Founded in 2018, PolicyMe is a startup life insurance company that modernizes the way people purchase life insurance online – making the process quicker, smoother, and more approachable. We sat down with their Strategy and Finance Manager, Suvansh Mehta, who has been with the company for just under two years. Since onboarding, Suvansh has first-hand experience using Float and had nothing but excellent feedback on the platform.

How long have you been using Float? What about Float made you choose them?

We started using Float in February 2022. Last year, our company headcount grew by 50% and our spending process at the time simply wasn’t cutting it for our level of growth. Our team and expenses increased and it was getting difficult to keep track of. In January, I noticed a lot of gaps and missing invoices from year-end. This wasn’t the way we wanted to start Q1 2022 so we became eager to find a better solution. That’s when our CEO introduced me to Float and I was instantly impressed with the quality and breadth of their features.

PolicyMe was looking for a way to issue credit cards easier – both physical and virtual – and Float deemed the best solution. Previously, we were sharing credit cards across the team, but this process wasn’t setting us up for growth. It became difficult to distinguish who was spending what, there was little accountability among spenders, and the reconciliation process was unimaginably tedious to say the least.

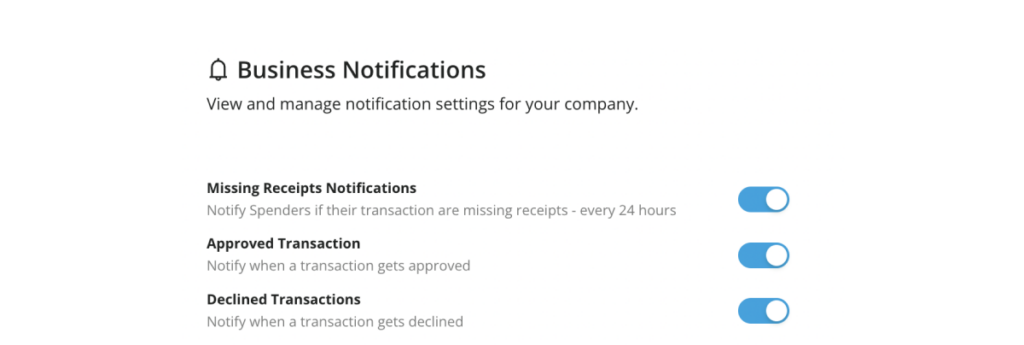

Float’s receipt management feature really won us over. The capability to link receipts from an employee and finance perspective, being able to forward invoices directly into Float, and automatch to the correct transaction together has saved us so much time.

What were the biggest pain points that Float solved for your business?

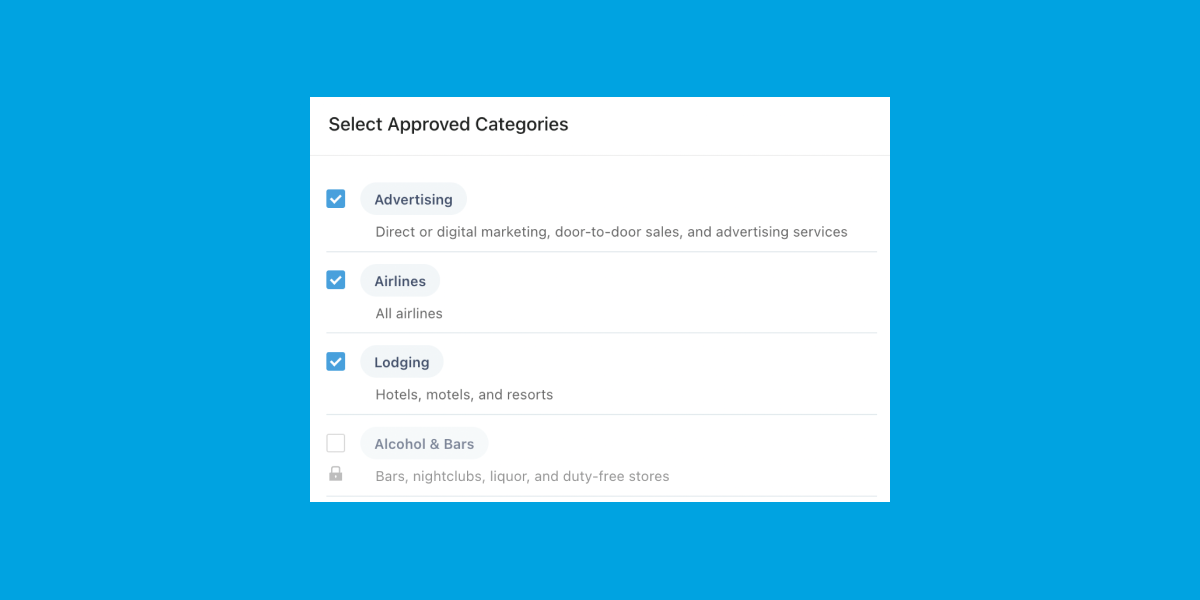

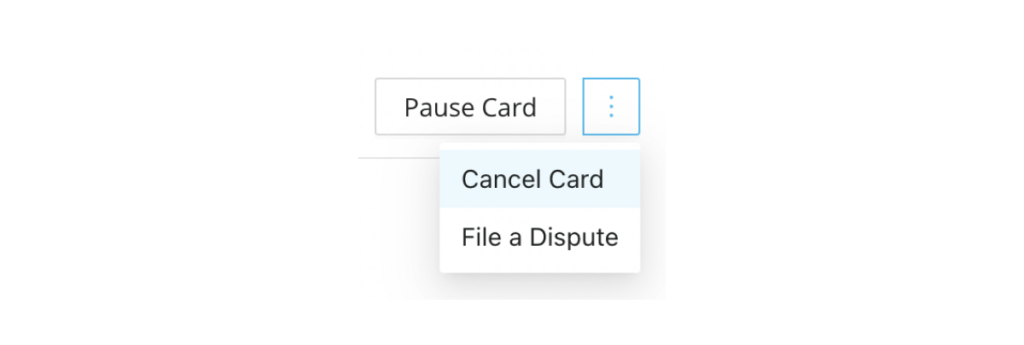

Before Float, we had very little oversight of who was spending company dollars and what the transactions were for. Today, we have the ability to instantly issue credit cards per vendor and assign them to specific users in various departments, resulting in greater spending accountability – all thanks to Float.

Being able to set card limits also helps us stay on budget and reassess whether a specific vendor is still worth using. These pre-set spending limits have been a positive trigger point and encourage us to constantly question and stay on top of our expenses.

“If there’s one corporate card used across the company, it’s difficult to discern if there are fee increases or unauthorized renewals from a vendor. But Float makes it easy for us to monitor and avoid that altogether.”

“Float’s approval workflow feature is also really helpful because it enables us to structure spend approval based on job titles. We’re able to give department managers the authority to approve a specific dollar amount, while anything greater goes to upper management to approve. “

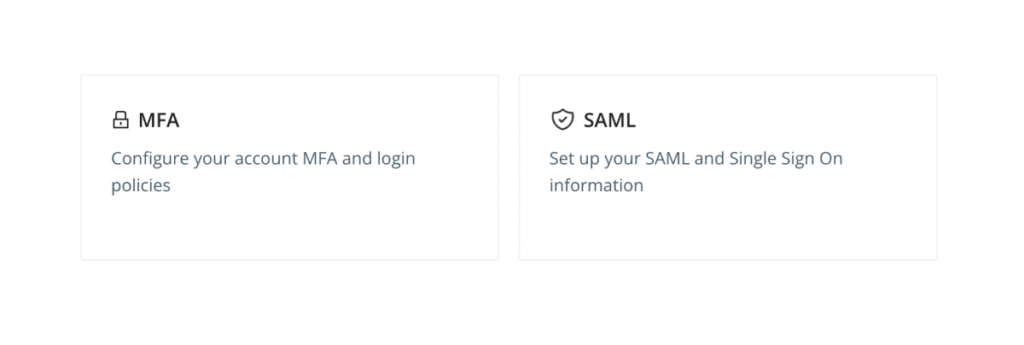

As a startup, it’s incredible for us to experience this level of financial organization by implementing a platform that doesn’t come with a hefty price tag or intense infrastructure. Not only has Float upgraded the way we keep track of how and where money is being spent but it has also improved our lives in the finance department. We’ve got multiple eyes on our dollars now.

What particular features were the most useful to your team and why?

The ability to issue and assign individual cards to employees was incredibly useful for us. Before, our team would have informal discussions on corporate spending and there was no clear or documented form of communication for it. At one point, we started using Google Forms to formalize the way we approved spending but it didn’t hold a candle to Float.

Now that we are fully immersed in Float, we’re able to easily communicate cross-functionally about spending policies, card limits, and authority – with the added benefit of being able to instantly distribute cards and adjust spend as we need to. The entire process is speedy and efficient – it’s exactly what we needed.

“Float has also played an integral role in the way we monitor and prevent expense fraud. While we haven’t come across any grave instances, it’s reassuring to know that we have these controls in place. “

How did the PolicyMe team respond to Float?

We received a really positive response from leadership.

There’s a general reassurance that Float offers – we know where funds are going and there’s more accountability being shared.

Float makes our spending process less ‘top down’ and allows us to provide managers and employees more autonomy to make daily spending decisions.

Our employees were also very enthusiastic about the simple process of getting a corporate card and requesting spend. We also received a lot of positive feedback about being able to upload a picture of a receipt via text. Our employees value convenience and Float delivers every time.

What would you say to other companies that are considering working with Float?

Go for it! Float is a fantastic company. It’s really great to be able to issue cards, manage receipts, monitor spend, and integrate with your accounting software.

“The level of support from the Float team is unmatched. It’s been the best part about working with their team. They are extremely responsive, personable, and always address my questions and concerns without delay.”

It’s very easy for us to reach out to Float and have our questions solved in a timely manner. There’s zero down time because the team addresses our problems within an hour, as opposed to three days or more. If I have a problem, I’m able to get a solution quickly. This is important especially if I am troubleshooting something for someone else in the company. If you’re looking for a software that checks all the boxes, it’s definitely Float.

About PolicyMe

PolicyMe offers a better way to buy life insurance in Canada with a mission to always put families first, protecting them with simple and affordable insurance policies.