Corporate Cards

When to Opt for Corporate Cards Over Personal Cards

This guide will help you evaluate corporate cards vs personal cards and, just as importantly, how to switch your company spending habits.

May 26, 2025

If you’ve ever wondered whether your employees should keep putting business expenses on their own cards or whether it’s time to roll out corporate cards, this guide’s for you.

The decision of corporate cards vs. personal cards may not sound like an exciting debate. But this one decision can make or break your cash flow, stress levels and how many receipts you’re chasing late into the night at month-end. And if you’re still relying on reimbursements, you’re likely carrying more risk (and frustration) than you need to.

A lack of clarity in company spending and cash flow isn’t a rare issue. In fact, 30% of small businesses say they do not have good cash flow visibility and cannot predict potential problems. Having all of your spending on corporate cards that provide you more visibility into spending can be a huge first step in improving that cash flow visibility.

Here’s how to evaluate your readiness for a better solution for company spending, and just as importantly, how to switch.

What are corporate cards?

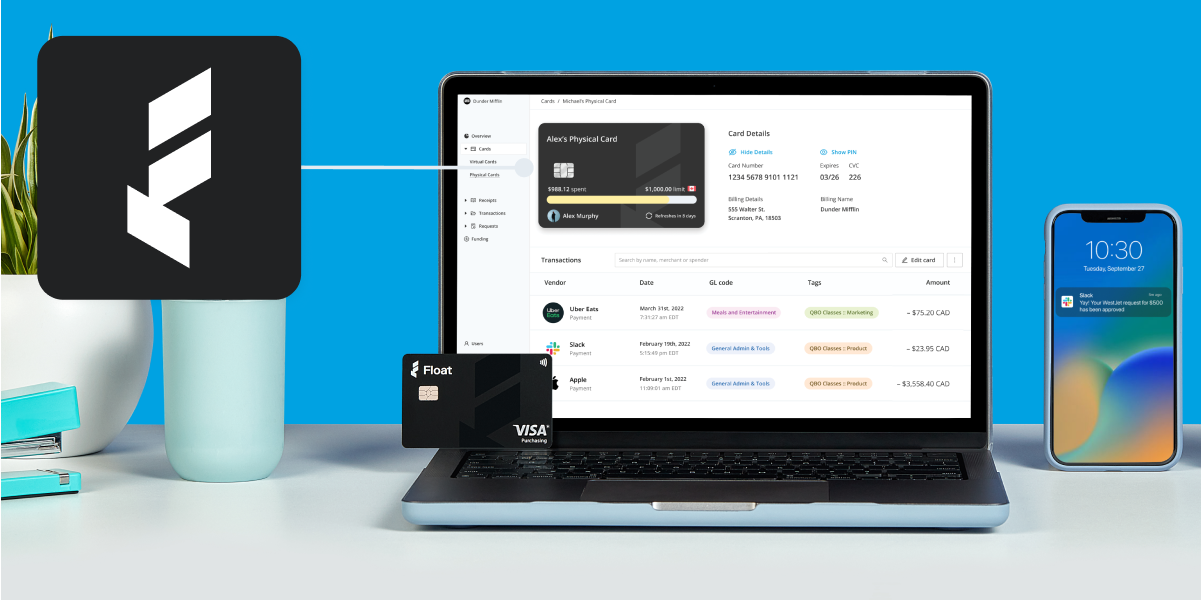

Corporate cards are company-issued credit cards that let employees make approved purchases on behalf of the business. Unlike personal credit cards, they’re tied to a central account and usually come with tools to control, track and report on spending.

Modern corporate cards like Float go a step further. You can issue physical or virtual cards with customizable limits, merchant restrictions and real-time visibility into every transaction.

There are typically two types of spend to consider:

- Corporate spend, such as software subscriptions, advertising or vendor payments

- Employee spend, such as travel, client lunches or office supplies

With the right controls in place, you can empower both types of spend while staying in control of your budget.

Corporate cards vs personal cards: When should employees use their own cards and request reimbursements?

For many small businesses, the debate around corporate cards vs personal cards often ends with employees using their personal cards and submitting reimbursements—it’s familiar, easy to set up, and can feel less risky.

There are a few scenarios in which reimbursements make sense:

- When the employee doesn’t have a corporate card yet. This could apply to new hires, as well as contractors or staff members who only incur business expenses on an infrequent basis.

- For a one-off or unexpected transaction. In situations where there isn’t enough time to get approval for a corporate card in advance, your best bet may be to use a personal card and get reimbursed.

- When the vendor only accepts cash, debit or a bank transfer. In cases where it’s just not possible to pay via credit card, reimbursement is often the way to go.

But here’s the catch: reimbursements from personal spending come with drawbacks. Employees are fronting company costs out of pocket, which can be a big burden if the expense is large or the repayment drags on. This model also leaves finance teams chasing receipts, sorting through manual submissions and dealing with unclear or delayed expense data.

And let’s be honest—most employees can’t (or would rather not) float the company hundreds or thousands of dollars while waiting for payday. Financial stress is a real thing, and they’re at work to reduce it, not ratchet it up.

Reimbursements can also hide spending issues until it’s too late for your team to do anything about it. By the time finance sees the expense, it’s already happened. That leaves little room to prevent duplicate charges, enforce business expense policies or catch fraud.

Corporate credit card benefits: When to choose corporate cards over reimbursements

Understanding the pros and cons of corporate cards vs personal cards is key as your business scales. Switching from personal cards to corporate cards streamlines expenses and helps you gain control, visibility, and agility as your business grows. A need can arise from having more team members on the road, a spike in marketing spend or an overloaded finance team.

If your current process is slowing things down or creating tension with employees, that’s a clear sign you’ve outgrown it. And when these corporate credit card benefits start to sound appealing, you’re likely in a good spot to make a change.

Here are some benefits of implementing a corporate credit card solution.

Improved spend control and visibility

Corporate cards offer real-time data on spending, which is something you’ll never get with a lagging reimbursement process. With Float, you can set transaction limits, restrict merchant types and spot a rogue spend instantly. That means fewer surprises at month-end and faster, more informed decisions and running your business proactively instead of reactively.

Streamlined expense management solutions

When you control spending at the point of purchase, everything that follows gets easier. Receipts are attached automatically, transactions are categorized and your accounting system is updated faster, especially if you use Float’s direct integrations. No more cross-referencing spreadsheets, chasing paperwork or playing catch-up at month-end.

Enhanced employee experience and satisfaction

Giving employees corporate cards means they don’t have to dip into personal funds or wait for reimbursements while crossing their fingers. It’s one less stressor, especially for those without large credit limits or savings buffers. And because Float offers $0 balance cards with pre-approved spend, you can empower your team without giving up control.

Reduced risk of expense fraud and misuse

Many business owners worry about employees going rogue with company credit card usage. Preventing the misuse of company cards is important, but the real risk lies in not having controls in place. And if your team is spending on their personal card, it’s near impossible to put your own controls on the card.

With Float, you can set category code restrictions, create temporary limits and even review transactions after they occur for full accountability. You get all the oversight of reimbursements, without the delay or administrative headache.

Best business credit cards

Compare top options, fees and benefits for

Canadian companies.

Implementing a corporate card program

You don’t have to wait for a problem to make the move. One of the best times to roll out a corporate card program is before your expense process breaks down. And as soon as you do, you’ll benefit from the practical advantages a corporate card program can offer.

Once you’re ready to move to corporate cards, a little planning upfront can make a big difference. Here are three handy steps to keep in mind.

1. Set clear goals and business expense policies

Start by defining what you want company credit card usage to achieve: better control, faster reconciliation or improved employee experience. Then build your expense policy around those goals. With the right rules and workflows, your card program becomes an extension of your financial strategy.

2. Use tools that scale with you

A modern solution that your business can grow with makes all the difference for your corporate card program. Float’s all-in-one spend platform offers cards, reimbursements and bill pay in a single solution. That means no more juggling tools that don’t talk to each other. You can start small and scale up without needing to rip out and replace systems later.

3. Lean on support and onboarding

You don’t have to go it alone with an expense management solution. Float’s implementation and support teams are there to guide you through setup, policy design and training, so you can roll out cards with confidence and clarity.

Float: Built-in guardrails for company spending

Reimbursements may have worked for a time, but they aren’t built to scale. As your business grows, so do the risks, delays and frustrations of relying on personal cards.

Float offers a smarter way forward with a corporate card program designed for better workflows. They improve control, speed up accounting, empower your employees and give you the real-time visibility you need to lead.

Still torn between personal cards and corporate cards? Don’t wait for your expense process to break when a smoother, more straightforward solution already exists.

Ready to make the switch? Explore how Float’s modern card platform can help.

Try Float for free

Business finance tools and software made

by Canadians, for Canadian Businesses.

Written by

All the resources

Cash Flow Optimization

Net Working Capital: How to Measure & Manage It

Let's explain what net working capital is, how to calculate it and tips for best ways to use it.

Read More

Cash Flow Optimization

A Step-by-Step Guide to Cash Flow Forecasting

Let's explore what cash flow forecasting is, why it matters to your business and how you can build a reliable

Read More

Cash Flow Optimization

Best Business Account Alternatives to Traditional Banking

Compare traditional banking head-to-head with Float and see why many Canadian companies are moving away from banks and toward modern

Read More