Corporate Cards

On-Demand Virtual Cards: Revolutionizing Business Payments

On-demand virtual cards are a game changer for businesses wanting to move quickly—learn how to get set up today.

July 2, 2025

Traditional payment methods can be slow, opaque and hard to control, creating a recipe for delays, confusion and risk. That’s why more businesses are turning to on-demand virtual cards for a faster, safer way to manage company payments.

If your business is still managing payments with shared corporate cards, clunky bank transfers, or—brace yourself—cheques, you’re not alone. But you’re also not moving at the pace your business needs.

Unfortunately, your expenses are unlikely to decrease anytime soon. In fact, 30% of SMBs from Float’s SMB Financial Outlook report had increased their spending over the past six months. All the more reason to gain clarity around company spend.

In this article, we’ll break down what on-demand virtual cards are, how they work and why they’re a game-changer for Canadian businesses.

Spoiler: there’s no sticky note with your CEO’s credit card number involved.

What are on-demand virtual cards?

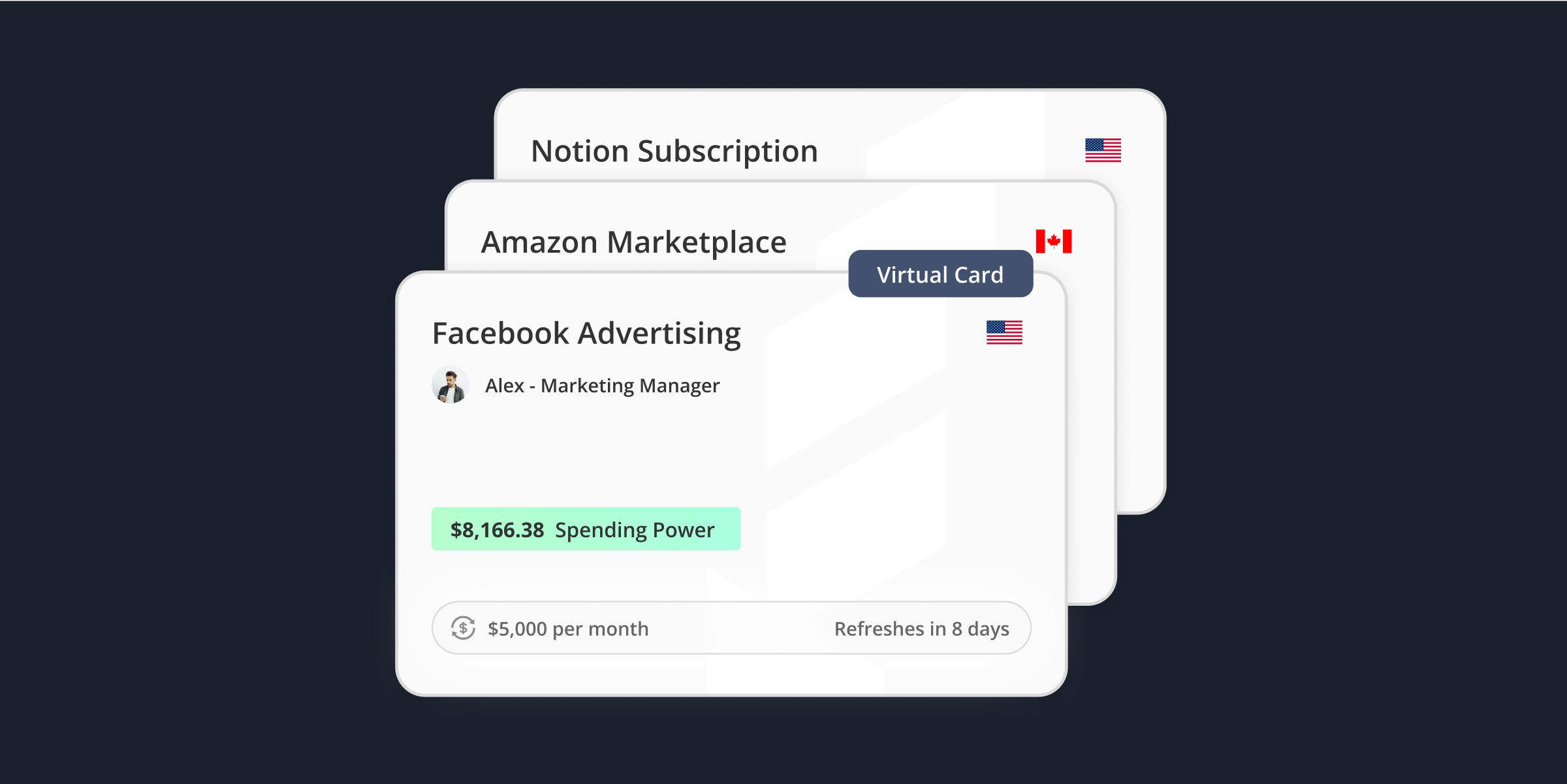

On-demand virtual cards are exactly what they sound like: instantly generated, digital-only card numbers tied to a central corporate account. There’s no special setup needed for vendors. They work just like a regular credit card number that any vendor can accept.

These cards are designed for specific use cases such as booking travel, paying for ad campaigns or managing recurring SaaS subscriptions. Virtual cards simplify vendor transactions, prevent overspending and give finance teams control without the admin drag.

Think corporate cards with built-in controls designed for business payments. Each 16-digit card number is unique, can be used for one-time or recurring purchases, and comes with built-in controls like spend limits, expiry dates and merchant restrictions.

And since they’re virtual, there’s no waiting for plastic in the mail (or risking lost cards in someone’s desk drawer). You issue them as needed, pause or revoke them just as fast and never lose track of where your money’s going.

How do on-demand virtual cards work?

Let’s gain a clear understanding of how a typical payment flow with virtual cards works by breaking it down step-by-step.

1. Request: A team member submits a spend request. Let’s say $500 for an upcoming event.

2. Approve: The request is automatically routed to the correct approver. Approvals can happen via email, Slack or directly in Float. No bank logins required.

3. Issue: Once approved, a virtual card is created instantly with built-in controls for merchant, amount and expiry as needed.

4. Spend: The employee uses the card like any credit card, either online or for recurring payments.

5. Reconcile: Float sends a prompt for receipts and auto-codes the expense. At month-end, reconciliation is more about reviewing than wrangling spreadsheets.

For finance teams, it’s a breath of fresh air. No bottlenecks, no chasing receipts and no last-minute Slack blasts asking, “Does anyone know what this charge is?”

Float helps you better manage your business spend

See how with your personalized

demo from a Float expert.

Benefits for business payments

On-demand virtual cards solve some of the most persistent headaches in business payments, offering better security, real-time control and way less manual admin. You’ll pay vendors instantly and reliably, with no disruption to your supplier relationships.

Here’s what that looks like in practice.

Stronger security

Every virtual card has a unique number and can be restricted to a single vendor or category. That means if your Meta Ads card is compromised, you won’t have to scramble to update 14 other subscriptions tied to the same number. They’ll even decline overspending attempts automatically, so you don’t need to chase refunds after the fact.

And if something looks suspicious? Freeze or cancel the card in seconds without affecting any other spend. That’s a major upgrade in virtual cards security, especially compared to traditional shared cards or manual payment flows.

Greater control and visibility

With virtual cards, financial management becomes proactive instead of reactive. Finance teams gain real-time insight into where money is going, who’s spending it and why. You can issue cards with custom limits, set merchant rules or expire cards after a set period.

Unlike traditional plastic cards, virtual corporate cards can be issued instantly with built-in limits and expiry dates. Need to cap ad spend at $10,000 per month? Easy. Want to give a sales rep access to $2,000 for a client trip that expires Friday? Done. That level of granularity enables you to align spending with actual budgets, rather than relying on guesswork.

Streamlined reconciliation and cash flow

Because each card is tied to a specific purpose, coding and reconciling expenses become ridiculously easy. You can automatically match spend to POs or invoices, apply the correct GL codes and even flag outliers before they become problems—this type of virtual card automation results in fewer manual errors and more time spent on strategic tasks.

For growing businesses, this means cleaner books, faster month-end closes and better cash flow planning. Not to mention, you’ll see fewer emails that start with “Just following up again on this receipt.”

Key features to look for in an on-demand virtual card provider

Not all virtual card platforms are created equal. If you’re looking to upgrade your payment workflows, it’s worth finding a solution that not only digitizes your cards but also streamlines your financial operations.

The right platform should take work off your plate, not just shift it around. For any business that handles recurring expenses, software subscriptions or B2B payments, virtual cards can bring order and oversight to spend.

If you’re evaluating platforms, here’s what to look for to find your finance team’s new favourite tool:

Ease of use and integration

Look for a platform that makes it dead simple to create, assign and manage cards in seconds. Even if you’re issuing dozens of cards, Float keeps things clean. Each card is tied to a user, purpose and budget, so nothing gets lost in the shuffle.

Bonus points if it integrates with your accounting tools or ERP to reduce double entry. You’ll want a platform that connects directly to your GL or gives you a custom export that’s plug-and-play.

Robust controls

You want to control expenses before they occur. The right provider will let you set granular rules for each card, including amount, merchant, expiry date and even category restrictions. You can automate approvals by team or dollar amount, shifting decision-making to the people who hold the budget.

Reconciliation and reporting tools

Automation is key. Look for built-in features like receipt prompts, coding reminders and post-transaction reviews. From coding prompts to post-transaction reviews, virtual cards automation keeps spend compliant and finance workflows efficient.

Provider expertise

Choose a partner that understands the unique needs of Canadian businesses, and isn’t just another U.S.-based platform with a maple leaf added on. It’s built from the ground up with Canadian tax rules, workflows and financial realities in mind.

Float for faster, safer business payments

On-demand virtual cards aren’t just a shiny new tool. From controlling ad spend to managing vendor subscriptions or funding last-minute travel, they offer real-time flexibility without sacrificing control.

Float’s corporate cards combine speed, automation and smart virtual cards for financial management made easy. You get instant card creation, smart approval flows, airtight controls and seamless reconciliation designed for the way Canadian finance teams actually work.

The right provider and rollout strategy could transform how you handle business payments forever. When it comes to virtual card security, control and compliance, Float gives you the tools to do it all, without slowing your team down.

Try Float for free

Business finance tools and software made

by Canadians, for Canadian Businesses.

Written by

All the resources

Corporate Cards

Discover: Virtual Credit Cards for Canadian Businesses

Explore the benefits of virtual credit cards with Float. Discover how this modern payment solution enhances security and simplifies your

Read More

Cash Flow Optimization

ACH vs EFT Payments: Key Differences for Canadian Companies

Learn the key differences between EFT and ACH payments, how they work, which options might be available to your business

Read More

Corporate Cards

Xero Integration for Corporate Cards: Modern Accounting Software Guide

Using Xero becomes more powerful the second you integrate it with your corporate cards. Here's what you need to know.

Read More