FLOAT USECASES

Canadian Small Businesses Streamline Expenses with Float’s Corporate Cards

Float is a modern all-in-one spend management platform for corporate cards, bill payments, and reimbursements — plus average savings of 7%.

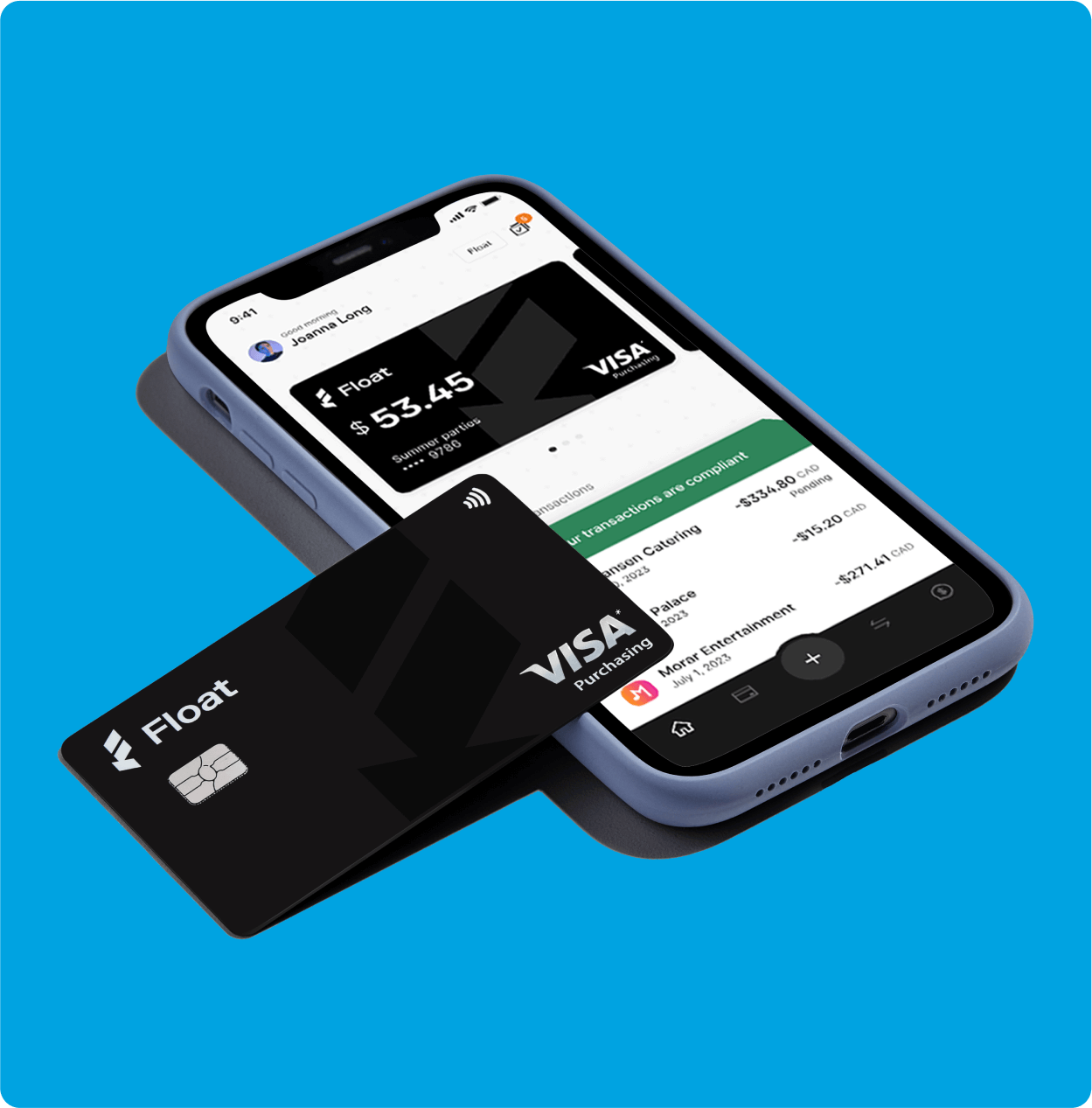

Unlimited Virtual and Physical corporate cards with no personal guarantees

4% interest on cash held with Float and <24 hours account opening

Easy to use mobile app to capture receipts on the go

Trusted by thousands of leading Canadian companies.†

Why Small Businesses in Canada Choose Float?

Float is Canada’s only modern all-in-one spend management platform to combine corporate cards, high interest accounts, bill pay, and expense tracking into a single solution.

High-limit corporate cards

Apply online to get access to high limit corporate cards with no personal guarantees and 1% cashback*.

Never run into spending limits with corporate cards.

Apply for a 10x higher card limit with Float’s Charge Card.

See transactions in real-time to track spend and spot spend anomalies.

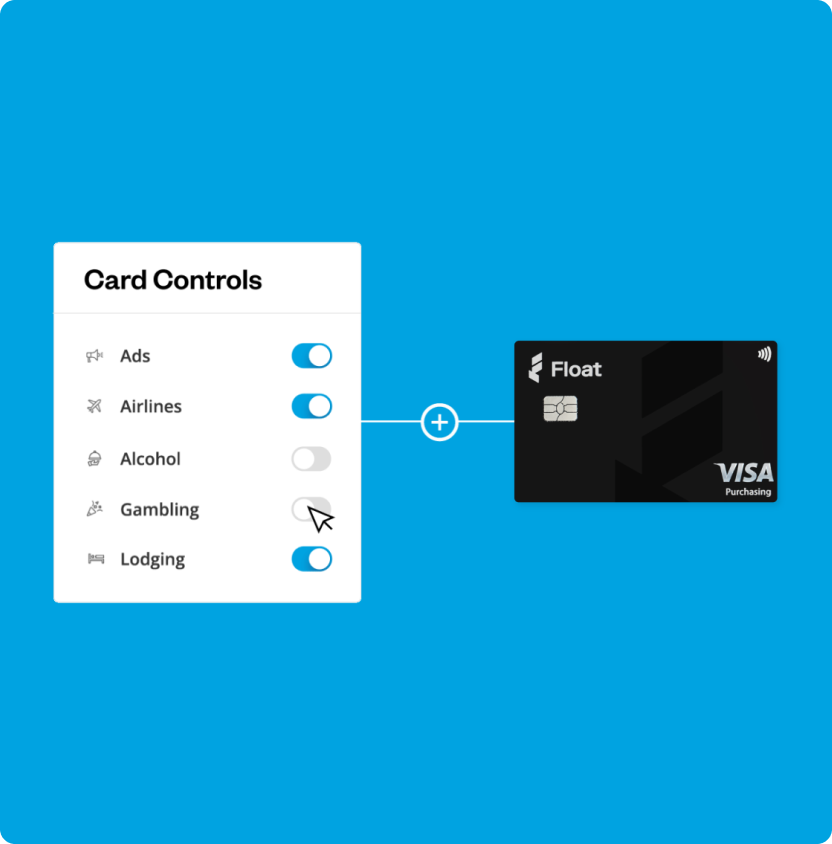

Real-time expense management

Enable your team to pay for expenses without the risk of using personal cards.

Issue physical and virtual cards to employees worry-free with zero-dollar balances.

Apply temporary or recurring limits to cards only when required.

Easily pay for expenses via Float’s mobile app or Google and Apply Pay.

Automated receipt tracking

Float automates receipts and reconciliation for business travel to save you valuable time closing the books.

Float instantly notifies employees to upload receipts, so you don’t have to.

AI-driven technology scans receipts, pulling amounts, taxes, and tips to reduce manual data-entry.

Smart rules automatically code spend with relevant GL codes, tax codes, merchants, and more.

Earn and save with high-yield accounts

Save an average of 7% of your spend when switching to Float.

Earn 1% cashback* on CAD and USD card spend on Float.

Earn 4% interest on funds held in Float with no lockups or minimums.

Save on FX fees and access exclusive perks and rewards.

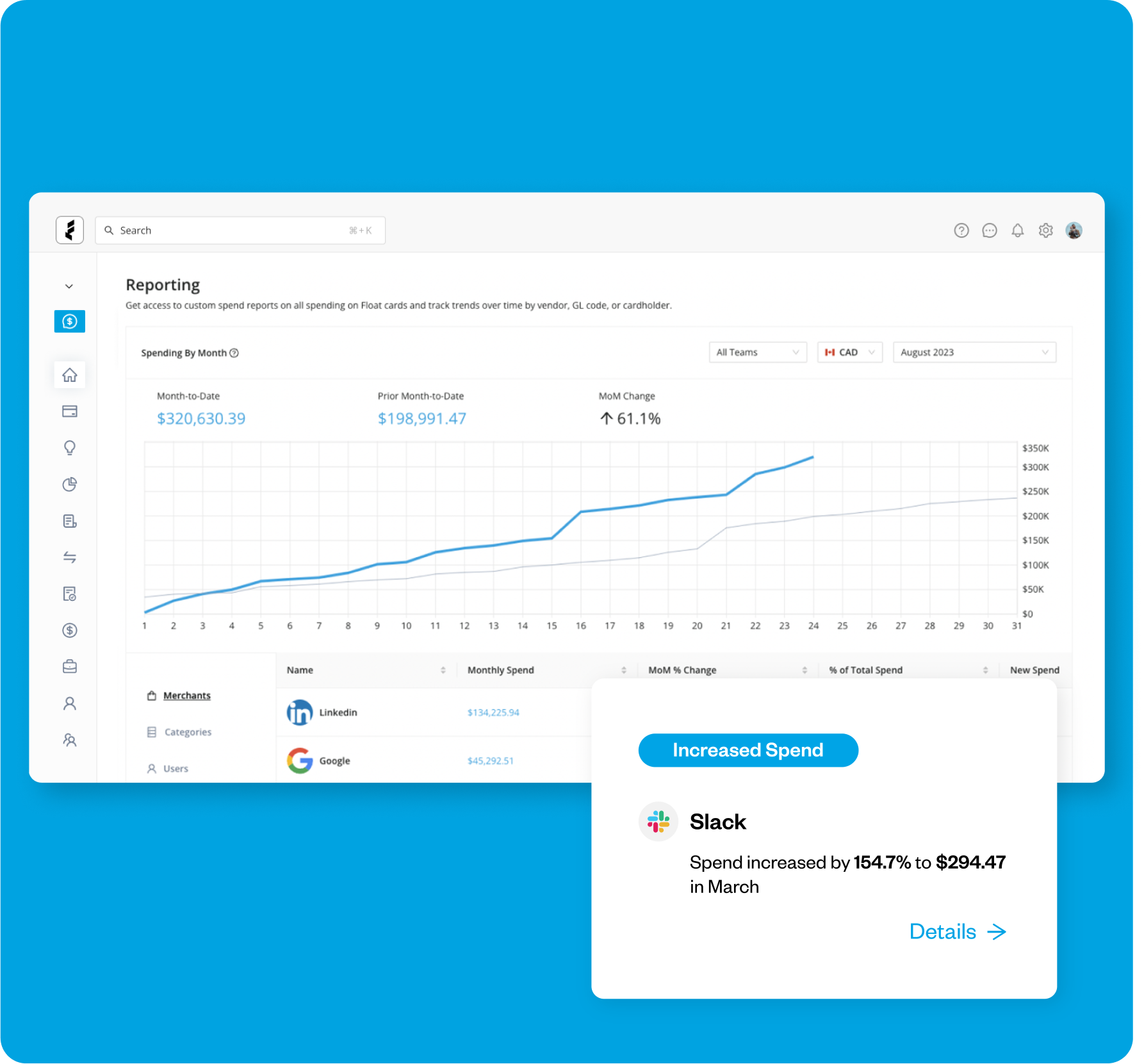

Powerful insights and analytics

Track all non-payroll expenses in a single place. Identify savings opportunities and prevent unwanted spend.

Track team budgets vs. actuals and see trends over time.

Quickly identify areas of overspending and find opportunities for savings.

Track duplicate subscriptions across teams to eliminate waste.

Business can sink or swim. Why not Float?

Benefits

Discover Benefits of Using Float

Learn how you can grow your business with Float’s rewards.

1% cashback

Earn 1% cashback* on all categories of credit card spend in both CAD and USD cards.

Earn 4% interest

Earn interest on funds held with Float and use them for daily spending. Withdraw cash any time with no lockups or minimums.

Close books 8x faster

Close your books faster with Float’s accounting integrations and enable your team to focus on things that really matter.

*1% with over $25k in monthly spending. Charge Card has different rewards structure. Contact sales for more information.

Save 7% on your Spend with Float

With Float businesses can earn 1% cashback on card spend, up to 4% interest on funds held in Float, and close the books up to 8x faster.

Estimate your Business Savings

with Float.

Average cash balance

(CAD):

Average cash balance

(USD):

Average monthly spend

(CAD):

Average monthly spend

(USD):

$21,150

That’s more than you’d earn with a bank.

Annual savings shown in CAD. Float is definitely not a bank. Learn more.

Businesses have evolved.

Banks haven’t.

A corporate card program with new types of perks and none of the hassle.

Come for the card,

stay for the software

Simplify your company spending with payments powered by intelligent software.

Automated Accounts Payable

Capture, approve and pay bills via EFT, ACH or Wire. Automatic syncs directly to your accounting software.

Expense Management

Get customized spend controls and approval policies to help you manage your company spend.

Corporate Cards

Spend, track, approve, and reconcile all your CAD and USD expenses in one simple to use platform.

Your questions,

answered

A small business corporate card offers tailored expense controls, higher credit limits, and business-specific rewards compared to traditional credit cards. It centralizes employee spending under one account, simplifies tracking, and provides enhanced reporting, while traditional credit cards are designed for personal use with fewer business management features.

Applying for a corporate card with Float is simple. Sign up online, provide your business details, and get approved quickly with no personal guarantees required. Float’s corporate card offers real-time controls, automated expense tracking, and powerful reporting tools to help streamline your business expenses.

It’s typically harder for small businesses to get a traditional corporate card due to strict credit requirements and personal guarantees. However, with Float, it’s easy! No personal guarantees are needed, and approval is fast, making it an ideal choice for small businesses looking to streamline expenses.

Yes, Float offers high-limit charge cards designed for small businesses, providing flexible working capital with limits up to $500K CAD, without requiring personal guarantees or collateral. Float’s charge card offers fast approval and helps streamline expense management with real-time controls and seamless accounting integrations.

Float helps small businesses manage expenses by providing real-time spending controls, automated approvals, and seamless integrations with accounting software. With Float’s corporate card, you can track employee expenses, set limits, and automate reporting, saving time and improving financial oversight, all while avoiding personal guarantees.

*Trademark of Visa International Service Association and used under licence by Peoples Trust Company.