Cash Flow Optimization

3 Effective Strategies to Speed Up Accounts Payable

Discover 3 strategies to streamline the accounts payable process, enhance cash flow, and improve supplier relationships with Float’s tips.

October 27, 2024

As a finance professional, you understand the critical role that accounts payable plays in maintaining your company’s financial health and operational efficiency. However, managing accounts payable can be a complex and time-consuming process, often leading to delays, errors, and strained vendor relationships.

Fortunately, there are proven strategies you can implement to accelerate your accounts payable process, streamline operations, and enhance overall financial management. In this article, we’ll explore three effective ways to speed up your accounts payable cycle, leveraging automation, optimizing workflows, and transitioning to electronic payments.

By adopting these strategies, you can significantly reduce manual errors, accelerate processing times, and foster stronger relationships with your vendors, ultimately contributing to a more robust and efficient financial operation.

What is Accounts Payable?

Accounts payable refers to the money a business owes to its suppliers for goods or services purchased on credit. It is a critical component of a company’s financial operations and management, ensuring timely payments and maintaining strong vendor relationships. Efficient management of accounts payable can lead to improved cash flow and enhanced operational efficiency.

Accelerate Accounts Payable with Float

Automate bill intake, approvals, accounting sync, and pay anyone in the world with Float’s Bill Pay — plus unlock 7% savings on your spend.

Automate intake with Float’s AI powered OCR and inbox integrations

Streamline approvals with flexible workflows and policies

Pay via Global Wires, EFT, or ACH with Float’s next day payments

Strategy 1: Automate Invoice Processing

Implementing automation tools to handle invoice capture and data entry can significantly accelerate your accounts payable process. By leveraging accounts payable automation, you can reduce manual errors and accelerate processing times, ensuring invoices are processed accurately and efficiently.

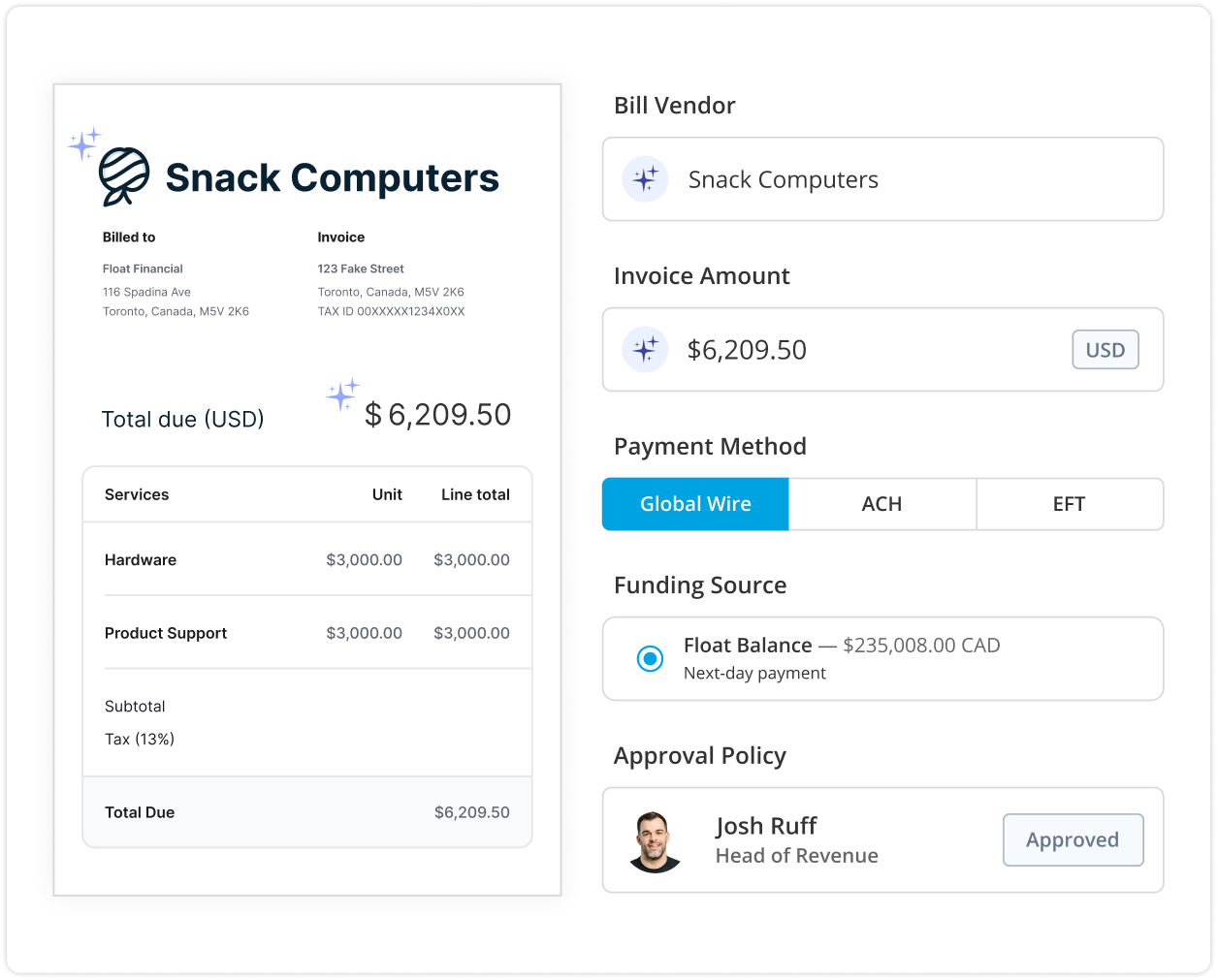

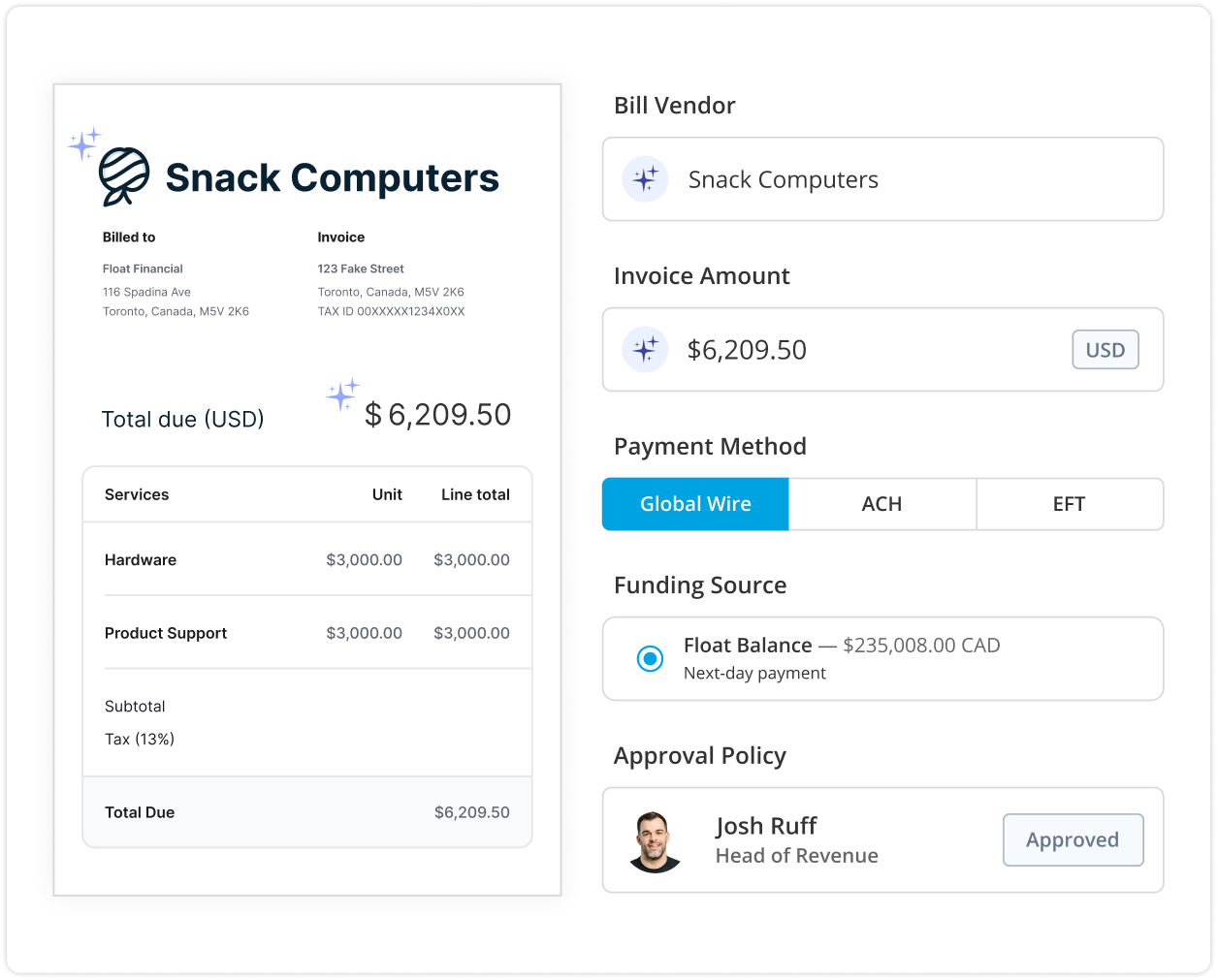

Optical character recognition (OCR) technology can help digitize paper invoices, facilitating faster approvals and reduced processing time. This eliminates the need for manual data entry, minimizing the risk of errors and delays.

Strategy 2: Optimize Approval Workflows

Streamlining the approval process is crucial for accelerating your accounts payable cycle. By setting clear approval hierarchies and thresholds, you can ensure invoices are routed to the appropriate individuals for timely review and approval.

Utilizing digital platforms to route invoices electronically can significantly reduce bottlenecks and accelerate approvals. Implementing a flexible bill approval software like Float can help track and manage approvals efficiently, enhancing accounts payable efficiency and reducing delays.

Strategy 3: Transition to Electronic Payments

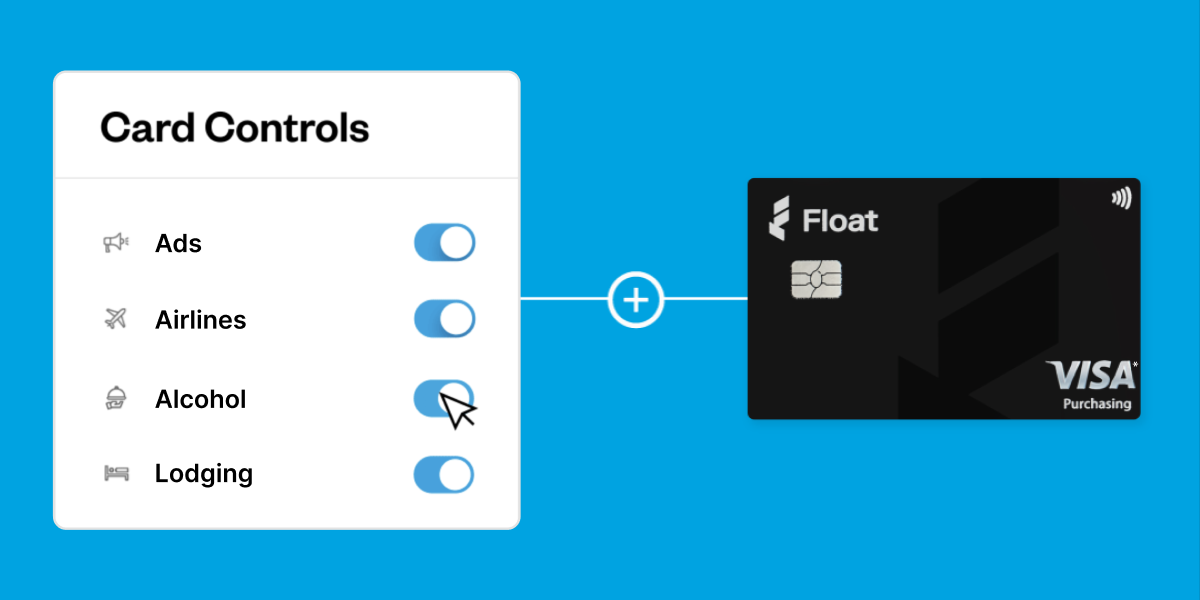

Moving from paper checks to electronic payment methods like ACH transfers and virtual cards can greatly speed up your accounts payable process. Electronic payments offer improved speed, reliability, and security compared to traditional paper checks. Learn more about the difference between ACH and EFT payments.

By using fast transfers, you can ensure payments are processed quickly and efficiently. Offering diverse, faster payment options to your vendors can enhance relationships and potentially lead to discounts and reduced processing costs.

Frequently Asked Questions

What are the most effective ways to accelerate accounts payable?

- Automation: Automating invoice processing, streamlining approval workflows, and transitioning to electronic payments are highly effective strategies for accelerating accounts payable.

How can technology be leveraged to speed up the accounts payable process?

- Leveraging tech: Technology can automate data entry, enhance approval workflows, and facilitate electronic payments, reducing manual errors and processing times.

What are common challenges in accounts payable and how can they be overcome?

- Challenges and solutions: Common challenges include slow processing times and manual errors. These can be overcome by implementing automation and improving workflow efficiencies.

How does improving accounts payable impact overall business efficiency?

- Business impact: Improving accounts payable leads to faster processing times, better cash flow management, and stronger vendor relationships, enhancing overall business efficiency.

Best Way to Accelerate Accounts Payable is with Float

By utilizing advanced automation tools and streamlined workflows, businesses can effectively manage their accounts payable processes, ensuring faster payments, reduced errors, and improved financial operations.

By implementing these strategies, you can significantly accelerate your accounts payable process, enhance financial operations, and foster stronger vendor relationships. We invite you to explore how our comprehensive automation solutions can help streamline your accounts payable workflow, reduce errors, and improve overall efficiency. Get started for free with us today and experience the benefits of a modern, optimized accounts payable process.

Accelerate Accounts Payable with Float

Automate bill intake, approvals, accounting sync, and pay anyone in the world with Float’s Bill Pay — plus unlock 7% savings on your spend.

Automate intake with Float’s AI powered OCR and inbox integrations

Streamline approvals with flexible workflows and policies

Pay via Global Wires, EFT, or ACH with Float’s next day payments

Written by

All the resources

Financial Controls & Compliance

Financial Controller Guide: Roles, Responsibilities & Success Strategies

Behind every confident CFO is a financial controller who knows the numbers inside out—and how to use them to guide

Read More

Corporate Cards

Business Credit Cards with No Personal Guarantee: Your Options

Want to avoid leveraging your personal credit for business financing? Business credit cards with no personal guarantee may be the

Read More

Corporate Cards

Discover: Virtual Credit Cards for Canadian Businesses

Explore the benefits of virtual credit cards with Float. Discover how this modern payment solution enhances security and simplifies your

Read More