FLOAT USECASES

High Limit Corporate Cards and Spend Management for E-commerce Businesses

Ditch the banks and get up to 10x higher limit cards with no personal guarantees. Manage all of your business expenses in a single platform — plus average savings of 7%.

Unlimited Virtual and Physical corporate cards with no personal guarantees.

4% interest on cash held with Float and <24 hours account opening.

30 days net terms and 10x higher credit limits than the banks.

Trusted by thousands of leading Canadian companies.†

Why E-commerce Businesses in Canada Choose Float

Float is Canada’s only modern all-in-one spend management platform to combine corporate cards, high interest accounts, bill pay, and expense tracking into a single solution. Plus, 4% interest on funds held in Float, 1% cashback*, and exclusive SaaS discounts and perks.

High-limits and flexible payment terms

Apply online to get access to high limit corporate cards with no personal guarantees and 1% cashback*.

Never run into spending limits with corporate cards.

Apply for a 10x higher card limit with Float’s Charge Card.

See transactions in real-time to track spend and spot spend anomalies.

Easily Manage Supplier and Inventory Expenses

Track and manage all card and bank supplier payments from a single place.

Issue unlimited virtual cards for vendor payments to maximize cashback and prevent overcharges.

Pay vendors that don’t accept cards via ACH, EFT, or Global Wires.

Best of all: never chase your team for invoices or receipts and eliminate tedious manual workflows

Track and Control Costs for Shipping and Logistics

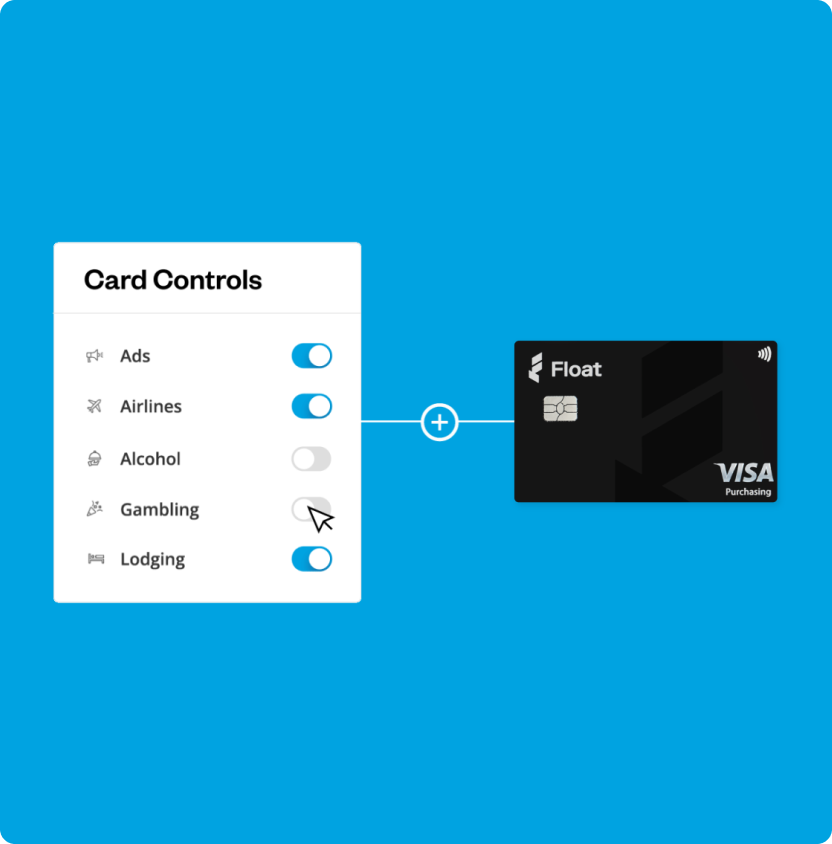

Get real-time spend visibility and flexible controls over cards with Float.

Issue one-off virtual cards with independent card limits to prevent vendor overcharges.

Save on FX with Float’s USD and CAD cards.

Grow faster with up to 10x higher credit limits* and flexible payment terms

Take Charge of Marketing and Advertising Spend

Track all non-payroll expenses in a single place. Identify savings opportunities and prevent unwanted spend.

Track team budgets vs. actuals and see trends over time.

Quickly identify areas of overspending and find opportunities for savings.

Track duplicate subscriptions across teams to eliminate waste.

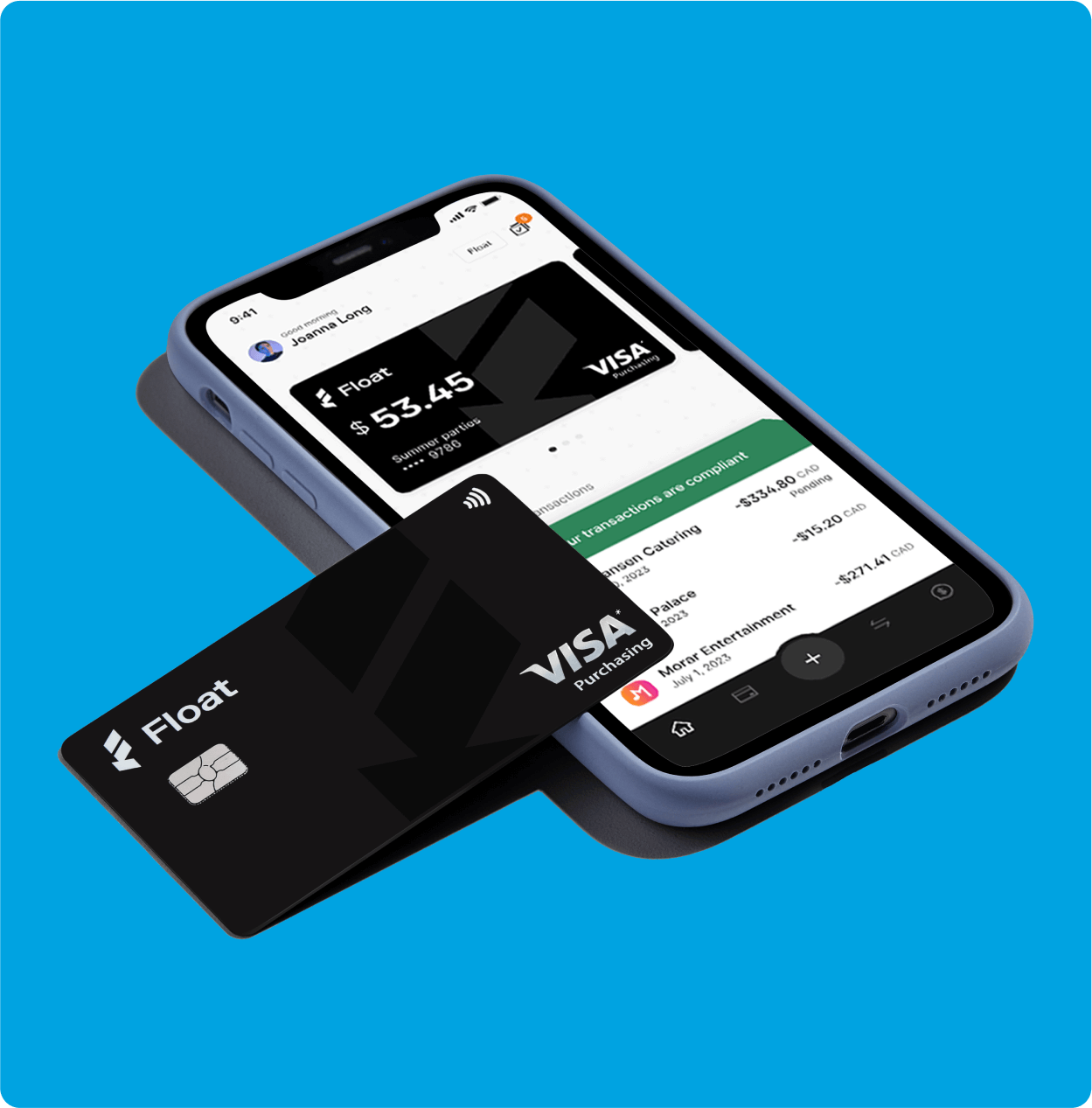

Track Expenses on the Go

When your business is on the move, Float’s mobile app allows to track expenses on the go.

Float’s free iOS and Android mobile app that enables your team to spend on the go.

Snap receipts and let Float’s AI match them automatically to relevant transactions.

Smart rules automatically code spend with relevant GL codes, tax codes, merchants, and more.

Businesses can sink or swim. Why not Float?

Benefits

Discover Benefits of Using Float

Learn how you can grow your business with Float’s rewards.

1% cashback

Earn 1% cashback* on all categories of credit card spend in both CAD and USD cards.

Earn 4% interest

Earn interest on funds held with Float and use them for daily spending. Withdraw cash any time with no lockups or minimums.

Close books 8x faster

Close your books faster with Float’s accounting integrations and enable your team to focus on things that really matter.

*1% with over $25k in monthly spending. Charge Card has different rewards structure. Contact sales for more information.

Save 7% on your Spend with Float

With Float businesses can earn 1% cashback on card spend, up to 4% interest on funds held in Float, and close the books up to 8x faster.

Estimate your Business Savings

with Float.

Average cash balance

(CAD):

Average cash balance

(USD):

Average monthly spend

(CAD):

Average monthly spend

(USD):

$21,150

That’s more than you’d earn with a bank.

Annual savings shown in CAD. Float is definitely not a bank. Learn more.

Thousands of Canada’s fastest growing businesses are powered by Float.

Hear from our customers on why they choose Float and how it enables them to grow their businesses faster.

“When we were using AMEX – it often put our ad campaigns on pause and we would lose users every day.”

Jerry Lin, VP Finance, Coinberry

“With Float it was easy to spot that a team had doubled their spend at a vendor in a single month.”

Gino Cacciatore, CFO, SKYBOX LABS

“48 hours after signing up, our account was fully active. You don’t get that with the Canadian banks.”

Darcie Vany, CFO, Crawford Technologies

“From unwanted monthly subscriptions to unauthorized transactions, the level of control we now have with Float is saving us approximately $10,000 a month.”

Jerry Lin, VP Finance, Coinberry

“The level of support from the Float team is unmatched. It’s been the best part about working with their team.”

Suvansh Mehta, Strategy and Finance Manager, PolicyMe

“We have hundreds of transactions a month. To go through that many receipts would be impossible.”

Heather Brunt, Financial Controller, Nerva Energy

Simplify spend management for your e-commerce business today

All-in-one platform that eliminates manual workflows and empowers your teams to focus on building.

Automated Accounts Payable

Capture, approve and pay bills via EFT, ACH or Wire. Automatic syncs directly to your accounting software.

Expense Management

Get customized spend controls and approval policies to help you manage your company spend.

Corporate Cards

Spend, track, approve, and reconcile all your CAD and USD expenses in one simple to use platform.

Your questions,

answered

An eCommerce corporate card offers dynamic spending limits, real-time tracking, and integration with digital tools, ideal for managing online business expenses. Traditional credit cards provide fixed limits and general rewards but lack specialized features for high-volume, online transactions. Float’s corporate card enhances control and efficiency for eCommerce operations.

To apply for a corporate card for your eCommerce business, gather financial information such as revenue data and bank account details. Look for providers that offer cards without personal guarantees. Float’s corporate card offers a straightforward application process, no personal credit checks, and tailored spend management tools for eCommerce businesses.

To choose the right expense management software for your eCommerce business, consider factors like automation, real-time tracking, and scalability. Look for software that integrates with your accounting system, provides custom spend controls, and offers reporting features. Float’s expense management solution is ideal for eCommerce businesses, offering automated workflows, dynamic spending limits, and seamless integrations, ensuring efficient control of expenses as you scale.

Float offers a range of pricing plans, including a forever-free Essentials Plan that covers essential features like bill intake, approvals, and vendor payments. For more advanced features such as custom workflows and enhanced integrations, Float provides paid plans with pricing based on your business needs. This makes Float flexible and scalable for businesses of all sizes.

*Trademark of Visa International Service Association and used under licence by Peoples Trust Company.