The Most Bizarre Business Expenses Ever Submitted

Have you ever wondered what employees are trying to pass off as legitimate business expenses? As a financial controller, you may think you’ve already seen it all. But our team at Float did some digging and uncovered some of the most outrageous expenses ever submitted. Here are some favourites.

Take your morning commute to new heights 💸

Ever wondered if a $2,500 helicopter ride labelled as “transportation” would be approved? Well, the answer is no. 🚁 However, during the pandemic, a $20K private jet to safely travel to an international photoshoot was quickly approved – no questions asked! ✈️

Something smells funky here 😬

Although it’s a key ingredient in some of our favourite recipes, it’s not quite the aroma you want while trying to get some shut eye on your business trip. In 2015, an employee from a sales team working in the food industry admitted to booking a separate hotel room for $85 per night to store hundreds of garlic samples simply because he couldn’t stand the smell. 👃🏼 The travel expense = not approved!

Repairs and maintenance…to thyself 💆🏼♀️

This past year an employee thought they would be able to get away with submitting a receipt for a $7K facelift, labelling it as repairs and maintenance. I guess you could say some repairs were made but not the kind that your CEO needs to pick up the tab for. 🤨

Everyone deserves a lunch break 🍽

Picture this, you’re a production crew member shooting a commercial on a farm. Among your fellow team members and models is a stable of horses waiting to enter the next scene. 🐎 Lunchtime rolls around and everyone’s gotta eat! In California, one woman felt that it was only right to expense lunch, even for the horses! 50 bags of carrots and a detailed explanation later, her finance team approved this and went on with their day. 🥕🤷🏻♀️

Allow us to pick your brain 🧠

How much does a human skull cost? Asking for a friend. In 2013, a finance manager expressed that one of the most bizarre expenses he came across was for a human skull.💀 While it was being used for a legitimate medical experiment, it’s not everyday that you see a transaction like this run through the general ledger.

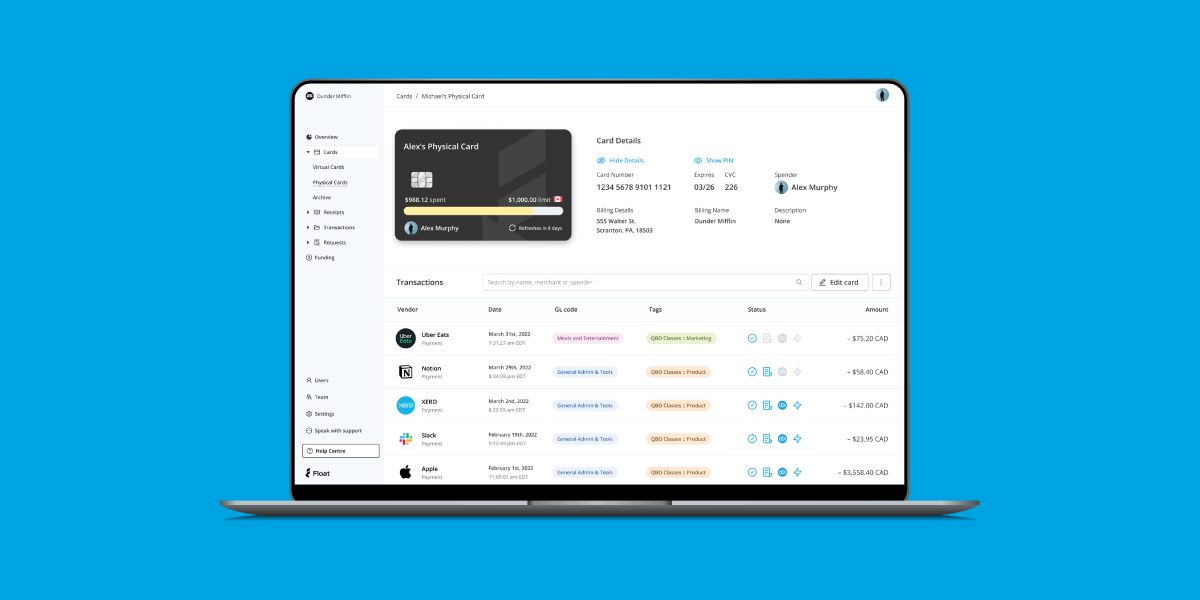

All jokes aside, many outrageous expense claims like the ones listed above can fall under the radar if a company doesn’t have a smart system in place. Using a platform like Float, finance managers can simplify expense management with full visibility over company spending, how much is spent and by who. It gives finance teams an eagle eye with more control and encourages employees to spend responsibly and ethically – minimizing the chances of ridiculous expense submissions. 👍🏼

Confident SMBs are 2x as likely to expect >10% profit growth

See how they’re doing it.