rates on cash reserves: Not all financial institutions are created equal. Even though rates will drop across the board, some started with higher baseline rates than others. Look for options with more competitive offerings. For instance, Float Yield is currently offering 4% interest.

4. Involve your controller for strategic earning research: Your controller can help evaluate earnings opportunities by comparing options and identifying accounts or tools that maximize your interest earnings. Like your finance team, their expertise is most valuable when focused on strategic contributions, not tedious administrative tasks (hint: a good time to calculate how much money you can save with software).

Spending

This is the big fish, where you can have the most impact on your business. But it does require a thoughtful approach.

5. Analyze your ROI before increasing spend: Now is the time to evaluate your spending decisions carefully. Create ROI frameworks to identify what’s working well in your business and double down on those areas. For example, where did you see the best returns over the last five wild years? Which products, services, or strategies accelerated your growth? Focus your spending on those proven areas.

6. Invest in high-return areas: Consider whether spending more on specialized talent, operational tools to improve efficiency, or R&D for new product development could generate a strong return. These areas can be game-changers if strategically timed with a rate cut.

7. Be cautious about debt in unproven areas: Avoid piling on debt for areas that don’t have a proven return. This isn’t the time for risky investments or overspending. Use ROI calculators or simple ROI math (gross profit divided by costs) to validate whether a spending decision is worth pursuing.

Even with a small finance team, a CFO or controller can bring a strategic lens to these decisions, helping you allocate resources effectively while steering clear of unnecessary risks. Investing during a rate cut can help your business grow, but only if you prioritize thoughtful, high-ROI opportunities.