Corporate Cards

Auto-Load Corporate Cards: Eliminate Transaction Declines with Smart Funding

Say goodbye to declined transactions and budgeting headaches! Let’s explore why smart funding matters and how auto-load works.

November 7, 2025

Prepaid corporate cards have become a go-to tool for businesses looking to grow. They offer better control over spending, help teams move faster and make it easy to keep budgets in check without relying on traditional credit. But for all the flexibility these cards offer, there’s one downside finance teams know all too well: running out of funds at the wrong time.

When a card’s balance dips below what’s needed, payments can fail—sometimes silently. That can mean paused ad campaigns, delayed vendor deliveries or a frustrated employee at checkout. It’s a small problem with a big ripple effect, costing time, credibility and even lost opportunities.

That’s where auto-load corporate cards come in. Instead of manually transferring funds into each account, auto-load technology keeps your balance topped up automatically based on thresholds you set. In this article, we’ll explore why smart funding matters and how auto-load works. We’ll also cover how it helps businesses eliminate transaction declines, strengthen cash flow management and simplify day-to-day operations.

Why auto-load is important for corporate cards

Prepaid corporate cards are designed to simplify life for finance teams. They offer flexibility, control and built-in guardrails that keep spending predictable. There’s no credit risk and no month-end surprises—just clear visibility and tighter budget management. That’s exactly why more and more growing businesses are choosing them over traditional credit cards. In fact, Canada’s prepaid account market is on track for major growth, with annual loads projected to exceed $17.4 billion CAD by 2028.

But here’s the dilemma: those same cards can become a source of frustration when used for recurring transactions. The very automation that makes corporate cards efficient can also expose the limits of a manual funding process.

Why?

When a prepaid card balance dips below the required amount, even by a few dollars, that recurring payment fails. The subscription pauses. The vendor invoice bounces. The ad campaign stops mid-flight. And suddenly, the “simple” card solution isn’t so simple anymore, because it’s led to:

- Strained vendor relationships when payments don’t go through on time.

- Operational disruptions as teams scramble to restore services or restart campaigns.

- Lost productivity from finance teams manually troubleshooting preventable issues.

- Late payments that mean additional fees.

As one business owner put it on Reddit: “We can’t afford to have a payment fail due to insufficient funds in a prepaid account.” That single sentence captures the issue perfectly. The money is there… just not in the right place, at the right time.

That’s the gap auto-load technology fills.

What is auto-load and how it works

Auto-load is a smart funding feature that keeps your prepaid corporate cards automatically topped up, eliminating the need for manual transfers. When a card account balance drops below a threshold you’ve set (for example, $2,000), the auto-load system automatically transfers additional funds from a linked business bank account (say, $5,000) to top it back up.

In other words, your account refills itself before a transaction ever has the chance to fail.

Behind the scenes, auto-load uses real-time balance monitoring and automated triggers to ensure your cards are always ready to go. You decide the rules (how low the balance can fall, how much to top up and which account to draw from), giving you the perfect mix of corporate card automation and control.

This differs from a traditional prepaid or manual funding model, where someone on your team must remember to transfer money in before a transaction happens. With auto-load, your funding simply happens in the background, keeping operations smooth and uninterrupted.

Benefits of auto-load for businesses

At first glance, auto-load might seem like a small feature. But for growing teams, it’s one of those small things that makes a big difference. Here’s what businesses gain with this new Float card feature.

Fewer transaction declines

Auto-load ensures your cards always have available funds, so payments and recurring charges that keep your business operating go through without a hitch. That means your digital ads don’t pause overnight, your software licenses renew on time and your vendor invoices are paid without delay. No more “card declined” alerts or last-minute transfers to get operations back online.

Better cash flow visibility

With predictable top-up rules and real-time monitoring, you always know where your funds are and when they’re moving. Finance teams can forecast spending patterns more accurately, identify upcoming peaks (like payroll weeks or seasonal campaigns) and allocate resources with confidence. Instead of reacting to low balances, you’re proactively managing them with a clear line of sight across departments and currencies.

Simplified accounting and reconciliation

Manual funding often creates a paper trail of small, time-consuming transactions that add up. Auto-load eliminates that. Funds move automatically and predictably, making it easier to reconcile expenses at month-end. Finance teams spend less time tracking balances and more time analyzing spend. No more panicked messages like, “Hey, my card’s maxed—can you top it up so I can pay this invoice?”

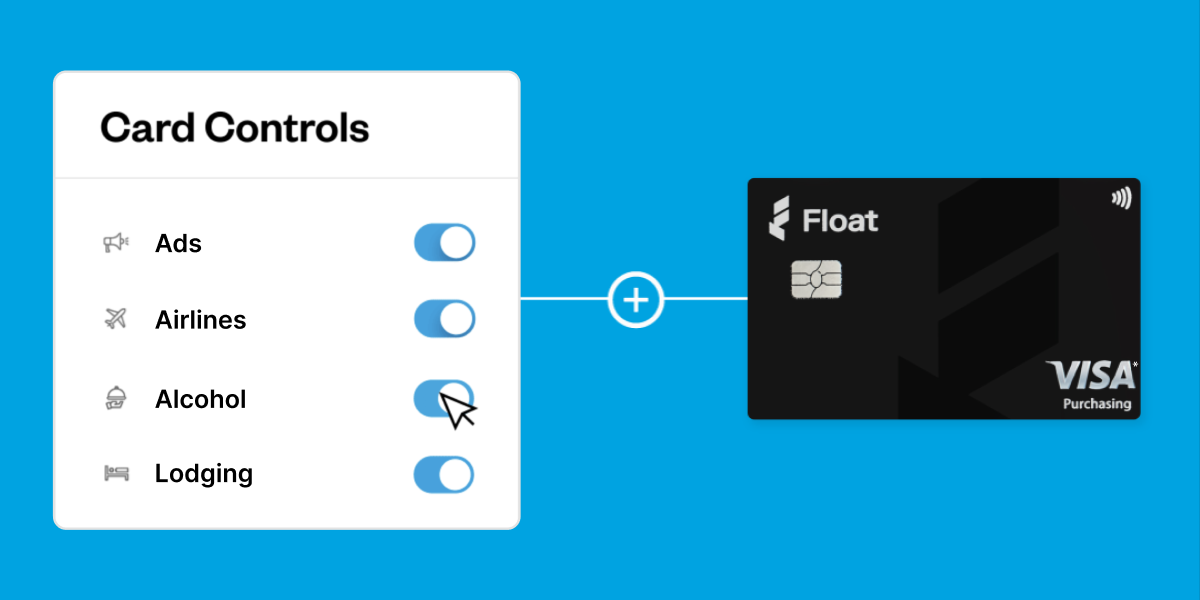

Enhanced spend control

Auto-load doesn’t mean letting go of control. It actually makes oversight stronger. You can pair automated funding with Float’s built-in spend controls, approval workflows and expense tracking integrations. Set clear limits, approvals and rules so you know every dollar is going where it should, and automation takes care of the rest. It’s the best of both worlds: speed and structure.

Scalable for growing operations

As your business grows, so does your card usage across new departments, projects and currencies. Auto-load scales effortlessly with you, ensuring funding never becomes a bottleneck. Whether you’re onboarding a new team, expanding into the US or launching a new marketing push, your cards stay funded, your team stays empowered and your finance department remains focused on strategy instead of firefighting.

For most companies, auto-load is all about removing friction. It replaces a manual, error-prone process with one that simply works in the background so you can focus on running your business, not refilling your cards.

Best business credit cards

Compare top options, fees and benefits for

Canadian companies.

Step-by-step implementation guide

So how do you get started with auto-load corporate cards? Follow these simple steps.

Step 1: Evaluate your business needs

Start by looking at your transaction history and identifying any recurring issues with card declines or manual funding delays. Ask yourself: which teams would benefit most from corporate cards with auto-load, and what thresholds make sense for your cash flow?

It’s also a good time to review or update your business credit card policy to make sure your spending limits, approval workflows and funding rules align with your company’s current operations. A clear policy helps your team use corporate cards responsibly and makes automated funding even more effective.

Step 2: Choose the right platform

Not all corporate card providers offer smart funding. Look for one that integrates seamlessly with your accounting and expense tools, supports multiple currencies and gives you visibility across teams. (With Float, auto-load is available within the platform settings—no extra tools required.)

Step 3: Set up smart funding

Once you’ve chosen your platform and have set your business card spending limits, configure your auto-load rules. This usually means linking your main business account, choosing your balance threshold (for example, “top up $5,000 every time the balance drops below $2,000”), and confirming your approval workflows.

Step 4: Integrate transaction monitoring

Pair your auto-load setup with real-time transaction monitoring to stay ahead of spending trends. The combination of smart funding and monitoring ensures you’re not only preventing declines, but also optimizing how and when money moves.

Step 5: Train your team

Make sure employees and finance staff understand how auto-load works and what it means for them. Highlight the benefits like fewer payment issues, faster processing and better transparency. When everyone understands the “why,” adoption sticks.

Keep cash flowing with smart, automated funding

Manual funding worked when business was simple. But today, money moves fast across currencies, platforms and teams, and balances can drain before you even notice. Auto-load takes the guesswork out of keeping your corporate cards ready by automatically topping up funds the moment your balance dips. It’s the simplest way to eliminate declines, optimize cash flow, and keep operations humming.

With Float corporate cards, which offer both pre-paid and charge models, that automation is just the beginning. Our cards come with built-in spend controls that make it easy to issue unlimited high-limit CAD or USD cards while keeping budgets in check. You can:

- Create new cards in seconds for any team, vendor or campaign—physical or virtual.

- Set spending limits and approval rules to prevent unwanted charges before they happen.

- Earn while you spend up to 1% cashback on card purchases (for programs spending over $25K/month) and up to 4% interest on Float-held balances of $50K or more.

- Skip the receipt chase with automatic expense uploads via our mobile app or text.

- Close your books up to 8x faster thanks to direct integrations with QuickBooks, Xero, and NetSuite.

Whether you’re managing recurring SaaS subscriptions, ad budgets or supplier payments, our Auto-Topup feature ensures your accounts stay funded and your team stays focused on growth.

If you’re ready to spend smarter and move faster, explore how Float corporate cards can help your business stay funded, flexible and in control.

Explore Float Corporate Cards →

FAQs about auto-load corporate cards

1. What is an auto-load corporate card?

An auto-load corporate card automatically transfers funds from your linked business account when your balance drops below a preset threshold. It keeps your card funded at all times—no manual top-ups or delays.

2. How is an auto-load corporate card different from a traditional corporate card?

With traditional corporate cards, you need to move money in manually before transactions can go through once your balance or spending limit has been reached. Auto-load cards automate that process, refilling your account in real time so payments never fail due to insufficient funds.

3. Can I control how much and how often funds are added to my auto-load corporate card?

Yes. Float’s Auto-Topups feature lets you set both the threshold (when to top up) and the transfer amount (how much to add). This keeps you in control of your cash flow while removing repetitive admin work.

4. Is auto-load secure?

Absolutely. Funds move securely between your linked business bank account and your Float account through regulated Canadian financial institutions. Float is a registered Money Services Business (MSB) in Canada. Funds held in Float Business Accounts are insured up to $100,000 CAD (combined CAD and USD equivalent) through Scotiabank, a CDIC-member financial institution. Float itself is not a bank or CDIC member.

5. Who should use auto-load corporate cards?

They’re ideal for businesses that rely on recurring transactions—like SaaS subscriptions, digital ads or vendor payments—and can’t risk a payment failing. Auto-load ensures those payments always go through, while keeping spend controls in place.

Written by

All the resources

Financial Controls & Compliance

Financial Controller Guide: Roles, Responsibilities & Success Strategies

Behind every confident CFO is a financial controller who knows the numbers inside out—and how to use them to guide

Read More

Corporate Cards

Business Credit Cards with No Personal Guarantee: Your Options

Want to avoid leveraging your personal credit for business financing? Business credit cards with no personal guarantee may be the

Read More

Corporate Cards

Discover: Virtual Credit Cards for Canadian Businesses

Explore the benefits of virtual credit cards with Float. Discover how this modern payment solution enhances security and simplifies your

Read More