FLOAT USECASES

High Limit Corporate Cards and Spend Management for Canadian Startups

Ditch the banks and get high-limit corporate cards with no personal guarantees. Manage all of your startup expenses in a single modern platform — plus average savings of 7%.

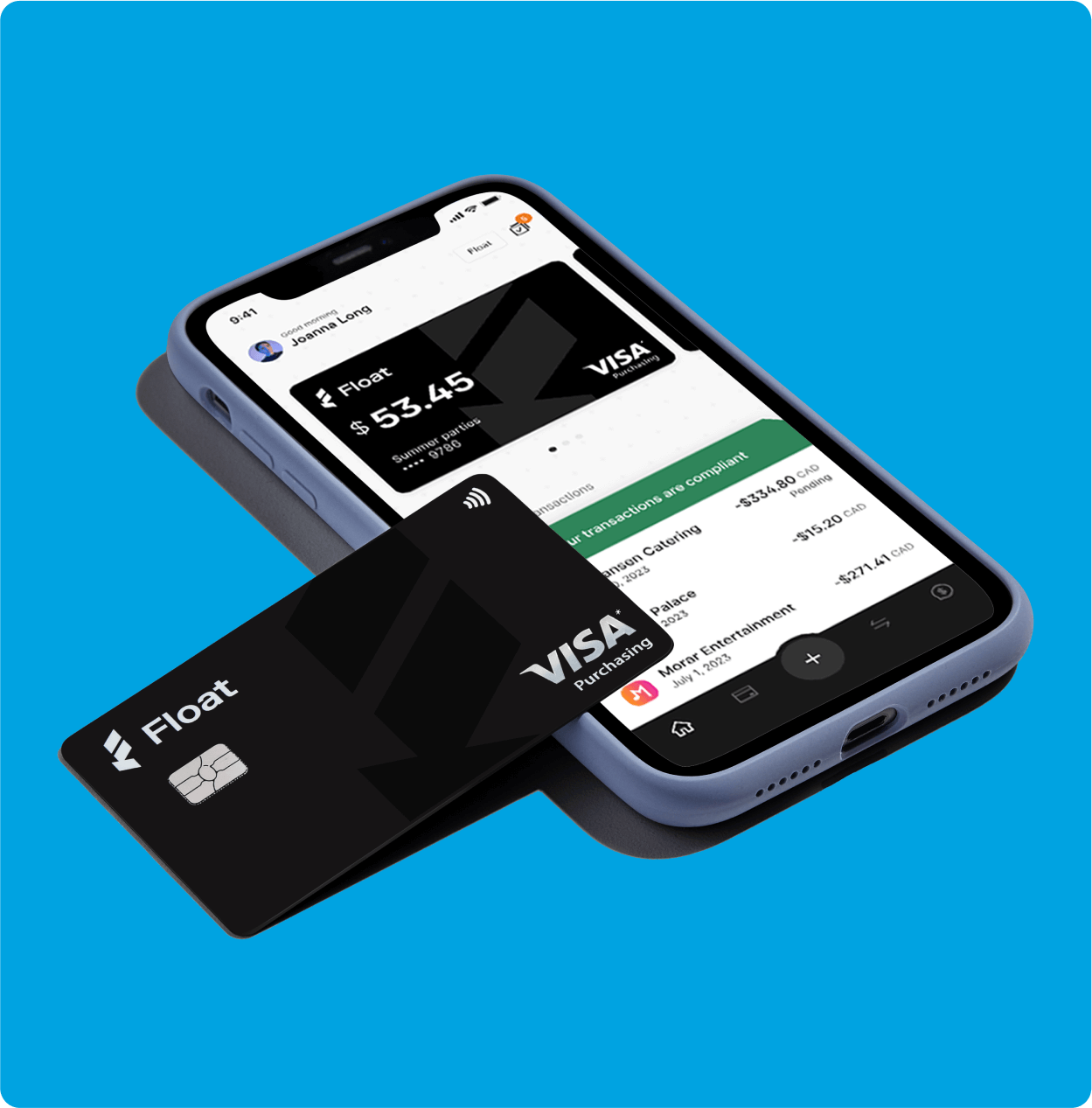

Unlimited Virtual and Physical corporate cards with no personal guarantees.

4% interest on cash held with Float and <24 hours account opening.

Easy to use mobile app to capture receipts on the go.

Trusted by thousands of leading Canadian companies.†

Why Startups in Canada Choose Float

Float is Canada’s only modern all-in-one spend management platform to combine corporate cards, high interest accounts, bill pay, and expense tracking into a single solution. Plus, 4% interest on funds held in Float, 1% cashback*, and exclusive SaaS discounts and perks.

High-limit corporate cards

Apply online to get access to high limit corporate cards with no personal guarantees and 1% cashback*.

Never run into spending limits with corporate cards.

Apply for a 10x higher card limit with Float’s Charge Card.

See transactions in real-time to track spend and spot spend anomalies.

Put your Finances on Auto-pilot

Float is an all-in-one spend management solution that automates tedious finance workflows and empowers teams to

Issue unlimited cards to your team for businesses expenses or reimburse employees for out of pocket spend directly from Float.

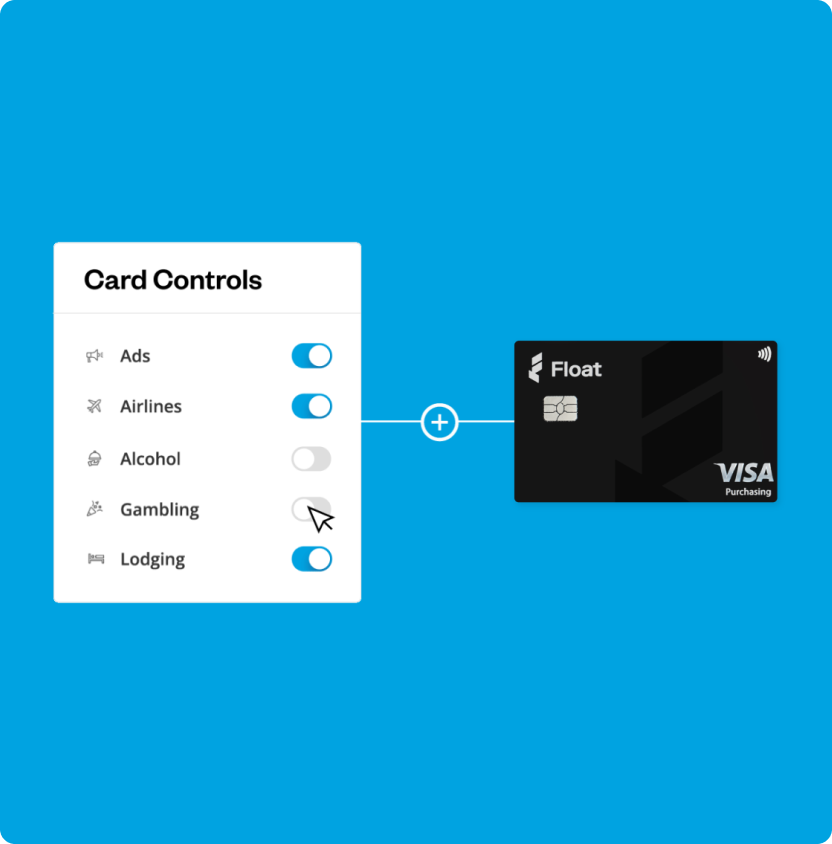

Send and approve card limits or spend requests with the click of a button, in both CAD and USD.

Best of all: never chase your team for receipts and eliminate tedious manual workflows

Float replaces:

Earn cashback and rewards

Save an average of 7% of your spend when switching to Float.

Earn 1% cashback* on CAD and USD card spend on Float.

Earn 4% interest on funds held in Float with no lockups or minimums.

Save on FX fees and access exclusive perks and rewards.

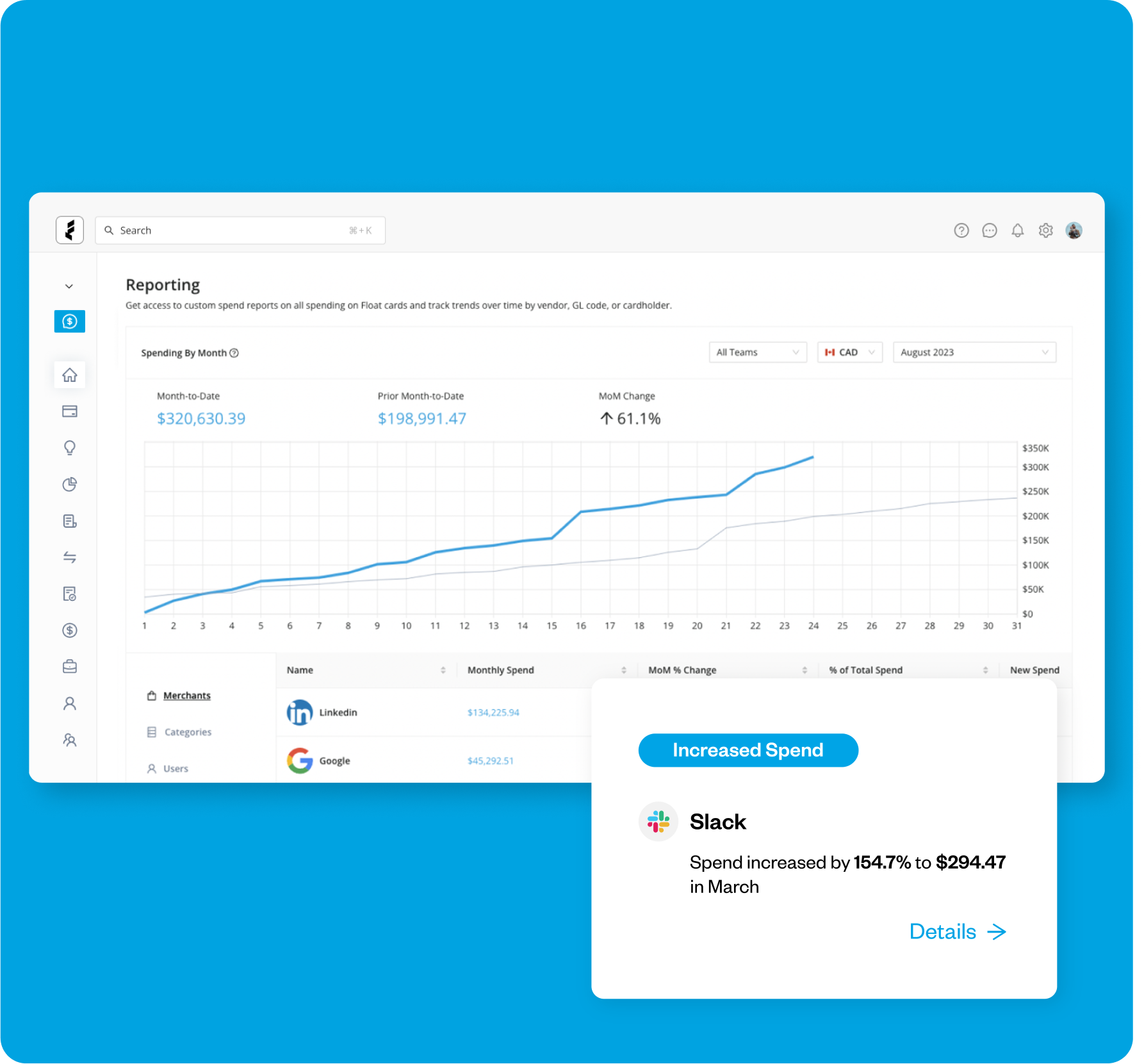

Powerful insights and analytics

Track all non-payroll expenses in a single place. Identify savings opportunities and prevent unwanted spend.

Track team budgets vs. actuals and see trends over time.

Quickly identify areas of overspending and find opportunities for savings.

Track duplicate subscriptions across teams to eliminate waste.

8x faster month-end

Float automates receipt capture and reconciliation to save you valuable time closing the books.

Float instantly notifies employees to upload receipts, so you don’t have to.

Float’s AI-powered OCR technology scans receipts, pulling amounts, taxes, and tips to reduce manual data-entry.

Smart rules automatically code spend with relevant GL codes, tax codes, merchants, and more.

Startups can sink or swim. Why not Float?

Benefits

Discover Benefits of Using Float

Learn how you can grow your business with Float’s rewards.

1% cashback

Earn 1% cashback* on all categories of credit card spend in both CAD and USD cards.

Earn 4% interest

Earn interest on funds held with Float and use them for daily spending. Withdraw cash any time with no lockups or minimums.

Close books 8x faster

Close your books faster with Float’s accounting integrations and enable your team to focus on things that really matter.

*1% with over $25k in monthly spending. Charge Card has different rewards structure. Contact sales for more information.

Save 7% on your Spend with Float

With Float businesses can earn 1% cashback on card spend, up to 4% interest on funds held in Float, and close the books up to 8x faster.

Estimate your Business Savings

with Float.

Average cash balance

(CAD):

Average cash balance

(USD):

Average monthly spend

(CAD):

Average monthly spend

(USD):

$21,150

That’s more than you’d earn with a bank.

Annual savings shown in CAD. Float is definitely not a bank. Learn more.

Thousands of Canada’s leading companies are powered by Float.

Hear from our customers on why they choose Float and how it enables them to grow their businesses faster.

Simplify Spend Management for your Startup Today

All-in-one platform that eliminates manual workflows and empowers your teams to focus on building.

Automated Accounts Payable

Capture, approve and pay bills via EFT, ACH or Wire. Automatic syncs directly to your accounting software.

Expense Management

Get customized spend controls and approval policies to help you manage your company spend.

Corporate Cards

Spend, track, approve, and reconcile all your CAD and USD expenses in one simple to use platform.

Your questions,

answered

A startup corporate card offers flexible spending limits, often linked to your company’s cash flow or funding, with no personal guarantee required. It also provides integrated expense tracking and management tools tailored for business needs. A traditional credit card, however, typically relies on personal credit history, has fixed limits, and lacks business-specific features. For startups, solutions like Float’s corporate cards offer spend controls, automated reconciliation, and real-time visibility into expenses, giving more control and efficiency than traditional options.

To apply for a corporate card for your startup, research providers that offer flexible terms without requiring personal guarantees. Prepare essential documents such as business financials, banking history, and company information. Float’s corporate card offers a simple application process, with no personal credit checks and spend management features tailored to startups, making it an ideal choice for growing businesses.

Startups often face challenges in getting traditional corporate cards due to limited credit history and lack of collateral. However, some providers, like Float, offer corporate cards without requiring personal guarantees or lengthy credit checks. Float’s cards are designed specifically for startups, providing flexible spending limits based on your company’s financials and real-time expense management tools.

Yes, Float offers flexible spending limits for its startup corporate cards. Instead of fixed credit limits, Float determines spending power based on your company’s financial health, including cash flow and account balances. This dynamic approach ensures startups have access to the funds they need, with real-time controls for better financial management.

Float offers a range of pricing plans, including a forever-free Essentials Plan that covers essential features like bill intake, approvals, and vendor payments. For more advanced features such as custom workflows and enhanced integrations, Float provides paid plans with pricing based on your business needs. This makes Float flexible and scalable for businesses of all sizes.

*Trademark of Visa International Service Association and used under licence by Peoples Trust Company.

@floatcard customer care is next level amazing. 3 separate issues over the last few months, all resolved in minutes (my issues were bank related, but Float went above and beyond in all cases)

March 28, 2023

Tarun Sachdeva

@terunsachdeva

Your support team is 🔥🔥🔥

Keep building an amazing product the rest will take care of itself!

October 4, 2022

Paolo Campisi

@pcampisi14

Banking with TD: Need year end statements, have to receive them by mail, pay $15 for them, scan them myself.

Banking with

@floatcard: Select last year, download statement as PDF. Done.

I love @floatcard

March 20, 2023

Steven Michael Thomas

@stevenwhatevr