Cash Flow Optimization

How to Efficiently Pay Invoices as a Canadian Business

Discover efficient strategies for Canadian businesses to pay invoices on time. Streamline your processes and improve cash flow with expert tips from Float.

January 30, 2025

As a Canadian business owner, paying invoices efficiently is essential to maintaining a healthy cash flow and fostering strong relationships with your suppliers. By streamlining your invoice payment process, you can save time, reduce errors, and ensure compliance with Canadian tax regulations.

In this guide, we’ll walk you through the steps to efficiently pay invoices, from verifying invoice details to optimizing your payment processes. We’ll also provide tips on leveraging technology and maintaining good supplier relationships to help your business thrive.

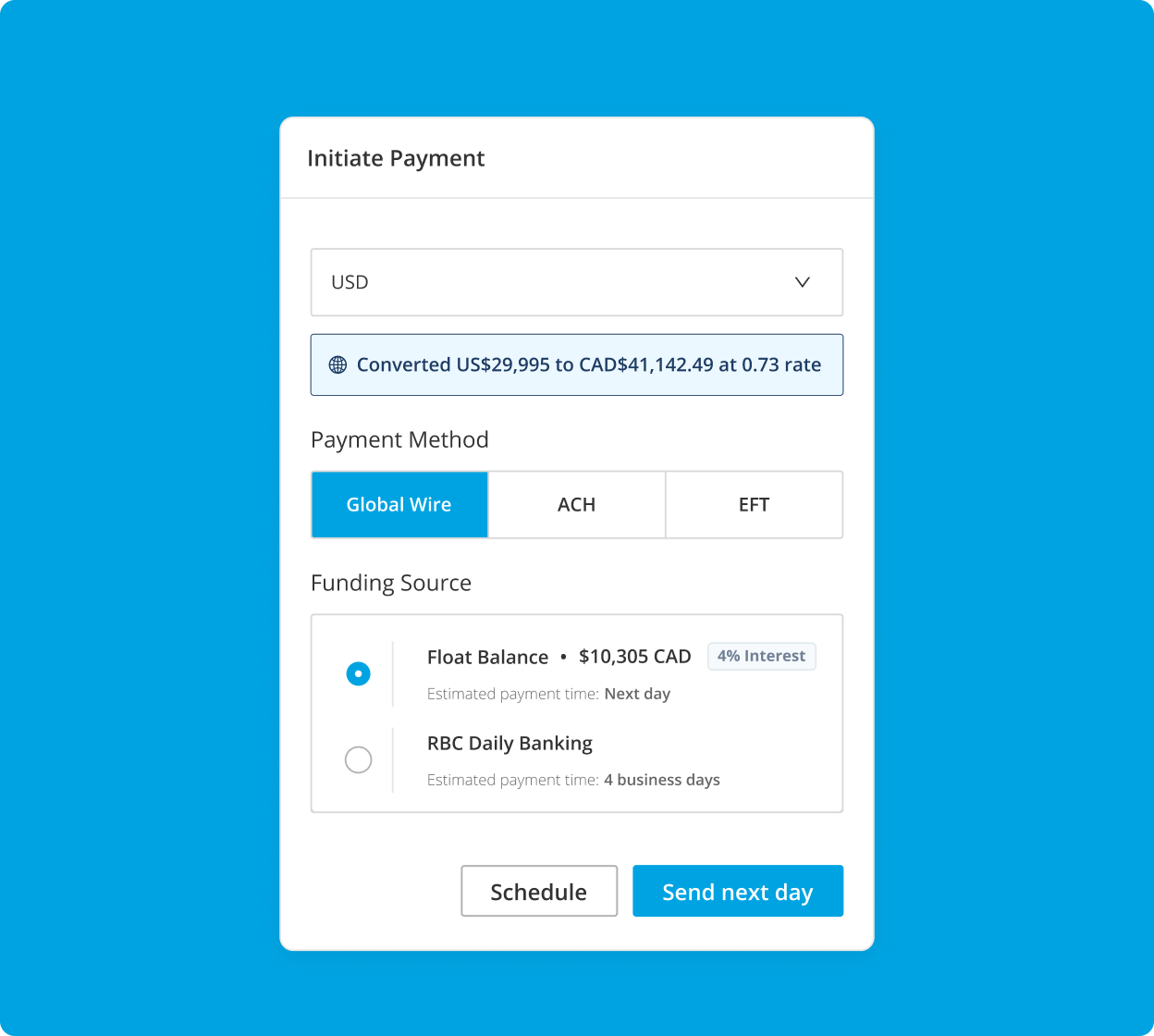

Pay Vendor Invoices with Float

Canada’s best-in-class EFT, ACH, and Global Wires payments platform for CAD and USD — plus average savings of 7%.

What is Invoice Payment?

Invoice payment for Canadian businesses involves the process of settling outstanding bills from suppliers or service providers. This typically includes verifying the invoice details, ensuring compliance with GST/HST regulations, and choosing the appropriate payment method.

How to Efficiently Pay Invoices as a Canadian Business

Efficient invoice payment is crucial for maintaining good supplier relationships and cash flow. Here are the steps to follow:

Step 1: Verify Invoice Details

- Accuracy is key: Cross-check the invoice for accuracy, including the amount, due date, and supplier details. Ensure that the invoice includes the correct GST/HST information. Verifying these details is crucial to avoid disputes and ensure tax compliance.

Step 2: Choose the Right Payment Method

- Select the best option: Evaluate the best payment method for your business needs, such as bank transfer, credit card, or online payment platforms. Consider factors like cross-border payments, currency conversion, and the efficiency of using a best accounts payable platform.

Step 3: Schedule Payments

- Timely payments matter: Set up payment schedules to avoid late fees and take advantage of early payment discounts. Utilize automated reminders and scheduling tools to ensure payments are made on time.

Step 4: Record and Reconcile Payments

- Maintain accurate records: Keep accurate records of all invoice payments for accounting and tax purposes. Reconcile payments with bank statements to ensure accuracy. Utilizing automated invoice payment systems can help streamline record-keeping.

Step 5: Review and Optimize Processes

- Continuously improve: Regularly review your invoice payment process to identify areas for improvement. Implement feedback from suppliers and internal teams to enhance efficiency.

Tips on Efficient Invoice Payment for Canadian Businesses

1. Utilize Technology

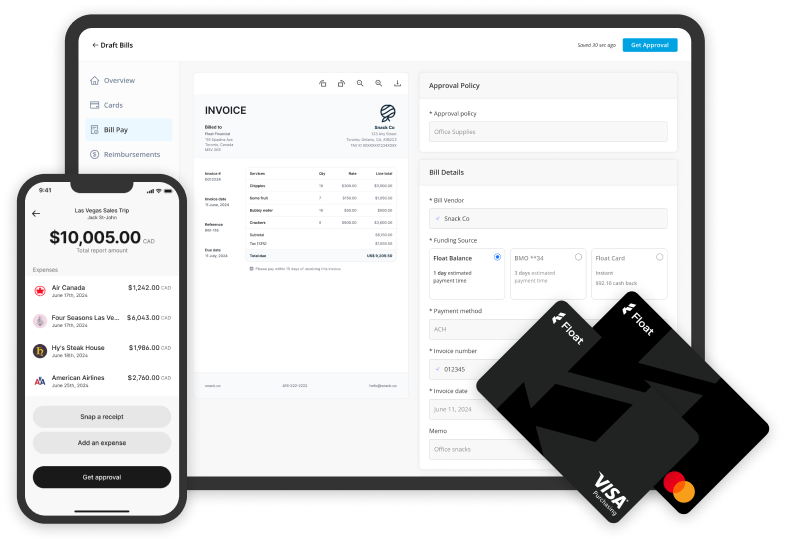

- Leverage tools: Bill pay and reimbursements tools can automate and streamline the invoice payment process, saving you time and reducing errors.

2. Maintain Good Relationships

- Foster strong partnerships: Ensure timely and accurate payments to build trust and maintain positive relationships with your suppliers.

3. Stay Compliant

- Adhere to tax laws: Ensure compliance with Canadian tax laws, including GST/HST, to avoid penalties and maintain good standing with tax authorities.

Frequently Asked Questions

The key steps to paying an invoice as a Canadian business include verifying invoice details, choosing the right payment method, scheduling payments, recording and reconciling payments, and reviewing processes for continuous improvement.

The best methods for paying invoices in Canada include bank transfers, credit cards, online payment platforms, and automated invoice payment systems. Choose the method that best suits your business needs and helps streamline your payment processes.

To ensure compliance with GST/HST when paying invoices, verify that the invoice includes correct GST/HST information and maintain accurate records for tax purposes. Staying compliant with Canadian tax laws is essential to avoid penalties and maintain good standing with tax authorities.

Most banks do not impose limits on the amount of money you can send via EFT. However, some banks may have daily or monthly transfer limits for security reasons. Check with your bank for specific limits.

Float is an all-in-one platform for Invoice payments that includes EFT, ACH, and Global Wire payment capabilities. Float is Free to use on our Essentials plan, where you will be able to issue unlimited virtual CAD/USD cards, earn 4% interest on deposits, reimburse employees and pay vendor bills.

Unlike traditional cards that get you to spend more, Float is the only corporate card in the world that helps businesses spend less. Through a combination of financial rewards like our 1% cashback, 4% interest on deposits, no FX fees with our USD cards and time savings of at least 8 hours per employee Float’s customers on average save 7% on their spend.

Role of Accounting Automation in Paying Vendor Invoices

Automation in accounts payable (AP) is revolutionizing how Canadian businesses handle financial processes. By automating tasks like invoice matching, data entry, and approval workflows, companies can reduce errors, save time, and improve efficiency. AP automation ensures compliance with Canadian tax regulations such as GST/HST, automatically calculating and reporting taxes accurately.

Additionally, accounting automation enhances cash flow visibility and strengthens vendor relationships by enabling timely payments. It reduces the risk of duplicate payments and fraud, while also supporting eco-friendly initiatives through reduced paper usage. For Canadian businesses, AP automation is key to boosting productivity and maintaining competitiveness.

How to Choose the Right Software to Manage Invoice Payments?

Choosing the right software to manage invoice payments is key to improving efficiency, reducing errors, and maintaining better control over cash flow. Our 2025 Best Accounts Payable Software review takes an in-depth look at the top solutions available in Canada, comparing key platforms based on:

- Automation & Efficiency – AI-driven invoice capture, GL coding and approval workflows to reduce manual work.

- Payment Capabilities – Support for EFT, ACH, credit card payments and international wire transfers.

- Integration & Usability – Seamless connections with accounting software and user-friendly interfaces.

- Pricing & Value – Transparent pricing, cost-saving features, and additional benefits like Float’s 4% interest on held funds.

It also includes a handy comparison chart of the top providers to help you easily compare costs, features and more.

How to Pay International Invoices as a Canadian Business?

Are you looking to pay international invoices out of your Canadian entity? We’ve got you covered with our dedicated step-by-step walkthrough of making payments across the globe.

- Making EFT Payments in Canada

- Making ACH Payments to the US

- Making a Global Wire Payment to the EU

- Making a Global Wire Payment to Mexico

- Making a Global Wire Payment to UK

- Making a Global Wire Payment to India

- Making a Global Wire Payment to Philippines

Also, check out our resource on ACH vs. EFT for a better understanding on the two payment methods and what might be right for your business.

Streamline Your Invoice Payments with Cutting-Edge Solutions like Float

By using a comprehensive bill pay service, you can enjoy a centralized platform for managing all your invoice payments, regardless of the payment method or currency. This streamlined approach saves you time, reduces the risk of errors, and provides greater visibility into your financial transactions.

If you’re looking for a comprehensive solution to streamline your invoice payment process, we invite you to explore Float’s Bill Pay service. With features like AI-powered Bill Intake, embedded EFT/ACH and Global Wires, and 4% interest on funds, Float’s platform is designed to simplify the way you manage and make invoice payments in Canada.

Written by

All the resources

Corporate Cards

Corporate Cards for Consulting Firms: An Industry-Specific Guide

Corporate cards for consulting firms don't need to be a headache. Get tips from industry experts to make the most

Read More

Corporate Cards

Credit Card Fraud Prevention Strategies for Canadian Businesses

Credit card fraud is a risk, but it's even riskier if you aren't prepared. Get tips from CPA and Senior

Read More

Corporate Cards

How to Get a Business Credit Card: A Step-by-Step Guide

Discover how to secure a business credit card with our guide. Boost your financial flexibility and manage expenses effectively with

Read More