The Ultimate Guide to Business Banking for Canadian Companies

Explore how modern business banking in Canada compares to traditional banks—and what to consider when choosing the right solution for your company.

May 20, 2025

Running a business in Canada means juggling a lot of moving parts—and your banking setup can either make things easier or more complicated. With over 98% of Canadian businesses falling into the small or medium-sized category, most business owners are dealing with the same challenges: managing cash flow, paying bills, tracking expenses—and doing it all without getting buried in spreadsheets.

The problem?

A lot of banking tools out there still feel stuck in the past. But the right business banking partner or business finance solution can flip the script—helping you ditch the clunky processes and grow your business with smarter, faster tools that work with you, not against you.

This guide will walk you through modern business banking in Canada, including what today’s fintech solutions offer, how they differ from traditional banks, and the key questions to ask when weighing your options between a traditional bank and a more modern business finance solution.

Why business banking matters for Canadian companies

So, why does business banking matter so much?

Sure, the obvious answer is that you need a place to keep your cash—no money, no growth. But there’s more to it than just having a safe spot to stash your funds.

Choosing the best business banking setup can actually shape your company’s financial foundation. It helps you separate business and personal finances (which is more important than many think), build your business credit, and influence how clients, partners, and investors perceive your professionalism and stability.

The main advantages are:

- Accurate tracking of income and expenses

- Simplified tax filing and audits

- Easier access to business credit and funding opportunities

- Protection of personal assets from business debts

What makes a business bank account “best” for you?

The ideal business bank account is one that aligns with your company’s specific needs, considering its scale, the volume of transactions it handles, and its future growth objectives.

- Low or transparent fees

- Digital banking tools

- High-yield savings options

- Integration with accounting software

- Flexible payment and card solutions

High-yield business accounts in Canada: What to look for

When looking at business banking solutions or a modern business finance solution, you want to make sure that you’re exploring high-yield business accounts.

Most typical business bank accounts don’t give you much in the way of interest, but there are special high-yield accounts that can actually help your business’ cash grow.

A high-yield business account helps your money work harder by earning interest on idle cash, boosting your returns without extra effort. And depending on your financial provider, you could see interest rates as high as 4% on business balances..

How do high-yield accounts work?

High-yield business accounts allow your company to earn interest on its cash balances, generating passive income on funds that are not immediately needed. These accounts offer significant advantages for various types of businesses, like:

- Service-based businesses (like agencies or consultants) can earn interest on retainers or prepaid contracts before using the funds for payroll or expenses.

- Ecommerce stores can grow idle cash between sales cycles or before big inventory purchases like Black Friday.

- Property managers benefit from earning interest on rent collections held for future maintenance, taxes or distributions.

- Bootstrapped startups and nonprofits can stretch their runway or funding by earning passive returns on reserve cash.

Here are some factors you want to evaluate with your high-yield savings accounts:

- Understand the annual percentage yield (APY) to know the actual return on your deposits.

- Be aware of any minimum balance requirements that might apply.

- Assess the ease with which you can access your funds when needed (liquidity).

- Consider how well the account integrates with your other banking services.

Float’s high-yield account provides up to 4% interest, transparent terms without hidden fees, and no lock-ups.

Corporate cards: no personal guarantee, high limits and spend control

Another key when it comes to your business banking or finance solutions? Corporate cards.

Corporate cards can be a game-changer for business owners. They usually come with higher limits, smart controls and no personal guarantees, so you’re not putting your own credit or assets on the line.

And the modern options come with some other major perks.

Traditional cards often demand a personal guarantee, which can expose your personal finances. Thankfully, new options provide high credit limits without this requirement, offering business owners greater adaptability and peace of mind.

Key benefits of corporate cards include:

- No personal guarantee required

- High spending limits tailored to business needs

- Real-time spend controls and customizable limits

- Automated receipt capture and expense categorization

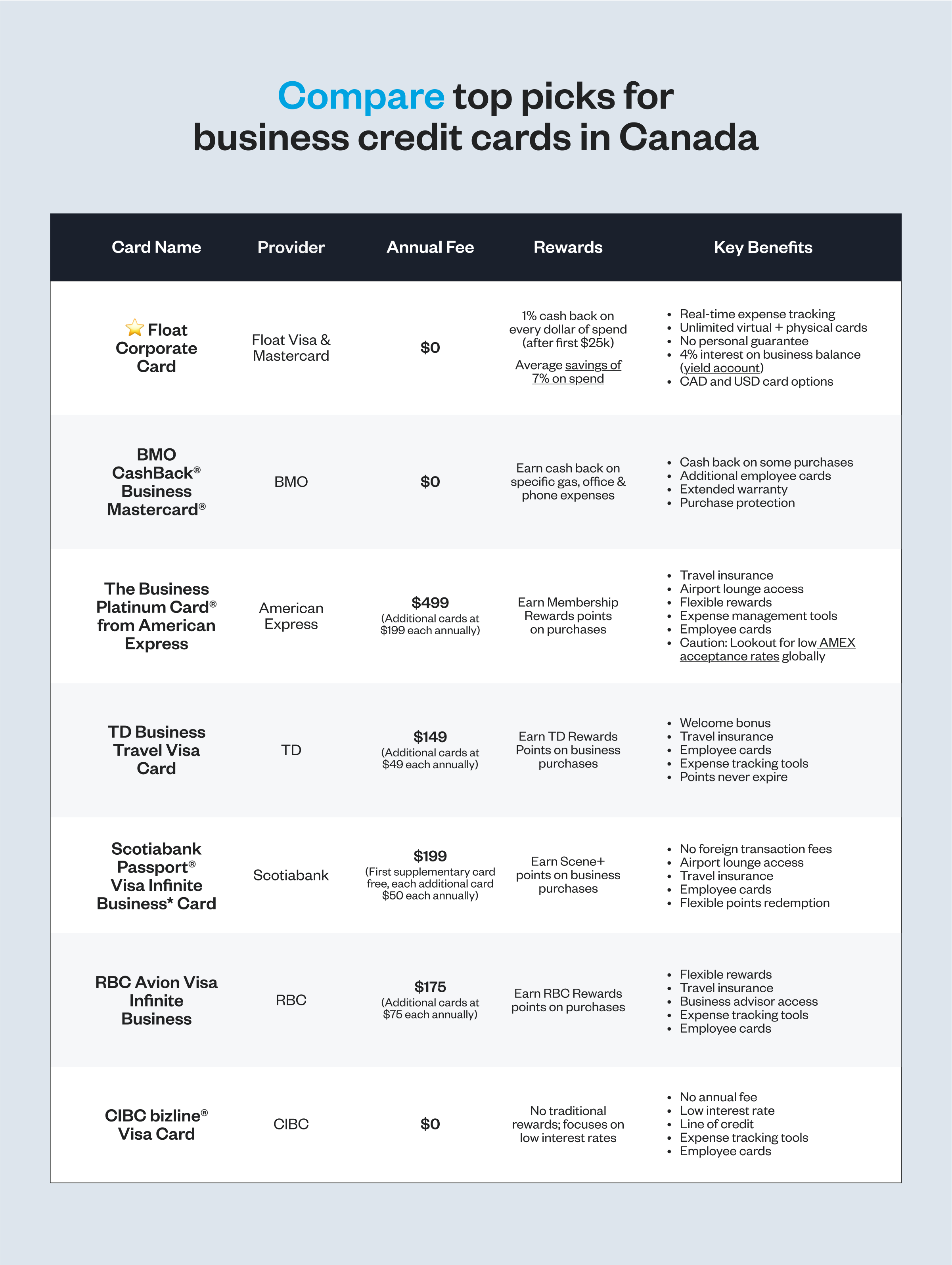

It’s important to weigh the different pros and cons of different corporate cards to ensure you’re getting what you need. Check out the handy comparison below for some of the best business credit cards in Canada:

Expense management software: Automate, integrate and save time

If a high-yield savings account helps your money grow in the background, automated expense tracking helps you save time and sanity upfront.

Manual expense tracking is a drain on time and opens the door to mistakes. Switching to automated expense management software can lighten your administrative load and boost accuracy. A modern expense management platform lets you:

- Snap and store receipts effortlessly with your phone or email.

- Keep a constant eye on your transactions in real time.

- Seamlessly connect with your accounting software, like QuickBooks or Xero.

- Set up customized approval steps that fit your team.

- Gain clear insights into your spending with detailed analytics.

So how does automated expense management software actually work?

Automated expense management software simplifies what used to be a manual, time-consuming process—by handling each stage of expense tracking for you. Here’s how it works in practice:

- Capture: The software automatically collects receipts and transaction data from various sources—credit card feeds, email, mobile uploads—so nothing slips through the cracks.

- Categorize: Once captured, expenses are instantly sorted into the correct categories, accounts, or project codes based on your pre-set rules.

- Approve: Submissions are routed through custom approval workflows, ensuring the right people review the right expenses—without back-and-forth emails.

- Reconcile: Finally, approved expenses sync directly with your accounting system, keeping your books up to date and audit-ready with minimal manual input.

Companies that have adopted automated expense management have seen real benefits. Some companies have seen upwards of 76% time back on their accounting processes—imagine what you could be doing with that kind of time!

Bill payment automation and accounts payable solutions

Once your internal spending is under control, the next big win is handling what goes out the door. Paying suppliers shouldn’t mean chasing emails or getting lost in spreadsheets—and yet, that’s the reality for a lot of businesses.

Paying your suppliers on time is crucial for any Canadian business. But let’s be real. Chasing down invoices and juggling manual payments can be a major time suck. It’s tedious, prone to errors, and not the best use of your team’s energy.

Thankfully, there’s a smarter way. Automating your bill payments lets you schedule and approve payments from anywhere online. This helps you avoid those annoying late fees, avoid duplicate payments and keep a trackable record of all your transactions without the stress.

Here’s how solutions like Float can help with bill payment automation:

- See all your invoices and schedule payments in one simple place.

- Set up customized approval steps to match your company’s needs.

- Connect directly with your accounting software to keep everything in sync.

- Know exactly where your payments are with real-time tracking.

Learn more about Float

Get a 10-minute guided tour through our platform.

Choosing the right business banking solution: What to consider

Now that you know everything your business banking or business finance solution can get for your business, it’s time to start shopping.

When you’re checking out different business banking and expense management options, ask yourself:

- What are the fees for accounts and transactions?

- How much interest can you earn on your deposits?

- What kind of card features and spending limits do they offer?

- Will it work with the tools you’re already using?

- How helpful and quick is their customer support?

The answers will reveal your business banking needs, helping you find the right solution.

What Makes Float Different?

One popular solution for Canadian businesses is Float. With Float, you can:

- Earn up to 4% interest on your business account.

- Get corporate cards with high spending power without a personal guarantee.

- Say goodbye to manual expense tracking with automation and easy receipt capture.

- Connect smoothly with QuickBooks and other accounting software.

- Enjoy transparent and honest pricing with no surprises.

Float eliminates the busywork, lowers risks, and equips Canadian businesses with the tools they need to expand effectively.

“Because of Float, we’re all free to focus on data-driven, value-added work that grows our business and supports our customers.”

– Eddison Ng, Co-Founder, Coastal Reign

Business finance solutions that works for you

Canadian businesses need more than just a basic place to keep their money. The ideal banking or finance solution fuels growth, improves cash flow and cuts down on annoying administrative tasks. They need a solution that work with them.

Float is a complete business finance platform that offers high-yield accounts, modern corporate cards and automated expense management—all built with Canadian businesses in mind.

Ready to see how Float can save your company time and money? Book a demo today.

All the resources

Industry Insights

Canada’s Crossroads: Why Now is the Moment to Move from Defensive to Intentional Growth

Float's 2025 report on Canadian business shows modest growth, rising costs and shrinking reserves. Find out exactly what the data

Read More

Expense Management

Controller Month-End Close Automation: Streamline Financial Reporting

Controllers, this one's for you. Let's talk about how how automating month-end close helps you move faster without sacrificing accuracy.

Read More

Corporate Cards

Corporate Card Program Implementation: Complete Management Guide

Ready to implement a corporate card program? This is where to start.

Read More