As a business owner, you know that managing your company’s finances is crucial to its success. One key aspect of financial management is understanding accounts payable (AP) and how it impacts your business’s cash flow and relationships with vendors.

In this article, we’ll dive into the essentials of accounts payable, including what it is, how the AP process works, and best practices for effective AP management. By the end of this guide, you’ll have a solid grasp of AP concepts and be better equipped to streamline your company’s AP processes.

What is Accounts Payable (AP)?

Accounts payable (AP) refers to the money a company owes its vendors for goods or services purchased on credit. AP is recorded as a current liability on the company’s balance sheet. The AP department is responsible for processing and paying vendor invoices, and maintaining vendor relationships.

The Accounts Payable Process

The AP process typically involves:

- Bill Intake — Receiving and verifying vendor invoices and setting up AP in the accounting system. This step is often managed in a centralized finance email inbox.

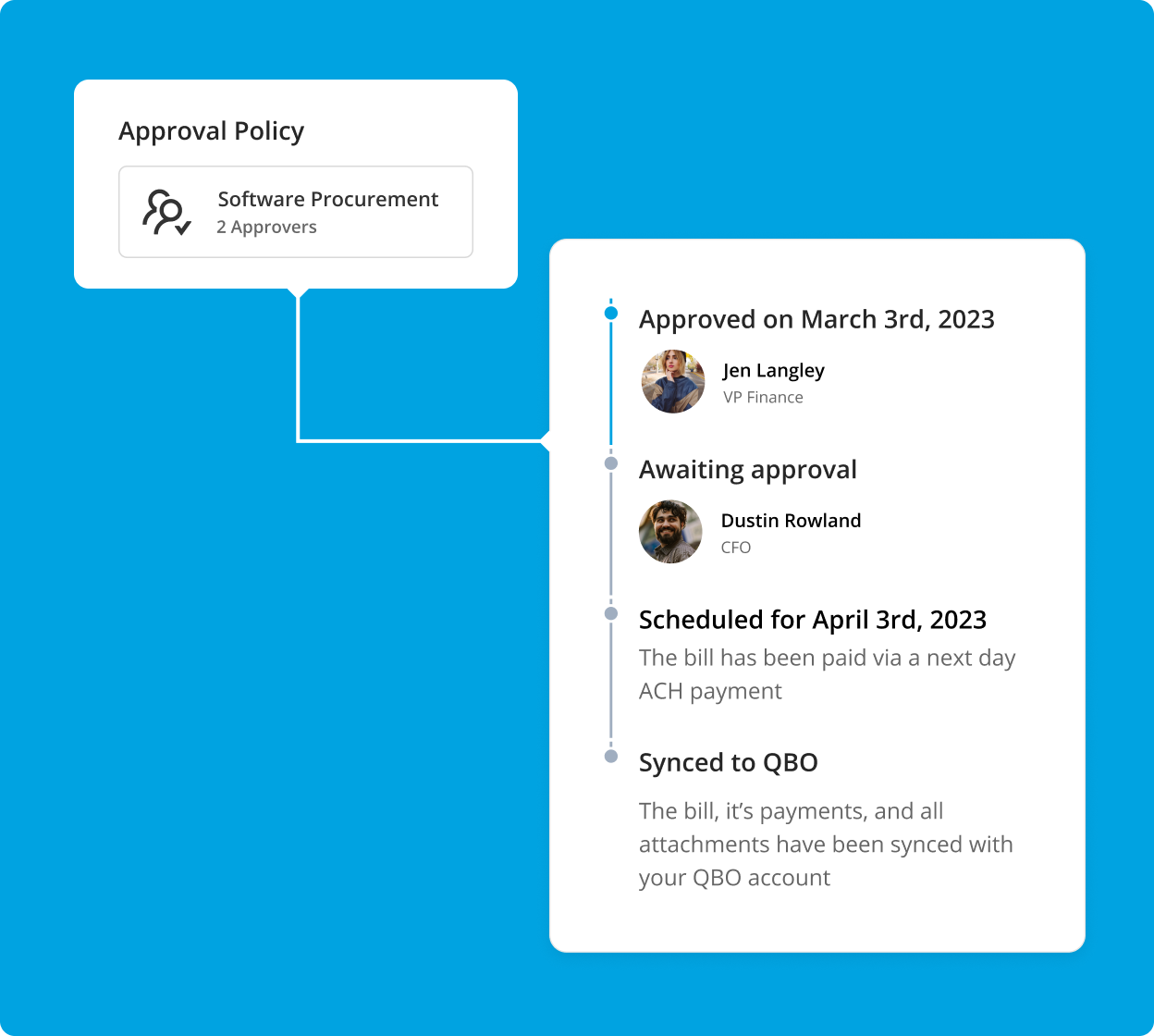

- Approvals — Obtaining approval for payments

- Payments — Processing payments to vendors

- Accounting Sync — Reconciling invoices and payments

Key takeaway: Efficient AP processes are critical for maintaining positive vendor relationships and avoiding late payment fees.

What to Look for in an AP Solution in 2024?

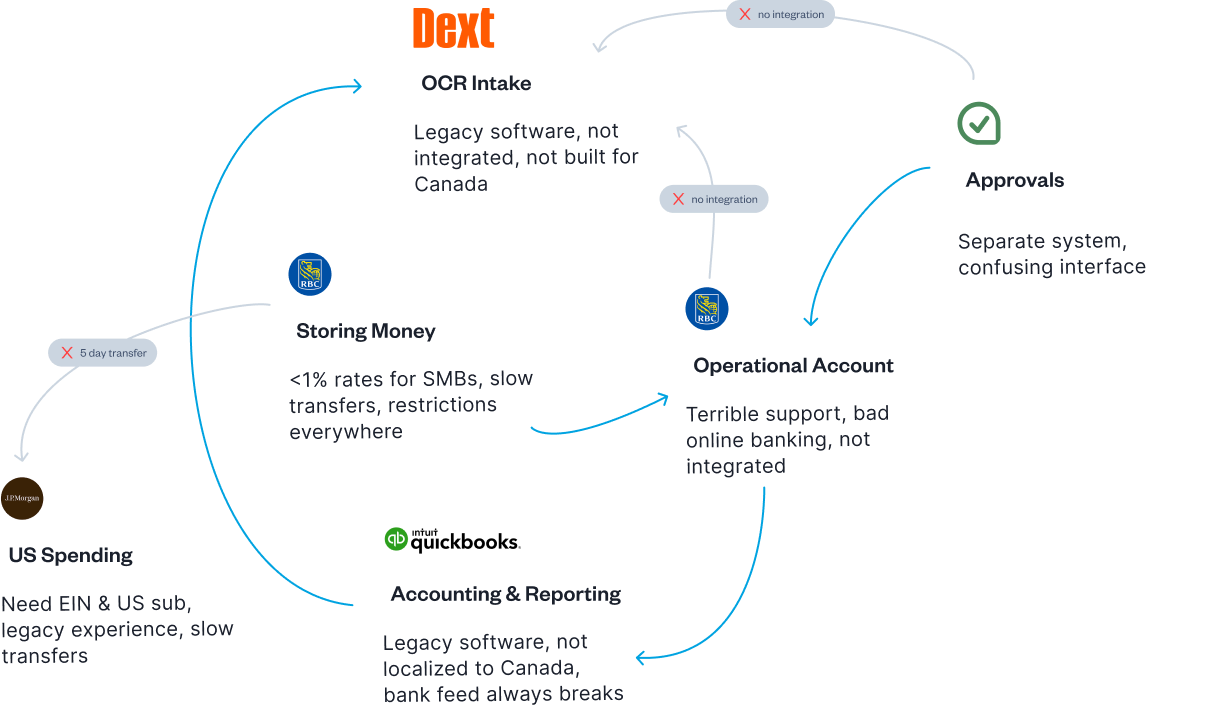

The messy “status-quo” in Canada

A lot of businesses are stuck with the same legacy setup for Accounts Payable in Canada in 2024. They use three or four separate tools just to manage the AP file:

- Dext or Hubdoc inbox for bill intake and OCR

- ApprovalMax for bill approvals

- Accounting system to track of the unpaid bills and schedule payments

- Bank portal to initiate money transfers

While this setup automates many parts of the AP process, it’s incredibly expensive, the integrations between softwares often break and need to be reconnected, and you are probably not going to save any time with this setup unless you are processing massive payments volumes every month.

The desired “state-of-the-art” solution

The ideal solution is a consolidated platform that features:

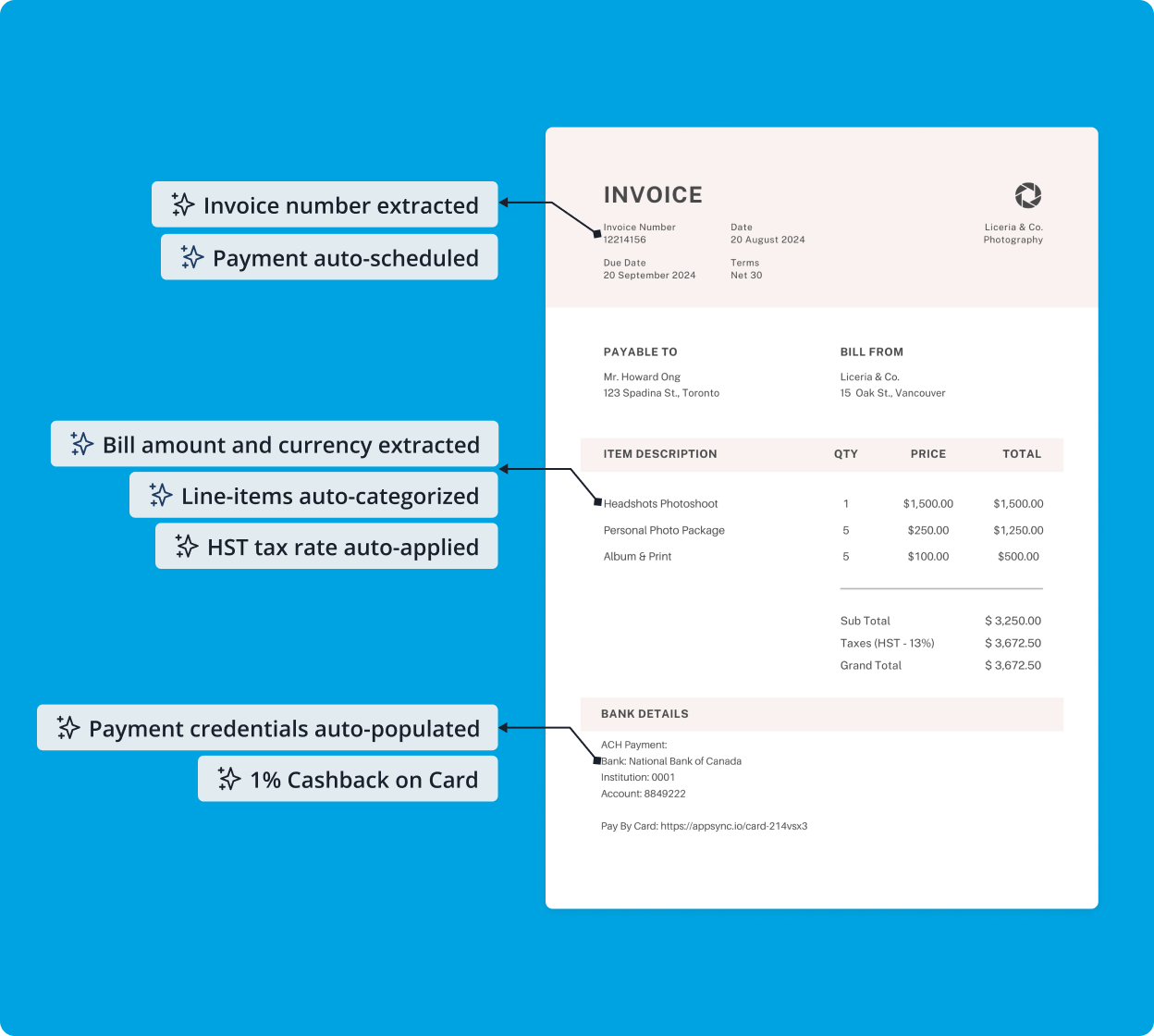

- Best-in-class AI document extraction experience

- Custom approval workflows

- Embedded EFT/ACH/Wire payments

- Built-in FX services

- Real-time two-way Accounting Sync

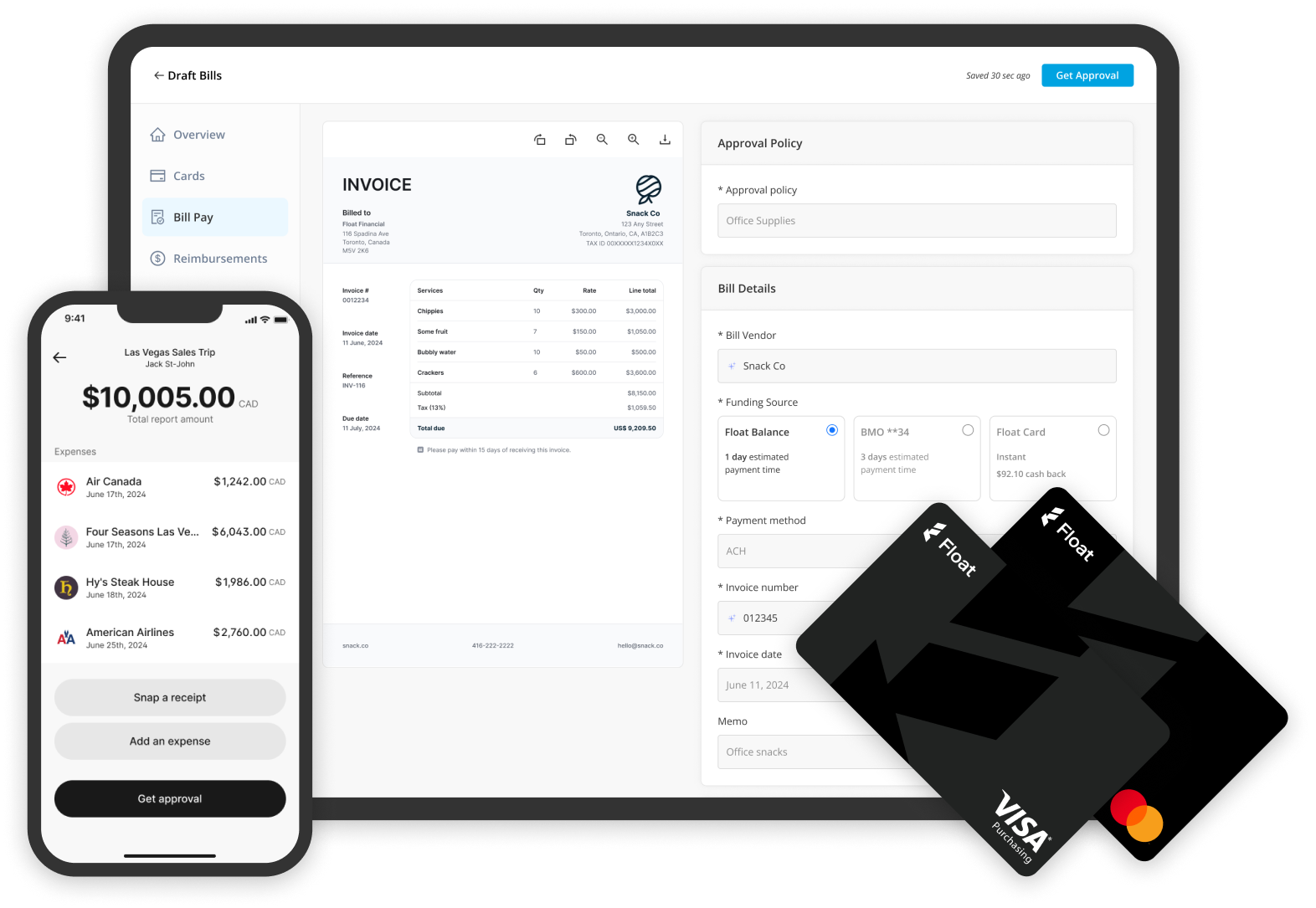

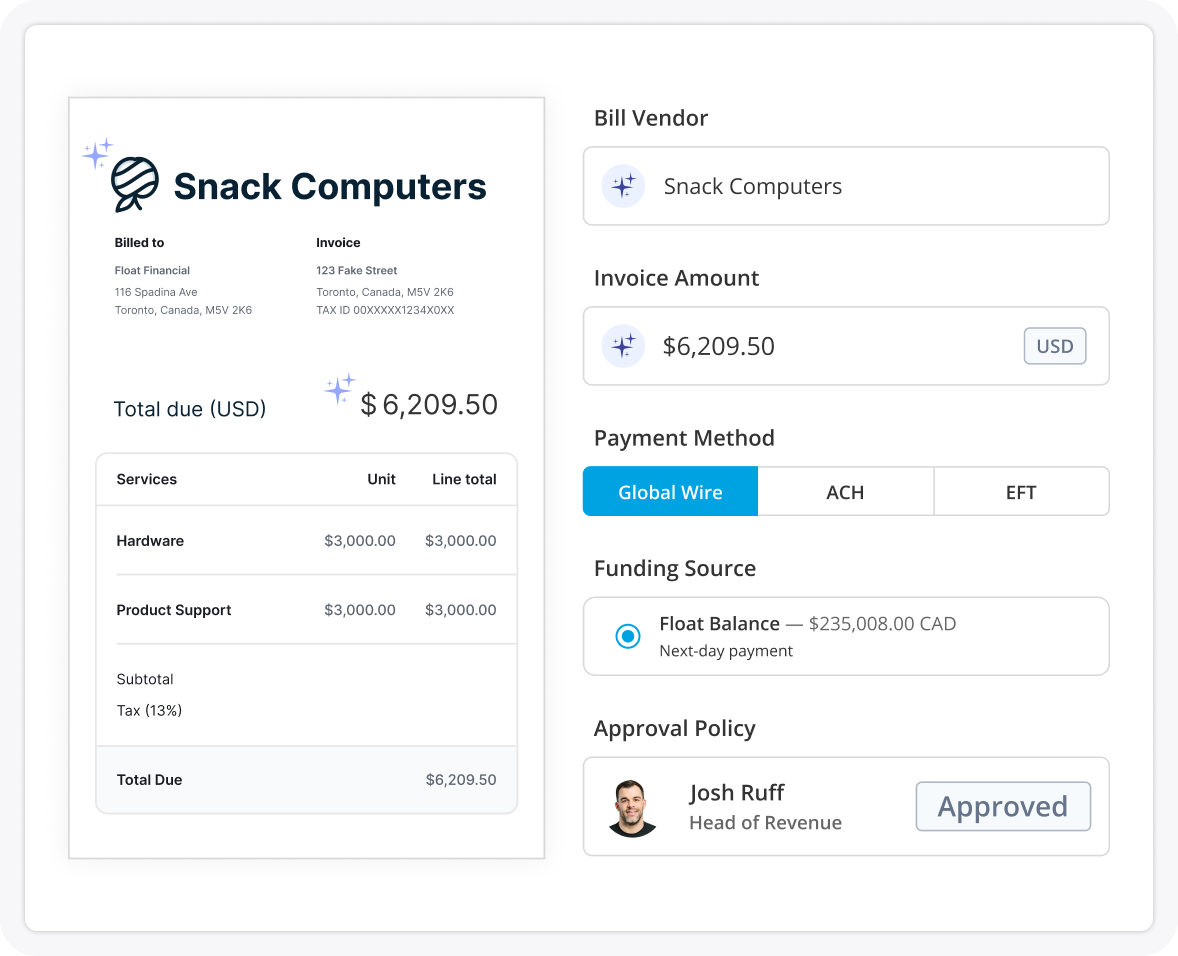

Good news, Float offers an all-in-one Accounts Payable solution for USD and CAD expenses.

Float is Canada’s Only All-in-one AP Solution

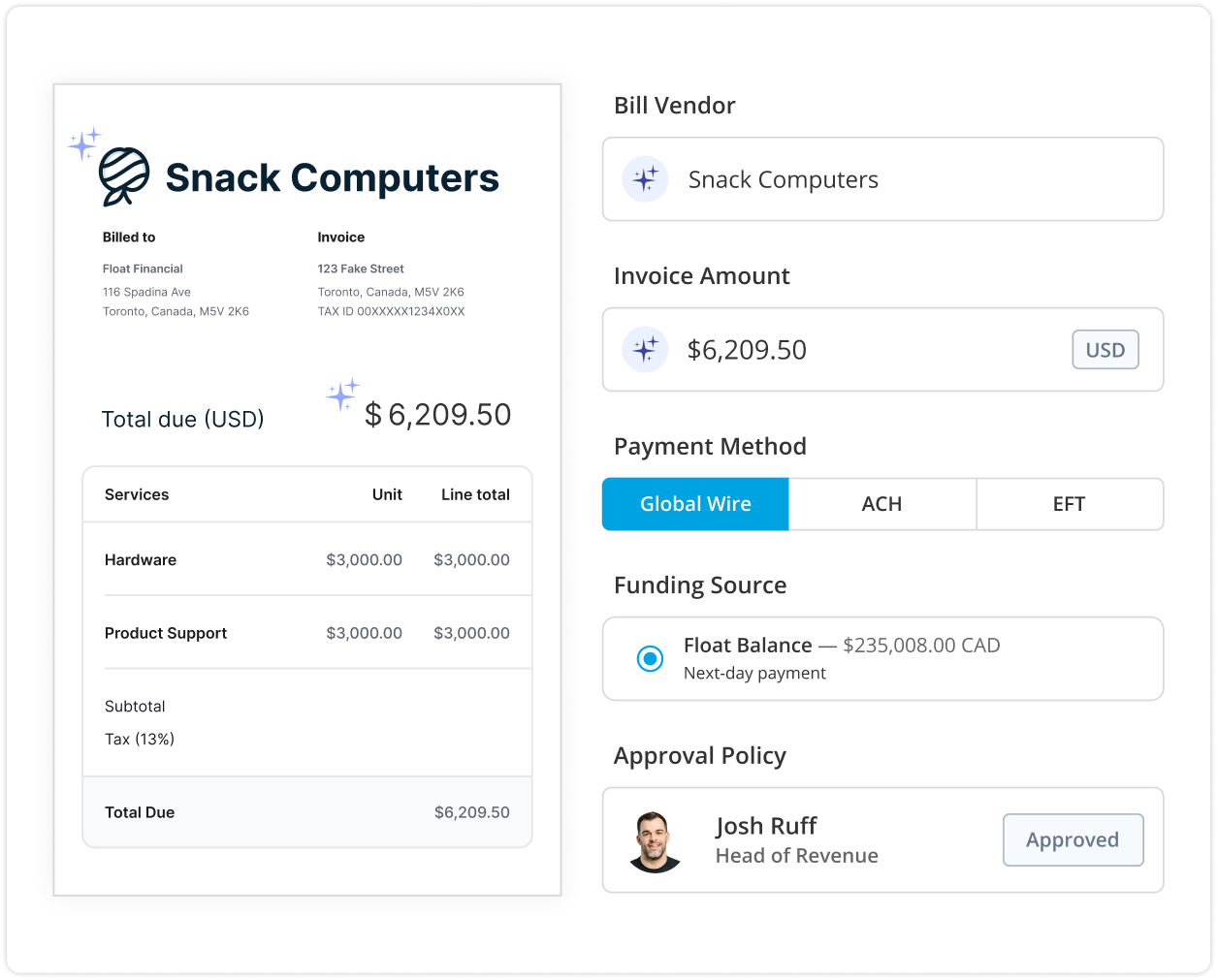

Automate bill intake, approvals, accounting sync, and pay anyone in the world with Float’s Bill Pay — plus unlock 7% savings on your spend.

Automate intake with Float’s AI powered OCR and inbox integrations

Streamline approvals with flexible workflows and policies

Pay via Global Wires, EFT, or ACH with Float’s next day payments

The Importance of Accounts Payable Management

Effective AP management ensures timely payments to vendors and helps maintain a company’s credit standing. Streamlined AP processes can help improve cash flow by taking advantage of early payment discounts. Proper AP management reduces the risk of fraud and duplicate payments. Accurate AP records are essential for financial reporting and audits.

Accounts Payable Automation

AP automation software streamlines the invoice processing and payment workflow. Key benefits of AP automation include:

- Reduced manual data entry and errors

- Faster invoice approvals and processing times

- Improved visibility into outstanding liabilities and cash flow

- Better control over payment timing to optimize working capital

Pro tip: When selecting an AP automation solution, look for a best accounts payable platform that integrates with your existing accounting system.

Accounts Payable Best Practices

- Implement standardized AP processes and policies

- Leverage AP automation to reduce manual tasks and errors

- Take advantage of early payment discounts when possible

- Regularly review and reconcile AP aging reports

- Maintain open communication with vendors to resolve any invoice discrepancies quickly

- Use Float Bill Pay for efficient and secure vendor payments

Accounts Payable Metrics to Track

- Days Payable Outstanding (DPO): measures the average time it takes to pay vendors

- Invoice processing time: tracks the efficiency of the AP process from invoice receipt to payment

- Early payment discount capture rate: shows the percentage of available discounts captured

- Electronic invoice adoption rate: indicates the level of automation in the AP process

- Vendor satisfaction score: assesses the strength of vendor relationships based on timely payments and communication

How to choose the right solution?

Choosing the right accounts payable solution in Canada for 2024 involves several important factors. First, consider automation capabilities. Look for software that offers automated invoice processing to reduce manual entry and minimize errors. Automation can save your team time and help ensure accuracy in managing payables.

Next, focus on integration. The accounts payable solution should integrate seamlessly with your existing accounting software, such as QuickBooks or Xero. This allows for smooth data flow, accurate financial reporting, and reduces the risk of discrepancies between systems.

Scalability is another key factor. If your business is growing, choose a solution that can scale with you, handling increased transaction volumes without a drop in performance or user experience. This helps future-proof your accounts payable processes as your business expands.

It’s also important to ensure the software offers robust security features to protect sensitive financial data. Security measures like encryption and multi-factor authentication can provide peace of mind.

Finally, ask your network about which solutions work well for them. Peer recommendations can provide valuable insights into the most effective tools for accounts payable management, helping you make a more informed decision.

“Float’s Bill Pay has become our main AP solution for Canadian business expenses. They built a product that is better than anything else on the market in Canada.”

Thomas Kwon

Head of Finance & Operations

The Conclusion

By understanding the key concepts of accounts payable and implementing best practices, you can optimize your company’s financial operations and foster strong relationships with your vendors. We’re here to help you streamline your AP processes and take control of your business finances. Get started for free with us today and experience the difference in your accounts payable management.

Float is Canada’s Only All-in-one AP Solution

Automate bill intake, approvals, accounting sync, and pay anyone in the world with Float’s Bill Pay — plus unlock 7% savings on your spend.

Automate intake with Float’s AI powered OCR and inbox integrations

Streamline approvals with flexible workflows and policies

Pay via Global Wires, EFT, or ACH with Float’s next day payments