Corporate Cards

Corporate Credit Cards in Canada: A Practical Guide for Businesses

Discover how corporate credit cards work in Canada. Types, perks and how to find the best ones for your business.

February 7, 2025

Canadians use credit cards more frequently than any other payment method, and 57% say it’s because of the rewards they get for spending. If the perks are paying off for the average shopper, just imagine what Canadian businesses with more bills and buying power stand to gain from the benefits that come with corporate credit cards.

But not all corporate card programs are created equal. Selecting the right one requires a bit of research—and thankfully, we’ve done the legwork for you.

In this guide, we’ll break down everything you need to know about corporate credit cards in Canada: how they work, the perks and how to choose the best corporate card program for your start-up, scale-up or SMB.

What is a corporate credit card?

A corporate credit card, often called a corporate card or commercial card, is a card issued to employees to manage business expenses. Corporate cards typically offer more features than your average personal credit card, like higher limits, expense tracking, and enhanced reporting tools.

In Canada, the terms “corporate credit card” and “business credit card” are often used interchangeably, but there are a few key differences.

- Business credit cards are suited for entrepreneurs, sole proprietors, or small businesses and require a personal credit check and guarantee. Think of these like an extension of your personal credit, where the card owner is held liable for the balance if the business can’t pay.

- Corporate credit cards are for businesses with more spending power—like scaling start-ups or SMBs. They typically offer higher spending limits, automated controls and no personal guarantees (meaning you won’t need to risk your personal assets or credit to secure a card for your business).

Corporate cards are issued based on your business’s financial health rather than the applicant’s personal credit. (Note: they may also have other eligibility requirements). The company is responsible for paying the balance in full each month—not the “cardholder” or employee the card is assigned to.

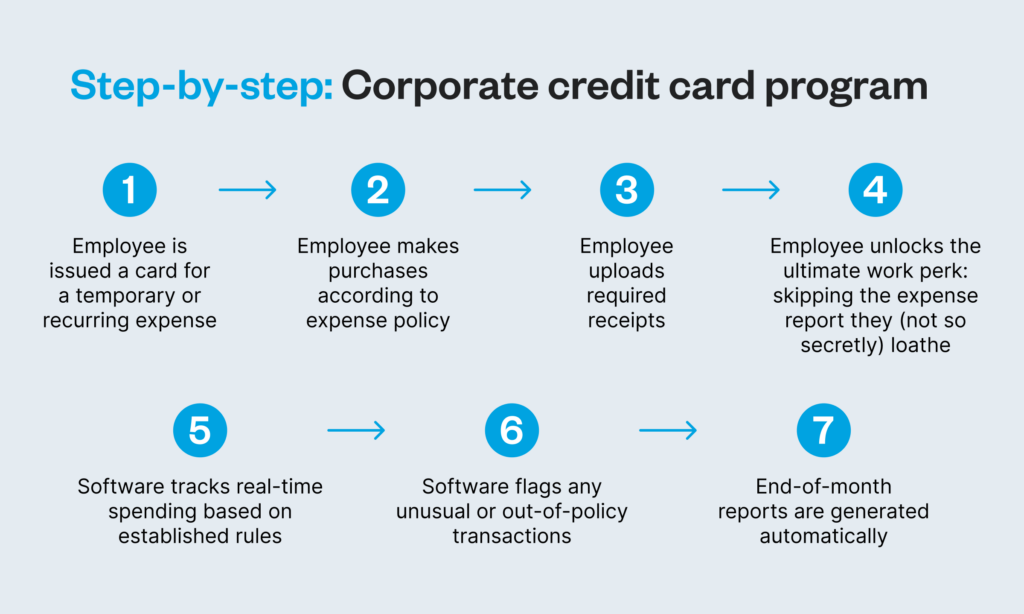

What is a corporate card program?

A corporate card program makes managing your business expenses faster and easier by bringing all credit spending into one place.

Here’s what to think about when building your corporate card program:

1. Issuance and eligibility

Full-time employees who regularly manage expenses—like client lunches, travel or team purchases—can benefit the most. For contractors or temporary staff, set clear guidelines on if and how they can use a card.

2. Types of charges

Spell out exactly what your corporate cards can be used for. Whether it’s travel, software subscriptions or team events, a clear expense policy helps your employees know how to use the card appropriately.

3. Responsibility for payments

With corporate cards, your business handles payments—not the employees. This takes the pressure off your not-so-finance-savvy teammates while giving whoever pays the bills complete visibility and control over spending.

4. Credit limits and policies

Set limits that match the needs of your team. For example, you might have higher limits set for frequent travelers or decision makers. Use tools like category-specific caps or single-use virtual cards for added security and flexibility.

5. Reconciliation

Here’s the best part about corporate cards: you can finally say goodbye to chasing receipts and juggling spreadsheets.

With automated tools, employees can upload receipts instantly, so your finance team can track and approve expenses in real time. For employees, this removes the hassle of out-of-pocket payments and slow reimbursements.

Who offers corporate card programs in Canada?

Traditional banks

Canada’s major banks, such as RBC, TD and Scotiabank provide corporate credit cards that often include features like rewards programs and travel perks. These cards are well-suited for larger enterprises but may come with higher fees, lengthy application processes and less flexibility.

Modern fintech providers

Fintech companies have introduced a new generation of corporate card solutions designed for more flexibility. These programs often prioritize ease of use, offering tools like virtual cards, automated expense tracking, and accounting integrations. Some providers (like Float) focus specifically on Canadian businesses, offering options like CAD and USD card limits with lower fees and faster approval processes.

Learn more about Float

Get a 10-minute guided tour through our platform.

Types of corporate credit cards

Traditional banks

Canada’s major banks, such as RBC, TD and Scotiabank provide corporate credit cards that often include features like rewards programs and travel perks. These cards are well-suited for larger enterprises but may come with higher fees, lengthy application processes and less flexibility.

Modern fintech providers

Fintech companies have introduced a new generation of corporate card solutions designed for more flexibility. These programs often prioritize ease of use, offering tools like virtual cards, automated expense tracking, and accounting integrations. Some providers (like Float) focus specifically on Canadian businesses, offering corporate card options like CAD and USD card limits with lower fees and faster approval processes.

Types of corporate credit cards

Corporate credit cards

Corporate cards or corporate credit cards are your versatile, all-purpose cards designed to cover a wide range of business expenses and day-to-day operational costs. They’re a great option for businesses looking for a straightforward way to manage spending without focusing on special categories.

Corporate charge cards

Charge cards vs credit cards—are they one in the same? Not exactly.

Charge cards require the full balance to be paid off at the end of each billing cycle, making them ideal if your business wants to maintain disciplined spending habits. With higher spending limits than traditional credit cards, they’re great if your company is growing or has variable cash flow. If you plan on spending a minimum of $10,000 per month and want to pay it off quickly, a charge card could be for you.

Purchasing cards (P-cards)

P-cards are built for procurement and vendor payments and eliminate the need for traditional purchase orders or invoices. These cards simplify tracking vendor-specific expenses, reduce paperwork and ensure spending stays within your allocated budgets.

Travel and entertainment (T&E) cards

T&E cards are designed for travel-related expenses like flights, hotels, car rentals, and client dinners. They often come with travel perks like discounted rates, travel insurance and airport lounge access, making them handy for sales teams or frequent travelers.

Virtual cards

Perfect for online transactions, virtual cards offer added security and flexibility to your business. These digital-only cards are ideal for managing subscriptions, one-off purchases or vendor payments online.

Wondering how to use virtual credit cards when there’s no physical plastic to swipe?

Using a virtual card platform, your accounting team generates a single-use card customized with a specific spending limit and assigns it to an individual employee or vendor. This limited nature minimizes the risk of fraud and is especially useful for recurring expenses.

Check out the best virtual credit card Canada has to offer >

Ghost cards

Ghost cards are assigned to vendors, projects or departments rather than individuals. They help your business track spending by budget or recurring expenses, offering an easy way to monitor compliance and streamline reconciliation.

Fleet cards

Designed for companies with vehicles, fleet cards manage fuel, maintenance, and other vehicle-related costs. They often include fuel discounts, detailed reporting on mileage and consumption, and tools to track vehicle expenses with ease.

Expense management cards

Expense management cards combine payment functionality with integrated tracking and approval workflows. They can reduce the time your finance team spends on reconciliation by syncing directly with accounting software.

Prepaid corporate cards

Unlike traditional credit cards, prepaid corporate cards require you to load funds onto the card upfront instead of borrowing from a bank. This gives your business more control over expenses while helping you avoid debt. Explore the prepaid business credit card Canada’s businesses love.

Types of corporate credit cards comparison chart

Top 4 benefits of corporate cards

1. Take back time with automated workflows

Corporate cards eliminate the hassle of managing paper receipts and processing reimbursements. With real-time tracking and automated expense reporting, your finance team will save hours on admin.

For start-ups and SMBs operating with lean resources, this means your staff spends less valuable time sorting through expense reports. For mid-market companies, finance teams will appreciate the ease of categorizing expenses without chasing receipts from hundreds of employees each month.

2. Drive smarter decisions with better cash flow

Corporate cards provide better visibility into company spending, allowing you to track it in real time and set individual limits. This is especially beneficial for start-ups and scale-ups diligently managing cash flow in the early stages of growth when budgets can be tight.

3. Save more and earn rewards

Many corporate card programs offer rewards, such as cashback, travel benefits, or discounts on essential services. At Float, we help businesses save an average of 7% on their spend through a combo of rewards like 1% cashback, 4% interest on deposits, no foreign transaction fees with our USD cards and employee time savings. We call that a win.

4. Control your capital by building credit

Building credit is vital for growth. For start-ups, corporate cards grant you access to higher business credit card limits without personal guarantees, creating a strong foundation for future financing opportunities. For larger SMBs and mid-market companies, you can strengthen your credit position to access larger credit lines as you scale.

Risks to be aware of

- Security and fraud: Stats show Canadian businesses experience a higher rate of fraud (20%) than Canadian consumers (13%). Make sure to look for features like virtual cards for one-time purchases, transaction alerts and the ability to freeze a card instantly if something seems off.

- Compliance headaches: Keeping track of expenses and ensuring they align with tax regulations can get complicated. Automate tracking and reporting to simplify these operations, giving you peace of mind and making tax season less stressful.

- Overspending: Without proper limits, it’s easy for spending to spiral. Set clear boundaries with spend limits and restricted categories so you’re always in the driver’s seat.

- Confusion: Sometimes, employees simply don’t know the rules. A quick onboarding session or a set of clear expense guidelines can make all the difference and keep everyone on the same page.

When you choose a corporate card program with smart controls and built-in security, you can enjoy all the perks without the headaches.

How to choose the right corporate card

- Currency: If your business operates across borders, look for a card that supports CAD and USD spending without high foreign transaction fees. For example, Float avoids conversion fees by linking directly to your CAD or USD bank account, while cards like the RBC Avion Visa Infinite Business focus solely on Canadian spending.

- Fees: High annual fees can eat into your budget, so consider whether the benefits outweigh the cost. Float has no annual fees, while traditional cards like the AMEX Business Platinum charge upwards of $799 annually, offering premium travel perks in return.

- Rewards: Cashback and point-based systems are common, but the value of these rewards can vary. Float offers unlimited 1% cashback on all spending, while cards like the Scotiabank Momentum for Business Visa provide 3% cashback on specific categories like office supplies.

- Features and controls: Real-time expense tracking, virtual cards, and integrations with accounting tools can save your team hours of work. Float excels in this area, offering both physical and virtual cards with spending controls, while traditional banking options focus more on rewards.

The best card for you depends on your goals, spending habits, and priorities. For a detailed breakdown of what’s available, compare Canadian corporate cards here.

💡Pro tip: Startups looking for the best credit cards? Instead of flashy rewards and points, consider prioritizing features and controls that help you scale faster while keeping tight reins on spend.

Best corporate credit cards in Canada

Choosing the best business credit card Canada offers can help you streamline expenses, earn rewards, and maintain better control over your company’s finances.

Here’s a brief overview of the leading programs to make an informed decision:

Corporate cards by banks

- RBC Avion Visa Infinite Business: Known for its travel perks and point-based rewards.

- TD Business Travel Visa Card: Tailored for frequent travelers with competitive travel rewards.

- Scotiabank Momentum for Business Visa: Great for cashback on office supplies and electronics.

- BMO AIR MILES No-Fee Business Mastercard: A no-fee card offering AIR MILES rewards.

- AMEX Business Platinum Card: A premium option for travel-heavy businesses, featuring luxury travel perks.

Corporate cards by fintechs

- Float: Offers no annual fees, unlimited 1% cashback, and advanced expense management tools with up to 7% savings on average.

- Keep: Provides higher credit limits, up to 4% cashback rewards, and no fees.

- Loop: Allows spending in multiple currencies with no foreign exchange fees.

Selecting the right corporate card comes down to how your business spends and other factors like your industry. For example, a Canadian e-commerce business often purchasing from US suppliers, might prioritize a card that doesn’t charge foreign transaction fees. Or, a marketing agency managing several online ad accounts might prioritize a card that tracks spending per client.

For a detailed comparison including fees, rewards, and features for the best corporate cards in Canada, click here.

How to apply

Wondering how to get a business credit card?

Once you’ve selected a corporate card and have confirmed you meet the qualifications, applying is quick and easy with most providers.

- Gather your business info: You’ll need basic details like your company name, location, type, industry, registration documents and financial figures.

- Verify identities: Provide ID for key shareholders or decision-makers, as required.

- Gather financial documents: Some providers may ask for proof of income or financial statements.

- Complete your application: Many fintechs offer online applications, while traditional banks might require more paperwork and in-person appointments. At Float, our fast online application only takes 10 minutes.

- Get approved: Approval times vary—some cards are ready in 24 hours (like Float), while others take a few days.

Once approved, you can start issuing cards to employees and using your new corporate card program to simplify spending.

Best business credit cards

Compare top options, fees and benefits for

Canadian companies.

How to implement a corporate card program

Start by establishing clear policies that outline which employees will receive cards, set spending limits, and define approved expenses.

Next, take advantage of your provider’s tools to set up spending controls. Features like customizable limits, category restrictions, and virtual cards for one-off purchases help you keep expenses organized and transparent.

Once the program is set up, train your team on how to use it effectively. A quick overview of the guidelines, including how to upload receipts and manage expenses, will set them up for success.

Finally, monitor spending using real-time reporting tools. This allows you to spot trends, adjust limits, and refine your policies to better fit your business as it changes.

Consider Float

Looking for the best business credit card Canada has to offer?

Float offers Canadian businesses a smarter, simpler way to manage spending. With no annual fees, unlimited 1% cashback on every dollar spent and tools like real-time tracking and virtual cards, Float puts you in control of your finances.

Unlike traditional corporate credit cards, Float corporate cards provide high spending limits with no personal guarantees, making it easier to grow without the stress of added liability. You’ll also earn 4% interest on funds held in Float and enjoy a seamless onboarding process that gets you started in as little as 24 hours.

Learn how to save with Float and discover how you can make your money count.

Written by

All the resources

Corporate Cards

Discover: Virtual Credit Cards for Canadian Businesses

Explore the benefits of virtual credit cards with Float. Discover how this modern payment solution enhances security and simplifies your

Read More

Cash Flow Optimization

ACH vs EFT Payments: Key Differences for Canadian Companies

Learn the key differences between EFT and ACH payments, how they work, which options might be available to your business

Read More

Corporate Cards

Xero Integration for Corporate Cards: Modern Accounting Software Guide

Using Xero becomes more powerful the second you integrate it with your corporate cards. Here's what you need to know.

Read More