How Float Simplifies Financial Audits

The word “audit” can set many of us in a tailspin. It’s a heavy lift and can take up to weeks to complete and sift through financial records – especially if you don’t have the right tools in place. However, internal and external audits are a customary part of business operations and help to assess and verify the accuracy of your financial records – which means they’re here to stay.

Thankfully, Float has a solution that helps your auditing process run smoother than butter. 🧈 Our smart spend software and corporate cards give finance teams automated spend controls and quick access to audit trails for company spending. With better control and greater access to your financial records, audits are no longer something to dread. 👍🏼 Here’s why.

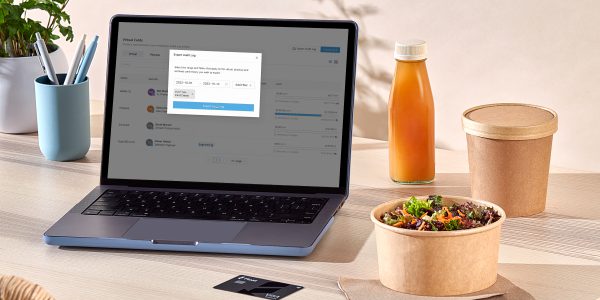

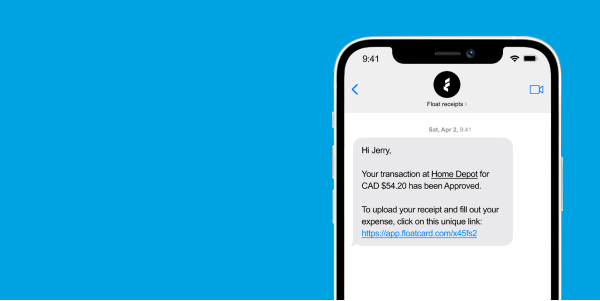

Get accurate information with real-time reporting 🕑

Audits are great for looking at historical snapshots of company spending, but wouldn’t it be great if you knew everything in real time? Float enables a real time overview of company spending so finance teams can ensure the books are always up to date with the right information. If your team is using Float cards for business purchases, then you’ll always know who is spending what as soon as a purchase is made. Float’s automatic SMS and Inbox receipt forwarding ensure that spenders submit their receipts on time, while automated receipt matching eliminates the need for manual expense reports and reconciliations. With Float there’s no waiting on employees to submit expense reports or tracking down receipts in the middle of an audit! 🧾

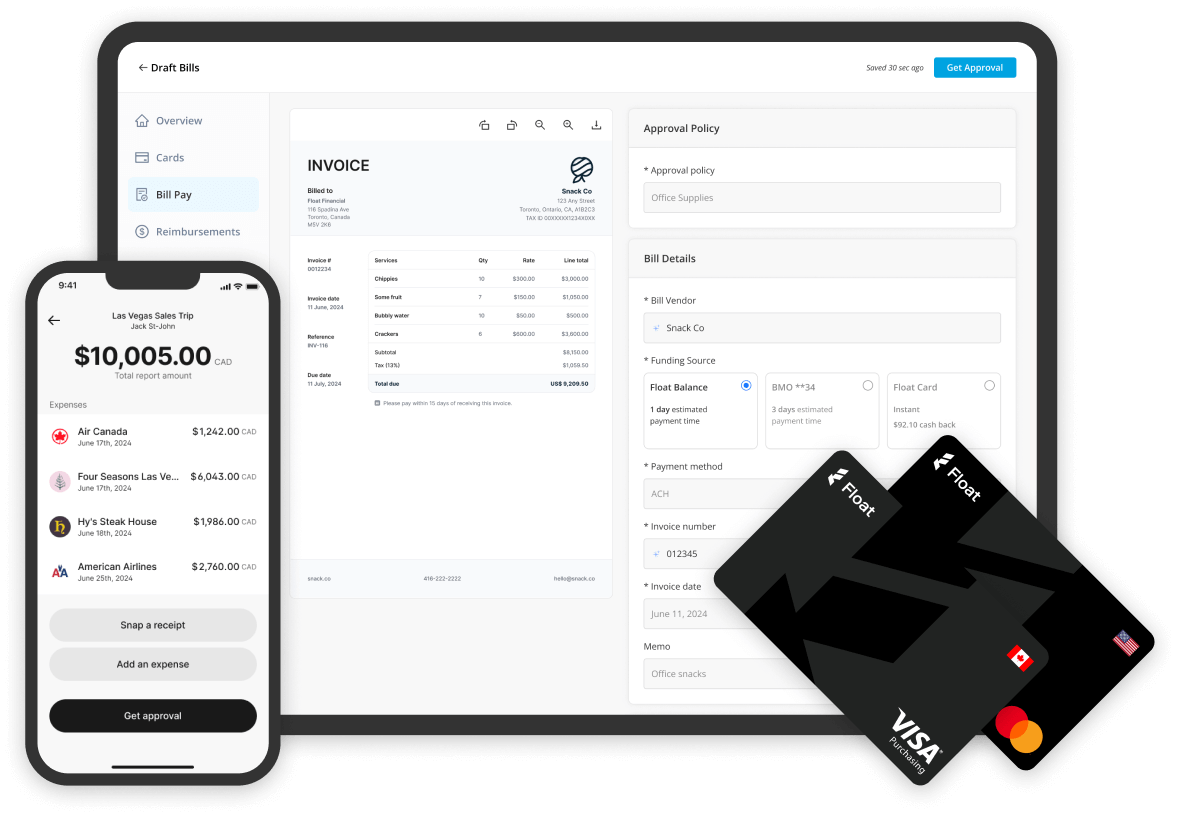

Set automated controls so everything runs smoothly 😌

Approval Policies ✅

Float allows finance managers to put financial controls in place to give teams the freedom to spend, while still having oversight and control on their end. This unique feature also offers proactive approvals for spend rather than reactive approvals. When you set up “Teams” in Float, you can ensure that approval requests are automatically sent to the right people every time an employee requests a corporate card or a spend increase. You can even set up multiple approval layers based on spend amounts and types.

Submission Policies 📩

Float also allows you to implement your company’s expense policies through our Submission Policies feature. Finance managers can set up submission policies for different expense categories and require employees to submit receipts and transaction details for purchases over a specific dollar amount or for all transactions. Float can also autopause cards for non-compliant transactions.

Seamlessly integrate with your existing accounting software👨💻

Float integrates directly into accounting software like QBO, Xero, and Netsuite to export transactions that are already coded and embedded with receipts for you. We also take the stress away through our Transaction Rules, which are designed to automatically code transactions from recurring merchants. So when an auditor is reviewing your books, you can rest easy knowing that all your transactions made on Float cards will have been exported with the correct GL codes, tax codes, and receipts too. ☑️

Stay organized and in-the-know with Audit Logs 🔎

Float offers Audit Logs for cards created on our platform and for spend requests and approvals too! 🤩 This allows finance teams to quickly access audit trails for specific time periods, ensuring their spend approval and card creation controls are being adhered to. The best part: Float provides a quick and easy way to submit documentation when it comes time for an audit. 💨 No loose paperwork or piles of receipts to gather. Our Audit Logs feature enables admins to export a history of creation, changes, pauses, expiration, and deletion for all their Float cards to date. You can also review a history of the creations, approvals, and declines of spend requests from your employees too.

—

Every finance team needs a set of controls in place to ensure business spending meets company policies – and that their financial records are as accurate as can be.👌🏼 Float’s smart spend software and corporate cards empower finance teams to easily automate their financial controls and have clear oversight of their corporate spending all year long. Finance teams can also use our real-time reporting tools and conveniently review records of audit trails for Float cards and spend requests so they’re fully prepared for an audit.

Ready to get started with Float? Book a demo or connect with us today and we’d be happy to show you all of the incredible features we have for you.