HIGH YIELD ACCOUNTS

High yield account for Canadian businesses

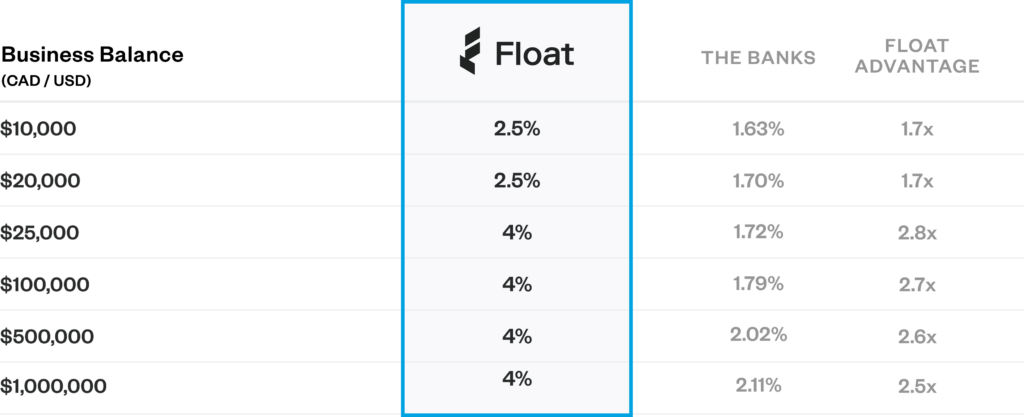

Earn up to 4% interest on your business balance with rates up to 2.8x the Canadian banks. No lock-ins or minimums required.

Trusted by thousands of leading Canadian companies.†

Ditch 0% chequing. Earn up to 4% instead.

Most Canadian businesses still use low-interest chequing accounts. Switch to Float Yield and effortlessly earn interest on CAD and USD cash—no lock-ups, no extra steps.

Zero

Balance Minimums

Zero

Lockups on Funds

Benefits

High earnings and no cash lockups

Earn up to 4% on your existing Float balance, automatically.

Compound earnings

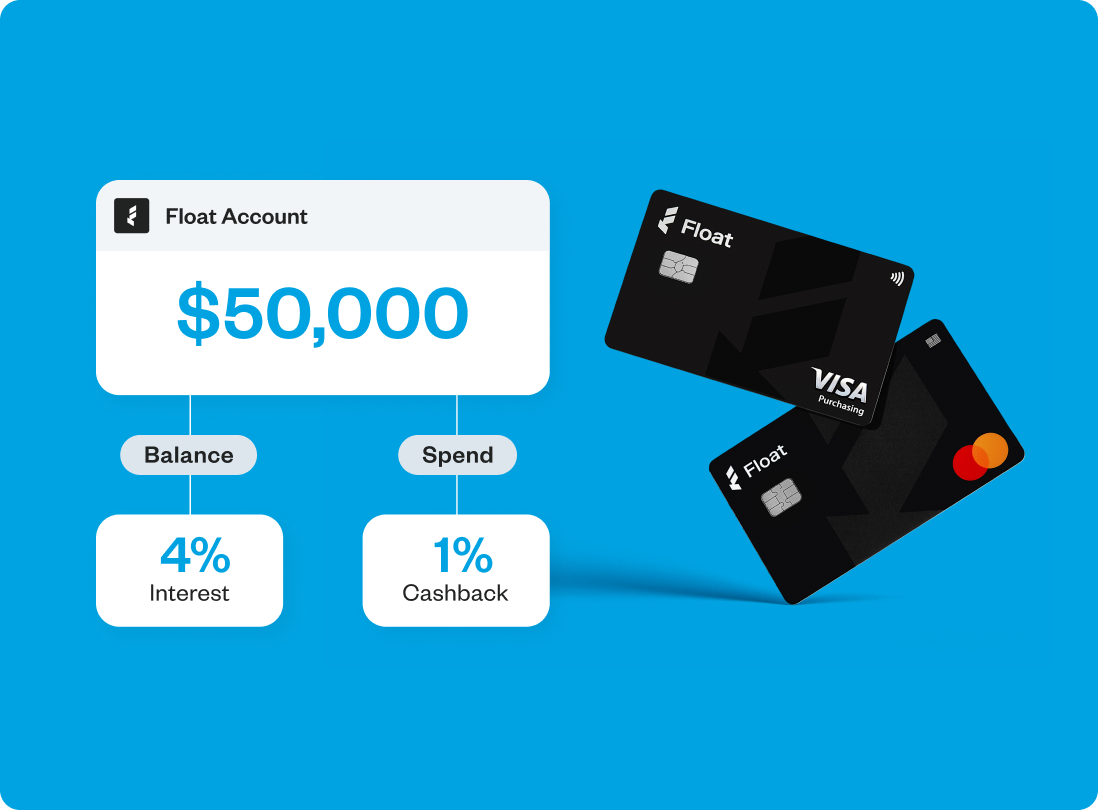

Every dollar in your CAD and USD balances earns up to 4% interest, plus 1% cashback* on corporate card spend. No extra steps required

No lockups

Withdraw your funds or use them for card expenses or bill payments with no lockups or penalties.

Stay liquid

Cash stays as cash in a dedicated account, not in GICs or money market.

Grow your company’s bottom line

Make every dollar count. Earn up to 4% interest+ on your entire CAD & USD balances.

+Interest is calculated daily and paid monthly on both CAD and USD cash balances. 2.5% yield for balances below $25,000 and 4% yield on balances of $25,000 or more. Float is definitely not a bank. Learn more.

How it Works

Sign up, transfer, earn

Fast, free account creation and hassle-free earnings on your cash balance and corporate card spend.

1. Sign Up

Apply in 15 minutes or less and get approved in one business day.

2. Transfer Funds

Connect your bank(s) and easily transfer funds to your Float balance in both CAD and USD.

3. Earn & Spend

Every dollar counts from day one. Earn 2.5% yield if your balance is under $25K, and level up to 4% yield on your total balance when it reaches $25K or more—plus 1 % cashback* on card spend.

*1% with over $25k in monthly spending. Contact sales for more information.

How much can your

business earn?

Average cash balance

(CAD):

Average cash balance

(USD):

Average monthly spend

(CAD):

Average monthly spend

(USD):

$21,150

That’s more than you’d earn with a bank.

Annual savings shown in CAD. Float is definitely not a bank. Learn more.

“Float Yield is another example of how Float uses innovation to help Canadian companies save more in today’s economy.”

Stephen Vescio

VP Finance at BenchSci

Come for the earnings,

stay for the software

Simplify your company spending with payments powered by intelligent software.

Automated Accounts Payable

Capture, approve and pay bills via EFT, ACH or Wire. Automatic syncs directly to your accounting software.

Expense Management

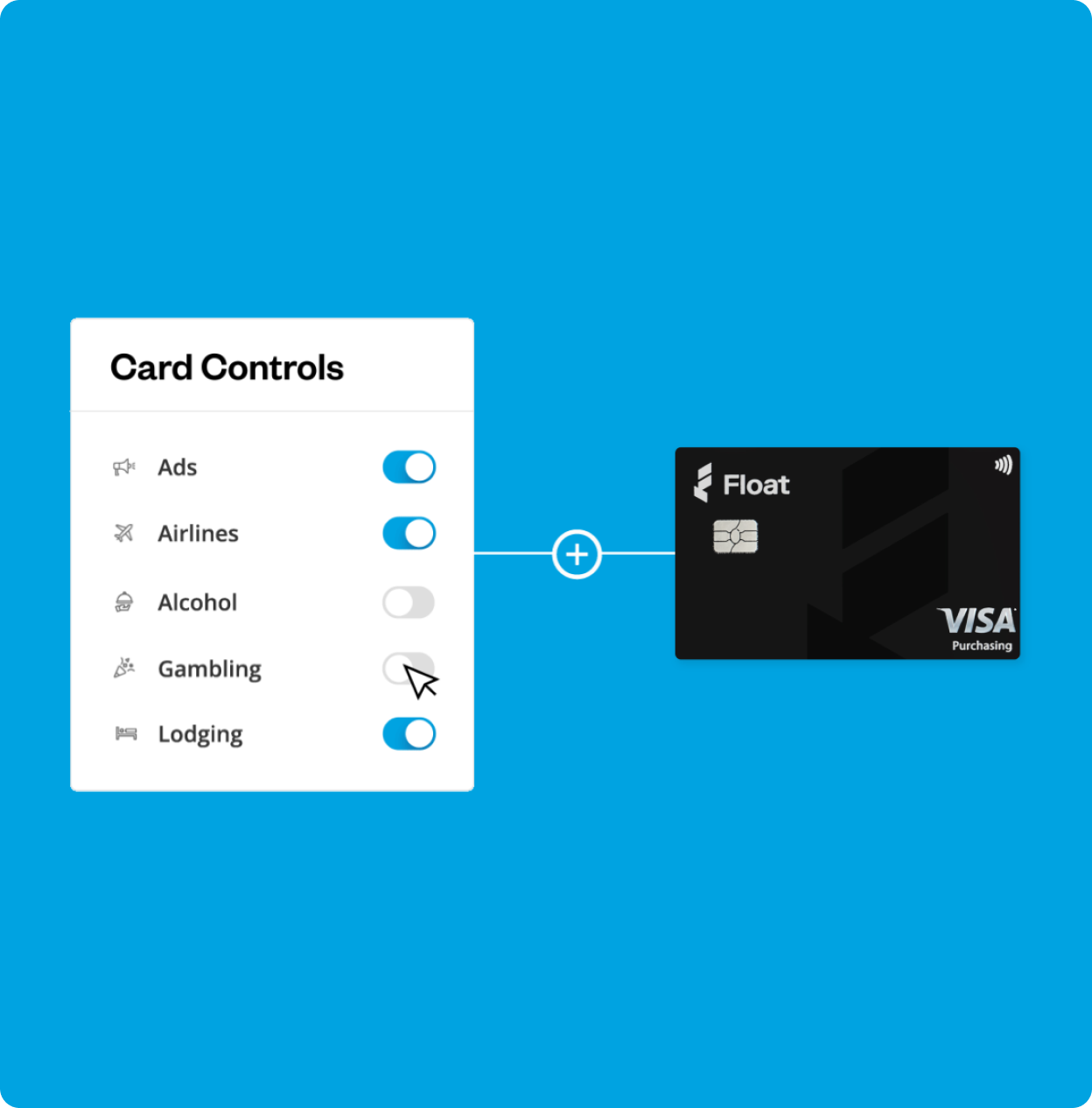

Get customized spend controls and approval policies to help you manage your company spend.

Corporate Cards

Spend, track, approve, and reconcile all your CAD and USD expenses in one simple to use platform.

Your questions,

answered

Book a demo with our team to learn more.

Float is a business finance platform here to help save your company time and money. Float is not a bank – we’re a FINTRAC-registered Canadian Money Services Business that counts thousands of Canadian companies as loyal customers.

Float’s interest is an annualized rate, calculated daily based on your Float balance (in both CAD or USD) and paid monthly. Any balance in Float will start earning interest from the first dollar.

When your balance is equal to or exceeds $25,000 (in CAD or USD), you’ll earn 4% annualized interest on your entire balance up to $1M.

When your balance is under $25,000 (CAD or USD), you’ll earn interest at an annualized rate of 2.5% on every dollar, adjusting in tandem with the Bank of Canada’s overnight interest rate.

For example: if your balance in CAD is $30,000 and your USD balance is $5,000 on a given day, you’d earn 4% on your CAD balance and 2.5% on USD on that day.

Interest payments occur on the first day of every month.

Your Float Account is a central place for you to earn rewards for your business while automating and managing your company’s spending.

You’ll receive interest on your CAD and USD balances in Float and cashback rewards when you spend on Float Cards. Plus, you’ll have access to smart spend management software.

Yes! You can earn up to 4% interest on monthly Float balances up to $1M and 1% cashback on monthly card spend over $25k, in both CAD and USD. Please note that interest is available on cash balances, and for Canadian entities only.

Float customers have access to physical and virtual corporate cards in both CAD and USD when they join Float, backed by intelligent spend management software to help you automate, manage, and control company spend. Even better? Our Essentials plan is free!

No lockups, and this isn’t a GIC. Customers can easily withdraw funds by contacting our Support team, which is available 7 days per week. Funds will take 2-5 business days to arrive back in the bank account you connect to Float.

Both CAD and USD funds are held in dedicated accounts at Tier 1 Canadian banks. All stages of our funds storage process use dedicated accounts for the storage of customer funds, and customer funds are segregated from operating funds at all times.

Please note: Float is not a bank or CDIC member institution, and funds aren’t CDIC insured. Float is a registered MSB (Money Services Business) in Canada. We are also SOC2, type 2-certified, ensuring adherence to robust security protocols as verified by independent audits.

We took the rates of commonly available business savings products from each of the 5 big banks on April 14, 2025 (assuming a 100% CAD balance) and averaged them.

For the calculator, research shows that high-limit no personal guarantee corporate cards in Canada don’t commonly have cashback rewards, and no cashback was assumed. Please note that Float balances are not directly comparable to these products.

We believe in passing the interest earned on your funds back to you. The rates we’re offering are often not available or negotiated by Canadian SMBs, so we’re proud to be able to do so.

What makes it worth Float’s while is that we hope that over time, customers will spend with us on Float corporate cards and use our software, and want to do more business with us.

When your balance is equal to or exceeds $25,000 (in CAD or USD), you’ll earn 4% annualized interest on your entire balance up to $1M. We will hold this rate until September 1, 2025.

When your balance is under $25,000 (CAD or USD), you’ll earn interest at an annualized rate of 2.5% on every dollar, adjusting in tandem with the Bank of Canada’s overnight interest rate.

*Trademark of Visa International Service Association and used under licence by Peoples Trust Company.