Cash Flow Optimization

How to Pay Invoices from the US: A Step-by-Step Guide

Learn important requirements when it comes to paying US invoices and innovative solutions available on the market, like Float, that you can use for free.

September 20, 2024

Paying invoices from the US can be a straightforward process, but it’s essential to understand the various methods available and choose the one that best suits your needs. By selecting the right payment method, you can ensure that your invoices are paid efficiently and cost-effectively, helping you maintain strong relationships with your vendors and service providers.

In this comprehensive guide, we’ll walk you through the steps involved in paying invoices from the US, including gathering the necessary information, choosing a payment method, and verifying the transaction. Whether you prefer online payments, credit cards, or bank transfers, we’ve got you covered with practical tips and insights to streamline your invoice payment process.

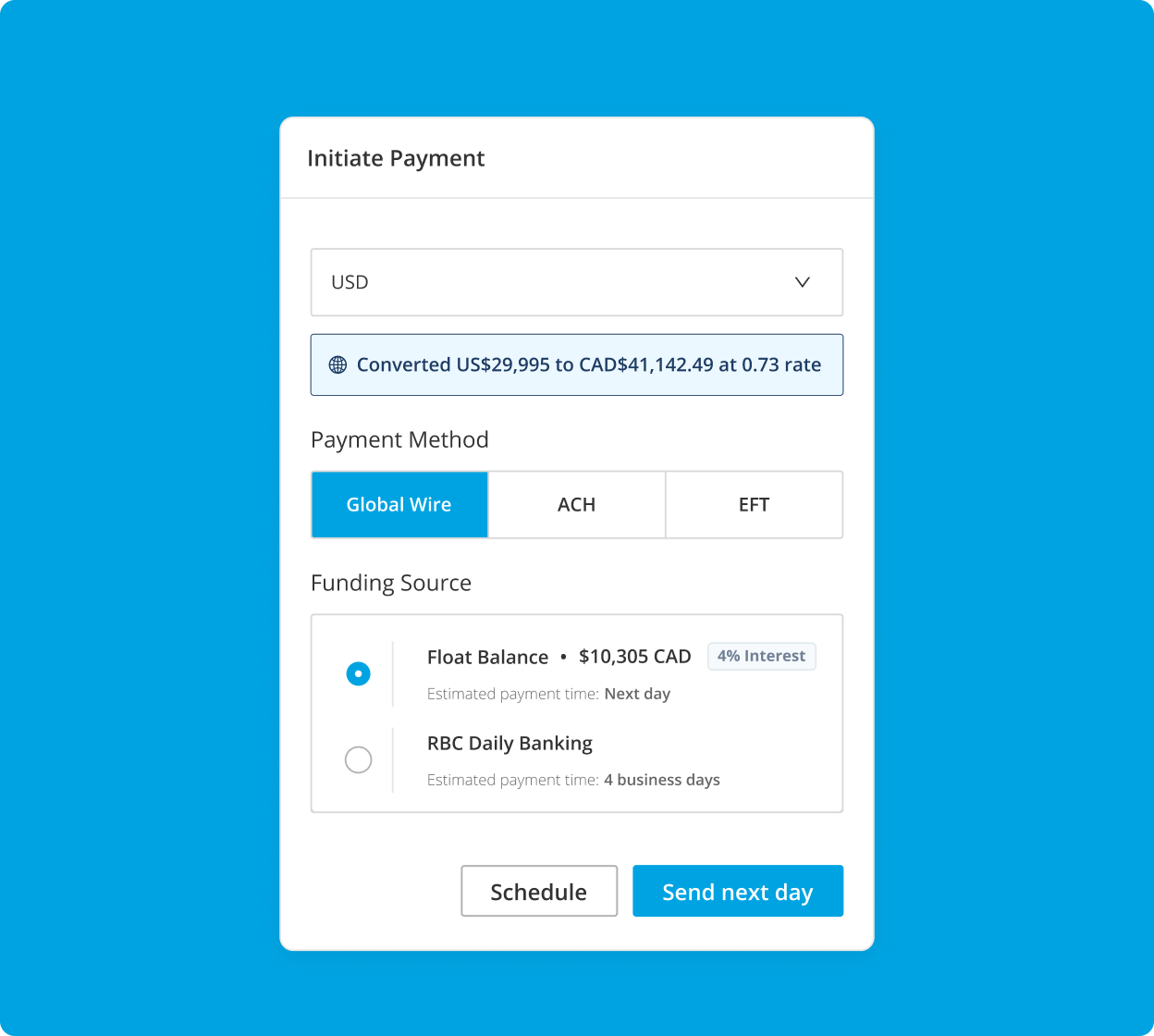

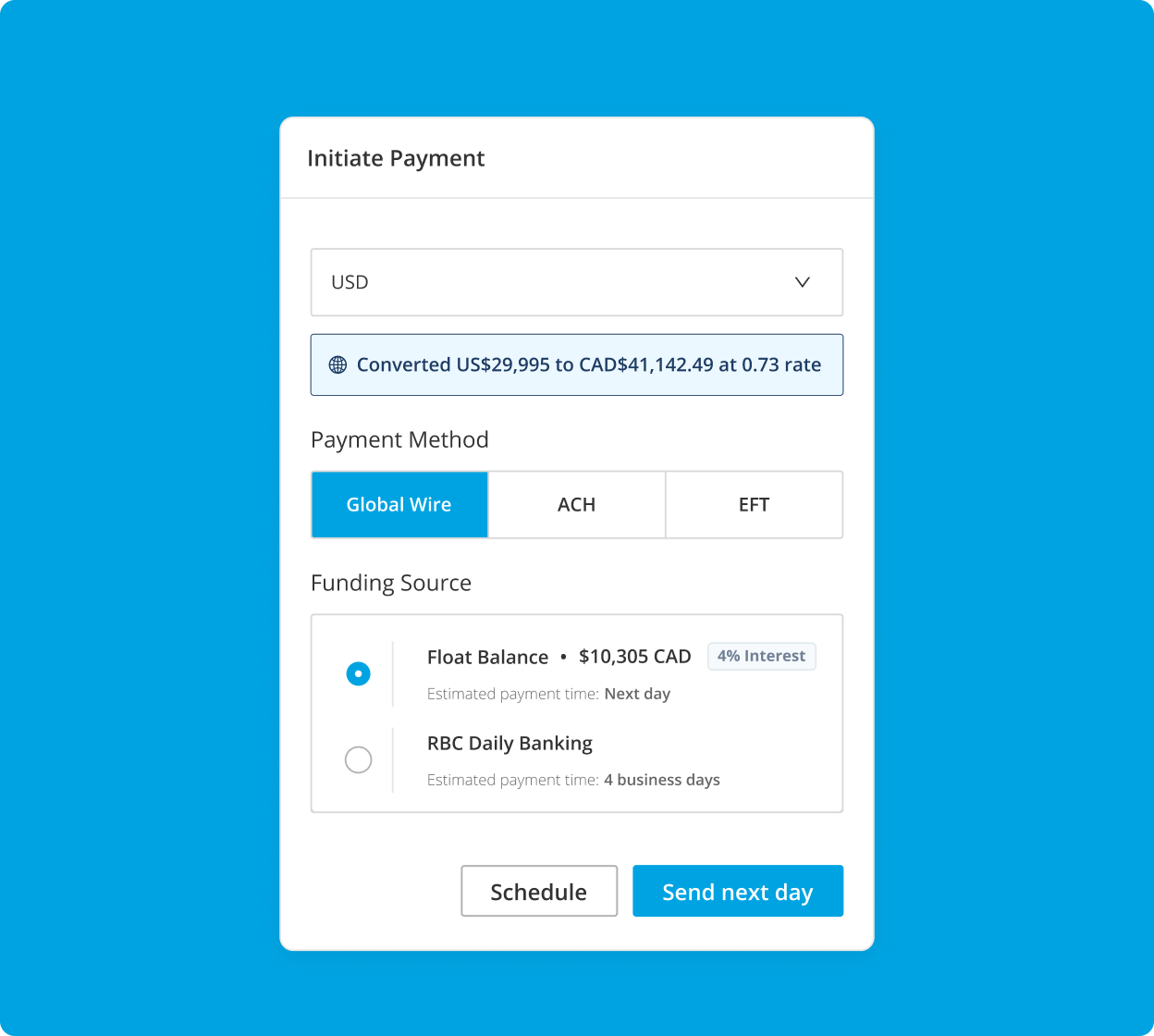

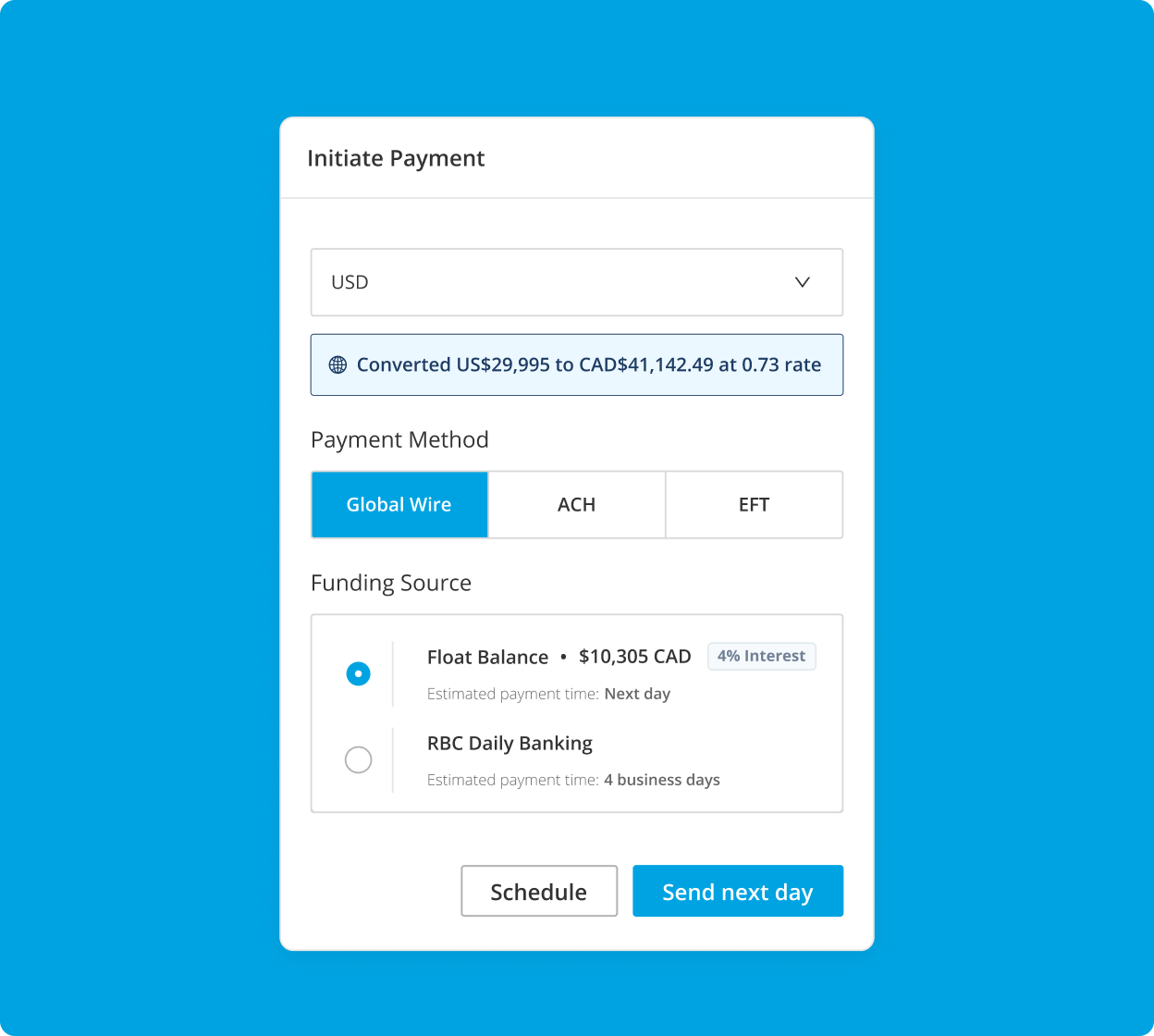

Pay US Bills with Float

Canada’s best-in-class Payments platform for USD and CAD ACH, Global Wires, and EFT payments — plus average savings of 7%.

What is Invoice Payment?

Invoice payment is the process of transferring funds to a vendor or service provider for goods or services received. Ensuring timely and accurate payment is crucial for maintaining good business relationships and avoiding late fees.

How to Pay Invoices from the US

Paying invoices from the US involves several methods, each with its own advantages and considerations. Choosing the right payment method is essential for efficiency and cost-effectiveness.

Step 1: Gather the Necessary Information

Before making a payment, ensure you have the invoice number, amount due, due date, and payment instructions. Verify the payment details to avoid errors and delays.

Step 2: Choose a Payment Method

There are several options for paying invoices from the US, including bank transfers, credit cards, online payment gateways, and checks. Consider factors like fees, speed, and convenience when selecting the best method for your needs.

Step 3: Pay Invoice Online

Paying invoices online is often the quickest and most convenient option. Log into your bank or payment provider’s portal, enter the required details, and authenticate the payment. Online payments offer the benefits of speed and ease of use.

Step 4: Pay Invoice with Credit Card

If the vendor accepts credit card payments, you can easily pay your invoice by entering the card details and confirming the transaction. Be aware of any potential fees associated with credit card payments, but also consider the benefits, such as rewards or cashback.

Step 5: Pay Invoice with PayPal

PayPal is another popular option for paying invoices. Log into your PayPal account, select ‘Send Money,’ and enter the vendor’s details. Confirm the payment and save the transaction receipt for your records.

Step 6: Bank Transfer Invoice Payment

Bank transfers are a reliable method for paying invoices. Log into your online banking portal, set up a new payee with the vendor’s bank details, enter the amount and payment reference, then confirm the transfer.

Step 7: Pay International Invoices

When paying international invoices, ensure you understand the currency and conversion rates. Using a reliable international payment provider can help simplify the process and provide benefits like competitive exchange rates and faster processing times.

Step 8: Verify and Record the Payment

After making a payment, check that the transaction has been processed and received by the vendor. Record the payment in your accounting system to maintain accurate financial records and facilitate future reconciliation.

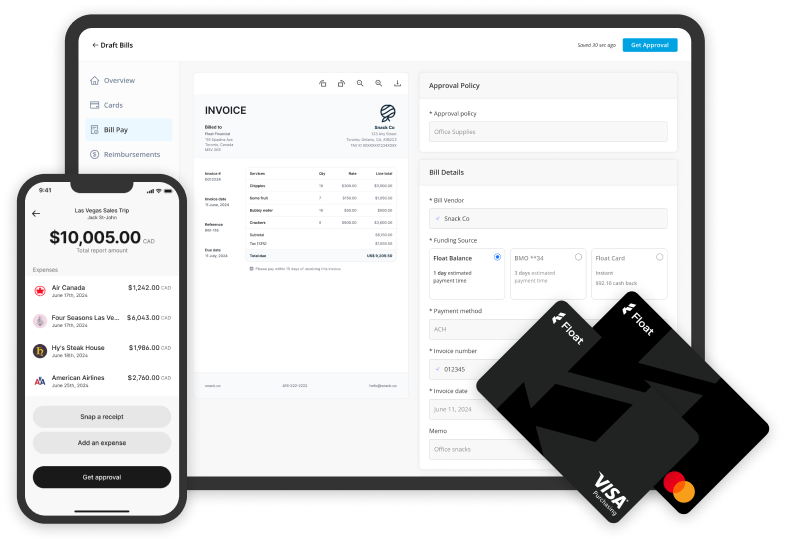

Pay US Bills with Float

Canada’s best-in-class Payments platform for USD and CAD ACH, Global Wires, and EFT payments — plus average savings of 7%.

Tips for Efficient Invoice Payment

1. Schedule payments in advance

To ensure you never miss a due date, consider setting up reminders or automatic payments for your invoices. This proactive approach helps you stay on top of your financial obligations and maintain a positive relationship with your vendors.

2. Consolidate payments

If you have multiple invoices to pay, consider using batch payments to streamline the process. By handling several invoices at once, you can save time and reduce the risk of errors.

3. Monitor payment statuses

Regularly checking the status of your pending and completed payments is crucial for maintaining accurate financial records. This practice allows you to quickly identify and resolve any issues that may arise.

4. Utilize payment integrations

Integrating your payment systems with your accounting software can significantly streamline your invoice payment processes. This integration enables automatic data synchronization, reducing manual data entry and minimizing the risk of errors.

The Best Solution for Paying Invoices from the US

When it comes to paying invoices from the US, using a dedicated bill pay service can greatly simplify the process and provide additional benefits. A reliable bill pay solution should offer features like Global Wires for international payments and USD ACH functionality for domestic transactions.

By using a comprehensive bill pay service, you can enjoy a centralized platform for managing all your invoice payments, regardless of the payment method or currency. This streamlined approach saves you time, reduces the risk of errors, and provides greater visibility into your financial transactions.

If you’re looking for a comprehensive solution to streamline your invoice payment process, we invite you to explore Float’s Bill Pay service. With features like Global Wires and USD ACH functionality, our platform is designed to simplify the way you manage and pay your invoices from the US. Get started for free today and experience the benefits of a powerful, user-friendly bill pay solution that can help you save time, reduce errors, and maintain better control over your financial transactions.

Frequently Asked Questions

To pay an invoice, you’ll need the invoice number, amount due, due date, and payment instructions provided by the vendor.

Yes, many vendors accept credit card payments for invoices. However, be aware of potential fees associated with this payment method.

After making a payment, verify that the funds have been received by the vendor and record the transaction in your accounting system for accurate bookkeeping.

To efficiently track invoice payments, maintain detailed records of all transactions and relevant documentation. Utilize accounting software to manage invoices and monitor payments. Regularly review your records to ensure accuracy and compliance.

Float is Free to use on our Essentials plan, where you will be able to issue unlimited virtual CAD/USD cards, earn 4% interest on deposits, reimburse employees and pay vendor bills. If you need more sophisticated functionality, like over 20 physical cards, Netsuite integration, or an API solution, you will have to consider our paid Professional and Enterprise plans.

Float offers Charge Card and Prepaid funding models. You can apply (*Conditions apply. Book a demo to learn more) for unsecured, 30-day credit terms with high limits up to $1M, no credit checks and personal guarantees. Prepaid model offers 4% interest on all deposits with no cash lockups with account opening in < 24 hours.

Unlike traditional cards that get you to spend more, Float is the only corporate card in the world that helps businesses spend less. Through a combination of financial rewards like our 1% cashback, 4% interest on deposits, no FX fees with our USD cards and time savings of at least 8 hours per employee Float’s customers on average save 7% on their spend.

Written by

All the resources

Corporate Cards

Discover: Virtual Credit Cards for Canadian Businesses

Explore the benefits of virtual credit cards with Float. Discover how this modern payment solution enhances security and simplifies your

Read More

Cash Flow Optimization

Working Capital Turnover: Measuring Efficiency

Ready to master your working capital turnover? Get expert tips from Float and Sendy Shorser.

Read More

Financial Controls & Compliance

4 Free Online Bookkeeping Courses for Canadian Businesses

Want to level up your bookkeeping? These courses might be the key. Read more to learn what you should be

Read More